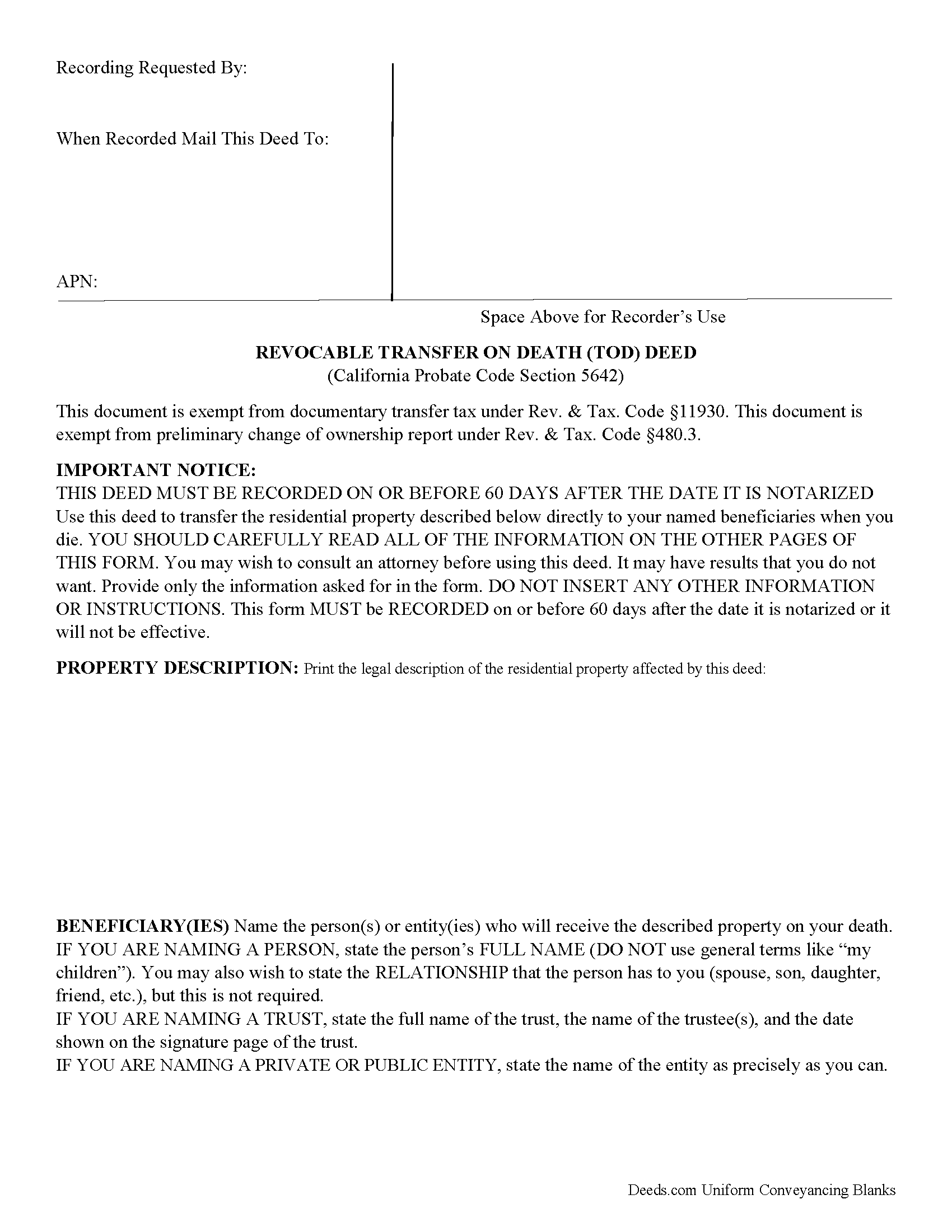

Mendocino County Transfer on Death Deed Form

Mendocino County Transfer on Death Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

