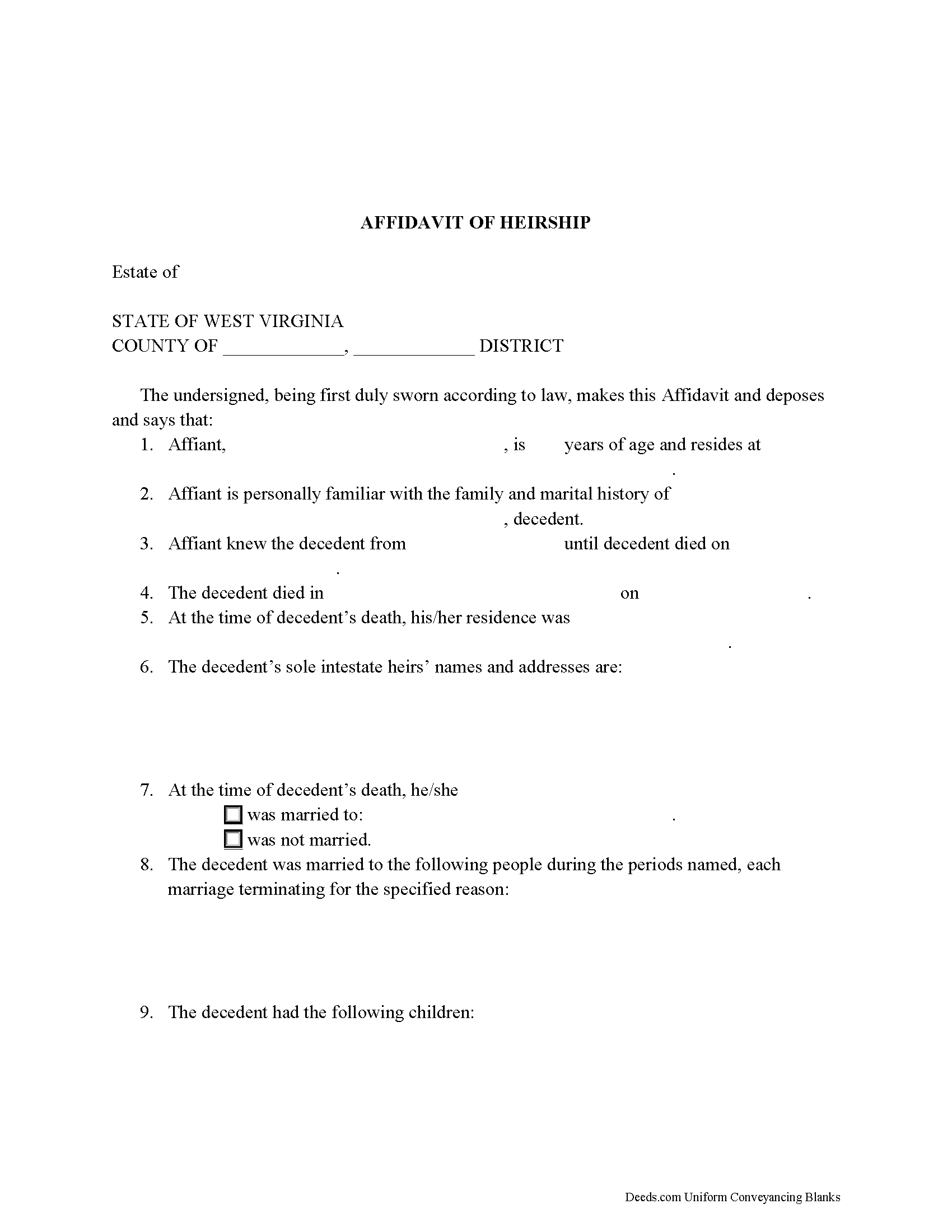

Lincoln County Affidavit of Heirship Form

Lincoln County Affidavit of Heirship Form

Fill in the blank form formatted to comply with all recording and content requirements.

