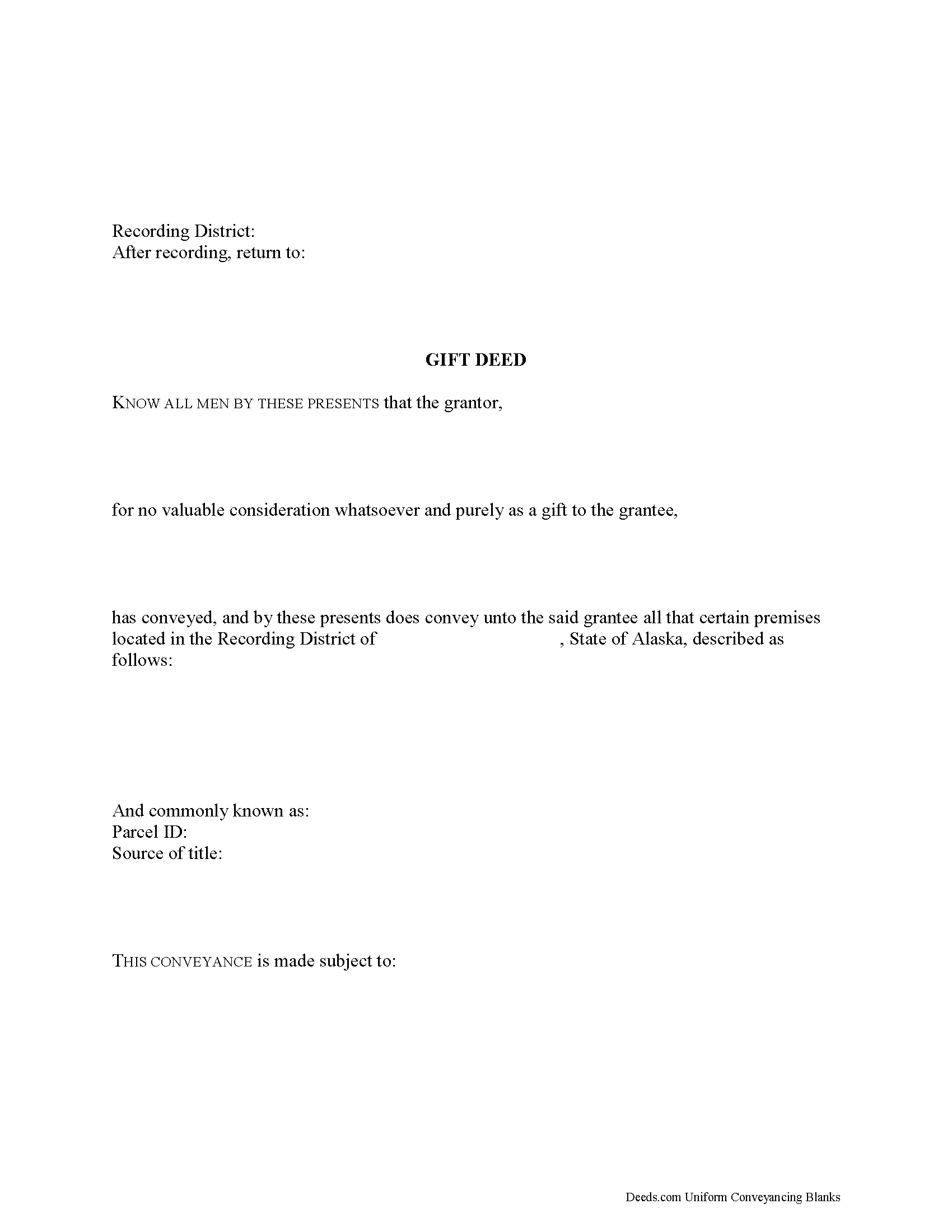

Wade Hampton Borough Gift Deed Form

Wade Hampton Borough Gift Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

