Hinsdale County Deed of Trust and Promissory Note Form

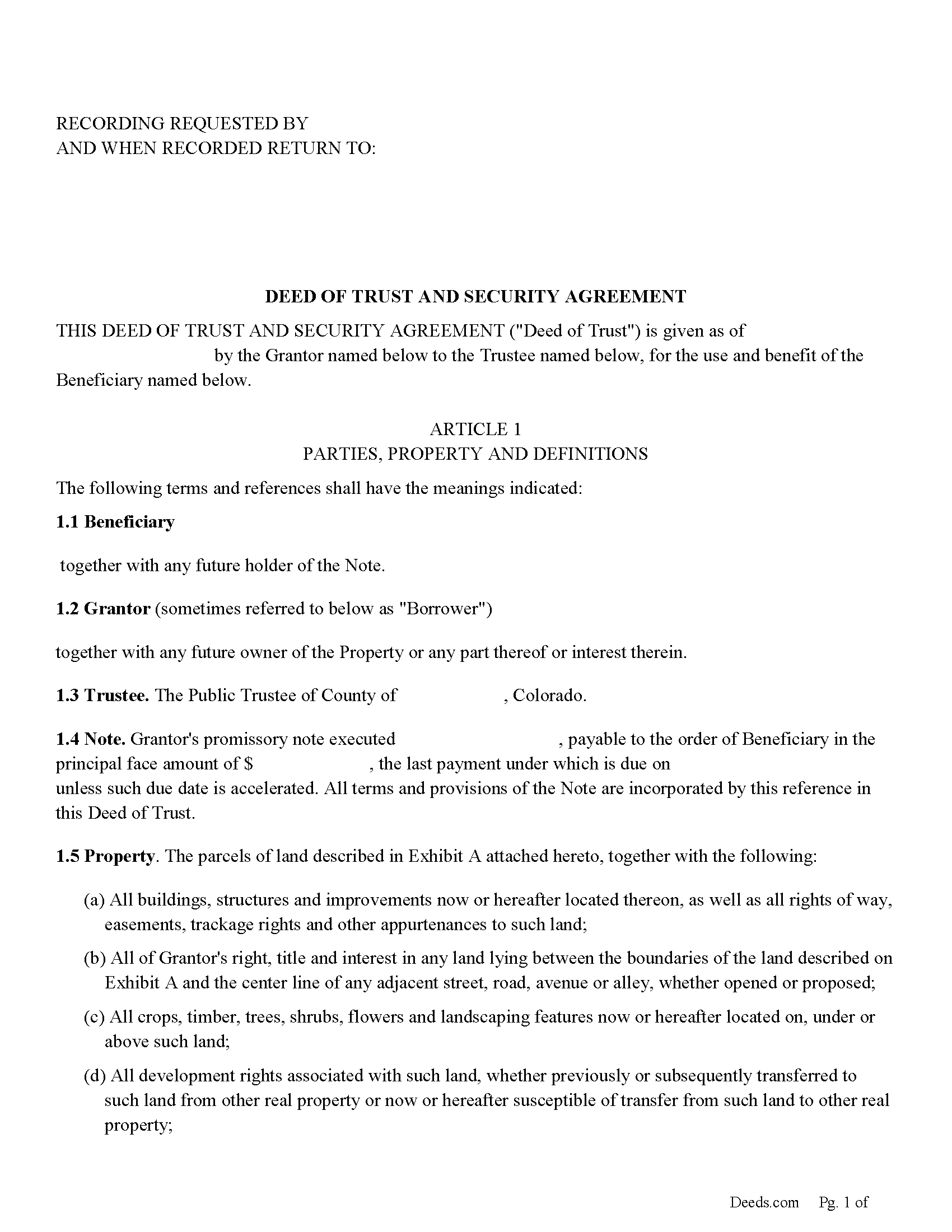

Hinsdale County Deed of Trust Form

Fill in the blank form formatted to comply with all recording and content requirements.

