Morgan County Notice of Claim Form

Morgan County Notice of Claim Form

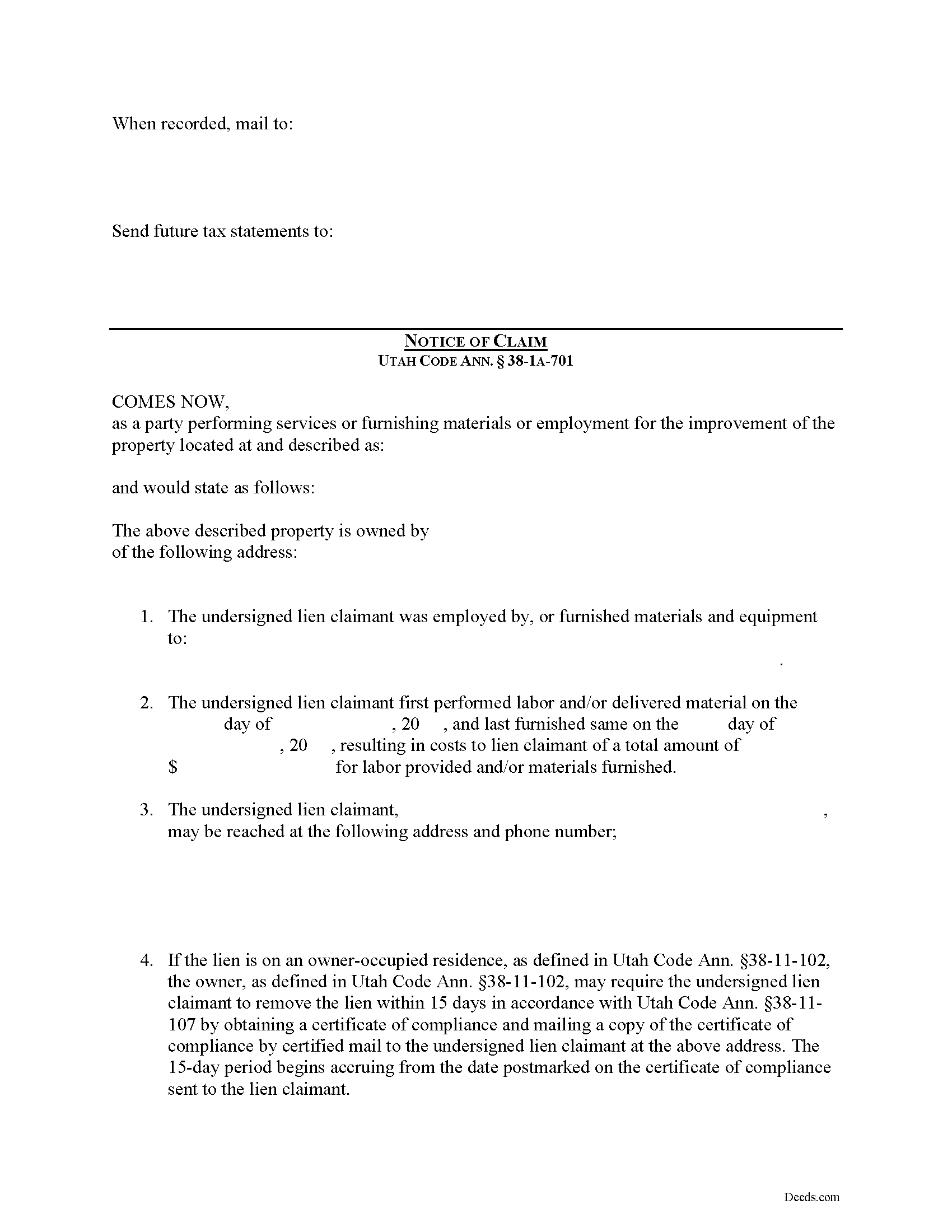

Fill in the blank Notice of Claim form formatted to comply with all Utah recording and content requirements.

