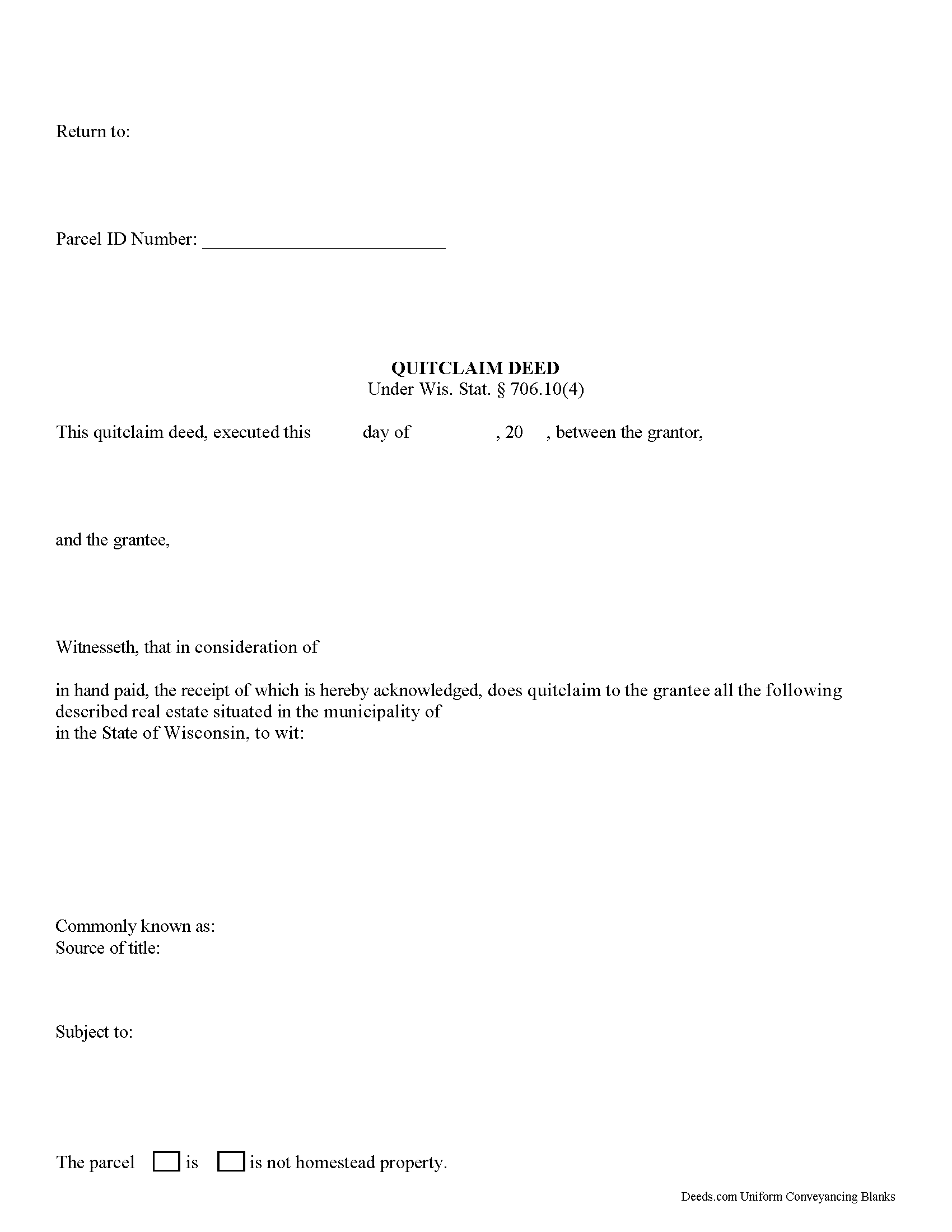

Iowa County Quitclaim Deed Form

Iowa County Quitclaim Deed Form

Fill in the blank Quitclaim Deed form formatted to comply with all Wisconsin recording and content requirements.

