San Juan County Statement of Mechanics Lien Form

San Juan County Statement of Mechanics Lien Form

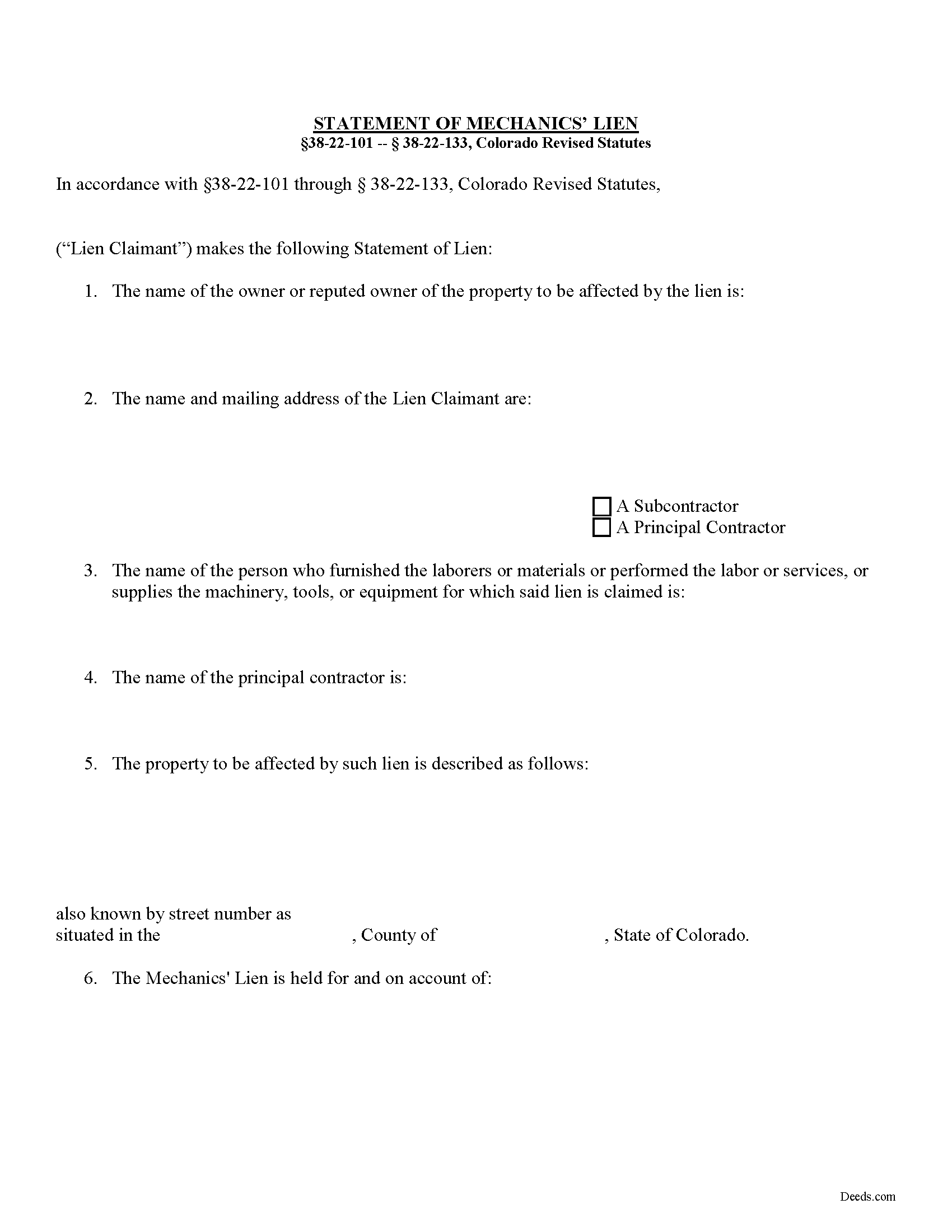

Fill in the blank Statement of Mechanics Lien form formatted to comply with all Colorado recording and content requirements.

