Marathon County Correction Deed Form (Wisconsin)

All Marathon County specific forms and documents listed below are included in your immediate download package:

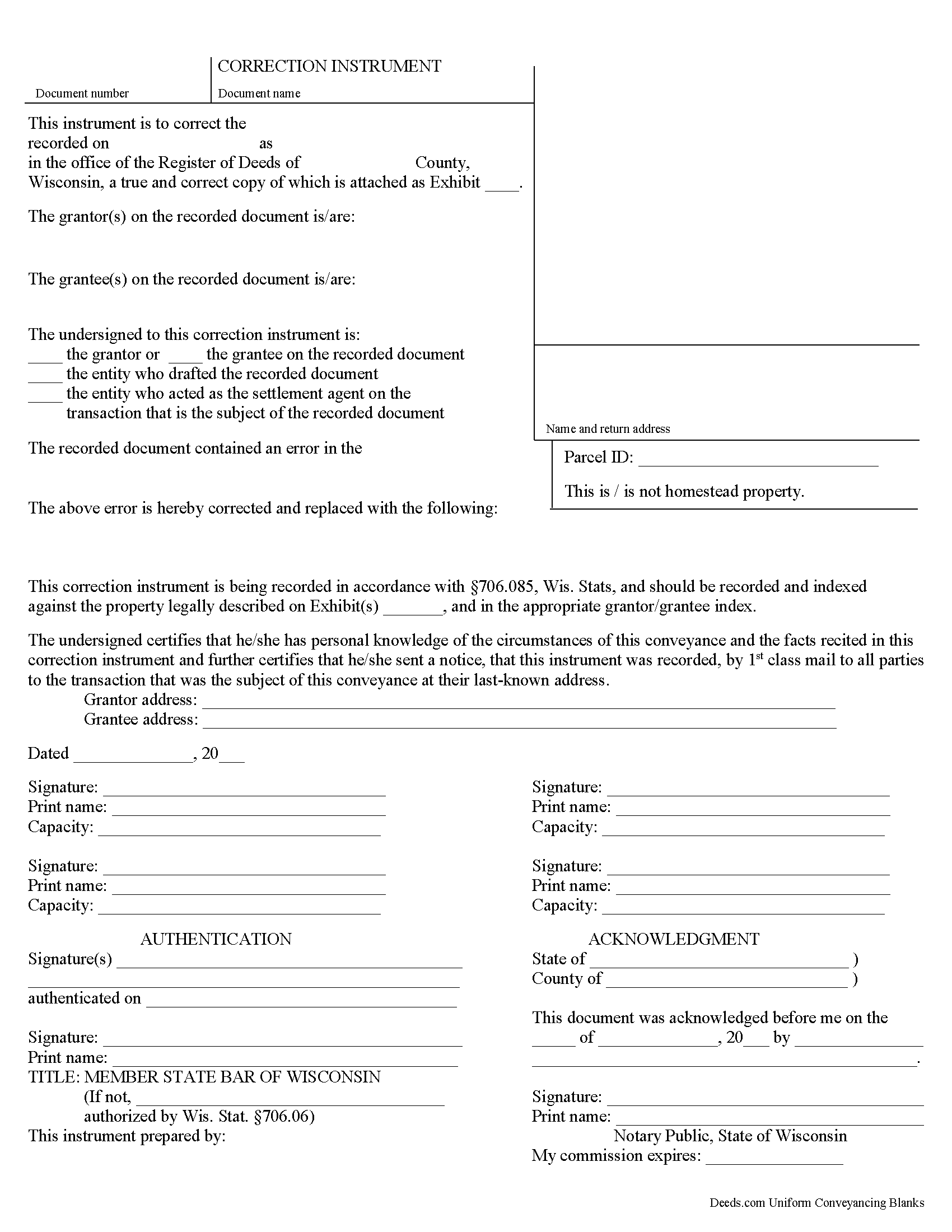

Correction Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Marathon County compliant document last validated/updated 7/1/2025

