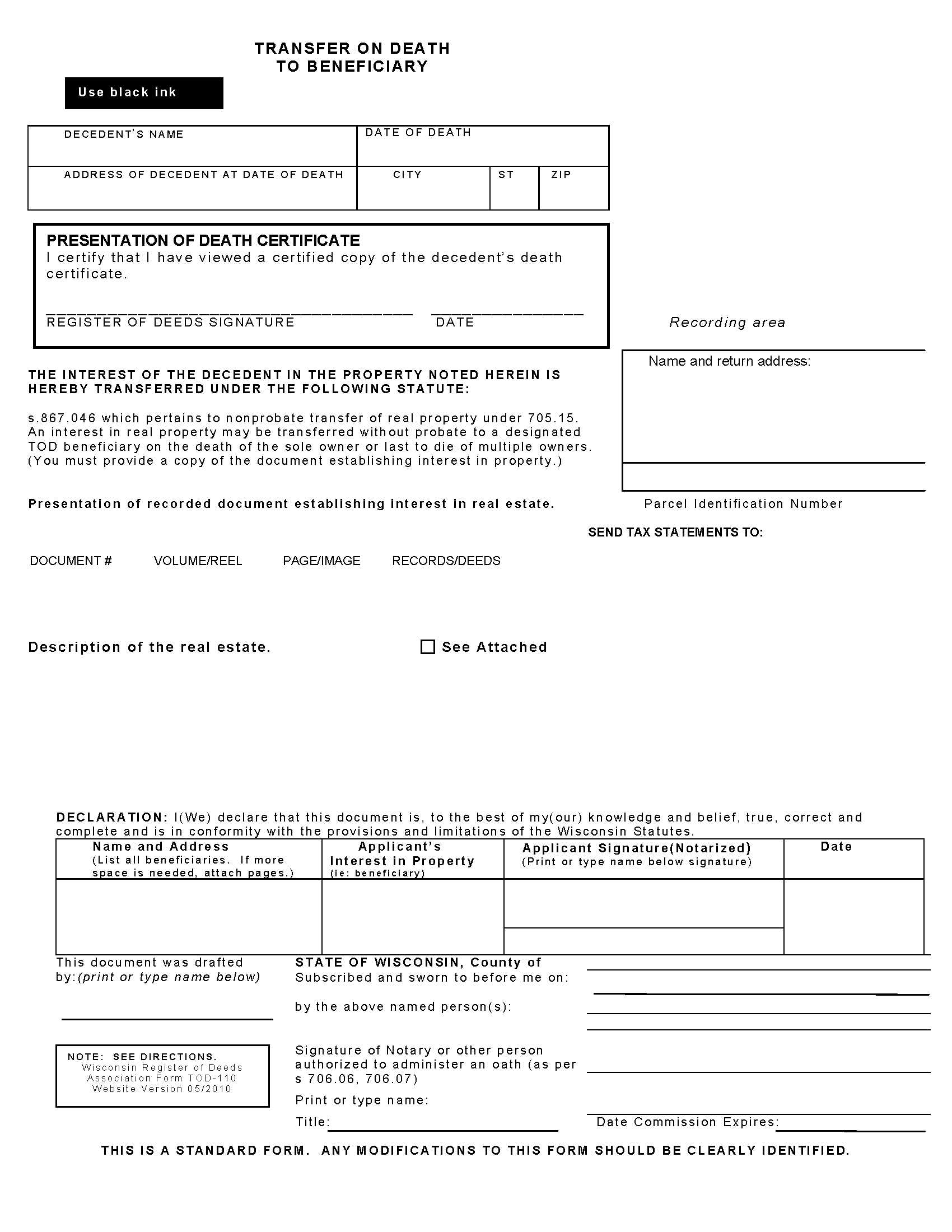

Barron County Transfer on Death to Beneficiary Form

Barron County Transfer on Death to Beneficiary Form

Fill in the blank form formatted to comply with all recording and content requirements.

