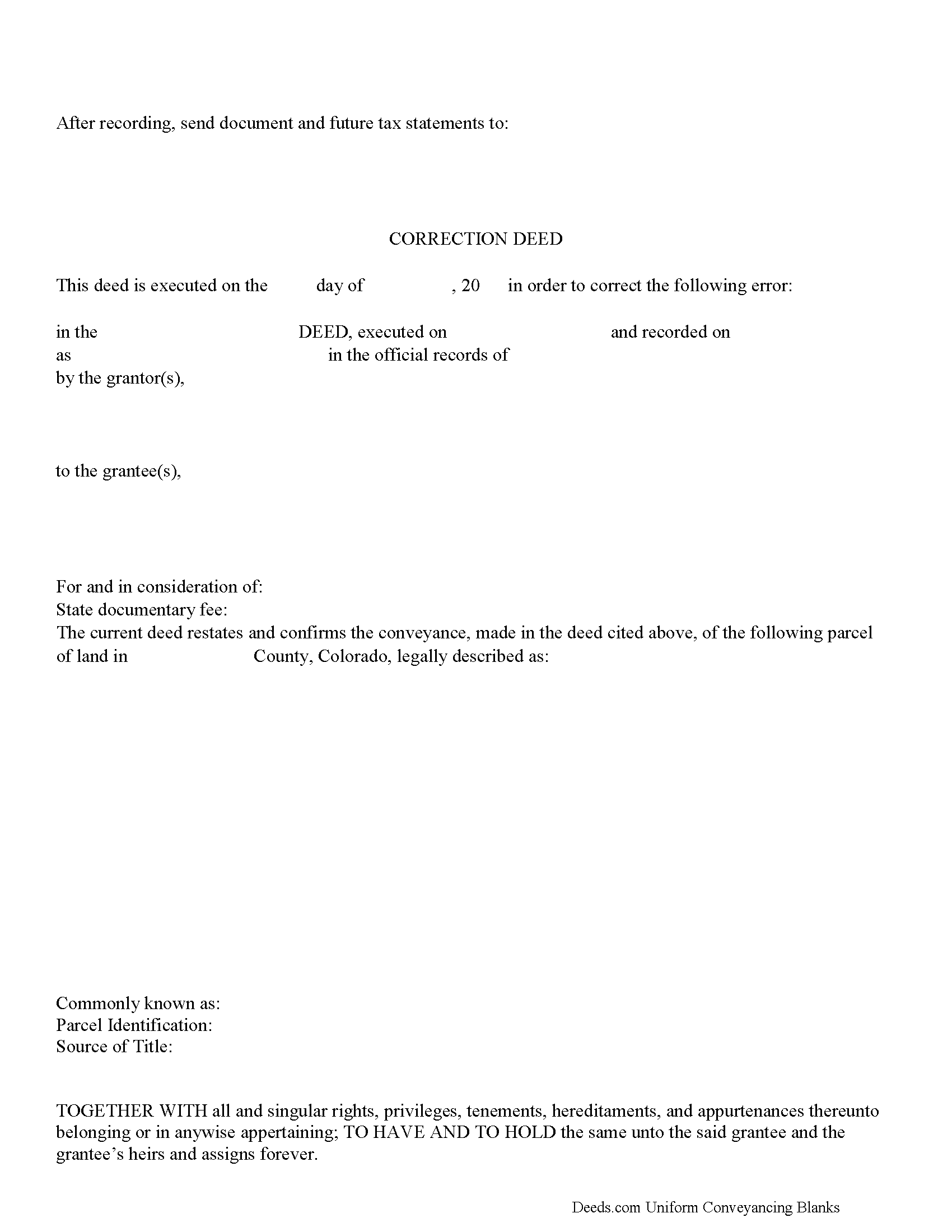

Morgan County Correction Deed Form

Morgan County Correction Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

