Converse County Correction Deed Form (Wyoming)

All Converse County specific forms and documents listed below are included in your immediate download package:

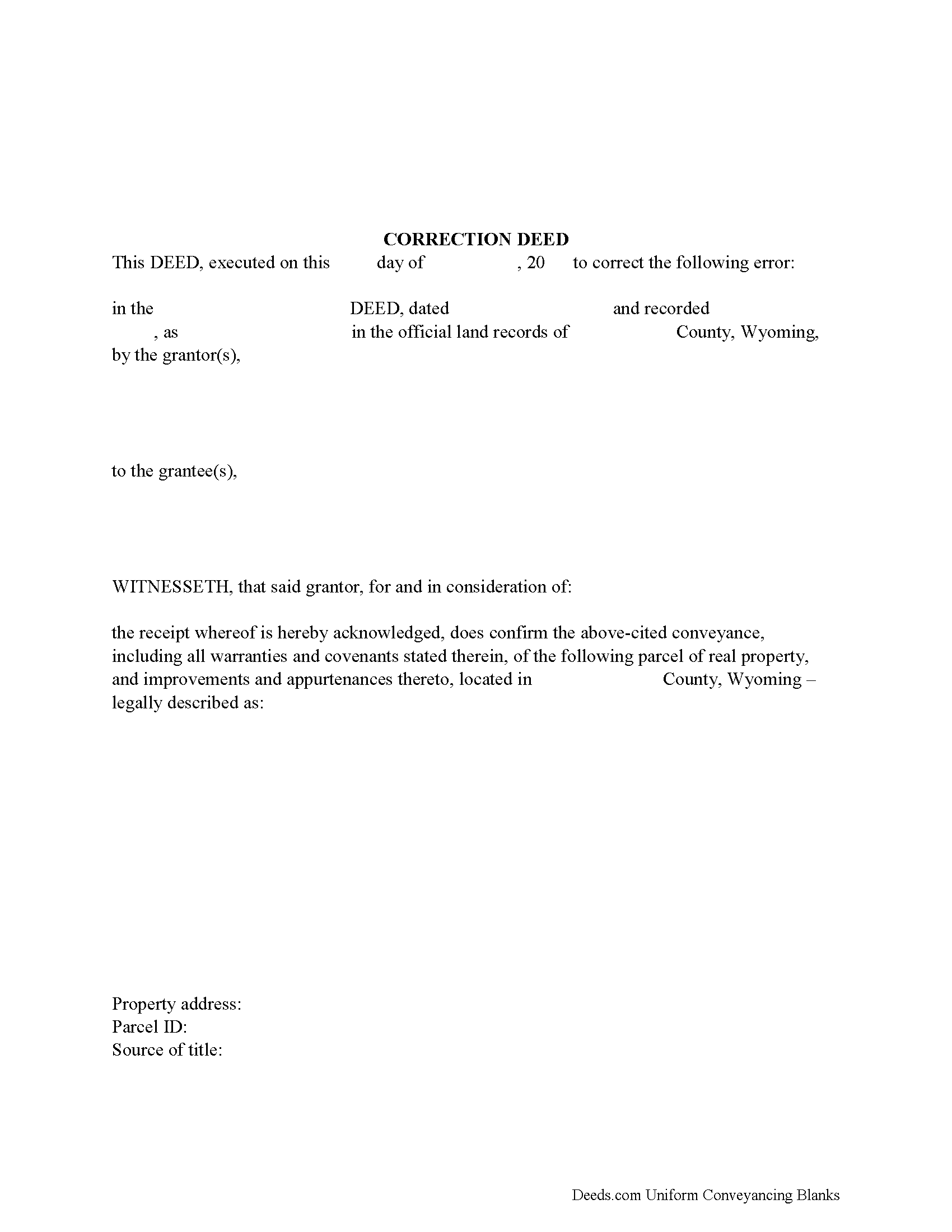

Correction Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Converse County compliant document last validated/updated 5/29/2025

