Iowa County Transfer on Death to Beneficiary Form

Iowa County Transfer on Death to Beneficiary Form

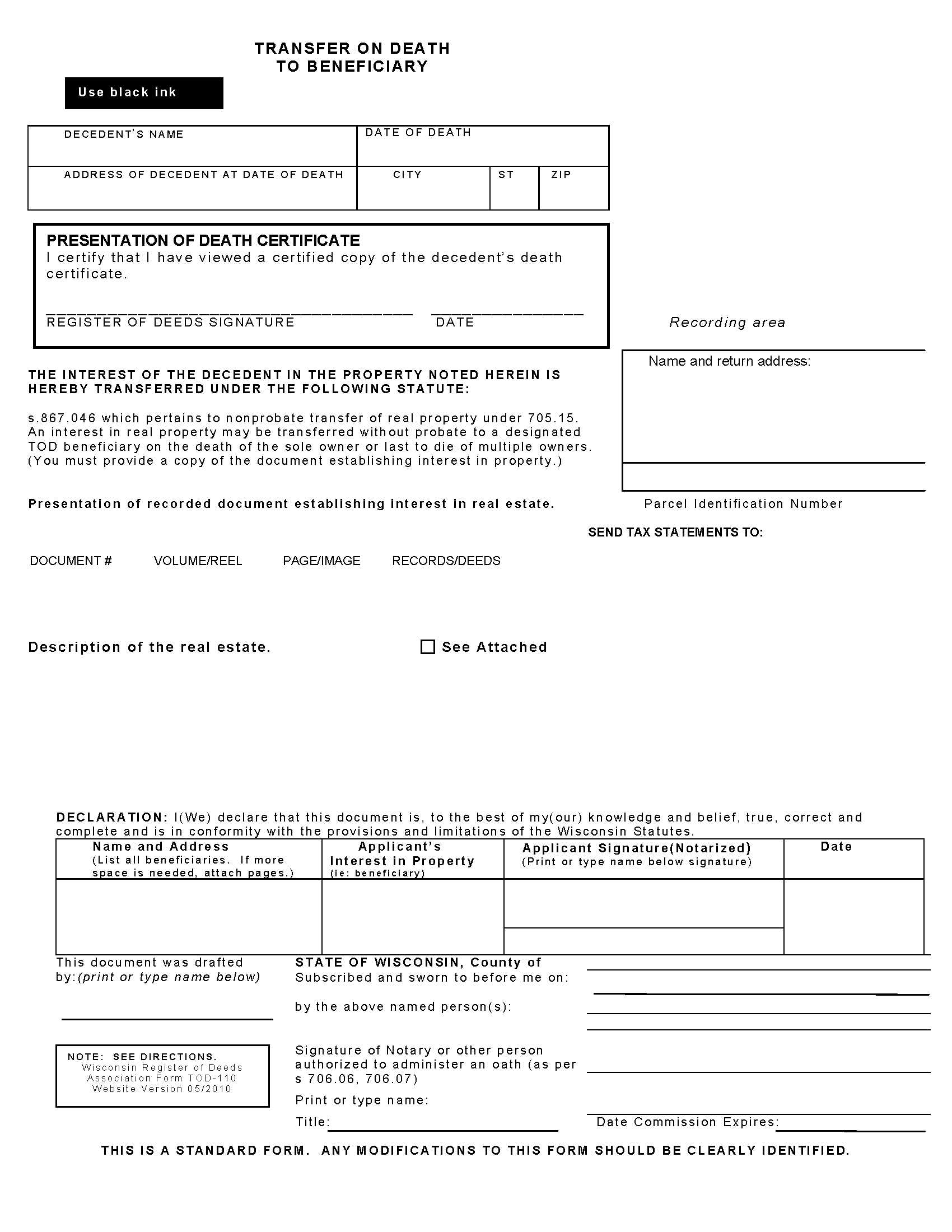

Fill in the blank form formatted to comply with all recording and content requirements.

