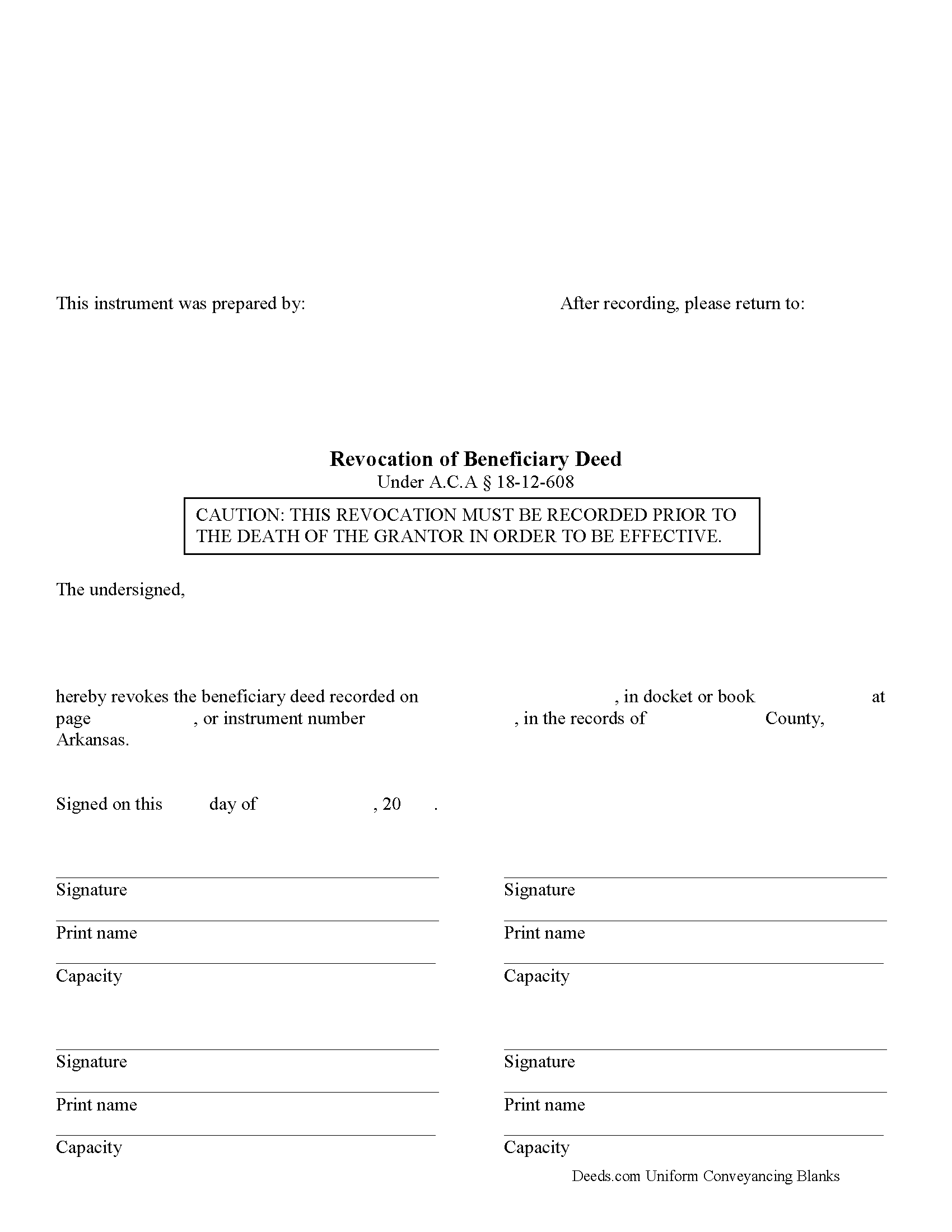

Poinsett County Beneficiary Deed Revocation Form

Poinsett County Beneficiary Deed Revocation Form

Fill in the blank form formatted to comply with all recording and content requirements.

