Kitsap County Mechanics Lien Notice to Construction Lender Form

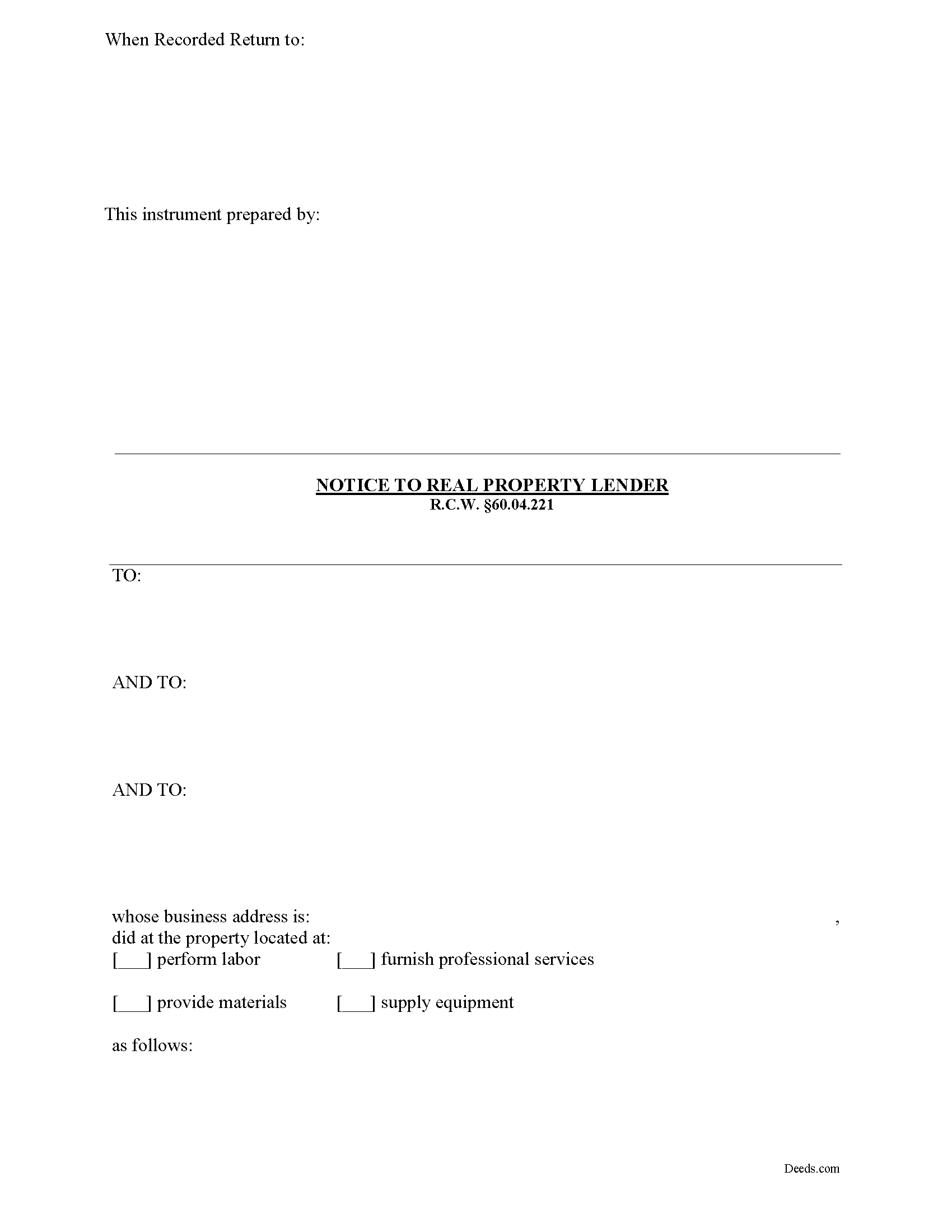

Kitsap County Mechanics Lien Notice to Construction Lender Form

Fill in the blank Mechanics Lien Notice to Construction Lender form formatted to comply with all Washington recording and content requirements.