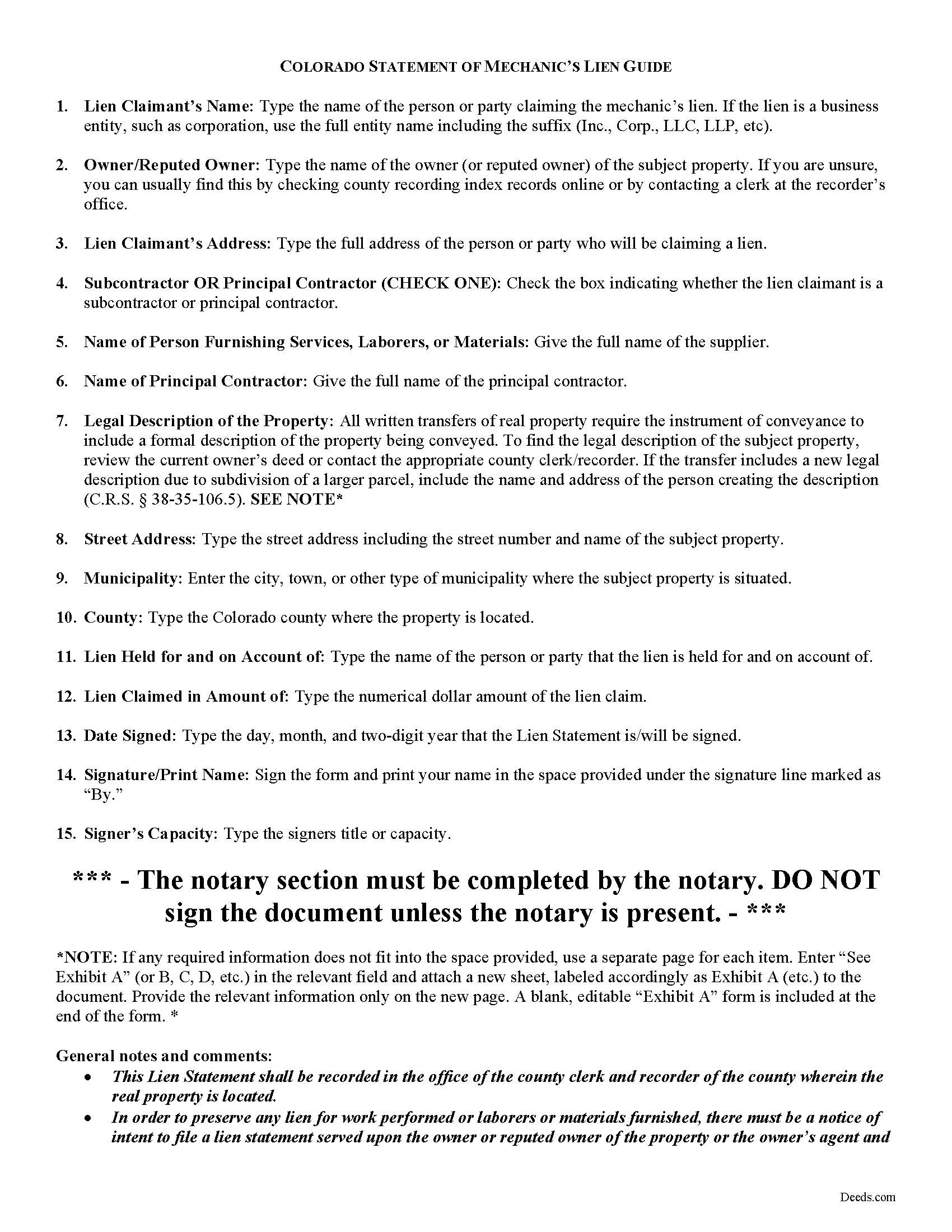

San Juan County Statement of Lien Guide

Line by line guide explaining every blank on the form.

