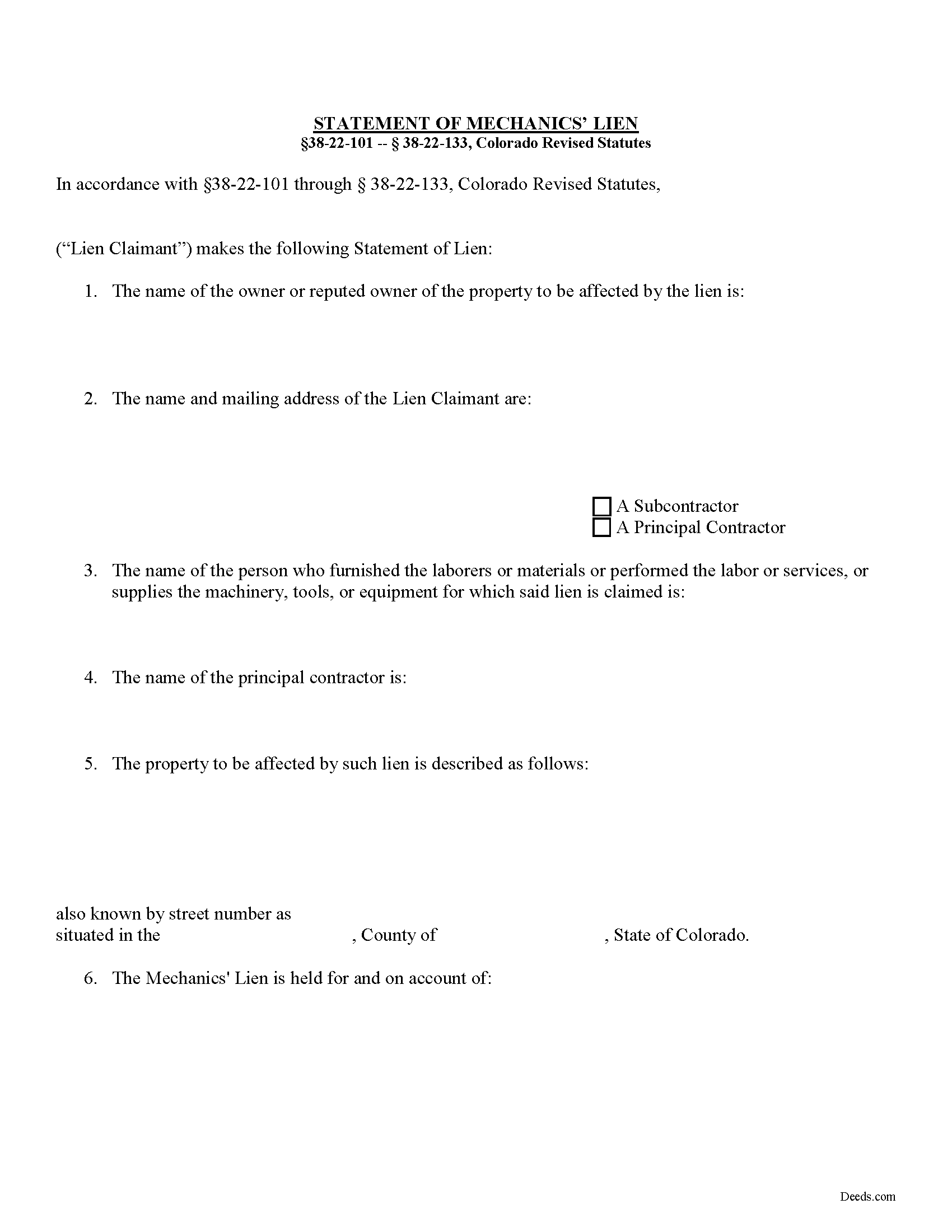

Teller County Statement of Mechanics Lien Form

Teller County Statement of Mechanics Lien Form

Fill in the blank Statement of Mechanics Lien form formatted to comply with all Colorado recording and content requirements.