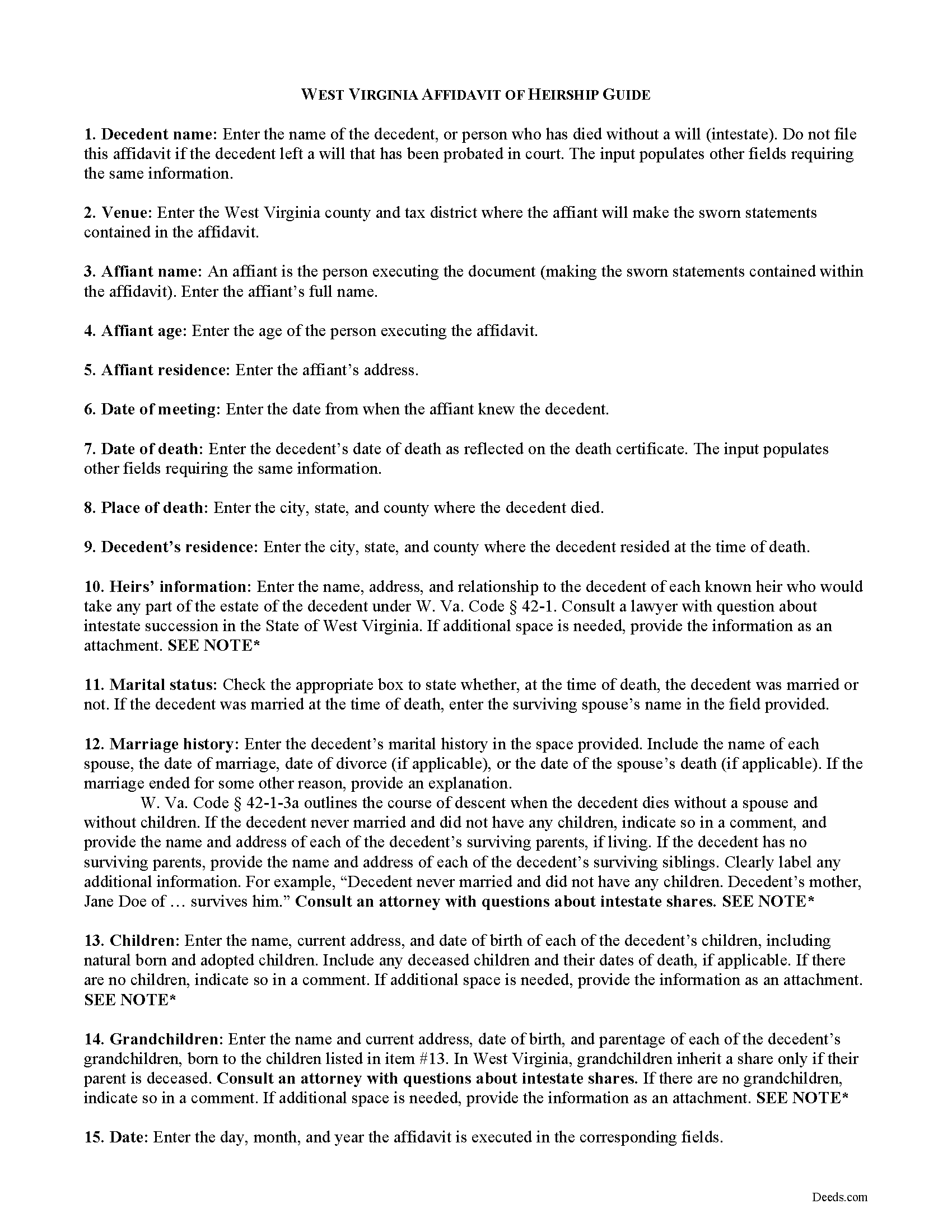

Lincoln County Affidavit of Heirship Guide

Line by line guide explaining every blank on the form.

