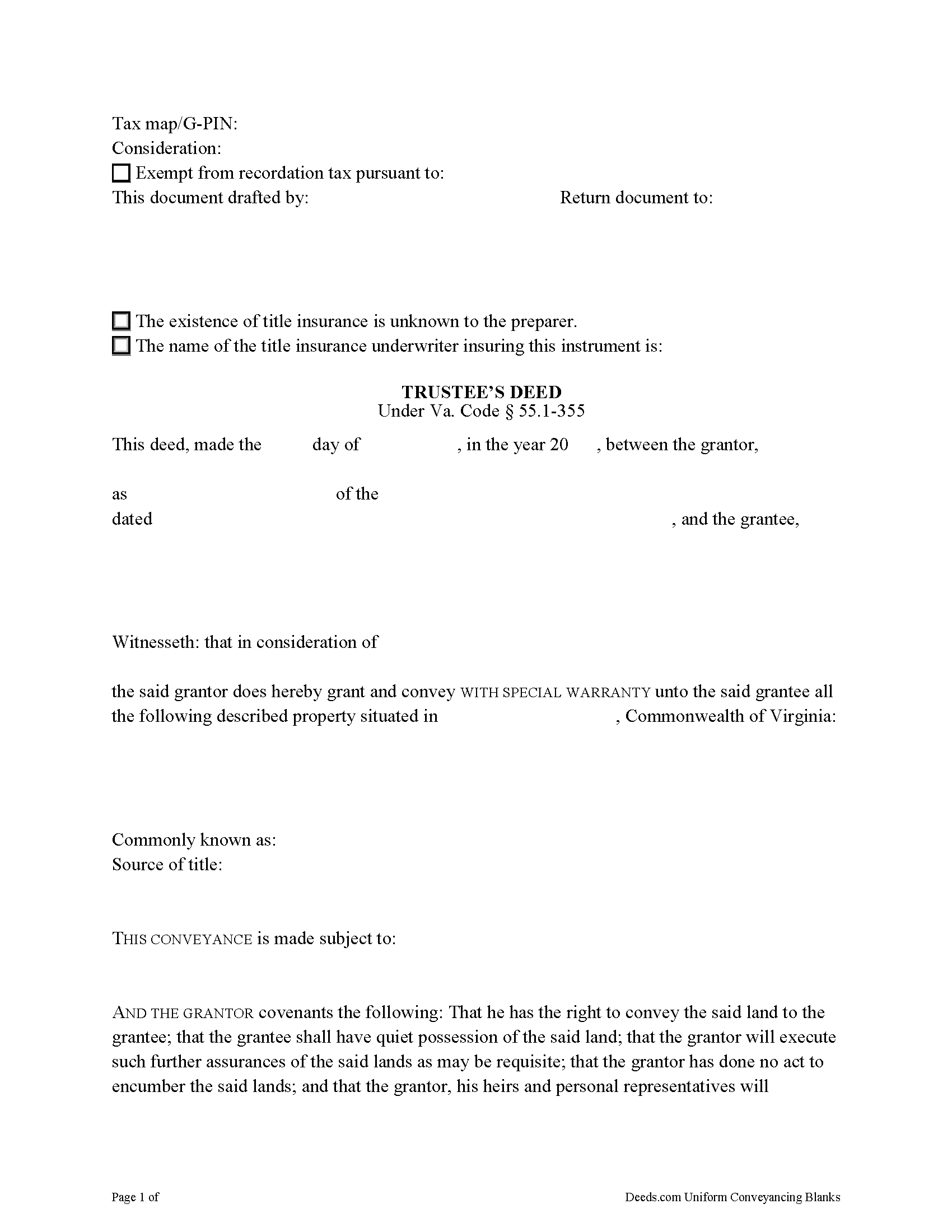

Warren County Trustee Deed Form

Warren County Trustee Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

