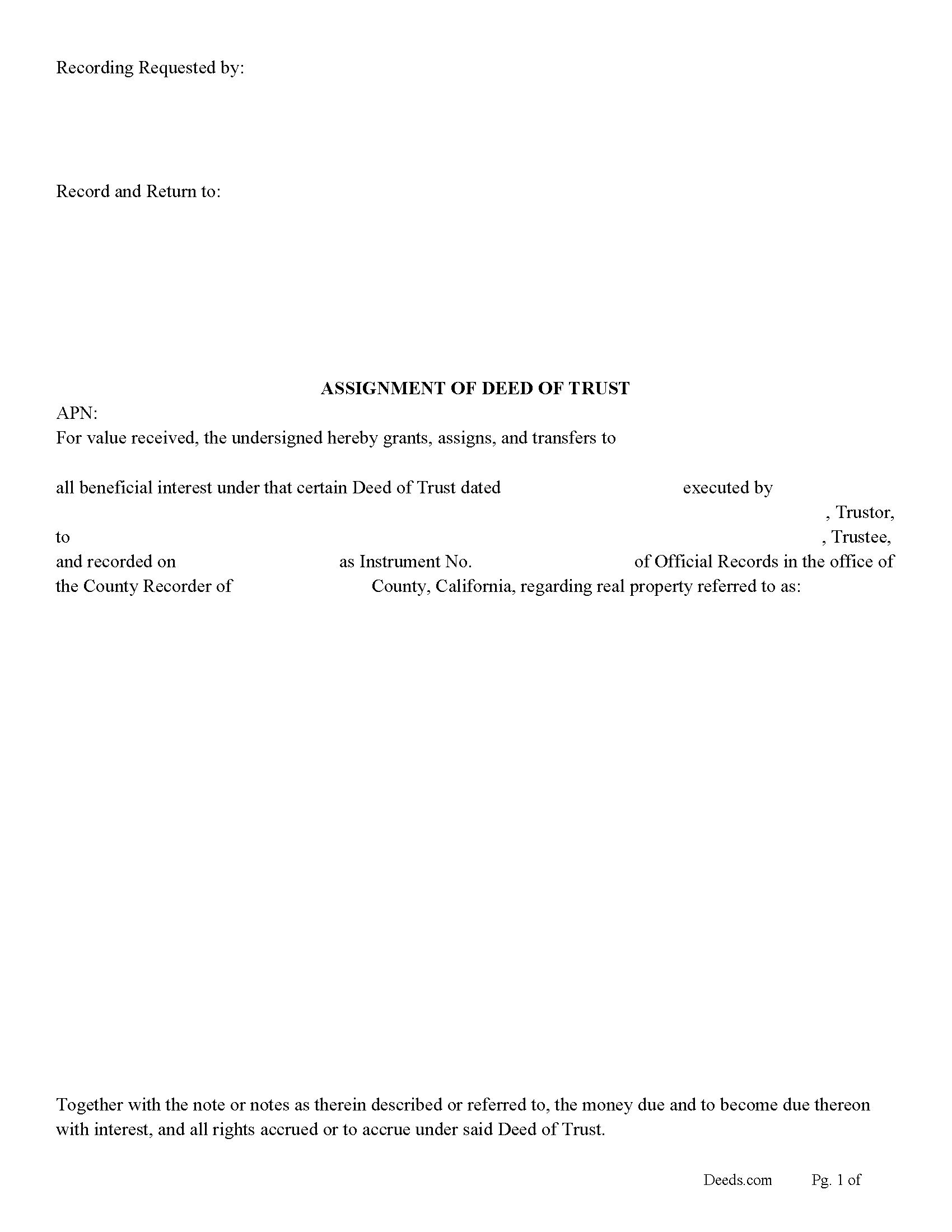

Glenn County Assignment of Deed of Trust Form

Glenn County Assignment of Deed of Trust Form

Fill in the blank form formatted to comply with all recording and content requirements.

