Sierra County Transfer on Death Revocation Form

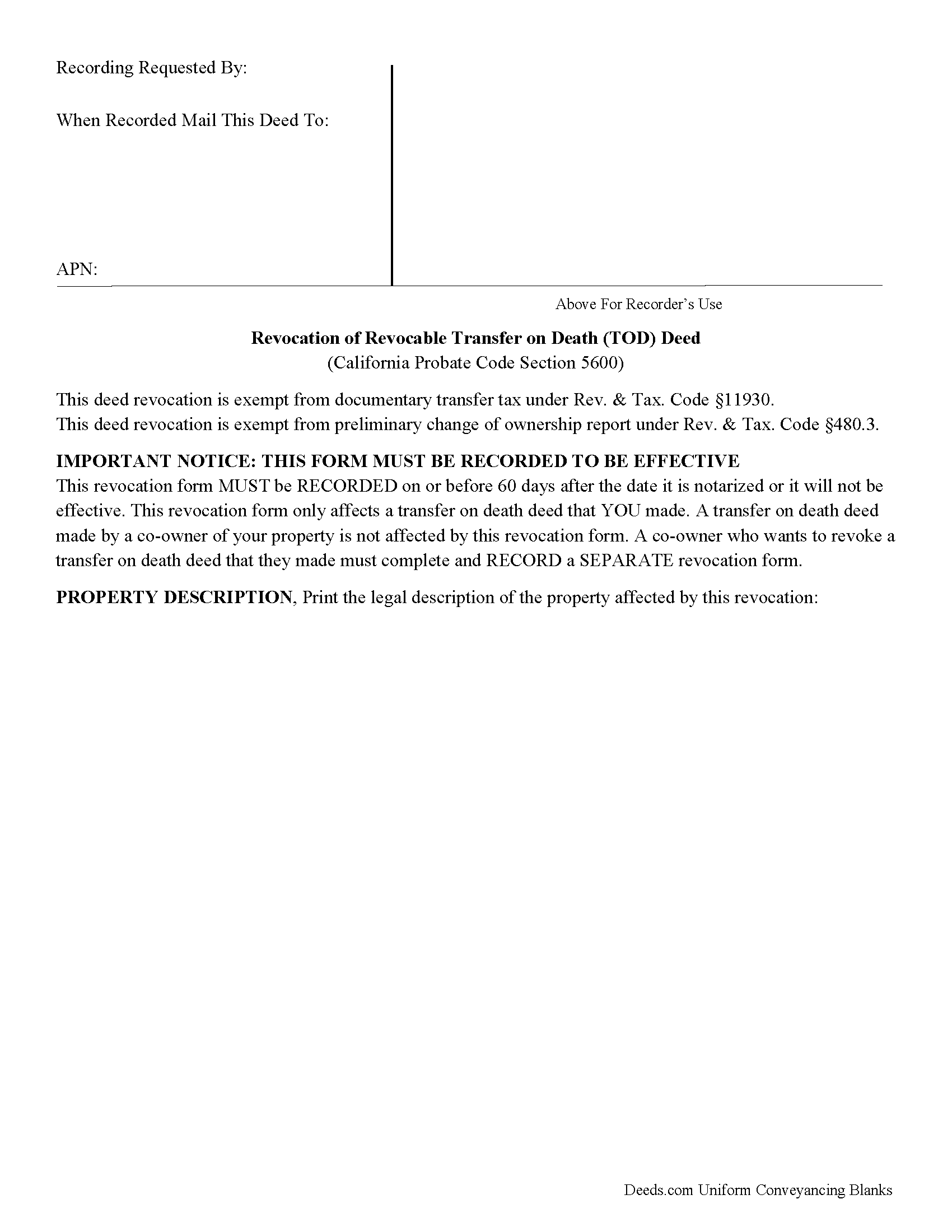

Sierra County Revocation of Transfer on Death Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

