Cache County Trustee Deed Form

Cache County Trustee Deed Form

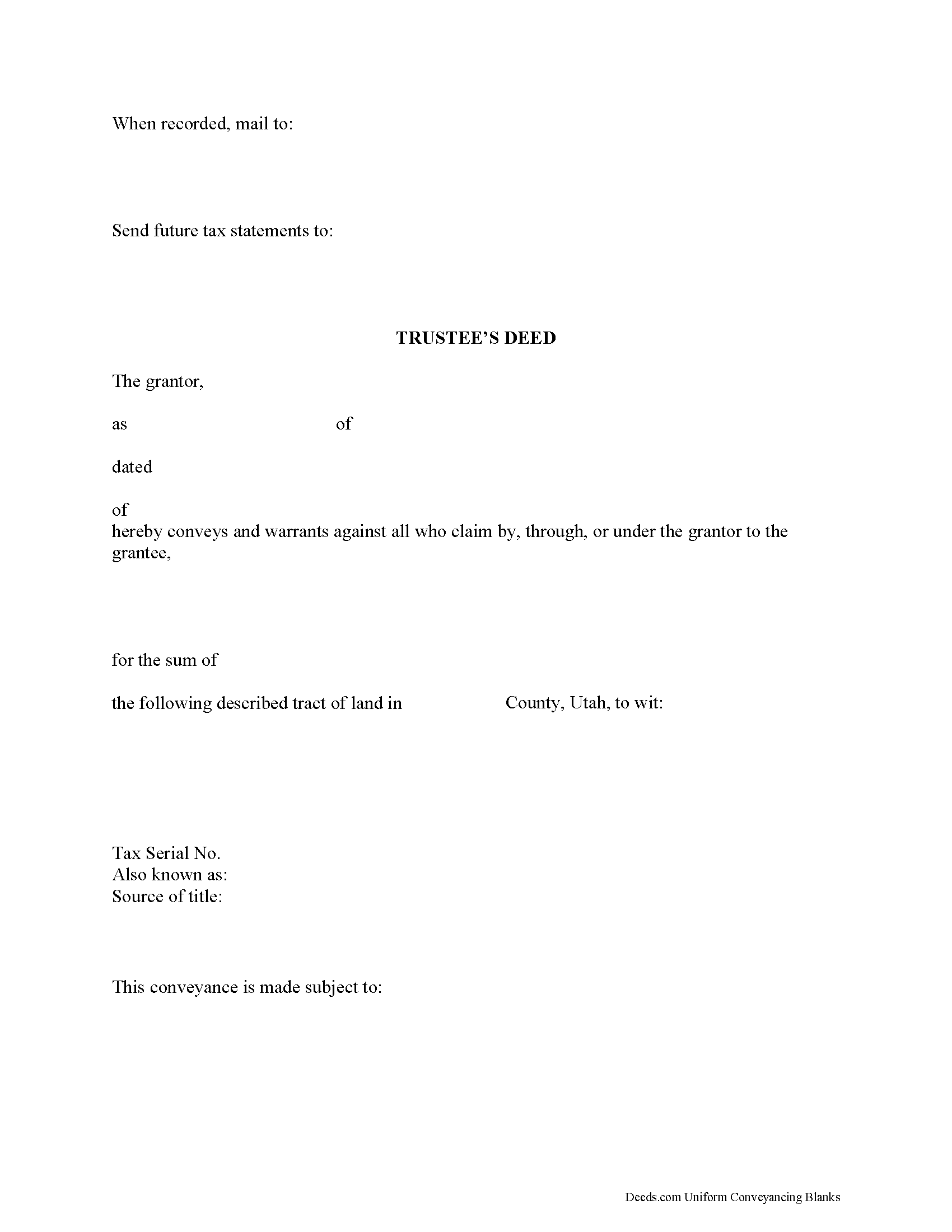

Fill in the blank form formatted to comply with all recording and content requirements.

