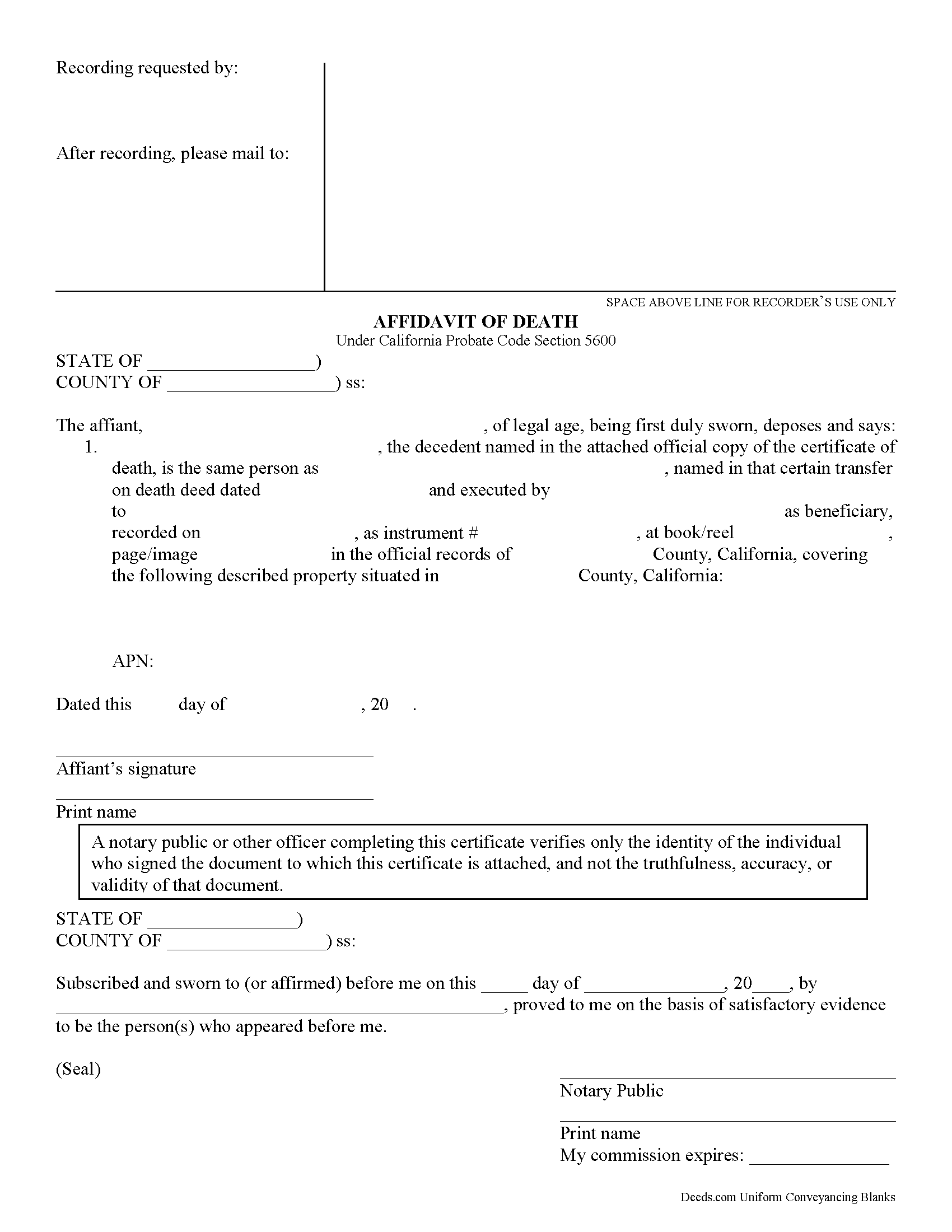

Amador County Transfer on Death Affidavit Form

Amador County Transfer on Death Affidavit Form

Fill in the blank form formatted to comply with all recording and content requirements.