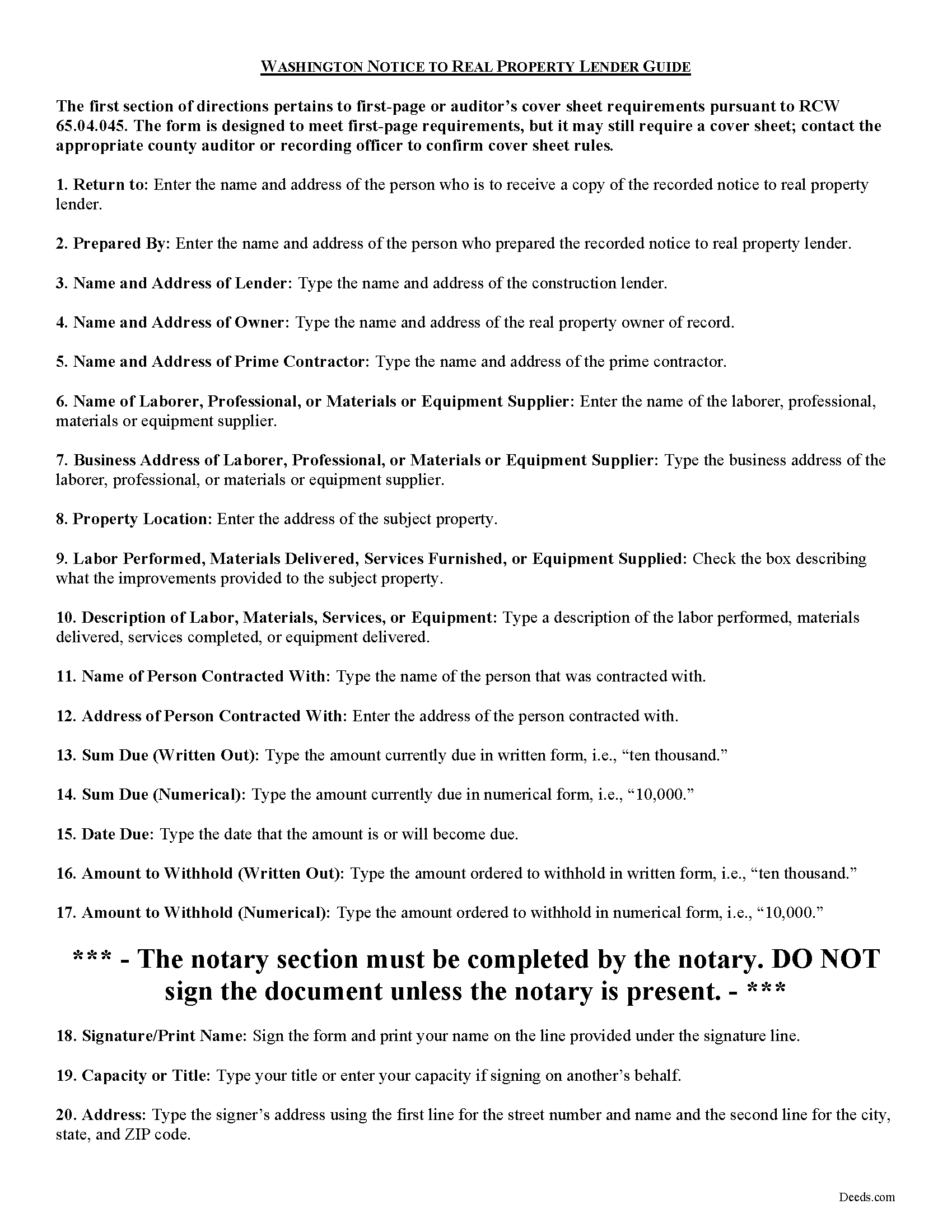

Kitsap County Notice to Construction Lender Guide

Line by line guide explaining every blank on the form.

