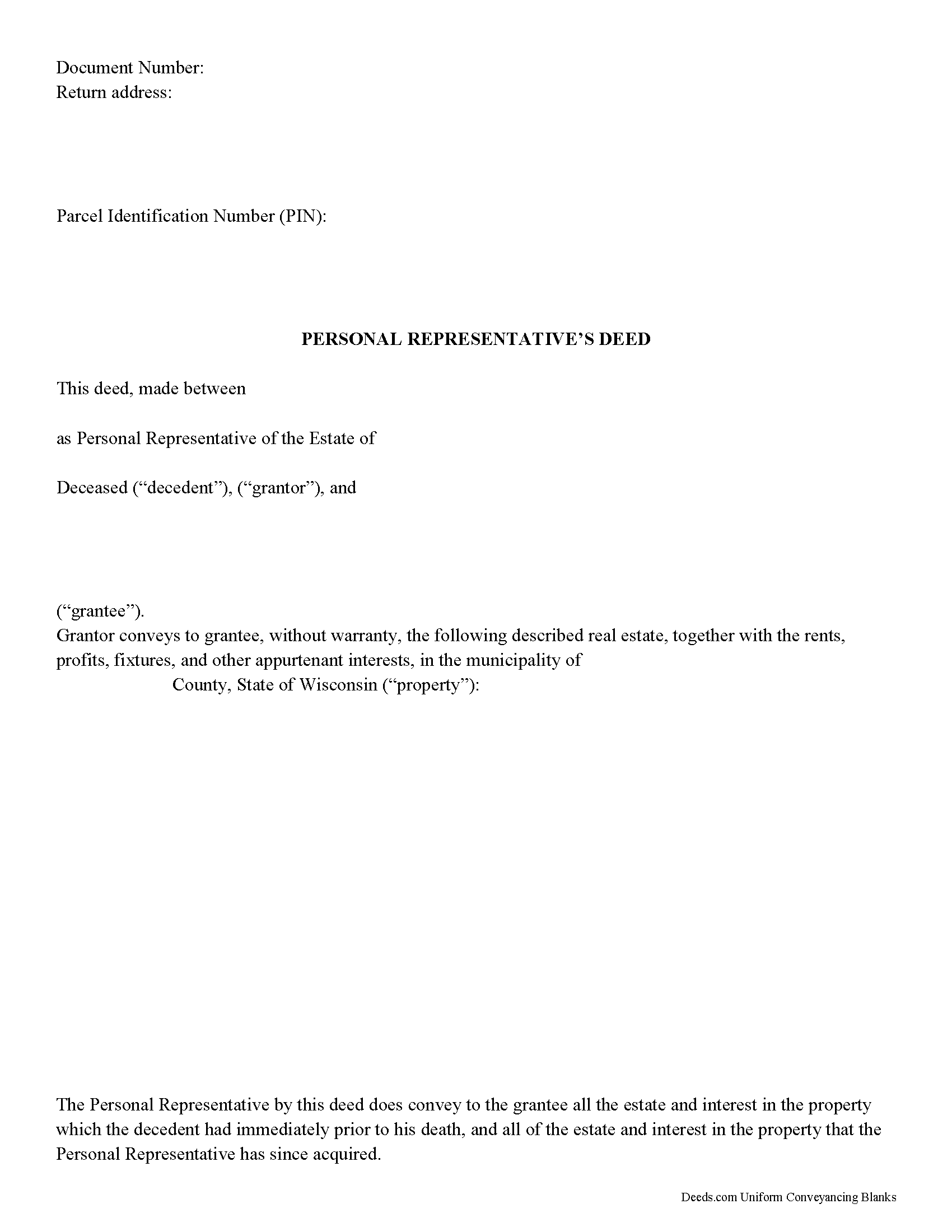

Price County Personal Representative Deed Form

Price County Personal Representative Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