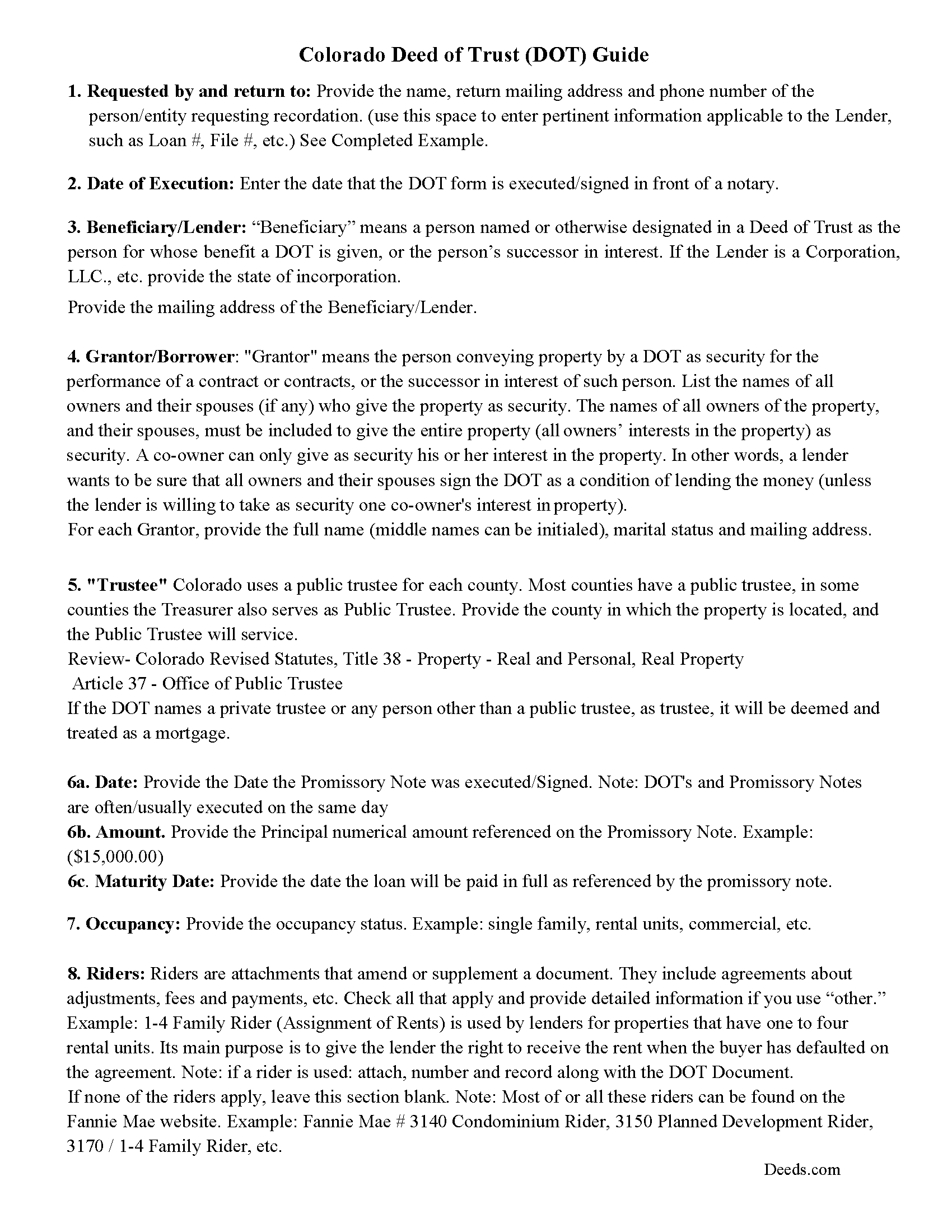

Hinsdale County Deed of Trust Guidelines

Line by line guide explaining every blank on the form.