Cache County Trustee Deed Guide

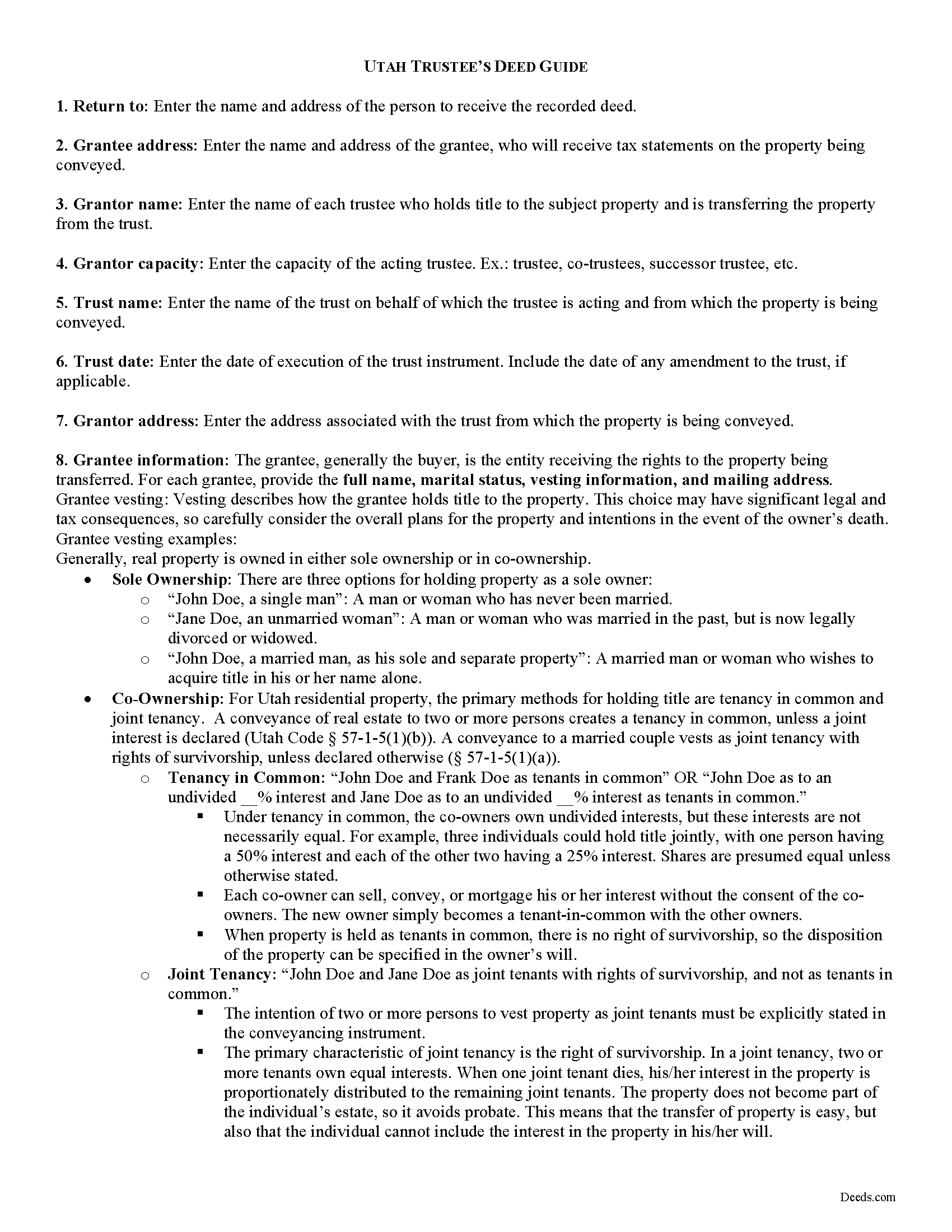

Line by line guide explaining every blank on the form.

