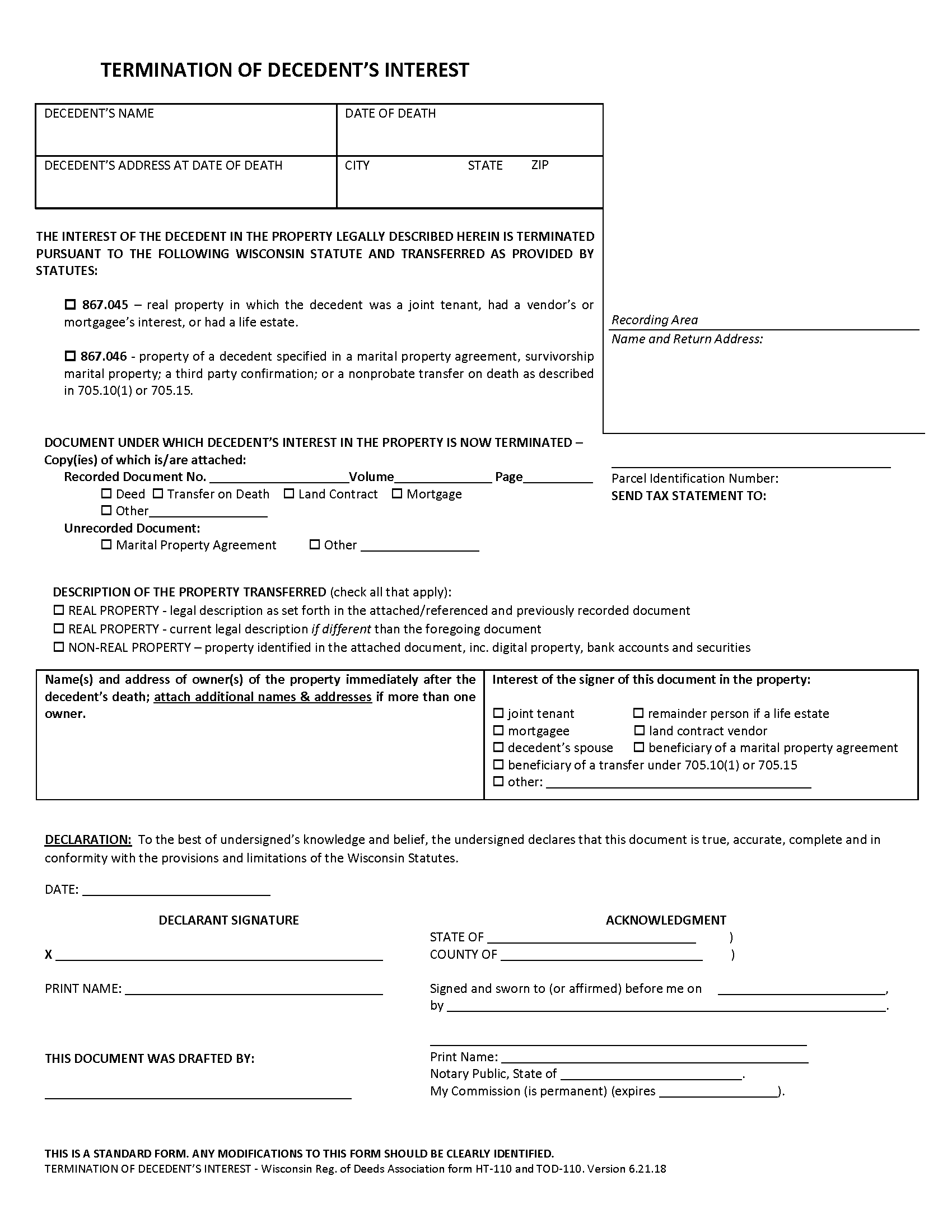

Jackson County Termination of Decedent Property Interest Form

Jackson County Termination of Decedents Interest Form

Fill in the blank form formatted to comply with all recording and content requirements.

