Saint Francis County Satisfaction of Deed of Trust Form

Saint Francis County Satisfaction of Deed of Trust Form

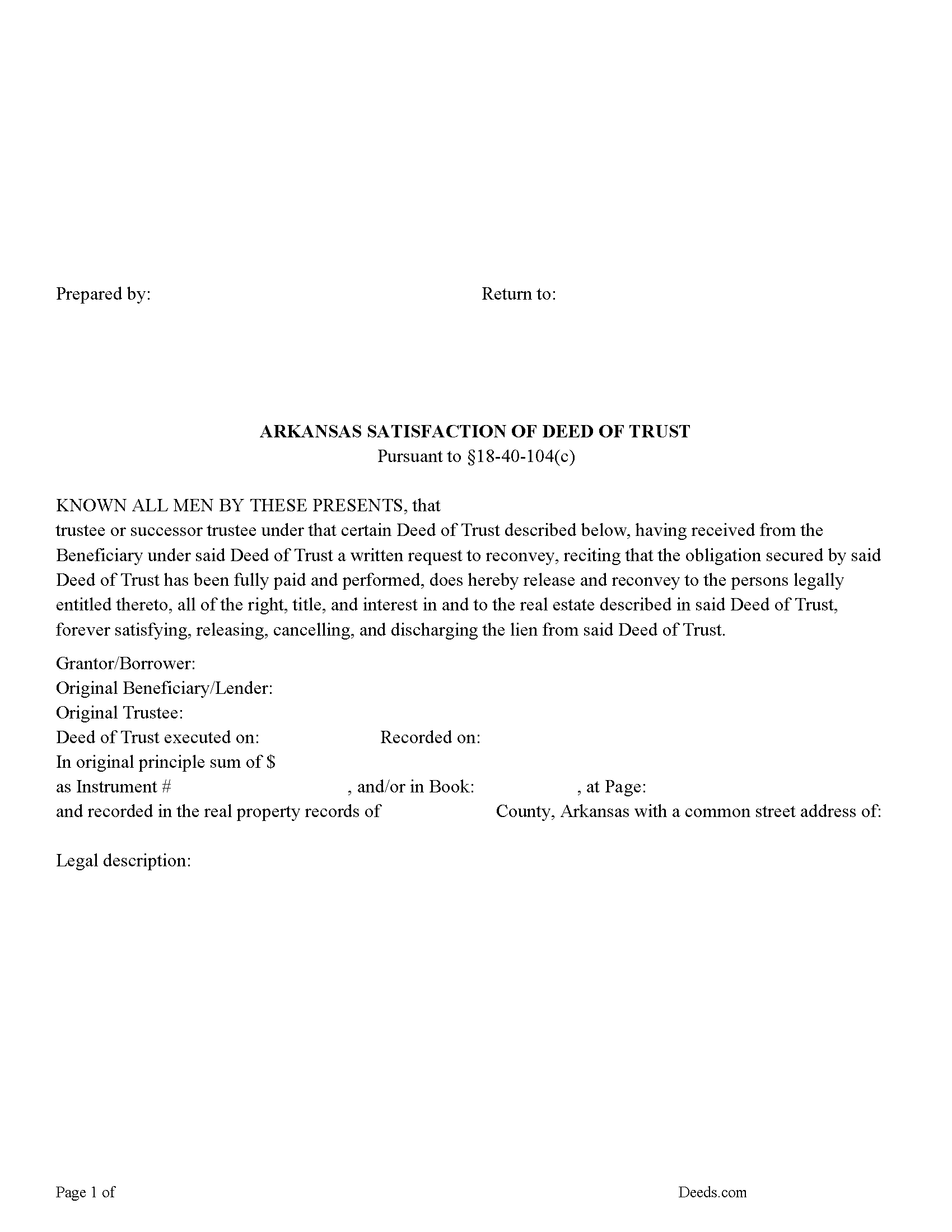

Fill in the blank form formatted to comply with all recording and content requirements.