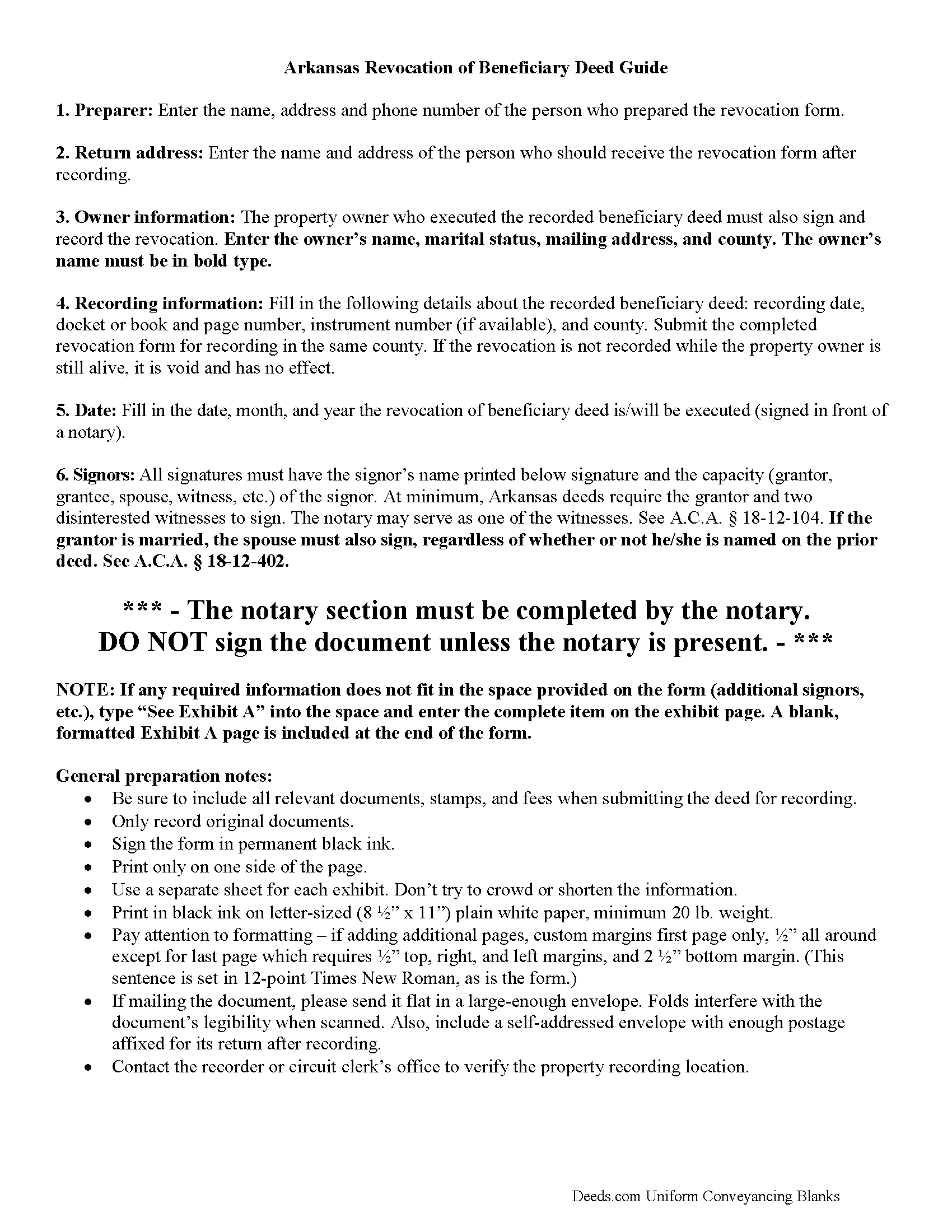

Poinsett County Beneficiary Deed Revocation Guide

Line by line guide explaining every blank on the form.

