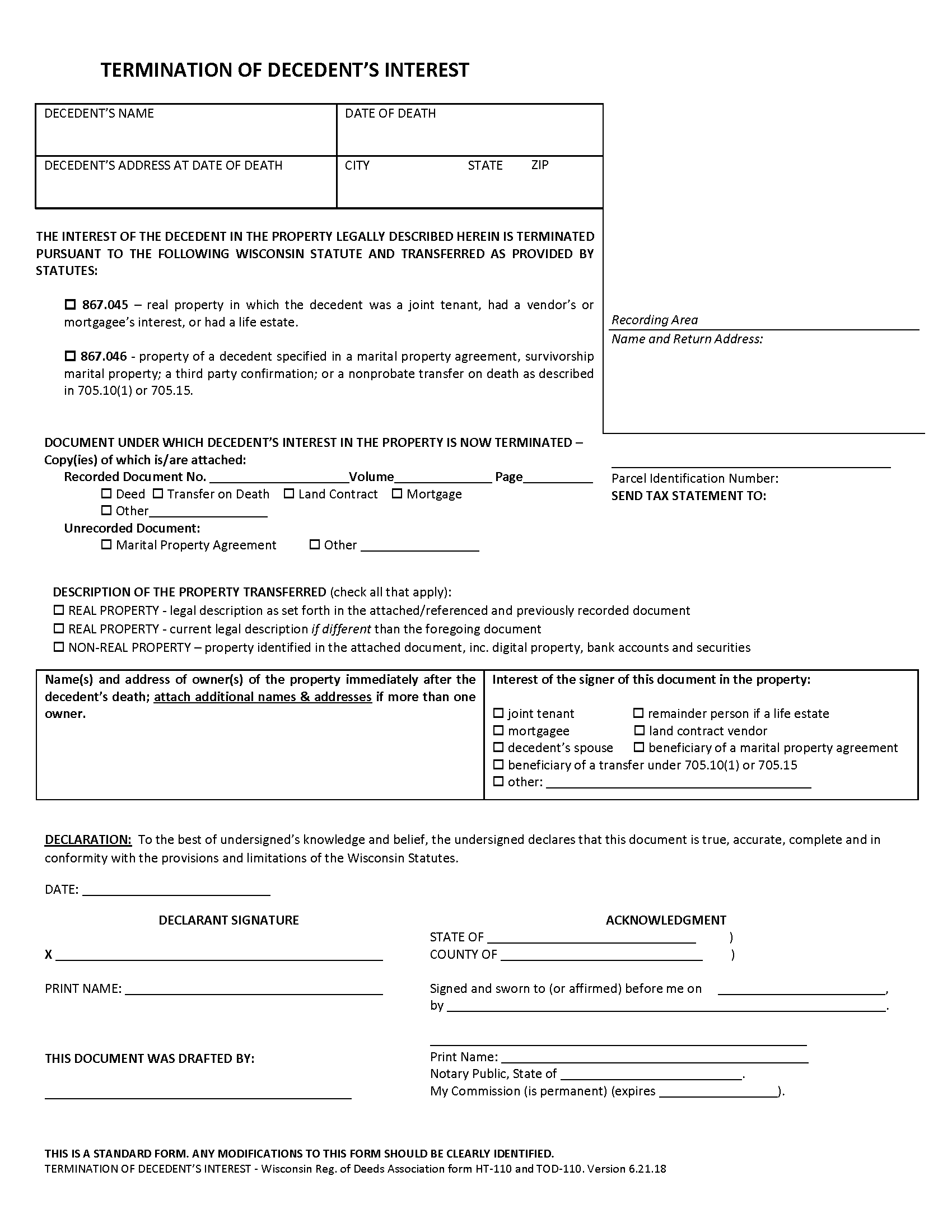

Iowa County Termination of Decedent Property Interest Form

Iowa County Termination of Decedents Interest Form

Fill in the blank form formatted to comply with all recording and content requirements.

