Converse County Trustee Deed Form (Wyoming)

All Converse County specific forms and documents listed below are included in your immediate download package:

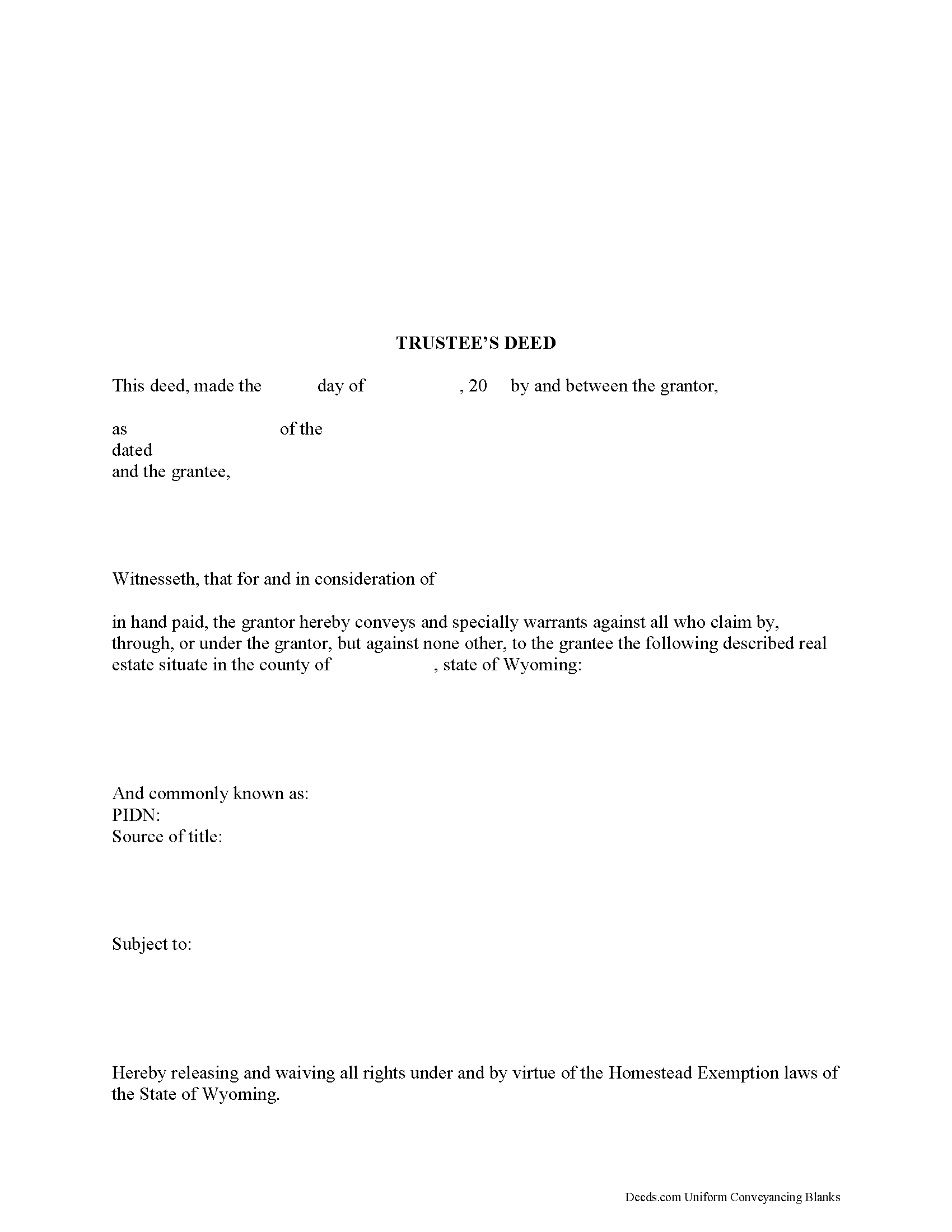

Trustee Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Converse County compliant document last validated/updated 5/26/2025