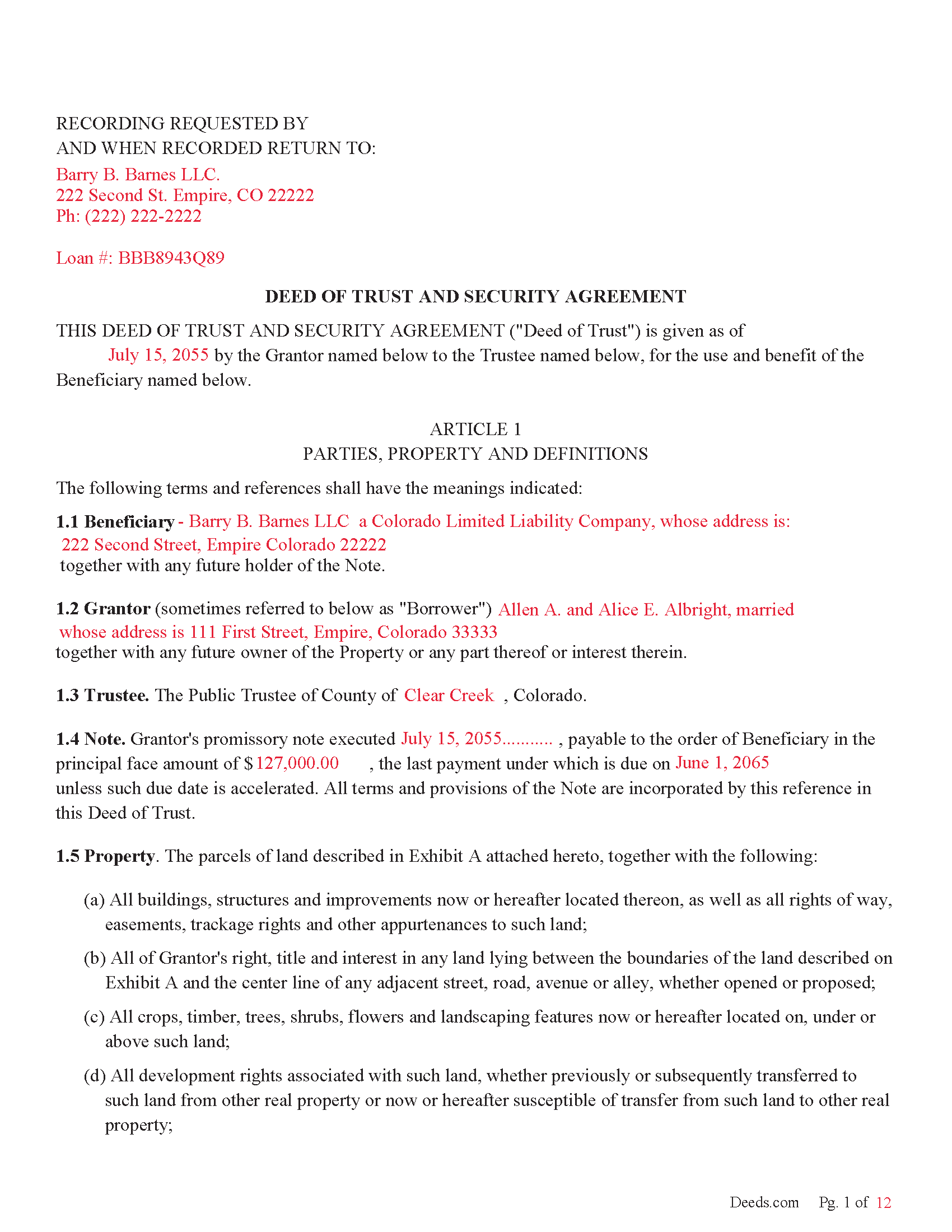

Hinsdale County Completed Example of a Deed of Trust Document

Example of a properly completed form for reference.