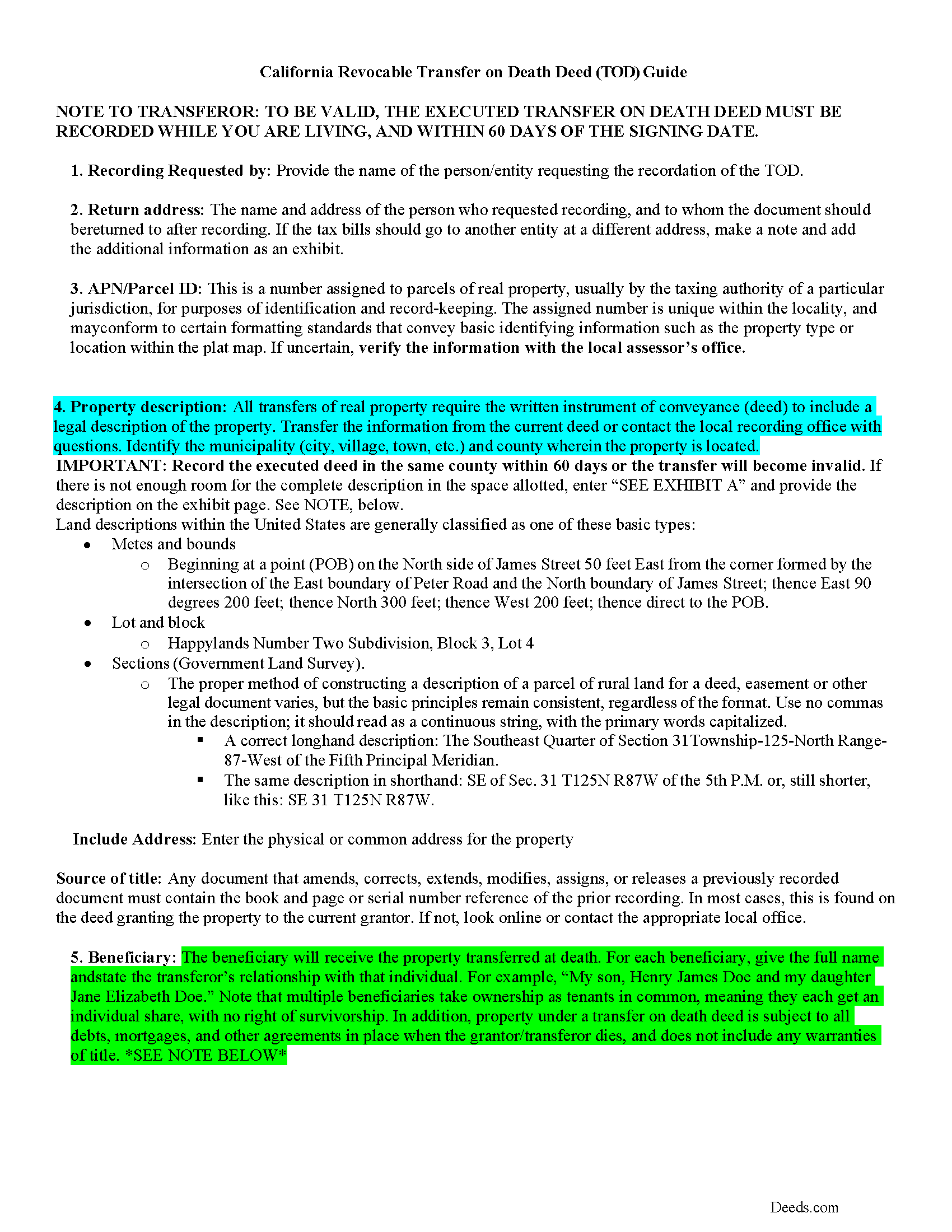

Mendocino County Transfer on Death Deed Guide

Line by line guide explaining every blank on the form.