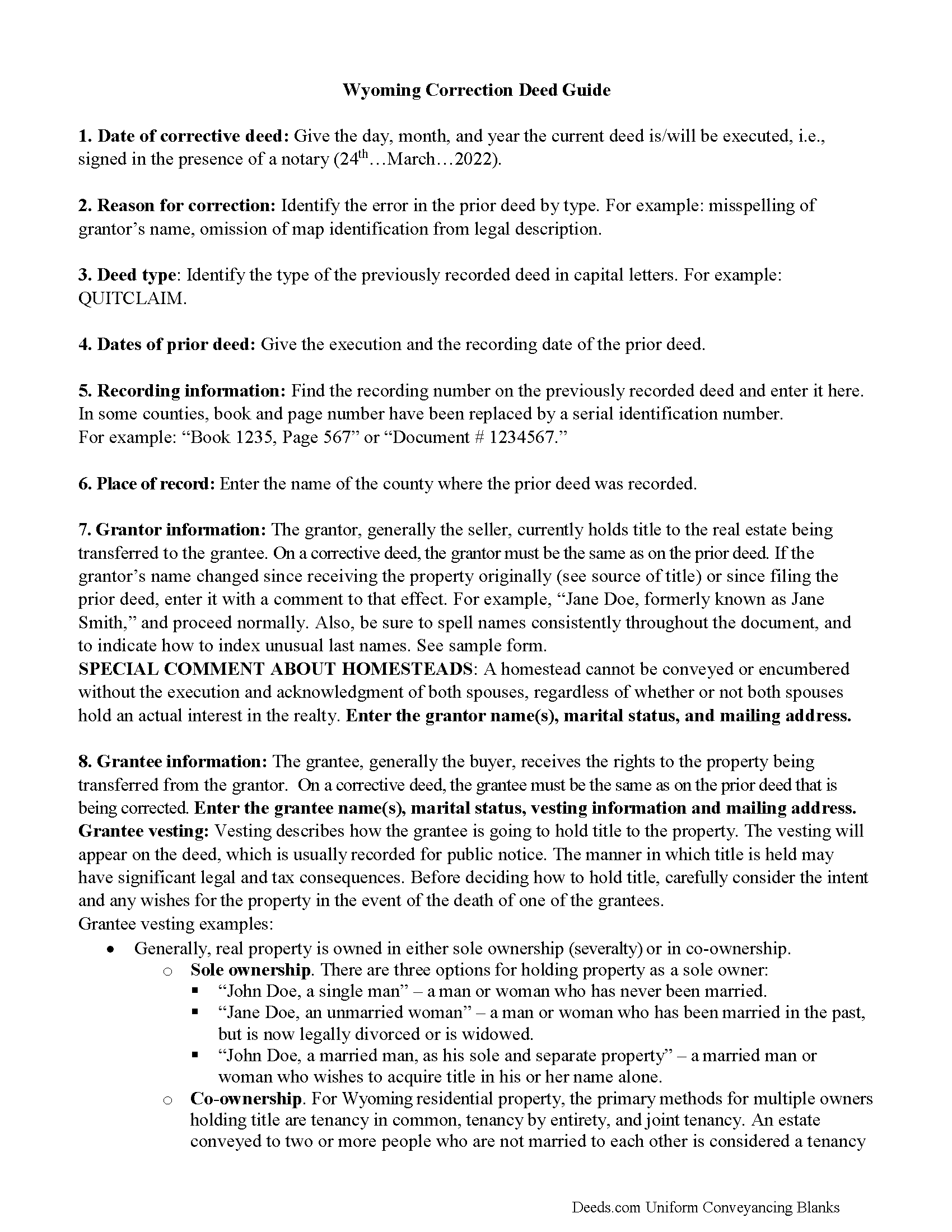

Correction Deed Guide

Line by line guide explaining every blank on the form.