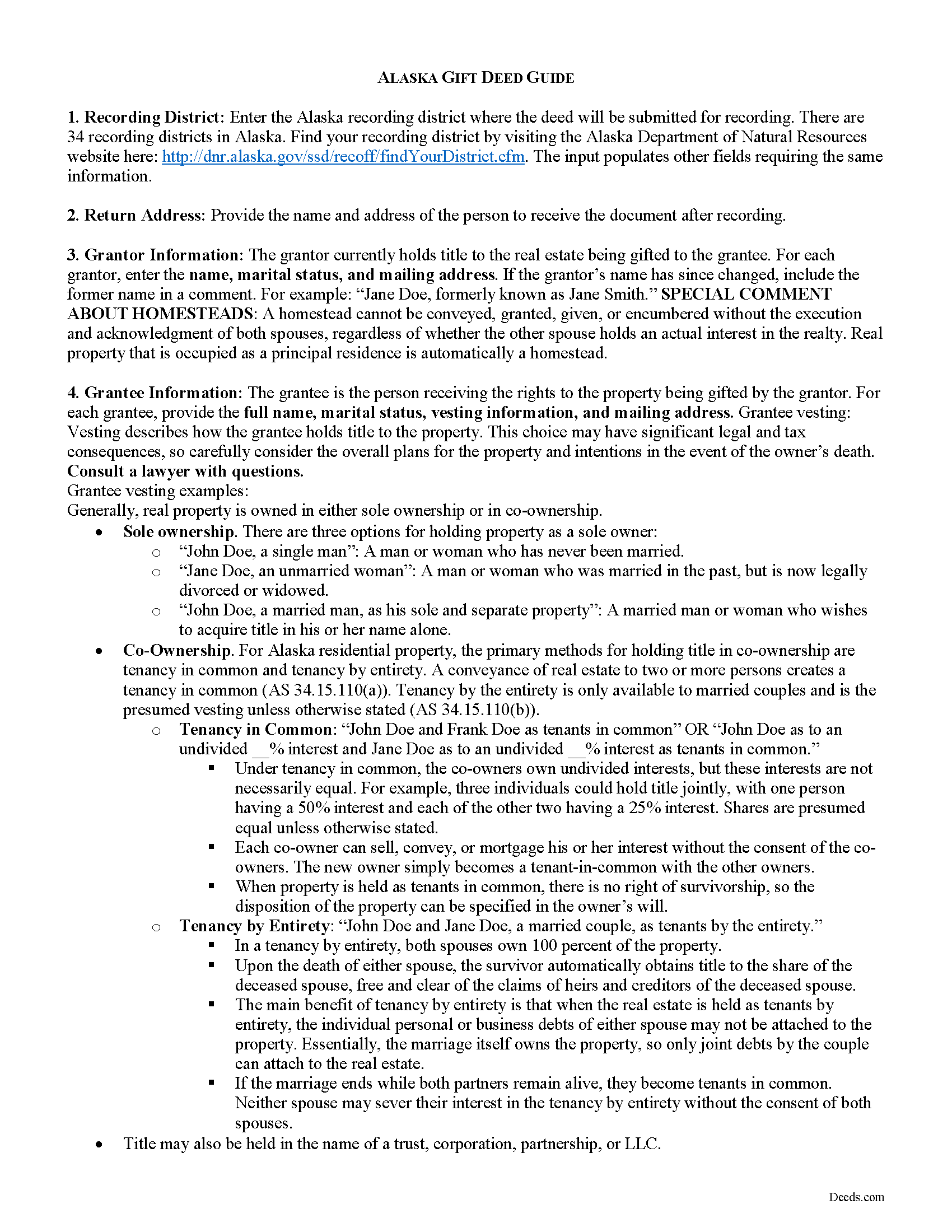

Wade Hampton Borough Gift Deed Guide

Line by line guide explaining every blank on the Gift Deed form.

