Litchfield County Disclaimer of Interest Form (Connecticut)

All Litchfield County specific forms and documents listed below are included in your immediate download package:

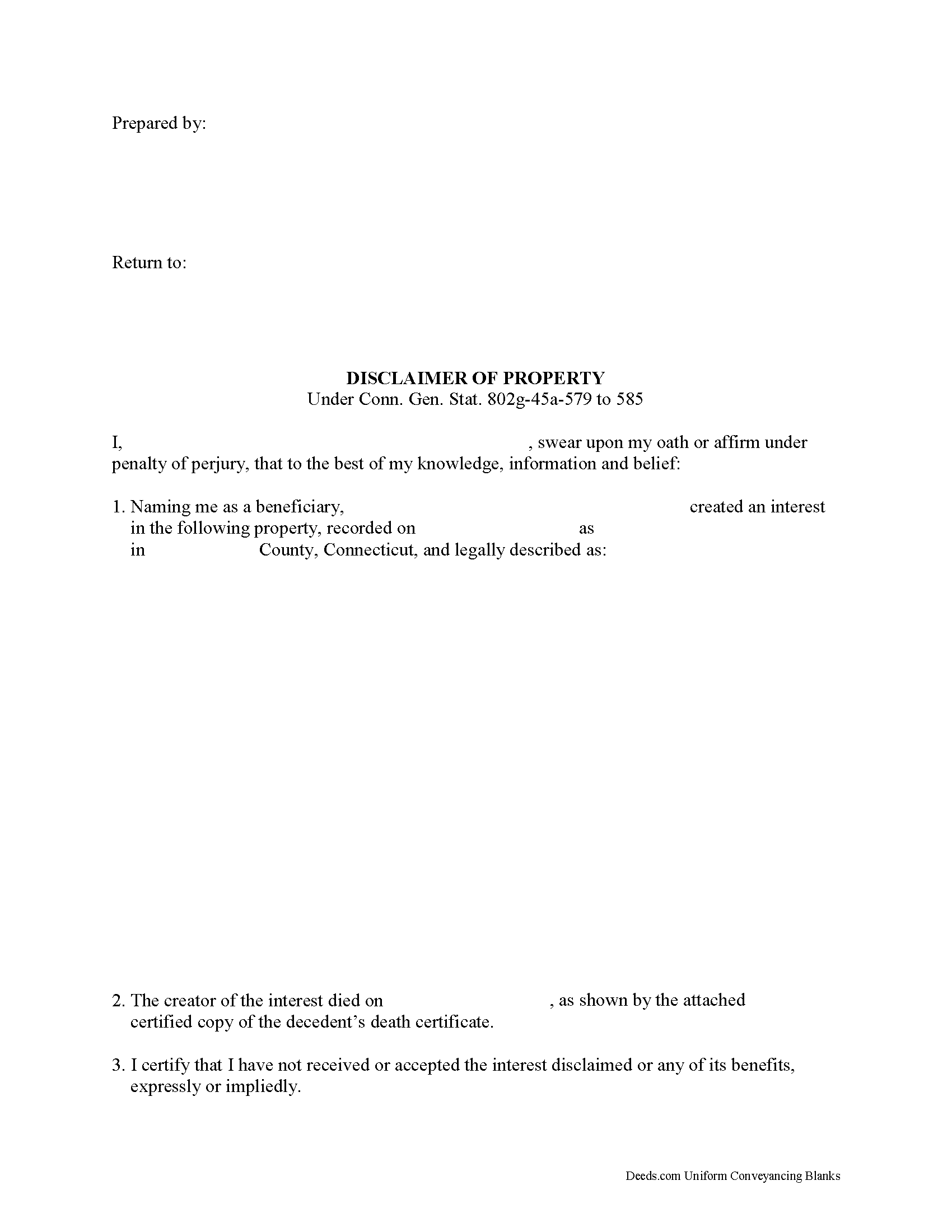

Disclaimer of Interest Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Litchfield County compliant document last validated/updated 1/28/2025