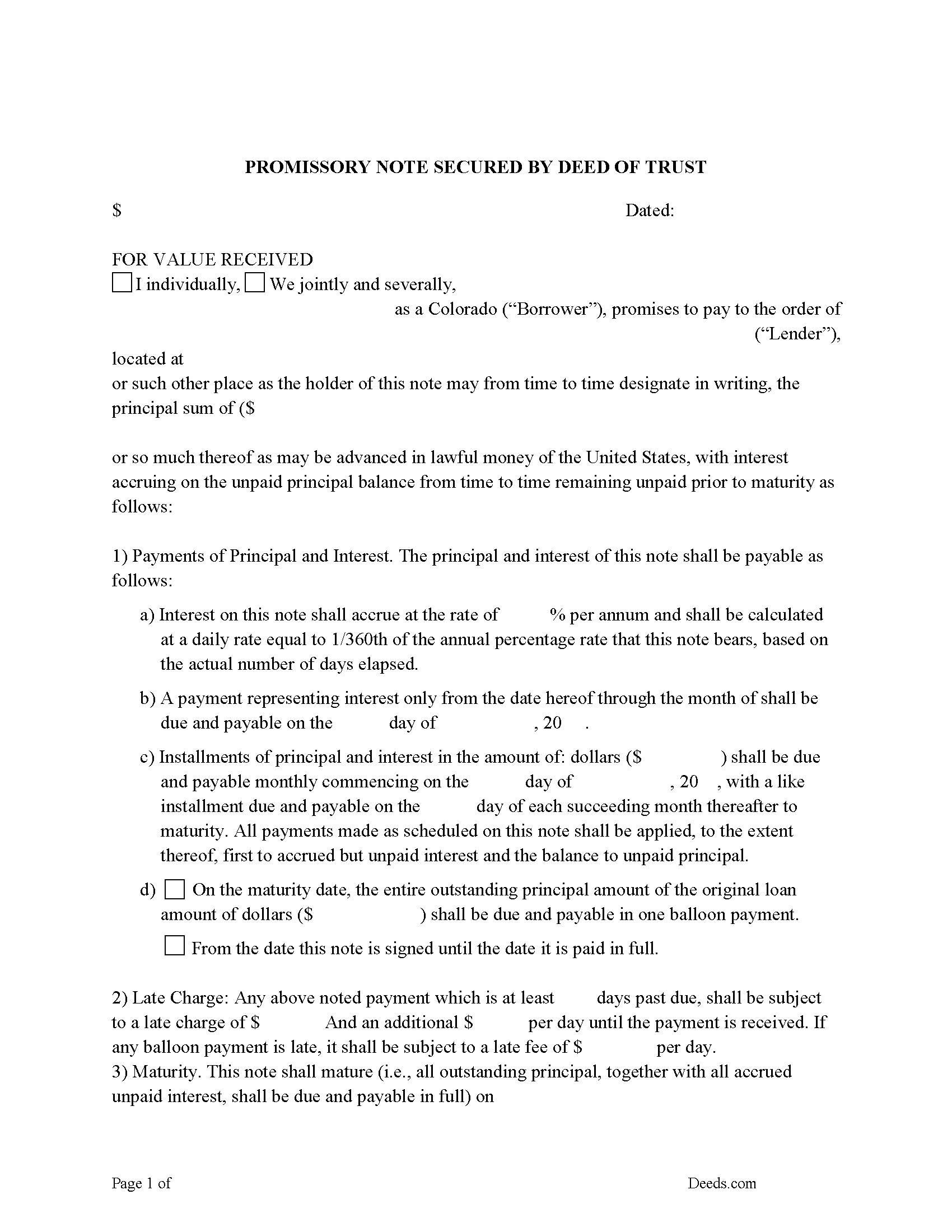

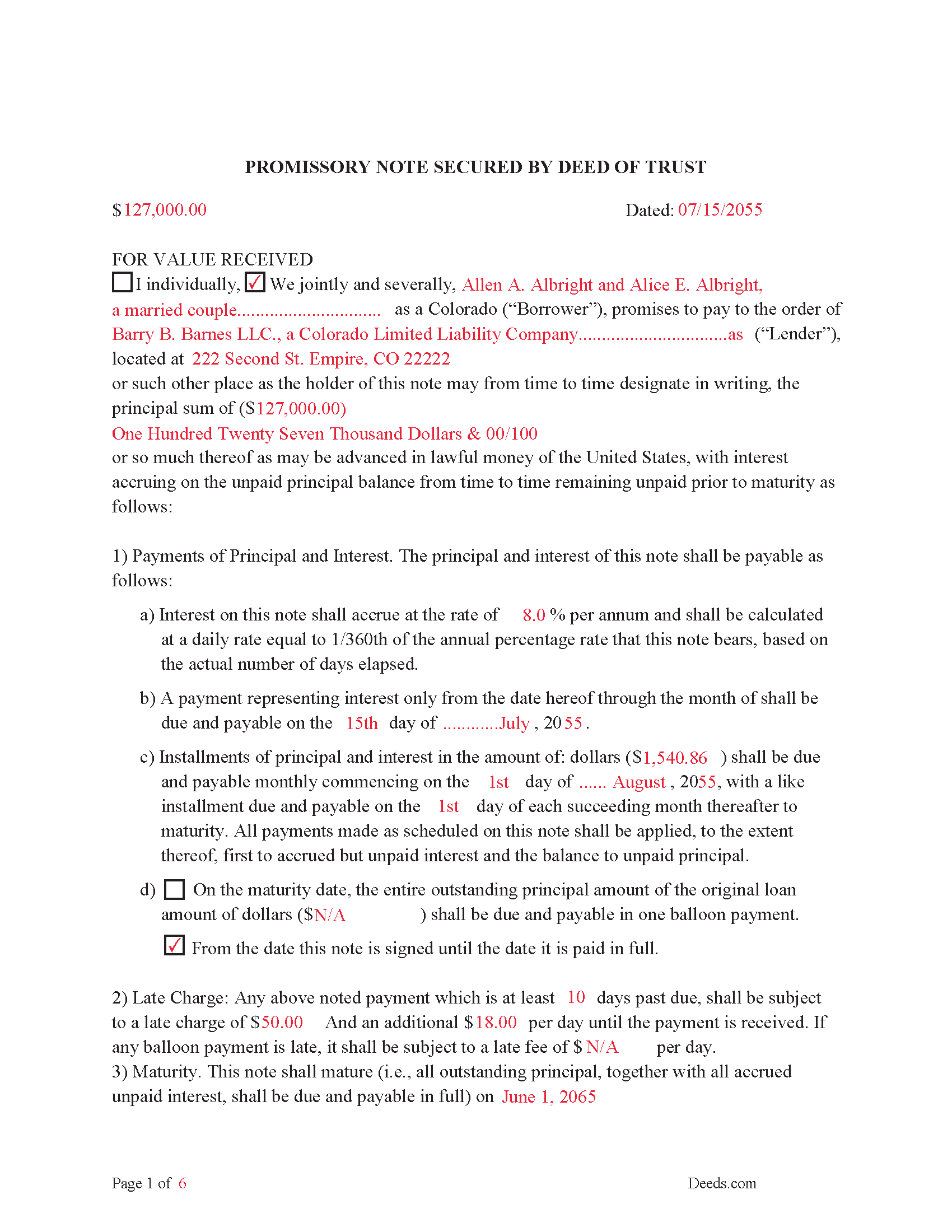

Hinsdale County Promissory Note Form

Note that is secured by the Deed of Trust.