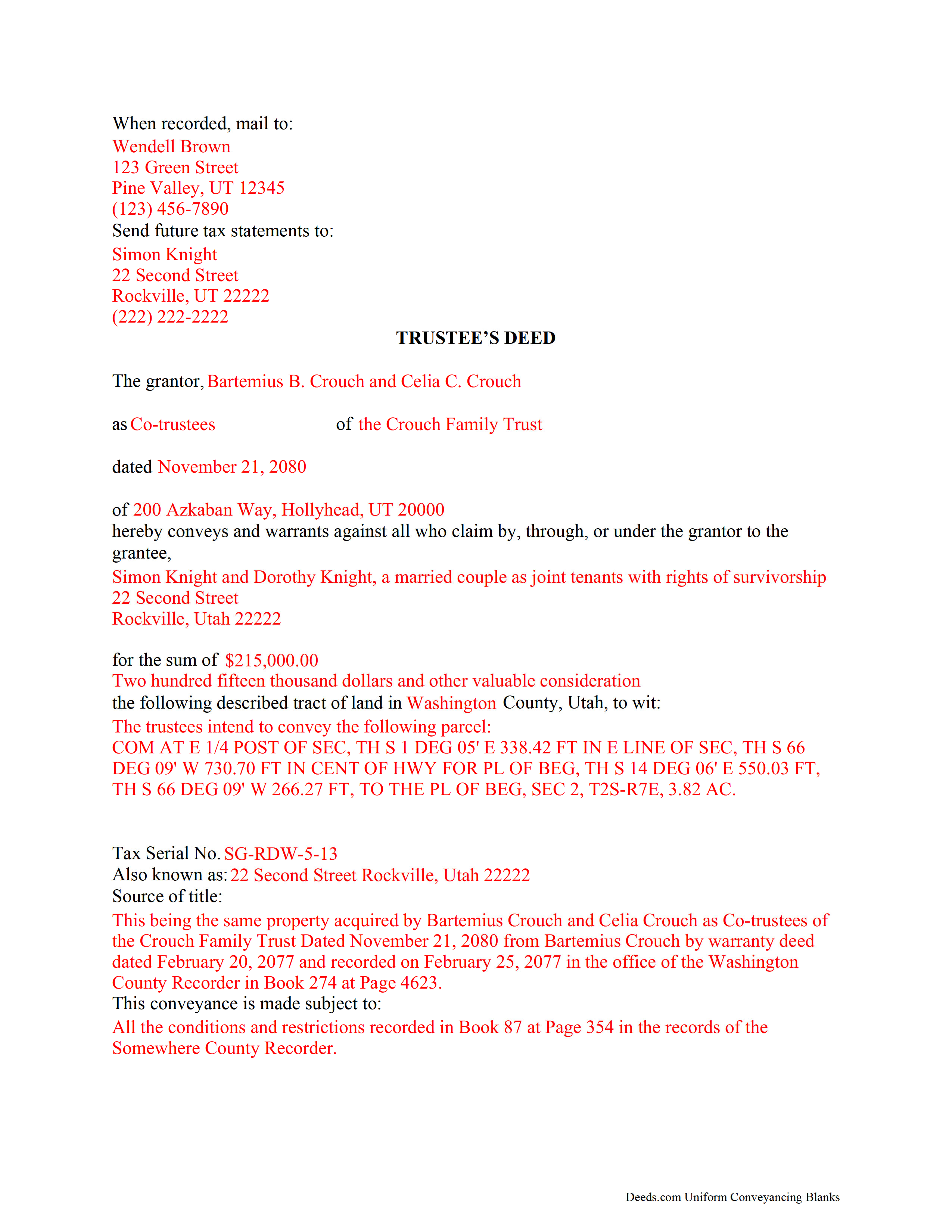

Cache County Completed Example of the Trustee Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Utah and Cache County documents included at no extra charge:

Where to Record Your Documents

Cache County Recorder

Logan, Utah 84321

Hours: 8:00 to 5:00 M-F

Phone: (435) 755-1530

Recording Tips for Cache County:

- Check that your notary's commission hasn't expired

- Request a receipt showing your recording numbers

- Make copies of your documents before recording - keep originals safe

- Bring extra funds - fees can vary by document type and page count

Cities and Jurisdictions in Cache County

Properties in any of these areas use Cache County forms:

- Cache Junction

- Clarkston

- Cornish

- Hyde Park

- Hyrum

- Lewiston

- Logan

- Mendon

- Millville

- Newton

- Paradise

- Providence

- Richmond

- Smithfield

- Trenton

- Wellsville

Hours, fees, requirements, and more for Cache County

How do I get my forms?

Forms are available for immediate download after payment. The Cache County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Cache County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Cache County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Cache County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Cache County?

Recording fees in Cache County vary. Contact the recorder's office at (435) 755-1530 for current fees.

Questions answered? Let's get started!

Transferring Real Property to and from Living Trusts in Utah

The Utah Uniform Trust Code, codified at Utah Code 75-7, governs trusts in Utah. A trust is an alternate method of holding title to property. In a trust arrangement, one person (the settlor) transfers property to another (the trustee), who administers the trust for the benefit of a third (the beneficiary). A transfer of property to a trustee during the settlor's lifetime results in a living (inter vivos) trust, and a transfer to a trustee pursuant to the terms of a settlor's will creates a testamentary trust.

A trust is valid only when the settlor has a capacity to create the trust and indicates an intention to do so; the trust has a definite beneficiary; the trustee has duties to perform; and the same person is not both sole trustee and sole beneficiary of the trust ( 75-7-402). The trust must be created for lawful purposes that are possible to achieve and for the benefit its beneficiaries ( 75-7-404).