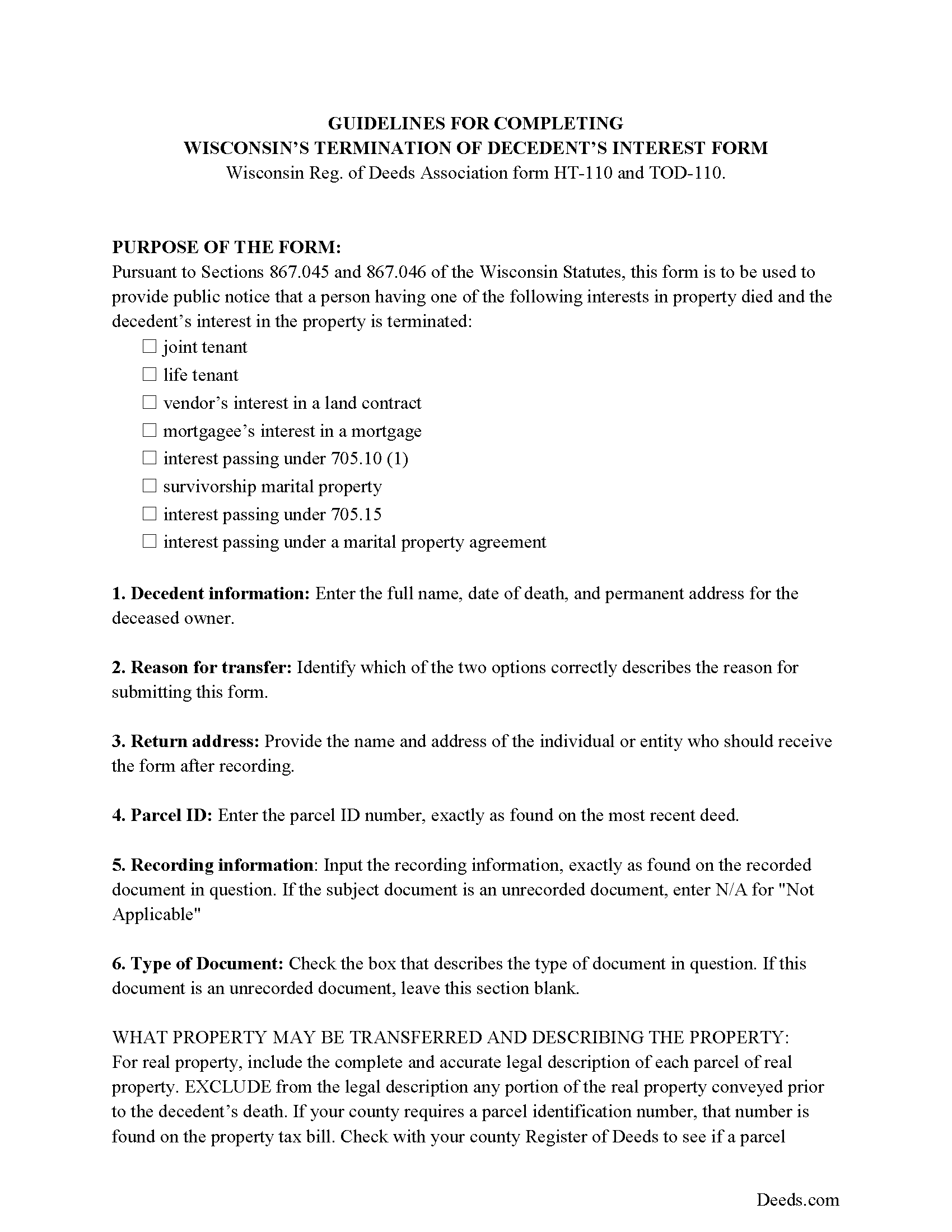

Jackson County Termination of Decedents Interest Guide

Line by line guide explaining every blank on the form.

