Wayne County Personal Representative Deed Form (West Virginia)

All Wayne County specific forms and documents listed below are included in your immediate download package:

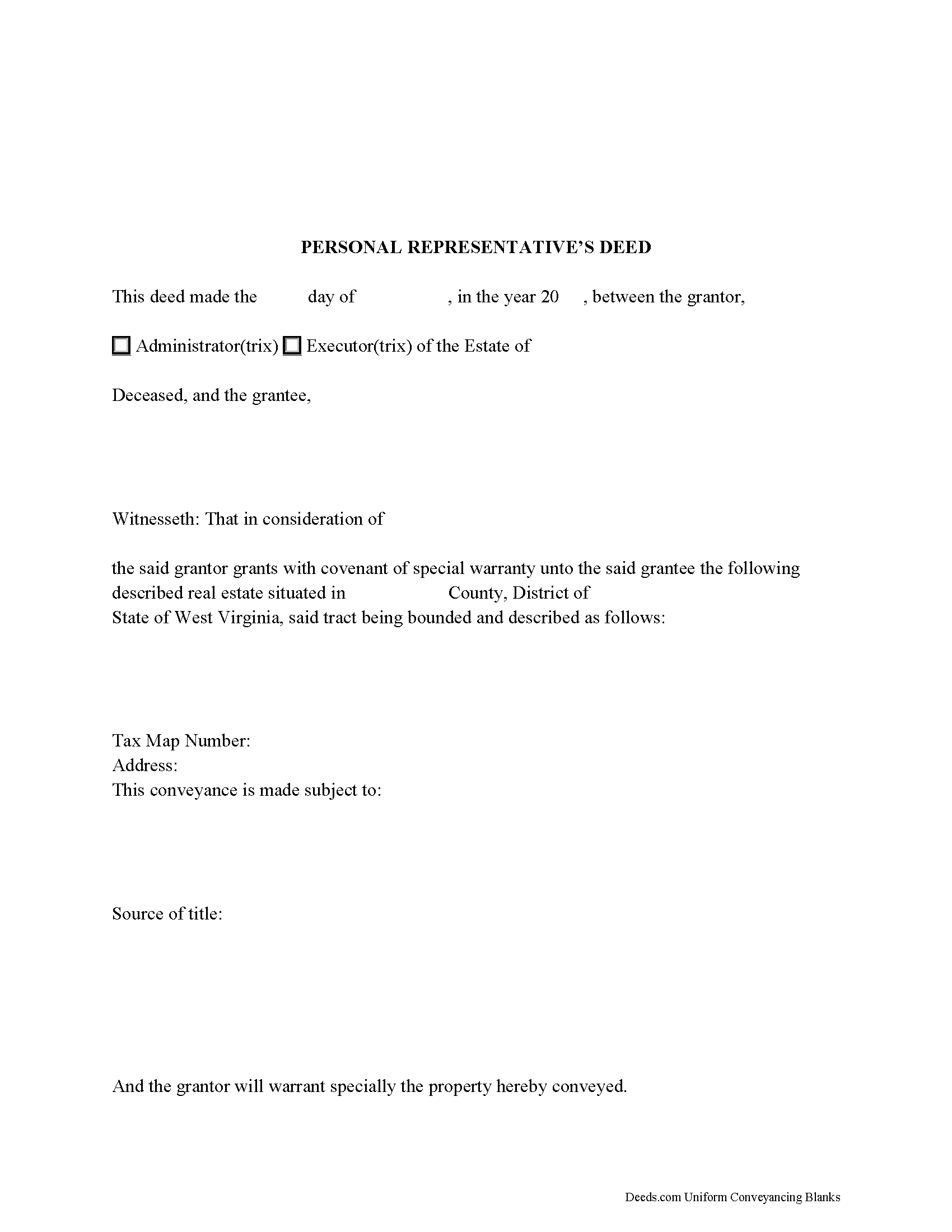

Personal Representative Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Wayne County compliant document last validated/updated 5/30/2025

