Rutland County Executor Deed Form (Vermont)

All Rutland County specific forms and documents listed below are included in your immediate download package:

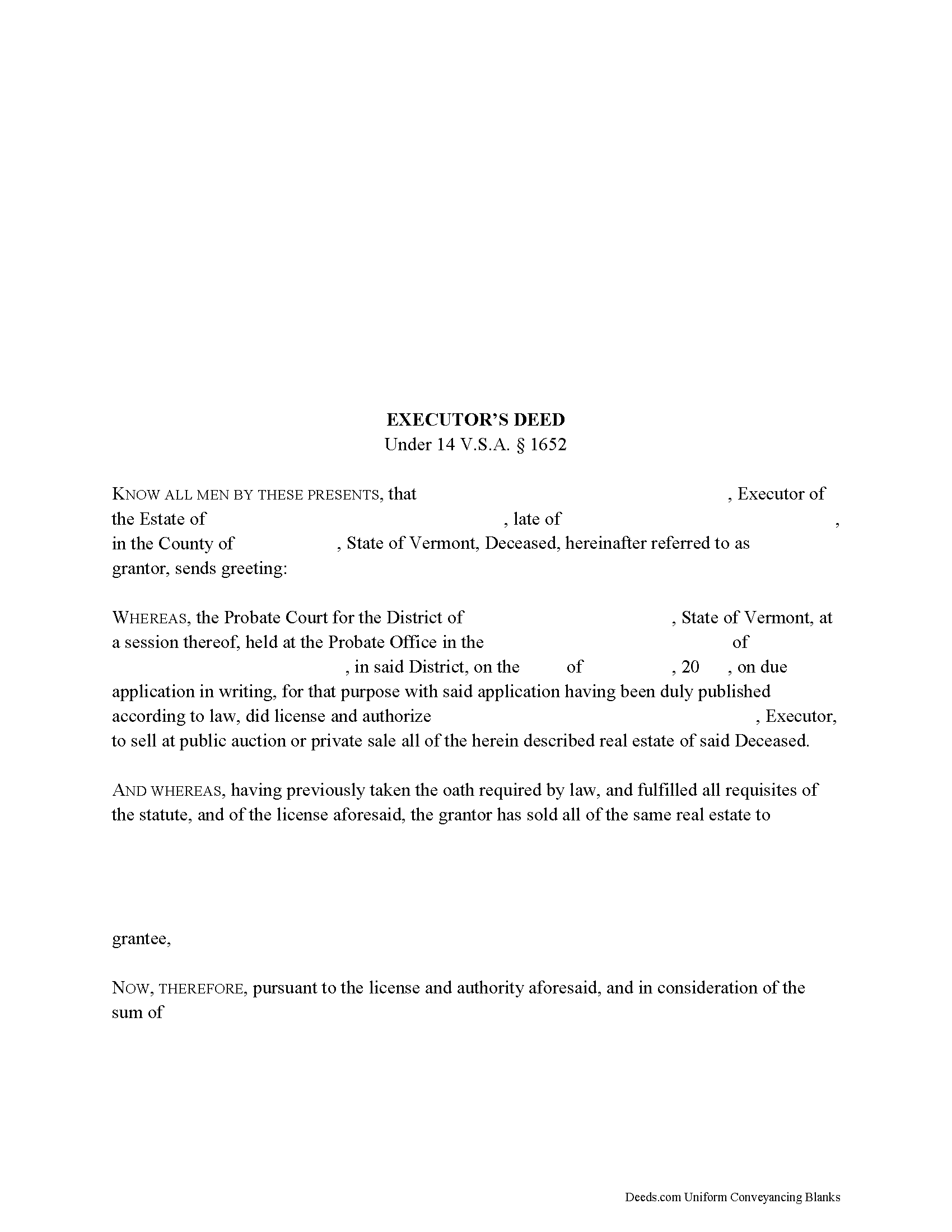

Executor Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Rutland County compliant document last validated/updated 5/23/2025