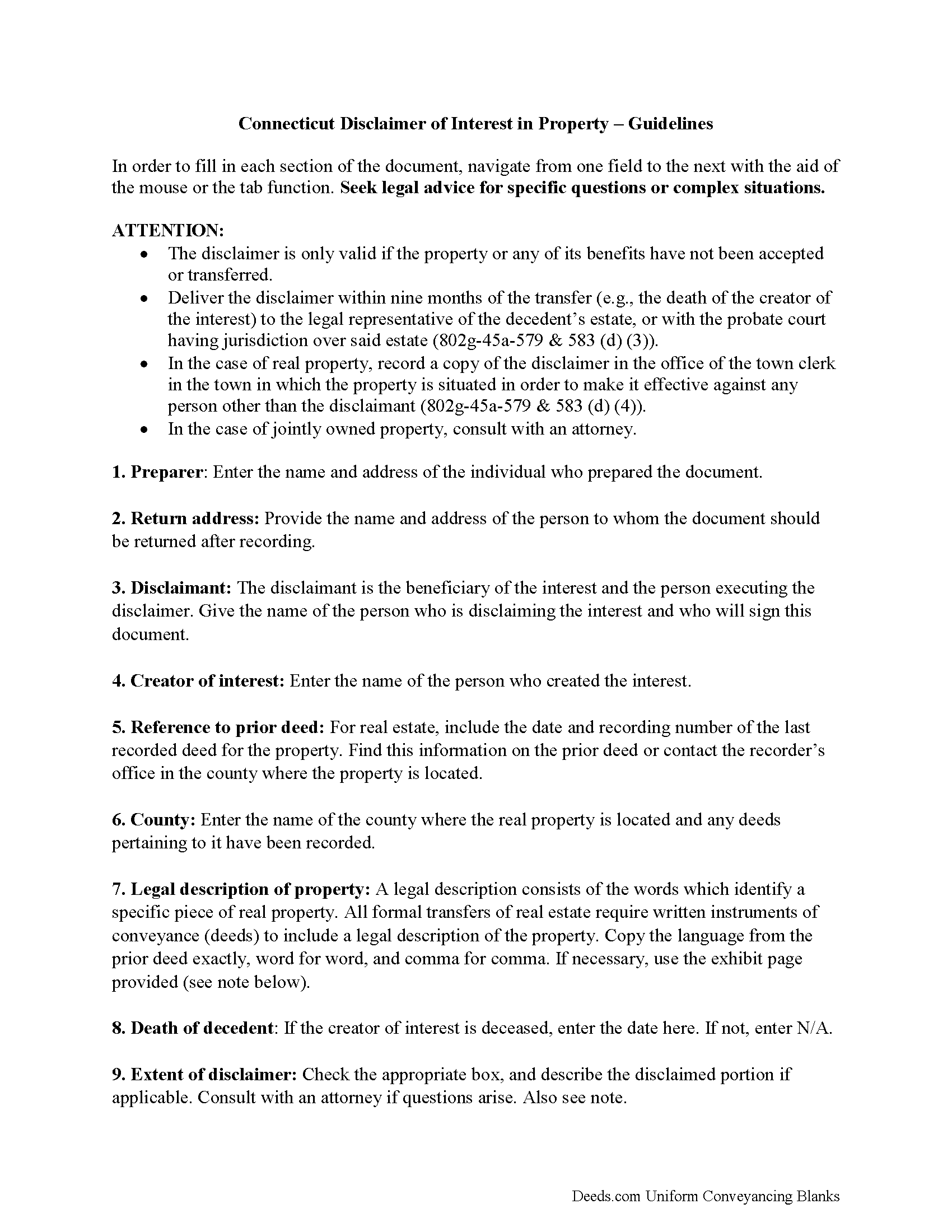

Disclaimer of Interest Guide

Line by line guide explaining every blank on the form.

