Cleveland County Beneficiary Deed Form

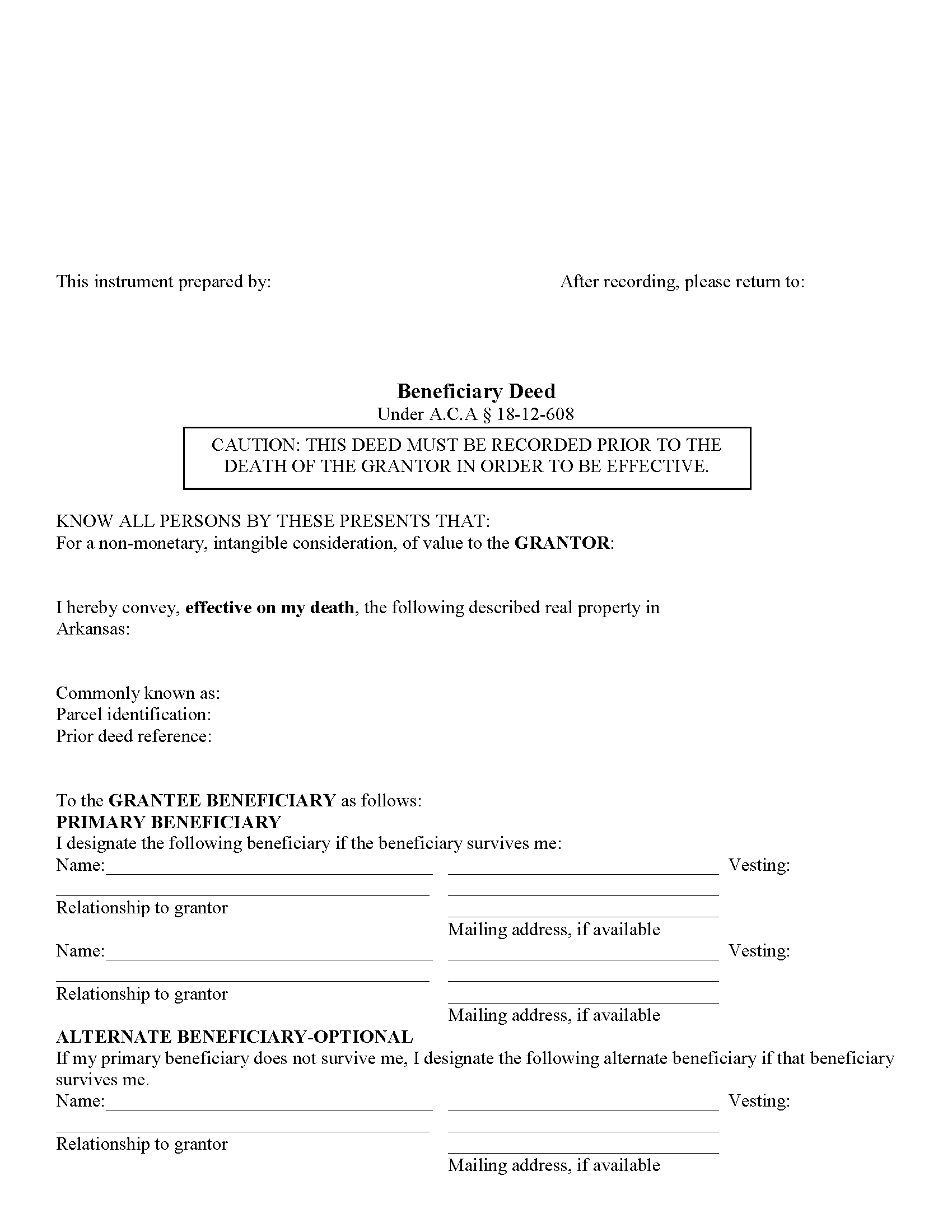

Cleveland County Beneficiary Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

