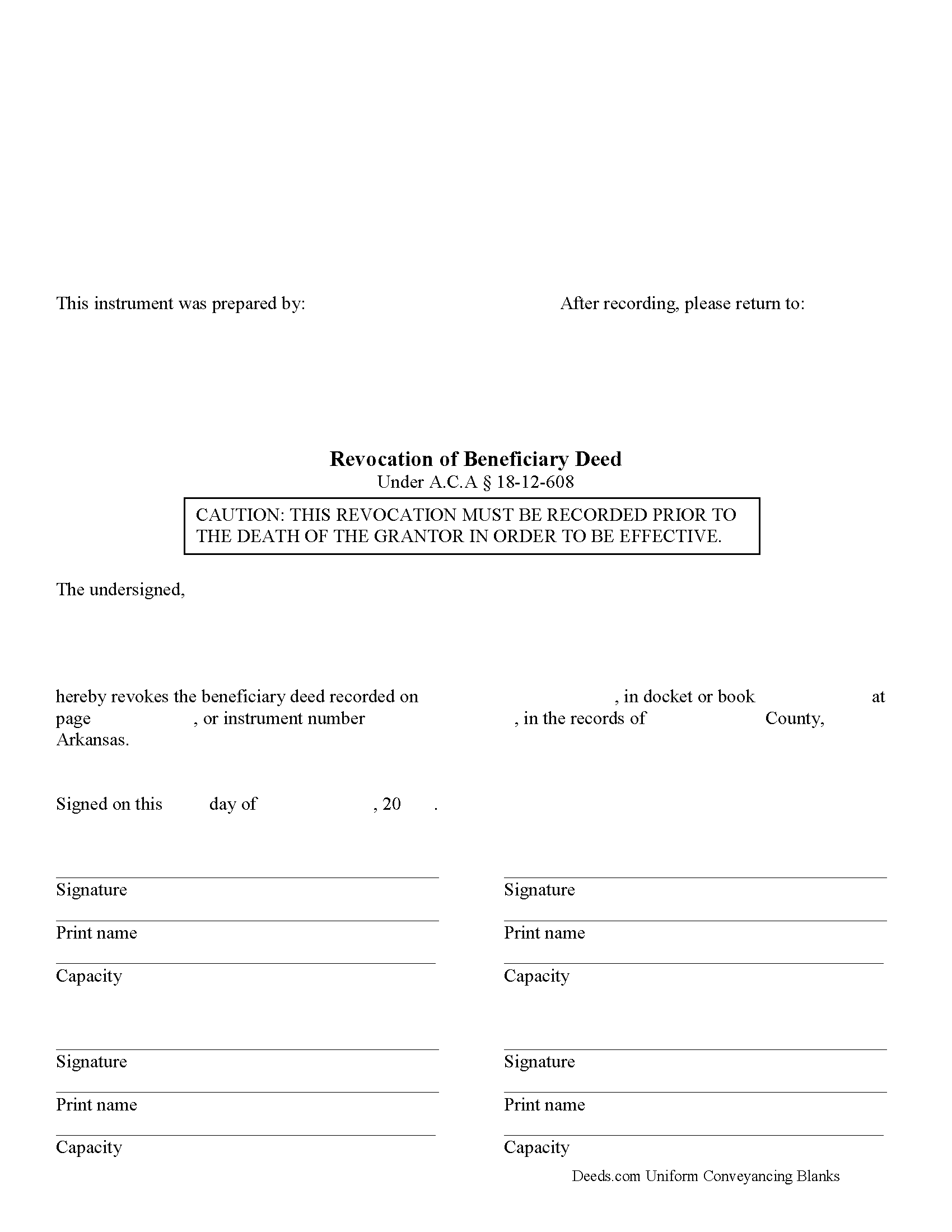

Woodruff County Beneficiary Deed Revocation Form

Woodruff County Beneficiary Deed Revocation Form

Fill in the blank form formatted to comply with all recording and content requirements.