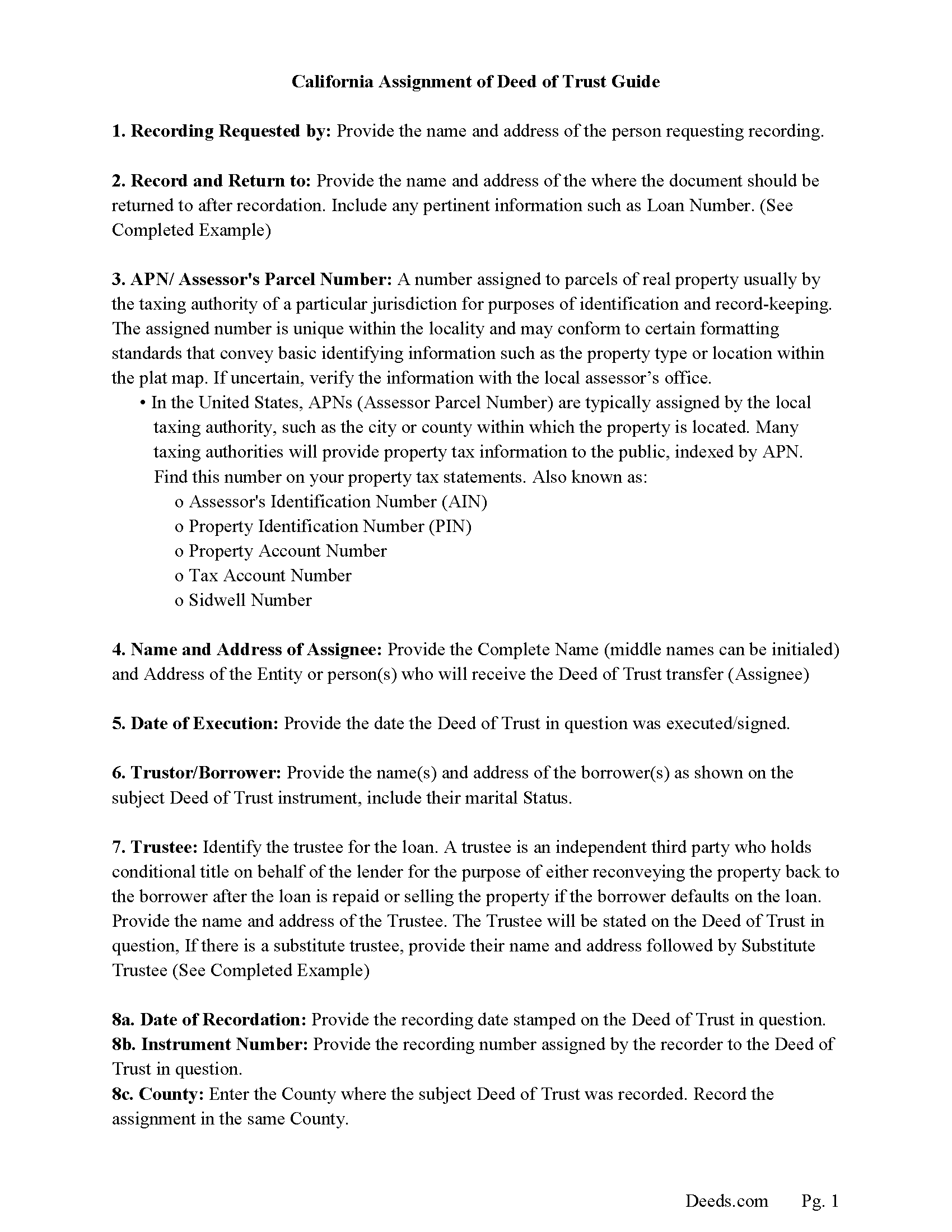

Glenn County Guidelines for Assignment of Deed of Trust

Line by line guide explaining every blank on the form.