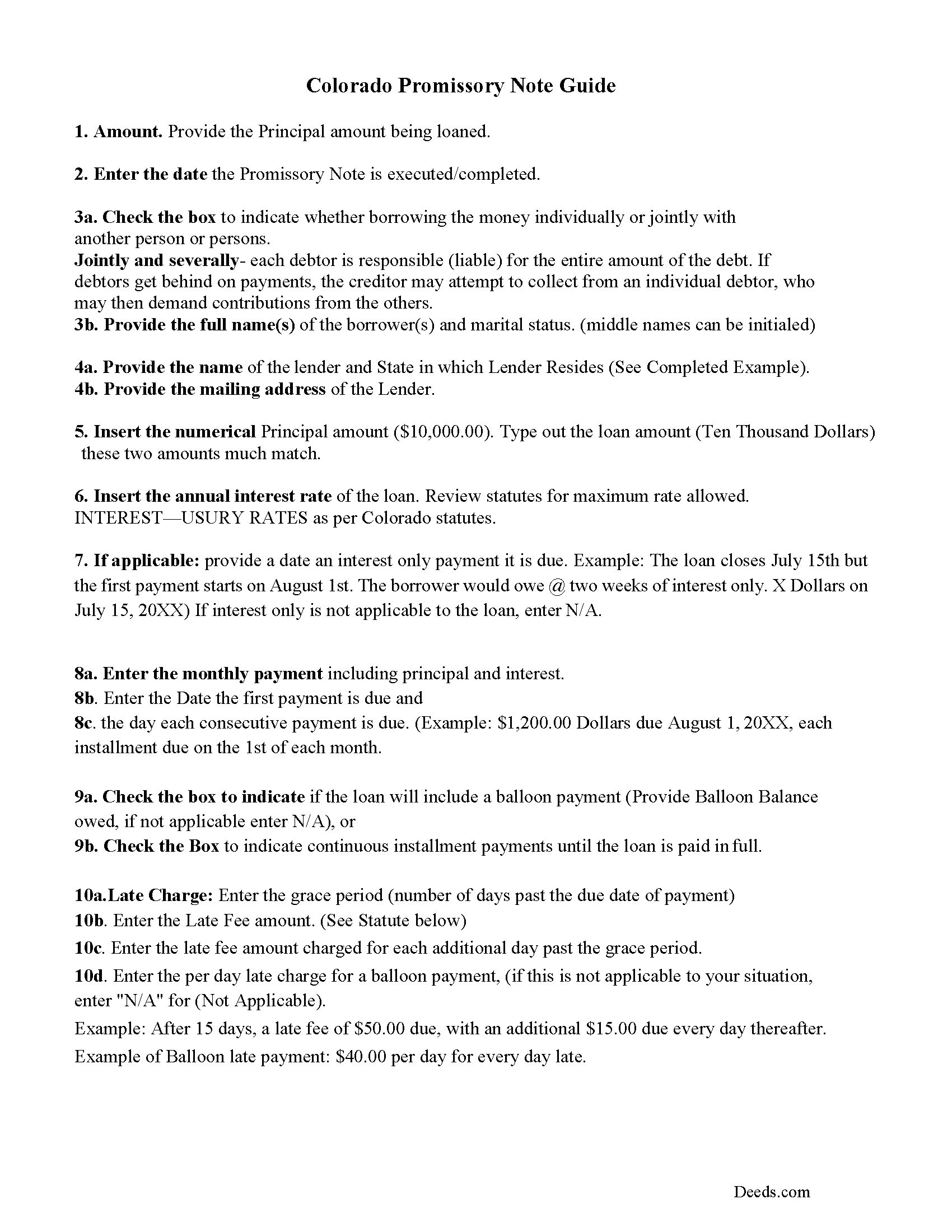

Hinsdale County Promissory Note Guidelines

Line by line guide explaining every blank on the form.

Hinsdale County Completed Example of the Promissory Note Document

Example of a properly completed form for reference.