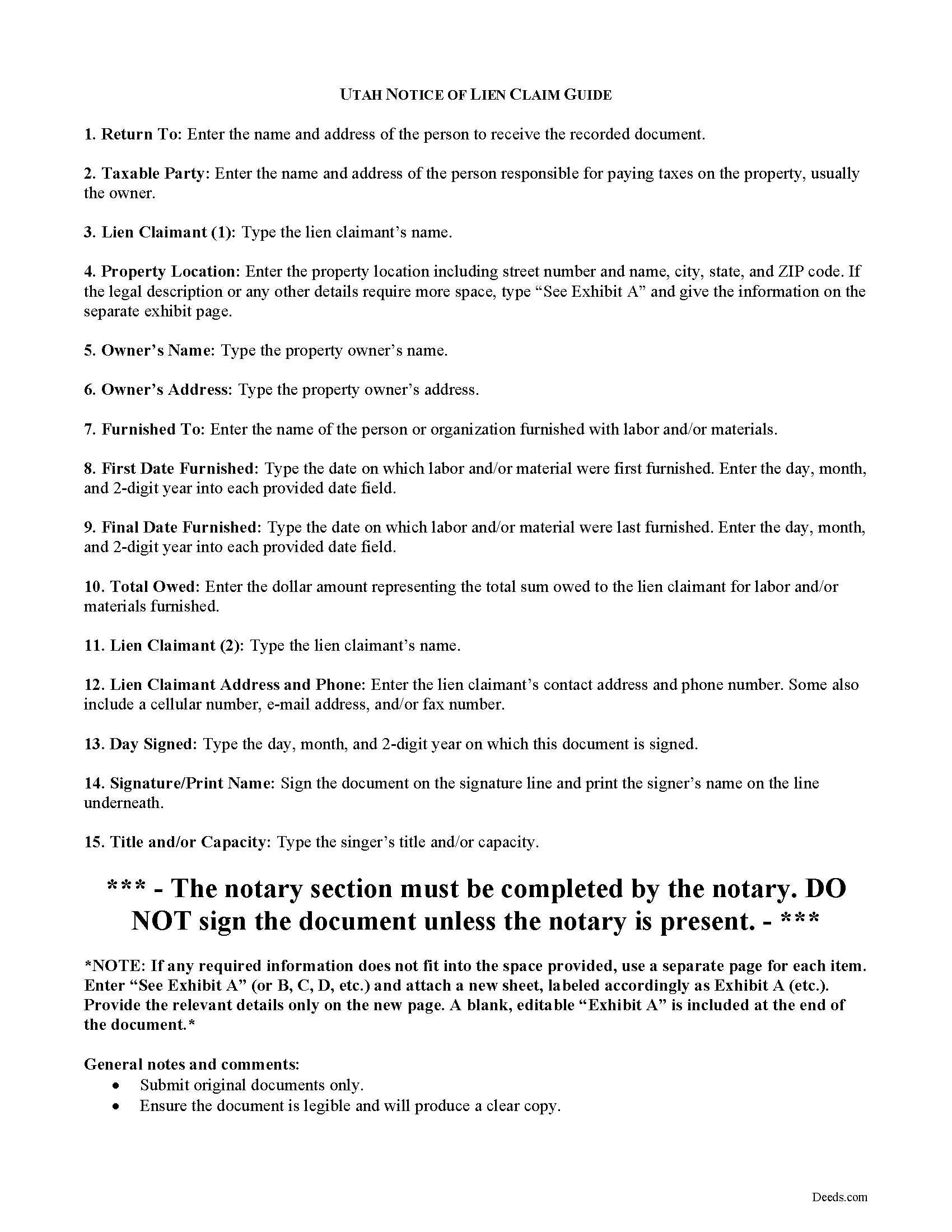

Morgan County Notice of Claim Guide

Line by line guide explaining every blank on the form.