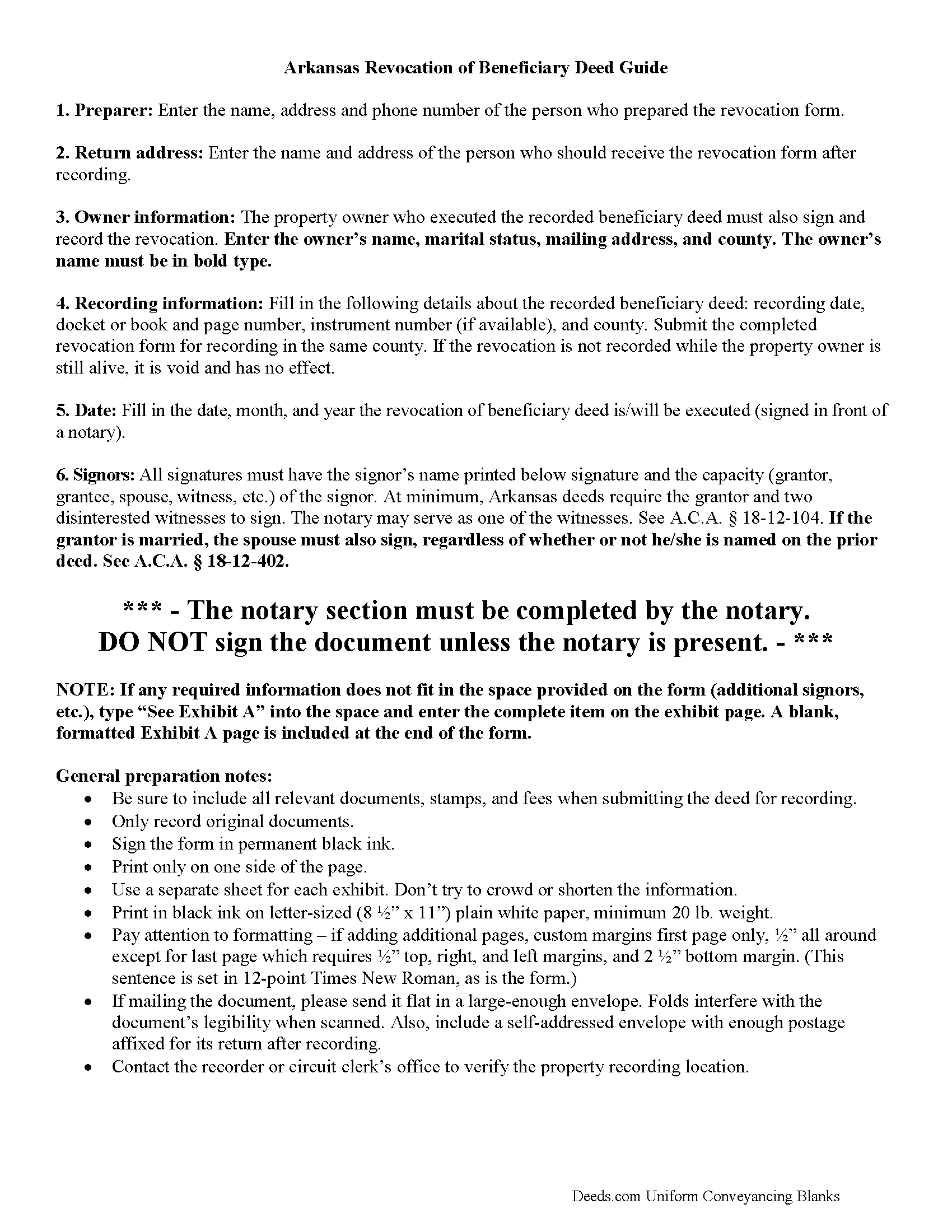

Woodruff County Beneficiary Deed Revocation Guide

Line by line guide explaining every blank on the form.

