El Dorado County Transfer on Death Affidavit Form (California)

All El Dorado County specific forms and documents listed below are included in your immediate download package:

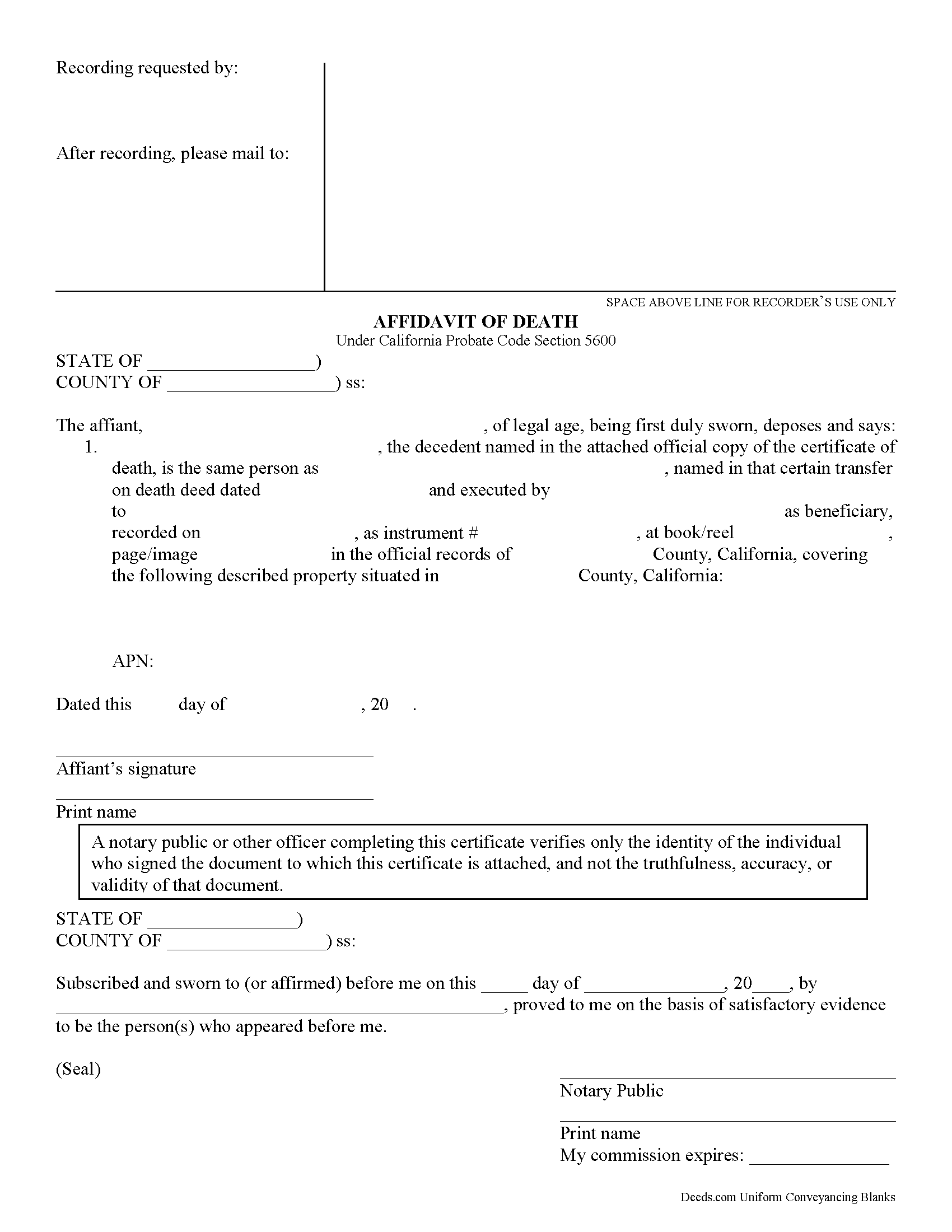

Transfer on Death Affidavit Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included El Dorado County compliant document last validated/updated 6/11/2025