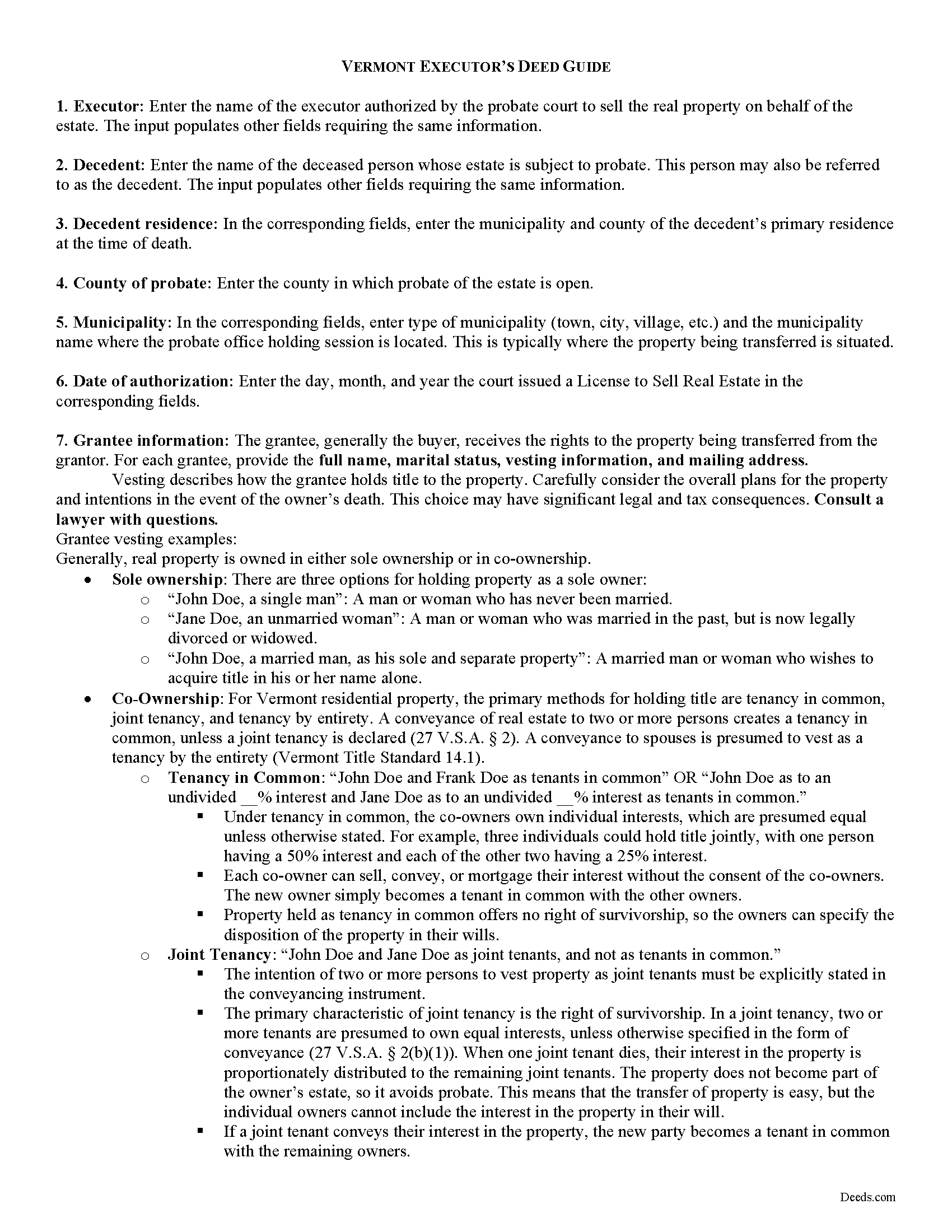

Executor Deed Guide

Line by line guide explaining every blank on the form.