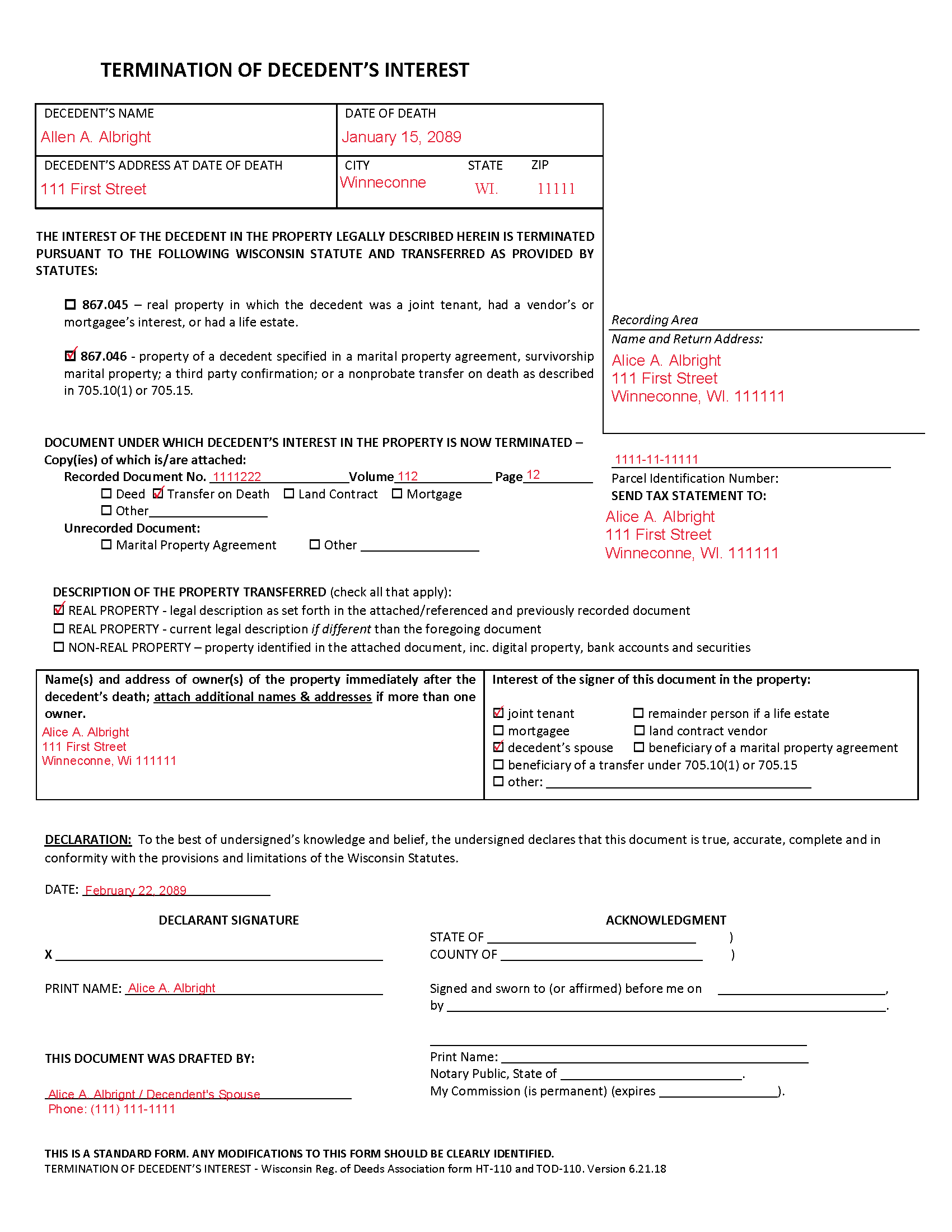

Jackson County Completed Example of the Termination of Decedents Interest Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Wisconsin and Jackson County documents included at no extra charge:

Where to Record Your Documents

Jackson County Register of Deeds

Black River Falls, Wisconsin 54615

Hours: Monday - Friday 8:00am - 4:30pm

Phone: 715-284-0205

Recording Tips for Jackson County:

- Ensure all signatures are in blue or black ink

- Verify all names are spelled correctly before recording

- Ask if they accept credit cards - many offices are cash/check only

- Both spouses typically need to sign if property is jointly owned

Cities and Jurisdictions in Jackson County

Properties in any of these areas use Jackson County forms:

- Alma Center

- Black River Falls

- Hixton

- Melrose

- Merrillan

- Millston

- Taylor

Hours, fees, requirements, and more for Jackson County

How do I get my forms?