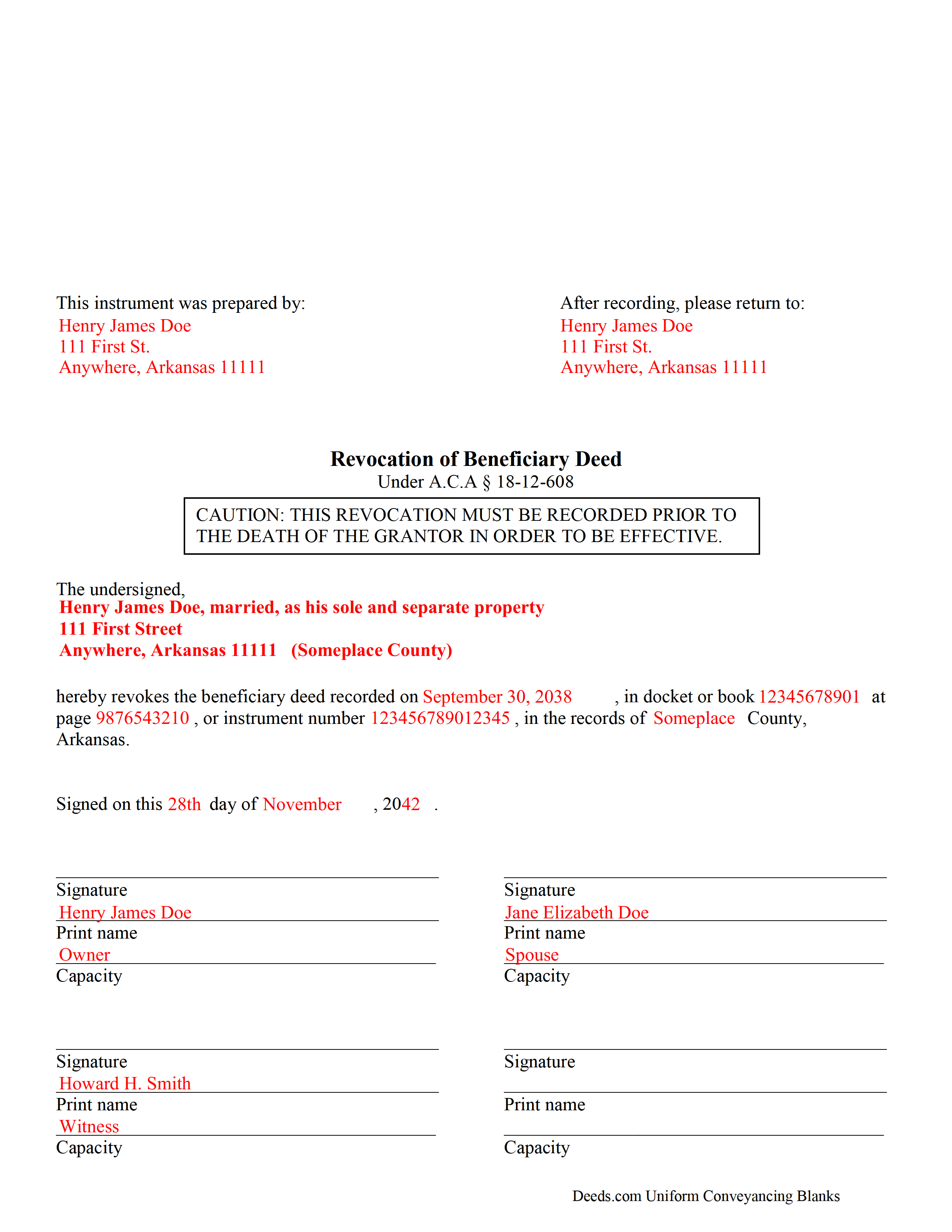

Poinsett County Completed Example of the Beneficiary Deed Revocation Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Arkansas and Poinsett County documents included at no extra charge:

Where to Record Your Documents

Poinsett County Circuit Clerk

Harrisburg, Arkansas 72432

Hours: 8:30 to 4:30 M-F

Phone: (870) 578-4420

Recording Tips for Poinsett County:

- Bring your driver's license or state-issued photo ID

- Ask if they accept credit cards - many offices are cash/check only

- Ask about their eRecording option for future transactions

- Request a receipt showing your recording numbers

- Recording fees may differ from what's posted online - verify current rates

Cities and Jurisdictions in Poinsett County

Properties in any of these areas use Poinsett County forms:

- Fisher

- Harrisburg

- Lepanto

- Marked Tree

- Rivervale

- Trumann

- Tyronza

- Waldenburg

- Weiner

Hours, fees, requirements, and more for Poinsett County

How do I get my forms?

Forms are available for immediate download after payment. The Poinsett County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Poinsett County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Poinsett County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Poinsett County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Poinsett County?

Recording fees in Poinsett County vary. Contact the recorder's office at (870) 578-4420 for current fees.

Questions answered? Let's get started!

Revoking a Beneficiary Deed in Arkansas

Beneficiary deeds in Arkansas are governed by A.S.A. 18-12-608. This statute also includes information about revoking an executed and recorded beneficiary deed.

Section 18-12-608 (d)(1) states that a beneficiary deed "may be revoked at any time by the owner or, if there is more than one (1) owner, by any of the owners who executed the beneficiary deed." Why is this flexibility important? Well, life is uncertain and circumstances change. The original beneficiary may no longer be an appropriate recipient of the real property. Perhaps the beneficiary knows about the transfer, but is unable or unwilling to accept it. Instead of disclaiming the gift when the owner dies, thus forcing the property back into the estate for probate, the owner has the option to revoke the beneficiary deed and designate someone else to receive it.