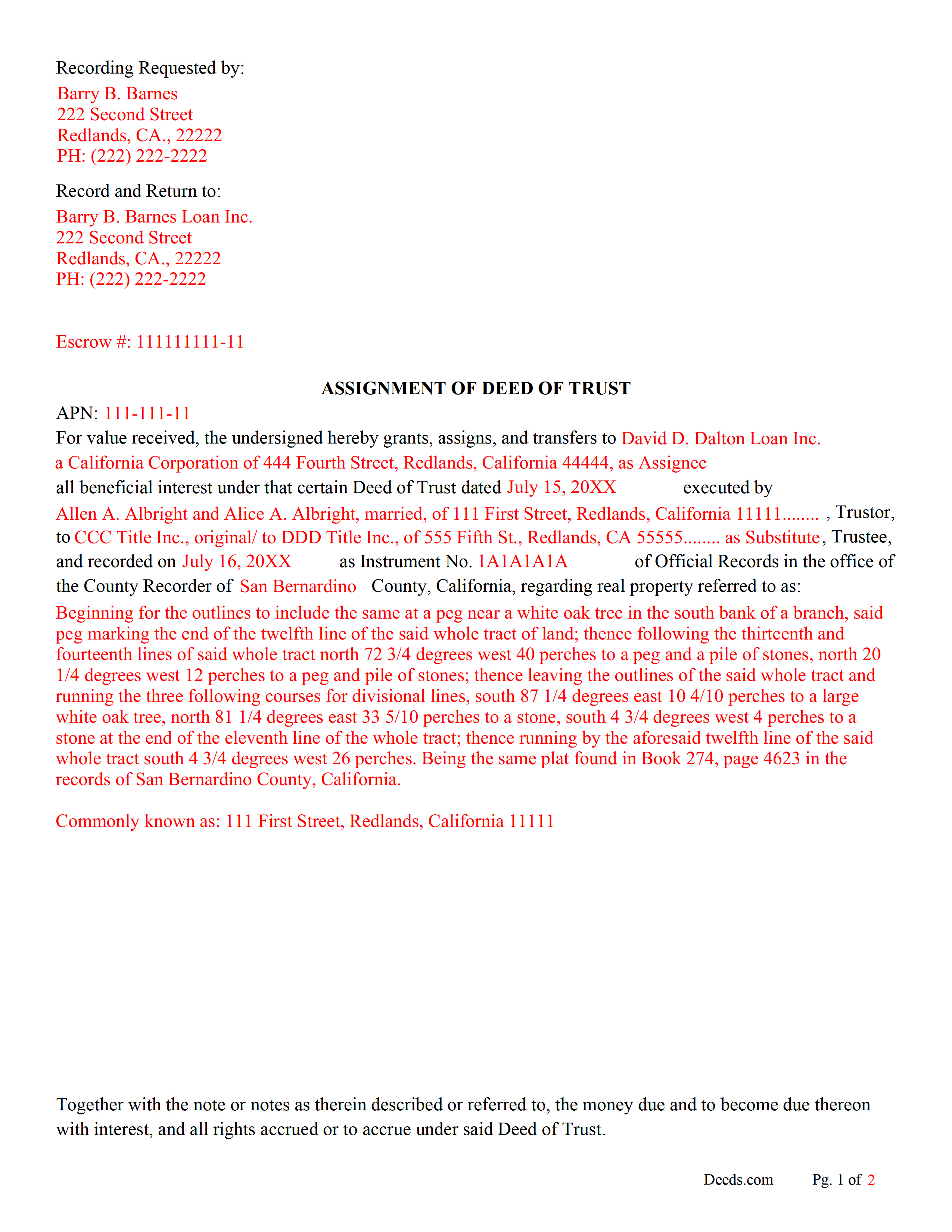

Glenn County Completed Example of the Assignment of Deed of Trust Document

Example of a properly completed form for reference.

Glenn County Notice of Assignment of Deed of Trust Form

Fill in the blank form formatted to comply with content requirements.

Glenn County Notice of Assignment Guidelines

Line by line guide explaining every blank on the form.

Glenn County Completed Example of Notice of Assignment Document

Example of a properly completed form for reference.

All 6 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional California and Glenn County documents included at no extra charge:

Where to Record Your Documents

Glenn County Clerk-Recorder

Willows, California 95988

Hours: 8:00 a.m. to 5:00 p.m. Monday through Friday

Phone: (530) 934-6412

Recording Tips for Glenn County:

- Ensure all signatures are in blue or black ink

- Documents must be on 8.5 x 11 inch white paper

- Ask about their eRecording option for future transactions

- Check margin requirements - usually 1-2 inches at top

Cities and Jurisdictions in Glenn County

Properties in any of these areas use Glenn County forms:

- Artois

- Butte City

- Elk Creek

- Glenn

- Hamilton City

- Orland

- Willows

Hours, fees, requirements, and more for Glenn County

How do I get my forms?

Forms are available for immediate download after payment. The Glenn County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Glenn County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Glenn County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Glenn County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Glenn County?

Recording fees in Glenn County vary. Contact the recorder's office at (530) 934-6412 for current fees.

Questions answered? Let's get started!