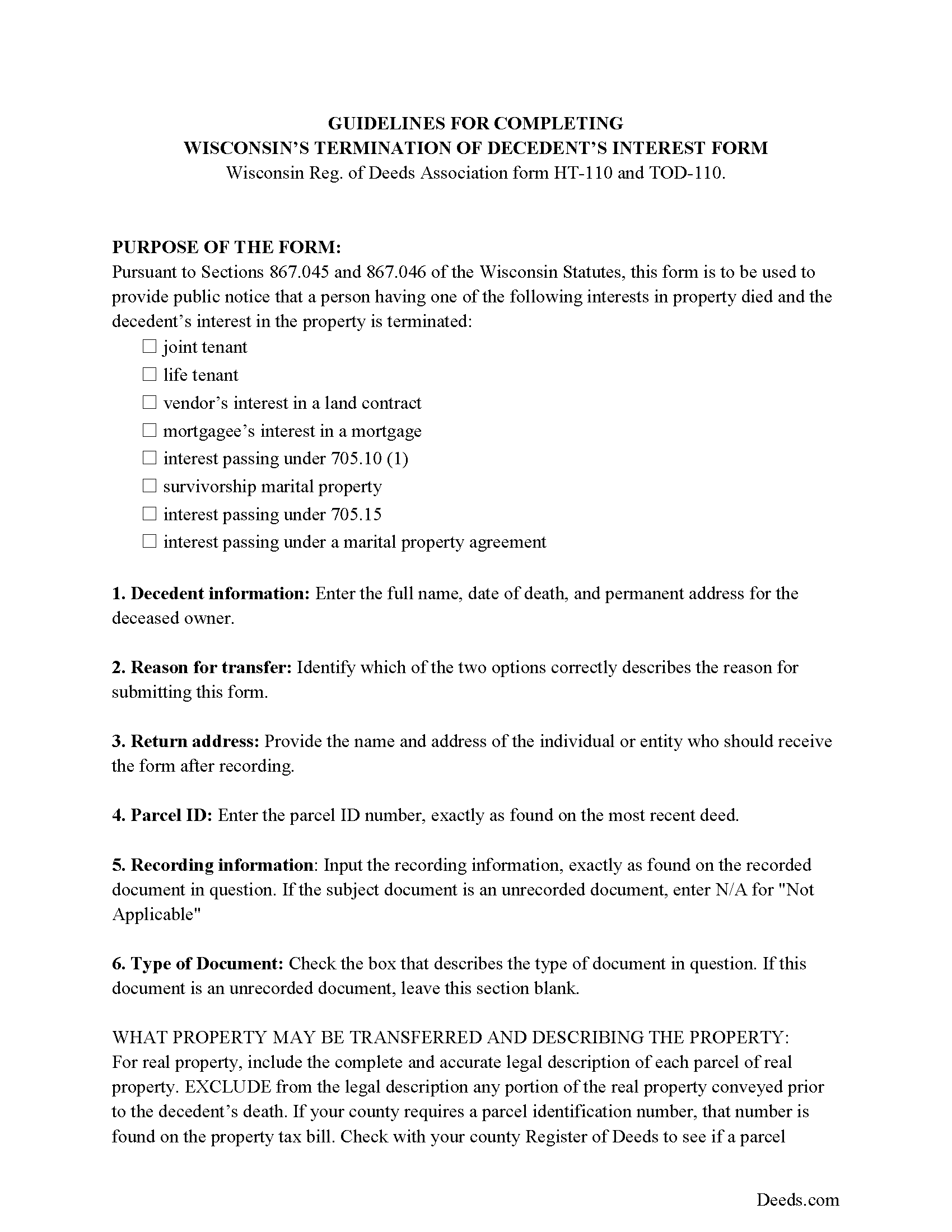

Iowa County Termination of Decedents Interest Guide

Line by line guide explaining every blank on the form.