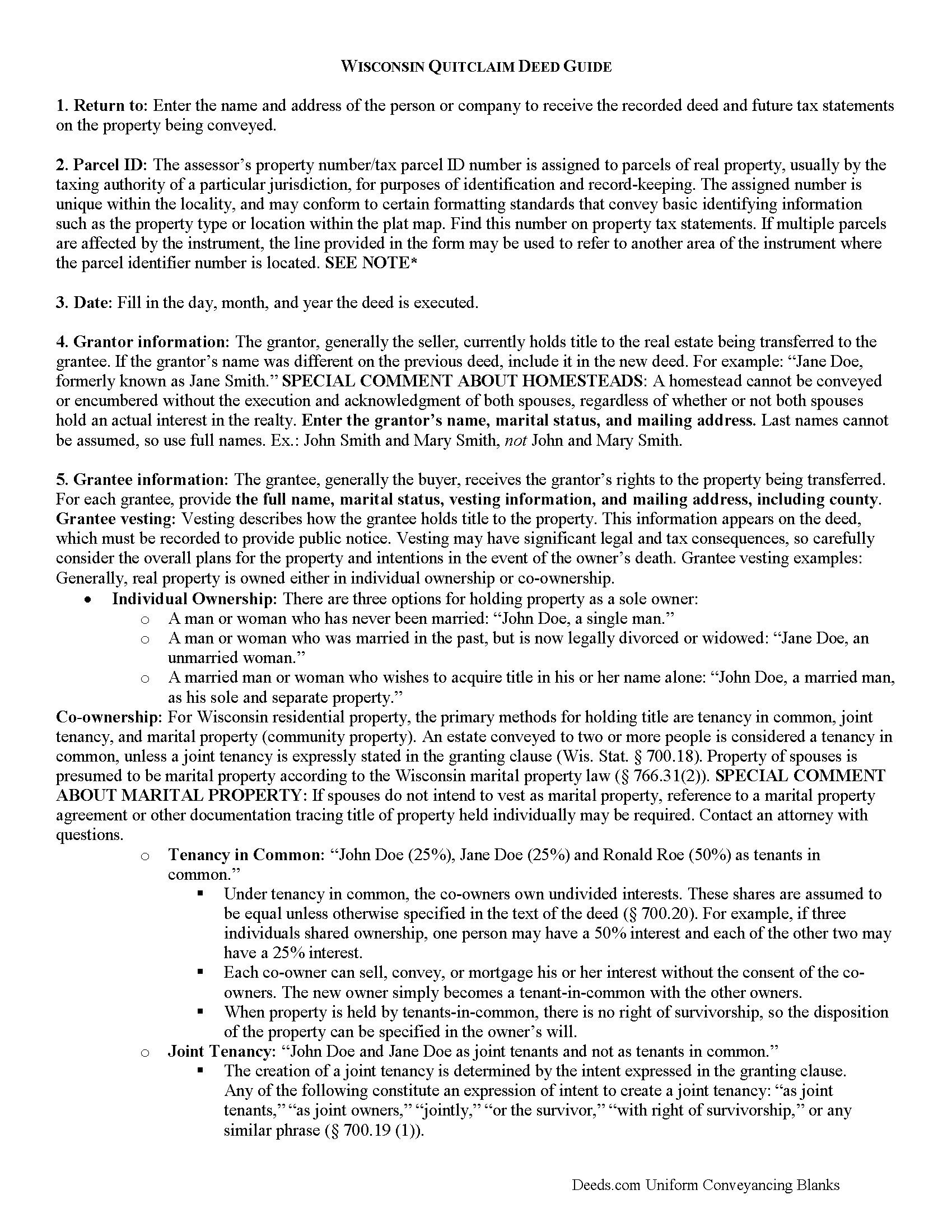

Iowa County Quitclaim Deed Guide

Line by line guide explaining every blank on the Quitclaim Deed form.

