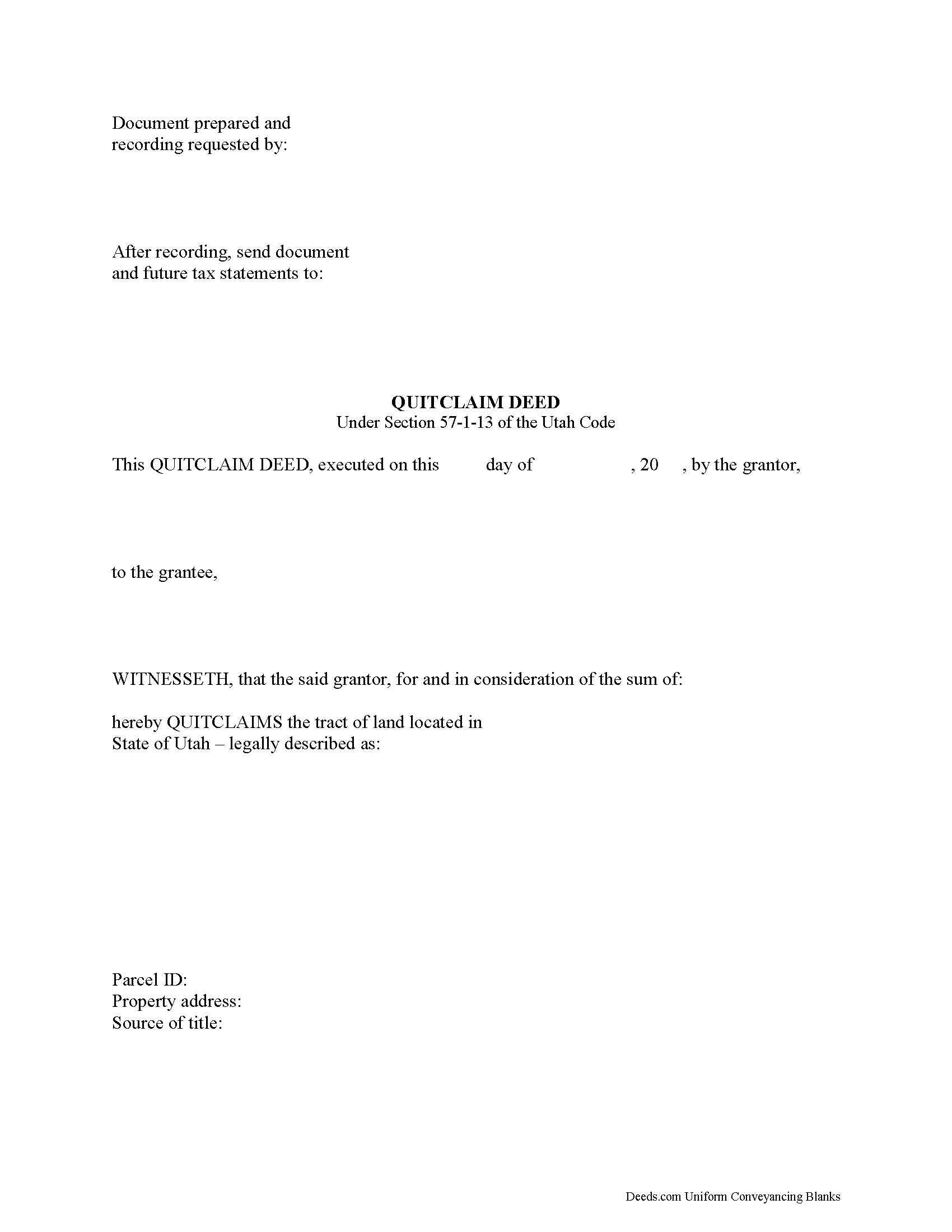

Morgan County Quitclaim Deed Form

Morgan County Quitclaim Deed Form

Fill in the blank Quitclaim Deed form formatted to comply with all Utah recording and content requirements.