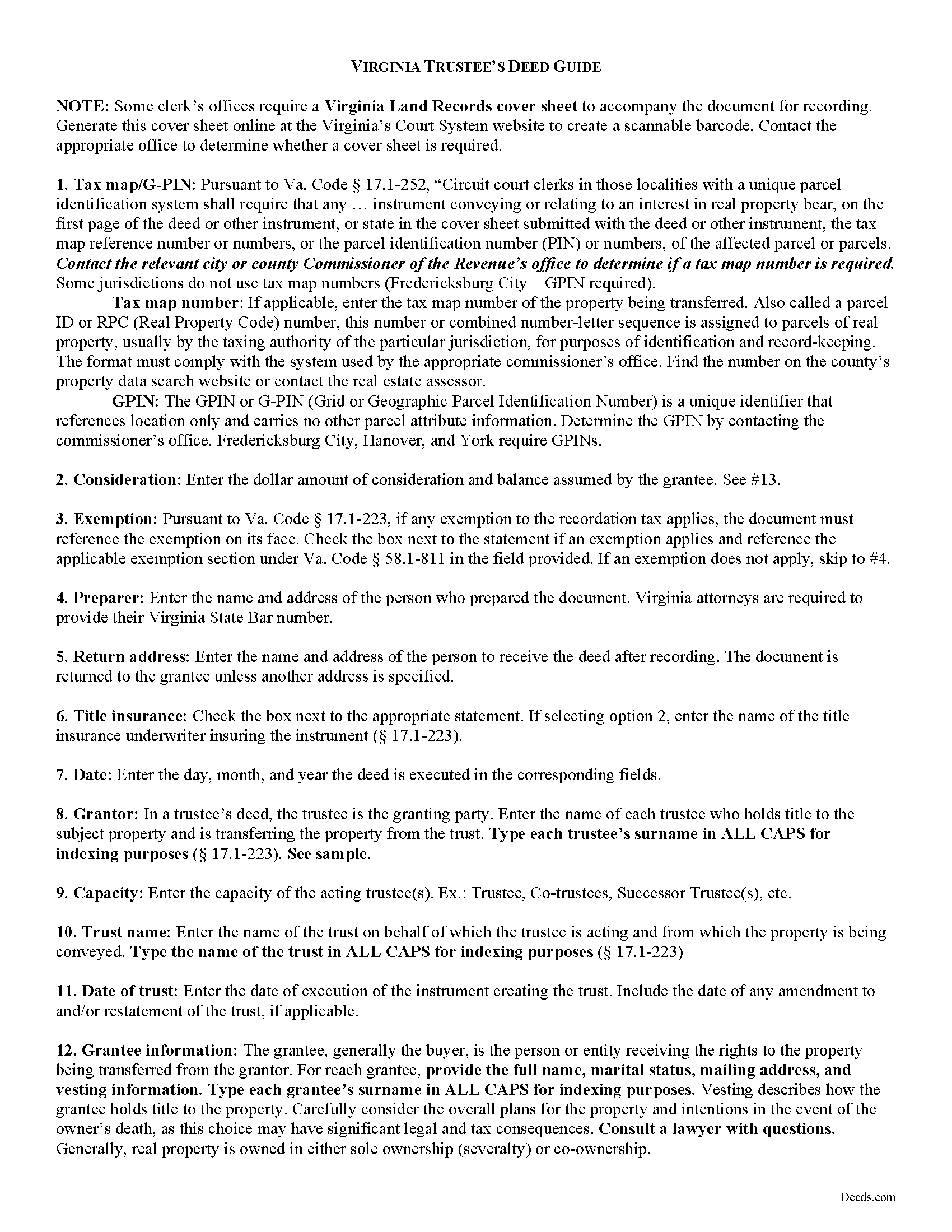

Warren County Trustee Deed Guide

Line by line guide explaining every blank on the form.