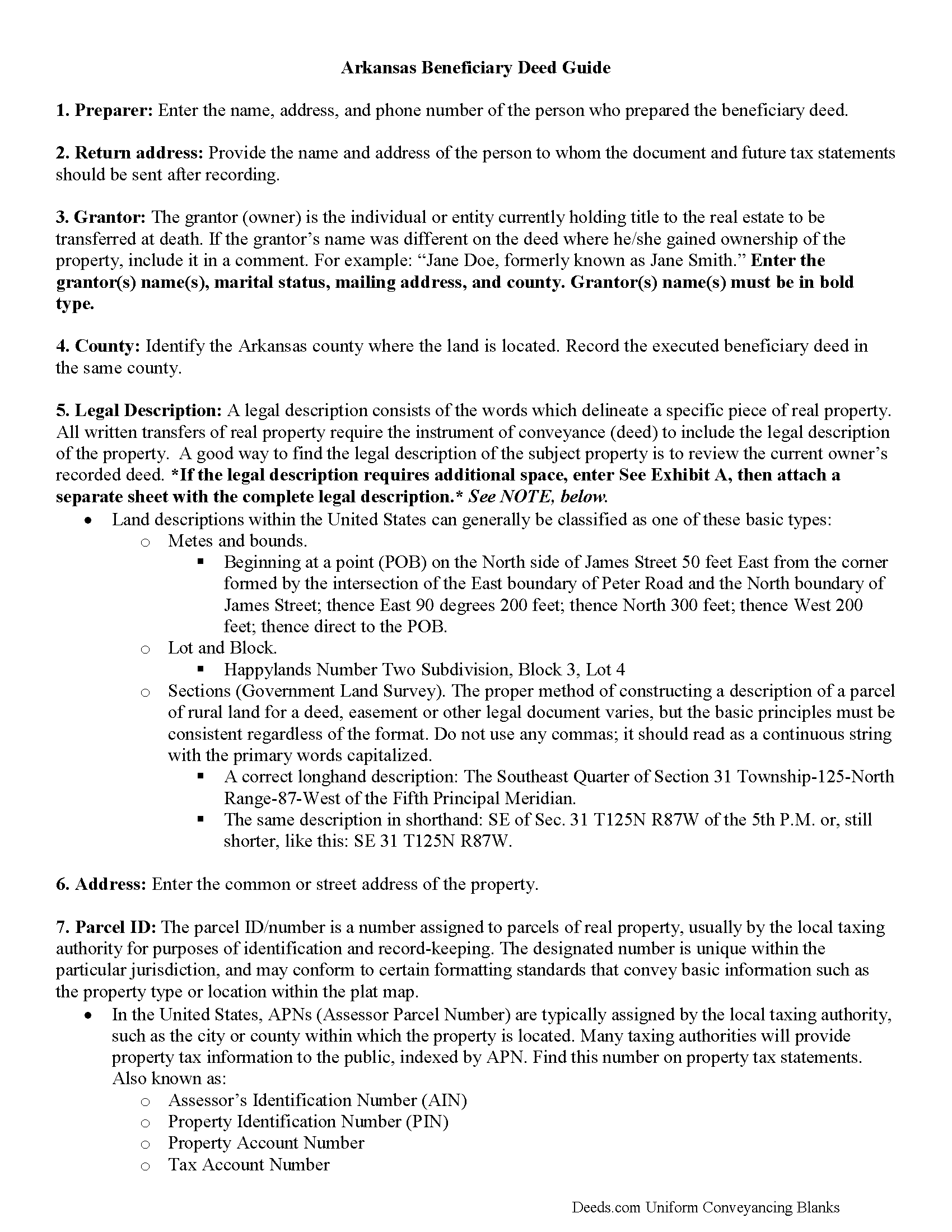

Cleveland County Beneficiary Deed Guide

Line by line guide explaining every blank on the form.