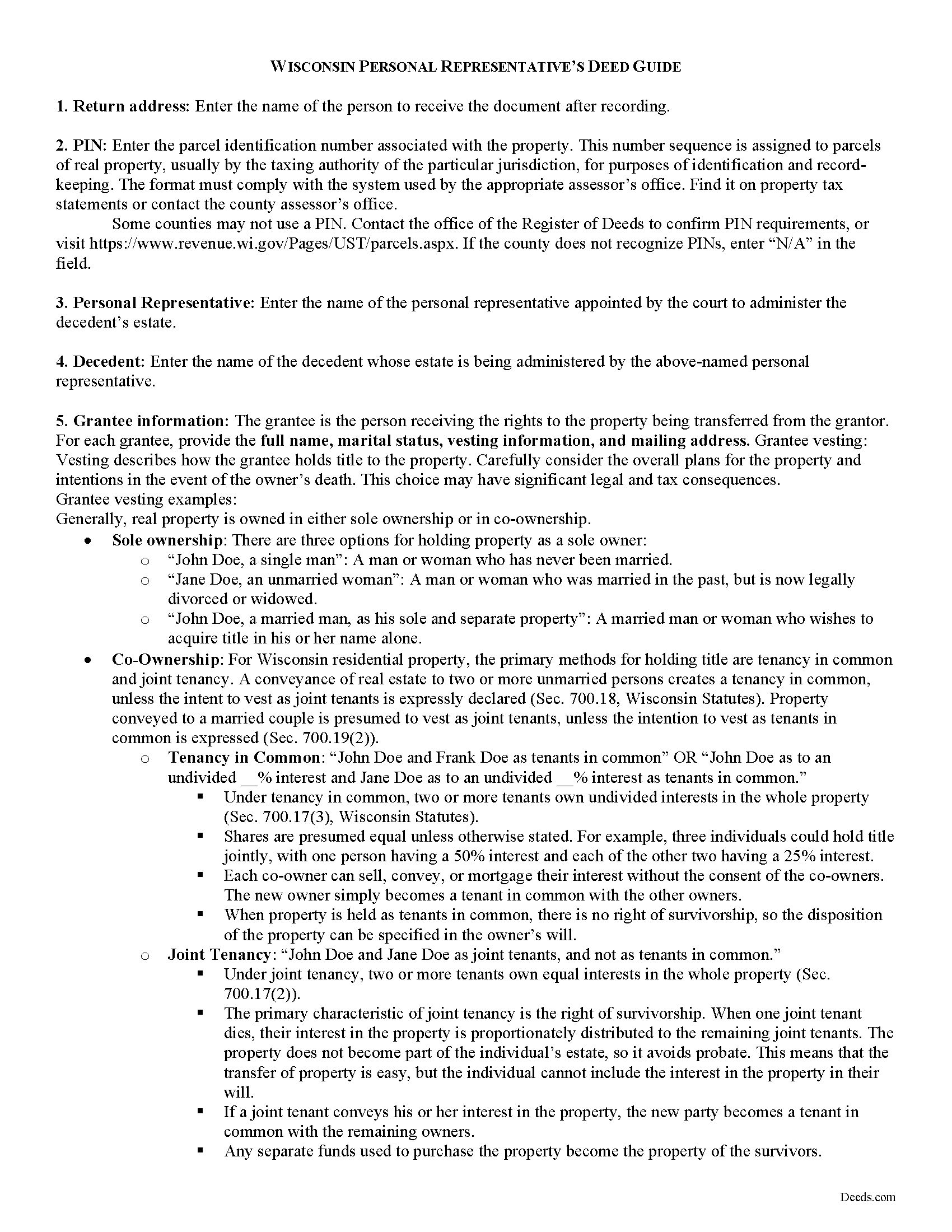

Price County Personal Representative Deed Guide

Line by line guide explaining every blank on the form.

