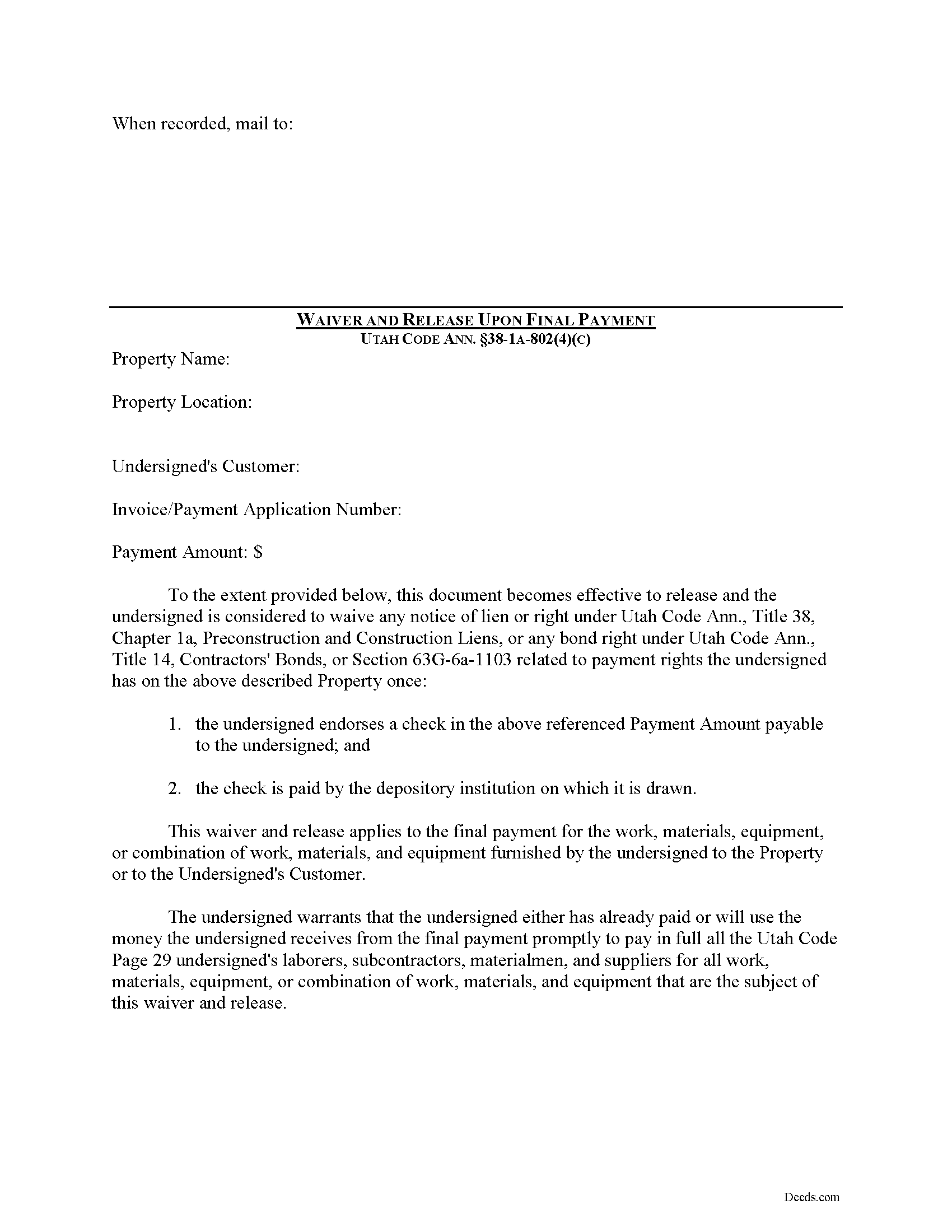

Washington County Waiver and Release on Final Payment Form

Washington County Waiver and Release on Final Payment Form

Fill in the blank Waiver and Release on Final Payment form formatted to comply with all Utah recording and content requirements.