Regardless of the reason, to revoke a beneficiary deed, the owner must execute a document setting forth the revocation and then record it, DURING HIS/HER LIFE, in the county where the property is situated. This should be the same county where the beneficiary deed was recorded earlier.

The owner may also simply sell the property outright, thereby extinguishing any remaining interest in it and leaving nothing to transfer at death. Or, he/she may execute and record another beneficiary deed, naming someone else to receive the real estate. This method is effective because "the recorded beneficiary deed that is last signed before the owner's death is the effective beneficiary deed, regardless of the sequence of recording." ( 18-12-608(e))

Even though there are several options available to revoke or change a recorded beneficiary deed, recording a revocation is the most efficient way to ensure the owner's wishes are carried out. A revocation discontinues the potential future interest described in the beneficiary deed, which then frees the real estate for whatever the owner wishes to do with it next. This is also important because it helps maintain a clear chain of title, which will make later sales or mortgages of the property less complicated.

Note: as with beneficiary deeds, any changes or revocations must be executed and recorded while the owner is alive.

(Arkansas Beneficiary Revocation Package includes form, guidelines, and completed example)

Important: Your property must be located in Poinsett County to use these forms. Documents should be recorded at the office below.

This Beneficiary Deed Revocation meets all recording requirements specific to Poinsett County.

Our Promise

The documents you receive here will meet, or exceed, the Poinsett County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Poinsett County Beneficiary Deed Revocation form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4583 Reviews )

Bobby T.

June 17th, 2020

Great!! Helps me out

Thank you!

Tai H.

September 21st, 2019

Great service. Save me a time and effort in filling out LA County Quitclaim Deed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Raad A.

November 25th, 2022

Not easy to navigate

Thank you for your feedback.

Denise G.

May 7th, 2020

It would be helpful if an email was sent to notify you of any additional invoices needed, documents were accepted and/or recorded. It is not always convenient to check your website on a daily basis to determine the status of the requesting recordings.

Thank you for your feedback. We really appreciate it. Have a great day!

Samuel M.

October 8th, 2020

it was convenient to have a starting place, however, though the property is in Colorado, the probate is in Iowa, so I had to create my own document because you locked my capacity to edit the form I paid for. If I pay for it, I should be able to edit everything including non fill in text. I could not open it in word, as I normally could.

Thank you for your feedback. We really appreciate it. Have a great day!

Carl S.

February 29th, 2020

Five Stars!

Thank you!

John M.

March 19th, 2024

Amazing customer service, I greatly appreciate their help and understanding. Will always come back to this site for form needs.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Lavonia L.

October 7th, 2024

Found exactly what I was looking for and it helped tremendously.

Thank you for your feedback. We really appreciate it. Have a great day!

Carnell G.

September 26th, 2020

The basic setup was fine but, I need to review the document in its entirety for accuracy which I have yet to do so. So far so good. The monthly fee is more than I need for right now.

Thank you!

Joyce H.

August 11th, 2020

I found the site very easy to use and upfront about the cost. I had tried two other sites both of which had hidden costs until after I filled out the forms.

Thank you for your feedback. We really appreciate it. Have a great day!

John G.

July 25th, 2022

I was actually quite pleased with the ease of use of this site. I really, really liked the step by step instructions and examples of the finished product !!

Thank you!

Rita M.

January 12th, 2019

Forget what I just wrote! I found it. Thank You! This is a very convenient service.

That's great to hear Rita, thanks for following up.

Terrence L.

April 29th, 2020

Awesome service! 4 services wouldn't handle a 1-time filing, but Deeds.com got the job done in less than 21 hours, for only $15 (plus filing fees). This saved me days of difficulty and aggravation, esp. during COVID-19 lockdown!

Thank you for your feedback. We really appreciate it. Have a great day!

Alexandra M.

April 28th, 2021

Needed a Limited Power of Attorney form for a real estate transaction in another state. Proper form came up immediately and was fairly easy to complete. I think the sample completed form should have been more completely explained in layman's language instead of legalese (such as person granting permission instead of grantor or something like your name and address and the person who will be signing on your behalf) but since the form was one price no matter how many ways it was printed out, it was fine. I just filled it out several ways and had it notarized and sent it to my sister. Whichever combination is appropriate she and the lawyer will have. I found the site easy to navigate

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

ruth l.

January 6th, 2021

I found this sight very helpful. All the information that one needs to file a quit claim deed. thank you so much.

Thank you!