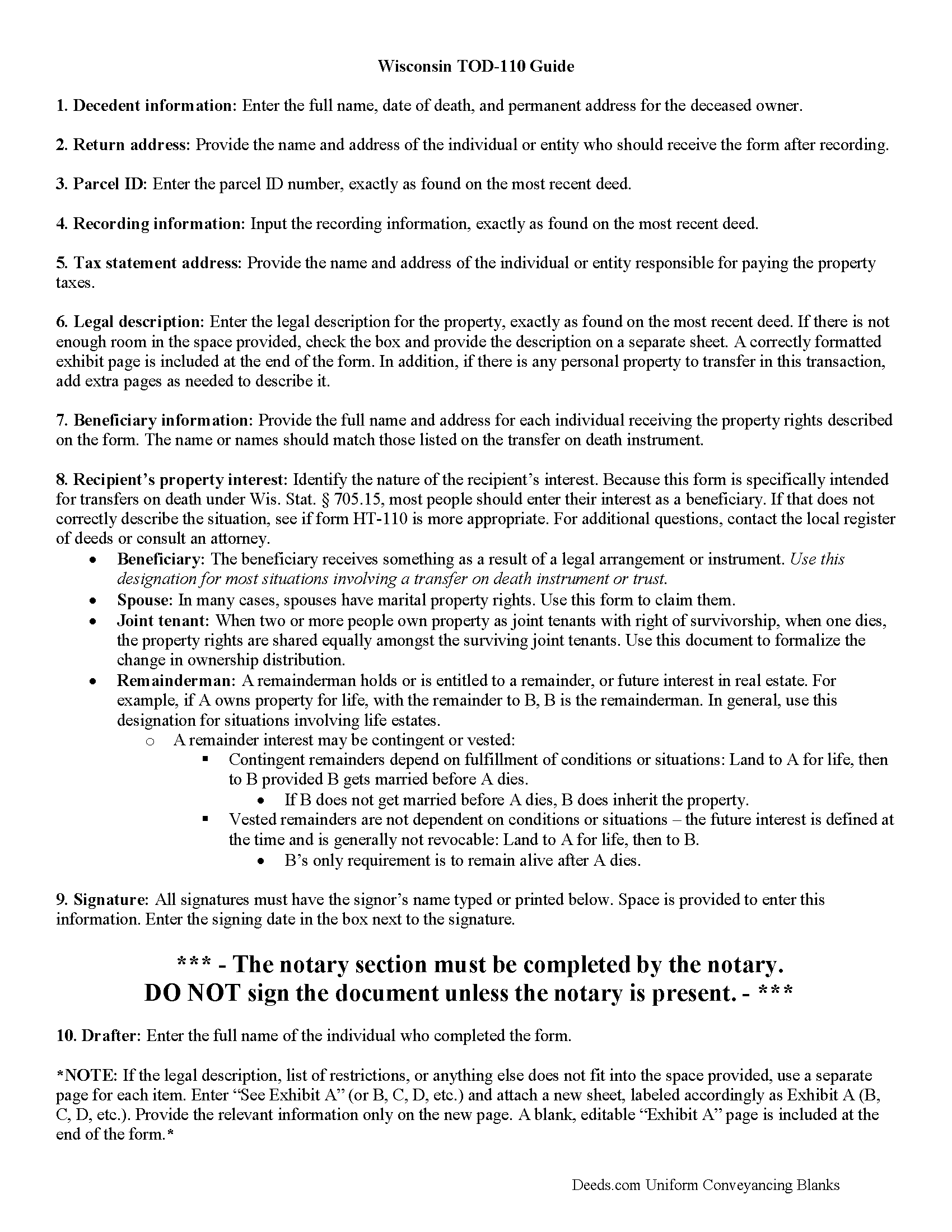

Barron County Transfer on Death to Beneficiary Guide

Line by line guide explaining every blank on the form.