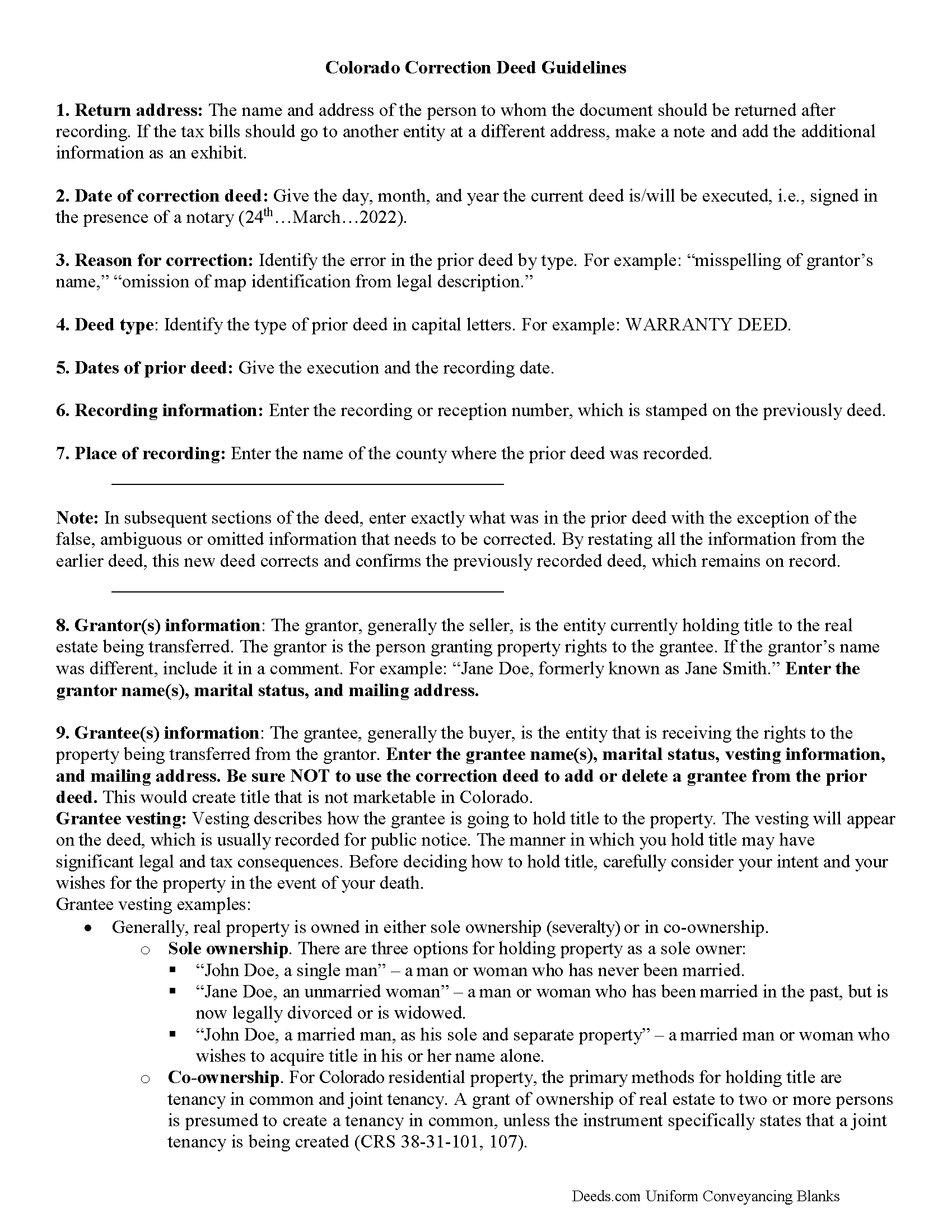

Morgan County Correction Deed Guide

Line by line guide explaining every blank on the form.