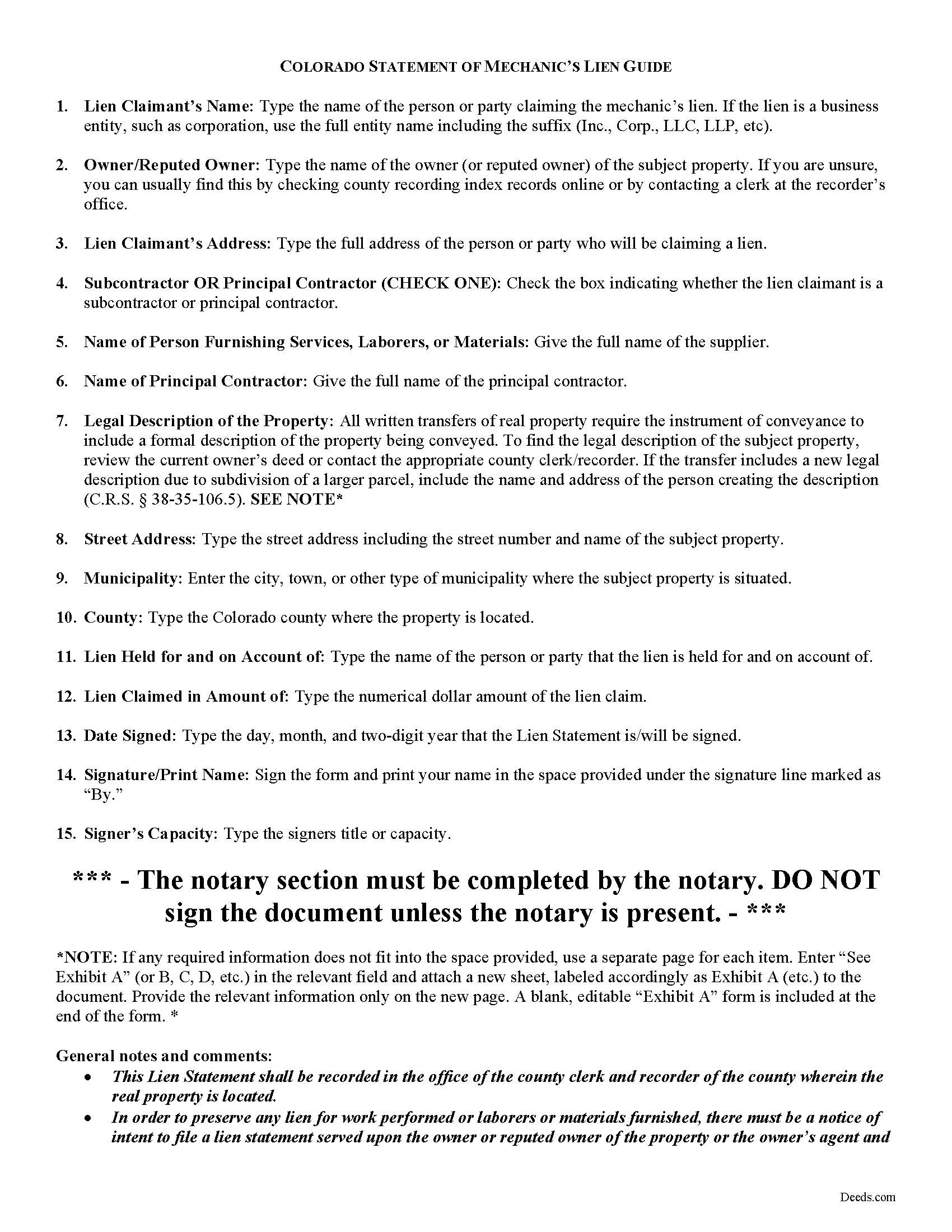

Teller County Statement of Lien Guide

Line by line guide explaining every blank on the form.