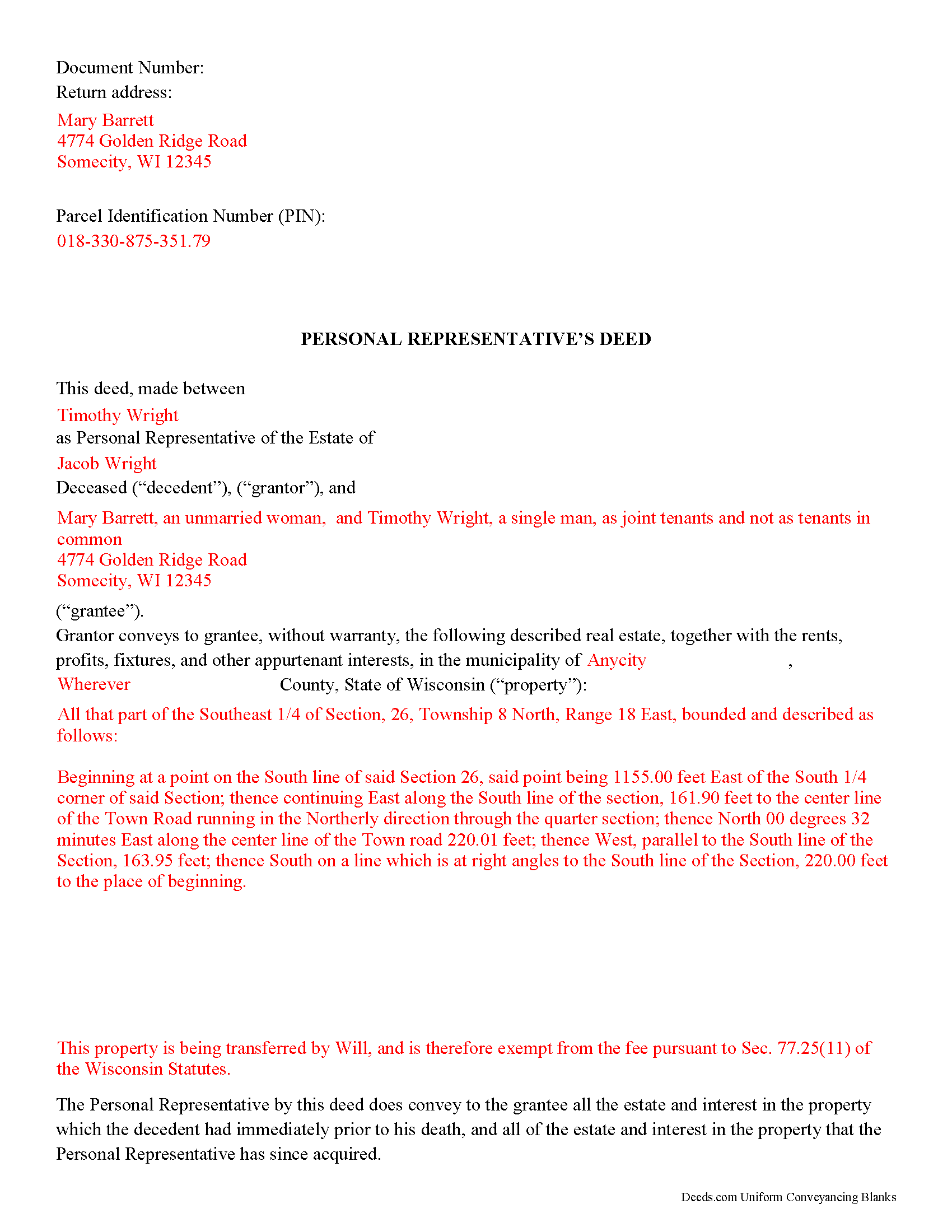

Price County Completed Example of the Personal Representative Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Wisconsin and Price County documents included at no extra charge:

Where to Record Your Documents

Price County Register of Deeds

Phillips, Wisconsin 54555

Hours: 8:00 to 12:00 & 1:00 to 4:30 M-F

Phone: 715-339-2515

Recording Tips for Price County:

- Ensure all signatures are in blue or black ink

- Request a receipt showing your recording numbers

- Bring extra funds - fees can vary by document type and page count

- Have the property address and parcel number ready

Cities and Jurisdictions in Price County

Properties in any of these areas use Price County forms:

- Brantwood

- Catawba

- Fifield

- Kennan

- Ogema

- Park Falls

- Phillips

- Prentice

Hours, fees, requirements, and more for Price County

How do I get my forms?

Forms are available for immediate download after payment. The Price County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Price County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Price County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Price County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Price County?

Recording fees in Price County vary. Contact the recorder's office at 715-339-2515 for current fees.

Questions answered? Let's get started!

Transfer or Sale of a Decedent's Real Estate in Wisconsin

At its most basic, probate means to prove a decedent's will. The term "probate," however, is frequently used to describe the legal process of estate administration, which includes intestate estate succession in addition to probating wills. Estates are called intestate when the decedent (deceased person) does not leave a will. Probate ensures that a decedent's estate is lawfully transferred pursuant to the provisions of his will or to the state's laws of intestate succession.

Property that does not transfer by means of a survivorship or beneficiary designation is subject to probate. Estates requiring formal or informal probate involve the appointment of a personal representative (PR), a fiduciary appointed by the court to administer the estate in accordance with Wisconsin's Probate Code, located at Chs. 851-882 of the Wisconsin Statutes. This article will focus on informal administration; formal administration may be necessary depending on such factors as specifications in the will and whether all persons having an interest in the estate agree on the administration. Consult a lawyer with questions.

The first step to administration is opening the estate by submitting a petition for administration in the circuit court of the county where the decedent resided at the time of death. If there is a will, it must be delivered to the probate registrar. If the testator (person making a will) has filed the will with the court for safekeeping, the court shall contact the person named in the will to administer the estate (Wis. Stat. Sec. 856.03). Upon petition, the court will set a time for proving the will (if applicable), determining heirship, and appointing a personal representative (Sec. 856.11).

To evidence the authority of a PR to act on behalf of the estate, the court grants Domiciliary Letters to the qualifying person. The person named in the decedent's will has priority in appointment, followed by any person interested in the estate or the person's nominee, under discretion of the court (Sec. 856.21). With the issuance of letters, the PR is granted the general powers and duties of a personal representative under Ch. 857, Wisconsin Statutes, to administer the estate as required by law.

