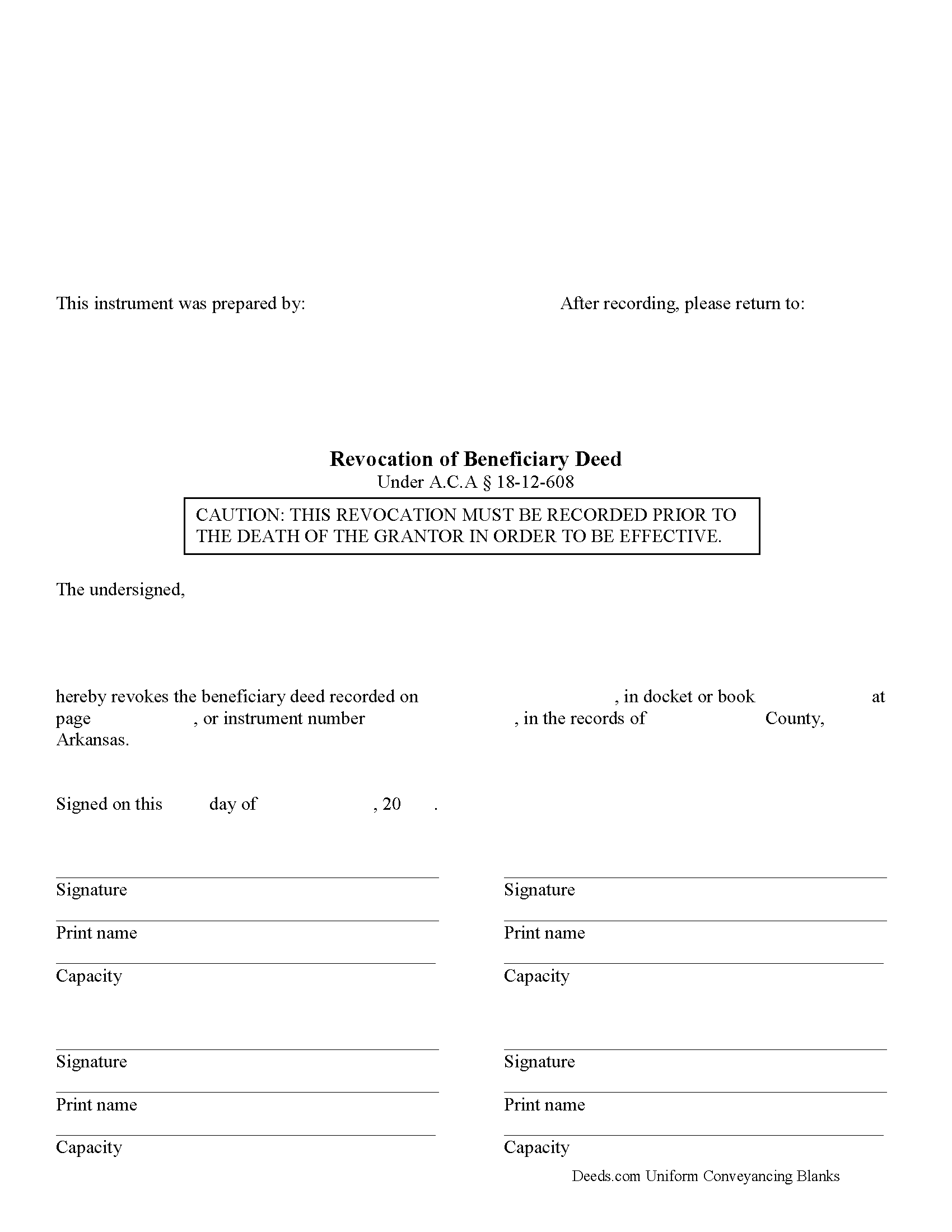

Izard County Beneficiary Deed Revocation Form

Izard County Beneficiary Deed Revocation Form

Fill in the blank form formatted to comply with all recording and content requirements.