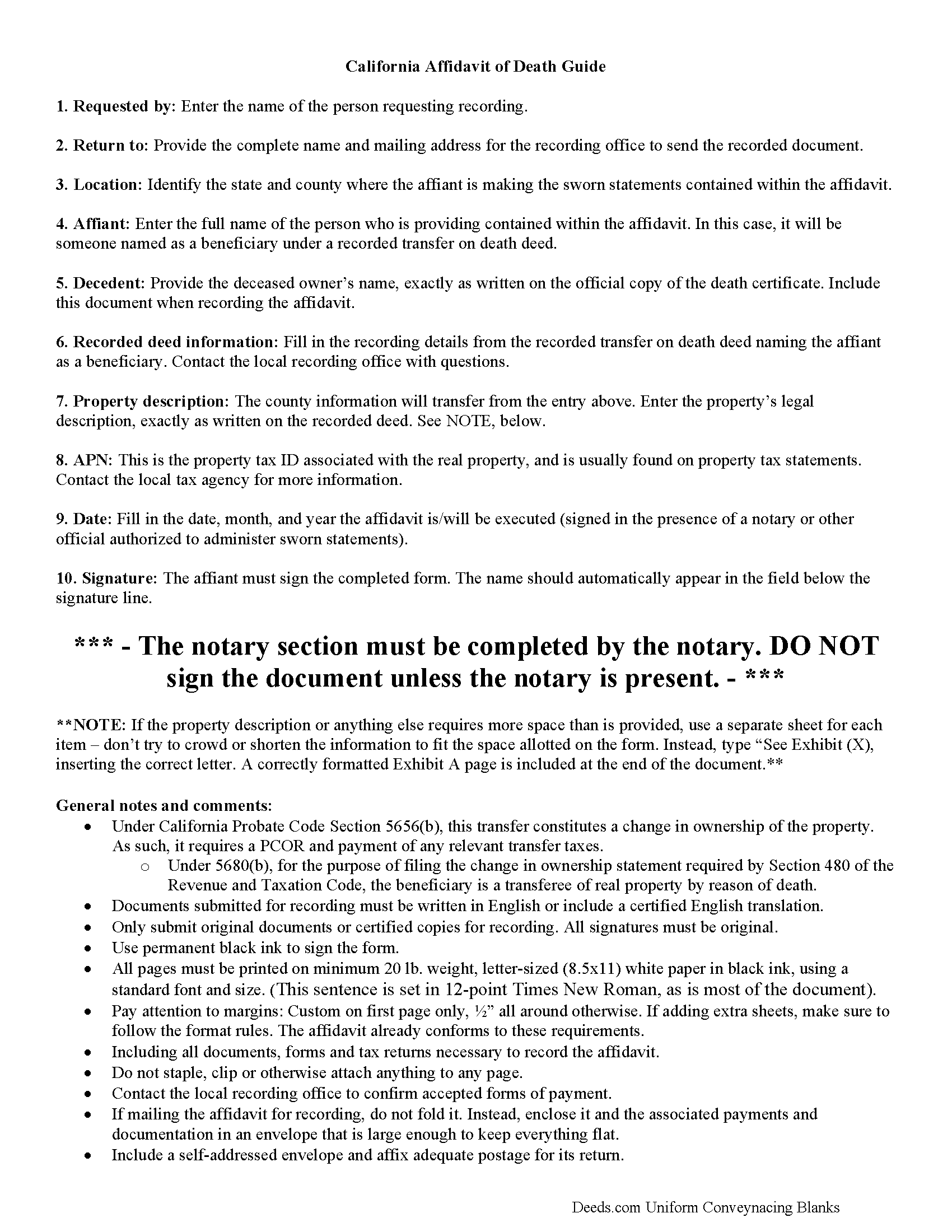

Transfer on Death Affidavit Guide

Line by line guide explaining every blank on the form.

