Marion County Correction Deed Form

Last validated December 26, 2025 by our Forms Development Team

Marion County Correction Deed Form

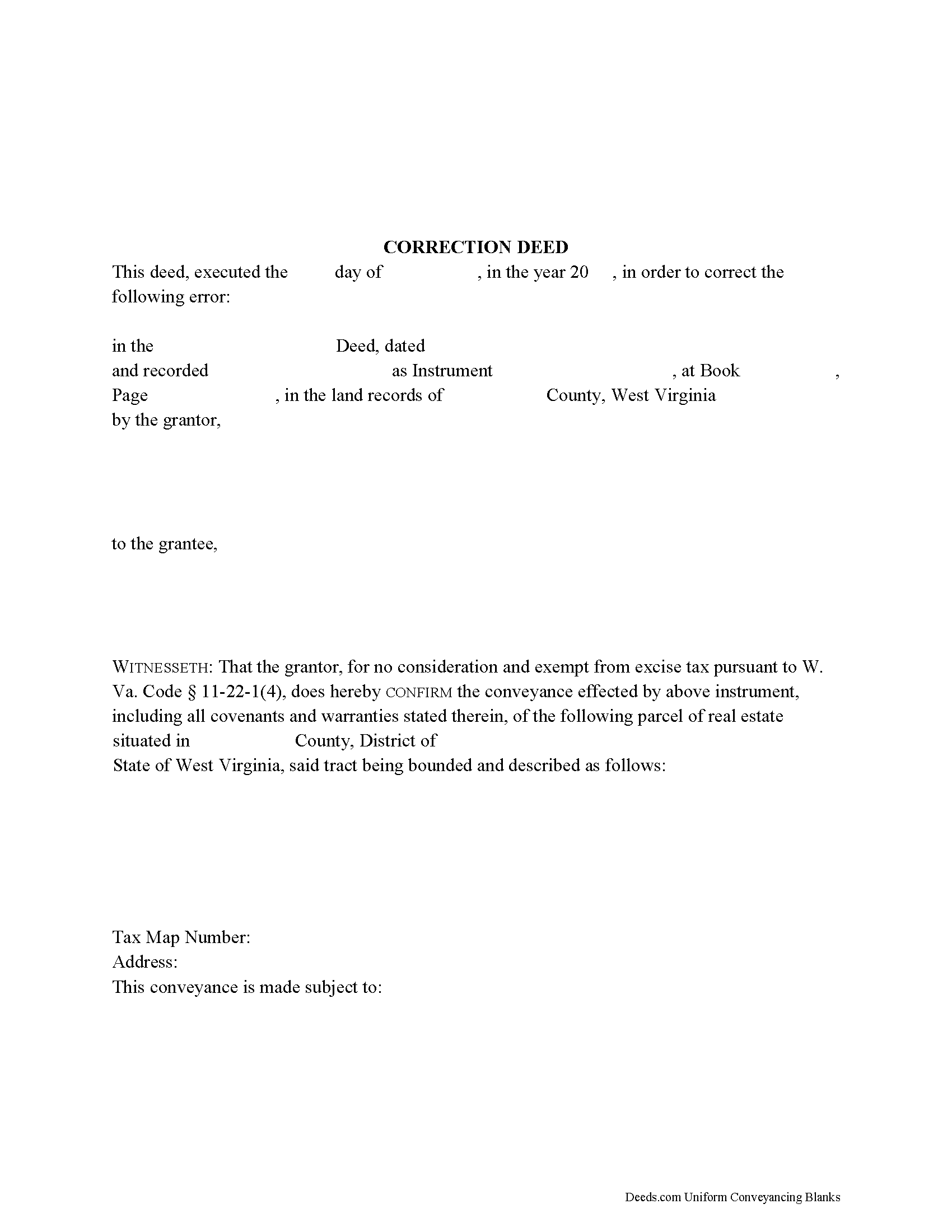

Fill in the blank form formatted to comply with all recording and content requirements.