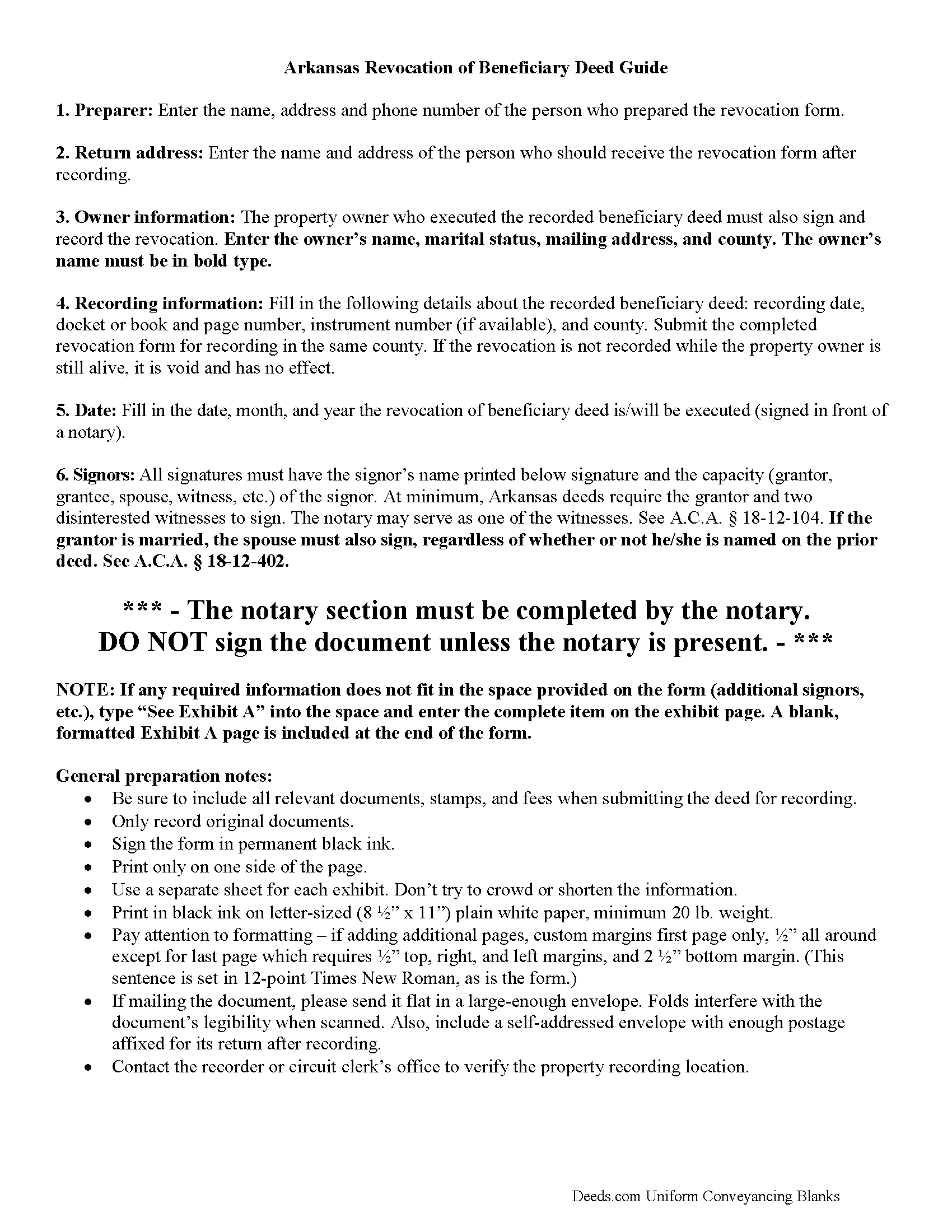

Izard County Beneficiary Deed Revocation Guide

Line by line guide explaining every blank on the form.