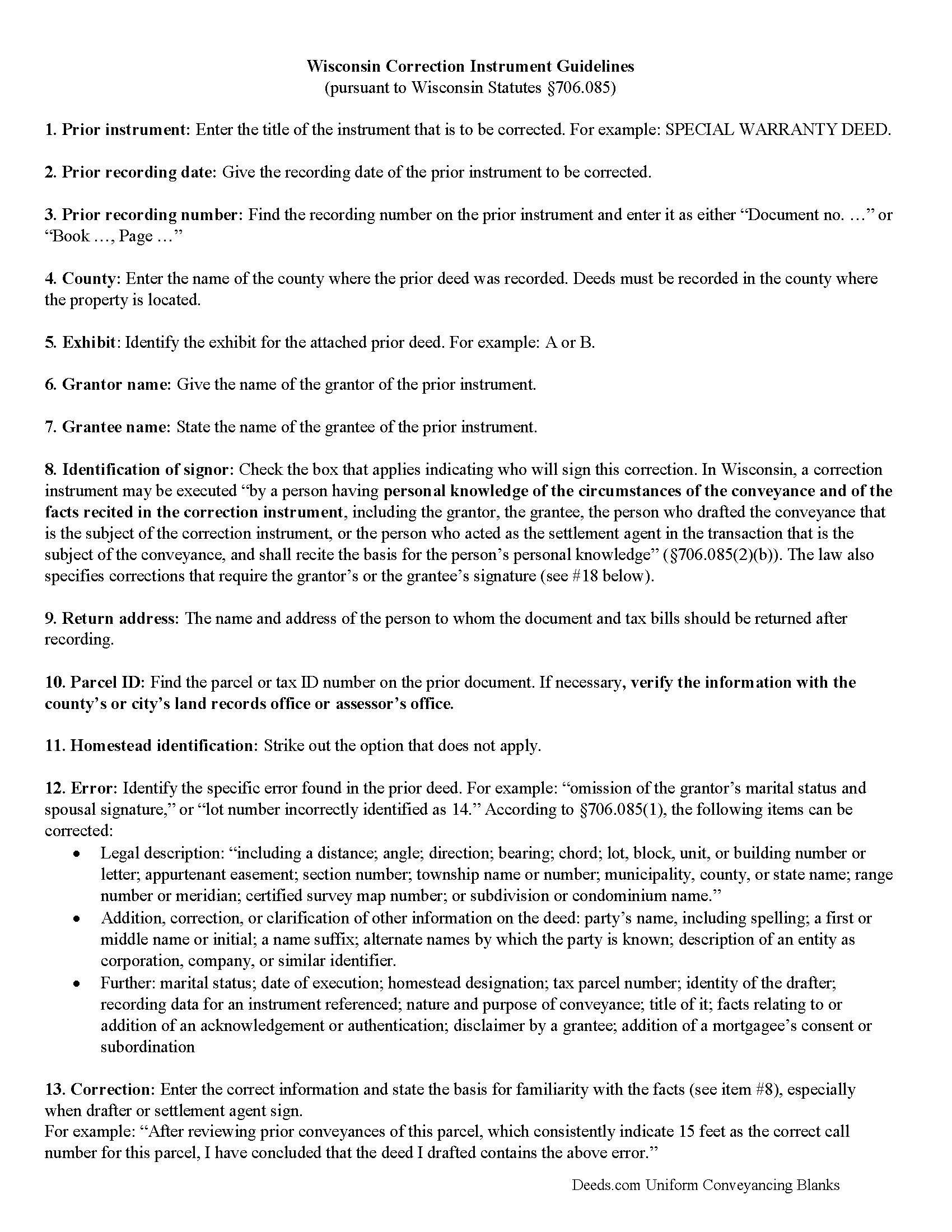

Correction Deed Guide

Line by line guide explaining every blank on the form.

