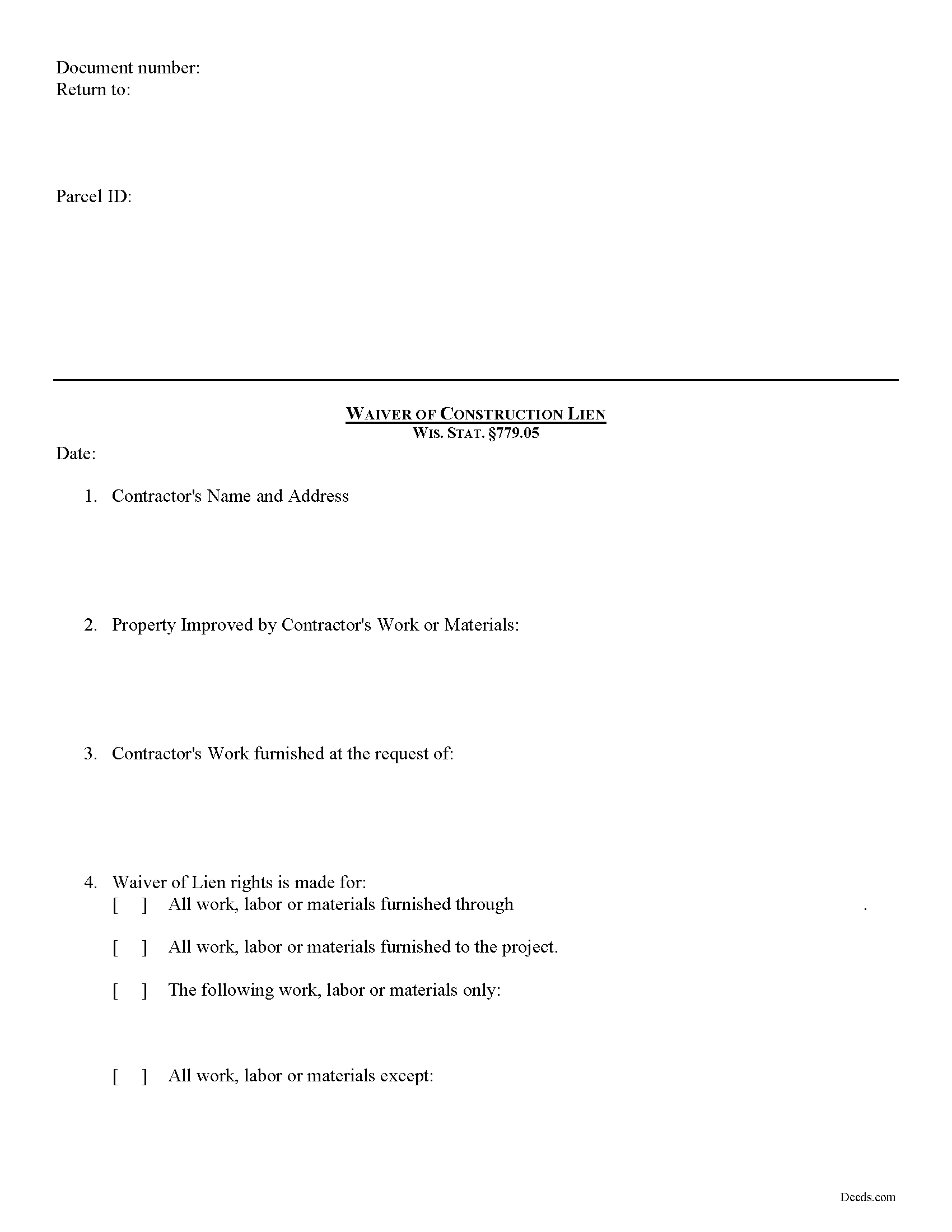

Grant County Construction Lien Waiver Form

Grant County Construction Lien Waiver Form

Fill in the blank form formatted to comply with all recording and content requirements.