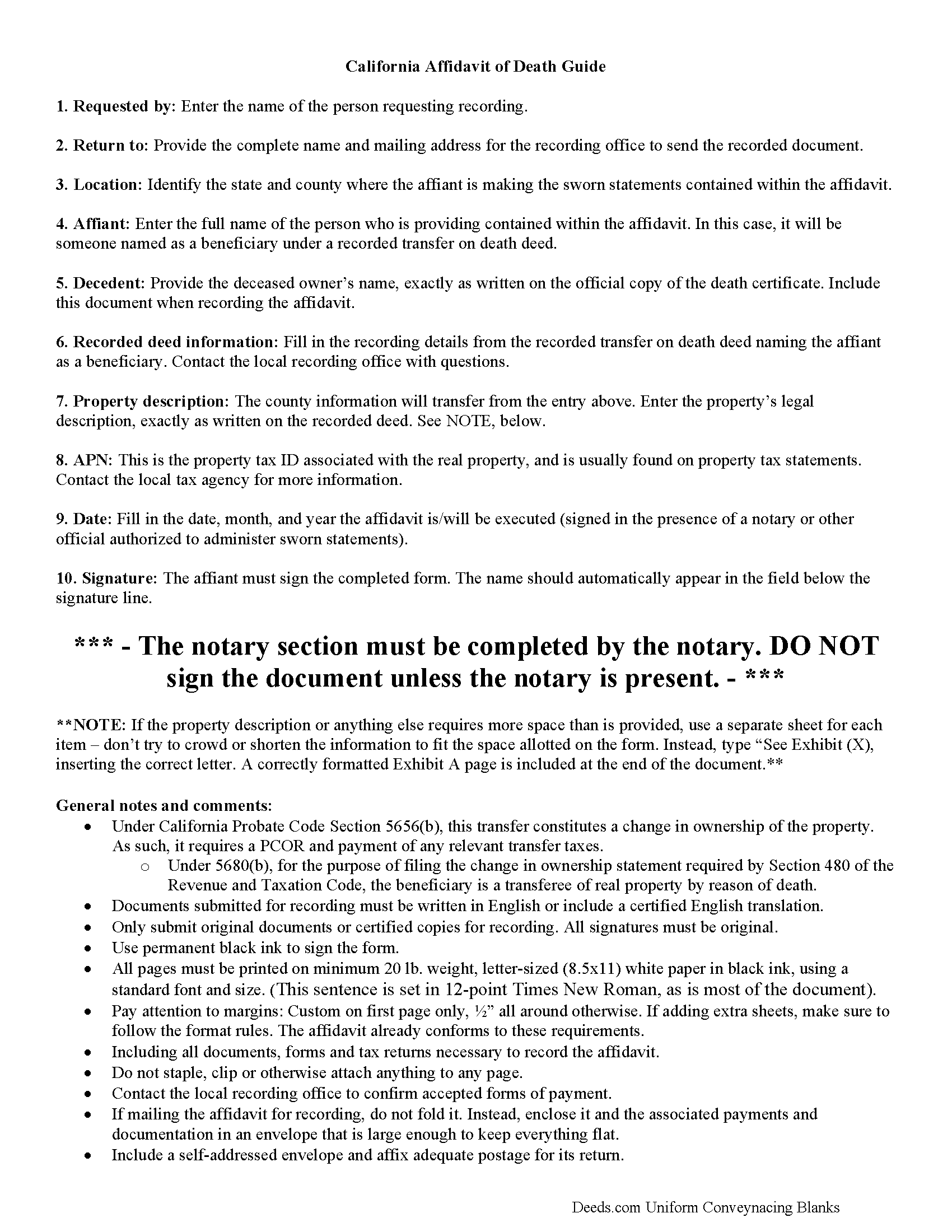

Amador County Transfer on Death Affidavit Guide

Line by line guide explaining every blank on the form.