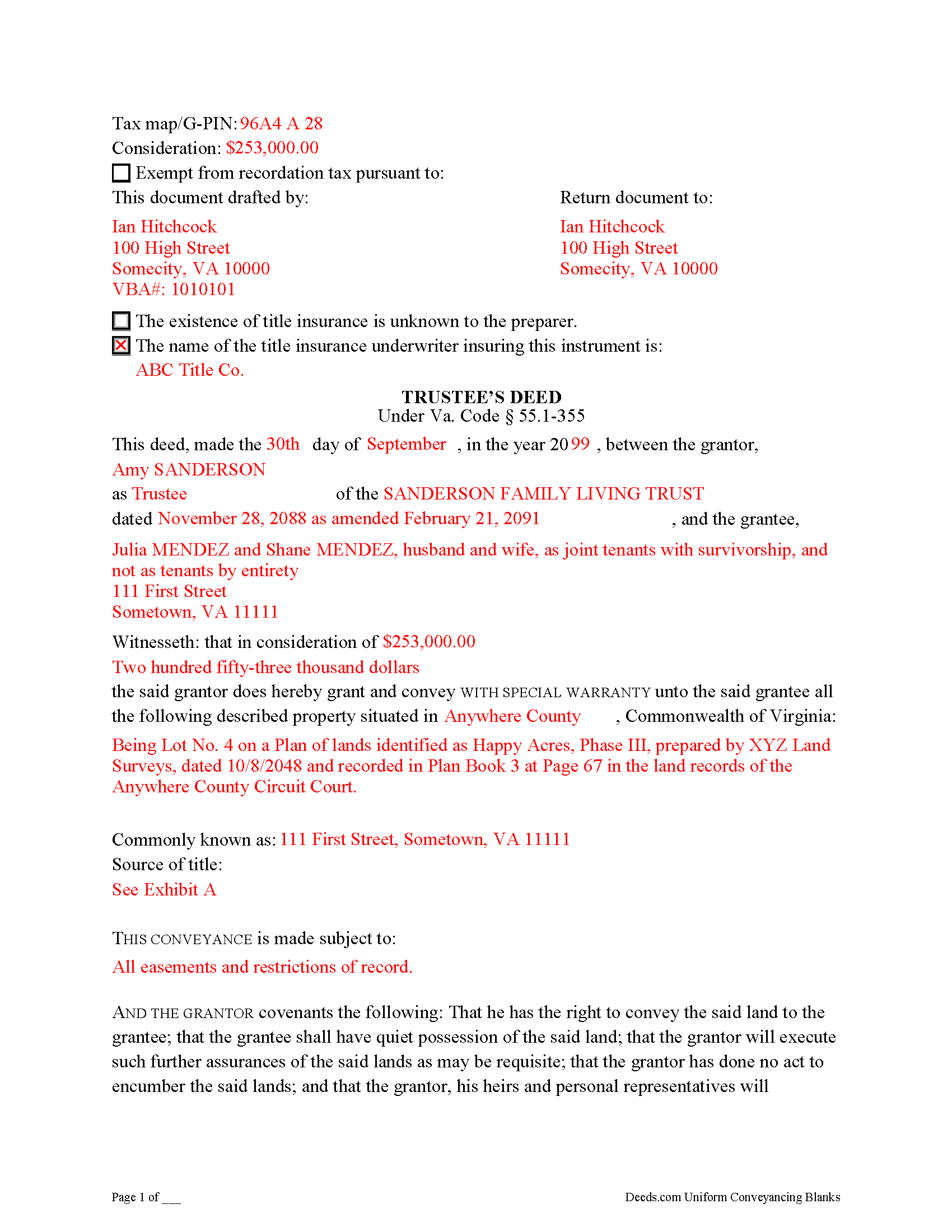

Warren County Completed Example of the Trustee Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Virginia and Warren County documents included at no extra charge:

Where to Record Your Documents

Warren County Circuit Court Clerk

Front Royal, Virginia 22630

Hours: 9:00am to 5:00pm M-F

Phone: (540) 635-2435

Recording Tips for Warren County:

- Ask if they accept credit cards - many offices are cash/check only

- Recording fees may differ from what's posted online - verify current rates

- Consider using eRecording to avoid trips to the office

- Ask about accepted payment methods when you call ahead

Cities and Jurisdictions in Warren County

Properties in any of these areas use Warren County forms:

- Bentonville

- Front Royal

- Linden

- Middletown

Hours, fees, requirements, and more for Warren County

How do I get my forms?

Forms are available for immediate download after payment. The Warren County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Warren County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Warren County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Warren County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Warren County?

Recording fees in Warren County vary. Contact the recorder's office at (540) 635-2435 for current fees.

Questions answered? Let's get started!

Transferring Real Property from a Living Trust Using a Virginia Trustee's Deed

A trustee's deed conveys interest in real property held in a living (inter vivos) trust. The deed is named for the granting party, the trustee, who holds legal title to property contributed to the trust by the trust's settlor. A settlor is any person who creates or contributes property to a trust by transferring it to another. Property held in trust is administered by the trustee for the benefit of a trust beneficiary. In most living trusts, the settlor designates himself as trustee and names a successor, who will take over fiduciary duties upon the settlor's death or incapacitation.

The trust is established by a written instrument executed by the settlor and governed by the Uniform Trust Code, codified in Virginia at Va. Code Ann. 64.2-7. The trust instrument contains the terms of the trust and sets forth the settlor's estate plan. The document names the trustees and enumerates the trustee's powers in acting on behalf of the trust, and designates the trust beneficiary or beneficiaries. Generally, the settlor designates himself as the living trust's beneficiary during his lifetime, and identifies another in the trust instrument who will receive the benefit of the trust's assets upon his death.