Included Marathon County compliant document last validated/updated 7/4/2025

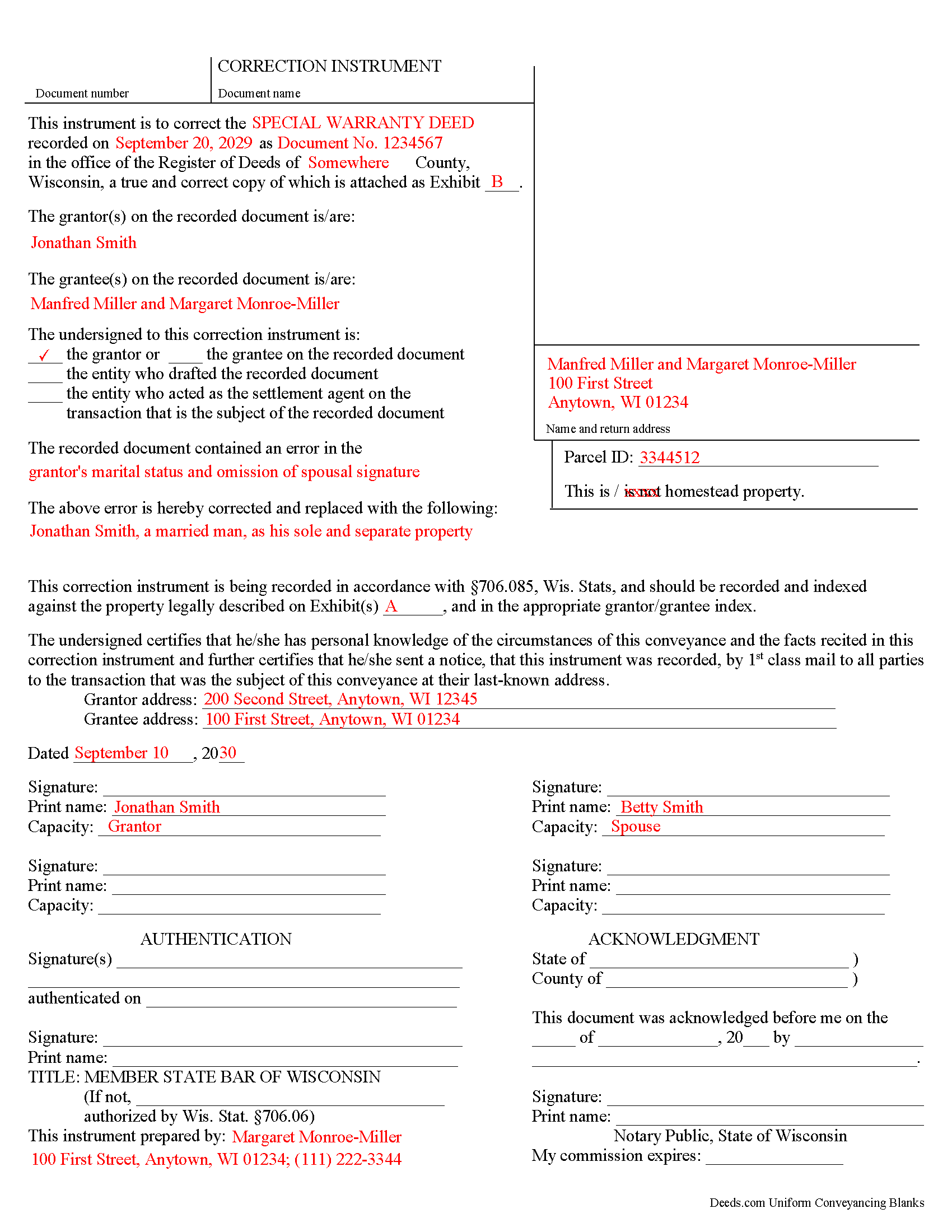

Completed Example of the Correction Deed Document

Example of a properly completed form for reference.

Included Marathon County compliant document last validated/updated 5/29/2025

The following Wisconsin and Marathon County supplemental forms are included as a courtesy with your order:

When using these Correction Deed forms, the subject real estate must be physically located in Marathon County. The executed documents should then be recorded in the following office:

Marathon County RoD

Courthouse - 500 Forest St, Wausau, Wisconsin 54403

Hours: Monday - Friday 8:00am to 4:30pm (After 4:15 p.m. the record can be picked up or mailed the following business day)

Phone: 715-261-1470

Local jurisdictions located in Marathon County include:

- Aniwa

- Athens

- Brokaw

- Edgar

- Eland

- Elderon

- Galloway

- Hatley

- Marathon

- Mosinee

- Ringle

- Rothschild

- Schofield

- Spencer

- Stratford

- Unity

- Wausau

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Marathon County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Marathon County using our eRecording service.

Are these forms guaranteed to be recordable in Marathon County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Marathon County including margin requirements, content requirements, font and font size requirements.

Can the Correction Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Marathon County that you need to transfer you would only need to order our forms once for all of your properties in Marathon County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Wisconsin or Marathon County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Marathon County Correction Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Use the correction instrument to correct an error in a deed in Wisconsin.

