Rock County Construction Lien Release Form

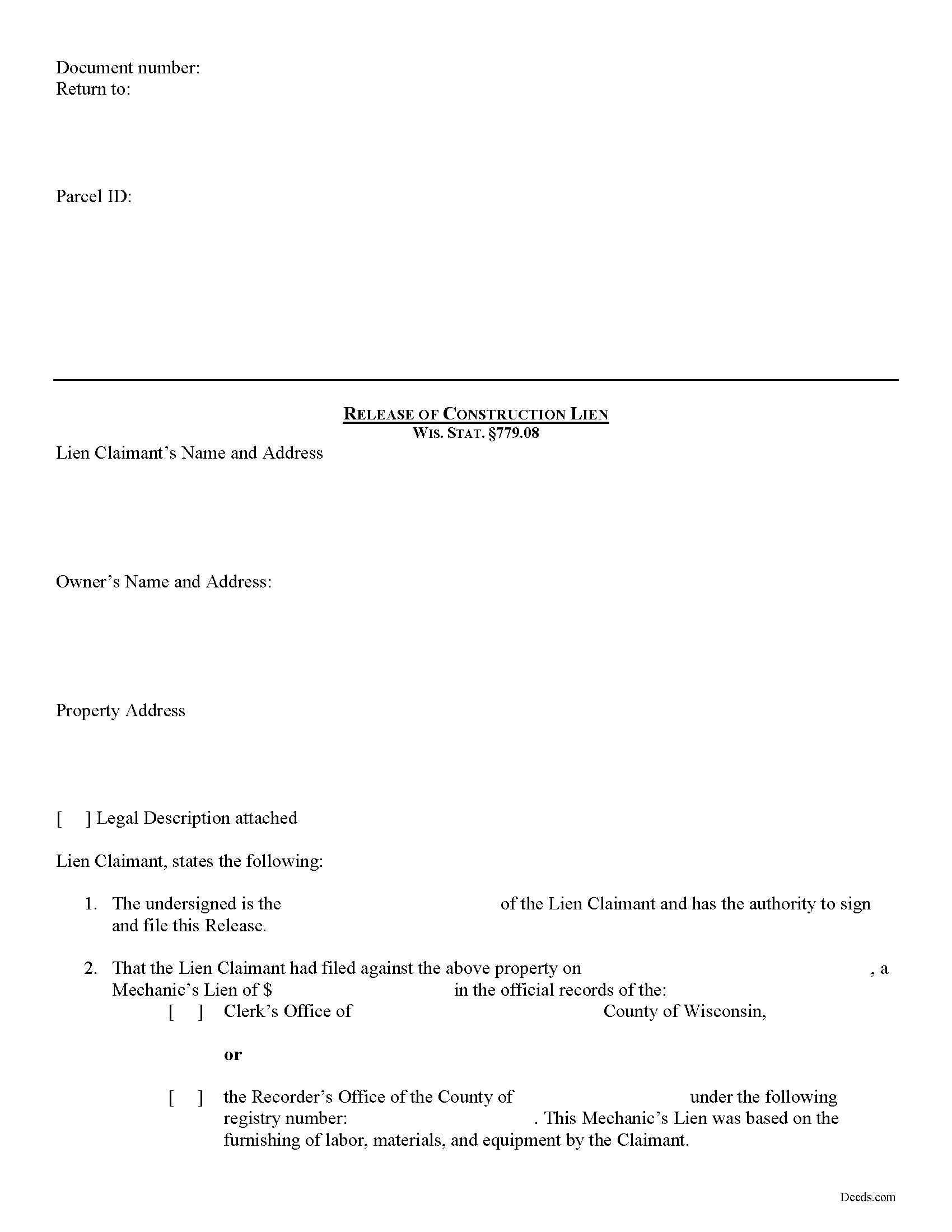

Rock County Construction Lien Release Form

Fill in the blank form formatted to comply with all recording and content requirements.