Included Rutland County compliant document last validated/updated 6/17/2025

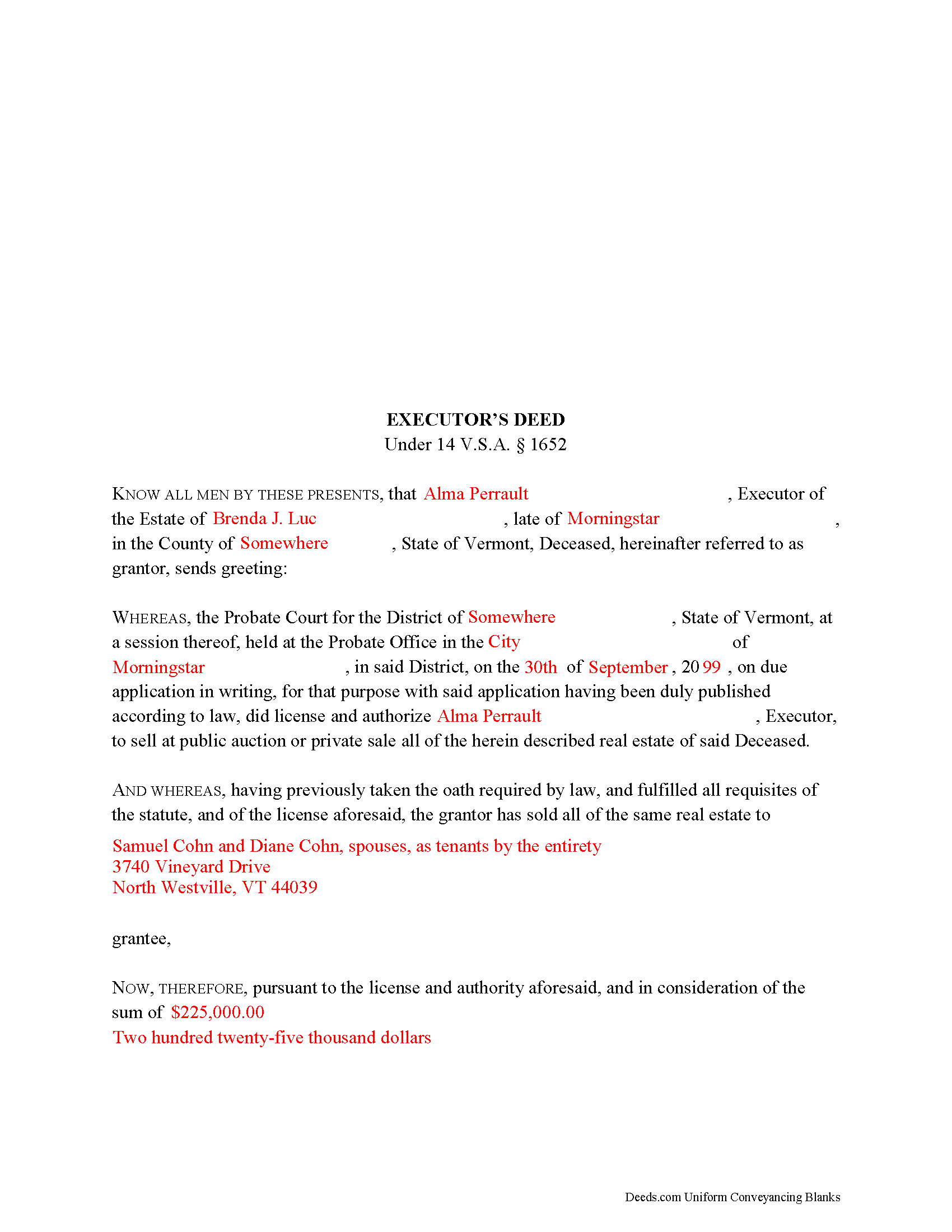

Completed Example of the Executor Deed Document

Example of a properly completed form for reference.