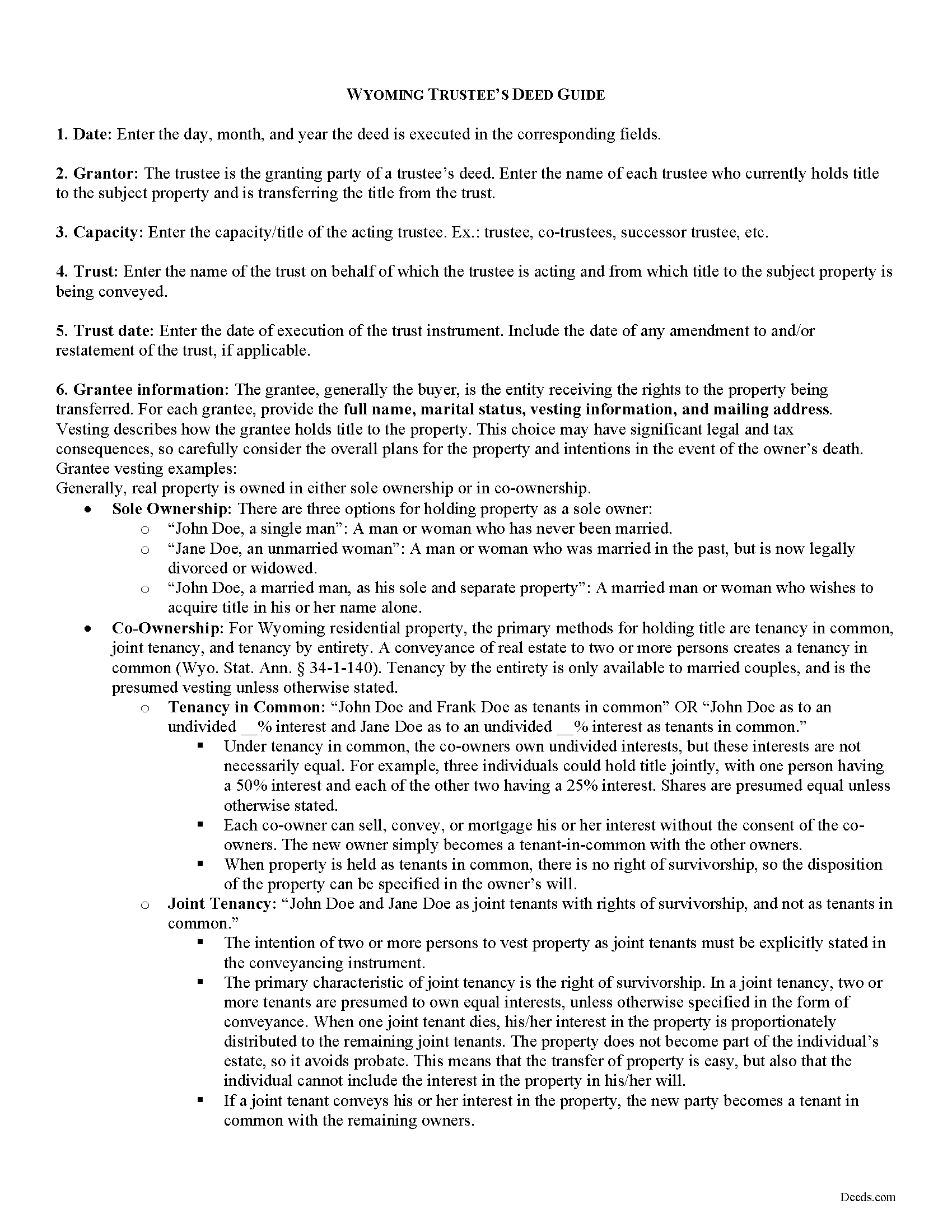

Trustee Deed Guide

Line by line guide explaining every blank on the form.