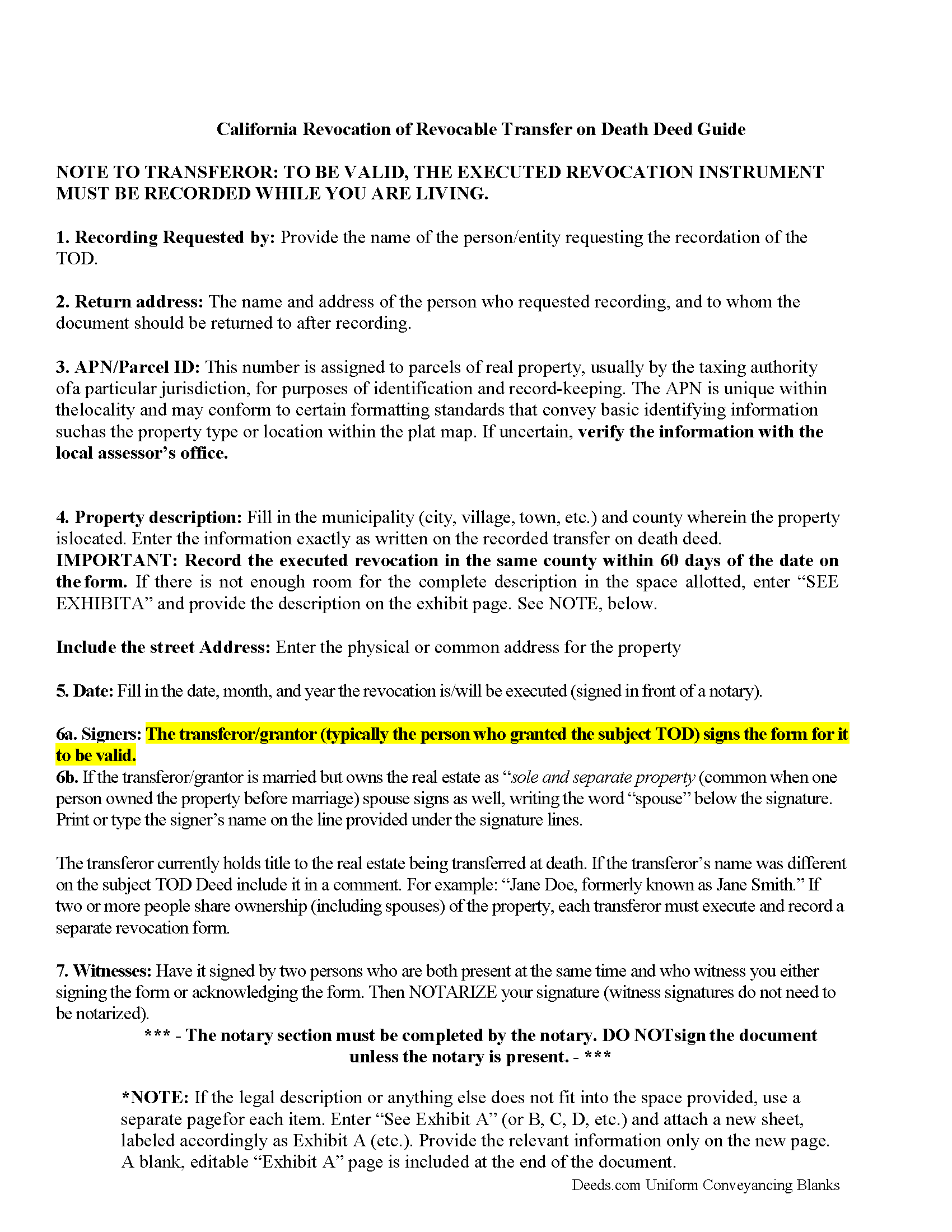

Sierra County Revocation of Transfer on Death Deed Guide

Line by line guide explaining every blank on the form.