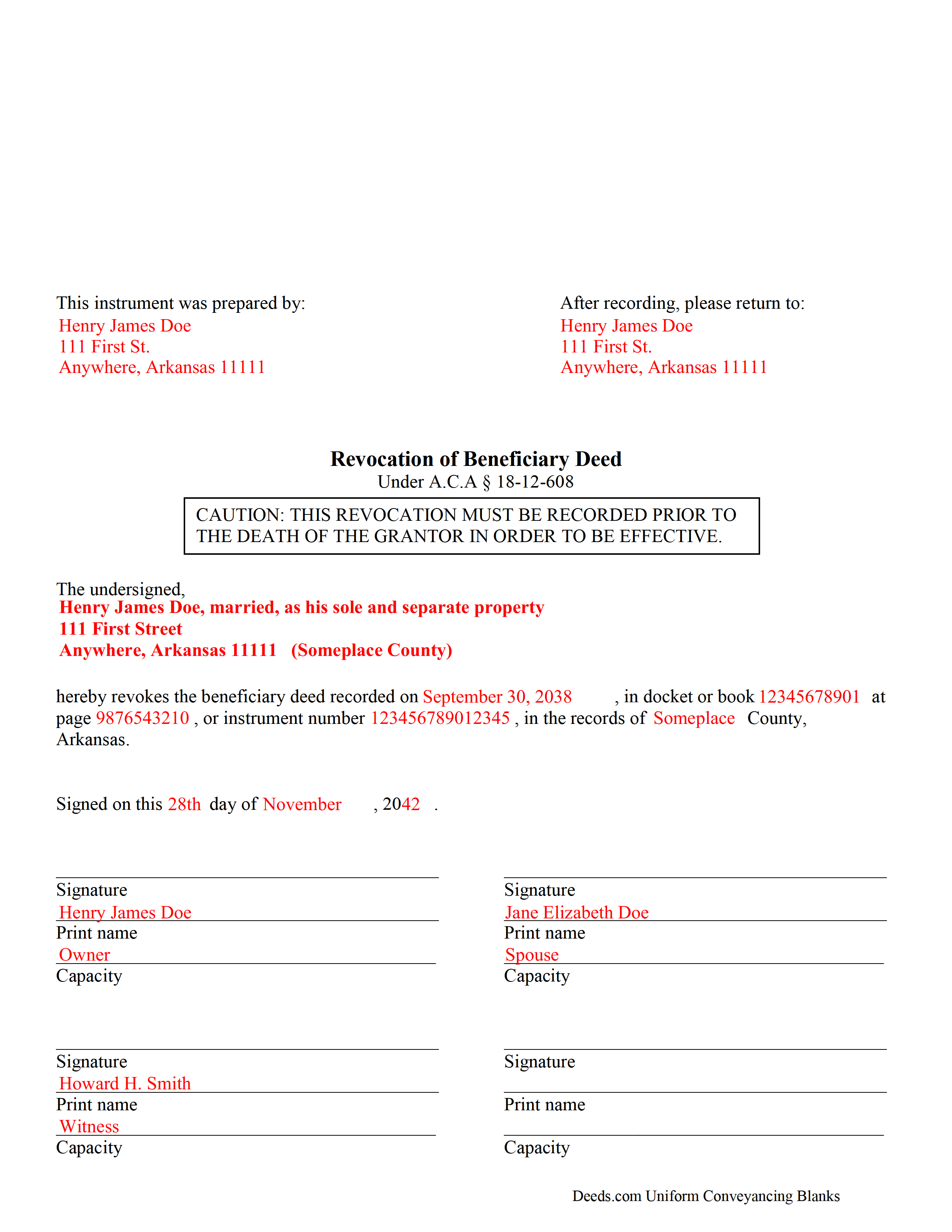

Izard County Completed Example of the Beneficiary Deed Revocation Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Arkansas and Izard County documents included at no extra charge:

Where to Record Your Documents

Circuit and County Clerk

Melbourne, Arkansas 72556

Hours: 8:30 to 4:30 M-F

Phone: (870) 368-4316

Recording Tips for Izard County:

- Verify all names are spelled correctly before recording

- Make copies of your documents before recording - keep originals safe

- Recording fees may differ from what's posted online - verify current rates

- Leave recording info boxes blank - the office fills these

Cities and Jurisdictions in Izard County

Properties in any of these areas use Izard County forms:

- Brockwell

- Calico Rock

- Dolph

- Franklin

- Guion

- Horseshoe Bend

- Melbourne

- Mount Pleasant

- Oxford

- Pineville

- Sage

- Violet Hill

- Wideman

- Wiseman

Hours, fees, requirements, and more for Izard County

How do I get my forms?

Forms are available for immediate download after payment. The Izard County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Izard County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Izard County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Izard County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Izard County?

Recording fees in Izard County vary. Contact the recorder's office at (870) 368-4316 for current fees.

Questions answered? Let's get started!

Revoking a Beneficiary Deed in Arkansas

Beneficiary deeds in Arkansas are governed by A.S.A. 18-12-608. This statute also includes information about revoking an executed and recorded beneficiary deed.