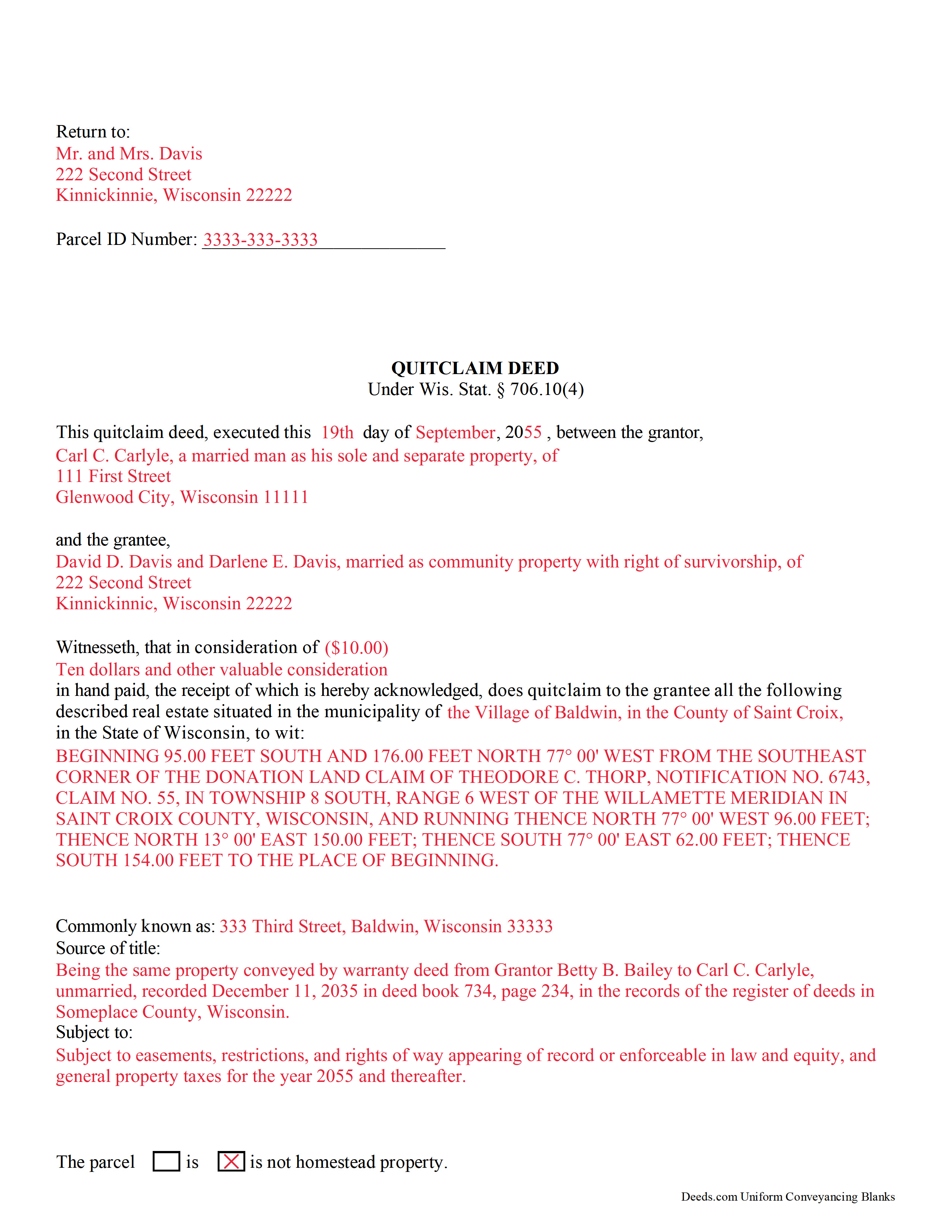

Iowa County Completed Example of the Quitclaim Deed Document

Example of a properly completed Wisconsin Quitclaim Deed document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Wisconsin and Iowa County documents included at no extra charge:

Where to Record Your Documents

Iowa County Register of Deeds

Dodgeville, Wisconsin 53533

Hours: Monday - Friday 8:30am to 4:30pm

Phone: 608 935-0396

Recording Tips for Iowa County:

- Bring your driver's license or state-issued photo ID

- Double-check legal descriptions match your existing deed

- Check that your notary's commission hasn't expired

- Recorded documents become public record - avoid including SSNs

- Verify the recording date if timing is critical for your transaction

Cities and Jurisdictions in Iowa County

Properties in any of these areas use Iowa County forms:

- Arena

- Avoca

- Barneveld

- Cobb

- Dodgeville

- Edmund

- Highland

- Hollandale

- Linden

- Mineral Point

- Rewey

- Ridgeway

Hours, fees, requirements, and more for Iowa County

How do I get my forms?

