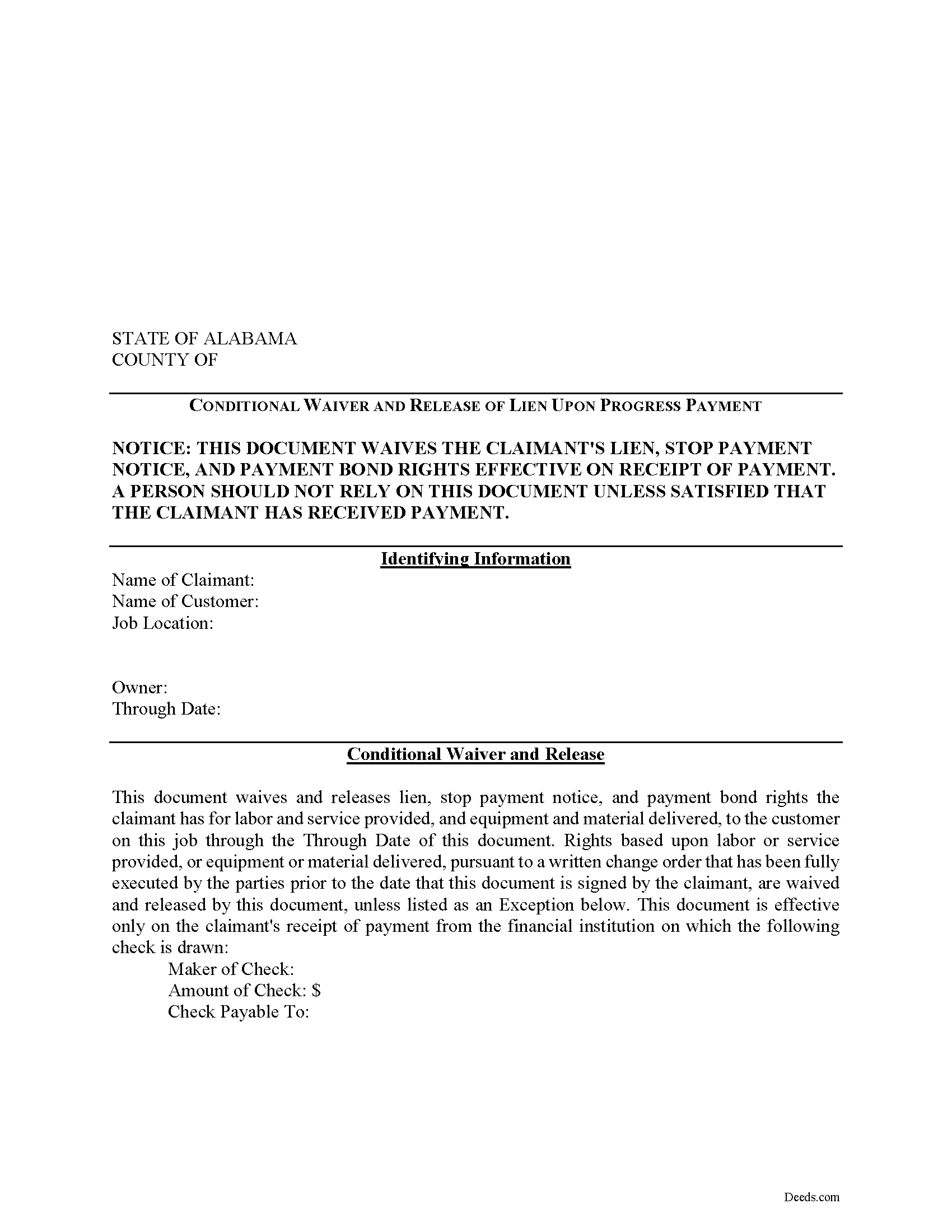

Lee County Conditional Lien Waiver on Progress Payment Form

Lee County Conditional Lien Waiver on Progress Payment Form

Fill in the blank Conditional Lien Waiver on Progress Payment form formatted to comply with all Alabama recording and content requirements.