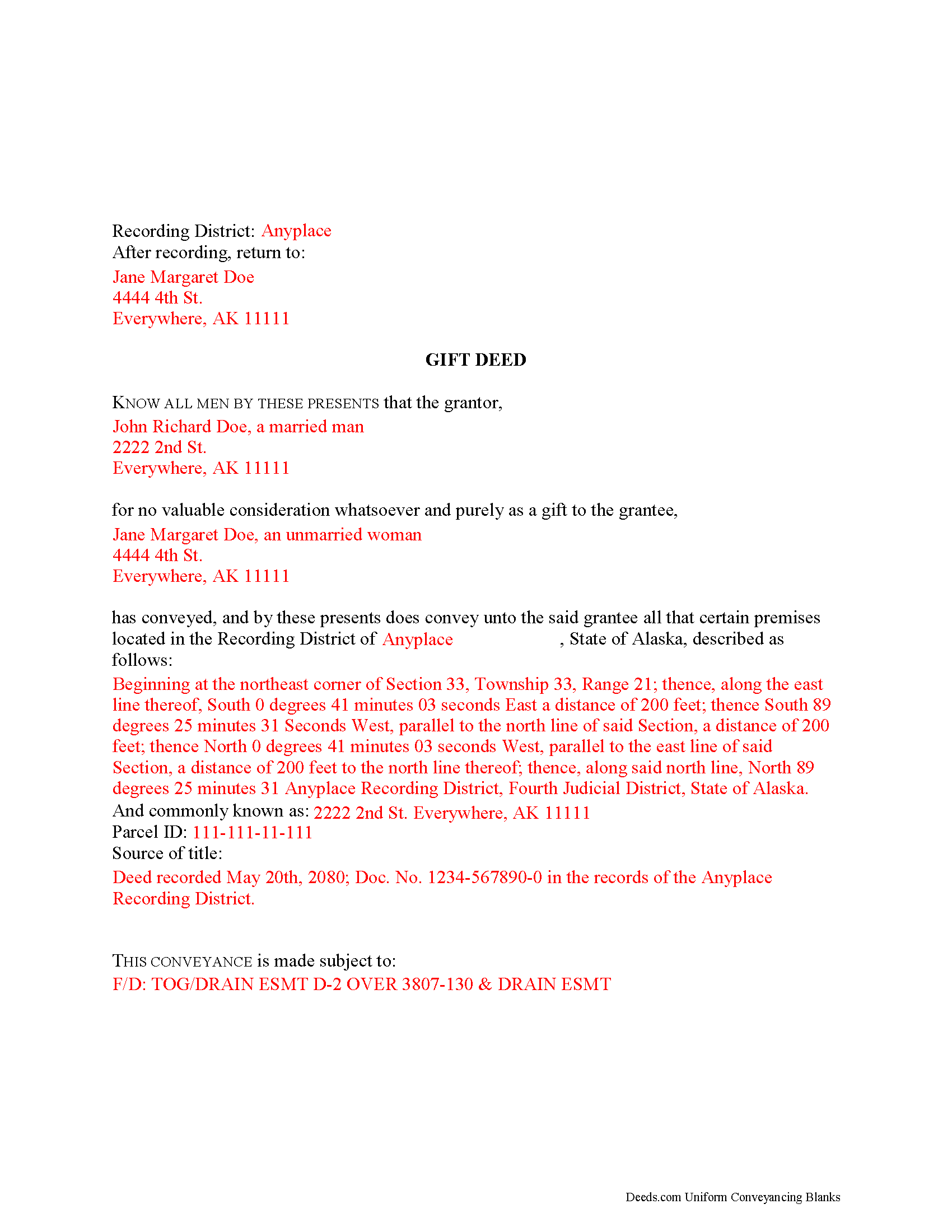

Wade Hampton Borough Completed Example of the Gift Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Alaska and Wade Hampton Borough documents included at no extra charge:

Where to Record Your Documents

Fairbanks Office (for Bethel & Cape Nome District)

Fairbanks, Alaska 99701-6206

Hours: 8:00am to 3:30pm M-F / Research from 7:30am

Phone: (907) 452-2298 or 452-3521

Recording Tips for Wade Hampton Borough:

- Verify all names are spelled correctly before recording

- Recorded documents become public record - avoid including SSNs

- Check margin requirements - usually 1-2 inches at top

- Verify the recording date if timing is critical for your transaction

Cities and Jurisdictions in Wade Hampton Borough

Properties in any of these areas use Wade Hampton Borough forms:

- Alakanuk

- Chevak

- Emmonak

- Hooper Bay

- Kotlik

- Marshall

- Mountain Village

- Nunam Iqua

- Pilot Station

- Russian Mission

- Saint Marys

- Scammon Bay

Hours, fees, requirements, and more for Wade Hampton Borough

How do I get my forms?

