Jefferson County Affidavit of Heirship Form (West Virginia)

All Jefferson County specific forms and documents listed below are included in your immediate download package:

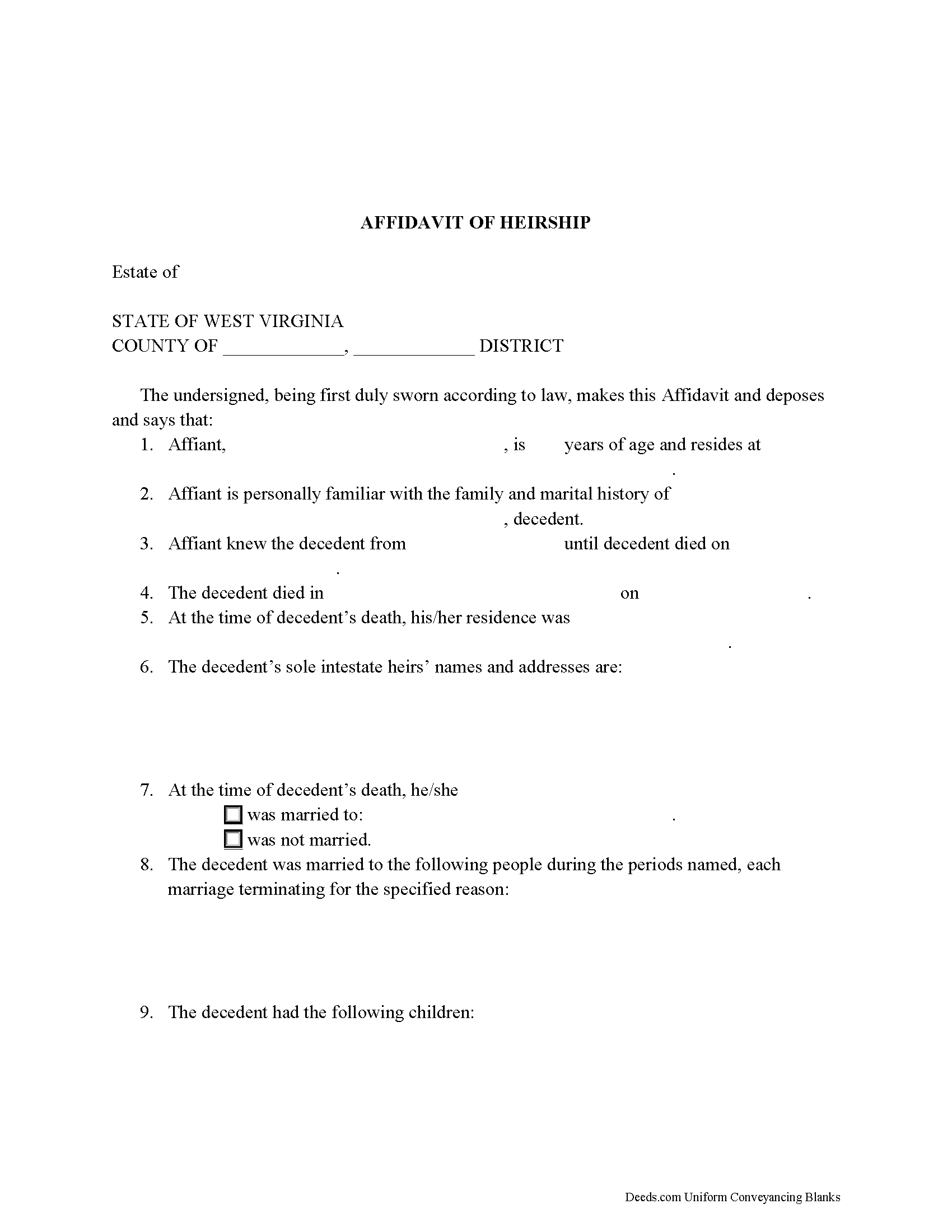

Affidavit of Heirship Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Jefferson County compliant document last validated/updated 2/17/2025

