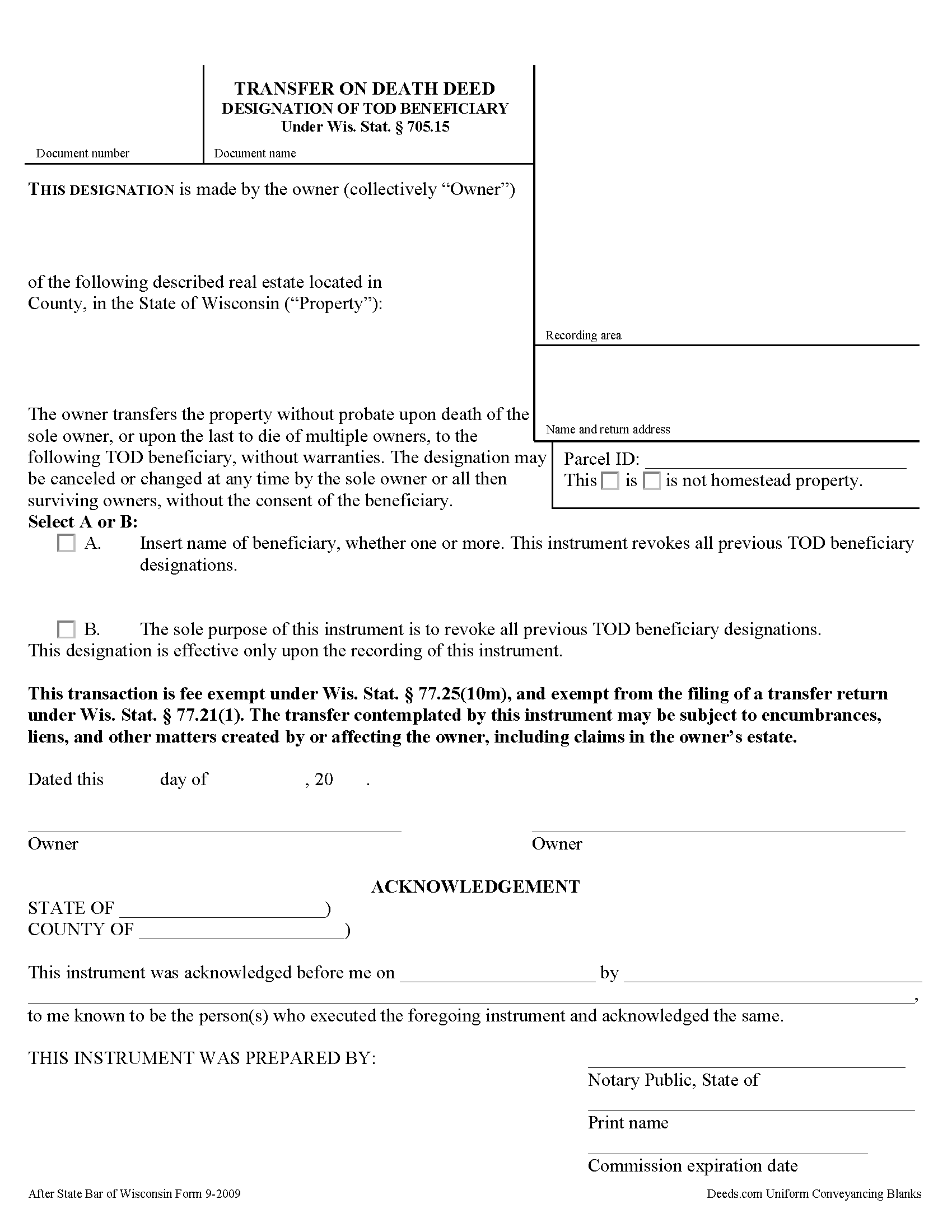

Barron County Transfer on Death Deed Form

Barron County Transfer on Death Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