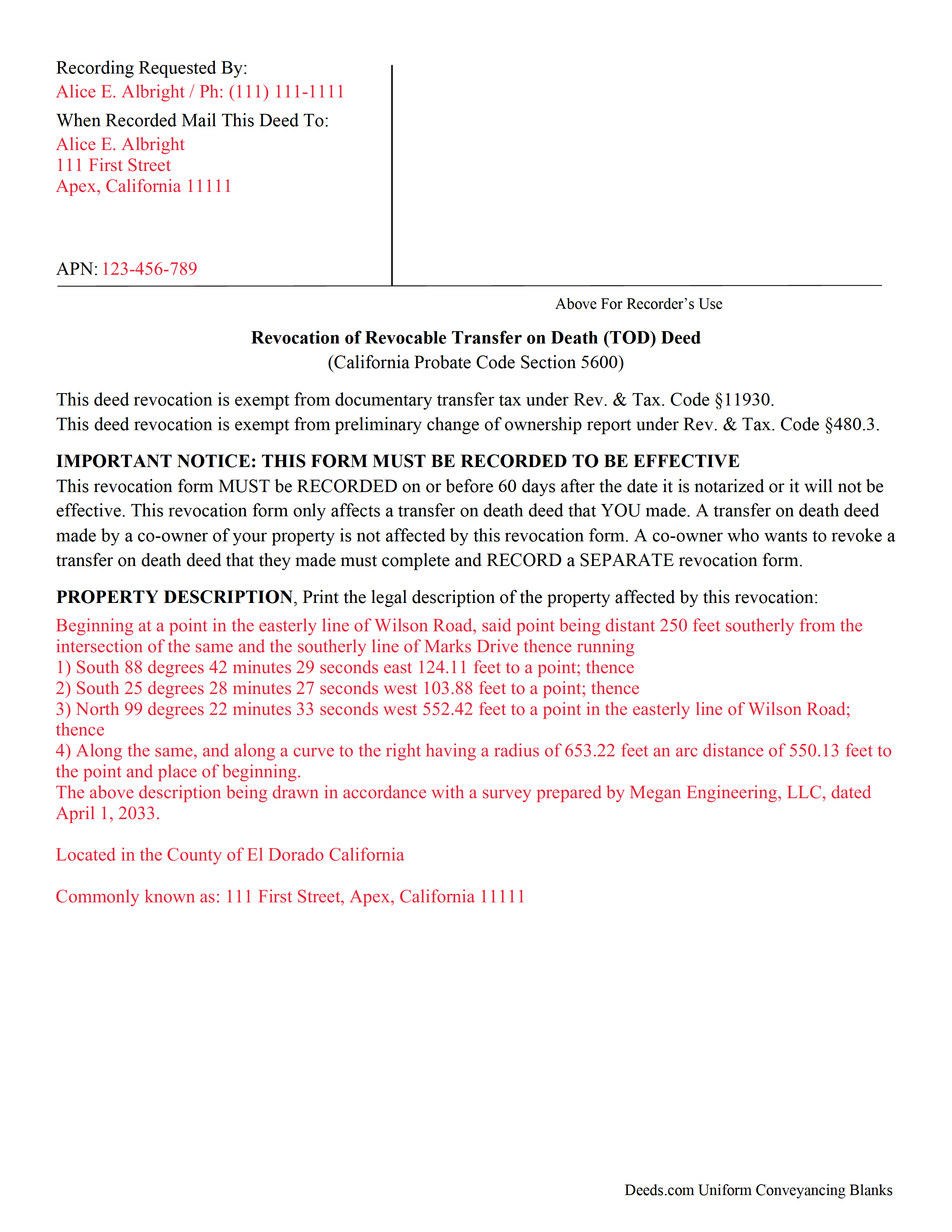

Sierra County Completed Example of the Revocation of Transfer on Death Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional California and Sierra County documents included at no extra charge:

Where to Record Your Documents

County Clerk-Recorder

Downieville, California 95936

Hours: 9:00 a.m. to 12:00 & 1:00 to 4:00 p.m.

Phone: (530) 289-3295

Recording Tips for Sierra County:

- Bring your driver's license or state-issued photo ID

- Verify all names are spelled correctly before recording

- Ask if they accept credit cards - many offices are cash/check only

- Ask about their eRecording option for future transactions

- Request a receipt showing your recording numbers

Cities and Jurisdictions in Sierra County

Properties in any of these areas use Sierra County forms:

- Alleghany

- Calpine

- Downieville

- Goodyears Bar

- Loyalton

- Sierra City

- Sierraville

Hours, fees, requirements, and more for Sierra County

How do I get my forms?

Forms are available for immediate download after payment. The Sierra County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Sierra County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Sierra County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Sierra County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Sierra County?

Recording fees in Sierra County vary. Contact the recorder's office at (530) 289-3295 for current fees.

Questions answered? Let's get started!

Revoking a Transfer on Death Deed in California

Transfer on death deeds allow individual landowners to transfer their real estate when they die, but outside of a will and without the need for probate. The transferor simply executes a TODD form, then records it during the course of his/her natural life, and within 60 days of the signing date (5626(a)). Unlike grant deeds or quitclaim deeds, however, there is no change in ownership when a transfer on death deed is recorded (5650).