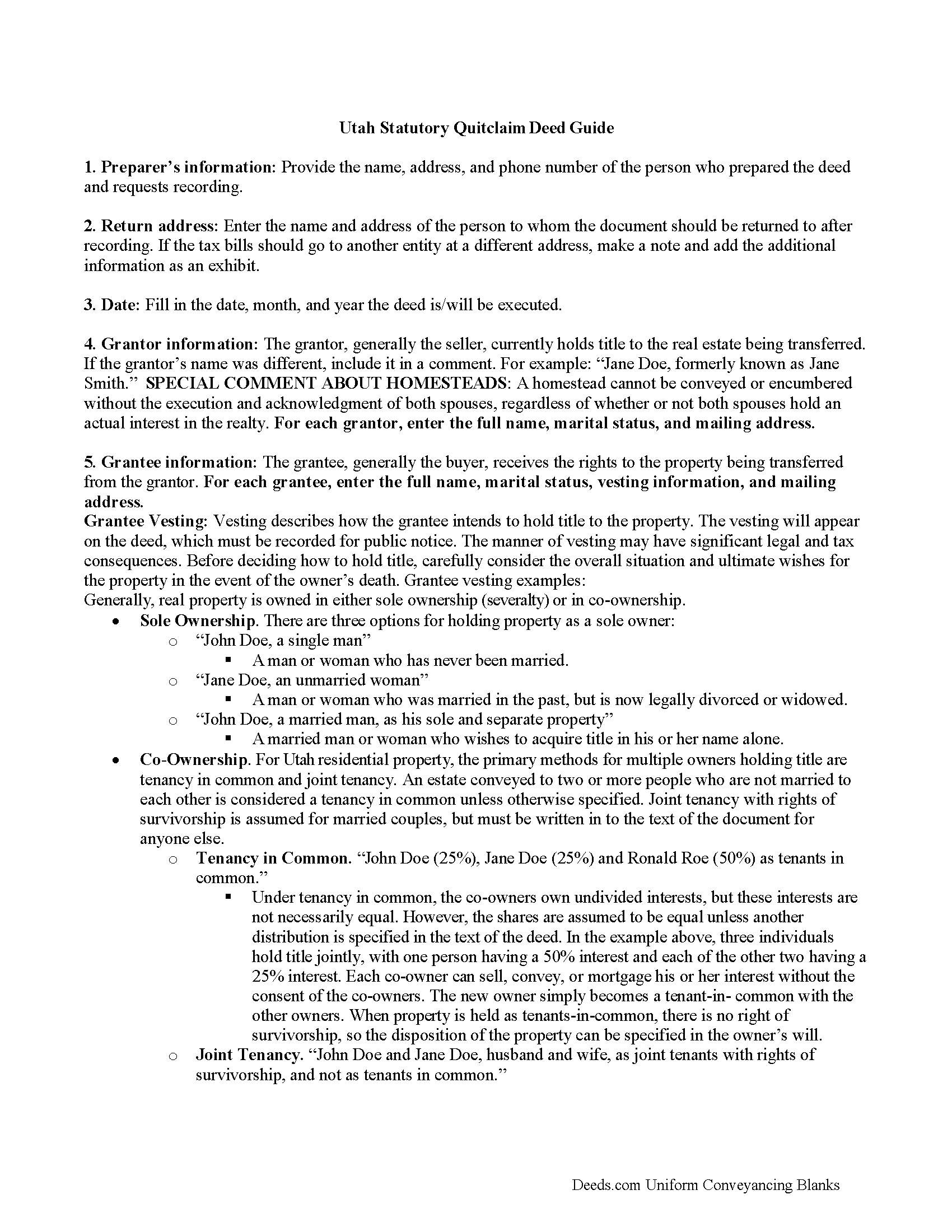

Morgan County Quitclaim Deed Guide

Line by line guide explaining every blank on the Quitclaim Deed form.