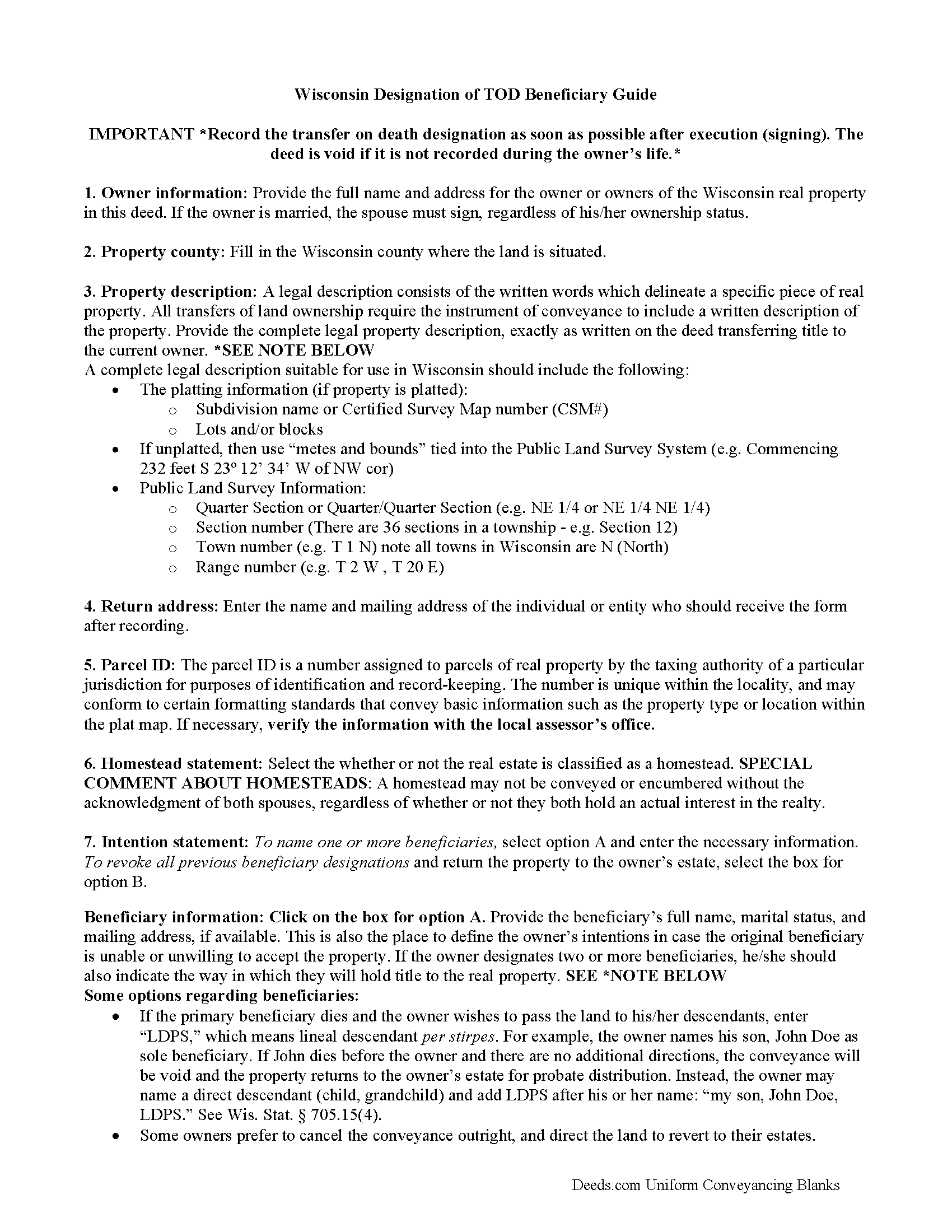

Barron County Transfer on Death Deed Guide

Line by line guide explaining every blank on the form.

