Snohomish County Transfer on Death Deed Form (Washington)

All Snohomish County specific forms and documents listed below are included in your immediate download package:

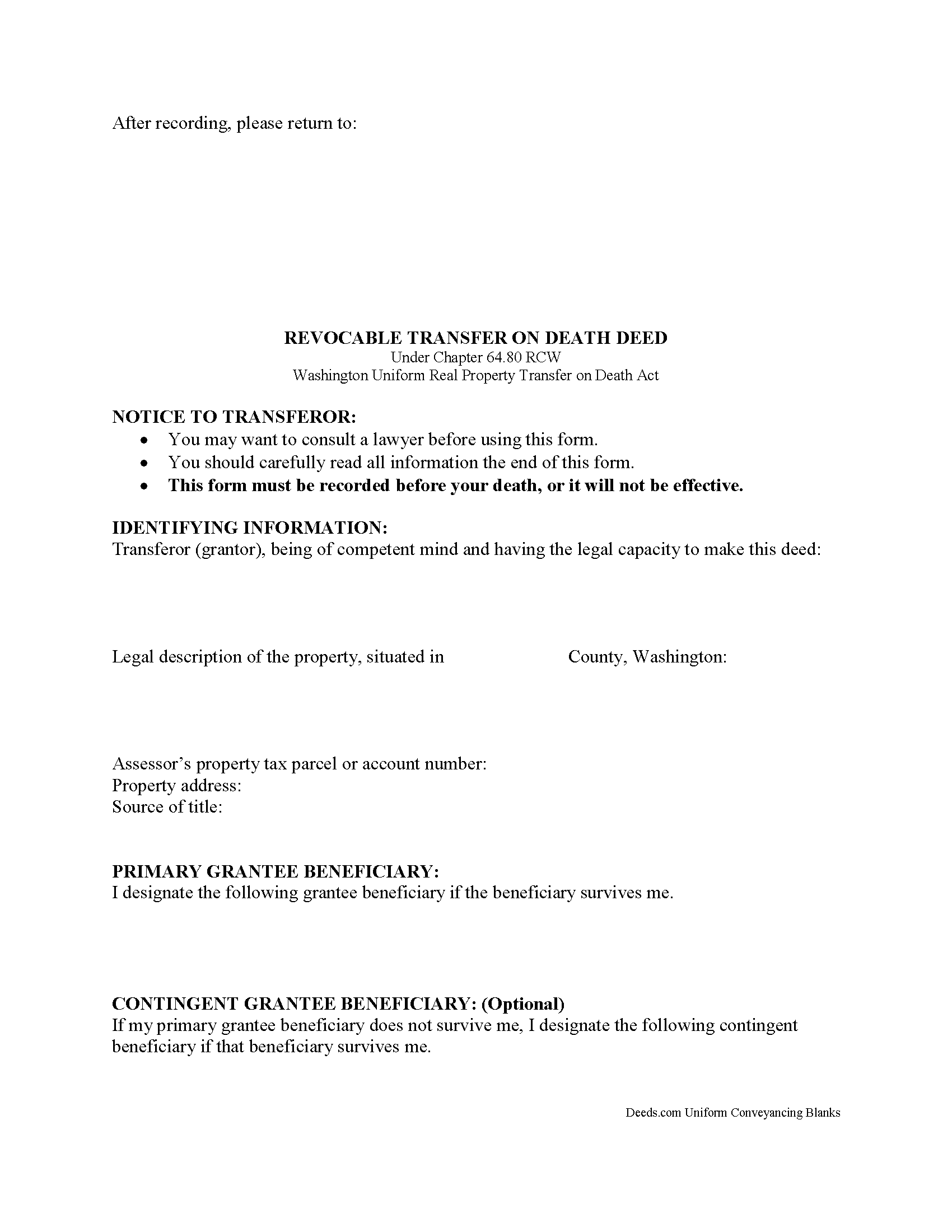

Transfer on Death Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Snohomish County compliant document last validated/updated 6/17/2025