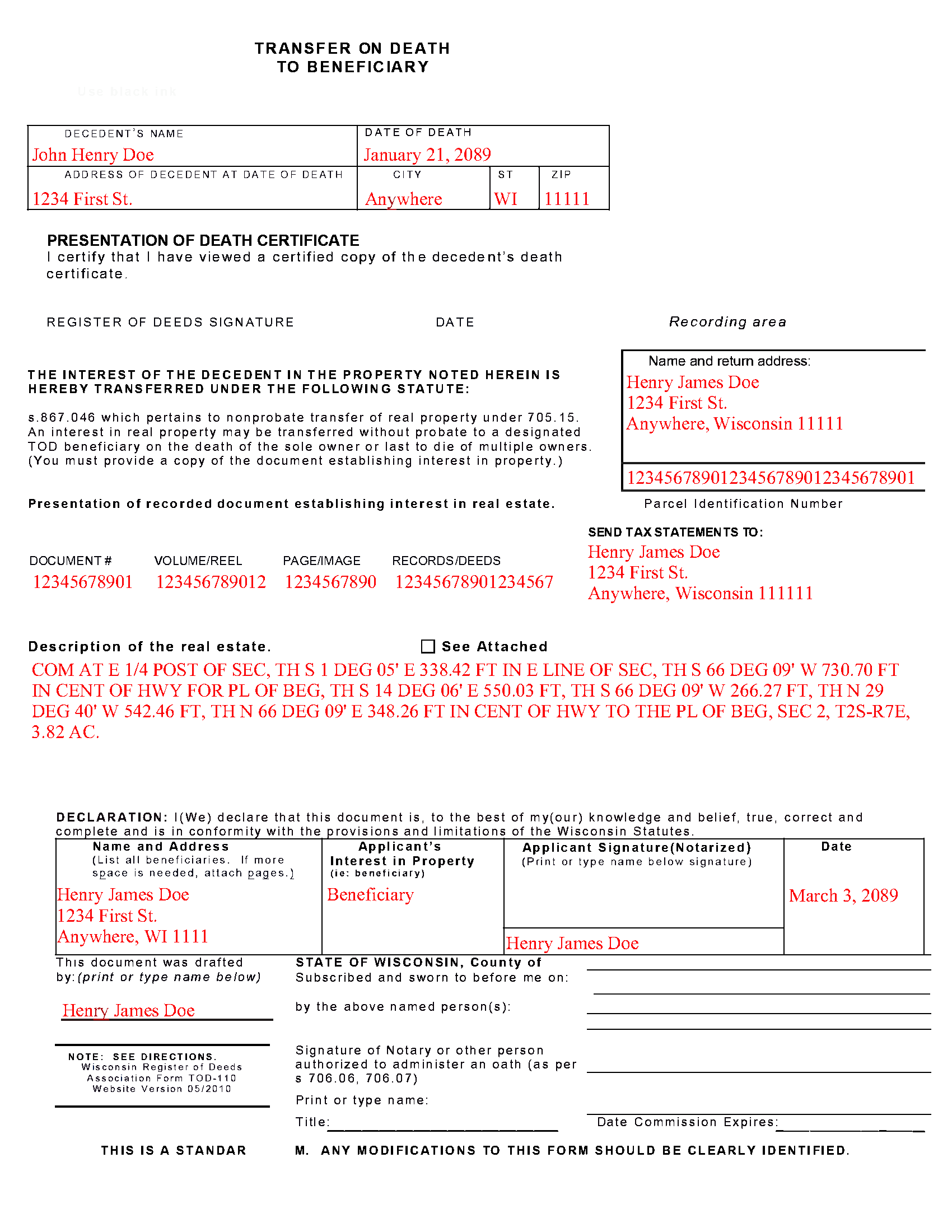

Barron County Completed Example of the Transfer on Death to Beneficiary Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Wisconsin and Barron County documents included at no extra charge:

Where to Record Your Documents

Barron County Clerk

Barron, Wisconsin 54812-1546

Hours: Monday - Friday 8:00am to 4:30pm

Phone: (715) 537-6210

Recording Tips for Barron County:

- Check that your notary's commission hasn't expired

- Bring extra funds - fees can vary by document type and page count

- Leave recording info boxes blank - the office fills these

Cities and Jurisdictions in Barron County

Properties in any of these areas use Barron County forms:

- Almena

- Barron

- Barronett

- Brill

- Cameron

- Chetek

- Comstock

- Cumberland

- Dallas

- Haugen

- Mikana

- Prairie Farm

- Rice Lake

- Turtle Lake

Hours, fees, requirements, and more for Barron County

How do I get my forms?