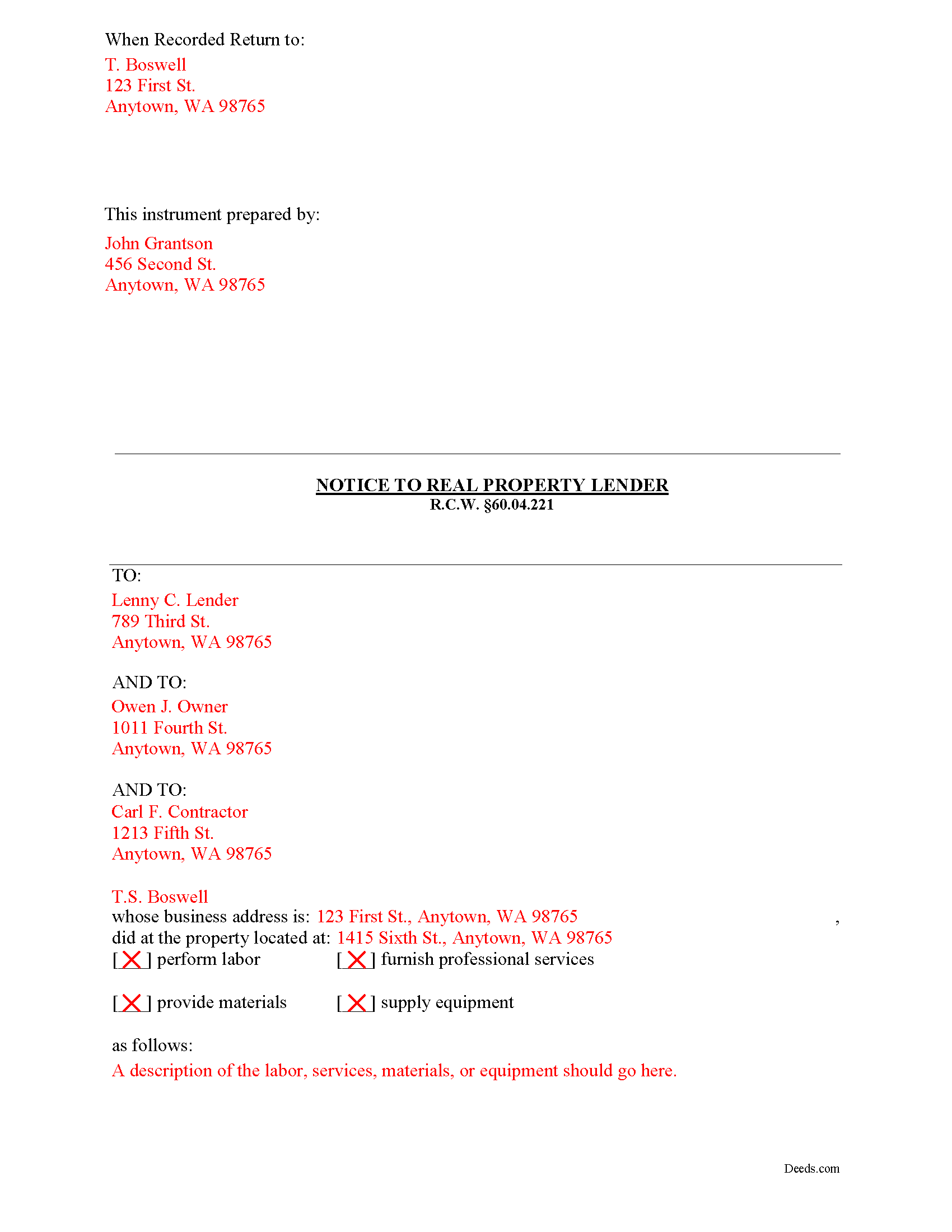

Kitsap County Completed Example of the Notice to Construction Lender Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Washington and Kitsap County documents included at no extra charge:

Where to Record Your Documents

Kitsap County Auditor: Recording

Port Orchard, Washington 98366

Hours: Monday through Friday 8:00am - 4:30pm

Phone: (360) 337-4935

Recording Tips for Kitsap County:

- Verify all names are spelled correctly before recording

- Check that your notary's commission hasn't expired

- Recorded documents become public record - avoid including SSNs

- Bring multiple forms of payment in case one isn't accepted

Cities and Jurisdictions in Kitsap County

Properties in any of these areas use Kitsap County forms:

- Bainbridge Island

- Bremerton

- Burley

- Hansville

- Indianola

- Keyport

- Kingston

- Manchester

- Olalla

- Port Gamble

- Port Orchard

- Poulsbo

- Retsil

- Rollingbay

- Seabeck

- Silverdale

- South Colby

- Southworth

- Suquamish

- Tracyton

Hours, fees, requirements, and more for Kitsap County

How do I get my forms?

Forms are available for immediate download after payment. The Kitsap County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Kitsap County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Kitsap County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Kitsap County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Kitsap County?

Recording fees in Kitsap County vary. Contact the recorder's office at (360) 337-4935 for current fees.

Questions answered? Let's get started!

Getting a Construction Lender to Withhold Funds

As part of the construction lien process, you might find it useful to send a notice to the construction lender ordering the lender to withhold distribution of funds from the loan proceeds until you are paid. This is another potential weapon in the lien claimant's arsenal. In some states, this notice is called as a "stop notice" because it instructions the lender to stop payment. The notice can be used as a first step or as an alternative to securing a mechanic's lien.

Any potential lien claimant who has not received a payment within five days after the date required by their contract, invoice, employee benefit plan agreement, or purchase order may give a notice to a construction lender within thirty-five days of the date required for payment of the contract, invoice, employee benefit plan agreement, or purchase order. See R.C.W. 60.04.221(1).

The notice must be signed by the potential lien claimant or some person authorized to act on his or her behalf. R.C.W. 60.04.221(2). The notice must be provided in writing to the lender at the office administering the construction financing, along with a copy given to the owner and the appropriate prime contractor. R.C.W. 60.04.221(3).

Two methods can be used to serve the notice: (1) mailing the notice by certified or registered mail to the lender, owner, and appropriate prime contractor; or (2) delivering or serving the notice personally and obtaining evidence of delivery in the form of a receipt or other acknowledgment signed by the lender, owner, and appropriate prime contractor, or an affidavit of service. Id.

The notice must include the following information: (1) the name of the person, firm, trustee, or corporation filing the notice, (2) the name of the prime contractor, common law agent, or construction agent ordering the same, (3) a common or street address of the real property being improved or the legal description of the real property, and (4) the name, business address, and telephone number of the lien claimant. R.C.W. 60.04.221(4).

After the lender receives a copy of the notice, the lender must then withhold from the next and subsequent draws the amount claimed to be due as stated in the notice. R.C.W. 60.04.221(5). Alternatively, the lender may obtain from the prime contractor or borrower a payment bond for the benefit of the potential lien claimant in an amount sufficient to cover the amount stated in the potential lien claimant's notice. Id. The lender is obligated to withhold amounts only to the extent that sufficient interim or construction financing funds remain undisbursed as of the date the lender receives the notice. Id.

Once the notice is received by the lender, sums that are withheld shall not be disbursed by the lender, except by the written agreement of the potential lien claimant, owner, and prime contractor, or court order. R.C.W. 60.04.221(6).

If the lender fails to abide by the terms of the notice, then the mortgage, deed of trust, or other encumbrance securing the lender will be made secondary to the lien of the potential lien claimant to the extent of the interim or construction financing wrongfully disbursed, but in no event more than the amount stated in the notice plus costs as fixed by the court, including reasonable attorneys' fees. R.C.W. 60.04.221(7).

Use caution in drafting the notice to the lender and ensure the form is accurate. If there are mistakes, any potential lien claimant will be liable for any loss, cost, or expense, including reasonable attorneys' fees and statutory costs, to a party injured thereby arising out of any unjust, excessive, or premature notice that is filed. R.C.W. 60.04.221(8).