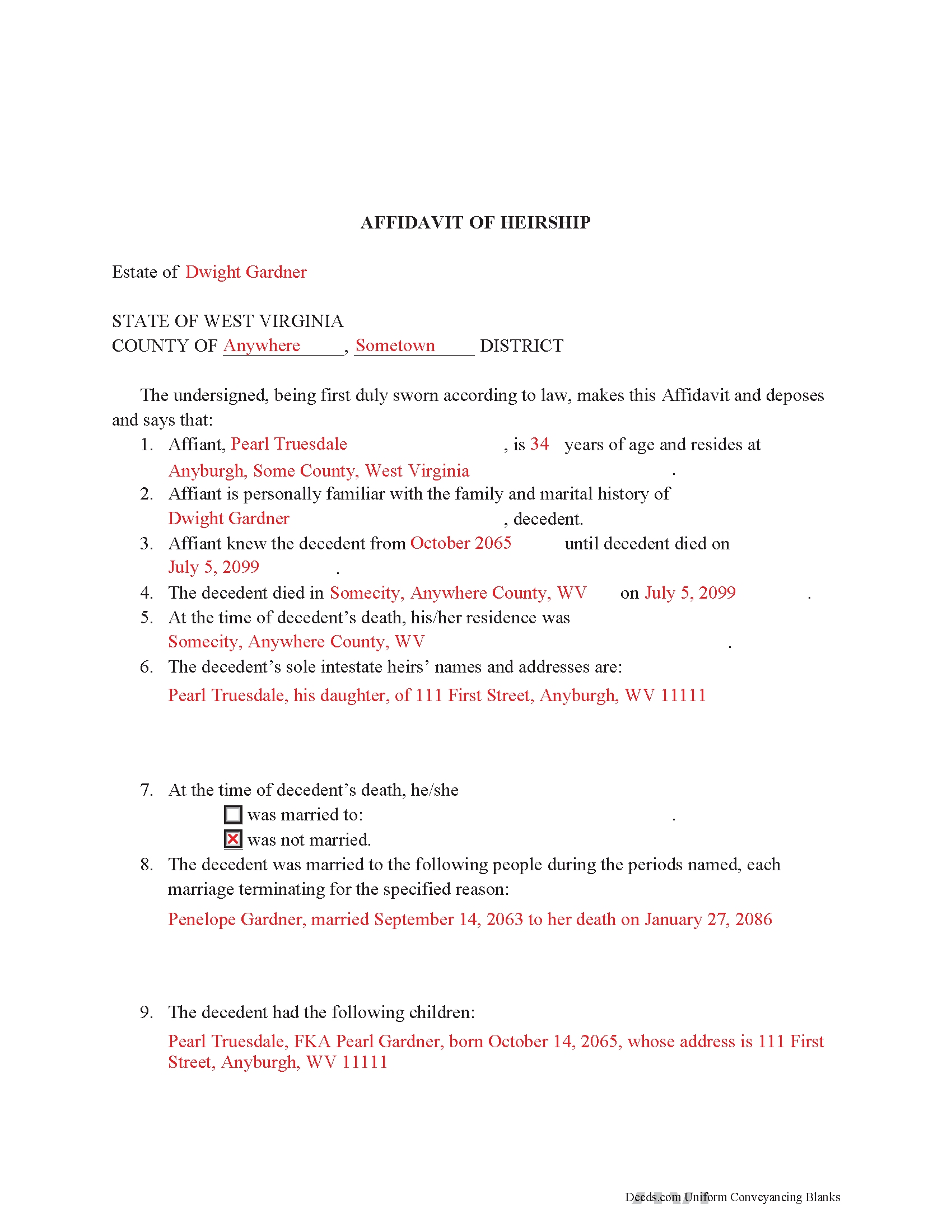

Lincoln County Completed Example of the Affidavit of Heirship Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional West Virginia and Lincoln County documents included at no extra charge:

Where to Record Your Documents

Lincoln County Clerk

Hamlin, West Virginia 25523-1419

Hours: 9:00 to 4:30 M-F

Phone: (304) 824-7990 x233

Recording Tips for Lincoln County:

- Ensure all signatures are in blue or black ink

- Ask about their eRecording option for future transactions

- Check margin requirements - usually 1-2 inches at top

Cities and Jurisdictions in Lincoln County

Properties in any of these areas use Lincoln County forms:

- Alkol

- Branchland

- Griffithsville

- Hamlin

- Harts

- Midkiff

- Myra

- Ranger

- Sod

- Spurlockville

- Sumerco

- West Hamlin

- Yawkey

Hours, fees, requirements, and more for Lincoln County

How do I get my forms?

Forms are available for immediate download after payment. The Lincoln County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Lincoln County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Lincoln County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Lincoln County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Lincoln County?

Recording fees in Lincoln County vary. Contact the recorder's office at (304) 824-7990 x233 for current fees.

Questions answered? Let's get started!

An affidavit of heirship establishes the lawful heirs of a decedent's estate when he or she dies intestate (without a will).

When recorded in the land records where the real property described within is located, the affidavit provides a record of the change in ownership and succession in interest of the within-described assets to the decedent's heir(s). The affidavit is not to be used when a will is probated or a proceeding for the administration of the decedent's estate has been opened.

While anyone can file an affidavit of heirship, the affiant, the person making the sworn statements contained in the affidavit, must have knowledge of the decedent's marital history and family tree in order to complete the affidavit accurately.

The instrument establishes the decedent's martial status at the time of death and whether the decedent left descendants (children, whether natural or adopted, and the children of any deceased child).

In West Virginia, interest in real property from a decedent's estate that does not transfer outside of probate (i.e., property not held with a survivorship designation) transfers by the laws of descent codified at W. Va. Code 42-1).

In general, the surviving spouse inherits a decedent's property. If the decedent has no surviving spouse, his descendants (children) inherit the property. A grandchild inherits the share of a deceased parent, if applicable. If the decedent has neither a surviving spouse nor descendants, his or her parents inherit the property. In the event there are no surviving parents, the decedent's siblings inherit. Always consult a lawyer with questions about intestate succession, as each situation is unique, and the law is complex.