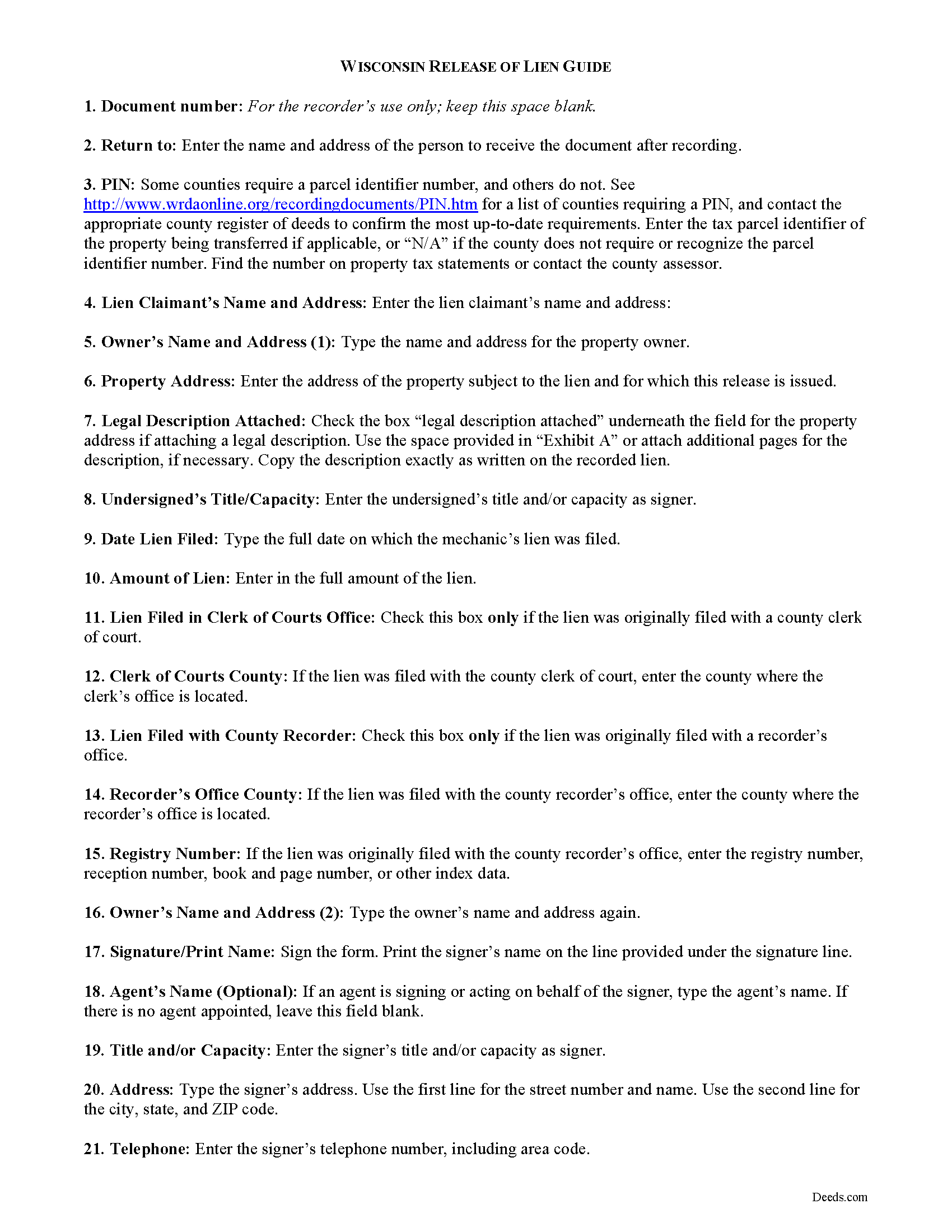

Rock County Construction Lien Release Guide

Line by line guide explaining every blank on the form.