Trustees rely on the terms of the trust instrument and statutory trustee powers to convey property held in trust. A deed executed by trustee to convey real property from a trust typically carries a special warranty covenant of title. This means that the grantor promises to warrant and defend the property for the grantee "against the claims and demands of the grantor, and all persons claiming or to claim by, through, or under him" (Va. Code Ann. 55.1-355). Because the trustee is acting "in a fiduciary capacity," a narrower covenant than a general warranty is offered "to warrant title [only] during the time they had legal possession of it" [1].

A trustee's deed requires additional information because the grantor is acting in a fiduciary capacity. When real property is held in trust, the assets vest in the name of the trustee on behalf of the trust. Therefore, the trustee's deed names the acting trustee, the trust, and the date of the trust when reciting the grantor's information. The trustee's deed should comply with the statutory form for deeds and satisfy recording requirements for documents pertaining to interest in real property in Virginia (55.1-300, 17.1-223 et seq.). A trustee may provide a certification of trust under 64.2-804 to confirm the trust's existence and his authority to convey real property.

Before recording the deed in the independent city or county wherein the subject property is located, the deed must be signed by each acting trustee and acknowledged in the presence of a notary public.

(Virginia TD Package includes form, guidelines, and completed example)

Important: Your property must be located in Warren County to use these forms. Documents should be recorded at the office below.

This Trustee Deed meets all recording requirements specific to Warren County.

Our Promise

The documents you receive here will meet, or exceed, the Warren County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Warren County Trustee Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4591 Reviews )

Joseh R.

May 6th, 2020

Very pleased! Forms easy to understand and use. Thank you!

Thank you for your feedback. We really appreciate it. Have a great day!

Michelle G.

May 28th, 2021

This was a great service! I was having trouble recording something and found this was the best, and quickest, way to get it completed. Excellent service! Will definitely use them again!

Thank you for your feedback. We really appreciate it. Have a great day!

Lawrence R.

February 4th, 2020

Forms do not allow enough space for fields and cutoff. Need to expand the fields to allow for more writing. I ended up re-typing to be able to include full property description. Would be nice if available in Word format rather than only PDF format.

Thank you for your feedback. We really appreciate it. Have a great day!

Lowell P.

May 26th, 2020

Exceptionally helpful instruments that are compliant with State law and anticipate various contingencies. Very pleased.

Thank you for your feedback. We really appreciate it. Have a great day!

Matthew C.

March 29th, 2022

Your Transfer on Death Deed is fine and you have plenty of information about that part. But where is the Confirmatory Deed that is required in many jurisdictions in order to actually pass ownership of a property when the Transfer on Death Deed becomes effective? IT IS MISSING!!

Thank you for your feedback. We really appreciate it. Have a great day!

April K.

September 25th, 2022

Great service & quick response. Thank U.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Alberta W.

December 23rd, 2022

Deeds.com was user-friendly, clear, specific and complete. I used the site to create and submit a Notice of Termination form, and was able to walk it to my local county court with no major issues. It worked out perfectly.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sandra H.

February 26th, 2019

I am a retired attorney. I chanced upon this website while looking for a Florida Lady Bird Deed Form. It conforms to Florida Law and was exactly what I needed. The forms are easy to obtain and even easier to use and print out.

Thank you so much Sandra, we really appreciate your feedback.

George S.

September 16th, 2021

Excellent product- very easy to use. Will use again...

Thank you for your feedback. We really appreciate it. Have a great day!

Jina N.

January 29th, 2019

Awesome site!! You guys really make it simple to understand and access any Deeds that I need. I know you keep very up to date forms, as my county is hard core when it comes to the smallest of details, even compared to every other county across the state. Yet you made it simple and quick, and I never had to redo anything. Even the clerk was impressed that I had it filled out correctly the first time, as that usually never happened. Even the size of type/font and the margins were perfect. That saved a lot of time, money and most of all, frustration. I've recommended you to relatives, friends and co-workers. Thanks to the staff at deeds dot com !! I truly appreciate you. j

Thank you!

Daren K.

April 29th, 2019

Awesome, so far. Thanks

Thank you!

Sharla B.

November 25th, 2019

Was very helpful it helped me find out everything I needed for the deed.

Thank you!

Laurie D.

January 24th, 2024

Comforting that you include an example of a completed TOD Deed form. Just downloaded all forms for my state & county and I'm SURE this will save a paying for a massive attorney fee!

We are grateful for your feedback and looking forward to serving you again. Thank you!

richard s.

March 26th, 2020

had exactly what i needed and good price

Thank you Richard! Have an amazing day.

Connie J L.

August 26th, 2020

Fast and easy to use. Easy to print.

Thank you!