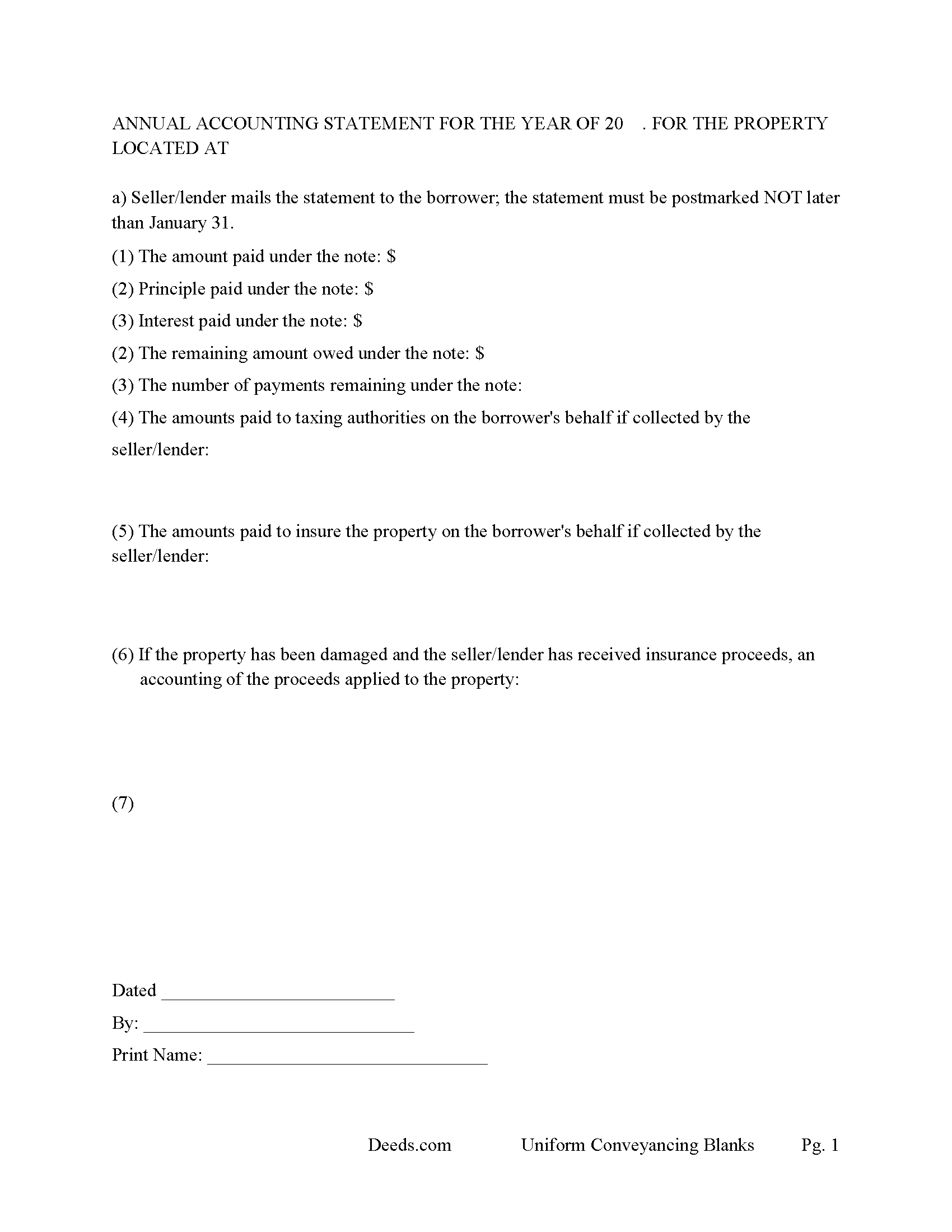

Hinsdale County Annual Accounting Statement Form

Mail to borrower for fiscal year reporting.

All 7 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Colorado and Hinsdale County documents included at no extra charge:

Where to Record Your Documents

Hinsdale County Clerk

Lake City, Colorado 81235

Hours: Monday through Friday 7 am to 5:30 pm

Phone: (970) 944-2225

Recording Tips for Hinsdale County:

- Bring your driver's license or state-issued photo ID

- Ensure all signatures are in blue or black ink

- Ask if they accept credit cards - many offices are cash/check only

- Documents must be on 8.5 x 11 inch white paper

Cities and Jurisdictions in Hinsdale County

Properties in any of these areas use Hinsdale County forms:

- Lake City

Hours, fees, requirements, and more for Hinsdale County

How do I get my forms?