The current Lender/Beneficiary uses this form to assign a Deed of Trust to another lender. This is often done when a Deed of Trust has been sold. This allows the new Lender the right to collect payments of the debt. A typical Deed of Trust contains a Power of Sale clause, allowing a non-judicial foreclosure. (The power of sale may be exercised by the assignee if the assignment is duly acknowledged and recorded.) (California Code 2932.5)

Current Borrowers must be notified of the assignment. Notification consists of contact information of the new creditor, recording dates, recording instrument numbers, changes in loan, etc. Included are "Notice of Assignment of Deed of Trust" forms.

The Truth and lending act requires that borrowers be notified when their deed of trust debt has been sold, transferred, or assigned to a new creditor. Generally, within 30 days to avoid up to $2,000.00 in statutory damages, plus reasonable attorney's fees. Systematic violations can reach up $500,000.00.

(California Assignment of Deed of Trust Package includes form, guidelines, and completed example) For use in California only.

Important: Your property must be located in Glenn County to use these forms. Documents should be recorded at the office below.

This Assignment of Deed of Trust meets all recording requirements specific to Glenn County.

Our Promise

The documents you receive here will meet, or exceed, the Glenn County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Glenn County Assignment of Deed of Trust form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4580 Reviews )

Donald W.

December 8th, 2019

Could not have been any easier to download the quit claim forms. The provided instructions and samples look to be helpful. Only have to set aside the time to fill out. Thanks

Thank you!

Charlotte V.

June 13th, 2024

t was a bit confusing at first. I am really old though. It was fairly easy to use. I will continue to use Deeds. com for all my future needs. Thank you Deeds.com for making life so much easier.

We are grateful for your feedback and looking forward to serving you again. Thank you!

tao a.

June 23rd, 2021

excellent. I will this service again.

Thank you!

Mike H.

February 11th, 2021

Great

Thank you!

Joanne H.

February 14th, 2022

easy to download and use. this document. thank you

Thank you!

Jim W.

June 2nd, 2022

ALL I CAN SAY IS WOW. I AM SO GLAD THAT SOMEONE THOUGHT OF THIS OPROCESS FOR NON-TITLE COMPANIES, SMALL COMPANIES, ETC. I REALLY APPRECIATED THE SERVICE WHEN I RECORDED MY FIRST SET OF DOCS HERE. THEY WERE A MESS AND I HAD A LOT OF QUESTIONS. AGAIN THANK YOU!

Thank you for your feedback. We really appreciate it. Have a great day!

Laurie J.

September 10th, 2024

Very satisfied with what I purchased.

Thank you for your positive words! We’re thrilled to hear about your experience.

David K.

March 16th, 2023

Price seemed high (~$28) for just some forms (especially because we may not actually use the forms), but it beats navigating the Hawaii state and Honolulu county websites for forms. It would be better if a single button push would download all 7 or 8 forms.

Thank you for your feedback. We really appreciate it. Have a great day!

Robert S.

January 23rd, 2019

The cost was well worth it. It was very easy to download, fill in the necessary information and then print the deed. I filed my need deed today and everything was complete and accurate because of the example you provided.

Thanks Robert, we appreciate your feedback!

star v.

July 19th, 2019

i have used you guys once and i am happy with the service i will be using you guys again

Thank you for your feedback. We really appreciate it. Have a great day!

SHASTA S.

February 13th, 2020

Ordered quitclaim deed form for Knox county Illinois. It got the job done however it was not a very good format. I had to explain all to the county recorder & was worried she would reject it. I would not recommend this item.

Thank you!

David B.

December 23rd, 2021

I found the information very helpful. Had problems producing a professional looking document due to the limited active fields on the PDF form. Finally I just typed it.

Thank you!

Christina D.

March 31st, 2025

The papers allowed me to get done what I needed. But for the price I would expect a spell check. There were spelling errors when there should not have been any. Please proof read

Your feedback is a crucial part of our dedication to ongoing improvement. Thank you for your insightful comments.

Cecelia C.

December 16th, 2021

Service was fantastic. So helpful and they promptly get back with you. No reason to drive if you are out of state and need to get a deed filed. Safe way to file if you don't want to go to public office or can't physically get there.

Thank you for your feedback. We really appreciate it. Have a great day!

Dorothy R.

August 27th, 2019

Actually, it was user friendly once I figured out where to go to get the forms. Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!