Forms are available for immediate download after payment. The Wade Hampton Borough forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Wade Hampton Borough?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Wade Hampton Borough including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Wade Hampton Borough you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Wade Hampton Borough?

Recording fees in Wade Hampton Borough vary. Contact the recorder's office at (907) 452-2298 or 452-3521 for current fees.

Questions answered? Let's get started!

Gifts of Real Property in Alaska

Gift deeds convey title to real property from one party (the grantor or donor) to another (the grantee or donee) with no exchange of consideration, monetary or otherwise. Often used to transfer property between family members or to gift property as a charitable act or donation, these conveyances occur during the grantor's lifetime. It is important that a gift deed contain language that explicitly states that no consideration is expected or required. Ambiguous language, or references to any type of consideration, can make the gift deed contestable in court.

In Alaska, no covenants are implied in a conveyance of real property, even if the conveyance contains special covenants (AS 34-15-080). Any guarantees must meet statutory language as prescribed by AS 35-15-030.

A lawful gift deed includes the grantor's full name and marital status, as well as the grantee's full name, marital status, vesting, and mailing address. Vesting describes how the grantee holds title to the property. Generally, real property is owned in either sole ownership or in co-ownership. For Alaska residential property, the primary methods for holding title in co-ownership are tenancy in common and tenancy by entirety. A conveyance of real estate to two or more persons creates a tenancy in common (AS 34.15.110(a)). Tenancy by the entirety is only available to married couples and is the presumed vesting unless otherwise stated (AS 34.15.110(b)). When real estate is held as tenants by entirety, upon the death of either spouse, the survivor automatically obtains title to the share of the deceased spouse, free and clear of the claims of heirs and creditors of the deceased spouse.

As with any conveyance of realty, a gift deed requires a complete legal description of the parcel. In Alaska, at minimum, the legal description should include the section, township, range, and meridian designation, or (for subdivided property) the lot, block, and subdivision name or plat number of the parcel. Recite the source of title to establish a clear chain of title, and detail any restrictions associated with the property. The document must be signed and acknowledged by the grantor in the presence of two credible witnesses, one of which can be the notary (AS 34-15-210). Submit the deed, along with any additional materials, to the recorder's office of the recording district where the property is located. Contact the same office to verify accepted forms of payment.

With gifts of real property, the recipient of the gift (grantee) is not required to declare the amount of the gift as income, but if the property accrues income after the transaction, the grantee is responsible for paying the requisite state and federal income tax.

In Alaska, there is no state gift tax, but the gift remains subject to federal taxation. The person or entity making the gift (grantor) is responsible for paying this tax; however, if the donor does not pay the gift tax, the donee will be held liable.

In accordance with federal law, individuals are permitted an annual exclusion of $15,000 on gifts. This means that, if a gift is valued below $15,000, a federal gift tax return (Form 709) does not need to be filed. However, if the gift is something that could possibly be disputed by the IRS -- such as real property -- a donor may benefit from filing a Form 709.

This article is provided for informational purposes only and is not a substitute for the advice of an attorney. Contact an Alaska lawyer with any questions about gift deeds or other issues related to the transfer of real property.

Important: Your property must be located in Wade Hampton Borough to use these forms. Documents should be recorded at the office below.

This Gift Deed meets all recording requirements specific to Wade Hampton Borough.

Our Promise

The documents you receive here will meet, or exceed, the Wade Hampton Borough recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Wade Hampton Borough Gift Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Willie T.

March 8th, 2019

Great

Thank you for your feedback. We really appreciate it. Have a great day!

Christina H.

December 29th, 2022

I appreciate having forms available and not having to go to a business supply or attorney. This is great. However, there are two individual quit claim deed forms and I don't know which one is appropriate.

Thank you for your feedback. We really appreciate it. Have a great day!

Lana J.