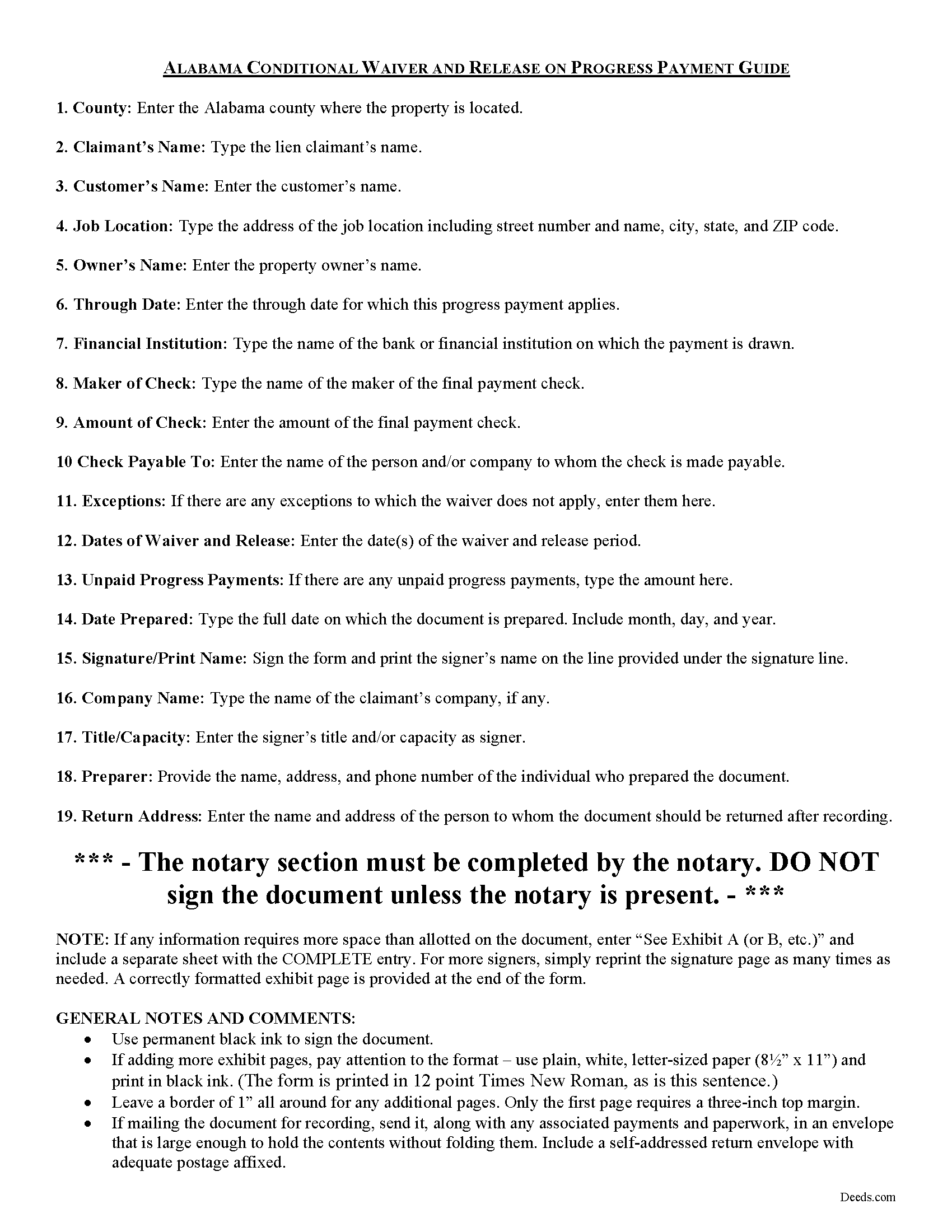

Lee County Conditional Lien Waiver on Progress Payment Guide

Line by line guide explaining every blank on the form.