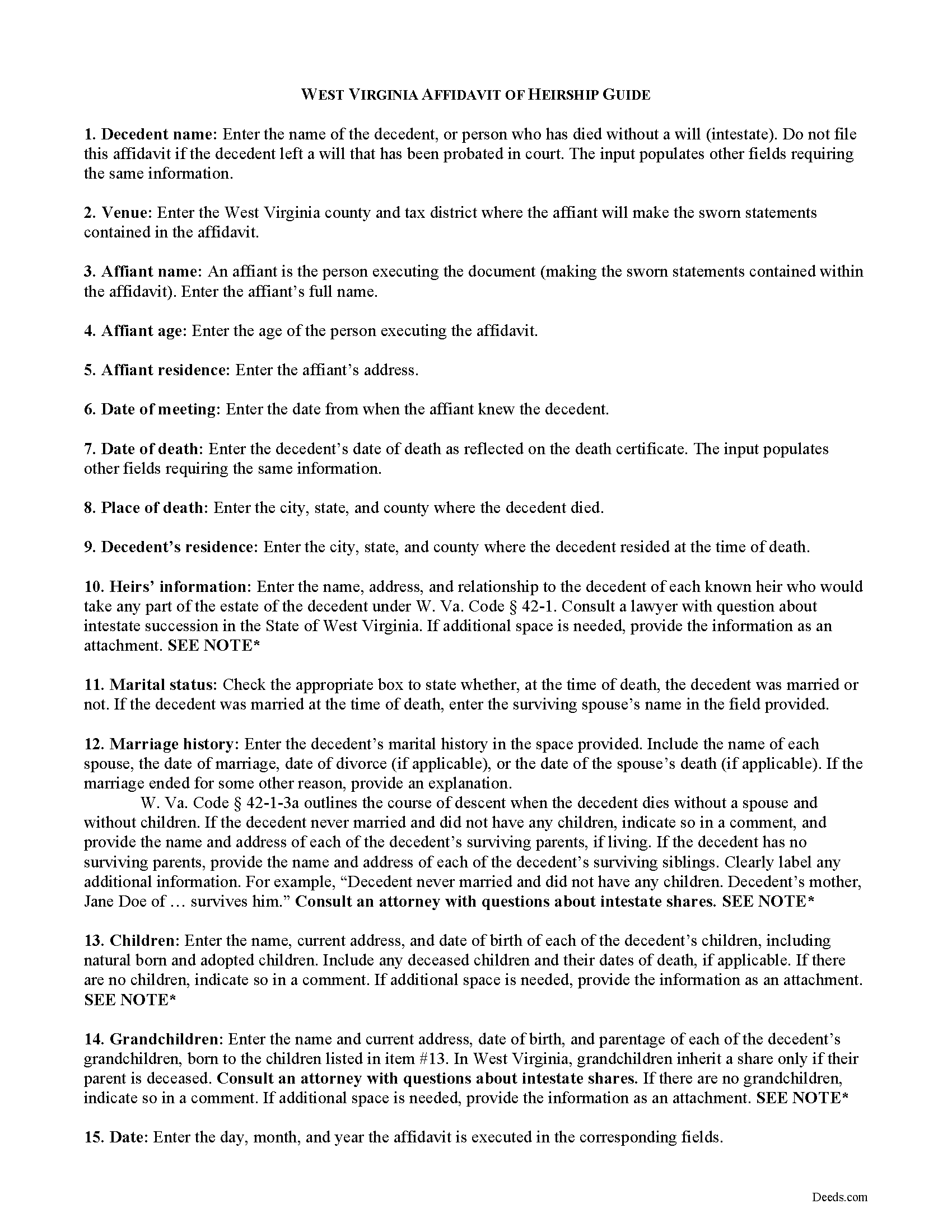

Affidavit of Heirship Guide

Line by line guide explaining every blank on the form.