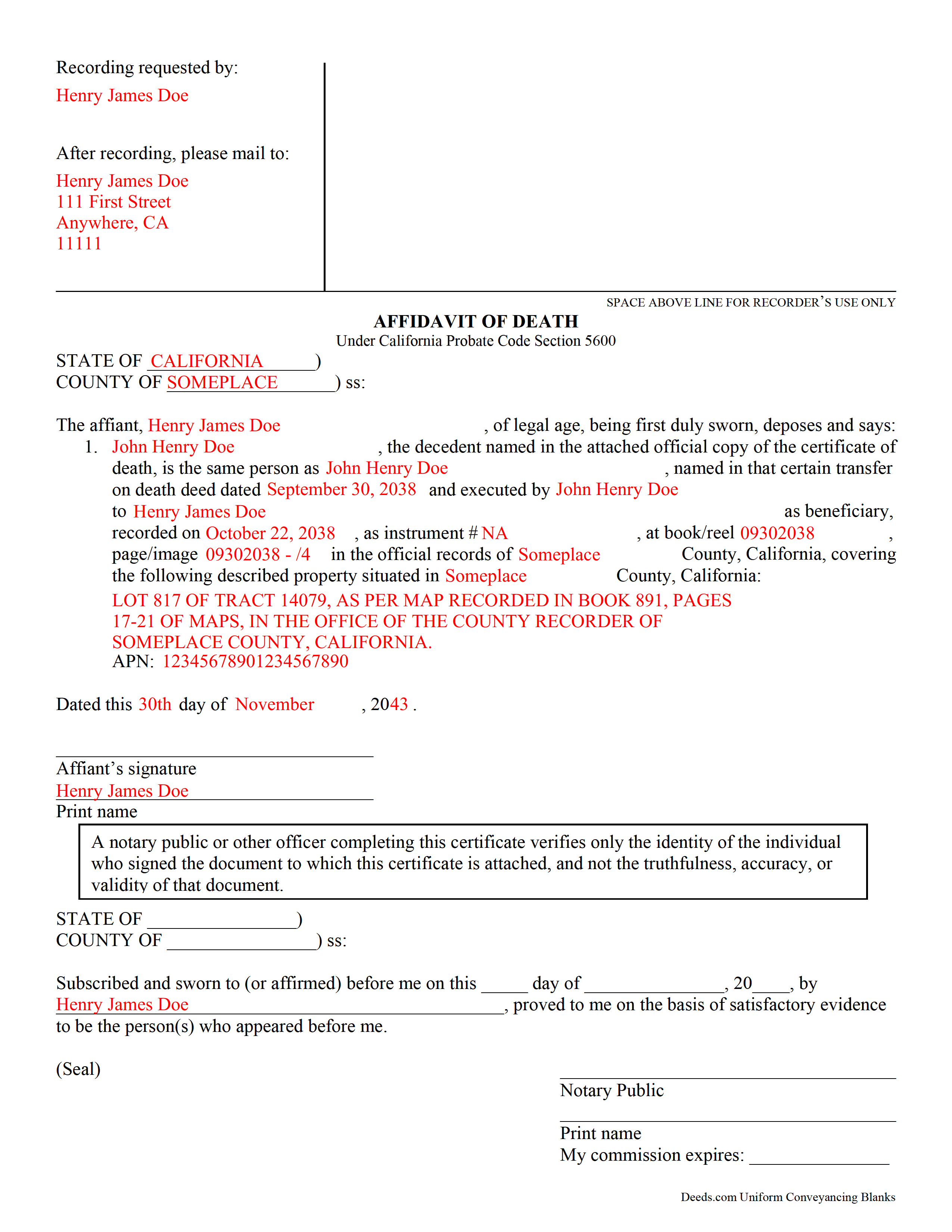

Amador County Completed Example of the Transfer on Death Affidavit Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional California and Amador County documents included at no extra charge:

Where to Record Your Documents

Amador County Recorder/Clerk

Jackson, California 95642

Hours: Mon-Fri 8:00 to 5:00

Phone: (209) 223-6468

Recording Tips for Amador County:

- Check that your notary's commission hasn't expired

- Leave recording info boxes blank - the office fills these

- Recording fees may differ from what's posted online - verify current rates

Cities and Jurisdictions in Amador County

Properties in any of these areas use Amador County forms:

- Amador City

- Drytown

- Fiddletown

- Ione

- Jackson

- Kit Carson

- Martell

- Pine Grove

- Pioneer

- Plymouth

- River Pines

- Sutter Creek

- Volcano

Hours, fees, requirements, and more for Amador County

How do I get my forms?

Forms are available for immediate download after payment. The Amador County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Amador County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Amador County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Amador County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Amador County?

Recording fees in Amador County vary. Contact the recorder's office at (209) 223-6468 for current fees.

Questions answered? Let's get started!