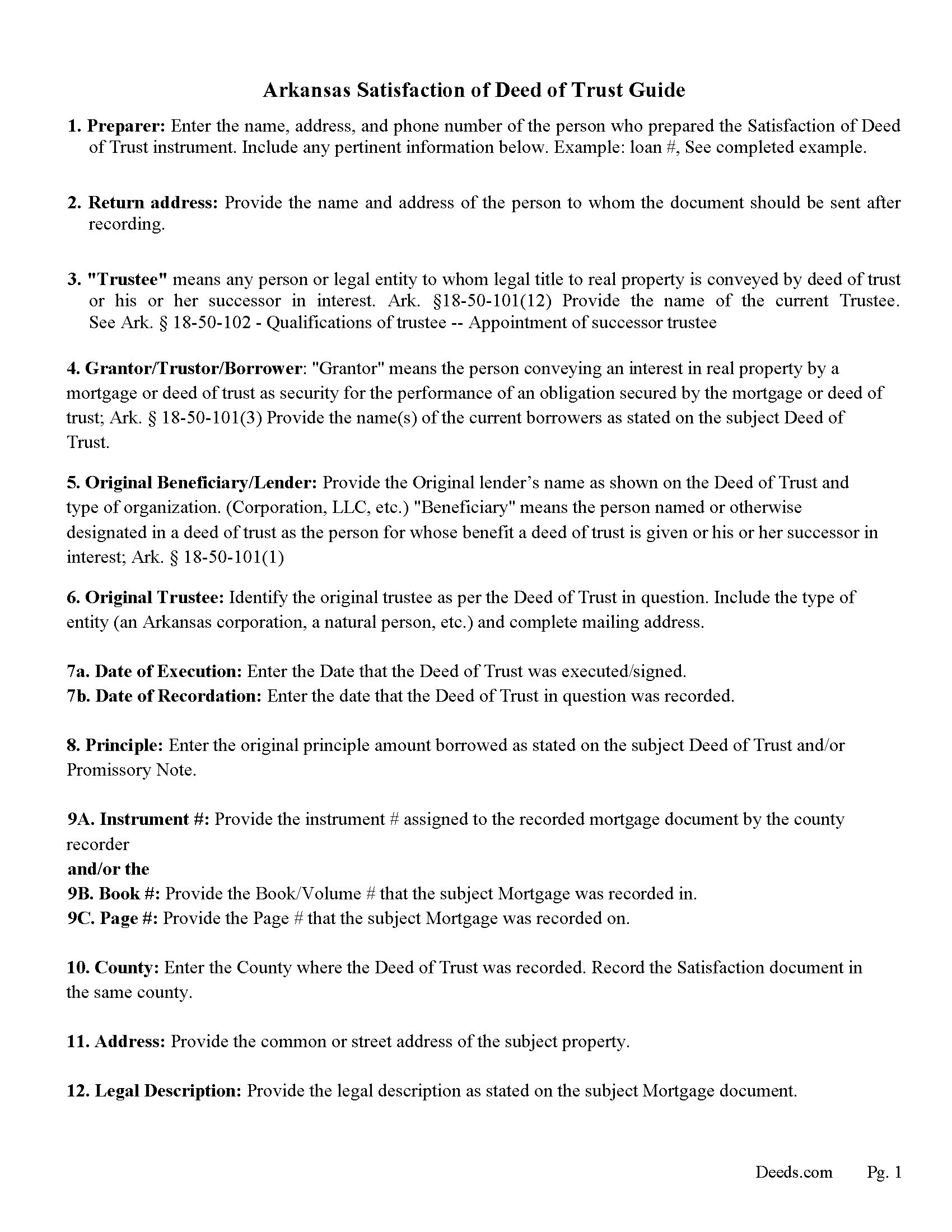

Saint Francis County Satisfaction of Deed of Trust Guidelines

Line by line guide explaining every blank on the form.