Forms are available for immediate download after payment. The Jackson County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Jackson County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Jackson County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Jackson County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Jackson County?

Recording fees in Jackson County vary. Contact the recorder's office at 715-284-0205 for current fees.

Questions answered? Let's get started!

Removing a Deceased Joint Tenant from a Wisconsin Real Estate Deed

Wisconsin laws provide that two or more people may hold real estate as joint tenants with right of survivorship. If one joint tenant dies, his/her share of the property is distributed evenly amongst the remaining co-owners without the need to pass through probate.

To terminate the decedent's interest in the property and to complete the distribution, file a form HT-110 under Wis. Stat. 867.045, with the register of deeds for the county where the property is located.

Recording the form formalizes the transfer of property rights, but the deceased joint tenant's name will still appear on the deed. Complete and record an updated deed from all joint tenants, but identify the deceased co-owner, and convey the property to the survivors only. It might be necessary to provide copies of the original deed, the death certificate, and the recorded HT-110 when submitted the revised deed.

(Wisconsin TODPI Package includes form, guidelines, and completed example)

Important: Your property must be located in Jackson County to use these forms. Documents should be recorded at the office below.

This Termination of Decedent Property Interest meets all recording requirements specific to Jackson County.

Our Promise

The documents you receive here will meet, or exceed, the Jackson County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Jackson County Termination of Decedent Property Interest form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Kimberly M.

January 8th, 2020

Love Deeds.com. Fast turnaround and easy to work with.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sheila P.

May 17th, 2023

What a great service to provide with excellent directions! At first I thought I would need an attorney, but I walked through the steps and now I have it finished! Saved a ton of money. Thanks Deed.com.

Thank you for your feedback. We really appreciate it. Have a great day!

Sara R.

July 24th, 2020

The deed is presently at the auditors office and will be recorded after approval from zoning board. As far as I know, everything is going along well. A self addressed envelope was left at recorder's office for return after recording is complete.

Thank you!

Rocio G.

December 8th, 2020

Better than in person service, I recommend this service 100%.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Patricia H.

October 15th, 2020

The process was so easy and result was excellent and expedient. I will definitely recommend your company for future recording needs.

Thank you!

Elbert M.

July 19th, 2021

I found The blank documents easy to use and the instructions informative and simple to follow. Thanks

Thank you for your feedback. We really appreciate it. Have a great day!

JAMSHEAD T.

December 13th, 2020

An excellent service. Exactly what one would hope for in the 21st century.

Thank you for your feedback. We really appreciate it. Have a great day!

Jeffery H.

October 18th, 2023

Very easy to use. Thanks for your quick response on my document submissions and follow up and guidance on specific questions.

Thank you for your positive words! We’re thrilled to hear about your experience.

Judith O.

January 13th, 2019

Unfortunately, it wasn't the information I needed. I wanted something that could remove my husbands name on our deed, because he passed away last month.

Sorry to hear about your situation Judith. The document you selected is one that would need to be used during the grantor's lifetime. Under the circumstances, we have canceled your order and refunded your payment.

Melvin L.

June 8th, 2022

So easy, very simple to use. I was very pleased with the service Deeds provided. Would definely use again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

John Z.

April 14th, 2022

This was an easy to use program. Easy payment. documents are on my desktop ready to fill out. I will have to update after my property transfer. Zuna

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kenneh C.

December 23rd, 2022

I was looking for something this website does not offer. Very dissapointed.

Sorry to hear that. We do hope you found what you were looking for elsewhere.

FRANCIS P.

July 17th, 2022

Finding what I needed was easy. The payment process was easy. Using what I found was easy. Easy-peasy and GREAT results. Professional and succinct all for the price of a steak dinner. I'll be back to DEEDS.COM when I need any paperwork/forms related to deeds.

Thank you for your feedback. We really appreciate it. Have a great day!

victor h.

February 26th, 2022

Easy to use and just what I was looking for

Thank you!

Robert J. F.

January 22nd, 2019

Nice work. Easy to use site for reasonable price. Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!