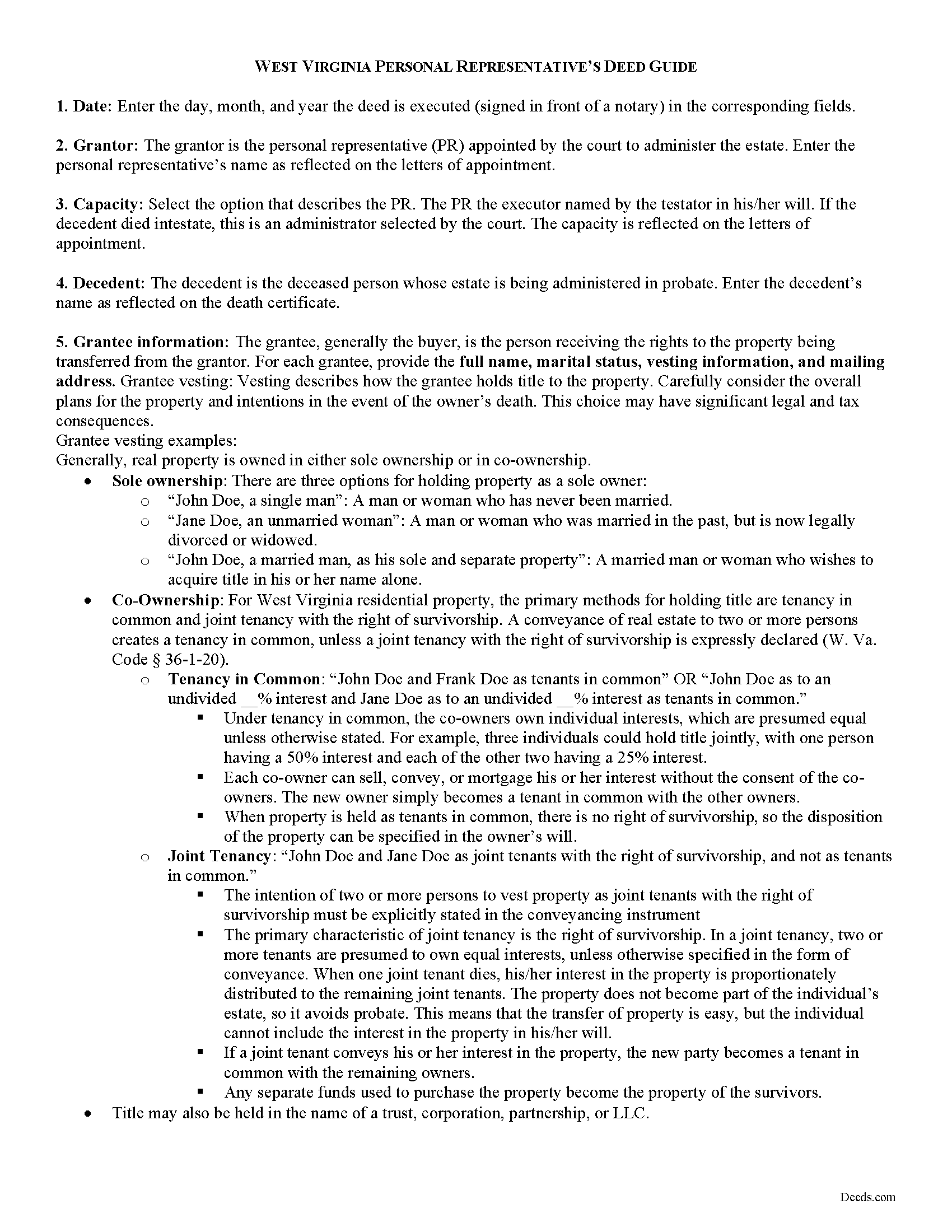

Personal Representative Deed Guide

Line by line guide explaining every blank on the form.