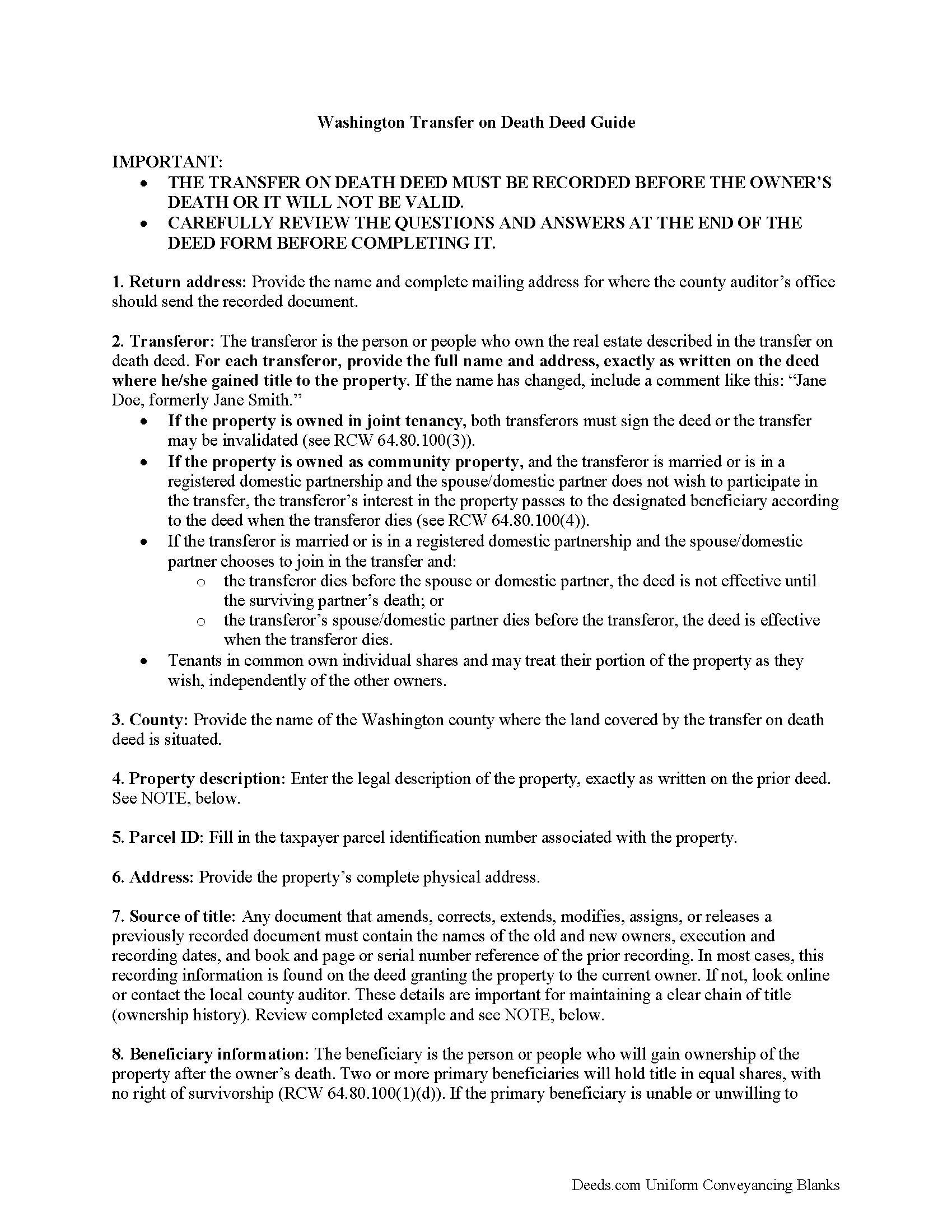

Transfer on Death Deed Guide

Line by line guide explaining every blank on the form.