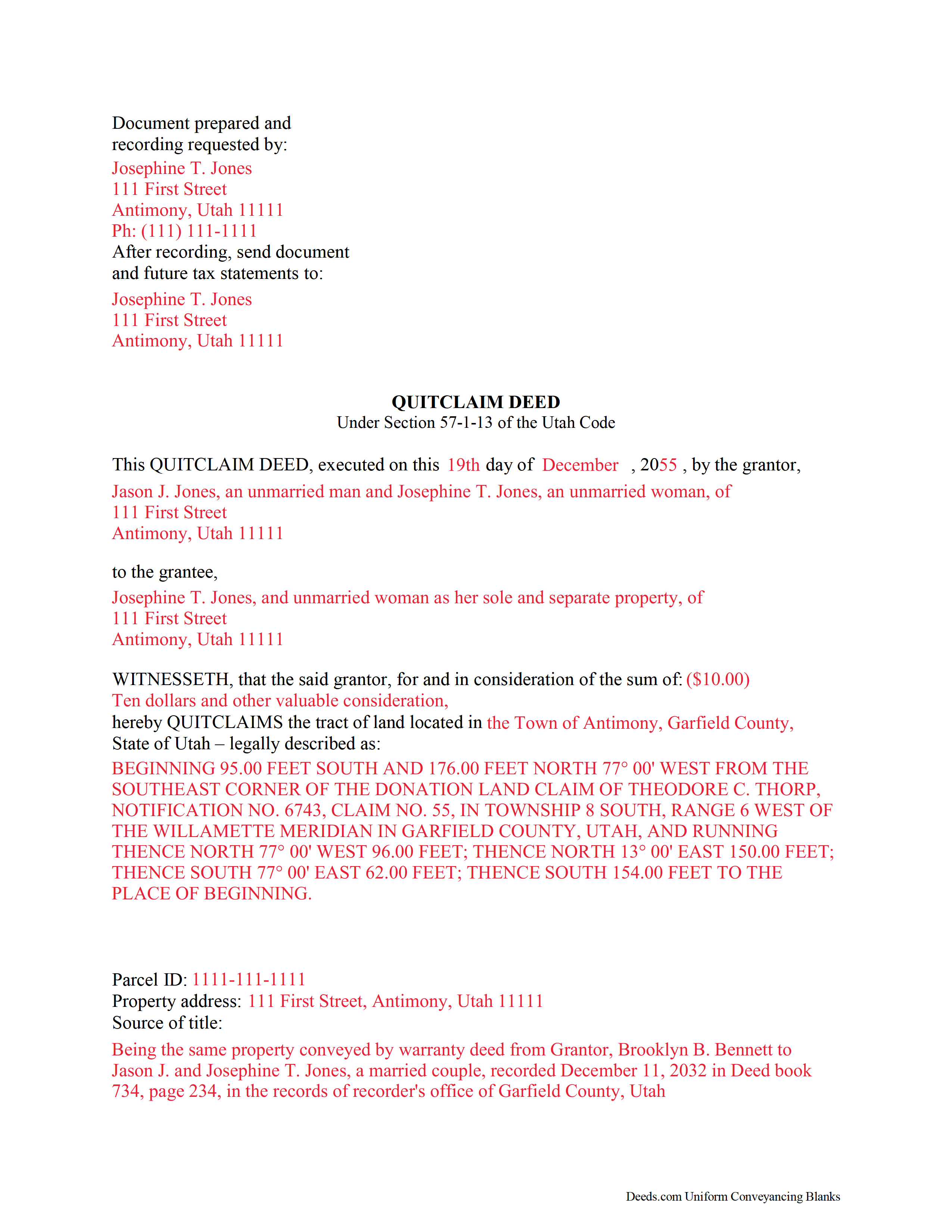

Morgan County Completed Example of the Quitclaim Deed Document

Example of a properly completed Utah Quitclaim Deed document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Utah and Morgan County documents included at no extra charge:

Where to Record Your Documents

Morgan County Recorder

Morgan, Utah 84050

Hours: Monday through Thursday 7:00 to 6:00; Friday 1:00 to 5:00

Phone: (801) 829-3277

Recording Tips for Morgan County:

- Recording fees may differ from what's posted online - verify current rates

- Bring extra funds - fees can vary by document type and page count

- Make copies of your documents before recording - keep originals safe

- Check margin requirements - usually 1-2 inches at top

- Recording early in the week helps ensure same-week processing

Cities and Jurisdictions in Morgan County

Properties in any of these areas use Morgan County forms:

- Croydon

- Morgan

Hours, fees, requirements, and more for Morgan County

How do I get my forms?