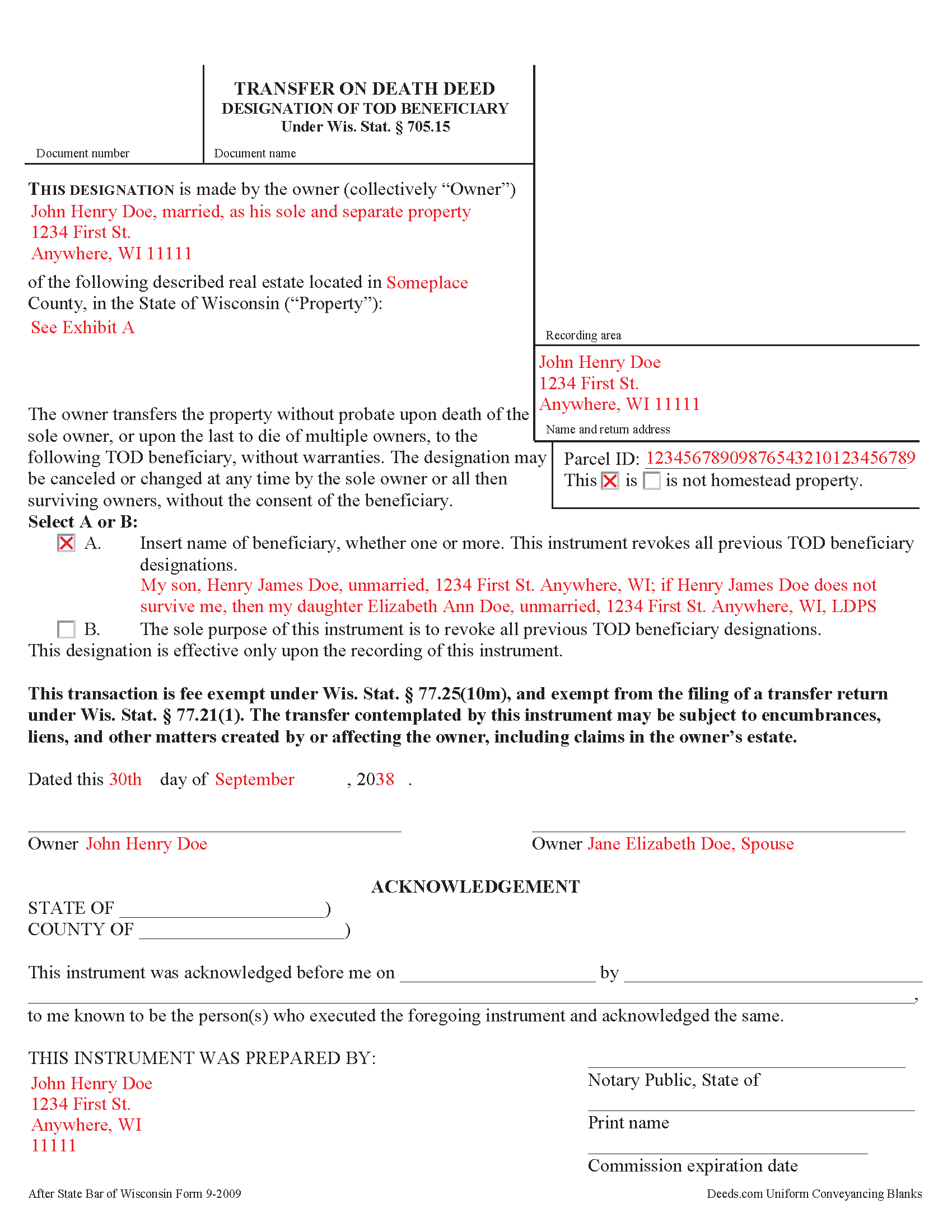

Barron County Completed Example of the Transfer on Death Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Wisconsin and Barron County documents included at no extra charge:

Where to Record Your Documents

Barron County Clerk

Barron, Wisconsin 54812-1546

Hours: Monday - Friday 8:00am to 4:30pm

Phone: (715) 537-6210

Recording Tips for Barron County:

- Verify all names are spelled correctly before recording

- Documents must be on 8.5 x 11 inch white paper

- Check that your notary's commission hasn't expired

- White-out or correction fluid may cause rejection

- Recorded documents become public record - avoid including SSNs

Cities and Jurisdictions in Barron County

Properties in any of these areas use Barron County forms:

- Almena

- Barron

- Barronett

- Brill

- Cameron

- Chetek

- Comstock

- Cumberland

- Dallas

- Haugen

- Mikana

- Prairie Farm

- Rice Lake

- Turtle Lake

Hours, fees, requirements, and more for Barron County

How do I get my forms?