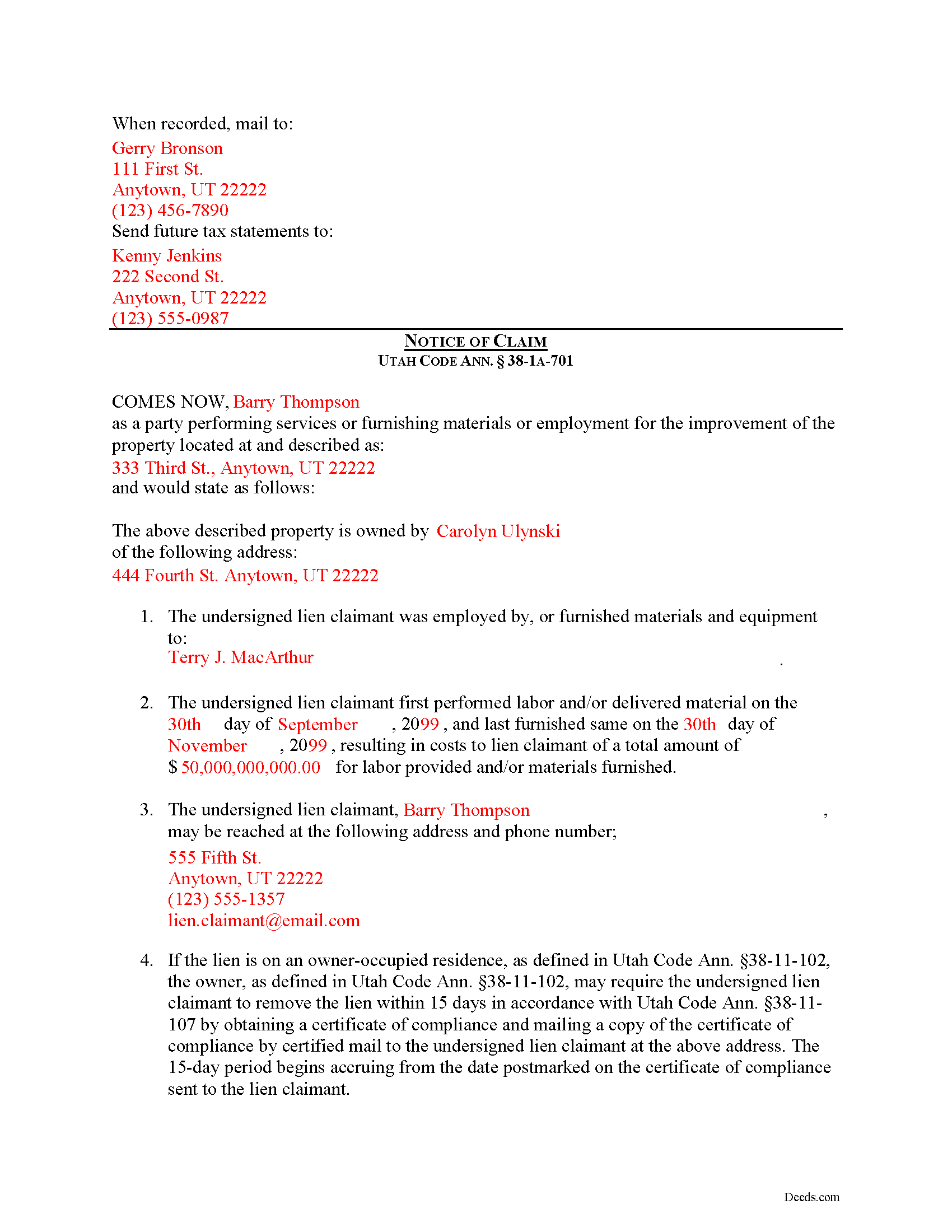

Morgan County Completed Example of the Notice of Claim Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Utah and Morgan County documents included at no extra charge:

Where to Record Your Documents

Morgan County Recorder

Morgan, Utah 84050

Hours: Monday through Thursday 7:00 to 6:00; Friday 1:00 to 5:00

Phone: (801) 829-3277

Recording Tips for Morgan County:

- White-out or correction fluid may cause rejection

- Leave recording info boxes blank - the office fills these

- Bring extra funds - fees can vary by document type and page count

- Make copies of your documents before recording - keep originals safe

- Bring multiple forms of payment in case one isn't accepted

Cities and Jurisdictions in Morgan County

Properties in any of these areas use Morgan County forms:

- Croydon

- Morgan

Hours, fees, requirements, and more for Morgan County

How do I get my forms?

Forms are available for immediate download after payment. The Morgan County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Morgan County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Morgan County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Morgan County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Morgan County?

Recording fees in Morgan County vary. Contact the recorder's office at (801) 829-3277 for current fees.

Questions answered? Let's get started!

Claiming a Construction Lien in Utah

In Utah, mechanic's liens are governed under Title 38, Chapter 1A of the Utah Code.

Construction liens, also known as mechanic's liens, are used the put a block or burden on an owner's title when construction work or materials delivery has taken place on the owner's property and the person or company providing the work or materials is not paid according to the contract. In Utah, a construction lien means a lien for construction work. Utah Code Ann. 38-1A-102(8). Construction work means labor, service, material, or equipment provided for the purpose and during the process of constructing, altering, or repairing an improvement; and includes scheduling, estimating, staking, supervising, managing, materials testing, inspection, observation, and quality control or assurance involved in constructing, altering, or repairing an improvement. 38-1A-102(11).