Included Converse County compliant document last validated/updated 6/30/2025

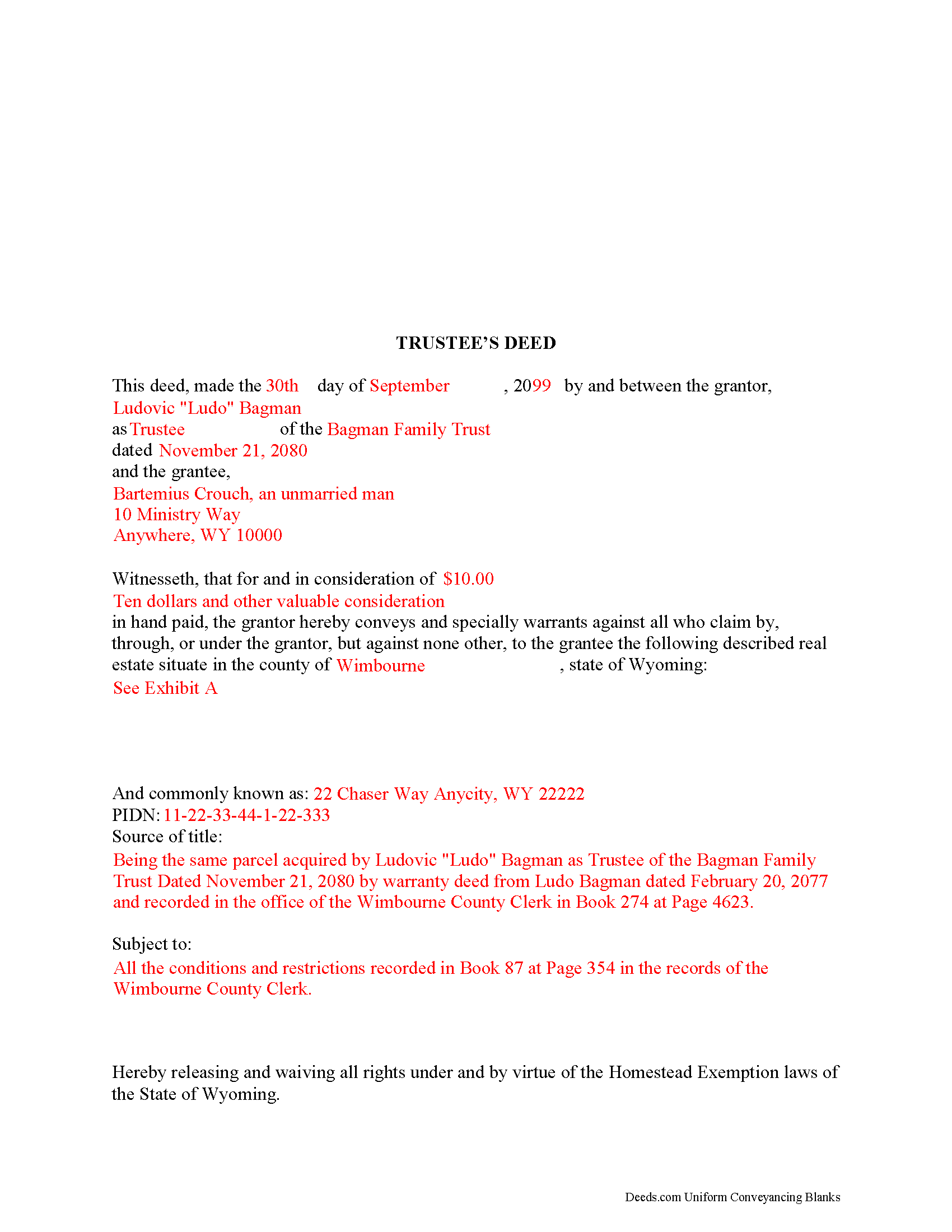

Completed Example of the Trustee Deed Document

Example of a properly completed form for reference.

Included Converse County compliant document last validated/updated 4/24/2025

The following Wyoming and Converse County supplemental forms are included as a courtesy with your order:

When using these Trustee Deed forms, the subject real estate must be physically located in Converse County. The executed documents should then be recorded in the following office:

Converse County Clerk

107 North 5th St, Suite 114, Douglas, Wyoming 82633-2448

Hours: Monday - Friday 8:00 am - 5:00 pm

Phone: (307) 358-2244

Local jurisdictions located in Converse County include:

- Douglas

- Glenrock

- Lost Springs

- Shawnee

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Converse County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Converse County using our eRecording service.

Are these forms guaranteed to be recordable in Converse County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Converse County including margin requirements, content requirements, font and font size requirements.

Can the Trustee Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Converse County that you need to transfer you would only need to order our forms once for all of your properties in Converse County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Wyoming or Converse County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Converse County Trustee Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

A trust is an arrangement whereby one person (the settlor) transfers property to another (trustee), who manages it for the benefit of a third (the beneficiary). A settlor may establish a trust to take effect during his lifetime (inter vivos trust), or a trust may be created upon his death through probate pursuant to the provisions of a will (testamentary trust).

The settlor creates a living trust by executing a trust instrument, which generally remains unrecorded. The settlor may elect to serve as the original trustee and name a successor trustee, who will assume the powers and duties of the trustee upon the settlor's death or incapacity.