Included Snohomish County compliant document last validated/updated 1/23/2025

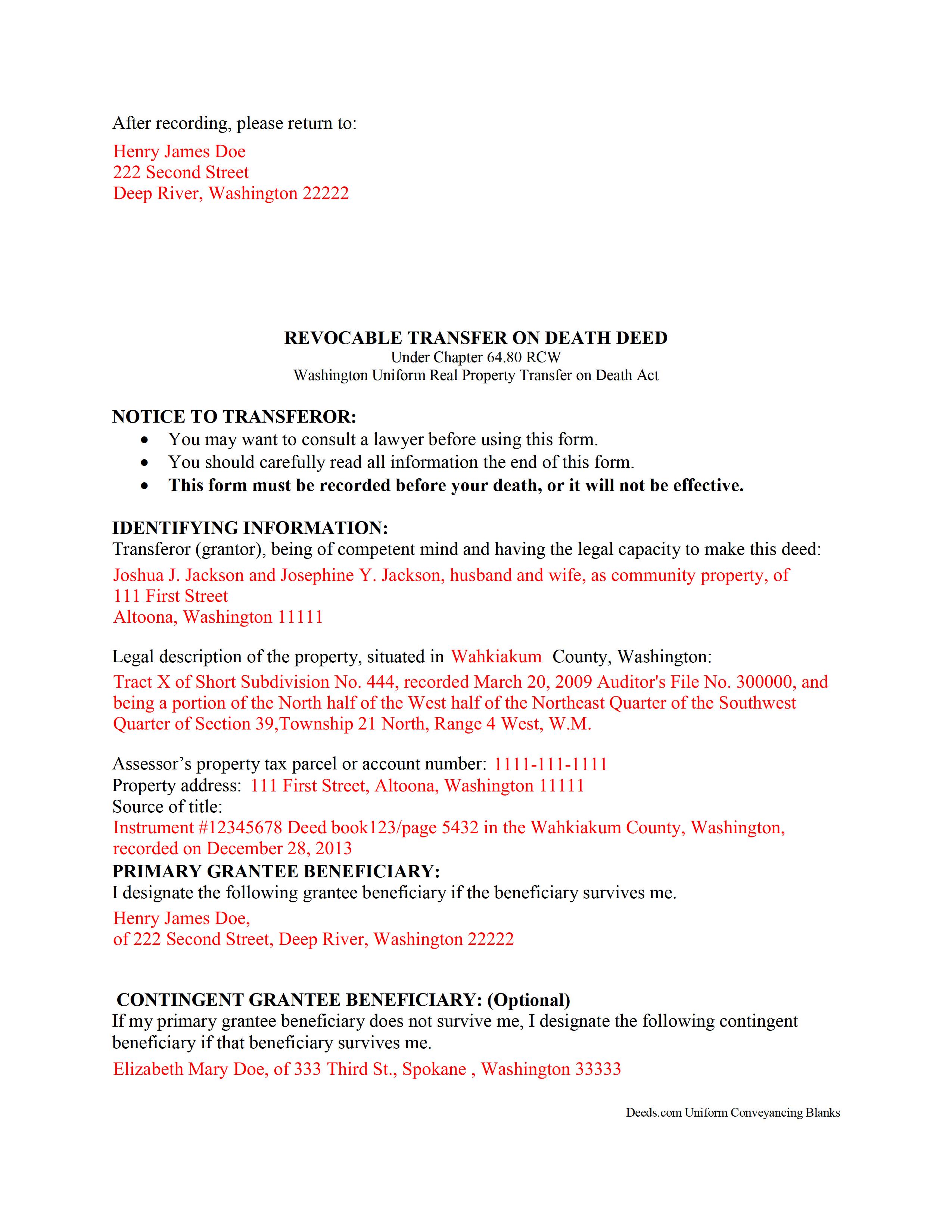

Completed Example of the Transfer on Death Deed Document

Example of a properly completed Washington Transfer on Death Deed document for reference.

Included Snohomish County compliant document last validated/updated 6/16/2025

The following Washington and Snohomish County supplemental forms are included as a courtesy with your order:

When using these Transfer on Death Deed forms, the subject real estate must be physically located in Snohomish County. The executed documents should then be recorded in the following office:

Snohomish County Auditor: Recording

Robert J. Drewel Building - 3000 Rockefeller Ave, 1st floor, Everett, Washington 98201

Hours: Mon-Thu 9:00-12:00 & 1:00-5:00; Fri 9:00-12:00 & 1:00-4:00

Phone: (425) 388-3483

Local jurisdictions located in Snohomish County include:

- Arlington

- Bothell

- Darrington

- Edmonds

- Everett

- Gold Bar

- Granite Falls

- Index

- Lake Stevens

- Lynnwood

- Marysville

- Mill Creek

- Monroe

- Mountlake Terrace

- Mukilteo

- North Lakewood

- Silvana

- Snohomish

- Stanwood

- Startup

- Sultan

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Snohomish County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Snohomish County using our eRecording service.

Are these forms guaranteed to be recordable in Snohomish County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Snohomish County including margin requirements, content requirements, font and font size requirements.

Can the Transfer on Death Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Snohomish County that you need to transfer you would only need to order our forms once for all of your properties in Snohomish County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Washington or Snohomish County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Snohomish County Transfer on Death Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Real estate owners in Washington have an estate planning option: the transfer on death deed (TODD). Find the full text in the Revised Statutes of Washington at Chapter 64.80.

This statute is based on the Uniform Real Property Transfer on Death Act (URPTODA). Along with Washington, a growing number of states are choosing to adopt the provisions of the URPTODA. The new law allows landowners to direct the distribution of what is often their most significant asset, their real estate, with a correctly executed and recorded transfer on death deed.