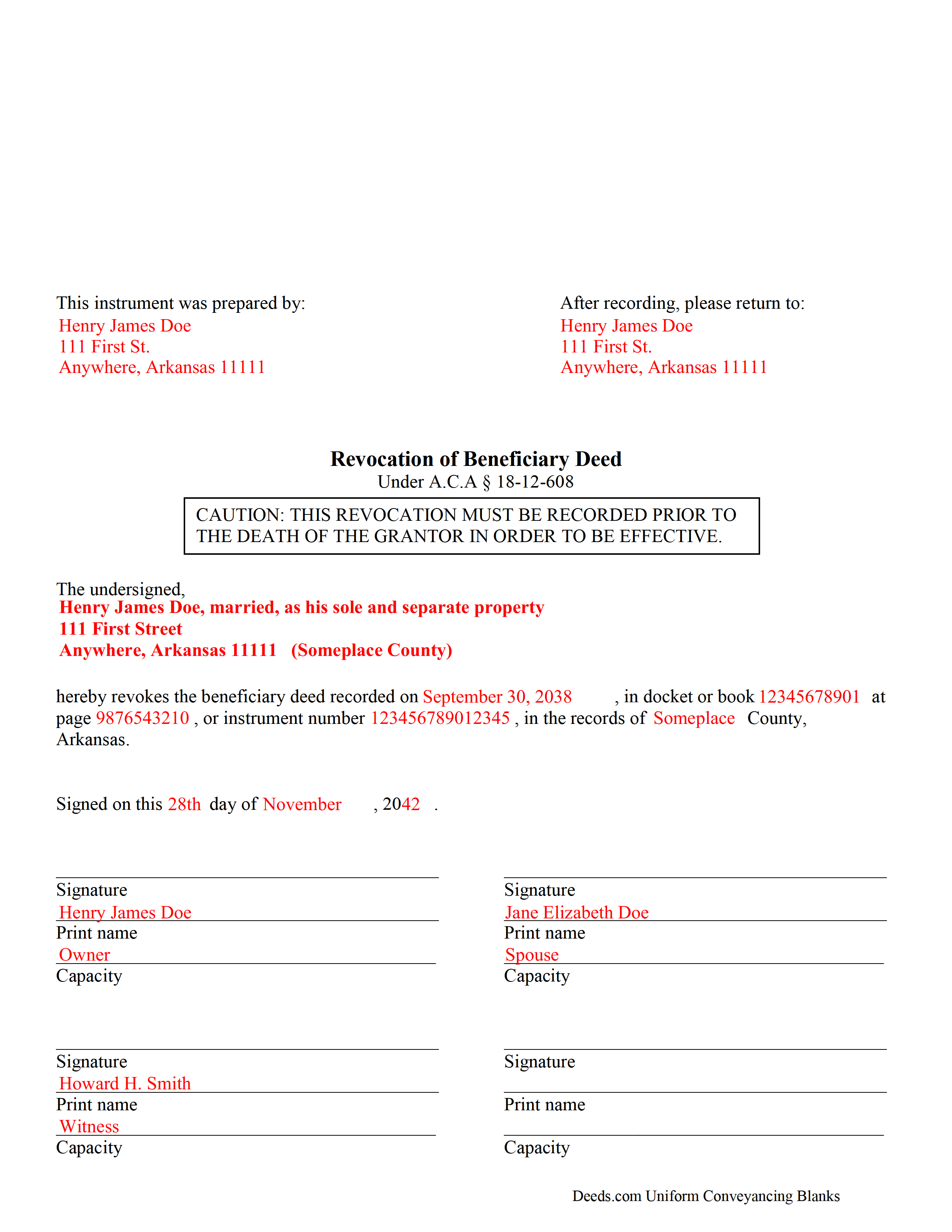

Woodruff County Completed Example of the Beneficiary Deed Revocation Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Arkansas and Woodruff County documents included at no extra charge:

Where to Record Your Documents

Woodruff County Circuit Clerk

Augusta, Arkansas 72006

Hours: 8:30 to 4:30 M-F

Phone: (870) 347-2391

Recording Tips for Woodruff County:

- Verify all names are spelled correctly before recording

- Check margin requirements - usually 1-2 inches at top

- Bring extra funds - fees can vary by document type and page count

- If mailing documents, use certified mail with return receipt

Cities and Jurisdictions in Woodruff County

Properties in any of these areas use Woodruff County forms:

- Augusta

- Cotton Plant

- Gregory

- Hunter

- Mc Crory

- Patterson

Hours, fees, requirements, and more for Woodruff County

How do I get my forms?

Forms are available for immediate download after payment. The Woodruff County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Woodruff County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Woodruff County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Woodruff County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Woodruff County?

Recording fees in Woodruff County vary. Contact the recorder's office at (870) 347-2391 for current fees.

Questions answered? Let's get started!

Revoking a Beneficiary Deed in Arkansas

Beneficiary deeds in Arkansas are governed by A.S.A. 18-12-608. This statute also includes information about revoking an executed and recorded beneficiary deed.