As with transfer on death deeds, any change or revocation must be recorded DURING THE TRANSFEROR'S LIFE or it will be void.

Revocability is one of the unique features of transfer on death deeds. By retaining title to the property, it's easier for the transferor to respond to changes in circumstances or intentions. There are three ways to revoke a recorded TODD: transfer the real estate outright (in other words, use a standard deed, such as a grant or quitclaim deed, to convey the title away from the transferor); execute and record a new TODD, which automatically supersedes the previous document; or execute and record an instrument of revocation (5628-5632, 5660(c)).

While the statute allows three options for revocation, to maintain a clear title, it makes sense to record an instrument of revocation before either of the other two options. This provides a clear endpoint to the beneficiary's potential future interest, which reduces the chances for future claims against the title. Once the revocation is in place, the transferor may sell or redirect the property without worrying about the prior TODD.

Be aware, too, that the TODD is NOT affected by provisions in the owner's will (5642(b)). Best practices dictate that any change to an estate plan initiates a review of the whole thing, so to reduce the chance for conflict, make sure that the transfer on death deed, as well as any modifications or revocations, reinforces the will and other related documents.

Revoking a recorded transfer on death deed is a fairly simple process. Even so, it may not be appropriate in all cases. Contact an attorney for complex situations or with any questions.

Effective January 1, 2022 by California Senate Bill 315

A Revocation of a Revocable Transfer on Death Deed shall be signed by two persons who are both present at the same time and who witness you either signing the form or acknowledging the form. Then NOTARIZE your signature (witness signatures do not need to be notarized). RECORD the form in the county where the property is located.

(California Transfer on Death Revocation Package includes form, guidelines, and completed example)

Important: Your property must be located in Sierra County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Revocation meets all recording requirements specific to Sierra County.

Our Promise

The documents you receive here will meet, or exceed, the Sierra County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Sierra County Transfer on Death Revocation form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Edward M.

July 22nd, 2020

Professional and courteous and responsive service by KVH for my problem. He or she should receive a pat on the back but not on the back side. Ed Mattingly

Thank you for your feedback. We really appreciate it. Have a great day!

Cathy P.

March 18th, 2021

I purchased the La St. Tammany Parish Quit Claim Deed as a gift for a friend. Currently waiting on a lawyer to draft his second version of what a La Quit Claim should look like. I have downloaded this St. Tammany La packet for simplicity and double protection for my friend. So far, I really like what I see from Deeds.com, short and to the point. It's truly a breath of fresh air. Thank you so much. Layperson Cathy for a friend.

Thank you for your feedback. We really appreciate it. Have a great day!

Ismael I.

April 10th, 2019

The service was fast and outstanding. Thank you.

Thank you!

Heidi G.

August 19th, 2020

Very happy with the service that you offer. My office will use you again.

Great to hear Heidi, glad we could help. Have an amazing day!

Steven W.

April 11th, 2021

Seems to be just what I needed and easy to use.

Thank you!

Kathleen M.

December 29th, 2023

I am very happy with this service

Your kind words have brightened our teams day! Thank you for the positive feedback.

Mary L M.

November 1st, 2022

Your website was very helpful & easy to use

Thank you for your feedback. We really appreciate it. Have a great day!

Margaret S.

August 2nd, 2021

Very nice. easy to use and not too expensive.

Thank you!

Michele B.

June 9th, 2022

It was a wonderful experience. Thank you for your help.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

ROBERT W.

June 30th, 2019

Very good service .I recommend it if you need your documentation on a weekend or when offices are closed.Very fast service

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Thomas F.

February 18th, 2021

Very convenient!

Thank you!

Darrell W.

November 10th, 2021

Fast and easy to use. Nice to have available online.

Thank you for your feedback. We really appreciate it. Have a great day!

Brenda M. K.

August 2nd, 2020

Great service Easy to do Efficient

Thank you for your feedback. We really appreciate it. Have a great day!

Terry M.

December 2nd, 2021

Application is not well laid out. I guess it does the job but leaves a lot to be desired. Hard to follow

Thank you for your feedback. We really appreciate it. Have a great day!

Gina B.

March 30th, 2023

This website is reliable and informative. So glad I can across this website. They provide a wide range of documents that are always provided on the recording county website. Thanks!

Thank you!