Included Rutland County compliant document last validated/updated 2/4/2025

The following Vermont and Rutland County supplemental forms are included as a courtesy with your order:

When using these Executor Deed forms, the subject real estate must be physically located in Rutland County. The executed documents should then be recorded in one of the following offices:

Town Clerk of Benson

2760 Stage Rd / PO Box 163, Benson, Vermont 05731

Hours: Mo, Tu, Th, Fr 9:00 to 3:00 & We 3:00 to 7:00

Phone: (802) 537-2611

Town Clerk of Brandon

49 Center St, Brandon, Vermont 05733

Hours: Mo-Fr 8:00 to 4:00

Phone: (802) 247-3635

Town Clerk of Castleton

1653 Main St / PO Box 727, Castleton, Vermont 05735

Hours: Mo-We 9:00 to 4:30; Th 10:00 to 5:30 (closed 12:30-1:00); Fr 9:00 to 1:00

Phone: (802) 468-2212

Town Clerk of Chittenden

260 Chittenden Rd / PO Box 89, Rutland, Vermont 05737

Hours: Mo-Th 9:00 to 4:00

Phone: (802) 483-6647 x1

Town Clerk of Clarendon

279 Middle Rd / PO Box 30, Clarendon, Vermont 05759

Hours: Mo-Th 10am to 4pm

Phone: (802) 775-4274

Town Clerk of Danby

130 Brook Rd / PO Box 231, Danby, Vermont 05739

Hours: Mo-Th 9am to 12pm & 1pm to 4pm

Phone: (802) 293-5136

Town Clerk of Fair Haven

3 North Park Place, Fair Haven, Vermont 05743

Hours: Mo-Th 8:00 to 4:00; We until 7:00; Fr 8:00 to 12:00

Phone: (802) 265-3610 x4

Town Clerk of Hubbardton

1831 Monument Hill Rd, Castleton, Vermont 05735

Hours: Mo, We, Fr 9am to 2pm; call on other days

Phone: (802) 273-2951

Town Clerk of Ira

53 West Rd, Ira, Vermont 05777

Hours: Tu 3:00 to 7:00 & Fr 8:30 to 2:30; or by appt

Phone: (802) 235-2745

Town Clerk of Killington

2706 River Road / PO Box 429, Killington, Vermont 05751

Hours: Mo-Fr 9:00 to 3:00

Phone: (802) 422-3243

Town Clerk of Mendon

2282 US Route 4, Mendon, Vermont 05701

Hours: Mo, Tu, Th 8:00 to 5:00

Phone: (802) 775-1662 x1

Town Clerk of Middletown Springs

10 Park Ave / PO Box 1232, Middletown Springs, Vermont 05757-1232

Hours: Mo, Tu 9:00 to 12:00 & 1:00 to 4:00, Fr 1:00 to 4:00, Sa 9:00 to 12:00

Phone: (802) 235-2220

Town Clerk of Mount Holly

50 School St / PO Box 248, Mount Holly, Vermont 05758

Hours: Mo-Th 8:30 to 4:00

Phone: (802) 259-2391

Town Clerk of Mount Tabor

522 Brooklyn Rd / PO Box 245, Mt. Tabor, Vermont 05739

Hours: Tu & We 9am to noon or by appt

Phone: (802) 293-5282 or 293-5020 (home)

Town Clerk of Pawlet

122 School St / PO Box 128, Pawlet, Vermont 05761-0128

Hours: Mo, We 8:30 to 3:30; Tu 11:00 to 6:00; Th 9:00 to noon

Phone: (802) 325-3309 x1

Town Clerk of Pittsfield

40 Village Grn / PO Box 556, Pittsfield, Vermont 05762

Hours: Tu 12pm to 6pm; We, Th 9am to 3pm

Phone: (802) 746-8170

Town Clerk of Pittsford

426 Plains Rd / PO Box 10, Pittsford, Vermont 05763-0010

Hours: Mo-We 8:00 to 4:30; Th 8:00 to 6:00; Fr 8:00 to 3:00

Phone: (802) 483-6500 x11, 12 & 13

Town Clerk of Poultney

9 Main St, Suite 2, Poultney, Vermont 05764

Hours: Mo-Fr 8:30 to 12:30 & 1:30 to 4:00

Phone: (802) 287-5761

Town Clerk of Proctor

45 Main St, Proctor, Vermont 05765

Hours: Mo-Fr 8:00 to 4:00

Phone: (802) 459-3333

City of Rutland: Clerk

City Hall - 1 Strongs Ave / PO Box 969, Rutland, Vermont 05702

Hours: Mo-Fr 8:30 to 5:00 (phone); 9:00 to 4:45 (vault)