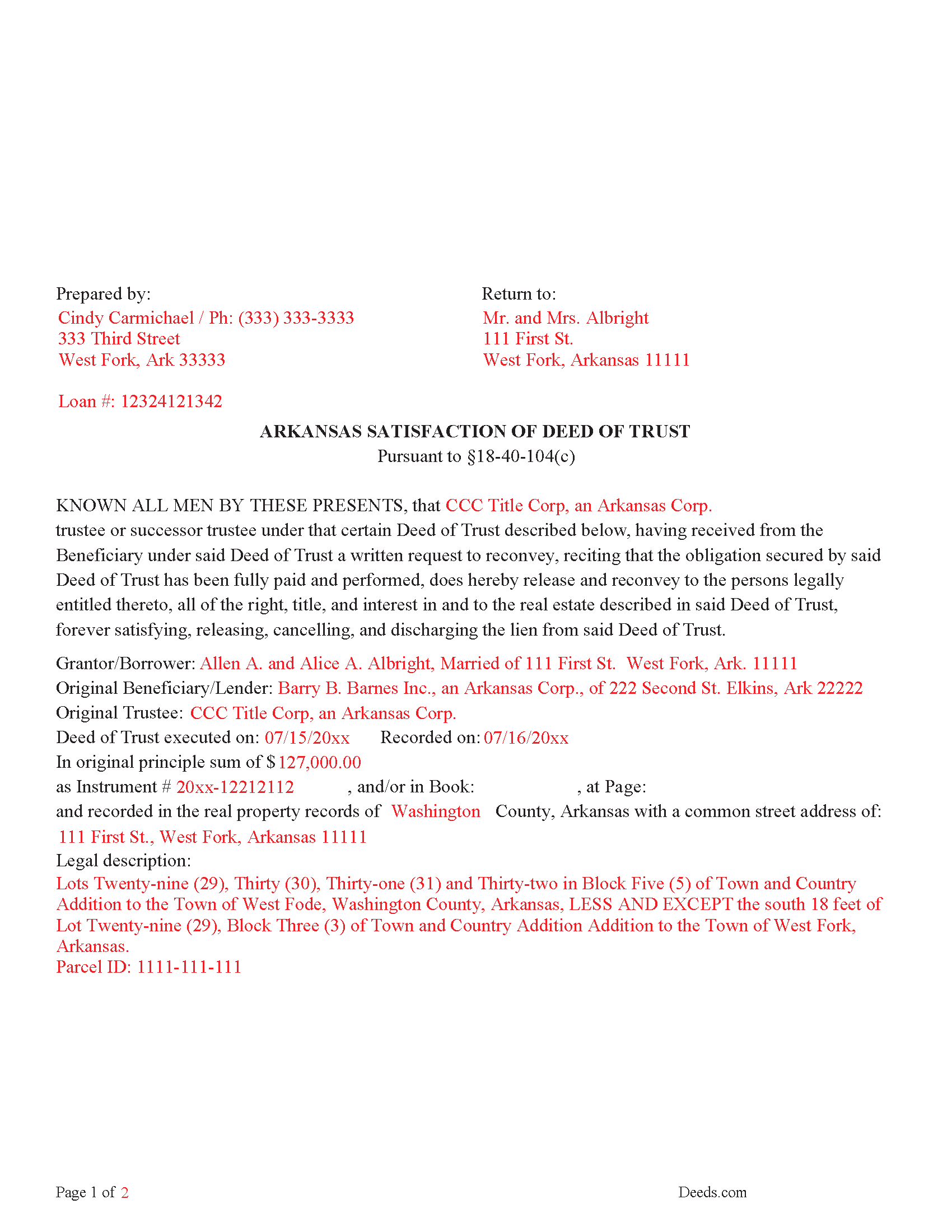

Saint Francis County Completed Example of the Satisfaction of Deed of Trust Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Arkansas and Saint Francis County documents included at no extra charge:

Where to Record Your Documents

St. Francis County Circuit Clerk

Forrest City, Arkansas 72335

Hours: 8:00 to 4:30 M-F

Phone: (870) 261-1715

Recording Tips for Saint Francis County:

- Verify all names are spelled correctly before recording

- Recorded documents become public record - avoid including SSNs

- Request a receipt showing your recording numbers

Cities and Jurisdictions in Saint Francis County

Properties in any of these areas use Saint Francis County forms:

- Caldwell

- Colt

- Forrest City

- Goodwin

- Heth

- Hughes

- Madison

- Palestine

- Wheatley

- Widener

Hours, fees, requirements, and more for Saint Francis County

How do I get my forms?

Forms are available for immediate download after payment. The Saint Francis County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Saint Francis County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Saint Francis County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Saint Francis County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Saint Francis County?

Recording fees in Saint Francis County vary. Contact the recorder's office at (870) 261-1715 for current fees.

Questions answered? Let's get started!

(The trustee of a deed of trust or a person employed by the trustee shall reconvey all or any part of the property encumbered by a deed of trust to the person entitled to the property on written request of the beneficiary of the deed of trust for a reasonable fee plus costs.)(Chapter 40 - Mortgages 18-40-104(c). Acknowledgment of satisfaction on record)

A trustee of a deed of trust shall be any:

(1) Attorney who is an active licensed member of the Bar of the Supreme Court of the State of Arkansas or law firm among whose members includes such an attorney;

(2) Bank or savings and loan association authorized to do business under the laws of Arkansas or those of the United States;

(3) Corporation which is an affiliate of a bank or savings and loan association authorized to do business under the laws of Arkansas or those of the United States, which is either an Arkansas bank or a registered out-of-state bank, as the terms are defined under 23-45-102, which maintains a branch in the State of Arkansas; or

(4) Agency or authority of the State of Arkansas where not otherwise prohibited by law.