Included Wayne County compliant document last validated/updated 2/20/2025

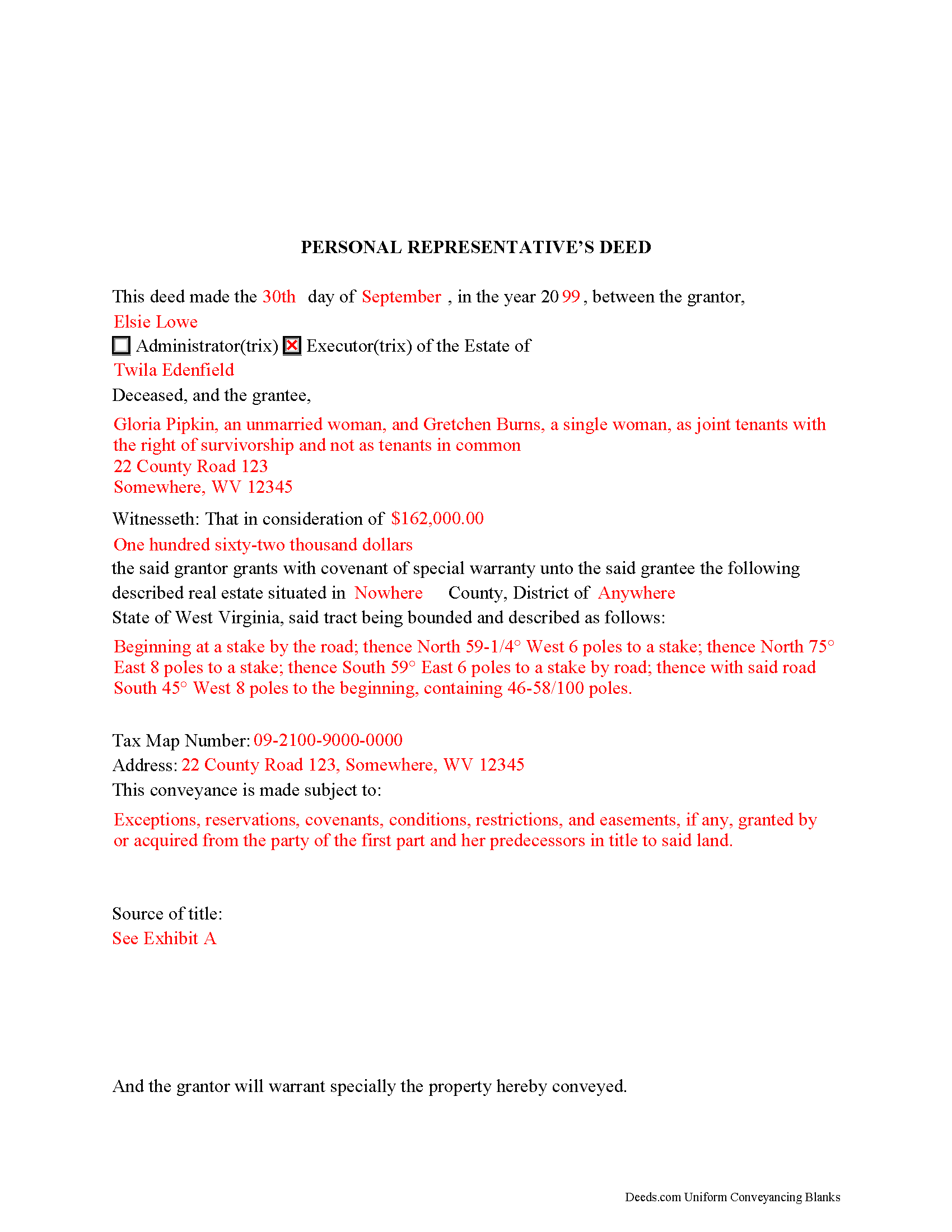

Completed Example of the Personal Representative Deed Document

Example of a properly completed form for reference.

Included Wayne County compliant document last validated/updated 2/10/2025

The following West Virginia and Wayne County supplemental forms are included as a courtesy with your order:

When using these Personal Representative Deed forms, the subject real estate must be physically located in Wayne County. The executed documents should then be recorded in the following office:

Wayne County Clerk

Courthouse - 700 Hendricks St / PO Box 248, Wayne, West Virginia 25570

Hours: 8:00 to 4:00 M-W, F; Th until 7:00

Phone: (304) 272-6362

Local jurisdictions located in Wayne County include:

- Ceredo

- Crum

- Dunlow

- East Lynn

- Fort Gay

- Genoa

- Huntington

- Kenova

- Kiahsville

- Lavalette

- Prichard

- Shoals

- Wayne

- Wilsondale

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Wayne County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Wayne County using our eRecording service.

Are these forms guaranteed to be recordable in Wayne County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Wayne County including margin requirements, content requirements, font and font size requirements.

Can the Personal Representative Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Wayne County that you need to transfer you would only need to order our forms once for all of your properties in Wayne County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by West Virginia or Wayne County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Wayne County Personal Representative Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

A personal representative is the fiduciary appointed to administer a decedent's estate in probate. When the decedent dies with a will, the personal representative is the executor named in the will, or, if no executor is named, a qualifying beneficiary. When the decedent dies intestate (without a will), the personal representative selected by the court is called the administrator.