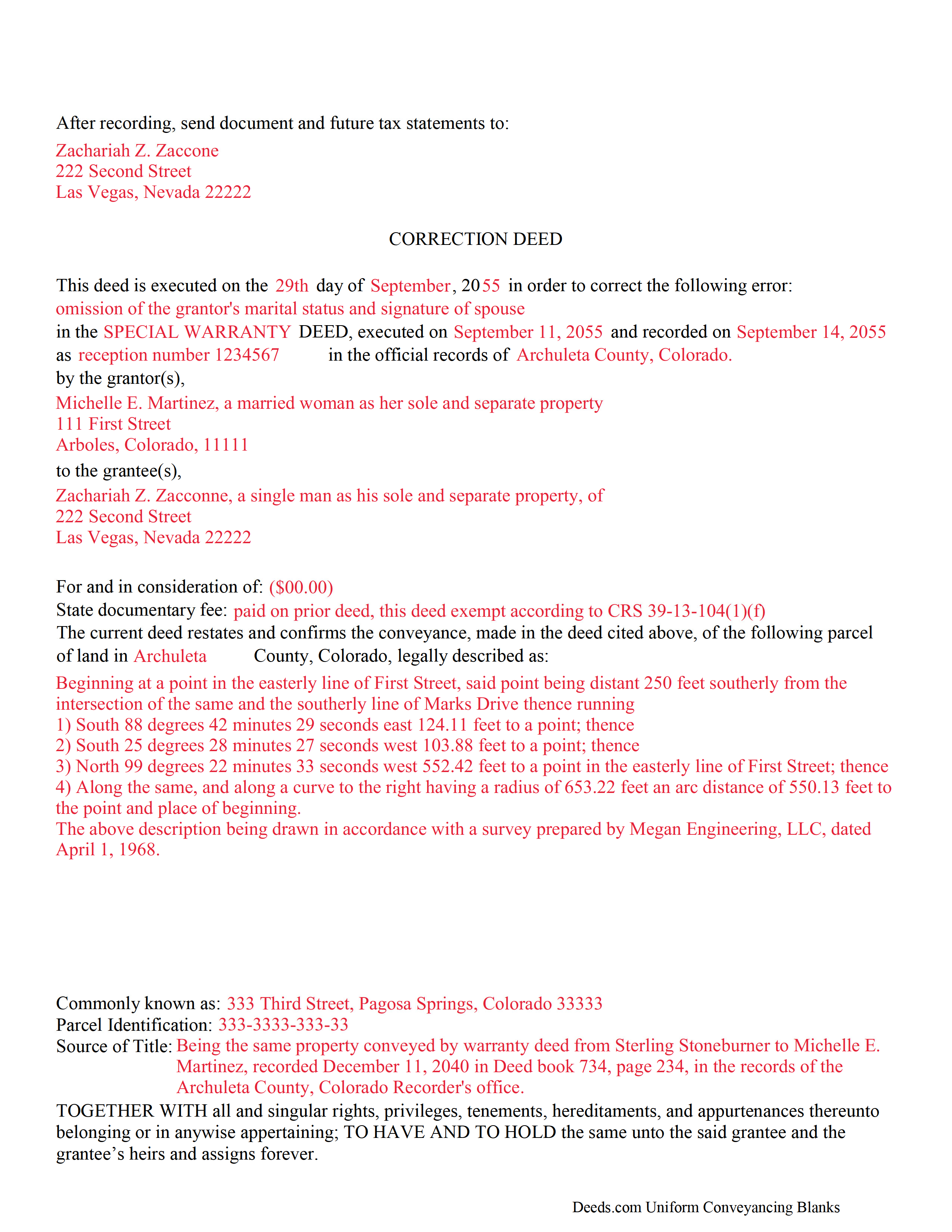

Morgan County Completed Example of the Correction

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Colorado and Morgan County documents included at no extra charge:

Where to Record Your Documents

Morgan County Clerk and Recorder

Fort Morgan, Colorado 80701

Hours: 8:00am to 4:00pm Monday - Friday

Phone: (970) 542-3553

Recording Tips for Morgan County:

- Check that your notary's commission hasn't expired

- Double-check legal descriptions match your existing deed

- Recording fees may differ from what's posted online - verify current rates

Cities and Jurisdictions in Morgan County

Properties in any of these areas use Morgan County forms:

- Brush

- Fort Morgan

- Hillrose

- Log Lane Village

- Orchard

- Snyder

- Weldona

- Wiggins

Hours, fees, requirements, and more for Morgan County

How do I get my forms?

Forms are available for immediate download after payment. The Morgan County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Morgan County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Morgan County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Morgan County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Morgan County?

Recording fees in Morgan County vary. Contact the recorder's office at (970) 542-3553 for current fees.

Questions answered? Let's get started!

Use this deed form to make minor corrections in a previously recorded warranty, special warranty or quitclaim deed.

In Colorado, a previously recorded deed can be corrected by recording a second deed, called a correction or corrective deed. The sole purpose of such a document is to prevent potential title flaws, which may create problems when the current owner attempts to sell the property. The correction deed does not convey title but confirms the prior conveyance. For the most part it reiterates the prior deed verbatim, except for the corrected item and the consideration.

The errors usually adjusted by a corrective deed are minor omissions or typographical mistakes, sometimes called scrivener's errors. Among those are misspelled names, omitted or wrong middle initial, a minor error in the property description, or an omitted execution date, or a faulty acknowledgment. However, certain types of changes cannot be achieved by using a correction deed. For example: the addition or omission of a grantee; changing the manner in which title is held to/from "joint tenants with rights of survivorship"; making material changes to the legal description; or deleting a portion of the originally transferred property. As far as changes to the legal description are concerned, use a correction deed only if a portion of the property was left out of the original conveyance.