Transfer on death deeds are nontestamentary, which means ownership of the property passes to the beneficiary without instructions in a will or the need for probate (64.80.040). Unnecessary conflicts are likely to add confusion and expense, so best practices dictate that landholders should take care to ensure that their wills and TODDs lead to the same outcomes.

Washington's version of the URPTODA sets out the specific requirements for lawful transfer on death deeds:

- The capacity required to make or revoke a transfer on death deed is the same as the capacity required to make a will (64.80.050, 11.12.010).

- It must contain the essential elements and formalities of a properly recordable inter vivos deed, such as warranty or quitclaim deed (64.80.060(1))

- It must state that the transfer to the designated beneficiary is to occur at the transferor's death (64.80.060(2))

- It must be recorded before the transferor's death in the office of the clerk of the county commission in the county where the property is located (64.80.060(3)).

The named beneficiary gains no present rights to the property, only a potential future interest. Instead, the transferors retain absolute control during their lives. This includes the freedom to sell or transfer it to someone else, and to modify or revoke the intended transfer on death (64.80.090). These details, along with the fact that TODDs only convey the property rights remaining, if any, at the owner's death, explain why they do not require notice or consideration (64.80.070).

According to 64.80.100(1)(a), the beneficiary gains equitable interest in the property ONLY when the owner dies. Note, however, that the beneficiary must be alive at the time of the transferor's death or the interest returns to the estate (64.80.100(1)(b)). To prevent this from happening, the owner may identify one or more contingent beneficiaries. All beneficiaries take title subject to any obligations (contracts, easements, etc.) associated with the property when the transferor dies (according to 64.80.100(2)).

With the new transfer on death deeds, real property owners in Washington have access to a convenient, flexible tool for managing one aspect of a comprehensive estate plan. Even so, a TODD may not be appropriate for everyone. Since each situation is unique, contact an attorney with specific questions or for complex circumstances.

(Washington TODD Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Snohomish County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Snohomish County Transfer on Death Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4563 Reviews )

JAMES D.

July 10th, 2025

Slick as can be and so convenient.rnrnWorked like a charm

Thank you for your feedback. We really appreciate it. Have a great day!

MARY LACEY M.

June 30th, 2025

Great service! Recording was smooth and swiftly performed. Deeds.com is an excellent service.rn

We are delighted to have been of service. Thank you for the positive review!

Robert F.

June 30th, 2025

Breeze.... It feels silly to hire an attorney to do this for just one beneficiary. Thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

Diana D.

June 23rd, 2020

I was very pleased as to how fast and easy the service was. I recommend this service to any one. It's not expensive and it was worth it. Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!

Christine A.

December 28th, 2018

So far do good. Don't understand the billing procedure yet and have just sent a request for information. Awaiting reply.

Thank you, Christine Alvarez

Thanks for the feedback. Looks like your E-recording invoice is available. It takes a few minutes for our staff to prepare documents for recording and generate the invoice.

Mary G.

November 24th, 2020

Very easy process, handled quickly without complications. Excellent communication about status.

Thank you!

Evelyn R.

June 21st, 2020

Responses to my needs were prompt and professional. I found the service easy to use and clearly outlined for processing.

Thank you.

Thank you!

Andrea H.

December 4th, 2020

I am very pleased with your service. The document that I downloaded along with the instructions and examples you provided made the process so easy. Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!

Margaret S.

February 19th, 2025

Your service is second to none. Your website is user-friendly, easy to navigate and within minutes I had the forms I needed. Keep up the good work!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Fred P.

April 1st, 2021

Great website to get your state and county forms.

Thank you!

Deirdre M.

July 11th, 2022

Thank for you guidance to amend & correct & recover my home with evidence you provide in Dead Fraud. I'll keep you updated.

Thank you!

Deborah D.

January 12th, 2021

Very easy to use, got everything I needed. Reasonable price.

Thank you!

Barbara J.

October 7th, 2023

Process was simple and fast. Awaiting response form agency. I’m happy to have found deeds.com for a speedy service.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Dennis M.

April 24th, 2022

Deeds was responsive and got back to me right away suggesting I go to the county and retrieve copies of the deed there. It's a couple of hundred miles away so was hoping I could do it online. A pretty good website though. Sorry we couldn't do business.

Thank you for your feedback. We really appreciate it. Have a great day!

THEODORE P.

August 28th, 2024

You were very helpful and patient with me in learning your portal. I now understand your process.

We are thankful for your continued support and feedback, which inspire us to continuously improve. Thank you..