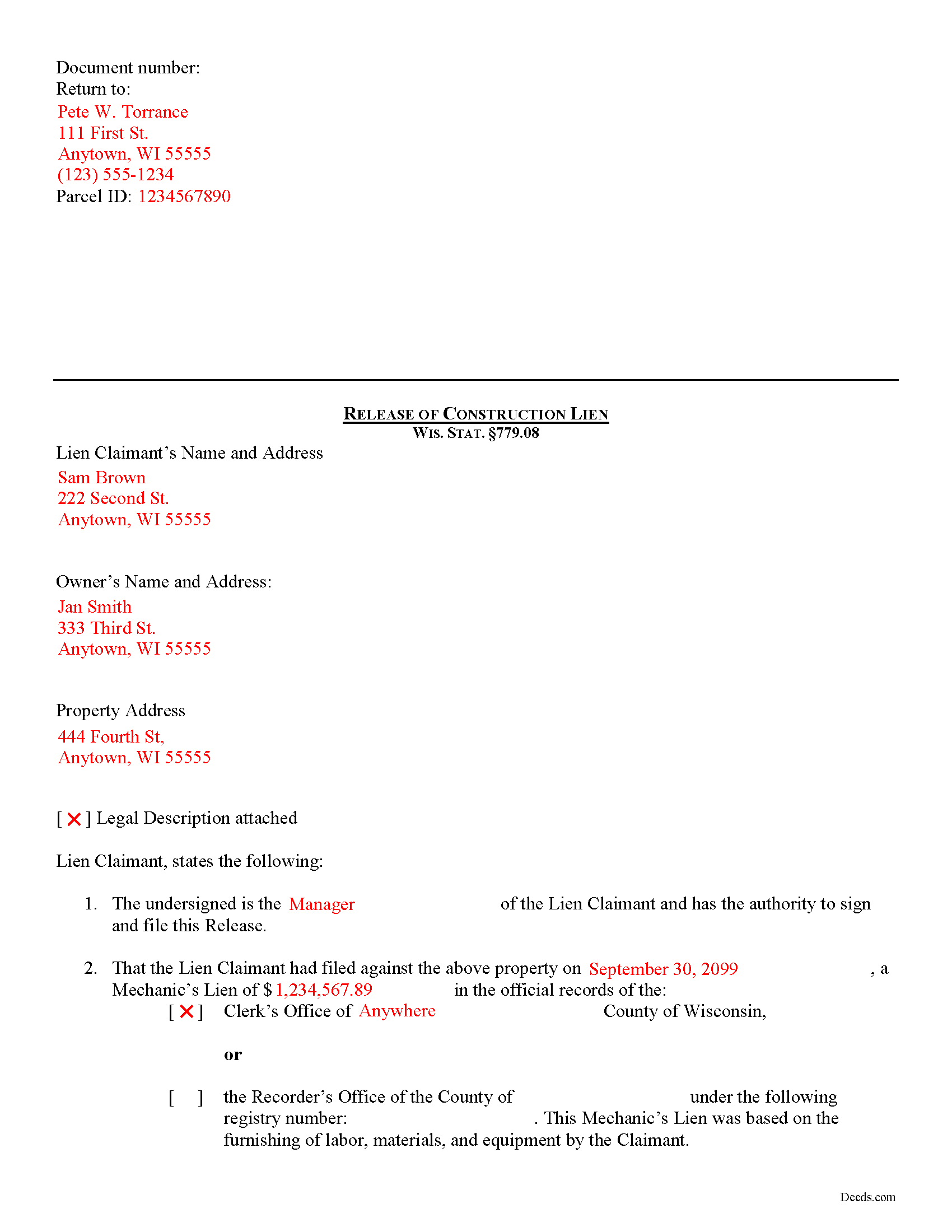

Rock County Completed Example of the Construction Lien Release Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Wisconsin and Rock County documents included at no extra charge:

Where to Record Your Documents

Rock County Register of Deeds

Janesville, Wisconsin 53545

Hours: Monday - Friday 8:00 am - 5:00 pm

Phone: (608) 757-5650

Recording Tips for Rock County:

- Leave recording info boxes blank - the office fills these

- Avoid the last business day of the month when possible

- Both spouses typically need to sign if property is jointly owned

- Check margin requirements - usually 1-2 inches at top

- Request a receipt showing your recording numbers

Cities and Jurisdictions in Rock County

Properties in any of these areas use Rock County forms:

- Afton

- Avalon

- Beloit

- Clinton

- Edgerton

- Evansville

- Footville

- Hanover

- Janesville

- Milton

- Orfordville

Hours, fees, requirements, and more for Rock County

How do I get my forms?

Forms are available for immediate download after payment. The Rock County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Rock County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Rock County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Rock County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Rock County?

Recording fees in Rock County vary. Contact the recorder's office at (608) 757-5650 for current fees.

Questions answered? Let's get started!

Releasing a Lien in Wisconsin

Property subject to a mechanic's lien should be released when the owner posts a bond or other surety to guarantee payment of the underlying lien. In exchange for posting the bond, the lien claimant should file a release with the clerk of court. Property should also be released when a lien is satisfied as a matter of course.