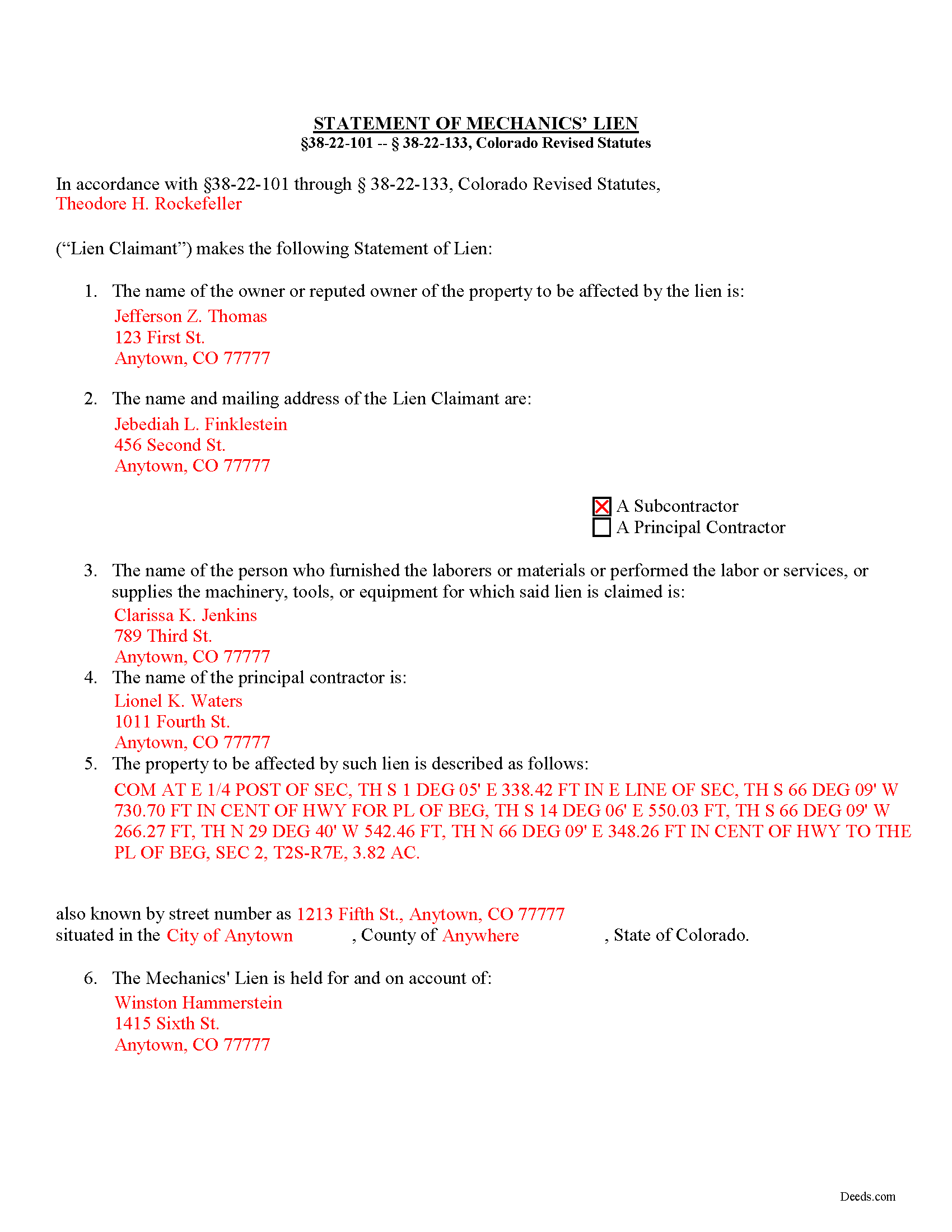

San Juan County Completed Example of the Verified Statement of Lien Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Colorado and San Juan County documents included at no extra charge:

Where to Record Your Documents

San Juan County Clerk and Recorder

Silverton, Colorado 81433

Hours: 8:00 to 12:00 & 1:00 to 4:00 Mon-Fri

Phone: (970) 387-5671

Recording Tips for San Juan County:

- Ask if they accept credit cards - many offices are cash/check only

- Avoid the last business day of the month when possible

- Recording early in the week helps ensure same-week processing

Cities and Jurisdictions in San Juan County

Properties in any of these areas use San Juan County forms:

- Silverton

Hours, fees, requirements, and more for San Juan County

How do I get my forms?

Forms are available for immediate download after payment. The San Juan County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in San Juan County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by San Juan County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in San Juan County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in San Juan County?

Recording fees in San Juan County vary. Contact the recorder's office at (970) 387-5671 for current fees.

Questions answered? Let's get started!

Statement of Lien in Colorado

Contractors and subcontractors have a unique remedy available to them when a property owner or some other party involved in the "chain" refuses to pay up. This special remedy is called a mechanic's lien, also sometimes known as a contractors, materialman, or construction lien. The lien works like a mortgage by giving a type of property interest to the lien holder. With a lien in place, it becomes more difficult for the owner to sell or refinance a property. Other contractors will also see there is already a lien before they begin any additional work. In Colorado, mechanic's liens are governed under 38-22-101 -- 38-22-133 of the Colorado Revised Statutes (C.R.S.). In Colorado, claimants must file a Statement of Lien document to claim a mechanic's lien.

The Statement of Lien must contain the following: (1) The name of the owner or reputed owner of such property, or in case such name is not known to him, a statement to that effect; (2) the name of the person claiming the lien; (3) the name of the person who furnished the laborers or materials or performed the labor for which the lien is claimed; (4) the name of the contractor when the lien is claimed by a subcontractor or by the assignee of a subcontractor, or, in case the name of such contractor is not known to a lien claimant, a statement to that effect; (5) a description of the property to be charged with the lien, sufficient to identify it; and (6) a statement of the amount due or owing such claimant. C.R.S. 38-22-109(1).

The Lien Statement must be signed and sworn to by the party, or by one of the parties who is claiming the lien, or by some other person on their behalf, to the best knowledge, information, and belief of the affiant; and the signature of any such affiant to any such verification shall be a sufficient signing of the statement. C.R.S. 38-22-109(2).