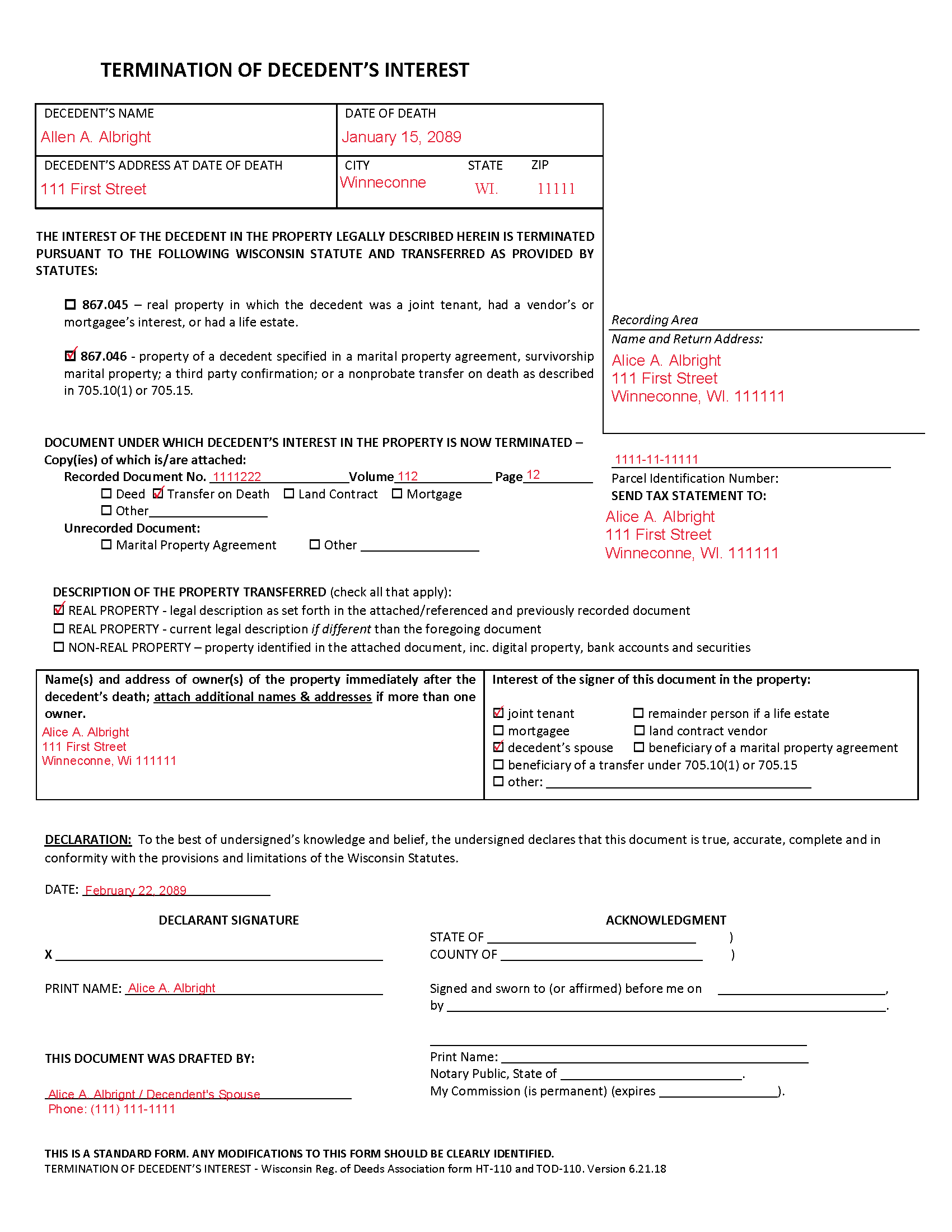

Iowa County Completed Example of the Termination of Decedents Interest Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Wisconsin and Iowa County documents included at no extra charge:

Where to Record Your Documents

Iowa County Register of Deeds

Dodgeville, Wisconsin 53533

Hours: Monday - Friday 8:30am to 4:30pm

Phone: 608 935-0396

Recording Tips for Iowa County:

- Double-check legal descriptions match your existing deed

- White-out or correction fluid may cause rejection

- Recorded documents become public record - avoid including SSNs

Cities and Jurisdictions in Iowa County

Properties in any of these areas use Iowa County forms:

- Arena

- Avoca

- Barneveld

- Cobb

- Dodgeville

- Edmund

- Highland

- Hollandale

- Linden

- Mineral Point

- Rewey

- Ridgeway

Hours, fees, requirements, and more for Iowa County

How do I get my forms?