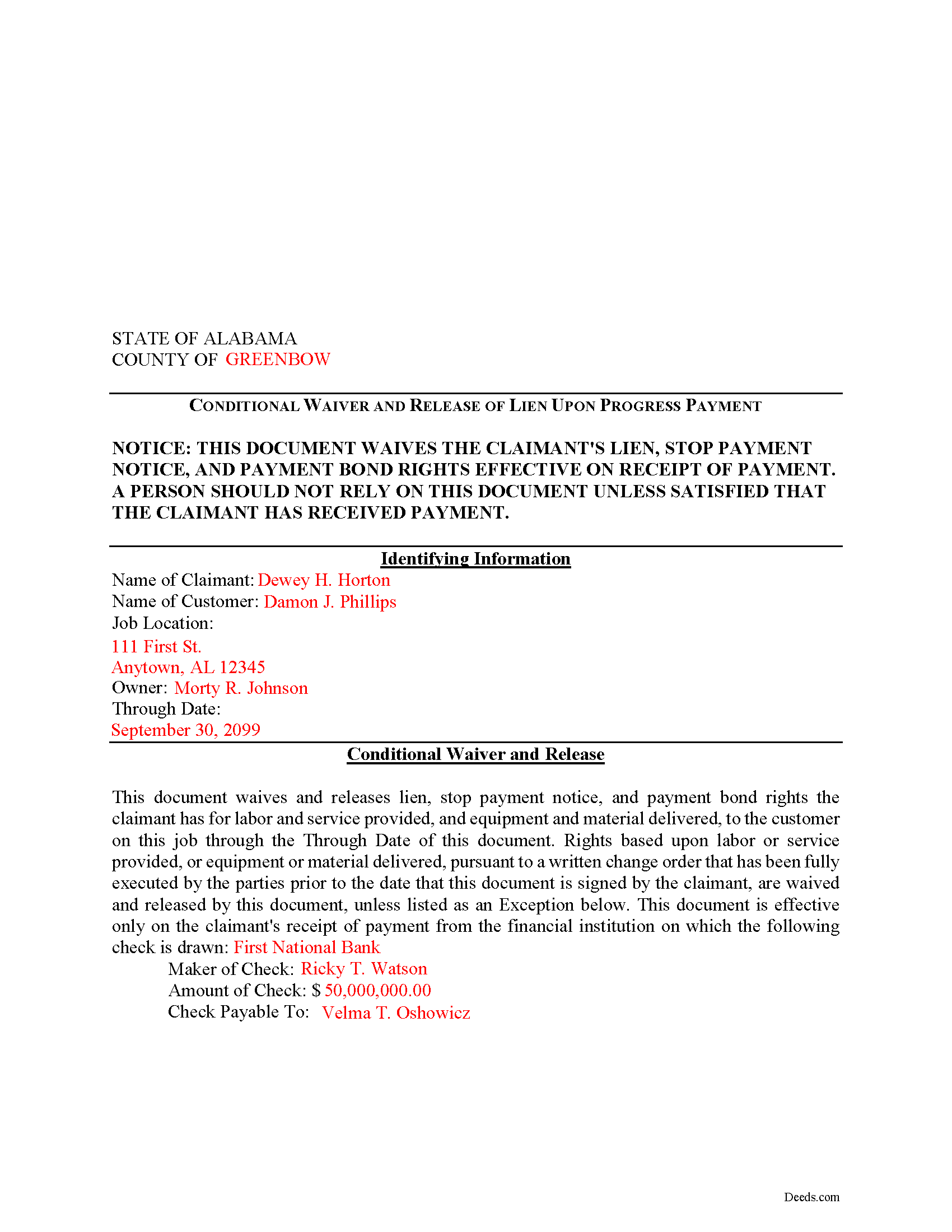

Lee County Completed Example of the Conditional Lien Waiver on Progress Payment Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Alabama and Lee County documents included at no extra charge:

Where to Record Your Documents

Probate Office: County Courthouse

Opelika, Alabama 36801

Hours: 8:30 to 4:30 M-F Central Time

Phone: 334-737-3670

Auburn Satellite Office

Auburn, Alabama 36830

Hours: 8:30 to 4:30 M-F

Phone: 334-737-7297

Smiths Station Satellite Office

Smiths Station, Alabama 36877

Hours: 9:00 to 4:30 M-F

Phone: 334-448-3299

Recording Tips for Lee County:

- Double-check legal descriptions match your existing deed

- Ask if they accept credit cards - many offices are cash/check only

- Both spouses typically need to sign if property is jointly owned

- Bring extra funds - fees can vary by document type and page count

Cities and Jurisdictions in Lee County

Properties in any of these areas use Lee County forms:

- Auburn

- Auburn University

- Cusseta

- Loachapoka

- Opelika

- Phenix City

- Salem

- Smiths Station

- Valley

- Waverly

Hours, fees, requirements, and more for Lee County

How do I get my forms?