Before the Lien Statement can be filed, you must have fulfilled the preliminary notice requirement. In order to preserve any lien for work performed or laborers or materials furnished, there must be a notice of intent to file a lien statement served upon the owner or reputed owner of the property (or the owner's agent and the principal or prime contractor or his or her agent) at least ten (10) days before the time of filing the lien statement with the county clerk and recorder. C.R.S. 38-22-109(3). The notice of intent must be served by personal service or by registered or certified mail, return receipt requested, addressed to the last known address of such persons, and an affidavit of such service or mailing at least ten (10) days before filing of the lien statement. Id.

The timeline for filing the lien depends on who is the party claiming the lien. Mechanic's liens claimed for labor and work by the day or piece, (but without furnishing laborers or materials), must be filed for record after the last items of labor has been performed and at any time before the expiration of two months after the labor or work is completed. C.R.S. 38-22-109(4). All other lien claimants must file their claims at any time before the expiration of four months after the day on which the last labor is performed or the last act of furnishing laborers or materials. C.R.S. 38-22-109(5).

If there is an error in a filed lien statement, a new or amended statement may be filed within the periods provided for claiming a lien to correct or cure any mistake (or for the purpose of more fully complying with the provisions of the lien law). C.R.S. 38-22-109(6).

Once the lien is in place, remember it won't last forever. A mechanic's lien will not remain effective longer than one year from the filing of the lien, unless within thirty days after each annual anniversary of the filing of the lien statement, the lien claimant files an affidavit in the office of the county clerk and recorder of the county wherein the property is located, stating that the improvements on said property have not been completed. C.R.S. 38-22-109(8).

This article is provided for informational purposes only and should not be relied upon a substitute for the advice of an attorney. If you have any questions about claiming a mechanic's lien, please contact a Colorado-licensed attorney.

Important: Your property must be located in San Juan County to use these forms. Documents should be recorded at the office below.

This Statement of Mechanics Lien meets all recording requirements specific to San Juan County.

Our Promise

The documents you receive here will meet, or exceed, the San Juan County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your San Juan County Statement of Mechanics Lien form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4587 Reviews )

Cameron M.

June 6th, 2023

This service is amazing. Always same day recording. Quick and easy. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

jeann p.

September 19th, 2024

The site was extremely helpful.

We are delighted to have been of service. Thank you for the positive review!

Robert S.

March 2nd, 2025

My Quick claim formsi downloaded had not come through so I contacted customer service and they provided me with the instructions on how to retrieve my forms, A plus service.

We are delighted to have been of service. Thank you for the positive review!

Kay Y.

February 27th, 2024

Fast and easy service.

Your words of encouragement and feedback are greatly appreciated. They motivate us to maintain high standards in our service.

Roger A.

November 2nd, 2023

Easy peasy to use! It's great to have the guide for completing the form and an example of a completed form.

It was a pleasure serving you. Thank you for the positive feedback!

Thomas G.

November 21st, 2024

Wasn’t what I expected

Sorry to hear that your expectations were missed. Your order has been canceled. We do hope that you find something more suitable to your expectations elsewhere. Do keep in mind that purchasing legal forms should not be an exploratory endeavor.

Brenda W.

June 30th, 2021

Good.

Thank you for your feedback. We really appreciate it. Have a great day!

Sherri S.

July 3rd, 2019

Appreciate your diligent assistance.

Thank you!

Theresa M.

October 25th, 2021

This company was very thorough in having all the forms that I needed.

Thank you!

Julie C.

July 21st, 2020

The process worked great! It's a great solution for recording documents at the county during the pandemic and in the future if you don't want to leave home!!

Thank you!

SAMANTHA P.

September 19th, 2021

Very easy very clear very informative of direct information stating the obvious and the underlining of both contexts. Right place for the right Tools to establish ,verify ,correct then guidance for not only myself, but for our legacy that should and will be live on to be know. Thank you deeds.com!

Thank you!

RICHARD M.

May 12th, 2020

After a little glitch due to heavy volume at the County Recorder, my document was recorded. County Recorder was closed to public access at the office (due to the coronavirus issues) so all documents were either mailed to them or sent in electronically. Deeds.com was very efficient at their end with very quick responses to my questions and concerns. I would definitely use their services again.

Thank you for your feedback. We really appreciate it. Have a great day!

Shawn H.

April 16th, 2019

The site provided exactly what I needed when I needed it.

Thank you for your feedback. We really appreciate it. Have a great day!

Glenda C.

February 21st, 2021

It was easy to find what I was looking for. The instructions were easy to follow. The example given was most beneficial in completing form.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Myron L.

November 29th, 2020

The forms were not identical to the county's version but it met my needs.

Thank you!