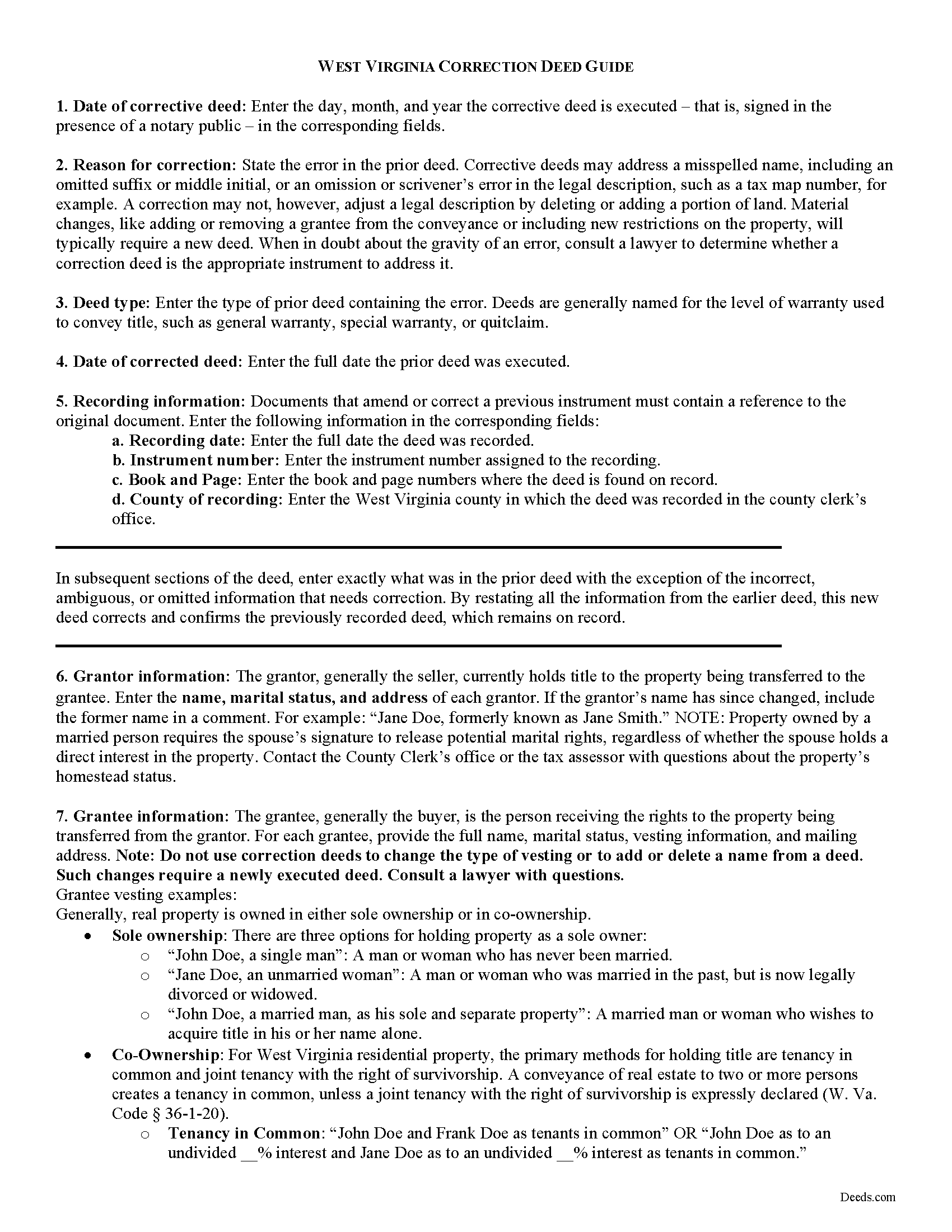

Marion County Correction Deed Guide

Line by line guide explaining every blank on the form.