Included El Dorado County compliant document last validated/updated 1/29/2025

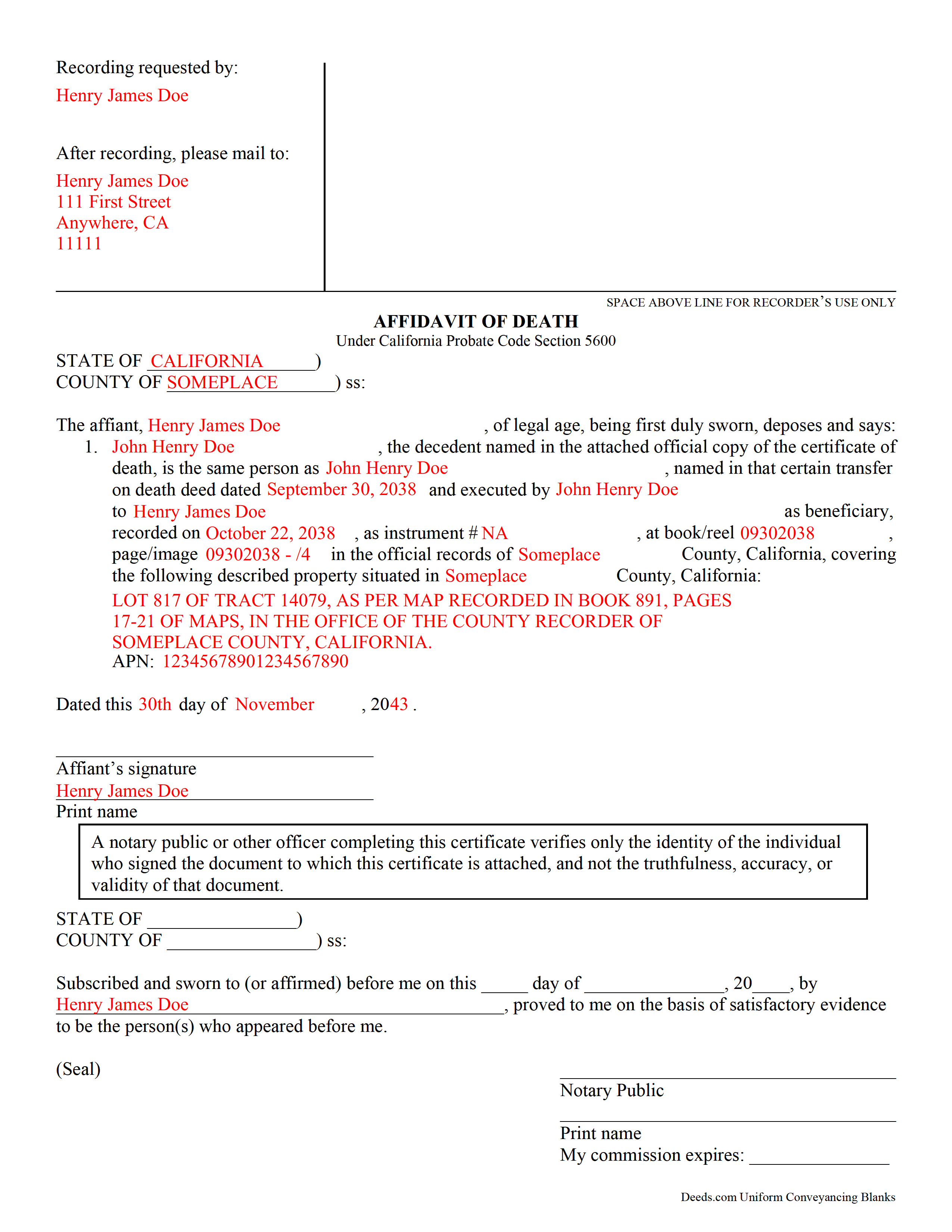

Completed Example of the Transfer on Death Affidavit Document

Example of a properly completed form for reference.

Included El Dorado County compliant document last validated/updated 6/30/2025

The following California and El Dorado County supplemental forms are included as a courtesy with your order:

When using these Transfer on Death Affidavit forms, the subject real estate must be physically located in El Dorado County. The executed documents should then be recorded in one of the following offices:

El Dorado Recorder-Clerk

360 Fair Lane, Placerville, California 95667

Hours: 8:00 am to 5:00 pm / Recording until 4:00 pm

Phone: (530) 621-5490 or numbers to the right

South Lake Tahoe Office

3368 Lake Tahoe Blvd. #108, South Lake Tahoe, California 96150

Hours: By Appointment

Phone: (530) 621-5490

Local jurisdictions located in El Dorado County include:

- Camino

- Coloma

- Cool

- Diamond Springs

- Echo Lake

- El Dorado

- El Dorado Hills

- Garden Valley

- Georgetown

- Greenwood

- Grizzly Flats

- Kyburz

- Lotus

- Mount Aukum

- Pilot Hill

- Placerville

- Pollock Pines

- Rescue

- Shingle Springs

- Somerset

- South Lake Tahoe

- Tahoma

- Twin Bridges

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the El Dorado County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in El Dorado County using our eRecording service.

Are these forms guaranteed to be recordable in El Dorado County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by El Dorado County including margin requirements, content requirements, font and font size requirements.