Since 2010 Wisconsin statutes have allowed for a correction instrument that can be used to correct any of the following (706.085, Wis. Stats.):

* An error in the legal description, "including a distance; angle; direction; bearing; chord; lot, block, unit, or building number or letter; appurtenant easement; section number; township name or number; municipality, county, or state name; range number or meridian; certified survey map number; or subdivision or condominium name."

* The addition, correction, or clarification of other information on the deed: party's name, including spelling; a first or middle name or initial; a name suffix; alternate names by which the party is known; and description of an entity as corporation, company, or similar identifier.

* An error in one of the following items on the deed: marital status; date of execution; homestead designation; tax parcel number; identity of the drafter; recording data for an instrument referenced; nature and purpose of conveyance; title of it; facts relating to or addition of an acknowledgement or authentication; disclaimer by a grantee; and addition of a mortgagee's consent or subordination

If any corrections are made to the legal description, the complete corrected legal description must be attached as exhibit page, in addition to the incorrect version on the attached prior deed.

The correction instrument may be executed "by a person having personal knowledge of the circumstances of the conveyance and of the facts recited in the correction instrument" (706.085, Wis. Stats.). This includes the grantor, the grantee, the person who drafted the prior deed, and the person who acted as the settlement agent in the prior conveyance. In the case of the latter two especially, "the basis for the person's personal knowledge" must be stated. Furthermore, the law specifies corrections that must be signed by the grantor or the grantee.

The grantor only can sign if land is added through the correction. If, on the other hand, a parcel is being removed, the grantee must sign. If a lot or unit number is being corrected and the lot or unit incorrectly recited on the conveyance is also owned by the grantor," the grantee's signature is required as well. If the incorrectly recited parcel is not also owned by the grantor, any party identified above can sign. The same holds true if the correction instrument "supplies a lot, block, unit, or building number or letter that was omitted from the conveyance" (706.085, Wis. Stats.). The correction instrument must be acknowledged or authenticated by a notary or official authorized to do so.

(Wisconsin CD Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Marathon County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Marathon County Correction Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4562 Reviews )

MARY LACEY M.

June 30th, 2025

Great service! Recording was smooth and swiftly performed. Deeds.com is an excellent service.rn

We are delighted to have been of service. Thank you for the positive review!

Robert F.

June 30th, 2025

Breeze.... It feels silly to hire an attorney to do this for just one beneficiary. Thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

Pauline C.

June 29th, 2025

Everything that was stated to be included in my order was complete. Very satisfied

Thank you for your positive words! We’re thrilled to hear about your experience.

Regina W.

February 3rd, 2022

So glad I found this form. Very easy to download and looks like all the instructions are there to correctly fill out my paperwork. Thanks.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Joyce B.

July 25th, 2019

Very easy to purchase and download.

Thank you!

Gene K.

April 24th, 2019

I am still in the trial stage. I am an older lawyer. Any help I can get is worth it. Once you get used to the format and data fill in the deed thing is excellent. Very professional if not a little slow. I have only done three deeds in one state so I will have to see how it goes. I like the product and their attitude towards pleasing the customer. We'll see when I try the recording part.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Thomas V.

January 7th, 2019

Easy to use. Accomplished my goal

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Roberta M.

February 21st, 2022

I found a lot of useful information regarding the Lady Bird Deed and feel it will serve my needs as opposed to a Revocable

Living

Trust. The information was easy to understand and very helpful. The forms seem easy to complete and I plan to get them notarized and filed at the courthouse very soon.

Thank you for your feedback. We really appreciate it. Have a great day!

Darrell J.

February 22nd, 2021

Easy to use, rapid response, excellent service.

Thank you for your feedback. We really appreciate it. Have a great day!

Jin L.

December 27th, 2019

Your service is pretty awesome! I needed to get my docs recorded before year end, and you guys were on it. Thank you very much for the quick turnaround!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ronald L.

January 21st, 2021

There is not enough room on the form to describe my property which was taken directly from the previous deed. Other than that worked as expected.

Thank you for your feedback. We really appreciate it. Have a great day!

CHRISTINE M.

September 6th, 2019

It was all I needed and guided me to fill it out.

Thank you!

Brenda M.

December 26th, 2018

It was quick and easy to obtain the document I needed

Thanks so much for your feedback Brenda, we really appreciate it. Have a great day!

Martha V.

August 30th, 2020

Great service!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Candy A.

June 27th, 2020

Super simple to download all necessary forms. BIG thank you for this service.

Thank you!