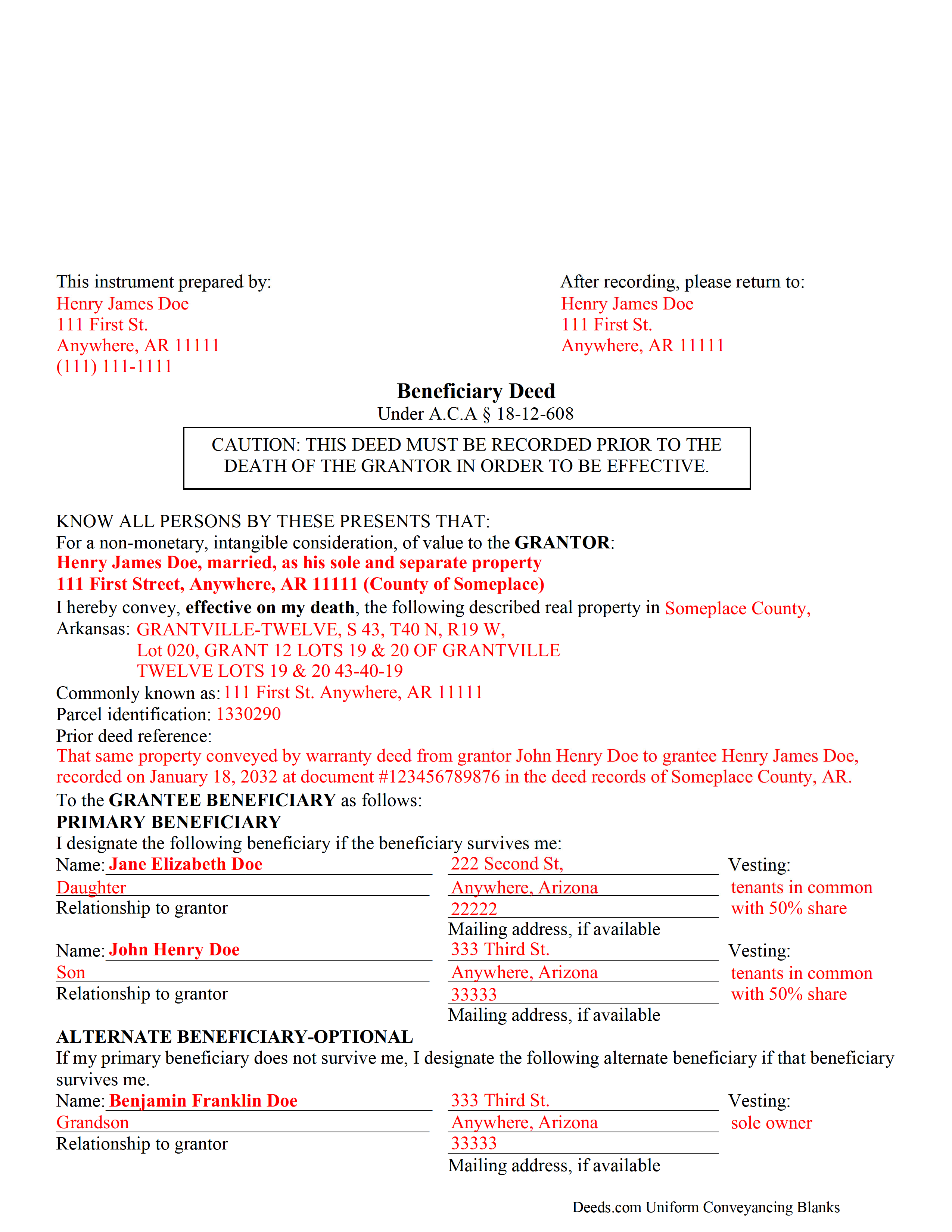

Cleveland County Completed Example of the Beneficiary Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Arkansas and Cleveland County documents included at no extra charge:

Where to Record Your Documents

Cleveland County Circuit Clerk

Rison, Arkansas 71665

Hours: 8:00 to 4:30 M-F

Phone: (870) 325-6521

Recording Tips for Cleveland County:

- Verify all names are spelled correctly before recording

- Avoid the last business day of the month when possible

- Request a receipt showing your recording numbers

- Mornings typically have shorter wait times than afternoons

Cities and Jurisdictions in Cleveland County

Properties in any of these areas use Cleveland County forms:

- Kingsland

- New Edinburg

- Rison

Hours, fees, requirements, and more for Cleveland County

How do I get my forms?

Forms are available for immediate download after payment. The Cleveland County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Cleveland County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Cleveland County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Cleveland County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Cleveland County?

Recording fees in Cleveland County vary. Contact the recorder's office at (870) 325-6521 for current fees.

Questions answered? Let's get started!

Beneficiary deeds in Arkansas are governed by A.S.A. 18-12-608. This statute offers owners of Arkansas real property to designate one or more beneficiaries who may gain the interest that remains in the owner's name at the time of his/her death.