A living trust is an estate planning tool allowing the settlor to determine how his assets will be distributed without the oversight of the probate court upon his death. The trust is governed by a trust instrument, a (typically) unrecorded document executed by the settlor that outlines the scope of the trust and the trust's terms. The settlor may concurrently transfer assets into the trust and/or transfer property into the trust at a later date.

In order to convey real property into trust, the settlor executes a deed titling property in the name of the trustee on behalf of the trust. Regarding real property transferred into trust, the deed of transfer requires recitation of the name and address of the trustee, and the name and date of the trust ( 75-7-816). Alternately, the trust instrument, signed by the grantor, may be recorded in the appropriate county recorder's office.

Unless otherwise limited by the terms in the trust instrument, the trustee holds the power to sell property held in trust ( 75-7-814(1)(b)). Because the trustee holds legal title to real property as the trust's administrator, the trustee executes a deed to convey interest to real property out of the trust. A trustee's deed to convey real property from a living trust is a form of special warranty deed, named after the executing party. Apart from conveying fee simple interest in the subject property to the grantee, a special warranty deed contains the grantor's covenants that the property is free from encumbrances by the grantor, and the grantor promises to warrant and defend the property's title against lawful claims arising from persons claiming by, through, or under the grantor (but none other).

The trustee's deed requires the basic information of the trust, including the name and date of trust instrument and the trustee's name and address. As with all conveyances of real property, the trustee's deed should include a legal description of the subject property. The deed must be signed by the granting party and notarized before it is recorded, if applicable, in the appropriate county. All requirements for form and content of documents pertaining to real property should be met before the document is recorded.

Recipients of a trustee's deed may require further proof of the trust's existence and the trustee's authority to transfer real property on behalf of the trust (See 75-7-1013 on certificates of trust). The information contained within this article is not a substitute for legal guidance. Consult a lawyer for regarding living trusts and conveyances of real property interests in the State of Utah, as each situation is unique.

(Utah TD Package includes form, guidelines, and completed example)

Important: Your property must be located in Cache County to use these forms. Documents should be recorded at the office below.

This Trustee Deed meets all recording requirements specific to Cache County.

Our Promise

The documents you receive here will meet, or exceed, the Cache County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Cache County Trustee Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4577 Reviews )

Jackie C.

April 10th, 2022

It was easy to access the documents for a minimal fee.

Thank you for your feedback. We really appreciate it. Have a great day!

Victoria L.

February 25th, 2019

This is a fantastic website and financial savings to many. Being able to download and complete the document I needed vs having my attorney complete saved me $800. I would highly recommend this website.

Thank you for the kind words Victoria. Have a great day!

Terry S.

March 23rd, 2022

Worked well for us except for not being able to edit. Got it completed and recorded with the county clerk! Having the instructions and example made it easy!

Thank you for your feedback. We really appreciate it. Have a great day!

ANGELIA E.

December 23rd, 2020

Thanks for your expedite process

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Diana D.

June 23rd, 2020

I was very pleased as to how fast and easy the service was. I recommend this service to any one. It's not expensive and it was worth it. Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!

Catherine A.

September 25th, 2022

Very good site, easy to get around, very thourough, easy to use. Definately will use again. I give you 5 stars

Thank you for your feedback. We really appreciate it. Have a great day!

Jana H.

March 23rd, 2020

This company has made my life so much easier. I'm not driving 25 miles twice a week to record a document. I'm almost giddy! Thank you for making my job so much faster! Jana Hamilton

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Angel T.

August 26th, 2021

First the convenience to get forms without going or calling Recorder's office is outstanding. Suggest that Recorder's staff be able to guide or assist users in filling up the forms.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kim C.

October 5th, 2020

Very user-friendly and easy to obtain exactly what I needed. I am impressed by the sample forms as well. I will definitely be using Deeds.com again!!

Thank you for your feedback. We really appreciate it. Have a great day!

Shaaron Z.

August 29th, 2019

So far, this is working well. However, I don't see a form to change name due to marriage.

Thank you!

yaakov f.

June 5th, 2023

you are awesome never had such a great expriance will be back with other transfers you the best

Great to hear Yaakov! Hope you have a great day!

Rodrigo M.

September 10th, 2022

Excellent service

Thank you!

Jacque G.

December 18th, 2019

Very helpful and easy to access.

Thank you!

Tonni L.

June 15th, 2021

Quick and easy with great instructions and accurate documents. I plan to make this site a part of our financial planning. Highly recommend. Saved big by this DIY process. TL

Thank you for your feedback. We really appreciate it. Have a great day!

Judith F.

October 15th, 2021

Easy to understand and use!

Thank you!