March 4th, 2022

Very easy to use and the forms were perfectly formatted. Great value and service!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

A. S.

February 27th, 2019

First, I am glad that you gave a blank copy, an example copy, and a 'guide'. It made it much easier to do. Overall I was very happy with your products and organization... however, things got pretty confusing and I have a pretty 'serious' law background in Real Estate and Civil law. With that said, I spent about 10+ hours getting my work done, using the Deed of Trust and Promissory note from you and there were a few problems: First, it would be FANTASTIC if you actually aligned your guide to actually match the Deed or Promissory Note. What I mean is that if the Deed says 'section (E)' then your guide shouldn't be 'randomly' numbered as 1,2,3, for advice/instructions, but should EXACTLY match 'section (E)'. Some places you have to 'hunt' for what you are looking for, and if you did it based on my suggestion, you wouldn't need to 'hunt' and it would avoid confusion. 2nd: This one really 'hurt'... you had something called the 'Deed of Trust Master Form' yet you had basically no information on what it was or how to use it. The only information you had was a small section at the top of the 'Short Form Deed of Trust Guide'. Holy Cow, was that 'section' super confusing. I still don't know if I did it correctly, but your guide says only put a return address on it and leave the rest of the 16 or so page Deed of Trust beneath it blank... and then include your 'Deed of Trust' (I had to assume the short form deed that I had just created) as part of it. I had to assume that I had to print off the entire 17 page or so title page and blank deed. I also had to assume that the promissory note was supposed to be EXHIBIT A or B on the Short Form Deed. It would be great if someone would take a serious look at that short section in your 'Short Form Deed of Trust Guide' and realize that those of us using your products are seriously turning this into a county clerk to file and that most of us, probably already have a property that has an existing Deed... or at least can find one in the county records if necessary... and make sure that you make a distinction between the Deed for the property that already exists, versus the Deed of Trust and Promissory note that we are trying to file. Thanks.

Thank you for your feedback. We'll have staff review the document for clarity. Have a great day!

shelley m.

March 5th, 2019

I thought the service was good

Thank you Shelley. Have a fantastic day!

JoAnn L.

September 10th, 2020

The process was easy, and efficient. There was a person available to help if needed. Very pleased, would use this again.

Thank you!

Lan S.

November 23rd, 2020

extremely satisfied with the service. I could not get file size correctly at the beginning. I received quick responses pointing out specific problem, which was very helpful for me to correct the mistake. It took 5 or 6 times due to different errors to finally achieve the qualified version. The customer care team was very patient walking me through the process.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

John P.

December 8th, 2019

Working with one document at a time every thing was great, but the program will not let multiple documents save independently. When I saved a document and created another document the changes I made on the second document were on the 1st document. No big deal if your printing, but if your saving to email later, its an issue.

Thank you for your feedback. We really appreciate it. Have a great day!

TAMARA B.

December 17th, 2020

Great service

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Pamela P.

October 12th, 2019

I liked the speed and efficiency of your website.

Thank you for your feedback. We really appreciate it. Have a great day!

bill h.

June 10th, 2021

so far getting what i needed was easy the site is well done thank you

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jayne S.

August 24th, 2023

Very prompt and excellent service!

Thank you for your feedback. We really appreciate it. Have a great day!

Julius D.

July 10th, 2020

Worked great....WV accepted this document and made the whole process easy...thanks

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Dale Mary G.

July 14th, 2020

This was an easy site to use - saving so much time and allowing me to complete what I needed to do. All the added information, guidelines and even a sample completed form. Great!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Deborah B.

September 30th, 2021

I was skeptical after experiencing other websites. However not only did we get the form we needed for a fraction of the cost vs going to an attorney, the additional resources (guides and samples) made the completion of the Enhanced Life Quitclaim deed quite simple, quick, and painless. We were having difficulty getting my mom to agree to meeting with an attorney or even considering a Lady Bird deed. Deeds.com gave us the ability to move forward with necessary actions with family members walking my mom through the steps, explaining the process and giving her plenty of time to find the needed information. She became part of the process which made it easy for her at a time when decision making was hard. We did everything in the comfort of her own home. I can't think of a better experience or service and I would consider Deeds.com for future needs.

Thank you for the kinds words Deborah. We appreciate you taking the time to share your experience.