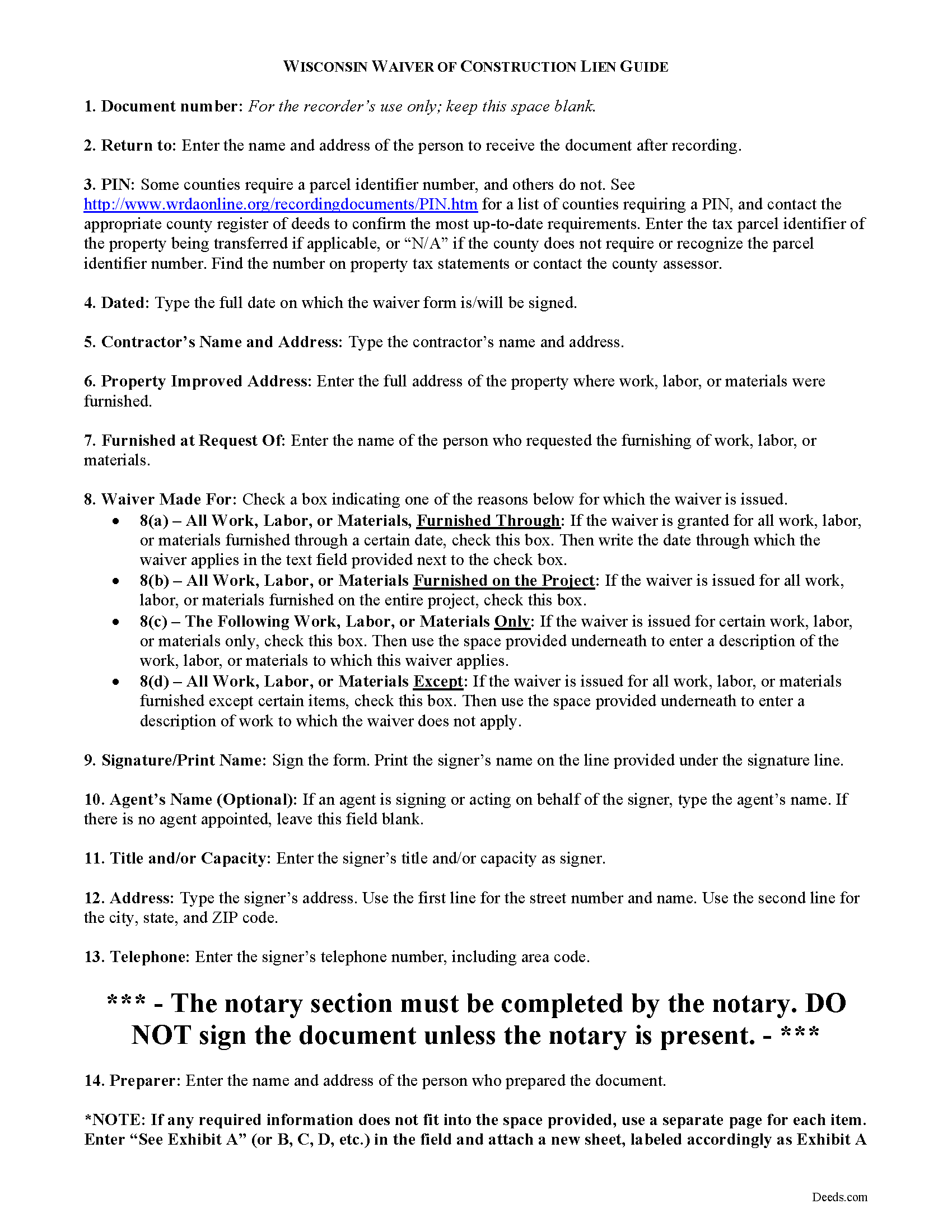

Grant County Construction Lien Waiver Guide

Line by line guide explaining every blank on the form.