Using an Affidavit of Death to Claim Real Estate from a California Transfer on Death Deed

Transfer on death deeds allow individual landowners to transfer their real estate when they die, without a will or the need for probate distribution. The transferor simply executes a TODD form, then records it during the course of his/her natural life, and within 60 days of the signing date (5626(a)). Unlike grant deeds or quitclaim deeds, the owner continues to hold title to the property when a transfer on death deed is recorded (5650). As such, TODDs are exempt from transfer taxes and the Preliminary Change of Ownership Report (PCOR).

What happens, then, when the owner dies? Section 5680 defines the process for switching the title over to the beneficiary. The beneficiary may establish the fact of the transferor's death under the procedure provided in California Probate Code Chapter 2 (commencing with Section 210) of Part 4 of Division 2. The first step is obtaining a certified copy of the death certificate. Then research the recording information from the transfer on death deed identifying the beneficiary. Complete an affidavit of death and sign it in front of a notary. Finally, file the affidavit, along with the copy of the death certificate, in the recording office for the county where the property is situated. Note that this act transfers title to the beneficiary, so it also requires the PCOR and any associated taxes and fees.

Beneficiaries take title to the property under the rules set out at section 5652. Be aware that any associated debts, obligations, or agreements in place when the owner died follow the real estate to the beneficiaries. In addition, the title transfers without warranty, so the beneficiaries might find themselves liable for future claims against the property. For these reasons, among others, some beneficiaries might wish to disclaim the gift (5652(a)(1)).

In general, transferring title to the beneficiary of a transfer on death deed is a simple process. Even so, complications may arise. Contact an attorney for complex situations or with any questions.

(California Transfer on Death Affidavit Package includes form, guidelines, and completed example)

Important: Your property must be located in Amador County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Affidavit meets all recording requirements specific to Amador County.

Our Promise

The documents you receive here will meet, or exceed, the Amador County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Amador County Transfer on Death Affidavit form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

brian d.

May 26th, 2020

I am a Loan Officer and this website saves me a bunch of time. Love it!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Anita W.

June 18th, 2020

Love this site. It has been truly helpful and easy to navigate.

Thank you Anita, glad we could help.

Marilyn C.

March 16th, 2021

Fillable documents, after a download, would be helpful. Very good to have all these forms online and accessible for an overall fee.

Thank you!

Lowell R.

July 29th, 2020

Awesome. Quick informative and very easy. I made a mistake the first time, emailed you and was able to get it fixed quickly and got it done.

Thank you for your feedback. We really appreciate it. Have a great day!

Gail W.

September 19th, 2019

Deeds.com had the forms I needed, along with completed examples. Fast download. Easy to use site. Thanks!

Thank you!

Kristen N.

October 3rd, 2023

Very easy to use, helpful instructions and examples. I also like the chat feature and the erecording. So much better than other DIY law websites out there.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Carol W.

September 6th, 2020

The guide and example provided made it so easy to complete the form. All was in order when I took it to the Register of Deeds. No hassles at all! Thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

Jonnie G.

November 15th, 2019

I very much dreaded this whole endeavor but very pleasantly surprised. So far, so good. I feel much more confidant that the crucial form, when presented, will play well with the county.......

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Anthony F.

April 7th, 2020

quick, easy and simple. Also thank you for having the e-submission area particularly with the Covid-19 /Shelter in place things happening.

Thank you for your feedback. We really appreciate it. Have a great day!

Mitchell S.

April 25th, 2024

This service was very helpful, quick, inexpensive and easy to use. Should I ever need it again, I know right where to go.

We are sincerely grateful for your feedback and are committed to providing the highest quality service. Thank you for your trust in us.

Estelle R.

May 25th, 2022

Easy to download. Hopefully easy to fill in. Just wish there was wording for a Beneficiary Deed for moving real estate property owned by a married couple to their Trust upon death of last Trustee.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jerome R.

July 22nd, 2021

great service clean and accurate

Thank you for your feedback. We really appreciate it. Have a great day!

FLORIN D.

December 3rd, 2020

Excellent service, will use in the future and will recommend to anyone that needs to record documents.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Michael K.

April 2nd, 2021

I haven't used them yet. So far so good.

Thank you!

Rocio G.

December 8th, 2020

Better than in person service, I recommend this service 100%.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!