Phone: (802) 773-1800 x5

Town of Rutland: Clerk

181 Business Rte 4, Ctr Rutland, Vermont 05736

Hours: Mo-Fr 8:00 to 4:30

Phone: (802) 773-2528

Town Clerk of Shrewsbury

9823 Cold River Rd, Shrewsbury, Vermont 05738

Hours: Mo-Th 9:00 to 3:00

Phone: (802) 492-3511

Town Clerk of Sudbury

36 Blacksmith Lane, Sudbury, Vermont 05733

Hours: Mo 9:00 to 4:00; We 7:00 to 9:00; Fr 9:00 to 3:00

Phone: (802) 623-7296

Town Clerk of Tinmouth

9 Mountainview Rd / Mail: 515 North End Rd, Tinmouth, Vermont 05773

Hours: Mo & Th 8:00 to 12:00 & 1:00 to 5:00; most Sats 9:00 to noon; and by appt

Phone: (802) 446-2498

Town Clerk of Wallingford

75 School St, Wallingford, Vermont 05773

Hours: Mo-Th 8:00 to 4:30; Fr 8:00 to 12:00

Phone: (802) 446-2336

Town Clerk of Wells

108 VT Rte 30 / PO Box 585, Wells, Vermont 05774

Hours: Mo-Th 7:30 to 3:30

Phone: (802) 645-0486 x10

Town Clerk of West Haven

2919 Main Rd, West Haven, Vermont 05743

Hours: Mo & We 1:00 to 3:30

Phone: (802) 265-4880

Town Clerk of West Rutland

35 Marble St, West Rutland, Vermont 05777

Hours: Mo-Th 9:00 to 3:00; Friday by appointment

Phone: (802) 438-2204

Local jurisdictions located in Rutland County include:

- Belmont

- Benson

- Bomoseen

- Brandon

- Castleton

- Center Rutland

- Chittenden

- Cuttingsville

- Danby

- East Poultney

- East Wallingford

- Fair Haven

- Florence

- Forest Dale

- Hydeville

- Killington

- Middletown Springs

- Mount Holly

- North Clarendon

- Pawlet

- Pittsfield

- Pittsford

- Poultney

- Proctor

- Rutland

- Wallingford

- Wells

- West Pawlet

- West Rutland

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Rutland County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Rutland County using our eRecording service.

Are these forms guaranteed to be recordable in Rutland County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Rutland County including margin requirements, content requirements, font and font size requirements.

Can the Executor Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Rutland County that you need to transfer you would only need to order our forms once for all of your properties in Rutland County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Vermont or Rutland County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Rutland County Executor Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Probate is the court-supervised process of settling an estate and distributing the remaining assets to beneficiaries following a property owner's death. An executor is a personal representative named in the decedent's will to administer his estate.

By operation of law, the title of a decedent passes to her devisees or heirs upon death, subject to a lien of the personal representative for payment of debts, expenses of administration, and other expenses legally chargeable against the estate.

If the decedent's debts outweigh his assets, the executor must sell property from the estate. Personal representatives of an estate may not sell real property without first obtaining a license from the probate division of the superior court. Following petition by the executor, the Register of the probate court executes and records the license in the land records of the town or city where the property to be sold is situated.

Following a sale of real property, the executor executes and records an executor's deed under 14 V.S.A. 1652. The deed contains covenants of special warranty, whereby the executor warrants to defend the title against claims stemming from the time the decedent held title to the property, but not before. The executor also covenants that he is lawfully seized of the property and has been authorized by the court to convey it.

A deed by executor also recites facts about the probated estate, such as the location where it is opened, the date of petition for license to sell, the probate docket number, and a reference to the location where the license is on record. The deed should also meet all state and local standards for content and format of recorded conveyances of real property, such as the grantee's name, address, and vesting information, the consideration the grantee is paying for the transfer of title, a legal description of the property conveyed, the source of the decedent's title to the property, and a list of any restrictions on the property.