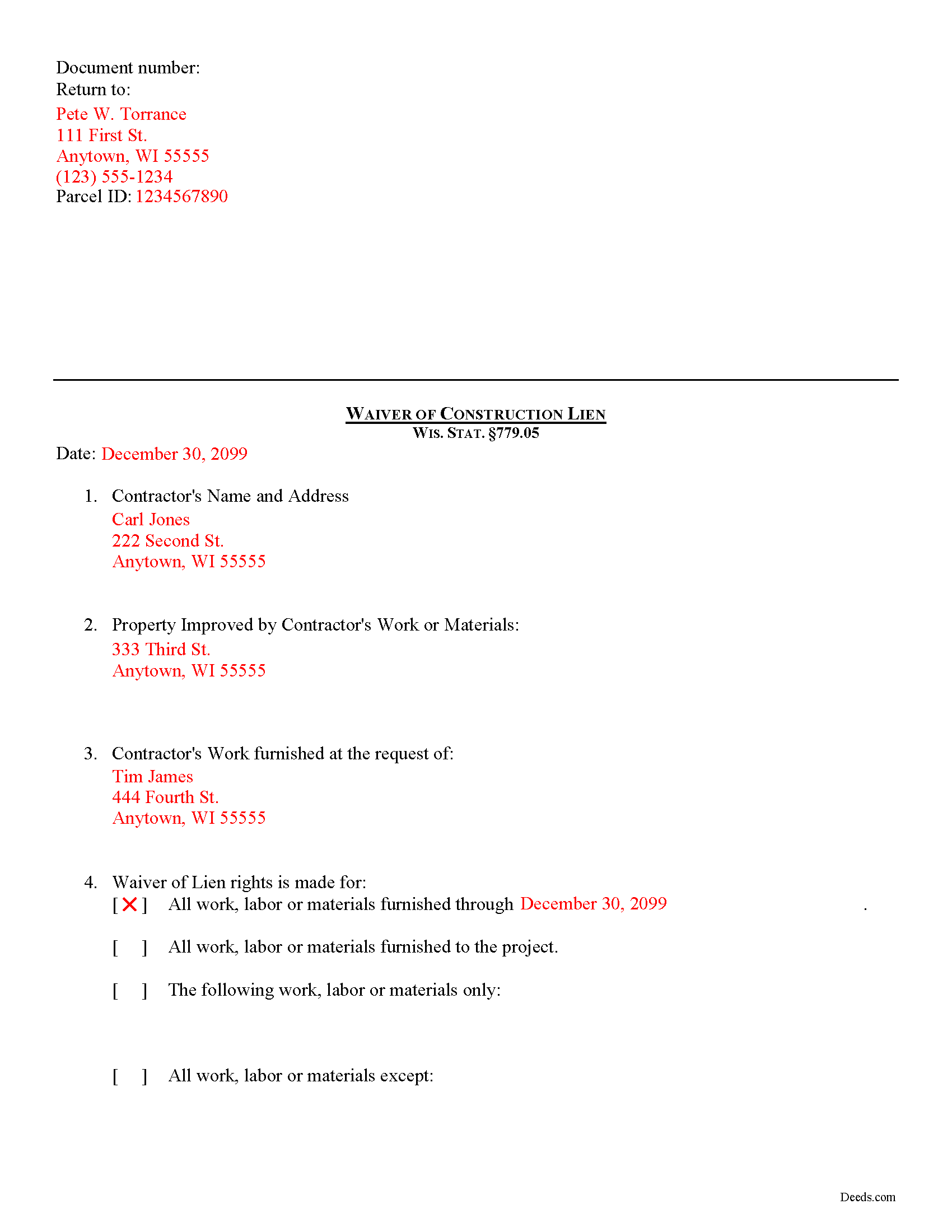

Grant County Completed Example of the Construction Lien Waiver Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Wisconsin and Grant County documents included at no extra charge:

Where to Record Your Documents

Grant County Register of Deeds

Lancaster, Wisconsin 53813

Hours: Monday - Friday 8:00am - 4:30pm

Phone: (608) 723-2727

Recording Tips for Grant County:

- Verify all names are spelled correctly before recording

- Recording fees may differ from what's posted online - verify current rates

- Recorded documents become public record - avoid including SSNs

- Some documents require witnesses in addition to notarization

Cities and Jurisdictions in Grant County

Properties in any of these areas use Grant County forms:

- Bagley

- Beetown

- Bloomington

- Blue River

- Boscobel

- Cassville

- Cuba City

- Dickeyville

- Fennimore

- Glen Haven

- Hazel Green

- Kieler

- Lancaster

- Livingston

- Montfort

- Mount Hope

- Muscoda

- Patch Grove

- Platteville

- Potosi

- Sinsinawa

- Stitzer

- Woodman

Hours, fees, requirements, and more for Grant County

How do I get my forms?

Forms are available for immediate download after payment. The Grant County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Grant County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Grant County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Grant County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Grant County?

Recording fees in Grant County vary. Contact the recorder's office at (608) 723-2727 for current fees.

Questions answered? Let's get started!

Lien Waivers in Wisconsin

Lien waivers are used to simplify payments between contractors, subcontractors, customers, and property owners. A waiver is a known forfeiture of a legal right. In this case, the person granting the waiver forfeits the right to seek a mechanic's lien for all or part of the amount due.

Unlike other states, Wisconsin outlines a broad array of waiver rights and the law does not require verification of payment before the waiver takes effect. Any document signed by a lien claimant or potential claimant and purporting to be a waiver of construction lien right, is valid and binding as a waiver whether or not consideration was paid therefor and whether the document was signed before or after the labor, services, materials, plans, or specifications were performed, furnished, or procured, or contracted for. WIS. STAT. 779.05(1). Any ambiguity in such document shall be construed against the person signing it. Id.

Any waiver document shall be deemed to waive all lien rights of the signer for all labor, services, materials, plans, or specifications performed, furnished, or procured, or to be performed, furnished, or procured, by the claimant at any time for the improvement to which the waiver relates, except to the extent that the document specifically and expressly limits the waiver to apply to a particular portion of such labor, services, materials, plans, or specifications. Id. Therefore, be sure to spell out any exceptions to the waiver in the waiver document as any mistake could lead to an inadvertent waiver.