This article is provided for informational purposes only and should not be relied upon as a substitute for the advice of an attorney. If you have any questions about the notice to lender document or any other issues related to liens, please consult with a Washington attorney.

Important: Your property must be located in Kitsap County to use these forms. Documents should be recorded at the office below.

This Mechanics Lien Notice to Construction Lender meets all recording requirements specific to Kitsap County.

Our Promise

The documents you receive here will meet, or exceed, the Kitsap County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Kitsap County Mechanics Lien Notice to Construction Lender form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Beverly A.

June 13th, 2019

The forms are incredibly easy to fill out. Thanks for the examples!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Charles S.

February 14th, 2025

very happy with guidance and responses - thank you - not finished yet but confident

We are sincerely grateful for your feedback and are committed to providing the highest quality service. Thank you for your trust in us.

KATHLEEN S.

January 21st, 2021

Excellent service, great feedback and recommendations by the deed preparer, and I really appreciate the personalized service. The website is amazing, everything is well thought out, and all messages are saved, clear and easy to read. I wish my website was so easy to navigate! Seriously, the person who worked on my account is awesome. They made recommendations about what to include and what not to include. They didn't make me feel dumb for asking questions about out-of-state service and filing procedures, and I will be using Deeds.com exclusively on my cases. Five stars !

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Martha V.

August 30th, 2020

Great service!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Cruz C.

December 8th, 2020

L-o-v-e your site. Great over-all usable docs. thanks

Thank you for your feedback. We really appreciate it. Have a great day!

John C.

April 14th, 2019

Excellent find (Deeds.com) from a google search, first hit. This was exactly what we were looking for. It also got me to upgrade Adobe to be able to fill in the forms. Will be back for follow up as needed, but I think I got everything we needed in the first downloads. Appreciate a well done site like yours. Thanks John

Thank you for your feedback. We really appreciate it. Have a great day!

Ronald C.

January 31st, 2019

My goal was to find the Covenant, Conditions, and Restrictions for my HOA. From what I can read, these documents should be attached to our Deed (single family, patio home in New Hanover County). I am not sure if I have a copy of my Deed. I would need to check my Safe Deposit Box. Unfortunately, I was not successful at finding these documents from your Website. If you can help me find them, I would appreciate that.

It is most common to obtain a copy of CC&Rs directly from the HOA. Alternatively, they are also usually a matter of public record recorded with the local recorder and you can obtain a copy there.

Sara R.

June 19th, 2019

Worked well for me to create a deed for a house I inherited. It was very thorough and easy to use. I have no experience with the law so I just googled terms I didn't understand and was fine. I also called land records a lot and ended up not needing a lot of the material included, but it was still good to have it.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Tiqula D.

July 14th, 2021

Deeds.com is beyond convenient! It's a wonderful service for all your recording needs. The service is beyond fast and professional. Easy as 1 2 3....

Thank you for your feedback. We really appreciate it. Have a great day!

Sheryl B.

March 2nd, 2019

Great forms. Just what I needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Krissyn S.

November 29th, 2021

It was so easy to find, download, and use the form I needed. Literally took about 5 minutes and I was ready to go. I loved that the download included a sample form and a guide to help fill out the form properly.

Thank you for your feedback. We really appreciate it. Have a great day!

Ed S.

October 1st, 2021

This is the first time that I have used this service. An employee at the Clerk and Register office in Arizona suggested that I try Deeds.com to find the form I needed and the county office could not provide. I am a licensed Realtor in Colorado with a 43-year career and this service has not been necessary in my own state but it was extremely helpful in finding a form in Arizona. Five star rating for the very user-friendly website!

Thank you for your feedback. We really appreciate it. Have a great day!

tamica l.

March 31st, 2022

Excellent Service! Fast and friendly. Thank you will use again!

Thank you!

Gerry V.

March 9th, 2021

Easy to use, fast and reliable. love deeds.com

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jimmy P.

November 20th, 2024

They sent me everything I would need to do this. Easy purchase -Easy download. Great!! I'll be back here for all my document needs.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!