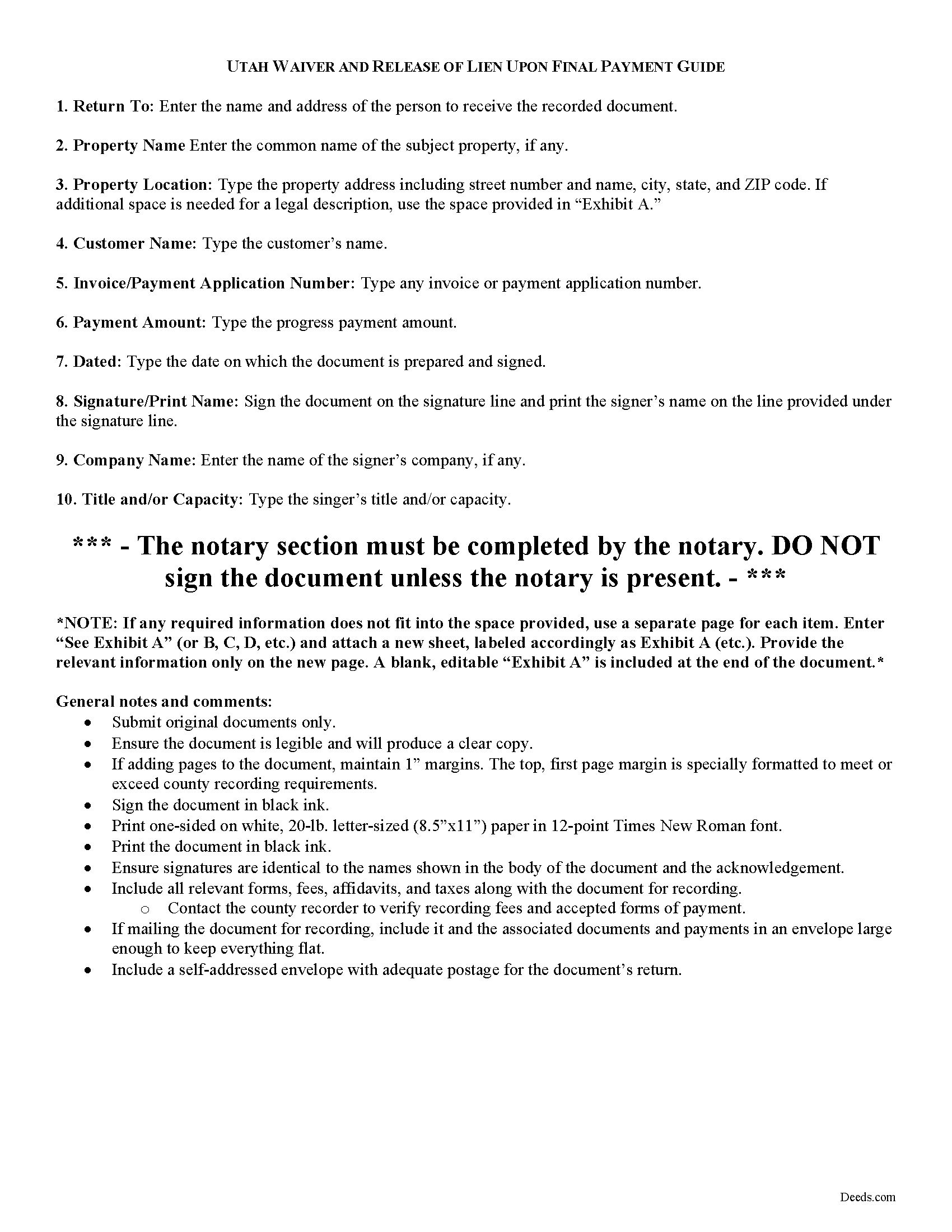

Washington County Waiver and Release on Final Payment Guide

Line by line guide explaining every blank on the form.