Forms are available for immediate download after payment. The Iowa County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Iowa County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Iowa County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Iowa County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Iowa County?

Recording fees in Iowa County vary. Contact the recorder's office at 608 935-0396 for current fees.

Questions answered? Let's get started!

Removing a Deceased Joint Tenant from a Wisconsin Real Estate Deed

Wisconsin laws provide that two or more people may hold real estate as joint tenants with right of survivorship. If one joint tenant dies, his/her share of the property is distributed evenly amongst the remaining co-owners without the need to pass through probate.

To terminate the decedent's interest in the property and to complete the distribution, file a form HT-110 under Wis. Stat. 867.045, with the register of deeds for the county where the property is located.

Recording the form formalizes the transfer of property rights, but the deceased joint tenant's name will still appear on the deed. Complete and record an updated deed from all joint tenants, but identify the deceased co-owner, and convey the property to the survivors only. It might be necessary to provide copies of the original deed, the death certificate, and the recorded HT-110 when submitted the revised deed.

(Wisconsin TODPI Package includes form, guidelines, and completed example)

Important: Your property must be located in Iowa County to use these forms. Documents should be recorded at the office below.

This Termination of Decedent Property Interest meets all recording requirements specific to Iowa County.

Our Promise

The documents you receive here will meet, or exceed, the Iowa County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Iowa County Termination of Decedent Property Interest form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

PATRICK C.

September 29th, 2021

Fast, honest company Worth every penny! DO IT YOURSELF SAVE THOUSANDS

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

RONALD F.

July 24th, 2020

Great service. Very reasonable cost. All necessary detailed information provided.

Thank you for your feedback. We really appreciate it. Have a great day!

Erika M.

November 13th, 2020

Received the forms I ordered, found them to be easy to complete with the guide and example that was included. Had no issues recording them, smooth as silk from start to finish.

Thank you for your feedback. We really appreciate it. Have a great day!

terrence h.

October 14th, 2023

Professional

Thank you!

Bonnee G.

January 16th, 2020

Arrived at your site from my county's government site. Saw that all the forms I think I need were included in one package deal, hopefully its the correct package. I Although I've not looked into other aspects of the site, retrieving the forms was pretty easy. Thank you

Thank you for your feedback. We really appreciate it. Have a great day!

Rebecca H.

August 6th, 2019

quick and easy. Perfect

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Thomas K.

December 26th, 2020

Very easy to navigate, download,and print forms!

Thank you!

Margaret S.

August 2nd, 2021

Very nice. easy to use and not too expensive.

Thank you!

John G.

March 28th, 2020

Applied for my Notice of Commencement to be recorded and it went very smoothly and fast. Will use again if a need irises. Thank You

Thank you for your feedback John, glad we could help.

Kathy Z.

November 11th, 2022

Great site !! Very easy to navigate and explanations are clear and simple to understand. Thank You!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

brian d.

May 26th, 2020

I am a Loan Officer and this website saves me a bunch of time. Love it!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Brenda B.

January 6th, 2019

Excellent transaction.

Thank you Brenda.

John L.

February 4th, 2020

Everything worked great. I hope I can get back to the document if I need to make changes. Thanks, John Lazur

Thank you!

Melody P.

May 13th, 2021

Thank you for getting our docs recorded so quickly and efficiently! Great and dependable service, as always!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

William B.

May 29th, 2021

The website works just as described. I couldn't ask for anything more helpful in drafting an easement and all at a very reasonable price. Thank you!

Thank you for your feedback. We really appreciate it. Have a great day!