In addition to establishing the decedent's heirs at law, the affidavit also describes all the real and personal property left by the decedent. The affiant must sign the affidavit in the presence of a notary public. Before recording with the land records of the county where the subject property is situated, ensure that the instrument meets standards of form and content for recorded documents in West Virginia.

Consult a lawyer with questions about intestate succession or affidavits of heirship in West Virginia.

(West Virginia Affidavit of Heirship Package includes form, guidelines, and completed example)

Important: Your property must be located in Lincoln County to use these forms. Documents should be recorded at the office below.

This Affidavit of Heirship meets all recording requirements specific to Lincoln County.

Our Promise

The documents you receive here will meet, or exceed, the Lincoln County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Lincoln County Affidavit of Heirship form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Jeffrey G.

March 9th, 2023

Transaction went smoothly. The forms in the package were just what was needed.

Thank you for your feedback. We really appreciate it. Have a great day!

Elma Jean B.

June 11th, 2023

My experience was great! Thank you, ejb

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Richard B.

April 27th, 2023

Excellent! I was able to complete the documents especially using the instructions as a guide. Thanks

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Dana Y.

October 22nd, 2019

Purchased and used the quitclaim form. I have no complaints with any aspect. The forms, instructions, and example all came together to make the process very easy.

Thank you Dana. Have a great day!

Louise D.

October 21st, 2022

It was easy to complete the form and I appreciated the sample form.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Laura L.

June 17th, 2025

Used a form from this service. Best part about these forms is that they don't let you get in trouble by removing or changing things that should not be changed. It's easy to look at something and think why is this margin so big, why is this field so small and want to change it only to find out it is incredibly important. That's why they are the deed document pros.

Thank you for the thoughtful review! We're so glad to hear you found our forms reliable and well-structured. It’s true—what might look like an odd margin or a small field is often there for a very specific legal or recording reason. We’ve seen how small changes can lead to big headaches, which is why we design our documents to be both user-friendly and compliant with strict recording standards. We really appreciate you recognizing the care that goes into each one. Thanks again for choosing us!

Pam B.

January 20th, 2019

This form really helped me out a lot could be a little more explanatory in some areas but all and all it works.

Thanks Pam, we appreciate your feedback.

Karen J.

December 20th, 2018

Excellent and easy to download and use. Love the example page and was so easy to fill out and use immediately. Thank you

Thank you for your feedback Karen. We really appreciate it. Enjoy your day!

Harman F.

April 7th, 2024

I was able to find the document I very much needed to get my process started. I really appreciate that there was a website to assist me in finding what I needed . I'm very Thankful that this website was available!

We are delighted to have been of service. Thank you for the positive review!

Pamela S.

July 1st, 2021

Getting the forms and paying the fee was very simple and easy to follow. Now we"ll see how it goes actually filling out the forms that are needed and correctly.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Janet S.

April 7th, 2021

I would've done this years ago if I'd known how easy it was! The plus is it's not expensive either. Thank you deeds.com

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Scott W.

April 8th, 2024

Finding and downloading necessary forms, and especially the example forms, were tremendously easy and trouble free, and the fact the forms were updated recently was a big selling point. If other forms are needed, this is were I'm coming.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

James J.

December 27th, 2019

Downloaded and used the Ladybird Warranty Deed for a county in Florida with no issues. Cost for the download and subsequent recording fee of the deed totaled less than $40. No reason to pay hundreds. I assume the subsequent transfer upon death will go smoothly, but I of course, will never know. The "example" of a completed form was very beneficial. Also, get a copy of the current deed and make sure legal description of real estate is exactly the same on the new deed.

Thank you for your feedback. We really appreciate it. Have a great day!

Michael A.

November 14th, 2020

Customer service was poor. I felt like I had to debate the representative to provide guidance and assistance. They acted as though I knew the process, the documents involved, etc. At the same time, they asked me to confirm which documents or at least pages needed to be filed. I was leaning of Deeds.com for their expertise.

Thank you!

Scott A.

August 3rd, 2019

The information and instructions provided is thorough and great. But, the fill-in-the-blanks form does not work well and is very frustrating. The font size of the information I was adding on each individual line varies and is determined by the number of characters entered on that individual line. So the font size is different on each line. And the number of lines is fixed making it impossible to fill in the full legal name of the trust I needed to fill out the form for. My needs are somewhat unusual, but the form should have been designed to be flexible enough to handle it. A blank paper form would have been more useful.

Thank you for your feedback. We really appreciate it. Have a great day!