Section 18-12-608 (d)(1) states that a beneficiary deed "may be revoked at any time by the owner or, if there is more than one (1) owner, by any of the owners who executed the beneficiary deed." Why is this flexibility important? Well, life is uncertain and circumstances change. The original beneficiary may no longer be an appropriate recipient of the real property. Perhaps the beneficiary knows about the transfer, but is unable or unwilling to accept it. Instead of disclaiming the gift when the owner dies, thus forcing the property back into the estate for probate, the owner has the option to revoke the beneficiary deed and designate someone else to receive it.

Regardless of the reason, to revoke a beneficiary deed, the owner must execute a document setting forth the revocation and then record it, DURING HIS/HER LIFE, in the county where the property is situated. This should be the same county where the beneficiary deed was recorded earlier.

The owner may also simply sell the property outright, thereby extinguishing any remaining interest in it and leaving nothing to transfer at death. Or, he/she may execute and record another beneficiary deed, naming someone else to receive the real estate. This method is effective because "the recorded beneficiary deed that is last signed before the owner's death is the effective beneficiary deed, regardless of the sequence of recording." ( 18-12-608(e))

Even though there are several options available to revoke or change a recorded beneficiary deed, recording a revocation is the most efficient way to ensure the owner's wishes are carried out. A revocation discontinues the potential future interest described in the beneficiary deed, which then frees the real estate for whatever the owner wishes to do with it next. This is also important because it helps maintain a clear chain of title, which will make later sales or mortgages of the property less complicated.

Note: as with beneficiary deeds, any changes or revocations must be executed and recorded while the owner is alive.

(Arkansas Beneficiary Revocation Package includes form, guidelines, and completed example)

Important: Your property must be located in Woodruff County to use these forms. Documents should be recorded at the office below.

This Beneficiary Deed Revocation meets all recording requirements specific to Woodruff County.

Our Promise

The documents you receive here will meet, or exceed, the Woodruff County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Woodruff County Beneficiary Deed Revocation form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4587 Reviews )

Donald C.

February 22nd, 2019

No review provided.

Thank you!

Roger A.

November 2nd, 2023

Easy peasy to use! It's great to have the guide for completing the form and an example of a completed form.

It was a pleasure serving you. Thank you for the positive feedback!

Laverne C.

September 2nd, 2020

Great service. The issue I had was uploading the file of several pages. Once I learned, everything became clear and easier. The support group have been extremely prompt and helpful, I would surely use the service again and recommend the serivce.

Thank you!

Cynthia D.

May 22nd, 2021

It turned out I didn't need the information was taken care of by my husband. Thank you.

Thank you!

Irma D.

June 14th, 2021

Very impressed with the Service in Miami-Dade County. THank you

Thank you!

Ariel S.

June 3rd, 2020

Awesome....love the ease of use and response.

Thank you for the kinds words Ariel, we appreciate you! Have a fantastic day!

VICTOR S.

November 16th, 2019

Wow! Nice and easy!

Thank you!

Koko H.

July 12th, 2019

Five star. Prompt and easy way to obtain information. Good value.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jo Ann M.

August 18th, 2022

Easy from the download to just fill out and print. Good instructions to follow. A cover letter form would be a extra plus

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Yvette B.

August 10th, 2021

Efficient

Thank you!

WILLIAM H.

April 17th, 2021

i also need a "NOTE" and this trust deed is not exactly what i wanted. it may work but not to well.

Thank you for your feedback. We really appreciate it. Have a great day!

Lorrisa L.

December 28th, 2018

No review provided.

Thank you for your rating. Have a great day!

Viola G.

July 7th, 2022

Some of the forms I ordered didn't have enough space for all of the information, but were useful as a guide for creating what I needed. Now I'll be trying the e-recording to see how that goes.

Thank you!

Tracey P.

December 24th, 2021

As always, amazing forms and information. A must have for anyone doing it themselves. Everything is available to make it happen but if you need a lot of hand holding you might want to look into a more full service option.

Thank you for your feedback. We really appreciate it. Have a great day!

Pauline C.

June 29th, 2025

Everything that was stated to be included in my order was complete. Very satisfied

Thank you for your positive words! We’re thrilled to hear about your experience.