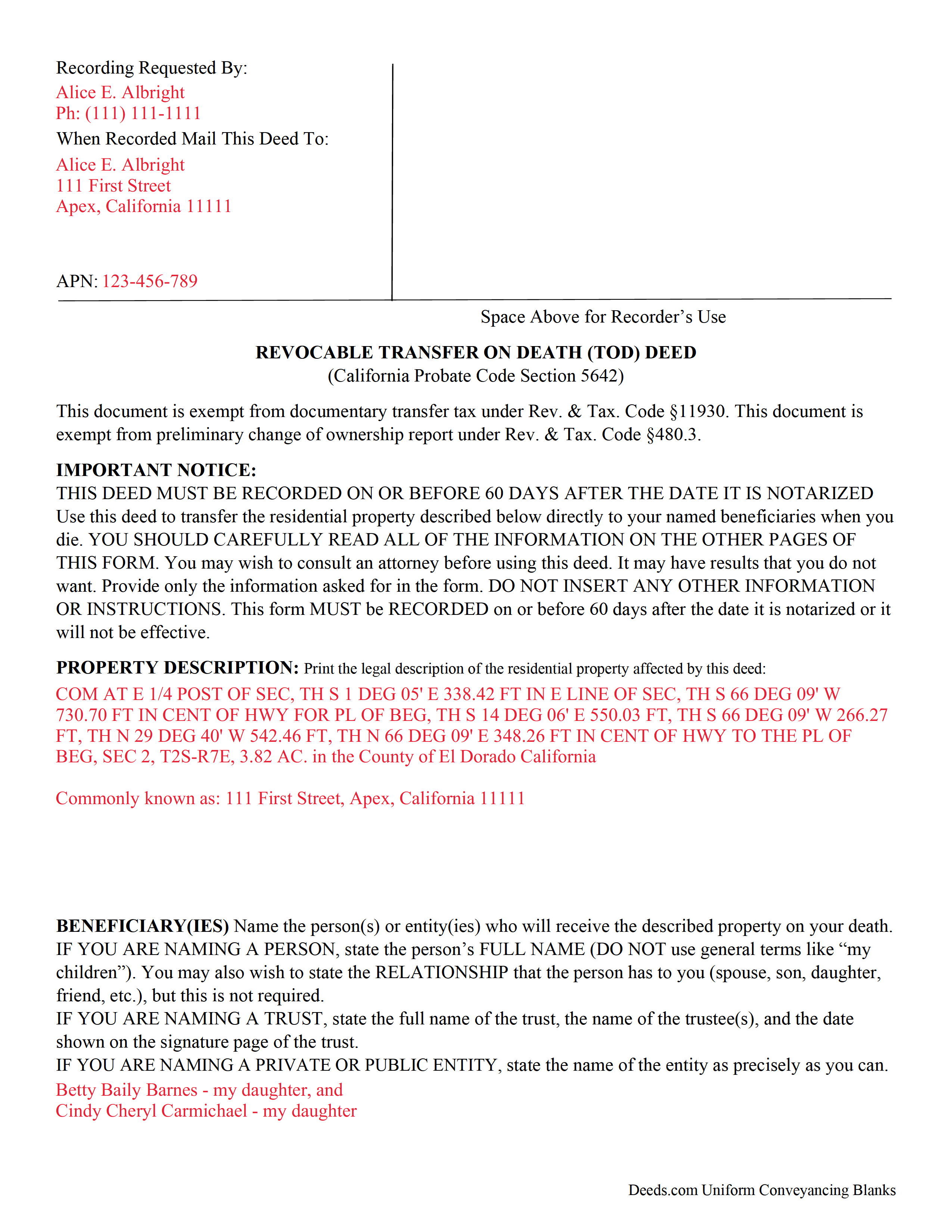

Mendocino County Completed Example of the Transfer on Death Deed Document

Example of a properly completed form for reference.