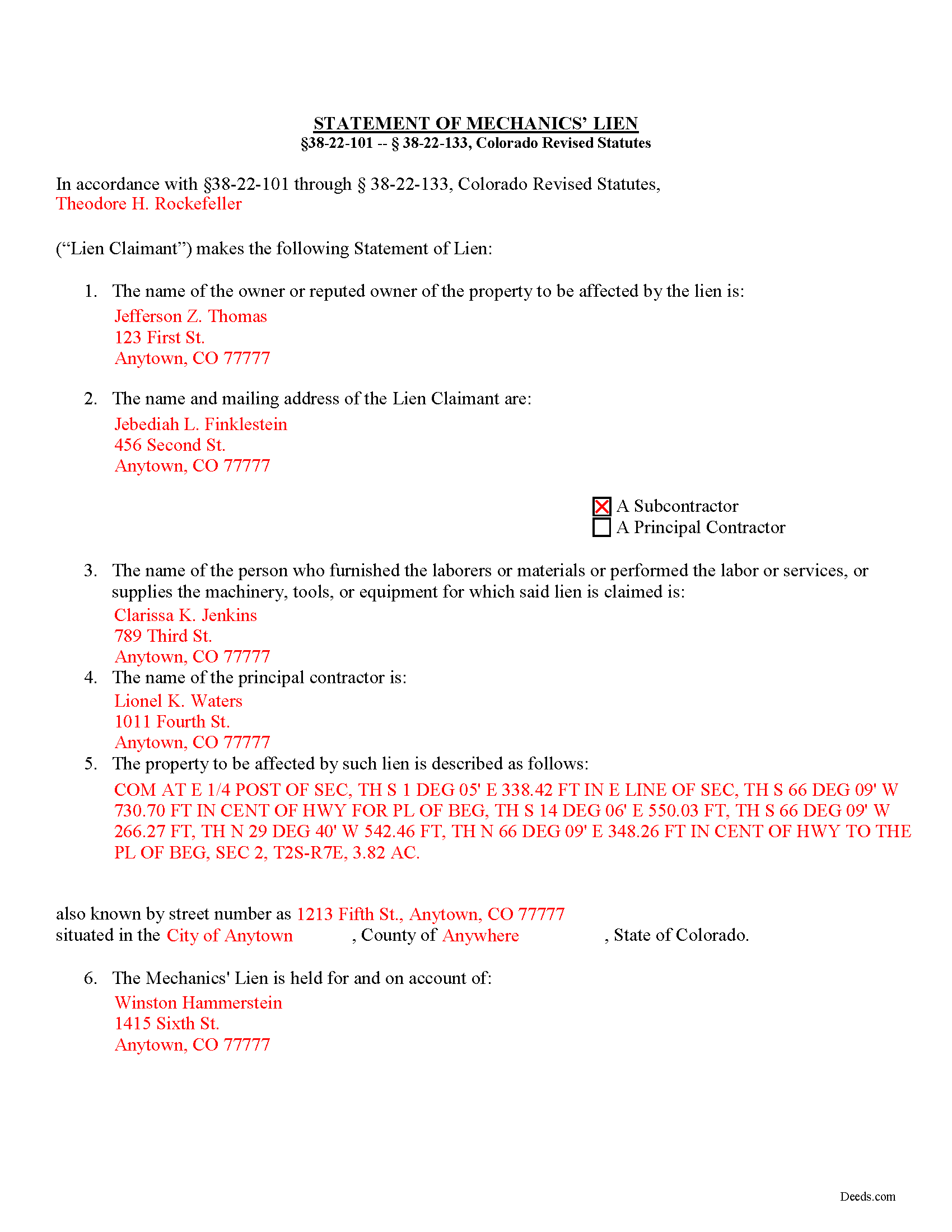

Teller County Completed Example of the Verified Statement of Lien Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Colorado and Teller County documents included at no extra charge:

Where to Record Your Documents

Branch Office location at Tamarac Business Center in Woodland Park

Woodland Park, Colorado 80863

Hours: 7:30 AM - 4:00 PM Monday thru Friday

Phone: 719-689-2951

Teller County Clerk and Recorder

Cripple Creek, Colorado 80813

Hours: 8:00 to 4:30 Mon-Fri

Phone: (719) 689-2951 x4

Recording Tips for Teller County:

- Bring your driver's license or state-issued photo ID

- Verify all names are spelled correctly before recording

- Documents must be on 8.5 x 11 inch white paper

- Bring extra funds - fees can vary by document type and page count

- Recorded documents become public record - avoid including SSNs

Cities and Jurisdictions in Teller County

Properties in any of these areas use Teller County forms:

- Cripple Creek

- Divide

- Florissant

- Victor

- Woodland Park

Hours, fees, requirements, and more for Teller County

How do I get my forms?

Forms are available for immediate download after payment. The Teller County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Teller County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Teller County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Teller County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Teller County?

Recording fees in Teller County vary. Contact the recorder's office at 719-689-2951 for current fees.

Questions answered? Let's get started!

Statement of Lien in Colorado

Contractors and subcontractors have a unique remedy available to them when a property owner or some other party involved in the "chain" refuses to pay up. This special remedy is called a mechanic's lien, also sometimes known as a contractors, materialman, or construction lien. The lien works like a mortgage by giving a type of property interest to the lien holder. With a lien in place, it becomes more difficult for the owner to sell or refinance a property. Other contractors will also see there is already a lien before they begin any additional work. In Colorado, mechanic's liens are governed under 38-22-101 -- 38-22-133 of the Colorado Revised Statutes (C.R.S.). In Colorado, claimants must file a Statement of Lien document to claim a mechanic's lien.

The Statement of Lien must contain the following: (1) The name of the owner or reputed owner of such property, or in case such name is not known to him, a statement to that effect; (2) the name of the person claiming the lien; (3) the name of the person who furnished the laborers or materials or performed the labor for which the lien is claimed; (4) the name of the contractor when the lien is claimed by a subcontractor or by the assignee of a subcontractor, or, in case the name of such contractor is not known to a lien claimant, a statement to that effect; (5) a description of the property to be charged with the lien, sufficient to identify it; and (6) a statement of the amount due or owing such claimant. C.R.S. 38-22-109(1).

The Lien Statement must be signed and sworn to by the party, or by one of the parties who is claiming the lien, or by some other person on their behalf, to the best knowledge, information, and belief of the affiant; and the signature of any such affiant to any such verification shall be a sufficient signing of the statement. C.R.S. 38-22-109(2).

Before the Lien Statement can be filed, you must have fulfilled the preliminary notice requirement. In order to preserve any lien for work performed or laborers or materials furnished, there must be a notice of intent to file a lien statement served upon the owner or reputed owner of the property (or the owner's agent and the principal or prime contractor or his or her agent) at least ten (10) days before the time of filing the lien statement with the county clerk and recorder. C.R.S. 38-22-109(3). The notice of intent must be served by personal service or by registered or certified mail, return receipt requested, addressed to the last known address of such persons, and an affidavit of such service or mailing at least ten (10) days before filing of the lien statement. Id.

The timeline for filing the lien depends on who is the party claiming the lien. Mechanic's liens claimed for labor and work by the day or piece, (but without furnishing laborers or materials), must be filed for record after the last items of labor has been performed and at any time before the expiration of two months after the labor or work is completed. C.R.S. 38-22-109(4). All other lien claimants must file their claims at any time before the expiration of four months after the day on which the last labor is performed or the last act of furnishing laborers or materials. C.R.S. 38-22-109(5).