To enforce a preconstruction lien or construction lien in Utah, a claimant shall file an action to enforce the lien within 180 days after the day on which the claimant files: (i) a notice of preconstruction lien, for a preconstruction lien; or (ii) a notice of construction lien, for a construction lien. Utah Code Ann. 38-1A-701(2)(a). Each notice must be filed with the county recorder in the county where the property is located. However, if an owner files for protection under the bankruptcy laws of the United States before the expiration of the 180-day period, the lien must be filed within 90 days after the automatic stay under the bankruptcy proceeding is lifted or expires. 38-1A-701(2)(b).

A claimant shall file for record with each applicable county recorder a notice of the pendency of the action. Utah Code Ann. 38-1A-701(3)(a)(i). If a claimant fails to file for record a notice of the pendency of the action, the preconstruction lien or construction lien, as applicable, is void, except as to persons who have been made parties to the action and persons having actual knowledge of the commencement of the action. 38-1A-701(3)(a)(ii). The burden of proof is upon the claimant and those claiming under the claimant to show actual knowledge. 38-1A-701(3)(b). A preconstruction lien or construction lien is automatically and immediately void if an action to enforce the lien is not filed within the time required. 38-1A-701(4)(a).

If a claimant files an action to enforce a preconstruction or construction lien involving a residence, the claimant must, when serving the complaint to the owner, include: (i) instructions relating to the owner's rights under Title 38, Chapter 11, Residence Lien Restriction and Lien Recovery Fund Act; and (ii) a form to enable the owner of the residence to specify the grounds upon which the owner may exercise those available rights. Utah Code Ann. 38-1A-701(6)(a). If a claimant fails to provide the instructions and form as required, the claimant is barred from maintaining or enforcing the preconstruction or construction lien upon the residence. 38-1A-701(6)(c).

This article is provided for informational purposes only and should not be relied upon as a substitute for advice from an attorney. Please contact a Utah attorney with questions about filing a notice of claim, or with any other issues regarding construction liens.

Important: Your property must be located in Morgan County to use these forms. Documents should be recorded at the office below.

This Notice of Claim meets all recording requirements specific to Morgan County.

Our Promise

The documents you receive here will meet, or exceed, the Morgan County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Morgan County Notice of Claim form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Kevin P.

March 19th, 2023

Just what my parents and I have been looking for to do a Quit Deed to transfer property into my name.

Thank you!

virginia a.

May 15th, 2022

Thank you for the prompt instructions on the download and installation. The only problem I had was trying to input data into the form once I renamed the form.and saved it. I was unable to change the size of the font and was very frustrated. In the end I finally had to redo the entire form through Word using your format.

Thank you!

Matilde A.

October 25th, 2021

Very easy to navigate... will be back to use!

Thank you for your feedback. We really appreciate it. Have a great day!

Lisa C.

October 7th, 2020

Please change on the example for the warranty deed the portion that says Source of Title: They don't use book and pages anymore They only use recording numbers. Please show an example with that for Maricopa County AZ Plus your Notary certificates should have a blank part for if it is signed in another state.

Thank you for your feedback. We really appreciate it. Have a great day!

LINDA J M.

November 18th, 2019

NO PROBLEMS. I LIKE THE DEED DOCUMENT AND INSTRUCTIONS. MADE IT EASY.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Gerald B.

April 5th, 2021

Thank you so much for the helpful service and quick action! If needed, I will definitely choose Deeds.com again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

David H.

May 25th, 2021

So So

Thank you!

Kay M.

August 27th, 2020

Worked great. Not being real tech savey was no problem.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Evelyn B.

June 23rd, 2023

Wow! Deeds.com provided proficient eRecording with great response time and great service... and it was super easy, super fast, and very reasonably priced. What more could you possibly want?! Highly recommended!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Marilyn C.

March 16th, 2021

Fillable documents, after a download, would be helpful. Very good to have all these forms online and accessible for an overall fee.

Thank you!

Candace K.

April 1st, 2021

I was able to find the Certificate of Trust after a little searching. Once found, the remainder of the process was easy. My task was done in no time. It's a great site.

Thank you for your feedback. We really appreciate it. Have a great day!

Jayne S.

December 20th, 2023

Simple and quick -- just what we needed!

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Christopher W.

July 29th, 2022

Completed in 1 day and no problems filing a deed in another county. Price was less than the gas I would have used, not to mention my time. Thanks

Thank you!

Tiffani D.

February 25th, 2020

The website was very user-friendly. I am glad it was available!

Thank you!

Jimmy W.

February 15th, 2022

The forms where easy to get to and I hope that they will be as easy to fill out.

Thank you!