Section 18-12-608 (d)(1) states that a beneficiary deed "may be revoked at any time by the owner or, if there is more than one (1) owner, by any of the owners who executed the beneficiary deed." Why is this flexibility important? Well, life is uncertain and circumstances change. The original beneficiary may no longer be an appropriate recipient of the real property. Perhaps the beneficiary knows about the transfer, but is unable or unwilling to accept it. Instead of disclaiming the gift when the owner dies, thus forcing the property back into the estate for probate, the owner has the option to revoke the beneficiary deed and designate someone else to receive it.

Regardless of the reason, to revoke a beneficiary deed, the owner must execute a document setting forth the revocation and then record it, DURING HIS/HER LIFE, in the county where the property is situated. This should be the same county where the beneficiary deed was recorded earlier.

The owner may also simply sell the property outright, thereby extinguishing any remaining interest in it and leaving nothing to transfer at death. Or, he/she may execute and record another beneficiary deed, naming someone else to receive the real estate. This method is effective because "the recorded beneficiary deed that is last signed before the owner's death is the effective beneficiary deed, regardless of the sequence of recording." ( 18-12-608(e))

Even though there are several options available to revoke or change a recorded beneficiary deed, recording a revocation is the most efficient way to ensure the owner's wishes are carried out. A revocation discontinues the potential future interest described in the beneficiary deed, which then frees the real estate for whatever the owner wishes to do with it next. This is also important because it helps maintain a clear chain of title, which will make later sales or mortgages of the property less complicated.

Note: as with beneficiary deeds, any changes or revocations must be executed and recorded while the owner is alive.

(Arkansas Beneficiary Revocation Package includes form, guidelines, and completed example)

Important: Your property must be located in Izard County to use these forms. Documents should be recorded at the office below.

This Beneficiary Deed Revocation meets all recording requirements specific to Izard County.

Our Promise

The documents you receive here will meet, or exceed, the Izard County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Izard County Beneficiary Deed Revocation form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4587 Reviews )

Mary M.

May 7th, 2019

So easy to use. I was able to download all the forms I need, it saves a lot of time!

Thank you!

Shannon R.

January 10th, 2019

Good forms, served the purpose. would not hesitate to use again if needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Estelle R.

May 25th, 2022

Easy to download. Hopefully easy to fill in. Just wish there was wording for a Beneficiary Deed for moving real estate property owned by a married couple to their Trust upon death of last Trustee.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Darren G.

December 10th, 2021

Your beneficiary deed sample contains a error of the LDPS designation. I copied the designation of LPDS instead of the correct designation

Thank you for your feedback. We really appreciate it. Have a great day!

Robert B.

September 28th, 2021

Excellent service. Unbelievably rapid and detailed responses. Was not happy to have to pay the fee but totally worth it.

Thank you for your feedback. We really appreciate it. Have a great day!

Maurice B.

April 18th, 2019

The program fields should allow the customer to change font size and allow additional space for information to be place on the Deed. Not Bad, still needs improvement.

Thank you for your feedback Maurice. Unfortunately we do not make the requirements for things like font size and margins, we only make the documents to be compliant with them.

Regina S.

January 13th, 2022

5 STARS!!! YOU WERE AWESOME!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sharon H.

April 28th, 2020

I was able to print the deed and follow the instructions and sample deed quite easily. Thank you

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Vicki C.

March 10th, 2023

I purchased a Deed on Death for Washington State. Very user friendly site. Thank you 5star

Thank you for your feedback. We really appreciate it. Have a great day!

Harry C.

February 11th, 2019

I got the wrong state and now they want to charge me again for the proper state. My fault, BUT!!!!

Sorry to hear that Harry. We've gone ahead and canceled the order you made in error. Have a wonderful day.

Mark R.

January 10th, 2019

Easy and simple to understand, had no trouble with the transaction or the forms. Recorded on the first try, not something that happens very often.

Great to hear that Mark. have an awesome day!

Patricia D.

January 22nd, 2019

It worked great- I had a little trouble at first with the site, figuring out where to do what, but the form was much better than the one we purchased at Staples, loved being able to fill out with the computer. We did need the other form as per the screen prior to ordering but couldn't figure out which one. The ladies at the recorders were great too.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Roy C.

January 25th, 2021

Great Product no problems filing

Thank you for your feedback. We really appreciate it. Have a great day!

Guadalupe G.

November 10th, 2022

Easy but why charge???

Thank you!

Marilyn O.

March 9th, 2021

Good resource. Got what I needed easily

Thank you for your feedback. We really appreciate it. Have a great day!