Included Jefferson County compliant document last validated/updated 6/25/2025

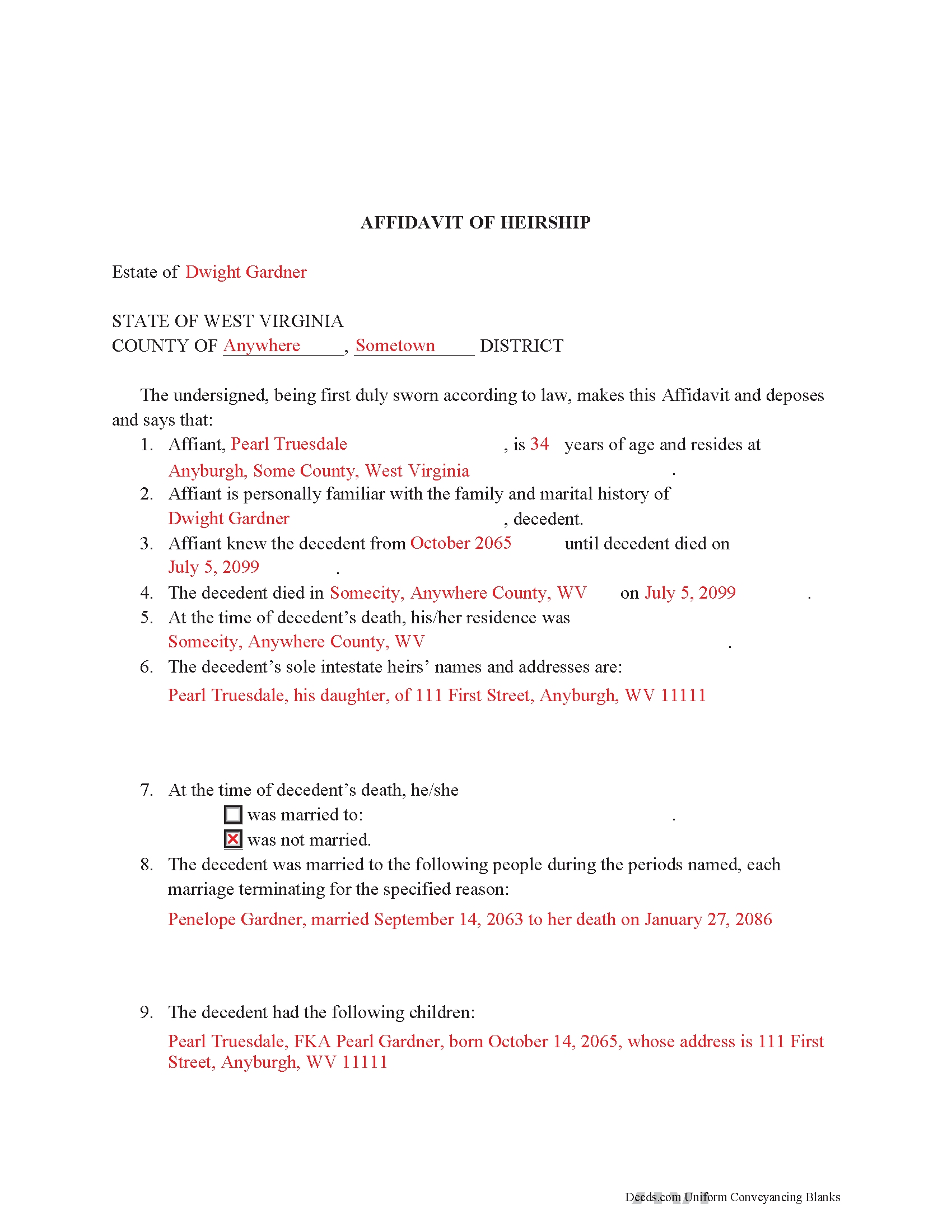

Completed Example of the Affidavit of Heirship Document

Example of a properly completed form for reference.

Included Jefferson County compliant document last validated/updated 3/31/2025

The following West Virginia and Jefferson County supplemental forms are included as a courtesy with your order:

When using these Affidavit of Heirship forms, the subject real estate must be physically located in Jefferson County. The executed documents should then be recorded in the following office:

Jefferson County Clerk

Old Courthouse - 100 E Washington St / PO Box 208, Charles Town, West Virginia 25414

Hours: 9:00 to 5:00 M-F / Same-day recording until 4:30

Phone: (304) 728-3215

Local jurisdictions located in Jefferson County include:

- Bakerton

- Charles Town

- Halltown

- Harpers Ferry

- Kearneysville

- Millville

- Ranson

- Rippon

- Shenandoah Junction

- Shepherdstown

- Summit Point

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Jefferson County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Jefferson County using our eRecording service.

Are these forms guaranteed to be recordable in Jefferson County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Jefferson County including margin requirements, content requirements, font and font size requirements.

Can the Affidavit of Heirship forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Jefferson County that you need to transfer you would only need to order our forms once for all of your properties in Jefferson County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by West Virginia or Jefferson County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Jefferson County Affidavit of Heirship forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

An affidavit of heirship establishes the lawful heirs of a decedent's estate when he or she dies intestate (without a will).

When recorded in the land records where the real property described within is located, the affidavit provides a record of the change in ownership and succession in interest of the within-described assets to the decedent's heir(s). The affidavit is not to be used when a will is probated or a proceeding for the administration of the decedent's estate has been opened.