The correction deed must be executed from the original grantor to the original grantee and state that its purpose is to correct a specific error, identified by type. It references the prior deed by date(s) and recording/reception number, as well as county of recording. A correction deed generally is exempt from state documentary fee (CRS 39-13-104(1)(f), which is calculated based on the consideration stated in the deed. Thus, many counties advise to enter $0 as consideration and to state the exemption on the correction deed (CRS 39-13-104(2)).

(Colorado Correction Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Morgan County to use these forms. Documents should be recorded at the office below.

This Correction Deed meets all recording requirements specific to Morgan County.

Our Promise

The documents you receive here will meet, or exceed, the Morgan County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Morgan County Correction Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4586 Reviews )

Joan S.

May 21st, 2020

Thanks for providing this service. We had searched for weeks for the correct documents. It might help clients to find you soon if the banks and mortgage companies can refer clients to you. They require the forms but offer no direct source to obtain them. You are 5 star in every way.

Thank you!

James S.

August 26th, 2020

unbelievable Deeds Rocks Start to finish 2=Day Recommended by Coconino County Recorders office in Arizona there were incomplete sections. I would correct and resubmit . All done Yeah!!!!!!

Thank you for your feedback. We really appreciate it. Have a great day!

Peter F.

February 25th, 2021

It was outstanding, seriously, I had 3 e mail correspondences asking for information and providing feedback within 2 hours and was ready for submission at that point. I paid the invoice online and by the end of the day I had electronic verification that Registry of Deeds had processed my documents. That work is good stuff ! Pete

Glad we could be of assistance Peter, thank you for the kinds words. Have an amazing day!

Jonathan W.

March 7th, 2023

Deeds gave me the forms and the guidance that I needed. If I had paid a pro for this service it would have cost at least $300.

Thank you for your feedback. We really appreciate it. Have a great day!

Mary H.

January 31st, 2019

Your site was very informative and I was able to instantly and easily download the documents that I needed. I could not be happier with your service. Thank You Mary Harju

Thank you Mary, we really appreciate your feedback.

Catherine E.

January 7th, 2021

I was referred to your company, but when i tried to process the recording of a deed to a property in City of Philadelphia my service was rejected. I appreciated the feedback i received from one of your representatives who instructed me in the right process for recording a deed in philadelphia. Thank you for all your help. The deed that needed to be recorded was overnighted yesterday. Stay safe and mask up

Thank you!

Stephanie P.

January 11th, 2023

It was a seamless process, inexpensive, and probably saved me thousands by having an attorney draw this same form us. Highly recommend!

Thank you!

Melissa S.

March 24th, 2024

Simple & easy to navigate. At time of writing this, guide & example of purchased deed is included. Plus lots of extra information to help secure your property. Would recommend to anyone.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

AMY J.

February 16th, 2022

Very easy user friendly thank you for that

Thank you!

ROSALYN L.

May 31st, 2021

I just now downloaded the forms. So far, so good.

Thank you for your feedback. We really appreciate it. Have a great day!

Missy J.

December 6th, 2019

as always, perfect!

Thank you!

Jose F.

May 19th, 2020

When I found this website, I was confused and hesitant to use this website to submit paperwork that needed to be submitted to the Clerks of Courts in Miami. I am glad I decided to go through with it. It was the easiest process I have encountered even with working with the City. Highly recommend as it is super easy to use and received that everything was approved and recorded in two working days. Thank you so much for bringing my stress level lower as many uncertainties of how to process my paperwork. Will use it again to finish my project as the City continues to not accept walk ins. Thank you so much.

So glad we were able help Jose, have a amazing day!

Darlo M.

November 19th, 2022

The process for getting the forms I needed was easy through Deeds.com I would use them again!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kelli M.

April 27th, 2020

It is easy to use but difficult to know when the document has been reviewed for recording and when the invoice is ready. It would be helpful for the website to send an email automatically once the document(s) are ready to be recorded to let you know what the time line is.....Thank you for your help.

Thank you for your feedback. We really appreciate it. Have a great day!

Thomas M.

August 24th, 2021

Great Service. I had to record 13 deeds in various Oregon counties, with o previous experience, and the process was straightforward with excellent instruction. Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!