Forms are available for immediate download after payment. The Hinsdale County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Hinsdale County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Hinsdale County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Hinsdale County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Hinsdale County?

Recording fees in Hinsdale County vary. Contact the recorder's office at (970) 944-2225 for current fees.

Questions answered? Let's get started!

Deeds of Trust are the preferred method of securing debt on property in Colorado, if the Deed of Trust includes a proper power of sale clause the lender can pursue a public trustee foreclosure in the case of default. The borrower pre-authorizes the sale of property to pay off the balance on a loan in the event of the their default.

("Deed of trust" means a security instrument containing a grant to a public trustee together with a power of sale.) ( 38-38-100.3(7))

A promissory note is a promise to pay and includes things such as interest rates, default rates, late fees, penalties, etc. The Deed of Trust makes the promissory note a debt secured by a lien on the subject property. In Colorado a promissory note must include the loan amount, payment schedule and time frame. Both borrowers and lenders must sign.

For use in Colorado only on residential property, rental property, condominiums, vacant land, second homes and planned units.

(Colorado Deed of Trust Package includes forms, guidelines, and completed examples)

Important: Your property must be located in Hinsdale County to use these forms. Documents should be recorded at the office below.

This Deed of Trust and Promissory Note meets all recording requirements specific to Hinsdale County.

Our Promise

The documents you receive here will meet, or exceed, the Hinsdale County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Hinsdale County Deed of Trust and Promissory Note form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Dennis D.

August 4th, 2022

Heard about this service from a lawyer who said their offic used it quite a bit.

Thank you for your feedback. We really appreciate it. Have a great day!

Laura H.

August 25th, 2020

I was very impressed with how quickly I was provided the data.

Thank you!

Catherine J S.

November 17th, 2022

Did not like that the lines aren't lining up smoothly to make the document look more professional.

Thank you for your feedback. We really appreciate it. Have a great day!

AKILAH S.

March 14th, 2024

It was a little challenging and I had to call to speak to someone a few time but I got it done and and over with so I'm happy.

It was a pleasure serving you. Thank you for the positive feedback!

Tonya J.

December 14th, 2019

User friendly and fast response time!!

Thank you for your feedback. We really appreciate it. Have a great day!

Mark S.

September 14th, 2023

The forms were easy and convenient to use

Thank you Mark. We appreciate your feedback.

Benjamin B.

November 10th, 2022

Your software was beneficial; facilitating preparation of a legal document and cover page in a state where I had limited legal experience.

Thank you for your feedback. We really appreciate it. Have a great day!

Gregory C.

March 17th, 2022

All of these forms should be downloadable in .zip format - having to do 8-9 downloads is ridiculous, respectfully.

Thank you for your feedback. We really appreciate it. Have a great day!

Darrell P.

February 23rd, 2019

My legal description exceeds the avaiable space in the one page Exhibit A...any way to add a second page as 'Exhibit A (continued)'?

It is not required to use the included exhibit page. Simply label your printed legal description as the appropriate exhibit.

Hal M.

September 23rd, 2022

Very good, and easy and fast to use.

Thank you!

Phyllis B.

May 24th, 2022

I saved a ton of money doing it on my own versus through legal counsel. When I took it to the auditor/recorder today, there was absolutely no problems.

Thank you for your feedback. We really appreciate it. Have a great day!

brian o.

September 17th, 2022

I was needing some forms from another state. I am a lawyer but don't have ready access to out of state forms. I was impressed with how thorough the intake process was. Very nice that I could download the form in Word so that I could adjust a few things. Very fine service. I recommend.

Thank you!

Cynthia S.

January 19th, 2019

Good find, provides guide to use.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Diane C.

December 5th, 2019

Hey, great job! Love these forms. They make the process really easy.

Great to hear Diane, have a fantastic day!

Diana D.

June 23rd, 2020

I was very pleased as to how fast and easy the service was. I recommend this service to any one. It's not expensive and it was worth it. Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!