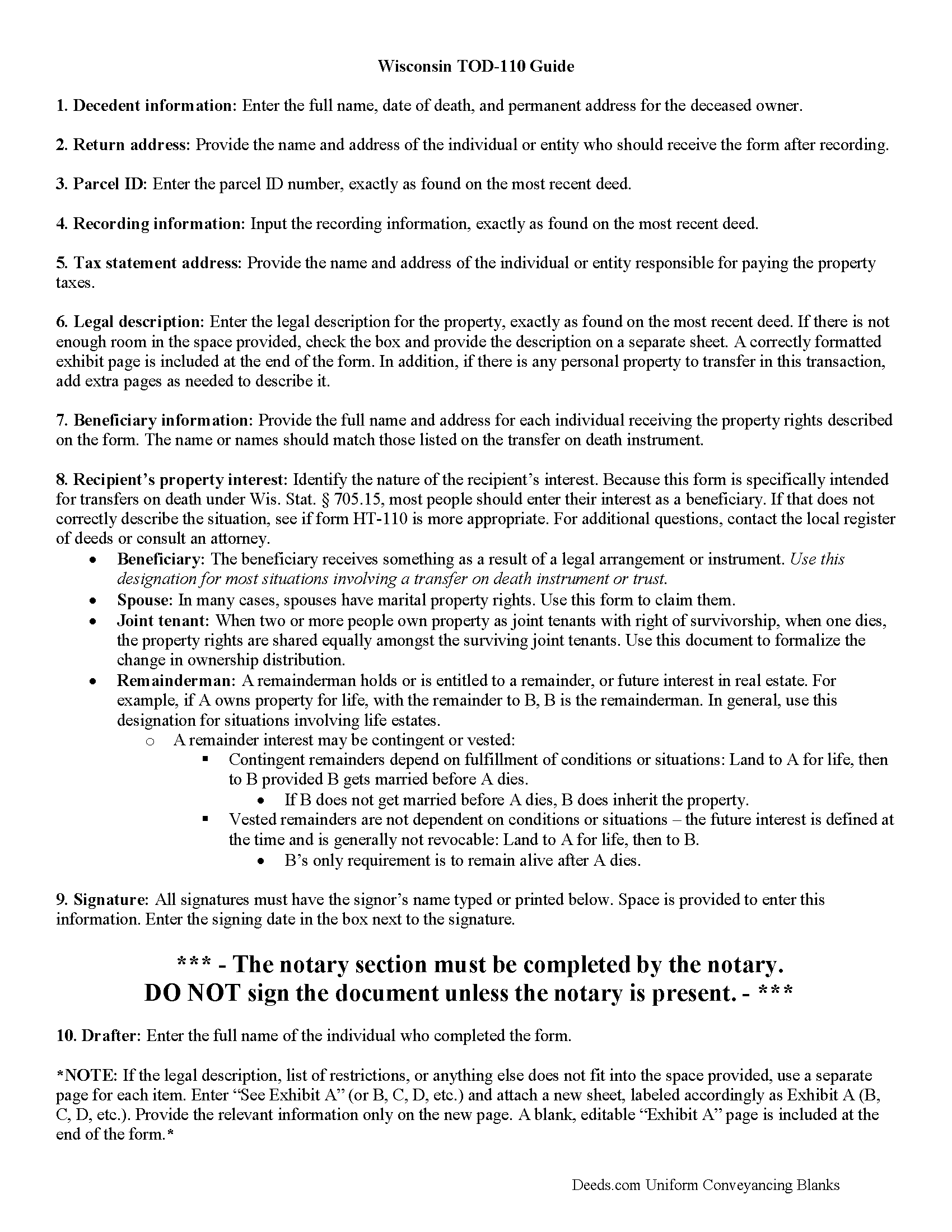

Iowa County Transfer on Death to Beneficiary Guide

Line by line guide explaining every blank on the form.