Included Converse County compliant document last validated/updated 5/9/2025

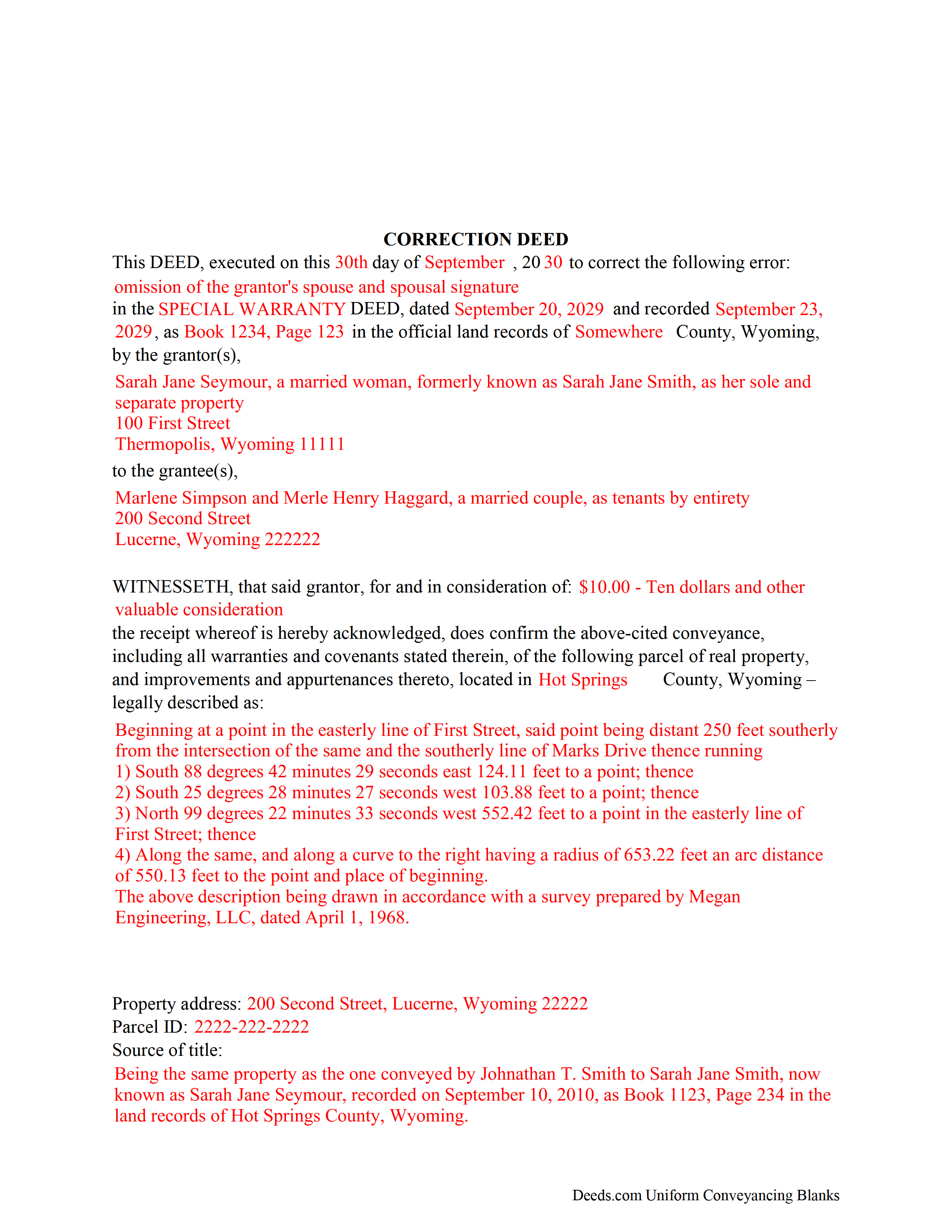

Completed Example of a Correction Deed Document

Example of a properly completed form for reference.

Included Converse County compliant document last validated/updated 7/14/2025

The following Wyoming and Converse County supplemental forms are included as a courtesy with your order:

When using these Correction Deed forms, the subject real estate must be physically located in Converse County. The executed documents should then be recorded in the following office:

Converse County Clerk

107 North 5th St, Suite 114, Douglas, Wyoming 82633-2448

Hours: Monday - Friday 8:00 am - 5:00 pm

Phone: (307) 358-2244

Local jurisdictions located in Converse County include:

- Douglas

- Glenrock

- Lost Springs

- Shawnee

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Converse County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Converse County using our eRecording service.

Are these forms guaranteed to be recordable in Converse County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Converse County including margin requirements, content requirements, font and font size requirements.

Can the Correction Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Converse County that you need to transfer you would only need to order our forms once for all of your properties in Converse County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Wyoming or Converse County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Converse County Correction Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Use the correction deed to correct an error in a previously recorded deed of conveyance, such as a warranty or quitclaim deed, in Wyoming.