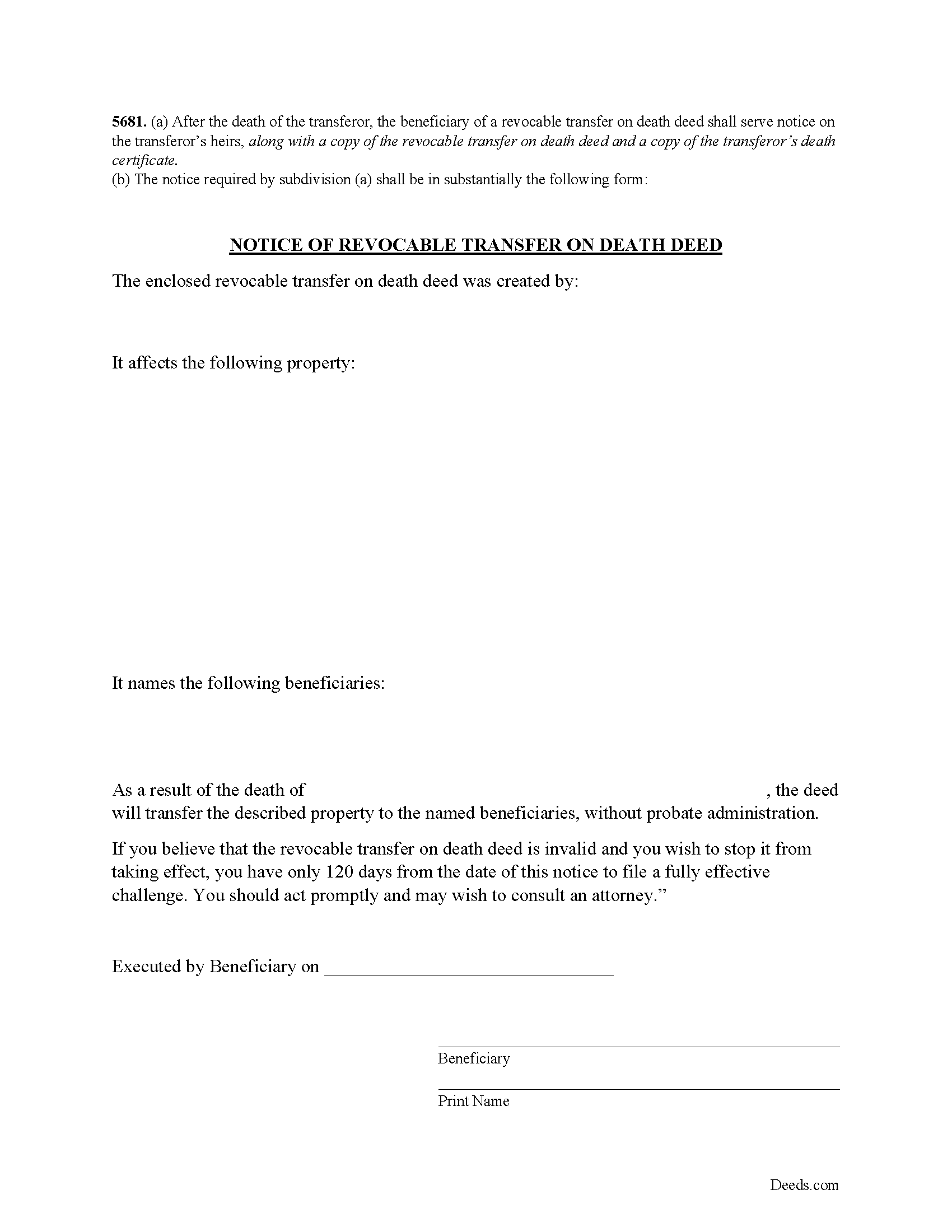

Mendocino County Notice of Revocable Transfer on Death Deed

Provide this form to your beneficiary(s).

All 4 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional California and Mendocino County documents included at no extra charge:

Where to Record Your Documents

Mendocino County Recorder

Ukiah, California 95482-4438

Hours: Mon - Fri: 8:00 am to 5:00 pm

Phone: (707) 234-6822

Recording Tips for Mendocino County:

- Bring your driver's license or state-issued photo ID

- Make copies of your documents before recording - keep originals safe

- Recording fees may differ from what's posted online - verify current rates

Cities and Jurisdictions in Mendocino County

Properties in any of these areas use Mendocino County forms:

- Albion

- Boonville

- Branscomb

- Calpella

- Caspar

- Comptche

- Covelo

- Dos Rios

- Elk

- Fort Bragg

- Gualala

- Hopland

- Laytonville

- Leggett

- Little River

- Manchester

- Mendocino

- Navarro

- Philo

- Piercy

- Point Arena

- Potter Valley

- Redwood Valley

- Talmage

- Ukiah

- Westport

- Willits

- Yorkville

Hours, fees, requirements, and more for Mendocino County

How do I get my forms?

Forms are available for immediate download after payment. The Mendocino County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Mendocino County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Mendocino County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Mendocino County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Mendocino County?

Recording fees in Mendocino County vary. Contact the recorder's office at (707) 234-6822 for current fees.

Questions answered? Let's get started!

Use this form to transfer real estate at death, but outside of a will and without the need for probate distribution. Execute the TODD form, then record it during the course of your life, and within 60 days of the signing date (5626(a)). Note that unlike grant deeds or quitclaim deeds, there is no change in ownership when transfer on death deeds are recorded (5650), so they are exempt from transfer taxes and the Preliminary Change of Ownership Report (PCOR).

Section 5650 explains that while you are alive, you retain absolute ownership of and control over your property. You may sell, mortgage, rent, or otherwise use the real estate in any lawful manner, without input from or notice to the beneficiaries, or even modify or revoke the future transfer.

Be aware, too, that the TODD is NOT affected by provisions in your will (5642(b)). Best practices dictate that any change to an estate plan initiates a review of the whole thing, so to reduce the chance for conflict, ensure that the transfer on death deed reinforces the will and other related documents.

Beneficiaries take title to the property under the rules set out at section 5652. Any associated debts, obligations, or agreements in place when you die follow the real estate to the beneficiaries. In addition, the title transfers without warranty, so the beneficiaries might find themselves liable for future claims against the property. For these reasons, among others, some beneficiaries might wish to disclaim the gift (5652(a)(1)).