Among the PR's powers is the power to "sell, mortgage or lease any property in the estate without notice, hearing or court order" under Sec. 860.01, unless restricted or prohibited by the decedent's will (Sec. 860.11). The beneficiary of property specifically devised to him by the decedent must join in the sale of such property (Sec. 860.11(2)). If the will contains any such limitations as to the sale of real property, yet the PR is unable to pay allowances, expenses of administration, or claims on the estate within those limitation, he can petition the court for sale (Sec. 860.11(4)).

To sell or transfer an interest in real estate, the PR executes a personal representative's deed. A PR deed passes title to the named grantee free and clear of the rights of creditors that have been filed and allowed in the estate under Ch. 859 (Sec. 860.05). The PR has no statutory power to make warranties in any sale of real estate binding on the PR or on the estate (Sec. 860.07). The deed conveys all the estate and interest in the property the decedent had immediately prior to his death, and all the estate and any interest in the property the PR has since acquired.

A lawful deed should meet the requirements for content established at Sec. 706.02, identifying the parties and the land involved, the interest conveyed, and any conditions. The grantor must sign and have the deed properly acknowledged under Sec. 706.06. All deeds in Wisconsin require the name of the person who drafted the instrument and full legal description of the property and meet statutory and local standards for formatting recorded instruments (Sec. 59.43).

Record the deed in the office of the register of deeds in each county where the property is situated. Conveyances of real property offered for recording must be accompanied by receipt of an electronic real estate transfer return or note an exemption on the face of the document 706.05(12)). Exemptions to the real estate transfer fee are codified at Sec. 77.25, and include transfers by will, descent, or survivorship (Sec.77.25(11)).

Consult an attorney about personal representative's deeds and informal probate procedures in Wisconsin, as each situation is unique.

(Wisconsin PRD Package includes form, guidelines, and completed example)

Important: Your property must be located in Price County to use these forms. Documents should be recorded at the office below.

This Personal Representative Deed meets all recording requirements specific to Price County.

Our Promise

The documents you receive here will meet, or exceed, the Price County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Price County Personal Representative Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Patricia D.

January 22nd, 2019

It worked great- I had a little trouble at first with the site, figuring out where to do what, but the form was much better than the one we purchased at Staples, loved being able to fill out with the computer. We did need the other form as per the screen prior to ordering but couldn't figure out which one. The ladies at the recorders were great too.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Candy A.

June 27th, 2020

Super simple to download all necessary forms. BIG thank you for this service.

Thank you!

JOHN L.

November 17th, 2020

Not just good, very good. Very intuitive and very responsive. It just works!

Thank you for your feedback. We really appreciate it. Have a great day!

Edwin M.

July 2nd, 2021

Good marks from me. Keep up the good work !

Thank you!

Cathy W.

December 18th, 2021

Easy to use and fee is reasonable.

Thank you!

tim g.

May 3rd, 2019

that is what I was looking for thanks

Thanks Tim, glad we could help.

Evelyn B.

June 23rd, 2023

Wow! Deeds.com provided proficient eRecording with great response time and great service... and it was super easy, super fast, and very reasonably priced. What more could you possibly want?! Highly recommended!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Susan G.

January 11th, 2025

Very easy to use!

We are thankful for your continued support and feedback, which inspire us to continuously improve. Thank you..

Vicky M.

September 1st, 2022

I would give Deeds.com 10 stars if I could!! The staff were super friendly and easy to work with. They kept me constantly updated during the process of uploading and forwarding my deeds for recording. And, the price was extremely reasonable. I look forward to utilizing Deeds.com every time I need to record a deed no matter what U.S. State. I wholeheartedly recommend them!

Thank you for your feedback. We really appreciate it. Have a great day!

Marsella F.

May 20th, 2021

Thank you so much!! This is a fantastic tool!! Marsella F.

Thank you for your feedback. We really appreciate it. Have a great day!

David L.

January 13th, 2021

Deeds.com makes recording quick and easier than driving a half an hour each way and needing to leave home! The fees are reasonable for the convenience, and while Covid is closing doors. Dave

Thank you!

Diane O.

September 1st, 2022

Filling out forms was easy....so far, I am happy !

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Christine P.

April 19th, 2020

Great service! Just what I needed and a bunch of informative extras too. Thanks!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Michael L.

December 28th, 2018

I accidentally ordered the wrong deed package. Was looking for a quit claim deed and got a trustee deed. I immediately emailed the company, nothing back from them. I would like to exchange my purchase.

Thank you for your feedback. We replied to your message on December 20th at 2:05 pm, the reply was as follows: As a one time courtesy we have canceled your order/payment for the Trustee Deed document.

Ming Z.

September 28th, 2022

Definitely 5 Stars !

Thank you!