In the course of estate settlement, a personal representative may be required to execute and record a deed conveying real property from the estate following a sale. A decedent may designate in their will the specific real estate to be sold, or an estate's assets may be insufficient to pay its debts, and the personal representative may need to commence a suit in equity to subject the real estate to payment under W. Va. Code 44-8-7.

A fiduciary deed follows the statutory form of a deed under W. Va. Code 36-3-5. In addition, West Virginia requires a Declaration of Consideration or Value confirming the actual consideration paid or monetary value of the property being transferred (W. Va. Code 11-22-6).

Due to the nature of the fiduciary as a representative, a special warranty is typically appropriate. A covenant of special warranty means that the grantor promises to warrant and defend the property for the grantee against claims or demands of the grantor and persons acting by, through, or under him (W. Va. Code 36-4-3). This warranty is more limited than that of a general warranty deed because it does not extend prior to the time the grantor obtained title. In West Virginia, covenants run with the land, meaning they are also binding on any successor in title.

In addition to the statutory contents of a deed, personal representative's deeds contain information about the subject estate, such as the decedent's name and date of death, whether he or she left a will, the personal representative's name and his or her source of authority to sell the subject real estate, such as a testamentary power of sale under W. Va. Code 44-5A-3 or an order by the county commission.

The deed must be signed by the executor or administrator in the presence of a notary public before recording in the County Clerk's office for a valid transfer. The instrument should meet all requirements of form and content for documents relating to real property in West Virginia.

Consult a lawyer with questions about estate administration or personal representative's deeds in West Virginia.

(West Virginia PRD Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Wayne County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Wayne County Personal Representative Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4560 Reviews )

Pauline C.

June 29th, 2025

Everything that was stated to be included in my order was complete. Very satisfied

Thank you for your positive words! We’re thrilled to hear about your experience.

Ed H.

June 28th, 2025

I filled out the Kansas form and presented it to the Clerk of Deeds in Rawlins Co and there were no problems and no expensive attorney involved for a simple transaction.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Loretta W.

June 26th, 2025

Thank you for your excellent service

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Joni Y.

November 25th, 2019

Deeds.com is a very up to date & easy instruction website. I recommend this site to all who are looking for forms dealing with deeds. Thank you for making life easy in this aspect.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Tamara H.

August 7th, 2021

Absolutely awesome, all the information and forms I needed

Thanks

Tamie Hamilton

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Donald C.

August 7th, 2020

As promised, my forms were immediately ready for download. The forms were exactly what i wanted. I couldnt be happier and i cant even guess how much money i saved. They were even formatted to the exact font, spacing and margin used by my county. It is obvious a lot of time and effort was put into the preparation of these documents. They are absolutely perfect. Check it out, you wont be disappointed and the price is much less than i expected.

Don caldwell

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Gerald S.

November 7th, 2020

Very pleased with the services provided by deeds.com. Quick response time after information was provided.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Michael L.

December 28th, 2018

I accidentally ordered the wrong deed package. Was looking for a quit claim deed and got a trustee deed. I immediately emailed the company, nothing back from them. I would like to exchange my purchase.

Thank you for your feedback. We replied to your message on December 20th at 2:05 pm, the reply was as follows: As a one time courtesy we have canceled your order/payment for the Trustee Deed document.

Koko H.

July 12th, 2019

Five star. Prompt and easy way to obtain information. Good value.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Rosemary W.

February 27th, 2021

considering the current epidemic your fees save me time and parking fees. with help from DC recorder of deeds I was directed to the correct link to process my deed

Thank you for your feedback. We really appreciate it. Have a great day!

Denise L.

February 3rd, 2025

Using the Gift Deed form from Deeds.com, along with the example and instructions thy provided, saved me at least $200 in legal fees and saved me time as well!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Michael S.

September 28th, 2019

So far so good! Easy site to navigate for old farts like me

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Phoenix D.

August 17th, 2020

I was looking for the proper quit claim deed for my state. I found it on deeds.com along with instructions and a sample. I couldn't have filed without them.

Thank you for your feedback. We really appreciate it. Have a great day!

Kevin M.

May 13th, 2020

Maricopa County Recorders office directed to use Deeds.com for all forms, etc. Easily found the Warranty Deed form, instructions & sample form I was looking for.

Thank you!

Sandra M.

November 17th, 2019

The forms were easy to use but there was a software issue that made it impossible to get the county name to appear on the form in the correct place. It made the deed look a little sloppy

Thank you!