The executor must sign the deed in the presence of a notary public or other authorized officer before recording in the appropriate town or city clerk's office. At the time of recording, submit a Vermont Property Transfer Tax Return, with tax remitted to the Vermont Department of Taxes, unless exempt under 32 V.S.A. 9603. In general, anyone who sells property in Vermont that was held by the seller for less than six years is required to file a Vermont Land Gains Tax Return (Form LGT-178) within 30 days of the sale, even if no tax is due.

Contact a lawyer with questions about probate procedures and executor's deeds in Vermont, as each situation is unique.

(Vermont Executor Deed Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Rutland County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Rutland County Executor Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4562 Reviews )

MARY LACEY M.

June 30th, 2025

Great service! Recording was smooth and swiftly performed. Deeds.com is an excellent service.rn

We are delighted to have been of service. Thank you for the positive review!

Robert F.

June 30th, 2025

Breeze.... It feels silly to hire an attorney to do this for just one beneficiary. Thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

Pauline C.

June 29th, 2025

Everything that was stated to be included in my order was complete. Very satisfied

Thank you for your positive words! We’re thrilled to hear about your experience.

Deneene C.

April 17th, 2020

Was a great help to me. I'm very pleased .

Thank you!

Elaine D.

January 15th, 2021

Easement deed contract was easy to complete, however after additional research raises some concerns because the Ohio deed does not list a requirement for witness signatures and does not provide lines or an area for witness signatures. The document does provide the necessary area for the notary information and the grantor and grantee.

Thank you for your feedback. We really appreciate it. Have a great day!

Pietrina P.

December 18th, 2020

Recording with Deeds.com was a seamless experience. Communications were timely, clear and professional. When I had a question, I received a prompt email reply. Overall an excellent experience

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

MARY LACEY M.

May 28th, 2025

Deeds.com has become a great assistant to our firm! The service is of highest quality and consistently helpful to our law firm in its recording needs. It's summer in Arizona and no one I know wants to drive to downtown Phoenix to record a property deed so think I will add "grateful" to my praise.

Thank you, Mary! We appreciate your kind words and are glad to help make recording easier — especially when it means avoiding a summer trip to downtown Phoenix. We’re grateful for your continued trust.

Denise G.

May 7th, 2020

It would be helpful if an email was sent to notify you of any additional invoices needed, documents were accepted and/or recorded. It is not always convenient to check your website on a daily basis to determine the status of the requesting recordings.

Thank you for your feedback. We really appreciate it. Have a great day!

STEPHEN C.

January 22nd, 2020

Excellent service. Easy to use. Thank you.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Robin M.

November 22nd, 2019

Thank you for your services...Attny office quoted a very large fee for the "TOD DEED" process, so this is very helpful that I am able to take care of this myself. If I would have researched your link sooner, I could have saved my Dad a lot of money for the "SURVIVORSHIP DEED". Thanks again & have a wonderful day:)

Thank you for your feedback. We really appreciate it. Have a great day!

Tim G.

April 23rd, 2020

Pretty good all in all. I do wish I could download forms to a word doc instead of a .pdf. Word is more 'accessable'.

Thank you!

Giustino C.

May 27th, 2020

I am pleased with this electronic service in making a time sensitive deed transfer since very few options exist currently with the Covid 19 Crisis. This was the only rapid and available option to record the deed transfer and the fee was reasonable. I was able to upload my notarized and executed document and had a record number as well as the official document within 24 hours. It was simple and easy to use. Thank you deeds.com!!

Thank you Giustino, glad we could help.

Jim A.

January 26th, 2022

Your website is user friendly and when I brought up issues they were quickly addressed. thank you so much! jim atkinson

Thank you!

Carl S.

February 29th, 2020

Five Stars!

Thank you!

Michael S.

August 7th, 2024

So convenient.

Knowing our customers are happy is our top priority. Thank you for the wonderful feedback!