(b) (1) The beneficiary may appoint a successor trustee at any time by filing a substitution of trustee for record with the recorder of the county in which the trust property is situated.

(2) The new trustee shall succeed to all the power, duties, authority, and title of the original trustee and any previous successor trustee. 18-50-102(a). Qualifications of trustee -- Appointment of successor trustee.

This form can be used by the Trustee or Successor Trustee, for full satisfaction/reconveyance. the beneficiary generally has sixty (60) days to record a Satisfaction of Deed of Trust once requested.

(If a person receiving satisfaction does not, within sixty (60) days after being requested, acknowledge satisfaction as stated in subsection (a) of this section or request the trustee to reconvey the property as stated in subsection (c) of this section, he or she shall forfeit to the party aggrieved any sum not exceeding the amount of the mortgage money, to be recovered by a civil action in any court of competent jurisdiction.) (Chapter 40 - Mortgages Ark. Statute 18-40-104(d). Acknowledgment of satisfaction on record)

(Arkansas Satisfaction Package includes form, guidelines, and completed example) For use in Arkansas only.

Important: Your property must be located in Saint Francis County to use these forms. Documents should be recorded at the office below.

This Satisfaction of Deed of Trust meets all recording requirements specific to Saint Francis County.

Our Promise

The documents you receive here will meet, or exceed, the Saint Francis County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Saint Francis County Satisfaction of Deed of Trust form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Michaela D.

February 27th, 2019

I purchased this form to add my boyfriend to the deed of our home. He owns his own business so he cannot be on our mortgage. The guide doesn't clearly explain adding a person rather than focusing on transferring during a purchase or selling of a home. For future, I'd recommend make a few different examples for those who are trying to use this for the other options a Quit Claim Deed is needed for.

Thank you for your feedback. We really appreciate it. Have a great day!

David O.

March 19th, 2022

Service was top-notch....fast, accurate, cost-effective.

Thank you!

Michelle N.

April 1st, 2019

Great experience

Thank you Michelle.

Peter K.

September 10th, 2019

Site was very easy to use. Lots of information provided...if the deed gets registered without a problem...you'll get a 10! and if it doesn't...I'll let you know!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Andrea R.

July 10th, 2020

Easy and fast. Thank you so much!!

Thank you!

Deborah G.

July 23rd, 2021

Absolutely wonderful customer service. I am very pleased with the service I received and highly recommend this to everyone.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Maribel P.

July 14th, 2023

Thank you so much for providing simple but very significant documents one can basically do PRO SE, without any additional huge counsel expenses and yet be legitimate enough to officially file them as state law allows and extends to basic documents processing and filings. Thank you so much for the professional documents provided as they do the proper job. MP

Thank you for the kind words Maribel. Glad we were able to help!

Vicky M.

September 1st, 2022

I would give Deeds.com 10 stars if I could!! The staff were super friendly and easy to work with. They kept me constantly updated during the process of uploading and forwarding my deeds for recording. And, the price was extremely reasonable. I look forward to utilizing Deeds.com every time I need to record a deed no matter what U.S. State. I wholeheartedly recommend them!

Thank you for your feedback. We really appreciate it. Have a great day!

Karelia W.

February 14th, 2024

Was a bit skeptical because I'd never heard of it, but just got something submitted and confirmed recorded in less than 24 hrs. UI could use some work but other than that, straightforward and works!

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Kermit S.

October 12th, 2020

Very easy to use.

Thank you for your feedback. We really appreciate it. Have a great day!

Thomas C.

April 12th, 2023

I got the right form but I waited too long to use it and Oregon changed the formatting. I should have checked and made sure the form was still good. Deeds responded quickly.

Thank you!

Linda K.

July 5th, 2019

This service was easy, quick, and to the point. It was a lifesaver! Downloaded quickly and without issues. I was able to fill out a soecifice form for my state and county, which saved me from making errors from a universal form.

Thank you for your feedback. We really appreciate it. Have a great day!

Sue C.

December 1st, 2023

Very helpful. Easy to use. Able to avoid the cost of having an attorney prepare the document I needed.

Your appreciative words mean the world to us. Thank you and we look forward to serving you again!

Jim J.

February 8th, 2019

The forms were easy to use and the fields are tabbed so that you can enter your information and then move quickly to the next entry. The Guide for the documents was very helpful.

Thanks Jim, we appreciate your feedback.

Tonni L.

June 15th, 2021

Quick and easy with great instructions and accurate documents. I plan to make this site a part of our financial planning. Highly recommend. Saved big by this DIY process. TL

Thank you for your feedback. We really appreciate it. Have a great day!