Forms are available for immediate download after payment. The Barron County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Barron County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Barron County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Barron County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Barron County?

Recording fees in Barron County vary. Contact the recorder's office at (715) 537-6210 for current fees.

Questions answered? Let's get started!

Transfer to Beneficiary -- TOD-110

Completing the Change of Property Rights from a Wisconsin Transfer on Death Deed

When a grantor/owner of real estate under a Wisconsin transfer on death deed dies, the named beneficiary or beneficiaries gain the rights to the property by function of law. Even though this transfer is, in theory, automatic, the best way to ensure accurate and up-to-date ownership records is to file a completed and notarized transfer on death to beneficiary form TOD-110 with the register of deeds for the county where the land is located. By recording this document, the new owner formalizes the transfer and provides public notice of the new status.

(Wisconsin TOD to Beneficiary Package includes form, guidelines, and completed example)

Important: Your property must be located in Barron County to use these forms. Documents should be recorded at the office below.

This Transfer on Death to Beneficiary meets all recording requirements specific to Barron County.

Our Promise

The documents you receive here will meet, or exceed, the Barron County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Barron County Transfer on Death to Beneficiary form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Harley N.

August 25th, 2022

Well thought out and user friendly website. The forms were easily fillable as well.

Thank you for your feedback. We really appreciate it. Have a great day!

April C.

May 18th, 2021

Spot on forms and process. YMMV but way more efficient and cost effective than contacting an ambulance... attorney.

Thank you!

Francine H.

April 18th, 2023

Somewhat confusing, but I'm really not sure what I need. I have not complete4d the document.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Debby P.

October 5th, 2023

Great company! I have been using Deeds.com for many years. I just opened a new account when I retired from my Escrow job. My recording was flawless!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ming W.

December 22nd, 2020

couldn't believe how efficient and perfect job you have done!! I will recommend your website to all friends.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Scott R.

September 22nd, 2020

Thanks that was great.

Thank you for your feedback. We really appreciate it. Have a great day!

Janet P.

July 30th, 2021

Extremely easy to use. The guide and sample were a great source of reference.

Thank you for your feedback. We really appreciate it. Have a great day!

John G.

March 28th, 2020

Applied for my Notice of Commencement to be recorded and it went very smoothly and fast. Will use again if a need irises. Thank You

Thank you for your feedback John, glad we could help.

Sean D.

September 13th, 2022

I am new to needing this type of service, and the Deeds.Com team has been fantastic. Responsive, professional, and thorough are the first 3 words that come to mind. Deeds.Com will be my first choice for all of our county recorder needs.

Thank you!

Vanessa G.

January 9th, 2024

Quick, painless, and they communicated with me during the entire process. I will certainly be suing them again.

We are delighted to have been of service. Thank you for the positive review!

DAVID K.

April 6th, 2019

Already gave a review Great site and help

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

James C.

November 3rd, 2020

Deed was filed with county quickly. Great service!

Thank you!

charles c.

October 14th, 2020

Great service, well worth the $15 fee. Especially helpful was the review of my documentation and the quick responses. Recommending it to associates who might need this service.

Thank you for your feedback. We really appreciate it. Have a great day!

Cindi S.

December 16th, 2018

I asked for a letter of testamentary form and this is what I got. Not at all what I was hoping for. Just spent $20 for nothing. Very disappointed.

Thank your or your feedback. We are sorry to hear of the disappointment caused when you ordered our Colorado Personal Representative Deed of Distribution hoping you would receive something entirely different. We have corrected your mistake by canceling your order and payment. Have a wonderful day.

Sophia G.

February 11th, 2022

Hassle free service , and don't have to wait in line

Thank you for your feedback. We really appreciate it. Have a great day!