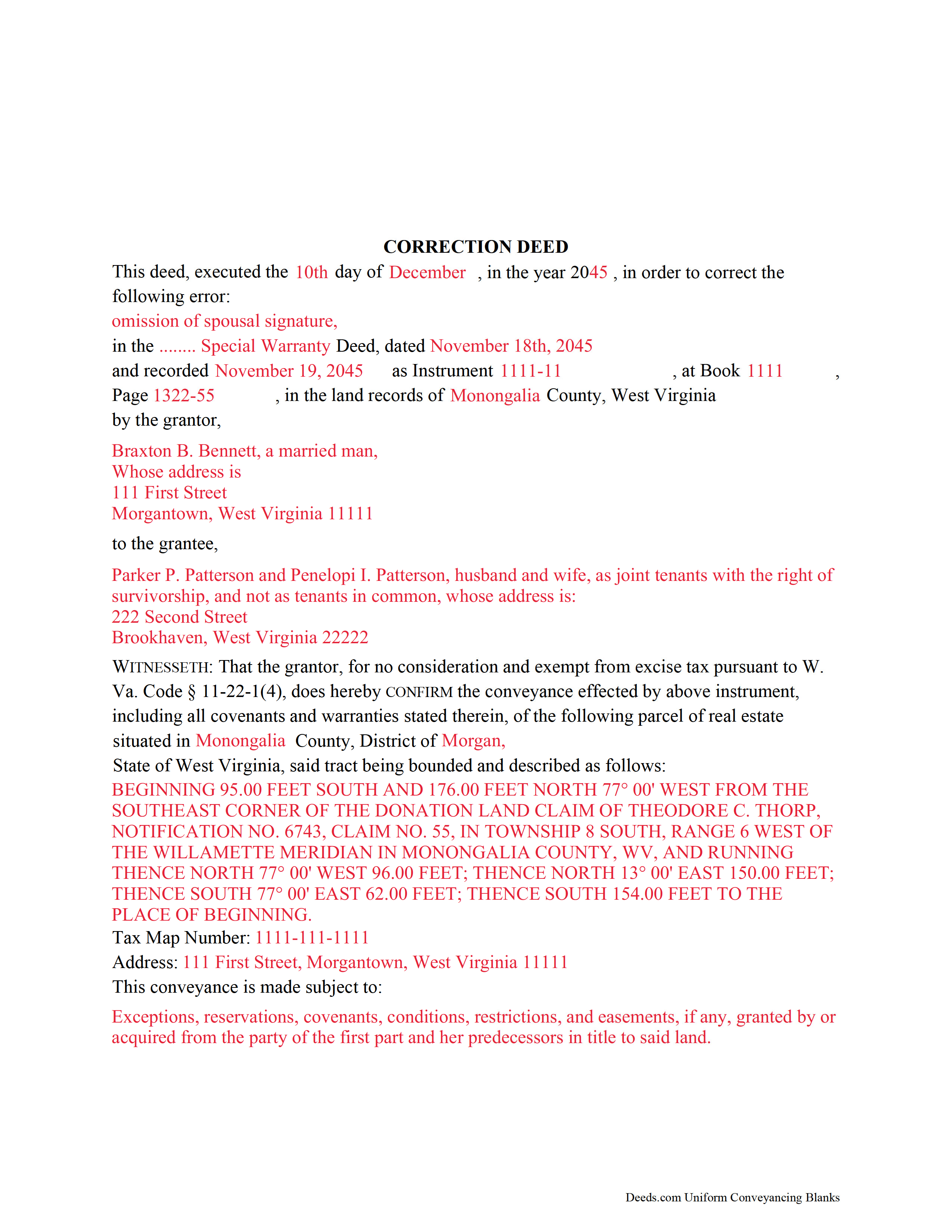

Marion County Completed Example of the Correction Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional West Virginia and Marion County documents included at no extra charge:

Where to Record Your Documents

Marion County Clerk

Fairmont, West Virginia 26554 / 26555-1267

Hours: 8:30 to 4:30 M-F

Phone: (304) 367-5440

Recording Tips for Marion County:

- White-out or correction fluid may cause rejection

- Documents must be on 8.5 x 11 inch white paper

- Verify all names are spelled correctly before recording

- Ask about their eRecording option for future transactions

Cities and Jurisdictions in Marion County

Properties in any of these areas use Marion County forms:

- Barrackville

- Baxter

- Carolina

- Colfax

- Fairmont

- Fairview

- Farmington

- Four States

- Grant Town

- Idamay

- Kingmont

- Mannington

- Metz

- Montana Mines

- Rachel

- Rivesville

- Worthington

Hours, fees, requirements, and more for Marion County

How do I get my forms?

Forms are available for immediate download after payment. The Marion County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Marion County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Marion County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Marion County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Marion County?

Recording fees in Marion County vary. Contact the recorder's office at (304) 367-5440 for current fees.

Questions answered? Let's get started!