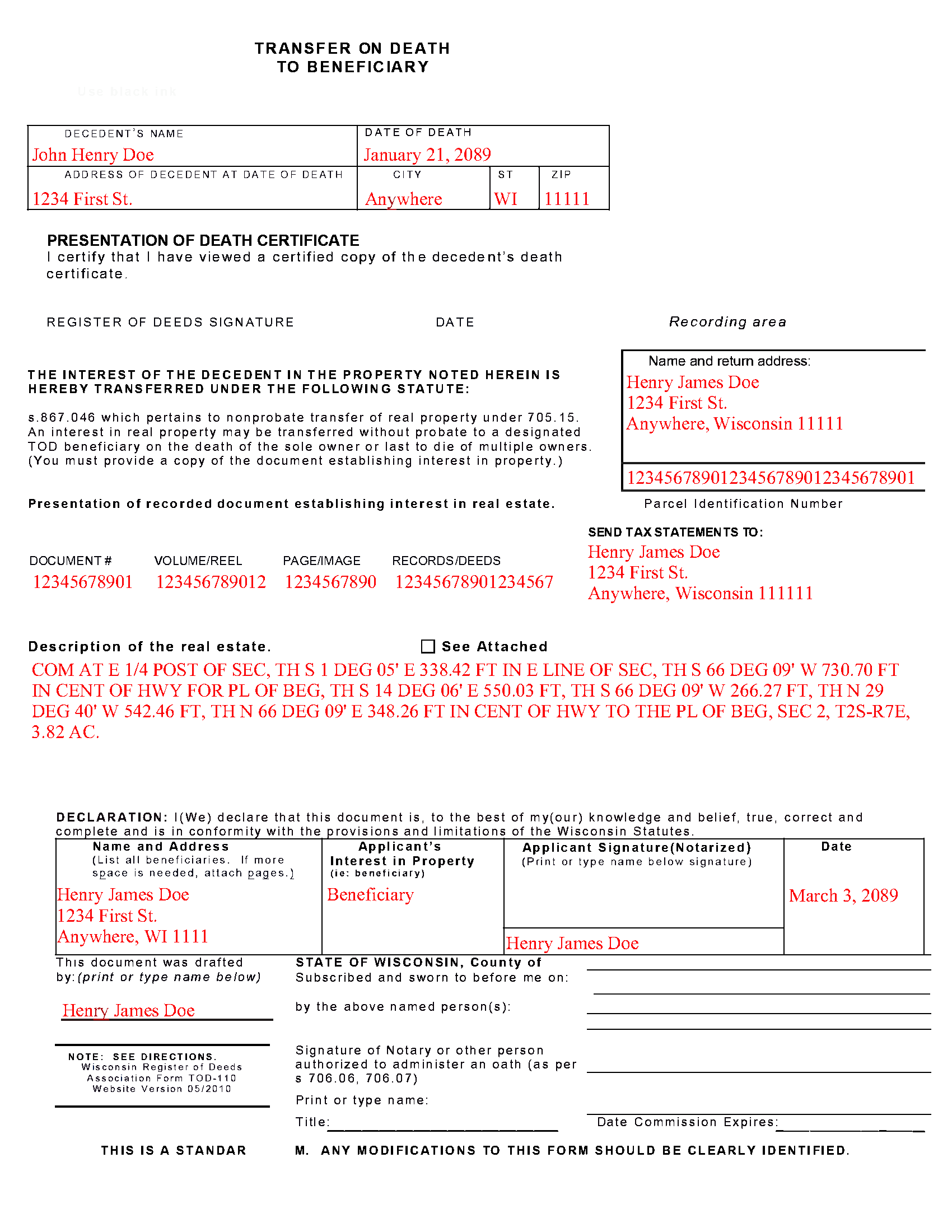

Iowa County Completed Example of the Transfer on Death to Beneficiary Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Wisconsin and Iowa County documents included at no extra charge:

Where to Record Your Documents

Iowa County Register of Deeds

Dodgeville, Wisconsin 53533

Hours: Monday - Friday 8:30am to 4:30pm

Phone: 608 935-0396

Recording Tips for Iowa County:

- Ask if they accept credit cards - many offices are cash/check only

- White-out or correction fluid may cause rejection

- Double-check legal descriptions match your existing deed

- Verify all names are spelled correctly before recording

- Ask about their eRecording option for future transactions

Cities and Jurisdictions in Iowa County

Properties in any of these areas use Iowa County forms:

- Arena

- Avoca

- Barneveld

- Cobb

- Dodgeville

- Edmund

- Highland

- Hollandale

- Linden

- Mineral Point

- Rewey

- Ridgeway

Hours, fees, requirements, and more for Iowa County

How do I get my forms?