Forms are available for immediate download after payment. The Lee County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Lee County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Lee County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Lee County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Lee County?

Recording fees in Lee County vary. Contact the recorder's office at 334-737-3670 for current fees.

Questions answered? Let's get started!

Conditional Waiver and Release of Lien on Progress Payment

Alabama mechanic's liens are governed under Chapter 11 of the Alabama Property Code (Section 11). Throughout the construction process, potential claimants may elect to serve the property owner with a lien waiver in exchange for partial or full payment.

The term "waiver" refers to giving up a legal right. In this case, the person granting the waiver is giving up the right to seek a mechanic's lien for all or part of the amount due. This assurance is usually enough to get the other party to pay. In Alabama, there are no statutory forms for waivers although according to the principles of contract law, the parties may agree to such modifications in writing.

Waivers generally come in four varieties: conditional or unconditional, and partial or final. A conditional waiver means the waiver is conditioned upon the claimant receiving the amount due, while unconditional waivers are effective regardless if payment is actually made. Partial waivers are used to waive a lien for up to the partial or progress payment amount, and final waivers release all lien rights based on a customer's full payment.

Partial waivers are used to waive a lien for up to the partial or progress payment amount. A conditional waiver means the waiver is conditioned upon the claimant receiving the amount due. Use the partial conditional waiver when the owner makes less than the full or final payment and the payment method does not guarantee receipt of the money (such as a check that hasn't cleared yet). Be sure to note any exceptions to which the waiver will not apply. This type of waiver offers more protection for the contractor or materials supplier.

This article is provided for informational purposes only and should not be relied upon as a substitute for the advice from an attorney. Please contact an attorney with questions about waivers or anything else related mechanic's liens in Alabama.

Important: Your property must be located in Lee County to use these forms. Documents should be recorded at the office below.

This Conditional Lien Waiver on Progress Payment meets all recording requirements specific to Lee County.

Our Promise

The documents you receive here will meet, or exceed, the Lee County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Lee County Conditional Lien Waiver on Progress Payment form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4577 Reviews )

Quanah N.

July 30th, 2022

Instruction easy to follow

Thank you!

Deborah M.

June 24th, 2021

Absolutely great. The staff is responsive and knowledgeable. The online interface is excellent. The total cost for finalizing the sale on our property (minus state filing fees) was $39. A wonderful experience.

Thank you for your feedback. We really appreciate it. Have a great day!

David L.

March 9th, 2021

You did refund my payment, but were unable to provide the deed i needed.

Thank you!

Abigail Frances B.

December 28th, 2018

Thanks for the easy download, clear instructions, good price- I'm looking forward to filling them out.

Thank you for your feedback. We really appreciate it. Have a great day!

Tiffany J.

December 26th, 2020

Easy steps to create an account, will recommend to anyone.

Thank you for your feedback. We really appreciate it. Have a great day!

Lynn H.

January 12th, 2023

A very informative WEB site. It was simple to access the forms I needed for my specific situation. I would highly recommend Deeds.com. I will be back with future needs when they arise! I was left with a very positive impression. Thank you so much!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Robert S.

December 21st, 2018

Were unable to help me because of the recorders office but credited my account promptly

Thank you for your feedback. We really appreciate it. Have a great day!

catherine f.

May 28th, 2019

Easy! 5 stars

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ben F.

April 14th, 2019

My initial review during download and before reading the guide and forms looks promising.

Thank you!

Kristina R.

March 27th, 2020

Fast and friendly service. I will use Deeds.com again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Joyce S.

September 30th, 2020

So happy, great forms made everything a breeze.

Thank you for your feedback. We really appreciate it. Have a great day!

Jay T.

August 6th, 2020

I filled out the deed, had it notarized, and recorded. No problems. I put this off for so long. Once I had the form it was recorded in one day.

Thank you for your feedback. We really appreciate it. Have a great day!

Donna W.

October 6th, 2022

Answered all of my questions and was very easy to use. I will use Deeds.com to do all of my real estate forms from now on. Thanks.

Thank you!

Judy F.

May 27th, 2022

The site was easy to use, I just wasn't sure which of all these documents I needed.

Thank you!

Janet P.

July 30th, 2021

Extremely easy to use. The guide and sample were a great source of reference.

Thank you for your feedback. We really appreciate it. Have a great day!