When real property is transferred into the trust, the property belongs to the trust. As the trust itself cannot hold title to the property, the settlor must execute a deed titling the property in the name of the trustee on behalf of the trust. The trustee is bound to serve the trust pursuant to its terms and the powers and duties of trustees, codified at Wyo. Stat. Ann 4-10-801 to 4-10-817 as part of the Uniform Trust Code in Wyoming.

To convey real property out of the living trust, the trustee must execute a deed as the granting party. A deed executed by a trustee in a representative capacity is simply titled a trustee's deed. In Wyoming, the trustee's deed is functionally equivalent to a special warranty deed. Though warranty deeds and quitclaim deeds are the most commonly used conveyancing forms in Wyoming, the special warranty deed was codified in 2015 at 34-2-136.

A special warranty deed is a conveyance in fee simple to the grantee and contains the covenants that the property is "free from all encumbrances made by the grantor" except those expressly noted in the form of conveyance, and that the grantor "will forever warrant and defend the title of the property in the grantee... against any lawful claim and demand of the grantor and any person claiming or to claim by, through, or under the grantor, but against none other" (34-2-137). Grantors serving in a representative capacity commonly use a special warranty deed for transfers because it limits their obligation to only the time they held title to the property.

The trustee's deed is modified from the statutory form of a special warranty deed to include the trust's vesting information in the granting field. It requires each acting trustee's name, the name of the trust, and the date of the trust instrument. To maintain a clear chain of title, the deed references the prior instrument by which the trustee acquired title. Trustees may present an affidavit or certification of trust to confirm their authority to convey trust property (see 4-10-1014). The deed is signed by each trustee in the presence of a notary public before recording in the county in which the subject property is located.

Consult a lawyer with any questions regarding trusts and trustee's deeds in the State of Wyoming.

(Wyoming TD Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Converse County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Converse County Trustee Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4564 Reviews )

Michael G.

July 14th, 2025

Very helpful and easy to use

Your appreciative words mean the world to us. Thank you.

JAMES D.

July 10th, 2025

Slick as can be and so convenient.rnrnWorked like a charm

Thank you for your feedback. We really appreciate it. Have a great day!

MARY LACEY M.

June 30th, 2025

Great service! Recording was smooth and swiftly performed. Deeds.com is an excellent service.rn

We are delighted to have been of service. Thank you for the positive review!

Vickie K.

May 5th, 2025

Easy to download, forms look to be pretty easy to use. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Robert h.

February 25th, 2019

excellent and simple to use. Great price for this.

Thank you Robert! We really appreciate your feedback.

Kelly L.

April 15th, 2019

So far so good. Please make the payment method easier after the information has been uploaded and submitted.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jan O.

April 22nd, 2021

This was so easy and just what I needed.

Thank you for your feedback. We really appreciate it. Have a great day!

Julie G.

December 15th, 2020

Such a great site!! Everyone is so helpful! Thanks again!

Julie

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Robin M.

November 22nd, 2019

Thank you for your services...Attny office quoted a very large fee for the "TOD DEED" process, so this is very helpful that I am able to take care of this myself. If I would have researched your link sooner, I could have saved my Dad a lot of money for the "SURVIVORSHIP DEED". Thanks again & have a wonderful day:)

Thank you for your feedback. We really appreciate it. Have a great day!

Barbara S.

February 28th, 2019

I had an issue due to the fact that I had many beneficiaries. I was and still am not sure how to handle this. We do have Adobe Pro and can modify the form, if needed. But I would like to talk to your organization for more information.

While we are unable to assist you specifically with completing the document we can note that this is addressed in the guide. Information that does not fit in the available space should be included in an exhibit page.

Paul A.

October 27th, 2020

The website worked fast but the information was limited and the actual deed of trust was what i was looking for from the county --- the info was limited

the website is fast and seemed accurate just limited the information I needed

Thank you!

Rajashree S.

January 2nd, 2019

Deed was easy to download and complete. Will use again if needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Susan J.

June 29th, 2020

very fast service. immediate response and kept me informed along the way. the county was not cooperating and this was communicated to me and my fee was refunded, just like that. will definitely use this company again

Thank you!

Giuseppina M.

October 23rd, 2024

Love to work with your company

It was a pleasure serving you. Thank you for the positive feedback!

Anne S.

June 13th, 2019

Responsive and honest. They were unable to obtain records for me, no fault of theirs, and immediately let me know and credited my account. I give Deeds dot com five stars and would come back. Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!