To release a lien, a surety bond must be posted in a value equal to 125 percent of the claim for lien. See Wis. Stat. 779.08(1). The court shall determine any question of sufficiency of the surety if an exception is taken by the lien claimant. Id.

The clerk of court shall remove the lien from the judgment and lien docket upon the court's order approving the surety in substitution for the lien. Id.

Issuing a release is required by law when the lien is no longer justified. Every lien claimant, or the attorney who executed and filed a claim for lien on the claimant's behalf, who has received satisfaction or tender of the claim with the costs of any action brought on the claim shall, at the request of any person interested in the premises affected and on payment of the costs of satisfying the same, execute and deliver the necessary satisfaction to the interested person. Wis. Stat. 779.13. When the satisfaction is filed with the clerk of circuit court, the clerk of circuit court shall enter satisfaction of the claim on the judgment and lien docket. Id.

Failure to execute and deliver the satisfaction or to satisfy the lien on the judgment and lien docket shall render the person so refusing liable to pay to the person requiring the satisfaction a sum equal to one-half of the sum claimed in the claim for lien. Id.

This article is provided for informational purposes only and should not be relied upon as a substitute for the advice from a legal professional. Please contact a Wisconsin attorney with any questions about filing a satisfaction of lien or releasing a lien.

Important: Your property must be located in Rock County to use these forms. Documents should be recorded at the office below.

This Construction Lien Release meets all recording requirements specific to Rock County.

Our Promise

The documents you receive here will meet, or exceed, the Rock County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Rock County Construction Lien Release form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

Patrick A.

April 13th, 2019

Real value. Excellent forms, guidance & samples. Included Homestead Exemption form & info are also valuable & greatly appreciated.

Thank you for your feedback. We really appreciate it. Have a great day!

EILEEN K.

March 17th, 2022

I received my product in great condition and it works ok. Thankyou!!!

Thank you!

Melody P.

May 4th, 2021

Great service as always, thanks!

Thank you for your feedback. We really appreciate it. Have a great day!

EARL R.

June 4th, 2023

easy to use once i found out i could fill it out right on the deeds website instead of downloading it to word duh.

Thank you for your feedback Earl. We'll work on ways to make it more clear that the forms are fill in the blank right in the PDF. Have an amazing day!

DOUGLAS H.

December 16th, 2020

Just as promised My quitclaim deed went through the county recorders office with no problem.

Thank you for your feedback. We really appreciate it. Have a great day!

Michael E.

December 2nd, 2020

First time user and my experience was just great! Great people to work with and would recommend to others!

Thank you!

Jennifer D.

March 9th, 2022

I was skeptical; but, so thankful I went with them. They were beyond helpful through the entire process and very patient with me. I could not have done my quit deed form without them. Thank you for all of your help.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

MYRON J.

October 24th, 2019

Great way to track and save forms.

Thank you!

Marion B.

September 2nd, 2023

As far as I know all is in order as far as my transfer on death instrument for Illinois. Thank you so much!

Thank you for your feedback. We really appreciate it. Have a great day!

Angel C.

September 28th, 2022

Solid forms hitting all the marks (statutory requirements) Fairly simple to accomplish what I was looking to do with minimal research. Would certainly use again when needed.

Thank you!

Rosanne E.

October 8th, 2020

Excellent response and all went well with downloading documents. Thank you for offering this important service.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Gerald B.

April 5th, 2021

Thank you so much for the helpful service and quick action! If needed, I will definitely choose Deeds.com again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Phyllis M.

August 3rd, 2019

Using your site was very easy. I found what my friend said she wanted easily and downloaded it to retype her quitclaim deed.

Thank you for your feedback. We really appreciate it. Have a great day!

Dwayne H.

November 3rd, 2020

The Oregon TODD transfer on death deed template worked great and was easy to use. They had instructions and a guide that had good pointers to filling everything out. It took about 2 weeks to mail in my filled TODD and receive it back from the county with their stamp. Would definitely use this service for other documents

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Charlotte V.

June 13th, 2024

t was a bit confusing at first. I am really old though. It was fairly easy to use. I will continue to use Deeds. com for all my future needs. Thank you Deeds.com for making life so much easier.

We are grateful for your feedback and looking forward to serving you again. Thank you!