As it stands, California's transfer on death deed is not valid for real estate held in joint tenancy or as community property with right of survivorship (5664).

5624. A revocable transfer on death deed is not effective unless all of the following conditions are satisfied:

(a) The deed is signed by the transferor and dated.

(b) The deed is signed by two witnesses who were present at the same time and who witnessed either the signing of the deed or the transferor's acknowledgment that the transferor had signed the deed.

(c) The deed is acknowledged before a notary public.

SEC. 10. Section 5625 is added to the Probate Code, to read:

5625. (a) Any person generally competent to be a witness may act as a witness to a revocable transfer on death deed.

(b) A revocable transfer on death deed is not invalid because it is signed by an interested witness.

(c) If a beneficiary of a revocable transfer on death deed is also a subscribing witness, there is a presumption that the witness procured the revocable transfer on death deed by duress, menace, fraud, or undue influence. This presumption is a presumption affecting the burden of proof. This presumption does not apply where the witness is named as beneficiary solely in a fiduciary capacity.

Overall, the Simple Revocable Transfer on Death Deed offers a convenient, flexible option to consider as part of an overall estate plan. Even so, they may not be appropriate in all cases. Contact an attorney for complex situations or with any questions.

Included NOTICE OF REVOCABLE TRANSFER ON DEATH DEED Form

5681. (a) After the death of the transferor, the beneficiary of a revocable transfer on death deed shall serve notice on the transferor's heirs, along with a copy of the revocable transfer on death deed and a copy of the transferor's death certificate. (b) The notice required by subdivision (a) shall be in substantially the following form:

(California Transfer on Death Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Mendocino County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Deed meets all recording requirements specific to Mendocino County.

Our Promise

The documents you receive here will meet, or exceed, the Mendocino County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Mendocino County Transfer on Death Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4587 Reviews )

Paul R. A.

September 10th, 2019

Great and prompt service. Thank you for your assistance. Paul R. Ashe, Esq.

Thank you!

John K.

July 11th, 2020

I was unable to finish what I started due to computer crash. I'll get back soon. I paid off my mortgage last year in November. I need to see what to do to get the deed to my property.

Thank you!

frederic m.

January 1st, 2021

surprisingly good, gave me all the info I needed to prepare a deed and necessary attachments for recording.

Thank you!

Carl T.

May 21st, 2020

Very simple to download and manage. very Impressed!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Mary M.

May 7th, 2019

So easy to use. I was able to download all the forms I need, it saves a lot of time!

Thank you!

Patricia R.

March 2nd, 2025

Very helpful. Worth the cost. Hopefully we will be able to proceed without expense of an attorney.

We are thankful for your continued support and feedback, which inspire us to continuously improve. Thank you..

Jamie P.

December 9th, 2024

Got it next business day in the morning. Saved me phone call and perhaps a trip to courthouse. Very pleased.

Your satisfaction with our services is of utmost importance to us. Thank you for letting us know how we did!

Priscilla Z.

November 7th, 2022

Very user friendly and easy. I appreciated the sample deed that was provided. Definitely recommend!

Thank you!

Karen L.

October 3rd, 2022

Good service could give a little more detail on where to location some of the information needed. Overall fairly simply to use.

Thank you for your feedback. We really appreciate it. Have a great day!

Bayyinah M.

March 30th, 2022

EasyPeasy!

Thank you!

Johanna R.

April 21st, 2022

As soon as payment was received the forms were downloaded, printed and were useable. The guide was helpful and I was able to get my forms filled out and filed with no problem here in Linn County Oregon. I would recommend the site to anyone.

Thank you for your feedback. We really appreciate it. Have a great day!

Jessi S.

March 4th, 2020

Delivery of documents was instantaneous once payment is received. Thank you for that. For future clarification to potential users, Deeds.com may want to categorize the type of easement documents that are available. I was needing a 'utility easement' form and received an 'ingress/egress' form. Had I known it was an ingress/egress document, I would not have made the purchase. Outside of this issue, this site is very helpful for the average layperson to hold guardianship over personal interests.

Thank you for your feedback. We really appreciate it. Have a great day!

Evelia G.

January 4th, 2019

I love this guide. Thank you for having this available.

Thanks so much for your feedback Evelia, have a fantastic day!

James R.

November 14th, 2019

Really Easy site to navigate!

Thank you James, have a great day!

Chris M.

May 9th, 2024

The personal attention and the ease of use is beyond any other service I have used. Thank you for making my work so much easier.

Thank you for your positive words! We’re thrilled to hear about your experience.