Forms are available for immediate download after payment. The Morgan County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Morgan County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Morgan County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Morgan County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Morgan County?

Recording fees in Morgan County vary. Contact the recorder's office at (801) 829-3277 for current fees.

Questions answered? Let's get started!

A quitclaim deed executed in Utah must be signed by each grantor involved in the conveyance. A certificate of acknowledgment, proof of execution, jurat, or other certificate may be required in order to effectively record a quitclaim deed with a county recorder. A quitclaim deed may not be presented to an appropriate county recorder in Utah unless it contains a legal description of the real property, names the grantee, and recites a mailing address for assessment and taxation. Additional requirements may apply to a Utah quitclaim deed. For a thorough discussion, visit the county links, or go to the Utah Revised Code.

When a quitclaim deed is recorded in the county where the property is located, notice of its contents is imparted to all persons (57-3-102). The recording act in Utah stipulates that if a quitclaim deed is left unrecorded, it is void against subsequent purchasers of the same real property or any portion of it if (1) the subsequent purchaser bought the property in good faith and for valuable consideration and (2) the subsequent purchaser's document is recorded first.

(Utah QD Package includes form, guidelines, and completed example)

Important: Your property must be located in Morgan County to use these forms. Documents should be recorded at the office below.

This Quitclaim Deed meets all recording requirements specific to Morgan County.

Our Promise

The documents you receive here will meet, or exceed, the Morgan County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Morgan County Quitclaim Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Teresa M.

July 22nd, 2020

Very easy and quick. Report gave me the info I needed to know. Will use again if I need to.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Wendy S.

December 19th, 2019

Very easy and affordable.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kristen N.

October 3rd, 2023

Very easy to use, helpful instructions and examples. I also like the chat feature and the erecording. So much better than other DIY law websites out there.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kyle K.

May 3rd, 2022

Deeds is extremely helpful and cost effective for small and large businesses. Saves me time to do more valuable tasks.

Thank you for your feedback. We really appreciate it. Have a great day!

Richard C.

February 10th, 2025

Fast, effective, and good communication. I have no complaints at all.

Thank you for your positive words! We’re thrilled to hear about your experience.

Carnell G.

September 26th, 2020

The basic setup was fine but, I need to review the document in its entirety for accuracy which I have yet to do so. So far so good. The monthly fee is more than I need for right now.

Thank you!

Stephanie P.

December 9th, 2020

So far Deeds.com has done everything they say they'll do and very promptly.

Thank you for your feedback. We really appreciate it. Have a great day!

Nicole M.

February 24th, 2020

Very helpful and happy with my service. Thanks much!

Thank you!

Kathy P.

November 25th, 2019

I like that the quit claim form was fill in the blank on my computer instead of online, made it so much easier than having to do everything at once, at the mercy of the internet connection. Will refer others here.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sara P.

February 1st, 2019

Wonderful response time, and patient with me. Thank you.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

BRIAN B.

August 17th, 2020

This site makes filing documents so easy and effortless. The response time is phenomenally fast, which saves time and frustration. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Christine L.

May 13th, 2025

User friendly!

Thank you!

Debbra .S C.

June 1st, 2023

Very easy and nice website to use.

Thank you for your feedback. We really appreciate it. Have a great day!

Kelli M.

April 27th, 2020

It is easy to use but difficult to know when the document has been reviewed for recording and when the invoice is ready. It would be helpful for the website to send an email automatically once the document(s) are ready to be recorded to let you know what the time line is.....Thank you for your help.

Thank you for your feedback. We really appreciate it. Have a great day!

Jim W.

June 2nd, 2022

ALL I CAN SAY IS WOW. I AM SO GLAD THAT SOMEONE THOUGHT OF THIS OPROCESS FOR NON-TITLE COMPANIES, SMALL COMPANIES, ETC. I REALLY APPRECIATED THE SERVICE WHEN I RECORDED MY FIRST SET OF DOCS HERE. THEY WERE A MESS AND I HAD A LOT OF QUESTIONS. AGAIN THANK YOU!

Thank you for your feedback. We really appreciate it. Have a great day!