Use the correction deed to amend a previously recorded warranty, special warranty, or quitclaim deed.

A correction deed explains and corrects an error in a prior instrument. As such, it passes no title, but confirms the conveyance effected by the previously recorded document. It must be executed from the original grantor to the original grantee, and it must be recorded in order to be legally valid.

The correction deed should reference the prior conveyance by type of error, date of execution, date of recording, as well as by recording number and location. Beyond that, it restates the information given in the prior deed, thus serving as its confirmation. The original instrument remains on record as well.

Deeds of correction are most appropriate for minor errors and omissions in the original deed, such as misspelled names, omission of marital status, or typos in the legal description. If an error has the potential to cloud the title and affect its future transfer, recording a correction deed will help.

More substantial changes, such as adding a name to the title or adding/subtracting a portion of land to the legal description of the property, usually require a new deed of conveyance instead of a correction deed. When in doubt, seek legal counsel to determine which instrument is most appropriate for a case that involves a material change.

(West Virginia CD Package includes form, guidelines, and completed example)

Important: Your property must be located in Marion County to use these forms. Documents should be recorded at the office below.

This Correction Deed meets all recording requirements specific to Marion County.

Our Promise

The documents you receive here will meet, or exceed, the Marion County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Marion County Correction Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4628 Reviews )

Judie G.

February 2nd, 2022

Review: Forms are on point, to the point, and cover the vast majority of situations. Would not suggest if your deal is overly complicated but most situations are not complicated at all.

Thank you!

Ma Luisa R.

July 2nd, 2020

Great service and fast

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Timothy N.

September 21st, 2020

Extremely easy and fast recording of real estate records. I was impressed that it was less than 6 hours from the time I uploaded the document to Deeds.com to receiving confirmation that it was recorded by the county clerk. I would highly recommend this service to save you time and quickly get documents recorded!

Thank you for your feedback. We really appreciate it. Have a great day!

Janet M.

February 9th, 2024

Deed.com is an amazing site. After calling many places and going on many websites to figure out what I needed to submit (most counties cannot help with questions and the place I needed to turn the documents into could not help either, they are not allowed to give legal advice) I came across Deeds.com. It has been so helpful and I was able to research what documents I needed. I purchased one document and after more research I realized I needed a different document. Deed.com refunded my first purchase. I then purchased an Affidavit of Death and a Deed for the county and state I needed them for. Both the example and guide were very helpful and I will be submitting my documents after I have them notarized. I give five stars

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

James B.

February 20th, 2020

Does everything I expected it to do. Very helpful. It is in compliance with applicable Nevada State regulations

Thank you for your feedback. We really appreciate it. Have a great day!

Agnes I H.

January 28th, 2019

Good knowing the price right up front...and not a FREE one you pay at the end....

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jesse C.

December 29th, 2018

I had a little problem understanding how to copie and use.

Thank you for your feedback Jesse. If you are having any issues please contact us so our customer care department can help you out.

John S.

June 29th, 2021

Your service is refreshingly clear, simple, and free of superfluous claims or unnecessary marketing. And, more affordable than other online legal document providers I've looked at. So nice! I forgot I had used it some years ago for another deed so glad you are still around for this time.

Thank you for the kind words John. Have a fantastic day!

Tami C.

May 11th, 2021

Excellent service, easy to follow instructions.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Pamela S.

July 1st, 2021

Getting the forms and paying the fee was very simple and easy to follow. Now we"ll see how it goes actually filling out the forms that are needed and correctly.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

DENIS K.

July 17th, 2020

Excellent, invaluable and reasonable!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Muhamed H.

February 3rd, 2022

Nice!

Thank you!

Monica M.

September 15th, 2020

I was very impressed with the quick responses I received from my questions. Usually when forced to communicate via email, responses aren't received right away. Thank you for being on top of things.

Thank you!

John S.

January 9th, 2023

You dont really know what your buying until after you spend the money. Cant use any of them

Thank you for your feedback. Best practice is to know what you need before purchasing. Buying legal documents should not be a exploratory endeavor. Your order has been canceled. We do hope that you find something more suitable to your needs elsewhere.

Katherine M.

October 6th, 2022

Easy smooth process to get a legal Maine template - thanks for providing

Thank you for your feedback. We really appreciate it. Have a great day!