Can the Transfer on Death Affidavit forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in El Dorado County that you need to transfer you would only need to order our forms once for all of your properties in El Dorado County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by California or El Dorado County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our El Dorado County Transfer on Death Affidavit forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Using an Affidavit of Death to Claim Real Estate from a California Transfer on Death Deed

Transfer on death deeds allow individual landowners to transfer their real estate when they die, without a will or the need for probate distribution. The transferor simply executes a TODD form, then records it during the course of his/her natural life, and within 60 days of the signing date (5626(a)). Unlike grant deeds or quitclaim deeds, the owner continues to hold title to the property when a transfer on death deed is recorded (5650). As such, TODDs are exempt from transfer taxes and the Preliminary Change of Ownership Report (PCOR).

What happens, then, when the owner dies? Section 5680 defines the process for switching the title over to the beneficiary. The beneficiary may establish the fact of the transferor's death under the procedure provided in California Probate Code Chapter 2 (commencing with Section 210) of Part 4 of Division 2. The first step is obtaining a certified copy of the death certificate. Then research the recording information from the transfer on death deed identifying the beneficiary. Complete an affidavit of death and sign it in front of a notary. Finally, file the affidavit, along with the copy of the death certificate, in the recording office for the county where the property is situated. Note that this act transfers title to the beneficiary, so it also requires the PCOR and any associated taxes and fees.

Beneficiaries take title to the property under the rules set out at section 5652. Be aware that any associated debts, obligations, or agreements in place when the owner died follow the real estate to the beneficiaries. In addition, the title transfers without warranty, so the beneficiaries might find themselves liable for future claims against the property. For these reasons, among others, some beneficiaries might wish to disclaim the gift (5652(a)(1)).

In general, transferring title to the beneficiary of a transfer on death deed is a simple process. Even so, complications may arise. Contact an attorney for complex situations or with any questions.

(California Transfer on Death Affidavit Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the El Dorado County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your El Dorado County Transfer on Death Affidavit form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4562 Reviews )

MARY LACEY M.

June 30th, 2025

Great service! Recording was smooth and swiftly performed. Deeds.com is an excellent service.rn

We are delighted to have been of service. Thank you for the positive review!

Robert F.

June 30th, 2025

Breeze.... It feels silly to hire an attorney to do this for just one beneficiary. Thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

Pauline C.

June 29th, 2025

Everything that was stated to be included in my order was complete. Very satisfied

Thank you for your positive words! We’re thrilled to hear about your experience.

Terreva B.

August 9th, 2019

Yes it helped with some things but I need more info

Thank you!

Guy G.

March 22nd, 2023

Deeds.com was easy to use and their easement deed was exactly what I was looking for. I knew I didn't need to spend hundreds of dollars talking to an attorney.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Janice W.

January 25th, 2019

Great instructions, samples, ease in getting the form I needed, filling it out as a PDF, and having it ready for a Notary's signature. I was hesitant a first, but glad I paid the fee - now it is done!

Great to hear Janice! Thanks, have a great day!

Stephanie B.

December 17th, 2021

Site is SO easy to use. Thank you for such a valuable resource.

Thank you for your feedback. We really appreciate it. Have a great day!

Julie Z.

December 7th, 2024

Just getting started with this process, but I was delighted to find this resource to speed up the decision making. Excellent! Very helpful!

Thank you for your positive words! We’re thrilled to hear about your experience.

Chris M.

April 19th, 2022

simple, Clean, and easy, to retrieve the forms i needed, while on this site.

and the Fee for the Fill-in forms is Remarkably inexpensive, to say the least!

Thank you!

Mary Ann H.

May 13th, 2020

Great service! Good documents. Easy to use! Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ashley D.

March 4th, 2021

Was able to print my documents immediately. Documents included deed form, a guide, a sample document, etc. Very helpful!

Thank you for your feedback. We really appreciate it. Have a great day!

Veda J.

September 11th, 2020

Good Work!

Thank you!

Ernest S.

July 30th, 2019

Took it to the Courthouse and the Register of Deeds said,"well Done" Thanks you so much.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lori C.

November 15th, 2019

It just a little disconcerting that I was not able to preview any of the forms prior to purchasing them. Thank goodness they were the correct forms I needed. I would suggest being able to at least make the picture of the forms a little larger or give the capability to zoom in.

Thank you!

Donna r.

September 18th, 2020

Downloads were easy but I am pretty lost in filling out. Thought be more instructions

Thank you for your feedback Donna. If you are not completely sure of what you are doing we highly recommend seeking the assistance of a legal professional familiar with your specific situation.