Forms are available for immediate download after payment. The Iowa County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Iowa County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Iowa County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Iowa County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Iowa County?

Recording fees in Iowa County vary. Contact the recorder's office at 608 935-0396 for current fees.

Questions answered? Let's get started!

Transfer to Beneficiary -- TOD-110

Completing the Change of Property Rights from a Wisconsin Transfer on Death Deed

When a grantor/owner of real estate under a Wisconsin transfer on death deed dies, the named beneficiary or beneficiaries gain the rights to the property by function of law. Even though this transfer is, in theory, automatic, the best way to ensure accurate and up-to-date ownership records is to file a completed and notarized transfer on death to beneficiary form TOD-110 with the register of deeds for the county where the land is located. By recording this document, the new owner formalizes the transfer and provides public notice of the new status.

(Wisconsin TOD to Beneficiary Package includes form, guidelines, and completed example)

Important: Your property must be located in Iowa County to use these forms. Documents should be recorded at the office below.

This Transfer on Death to Beneficiary meets all recording requirements specific to Iowa County.

Our Promise

The documents you receive here will meet, or exceed, the Iowa County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Iowa County Transfer on Death to Beneficiary form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Beverly H.

February 13th, 2019

Thanks!!

Thank you!

Chris M.

April 19th, 2022

simple, Clean, and easy, to retrieve the forms i needed, while on this site. and the Fee for the Fill-in forms is Remarkably inexpensive, to say the least!

Thank you!

EILEEN K.

March 17th, 2022

I received my product in great condition and it works ok. Thankyou!!!

Thank you!

Betty H. S.

February 11th, 2019

I have no complaints thank you.

Thanks Betty, Have a great day!

Donna F.

March 4th, 2019

Straight forward easy to understand completing my document. The guide readily explained filing all portions of the document.

Thank you Donna, we appreciate your feedback.

Steven M.

February 13th, 2025

Happy with your service. Everything as advertised.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

April K.

October 27th, 2020

Thank you so much! Quick and easy. Received it in under 5 minutes.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Laurence G.

May 23rd, 2020

Easy to use, inexpensive, very helpful

Thank you!

Gary H.

October 18th, 2023

The package was very helpful and very easy to use. I saved me a lot of time and eliminated attorneys being involved. I would highly recommend your forms.

It was a pleasure serving you. Thank you for the positive feedback!

Michelle K.

August 20th, 2020

Excellent service! Easy to use, great communication, quick response time and very helpful with any questions I had. I would recommend to anyone seeking the services they provide.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ismael T.

January 19th, 2021

I was surprised and how quickly you guys process documents and helped on a mistake I had. Thank so much. I will definitely keep using Deeds.com

Thank you!

HELEN F.

July 12th, 2019

Was straight to the point... Easy to read instructions... smooth process

Thank you for your feedback. We really appreciate it. Have a great day!

Norma G.

May 9th, 2019

Thank you! This is very helpful

Thank you!

Karen B.

January 13th, 2020

Completed although having the sample really helped. Now to file.

Thank you for your feedback. We really appreciate it. Have a great day!

Kendrick S.

May 29th, 2020

Really solid system for determining what may prevent your documents from being accepted. I love the comments section allowing for fluid communication. I only wish there were automated emails for all those communications and once documents were accepted, but I did receive a couple personally-generated emails regarding the progress instructing me to check the site.

Thank you for your feedback. We really appreciate it. Have a great day!