Even though beneficiary deeds, just like other deeds of conveyance, must be lawfully recorded after they are completed and executed (signed in front of a notary), they differ from standard deeds in some important ways. If they are not recorded during the owner's life, they have no effect. Beneficiary deeds do not transfer any present interest in the real estate, so there is no requirement for consideration.

Perhaps one of their most unique features is the fact that the owner may execute and record new beneficiary deeds that change the beneficiary, the terms of the transfer, or even revoke the whole thing. The owner may even sell the property to someone else, leaving no interest to convey at death. Again, like the beneficiary deeds, to be effective, any changes must be recorded while the owner is alive. This flexibility allows land owners to retain absolute control over and use of the property.

When the owner dies, the beneficiary gains the title to the real estate described in the beneficiary deed. Any mortgages, liens, or obligations attached to the land at the time of the owner's death become the beneficiary's responsibility. In addition, if the owner received benefits from state or federal agencies, they might file reimbursement claims against the estate or the beneficiary.

Ultimately, beneficiary deeds can be a useful part of an overall estate plan. Still, executing one may impact the owner's eligibility for asset-based programs. Carefully consider the benefits and drawbacks to this type of conveyance to ensure that it supports the owner's overall intentions. Because each situation is unique, consult an attorney with specific questions.

(Arkansas Beneficiary Deed Package includes form, guidelines, and completed example) For use in Arkansas only.

Important: Your property must be located in Cleveland County to use these forms. Documents should be recorded at the office below.

This Beneficiary Deed meets all recording requirements specific to Cleveland County.

Our Promise

The documents you receive here will meet, or exceed, the Cleveland County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Cleveland County Beneficiary Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Burr A.

November 7th, 2020

So far so good. Prompt and responsive. Thank you.

Thank you!

Khadija K.

March 2nd, 2023

Great Service. Not only the required form, but also the state guidelines. Thank you for making it easy.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lucinda L.

December 29th, 2021

mostly good; however, you need to update the annual exclusion gift amount from $14,000 to $15,000 (where it has ben for several years), and you need to make your Gift Deed final paragraph be gender neutral like "they" or "he or she" rather than just"he". We women lawyers and our women clients appreciate that.

Thank you for your feedback. We really appreciate it. Have a great day!

Alice L.

October 21st, 2021

County accepted Quit Claim Deed without any issues! Saved money using Deeds.com - thank you!!!!

Thank you for your feedback. We really appreciate it. Have a great day!

Nora P.

January 10th, 2019

I'm typing along and suddenly I can't fit anything more into the page and there's plenty of room. This is my 2nd time using this site. No problem the first time years ago. Now it's an issue, looks like I'll need a typewriter to finish the form. Where do I find a typewriter?!! I can't complete the legal description!

Thanks for your feedback Nora. If you are unable to find a typewriter you can always do as the guide suggests and use the included exhibit page.

Tyler F.

December 14th, 2020

worked great!!!

Awesome, great to hear. Thank you.

Jerry B.

May 14th, 2023

Easy to use and fully comprehensive.

Thank you for your feedback Jerry, we appreciate you.

TRACEY W.

April 18th, 2019

The system is very easy to use. I wasn't able to access what I needed but my fees were refunded without issue.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Shawn S.

August 30th, 2019

Seems to be exactly whst j needed. Great job!

Thank you!

RUTH O.

November 9th, 2019

Got access to the forms immediately after ordering. Lots of helpful information, forms were easy to use. Happy I choose this site.

Thank you Ruth. Have a great day!

Janice W.

October 10th, 2020

So easy to follow the directions and get what you need. Simple Quick and Easy.' I am very pleased with the outcome.

Thank you!

Barbara D.

November 11th, 2021

Very helpful, clear and precise. The example further clarifies exactly what is needed to be included in information.

Thank you!

John K.

June 21st, 2023

Very pleased. Responsive staff and fast recordation.

Thank you for the kind words John. Our staff appreciates you and your feedback. Have an amazing day!

Helen H.

August 31st, 2022

I had a notary to read over my quitclaim deed and she said it looked good. So I am pleased.

Thank you!

Kimberly M.

May 20th, 2019

Great service once again from Deeds.com. I will be using them again in the future.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!