Forms are available for immediate download after payment. The Iowa County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Iowa County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Iowa County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Iowa County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Iowa County?

Recording fees in Iowa County vary. Contact the recorder's office at 608 935-0396 for current fees.

Questions answered? Let's get started!

A quitclaim deed, according to the prerequisites for transfers as defined under section 706.02 (1) of the Wisconsin Annotated Statutes, needs to identify the parties, the land, and the interest conveyed along with any material terms or conditions. The grantor's signature is needed in order to record a quitclaim deed. If the conveyance alienates any interest of a married person in a homestead under Sec. 706.01(7) of the Wisconsin Annotated Statutes, it must be signed or joined in a separate conveyance on behalf of each spouse. The Register of Deeds can refuse to record a quitclaim deed unless specific standardization requirements are met. These standardization requirements are further explained below according to county.

The first recorded quitclaim deed will have priority over later recordings involving the same real estate. The Wisconsin Annotated Statutes 706.08(1) permit that if a quitclaim deed is not recorded, it is "void as against any subsequent purchaser, in good faith and for a valuable consideration, of the same real estate or any portion of the same real estate whose conveyance is recorded first". This is known as a race-notice statute recording act, which does not create a criminal penalty for not recording, but is meant to provide incentive to record.

(Wisconsin QD Package includes form, guidelines, and completed example)

Important: Your property must be located in Iowa County to use these forms. Documents should be recorded at the office below.

This Quitclaim Deed meets all recording requirements specific to Iowa County.

Our Promise

The documents you receive here will meet, or exceed, the Iowa County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Iowa County Quitclaim Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Marlene B.

February 21st, 2024

I appreciated the fact that the forms were by Texas County and I knew I had the right form. The form were fairly easy to complete. I had trouble completing the form because the property description was long and kept disappearing and I had to re-type. It would also have helped it I could have saved and not had to start over every time.

Your satisfaction with our services is of utmost importance to us. Thank you for letting us know how we did!

Patrick U.

November 9th, 2023

Great product. They processed and transmitted the deed promptly. A small question I had was answered quickly and professionally. I would use again if the need arises and will recommend to friends.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Fred D.

August 31st, 2022

At first glance, explanations and guidance to fill out the grant deed seems quite direct and no too difficult. I did not see any reference to a mortgagee which I believe needs to be incorporated in a boundary line adjustment (BLA), though not sure I'll do the actual filling out the form in the next couple of weeks and will be in a better position for a more complete review.

Thank you for your feedback. We really appreciate it. Have a great day!

Lowell P.

May 26th, 2020

Exceptionally helpful instruments that are compliant with State law and anticipate various contingencies. Very pleased.

Thank you for your feedback. We really appreciate it. Have a great day!

Barbara J.

February 27th, 2020

I haven't actually used any forms yet, but I am very pleased with the simplicity of the website. I love the nmber and variety of forms offered. Thank you for such a great website,

Thank you!

Mary D.

March 29th, 2021

LOVE this site.. easy to use and very very quick to record

Thank you for your feedback. We really appreciate it. Have a great day!

Scott R.

September 22nd, 2020

Thanks that was great.

Thank you for your feedback. We really appreciate it. Have a great day!

DARRYL B.

June 16th, 2020

Professional and convenient.

Thank you for your feedback. We really appreciate it. Have a great day!

Idiat A.

January 20th, 2023

Service was fast and easy to use. But let documents appear clearer next time.

Thank you for your feedback. We really appreciate it. Have a great day!

Joanne H.

February 14th, 2022

easy to download and use. this document. thank you

Thank you!

Missy J.

December 6th, 2019

as always, perfect!

Thank you!

Frank W.

January 19th, 2023

Everything worked smoothly

Thank you!

Janette P.

April 30th, 2021

It was easy to find what I needed but I thought the price was too high.

Thank you for your feedback. We really appreciate it. Have a great day!

Timothy G.

August 1st, 2020

Easy peezy.

Thank you!

Christina A G.

December 19th, 2020

It was easy to locate, purchase, and download the documents I needed on the Deeds.com website.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!