Be certain that payment is guaranteed before issuing a waiver, especially if the account still shows a balance due. A lien claimant or potential lien claimant of whom a waiver is requested is entitled to refuse to furnish a waiver unless paid in full for the labor, services, materials, plans, or specifications to which the waiver relates. Id. A waiver furnished is a waiver of lien rights only, and not of any contract rights of the claimant otherwise existing. Id.

A promissory note or other evidence of debt given for any lienable claim shall not be deemed a waiver of lien rights unless the note or other instrument is received as payment and expressly declares that receipt thereof is a waiver of lien rights. WIS. STAT. 779.05(2).

This article is provided for informational purposes only and should not be relied upon as a substitute for the advice from a legal professional. Please contact an attorney with questions about lien waivers, or any other issues related to liens in Wisconsin.

Important: Your property must be located in Grant County to use these forms. Documents should be recorded at the office below.

This Construction Lien Waiver meets all recording requirements specific to Grant County.

Our Promise

The documents you receive here will meet, or exceed, the Grant County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Grant County Construction Lien Waiver form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Janice S.

August 27th, 2019

Well, you couldn't find the deeds, but you didn't charge me for it so great! Thanks Jan

Thank you for your feedback. Sorry we were not able to assist you better with your deed search. Have a wonderful day!

Howard N.

March 26th, 2025

I tried several other online sites for lady bird deed. The county said they didn't contain the correct information. The form from Deeds.com was the right one. Thank you Howard Nielsen

Thank you for your positive words! We’re thrilled to hear about your experience.

John C N.

June 17th, 2023

Just the website I needed. Very detailed and efficient.

Thank you for taking the time to provide your feedback John, we really appreciate it. Have an amazing day!

James K.

January 12th, 2023

Gave me exactly what i needed

Thank you for your feedback. We really appreciate it. Have a great day!

Austin S.

August 13th, 2020

Everything is done in a timely manner which is very much appreciated.

Thank you for your feedback. We really appreciate it. Have a great day!

Jo Carol K.

October 17th, 2020

The information/forms/and ease of filling in the blanks provided me with the confidence to "do it myself". Excellent customer service. Thank you for being there.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Justine John S.

February 17th, 2022

Splendid! I will definitely and absolutely recommend you guys and this company to my co-investors !

Thank you!

annie m.

February 13th, 2023

recently joined Deeds.com. still exploring the site. has been very helpful in providing local information for recording, such as fees and requirements. i am working to correct mistakes made within a deed. it is amazing how these municipalities operate outside the scope of Article 1, Section 8, Clause 17; to claim land is "in" the "State of ____. when the land is actually not ceded to the United States of America as for use for needful buildings. beware of the fraud perpetrated by Attorneys in the recording of your Deeds. Registration as "RESIDENTIAL" puts your private-use land on the TAX rolls with the use of that one word. i recommend this site as it appears there is information for each state and each county office. will update my review once i place an order.

Thank you!

Richard A.

June 24th, 2020

Great product. It would be better if the document files were not embedded within other files. It made downloading a little confusing. The titles of the forms did not match exactly word for word, which required a lot of back and forth to make sure I had downloaded the proper document. What would be great is if once you download a document, the hyperlink changed color, or somehow denoted the document had been downloaded. Just a suggestion. You have my email address if you have questions. STILL! Five stars for you guys. I would not let that hiccup dissuade me from buying any form package from you guys. Thanks!

Thank you for your feedback. We really appreciate it. Have a great day!

David C.

April 21st, 2021

This has been a lifesaver for me. Exactly what I needed. Forma are easy to fill in. Thank you for offering this instead of going thru a lawyer. faster and no wait time.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Harry C.

September 14th, 2021

Sign up was rocky. Tried to access documents and msg. said did not recognize my email (even though it had sent me an email). Contacted support and it was resolved. House transfer affidavit straight forward and easy to fill out.

Thank you for your feedback. We really appreciate it. Have a great day!

Kim P.

July 23rd, 2021

I want to thank you so much. You made a stressful process easy. The customer service was amazing. There is no doubt I will use your service again.

Thank you!

Robert P.

November 3rd, 2020

Overall, your website was straightforward and easy to navigate. I was able to accomplish what I needed to do very quickly. If needed again, I would certainly use and recommend others to use deeds.com.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Christina A G.

December 19th, 2020

It was easy to locate, purchase, and download the documents I needed on the Deeds.com website.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

April K.

September 25th, 2022

Great service & quick response. Thank U.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!