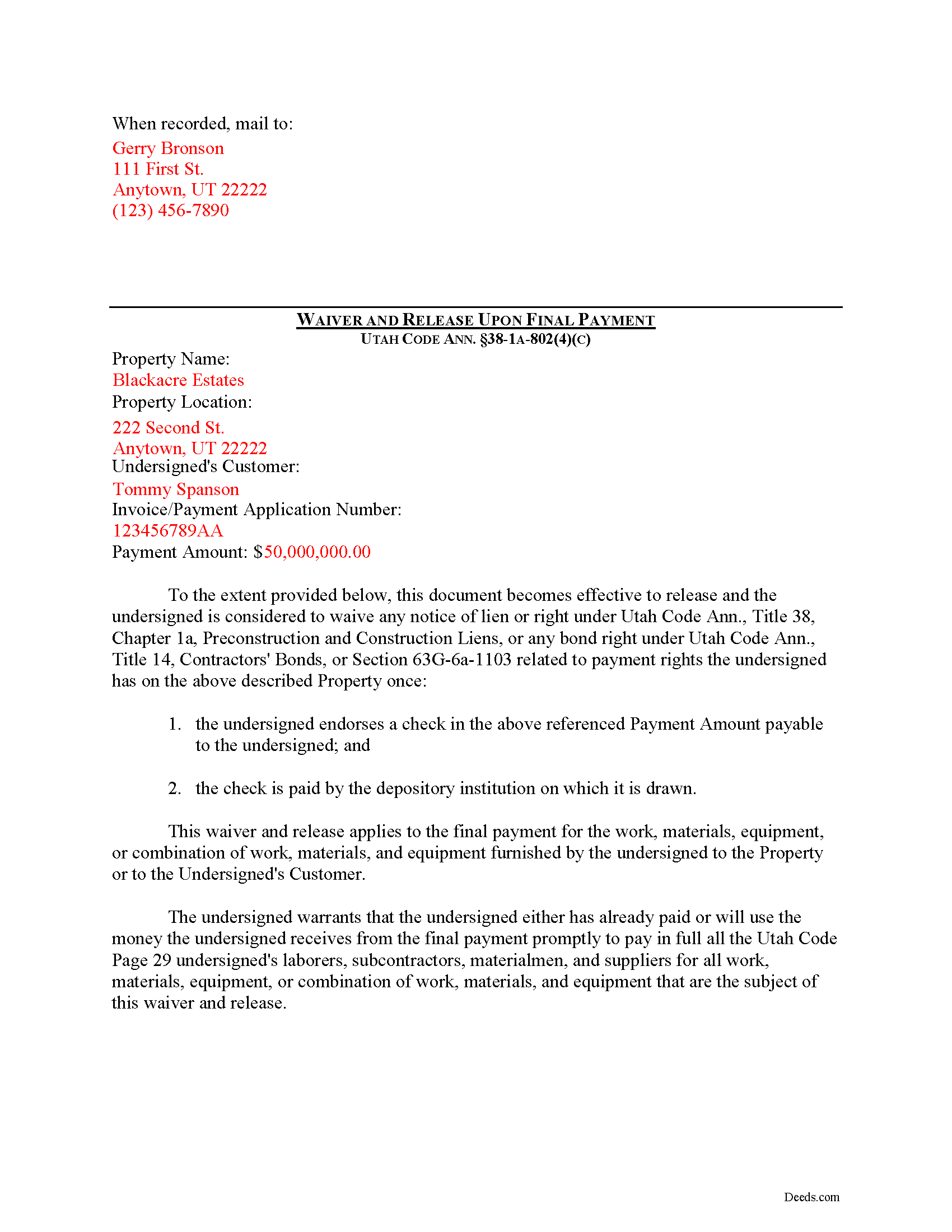

Washington County Completed Example of the Waiver and Release on Final Payment Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Utah and Washington County documents included at no extra charge:

Where to Record Your Documents

Washington County Recorder

St. George, Utah 84770

Hours: 8:00 to 5:00 M-F

Phone: (435) 634-5709

Recording Tips for Washington County:

- White-out or correction fluid may cause rejection

- Leave recording info boxes blank - the office fills these

- Both spouses typically need to sign if property is jointly owned

- Recorded documents become public record - avoid including SSNs

- Make copies of your documents before recording - keep originals safe

Cities and Jurisdictions in Washington County

Properties in any of these areas use Washington County forms:

- Central

- Dammeron Valley

- Enterprise

- Gunlock

- Hildale

- Hurricane

- Ivins

- La Verkin

- Leeds

- New Harmony

- Pine Valley

- Rockville

- Saint George

- Santa Clara

- Springdale

- Toquerville

- Veyo

- Virgin

- Washington

Hours, fees, requirements, and more for Washington County

How do I get my forms?

Forms are available for immediate download after payment. The Washington County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Washington County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Washington County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Washington County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Washington County?

Recording fees in Washington County vary. Contact the recorder's office at (435) 634-5709 for current fees.

Questions answered? Let's get started!

In Utah, mechanic's liens are governed under Title 38, Chapter 1A of the Utah Code. Throughout the construction process, claimants may elect to serve the property owner with a lien waiver in exchange for partial or full payment. Title 38, Chapter 1a, Section 802 sets forth requirements for lien waivers.