Correcting an error in a recorded deed helps prevent problems that might arise when the current owner tries to sell the property. The best method for correction is to prepare and record a new document, often called a corrective or correction deed. This document does not convey title; instead, it confirms the prior conveyance of the property.

Apart from supplying the correct information, the new deed must give the reason for the correction by identifying the error. It also must reference the prior deed by title, date, and recording number. The original grantor signs the corrective deed, which confirms the property transfer to the grantee. Generally, deeds of correction are used to address minor omissions and errors in a recorded document, such as typos, accidentally omitted suffixes or middle initials of names. When correcting the legal description, both grantor and grantee should sign the corrective instrument to avoid doubt regarding any portions of the conveyed property.

For certain changes, however, a correction deed cannot be used. Adding or removing a grantee, for example, or making material changes to the legal description, especially deleting a portion of the originally transferred property, may all require a new deed of conveyance, instead of a correction deed. When in doubt about the gravity of an error and whether a corrective deed is the appropriate vehicle to address it, consult a lawyer.

(Wyoming CD Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Converse County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Converse County Correction Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4564 Reviews )

Michael G.

July 14th, 2025

Very helpful and easy to use

Your appreciative words mean the world to us. Thank you.

JAMES D.

July 10th, 2025

Slick as can be and so convenient.rnrnWorked like a charm

Thank you for your feedback. We really appreciate it. Have a great day!

MARY LACEY M.

June 30th, 2025

Great service! Recording was smooth and swiftly performed. Deeds.com is an excellent service.rn

We are delighted to have been of service. Thank you for the positive review!

Ismael T.

January 19th, 2021

I was surprised and how quickly you guys process documents and helped on a mistake I had. Thank so much. I will definitely keep using Deeds.com

Thank you!

Edith W.

February 4th, 2020

I was very pleased to be able to get all the legal forms, with instructions, I need to file a beneficiary deed specific to my county in one place. The downloads went smoothly. Deeds.com has saved me time and money by offering this service.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Linda S.

March 8th, 2019

I am quite pleased with this website. I was able to complete my task with relative ease thanks to all the help these forms provided .The example forms really helped me to navigate the process. I would recommend this service highly.

Thank you Linda, we really appreciate your feedback.

Dianna B.

July 23rd, 2020

Amazingly easy! I absolutely love it because it is so efficient and I only have to pay for when I use it. I use to have to drive to the recorders office or to a Kiosk station. The turn-around time was really quick as well.

Thank you!

sandra f.

December 9th, 2020

excellent transaction...very informative prior to purchase..

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

leila m.

January 30th, 2021

Very good service, friendly customer service

I absolutely will use the service again

Thank you!

David S.

April 6th, 2024

This site was recommended by my County's Clerks office website. Let me tell you when I received my specific State and County's Quit Claim Deed forms from Deeds.com, every conceivable form that could be needed in addition to the full instructions, and a sample filled out form, I was impressed (five stars) and made things so easy for me to feel confident in my legal activity on a land transaction.

Thank you for your positive words! We’re thrilled to hear about your experience.

Corinne S.

December 3rd, 2019

Did not need power to "serve" contractor. All work done well, paid for, nothing more. Worth noting when things could go awry!

Thank you!

Sandra T.

May 4th, 2023

I hope this will address all I need to make sure my father is not being taken for granted by my siblings and a nephew and his wife.

thank you

Thank you!

Keli A.

June 3rd, 2021

Excellent site, super fast responses to messages, and great patience with a newbie user. Couldn't be more pleased. Thank you!

Thank you for your feedback. We really appreciate it. Have a great day!

janelle s.

September 15th, 2020

Uncertain about use as I am new to online forms. Through use I am sure it will feel more comfortable. I like the storage of filled in info forms because I might be using I will be using them or the info in the future.

Thank you for your feedback. We really appreciate it. Have a great day!

Carolyn D.

March 18th, 2022

The sight provided exactly what I needed and was easy to use. I was able to download the type of Deed I used and was completely satisfied with the website.

Thank you for your feedback. We really appreciate it. Have a great day!