Forms are available for immediate download after payment. The Barron County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Barron County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Barron County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Barron County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Barron County?

Recording fees in Barron County vary. Contact the recorder's office at (715) 537-6210 for current fees.

Questions answered? Let's get started!

Under Wisconsin Statutes section 705.15, owners of real property in Wisconsin may designate one or more people to gain ownership of their property outside of the probate process. The transfer on death deed form contains the designation and must be recorded, DURING THE OWNER'S NATURAL LIFE, for validity.

By executing and recording a transfer on death beneficiary designation, the owner retains absolute control over the real estate, and may sell, mortgage, or use the property in any legal manner, and change or revoke the beneficiary designation without penalty or obligation to inform the beneficiary.

Because the transfer does not occur until after the owner's death, there is no transfer tax due when recording the deed under 77.21(1) and 77.25(10m). While the change in ownership happens as a function of law when the owner dies, when the beneficiary claims the land, he or she must record form TOD-110 to make the transfer official and enter the updated information into the public records.

Wisconsin's transfer on death deeds are useful estate planning tools. Even so, carefully consider the potential impact of a non-probate transfer of property on taxes, as well as eligibility for local, state, and federal benefits. Each case is unique, so contact an attorney with questions or for complex situations.

(Wisconsin TODD Package includes form, guidelines, and completed example)

Important: Your property must be located in Barron County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Deed meets all recording requirements specific to Barron County.

Our Promise

The documents you receive here will meet, or exceed, the Barron County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Barron County Transfer on Death Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

James S.

December 2nd, 2020

It worked great. But it turns out I didn't need it.

Thank you!

Thomas H.

March 9th, 2023

I received every form I requested, immediately upon payment. All forms were up to date and easy to edit as needed. I'll come back here for all my future needs of this nature.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Susie k.

March 3rd, 2020

No complaints

Thank you!

Oldemar T.

June 7th, 2020

Messaging system should reach customer email. It took me a couple of days to find out the processor had messaged me. A customer notification should be implemented for every message left in the account.

Thank you!

Philip B.

October 18th, 2019

Pleased with the results, except for the "notice of confidentiality rights" above the QUIT CLAIM DEED headline. Is it needed to be included on the form or can it be removed ? How can it be removed, I do not see a reason for it to be on the print out copy. Thank you.

Thank you!

John G.

August 6th, 2019

Great on line help with the recording process!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kwaku A.

May 27th, 2021

Excellent service ! Came through in the clutch! Easy to use and understand ! Exceptional service ! 10/10

Thank you!

Jonnie G.

November 15th, 2019

I very much dreaded this whole endeavor but very pleasantly surprised. So far, so good. I feel much more confidant that the crucial form, when presented, will play well with the county.......

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Joni S.

February 6th, 2024

Excellent service, no hassle, easy to use, affordable, best service -- hands down. I thought it would be difficult for me to record a deed in Florida while residing in California but you made it so easy. I will tell everyone about your service. Thank you.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Helen D.

July 27th, 2020

I was just trying to look up a record.

Thank you for your feedback. We really appreciate it. Have a great day!

Shirley S.

June 11th, 2025

Laborious process to gain access; need to indicate PRIINT when complete and inform that if page is backspaced, entered info disappears, necessitating starting all over again. There is only one “A” provision, when some documents have several more. Space is too limited in some instances to provide what is necessary for recording. Thank you

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

Melanie W.

October 23rd, 2022

I used deeds.com to complete a gift deed for transferring a house to our son. Finding the correct form and completing it correctly was extremely easy due to wonderful explanations and examples provided with the purchase of the form. The registrar filing the deed told me she was impressed with the work we did. An attorney would have charged $150 so the $28.00 was well worth the money.

Thank you for your feedback. We really appreciate it. Have a great day!

Betty G.

February 4th, 2020

I was very impressed with your site! My experience was excellent. Made my quest an easy one. Thank you!

Thank you so much Betty. We appreciate you!

DIANE S.

June 6th, 2020

I received my report pretty quick! Had info that I needed. Thank you!

Thank you!

Santos V.

March 18th, 2023

Great and easy to understand.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!