While anyone can file an affidavit of heirship, the affiant, the person making the sworn statements contained in the affidavit, must have knowledge of the decedent's marital history and family tree in order to complete the affidavit accurately.

The instrument establishes the decedent's martial status at the time of death and whether the decedent left descendants (children, whether natural or adopted, and the children of any deceased child).

In West Virginia, interest in real property from a decedent's estate that does not transfer outside of probate (i.e., property not held with a survivorship designation) transfers by the laws of descent codified at W. Va. Code 42-1).

In general, the surviving spouse inherits a decedent's property. If the decedent has no surviving spouse, his descendants (children) inherit the property. A grandchild inherits the share of a deceased parent, if applicable. If the decedent has neither a surviving spouse nor descendants, his or her parents inherit the property. In the event there are no surviving parents, the decedent's siblings inherit. Always consult a lawyer with questions about intestate succession, as each situation is unique, and the law is complex.

In addition to establishing the decedent's heirs at law, the affidavit also describes all the real and personal property left by the decedent. The affiant must sign the affidavit in the presence of a notary public. Before recording with the land records of the county where the subject property is situated, ensure that the instrument meets standards of form and content for recorded documents in West Virginia.

Consult a lawyer with questions about intestate succession or affidavits of heirship in West Virginia.

(West Virginia Affidavit of Heirship Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Jefferson County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Jefferson County Affidavit of Heirship form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4564 Reviews )

Michael G.

July 14th, 2025

Very helpful and easy to use

Your appreciative words mean the world to us. Thank you.

JAMES D.

July 10th, 2025

Slick as can be and so convenient.rnrnWorked like a charm

Thank you for your feedback. We really appreciate it. Have a great day!

MARY LACEY M.

June 30th, 2025

Great service! Recording was smooth and swiftly performed. Deeds.com is an excellent service.rn

We are delighted to have been of service. Thank you for the positive review!

Sally F.

January 22nd, 2020

Amazing forms, thanks so much for making these available.

Thank you!

MARISSA G.

December 22nd, 2024

I recomemed this webside

Thank you for your feedback. We really appreciate it. Have a great day!

Nancy W.

November 6th, 2020

This was very easy to use to record my NOC. With the new COVID restrictions, I can't record my NOC in person and I'm working from home. This was a huge convenience and easy to use. I submitted the NOC late in the day and had the recorded NOC the next day.

Thank you!

Gerry H.

July 29th, 2020

Very good instruction for filling out the forms!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Rosalinda R.

January 4th, 2023

THESE FORMS ARE JUST WHAT I NEEDED, SHORT AND TO THE POINT. EXCELLENT QUESTIONS FOR MY NEED. THAK YOU!!!!

Thank you for your feedback. We really appreciate it. Have a great day!

Jina N.

January 29th, 2019

Awesome site!! You guys really make it simple to understand and access any Deeds that I need. I know you keep very up to date forms, as my county is hard core when it comes to the smallest of details, even compared to every other county across the state. Yet you made it simple and quick, and I never had to redo anything. Even the clerk was impressed that I had it filled out correctly the first time, as that usually never happened. Even the size of type/font and the margins were perfect. That saved a lot of time, money and most of all, frustration. I've recommended you to relatives, friends and co-workers. Thanks to the staff at deeds dot com !! I truly appreciate you. j

Thank you!

Vanessa G.

January 9th, 2024

Quick, painless, and they communicated with me during the entire process. I will certainly be suing them again.

We are delighted to have been of service. Thank you for the positive review!

Adam P.

September 17th, 2020

So far so good I am happy with the service and the timeliness of the recordings. One of the only recording services that allows for the use of credit card.

Thank you for your feedback. We really appreciate it. Have a great day!

George S.

June 24th, 2020

Very good, very expensive. I hope that this is what my lawyer needed for us to finish our wills.

George

Thank you!

Patricia N.

May 7th, 2025

Wonderful fast service, quick thoughtful responses on chat! Files download easily too, great pruces

We are delighted to have been of service. Thank you for the positive review!

Debra R.

August 17th, 2021

So easy to follow when preparing a deed. The example places given helped to know how to correctly fill out the form! Very easy! I will use deeds.com again!

Thank you!

Thank you!

Mary W.

June 9th, 2019

Great service. Thank you

We appreciate your business and value your feedback. Thank you. Have a wonderful day!