The term "waiver" refers to giving up a legal right. In this case, the person granting the waiver is giving up the right to seek a mechanic's lien for all or part of the amount due. This assurance is usually enough to induce the other party to pay. In many states, waivers can be conditional or unconditional. In Utah, however, all lien waivers are conditional, meaning if the payment given in exchange for any waiver and release of lien is made by check; and the check fails to clear the depository institution on which it is drawn for any reason, the waiver and release is void. Id. In contrast to other states, Utah offers stronger protection for contractors using lien waivers.

A claimant's written consent that waives or limits the claimant's lien rights is enforceable only if the claimant executes a waiver and release that is signed by the claimant or an authorized agent; or for a restrictive endorsement on a check, includes a restrictive endorsement on a check that is signed by the claimant or the claimant's authorized agent; and includes restrictive language that specifies that payment is for a waiver. Utah Code Ann. 38-1A-802. For any waiver to be effective, the claimant must also receive payment of the amount identified in the waiver and release or check that includes the restrictive endorsement, including payment by a joint payee check. Id.

Use the "Waiver and Release of Lien upon Final Payment" in exchange for or to induce a final payment. Utah Code Ann. 38-1A-802(4)(c). The document includes the property name (if any), property location, customer's name, invoice or payment application number, and payment amount. Id. Sign and date the document in the presence of a notary, then submit it to the local recording office if the claimant is releasing a previously filed lien. If the claimant is simply waiving lien rights, deliver the signed waiver to the customer and/or property owner in exchange for the final payment.

This article is provided for informational purposes only and should not be relied upon as a substitute for advice from an attorney. Please contact a Utah attorney with any questions regarding construction liens or lien waivers.

Important: Your property must be located in Washington County to use these forms. Documents should be recorded at the office below.

This Waiver and Release on Final Payment meets all recording requirements specific to Washington County.

Our Promise

The documents you receive here will meet, or exceed, the Washington County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Washington County Waiver and Release on Final Payment form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Daniel S.

August 28th, 2019

Fast. Easy. More than I expected. Hope it all works with MD bureaucrats.

Thank you for your feedback. We really appreciate it. Have a great day!

Jann H.

July 18th, 2019

Was helpful information

Thank you!

Laura M.

November 12th, 2023

Very easy and I appreciate that when you hover over the blank, directions pop up and tell you what to put in that blank. I also appreciated that when I lost the original password, I sent an email and Deeds.com cancelled my order, refunded my account, so that I could start over.

It was a pleasure serving you. Thank you for the positive feedback!

Mary D.

January 21st, 2022

Gift Deed is exactly what was required. Thank you!

Thank you for your feedback. We really appreciate it. Have a great day!

Tod F.

August 9th, 2019

In 15 minutes I had my out of state documents. I am very pleased with the ease of acquiring them. I will definitely be using Deeds.com again if the need arises.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Amy L B.

March 12th, 2025

easy to download forms and help is there if you need it!

Thank you, Amy! We appreciate your kind words and are glad you found the forms easy to download. Our team is always here if you ever need assistance. Thanks for choosing us!

Willie P.

May 13th, 2020

Your service was excellent

Thank you for your feedback. We really appreciate it. Have a great day!

Patricia J.

September 17th, 2020

Easy quick process to download at a reasonable price. Some good info provided.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Shari W.

July 30th, 2020

Fast and easy. Great service. Thanks.

Thank you!

Andre W.

May 20th, 2020

I was truly impress with the customer service. The young lady that assisted me was AWESOME. She was very professional,patienc was extraordinary and very knowledgable. Thank you thank you

Thank you for your feedback. We really appreciate it. Have a great day!

Eric L.

June 28th, 2021

This is a great service. The fact that there are no recurring fees and all of the supporting documents as well as the main warranty deed is another excellent feature. Highly recommend

Thank you for your feedback. We really appreciate it. Have a great day!

Laura B.

May 5th, 2020

Quick and easy! Took the hassle out of trying to locate information during this quarantine.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Susan M.

September 3rd, 2020

Outstanding service. Docs delivered to recorder as expected without issue. Happy our recorder recommended Deeds.com.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

James S.

August 26th, 2020

unbelievable Deeds Rocks Start to finish 2=Day Recommended by Coconino County Recorders office in Arizona there were incomplete sections. I would correct and resubmit . All done Yeah!!!!!!

Thank you for your feedback. We really appreciate it. Have a great day!

Cindy H.

October 22nd, 2021

Very easy to use and organized. When I needed the form I needed it immediately. I didn't want to get locked into a monthly subscription. Deeds.com met that need. Thanks!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!