If there is an error in a filed lien statement, a new or amended statement may be filed within the periods provided for claiming a lien to correct or cure any mistake (or for the purpose of more fully complying with the provisions of the lien law). C.R.S. 38-22-109(6).

Once the lien is in place, remember it won't last forever. A mechanic's lien will not remain effective longer than one year from the filing of the lien, unless within thirty days after each annual anniversary of the filing of the lien statement, the lien claimant files an affidavit in the office of the county clerk and recorder of the county wherein the property is located, stating that the improvements on said property have not been completed. C.R.S. 38-22-109(8).

This article is provided for informational purposes only and should not be relied upon a substitute for the advice of an attorney. If you have any questions about claiming a mechanic's lien, please contact a Colorado-licensed attorney.

Important: Your property must be located in Teller County to use these forms. Documents should be recorded at the office below.

This Statement of Mechanics Lien meets all recording requirements specific to Teller County.

Our Promise

The documents you receive here will meet, or exceed, the Teller County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Teller County Statement of Mechanics Lien form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4587 Reviews )

RUSSELL E.

August 5th, 2020

The process sure was easy and fast. Not sure why a rep would question why I am requesting an exhibit page on the Deed when that's a common practice here in AZ. They recorded it the way I sent it so all good.

Thank you!

Angie K.

March 29th, 2019

Thank You!

Thank you Angie.

Rasheedah M.

October 9th, 2020

Excellent service. Received the exact quit claim form and additional information promptly. Thank you so much!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Rosie R.

November 22nd, 2021

LOVE THIS!! I am a REALTORand from time to time I have had to take documents for filing. I'm so glad I invested some time online researching eFiling services. The first few search results that populated required an expensive annual or monthly subscription. Luckily I continued to scroll and found Deeds.com. No annual or monthly subscription required. Just pay per use. I uploaded a ROL late one night and Deed.com had it eFiled the very next morning!!! They keep you updated throughout the process via email notifications which you click on the link provided in the email that directs you to your online portal to view the status and once your documents have been filed you can immediately download the filed of record documents including the receipt from the county in which the documents were filed. SO SIMPLE, CONVENIENT, & QUICK-THANK YOU DEEDS.com!!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Nigel S.

June 24th, 2025

Very simple to use. The 'completed examples' are very helpful.

Thank you for your feedback. We really appreciate it. Have a great day!

Gretchen D.

January 7th, 2019

Quick and easy process to get the documents, and helpful to see the example filled out.

Thank you for your feedback Gretchen, we really appreciate it. Have a great day!

Sandra K.

April 29th, 2019

Seems fairly simple with forms and instructions

Thank you for your feedback. We really appreciate it. Have a great day!

Janice W.

January 25th, 2019

Great instructions, samples, ease in getting the form I needed, filling it out as a PDF, and having it ready for a Notary's signature. I was hesitant a first, but glad I paid the fee - now it is done!

Great to hear Janice! Thanks, have a great day!

James A.

June 11th, 2019

As advertised.

Thank you!

David S.

August 2nd, 2019

The form was just what I needed for the Circuit Court and Land Records office. The additional information provided was very helpful as well.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Constance R.

July 13th, 2020

It was very easy to e-file. I liked it.

Thank you for your feedback. We really appreciate it. Have a great day!

Edward B.

May 13th, 2020

Thank you for the rapid response. I shall persevere in my search using other public records. I shall keep your website handy for other such searches in the future.

Thank you!

Nancy J.

September 9th, 2020

It is helpful that an example of filled out form is included.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Samantha B.

December 9th, 2020

Awesome service! This took care of my needs 10x faster than I thought possible. I even bought an extra service that wasn't needed to accomplish my end goal and they refunded me without me even asking. Highly recommend!

Thank you for your feedback. We really appreciate it. Have a great day!

george k.

March 6th, 2019

Thank u the site helped me get the quick deed forms I needed for TN.i will use it in the furture.

Thank you for your feedback. We really appreciate it. Have a great day!