Included Litchfield County compliant document last validated/updated 10/21/2024

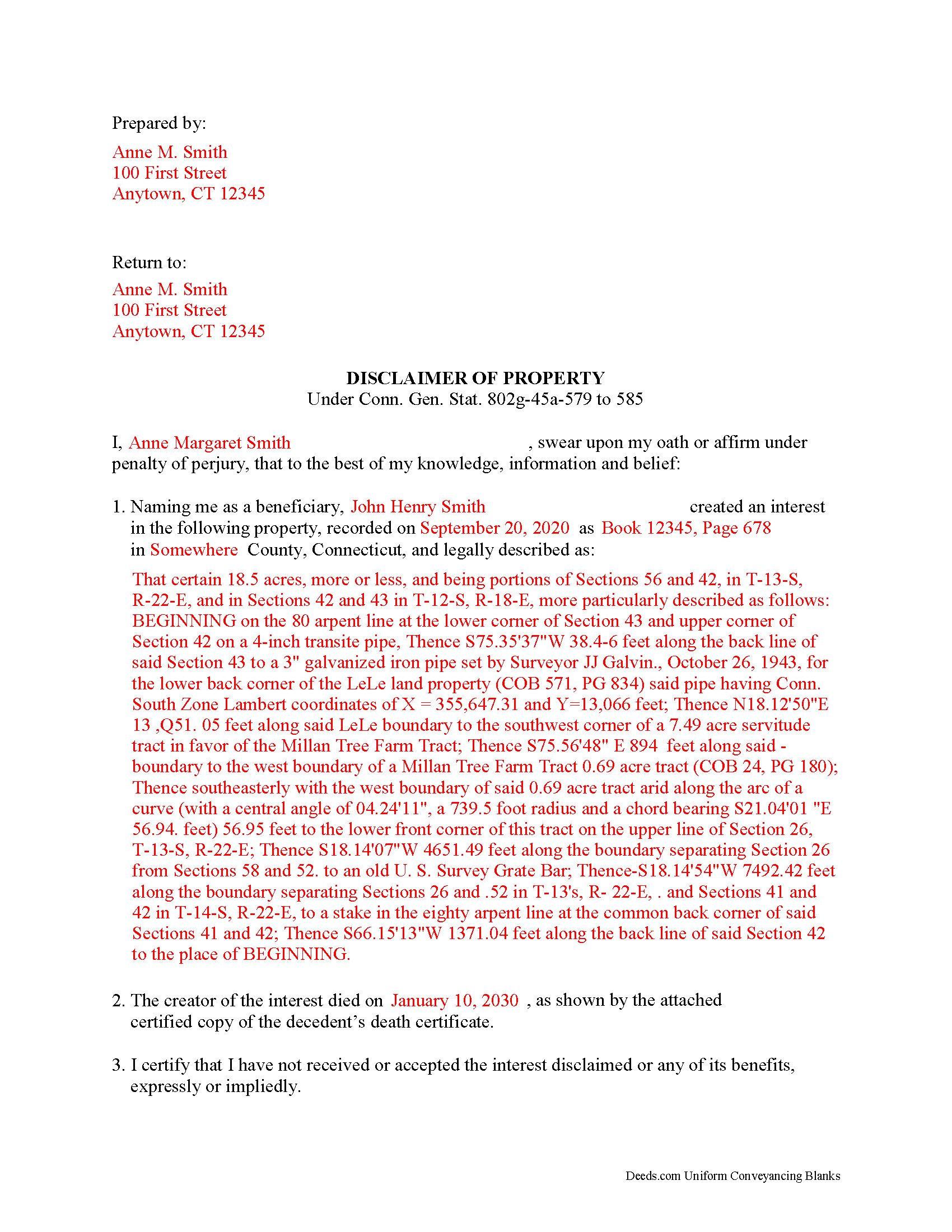

Completed Example of the Disclaimer of Interest Document

Example of a properly completed form for reference.

Included Litchfield County compliant document last validated/updated 6/11/2025

The following Connecticut and Litchfield County supplemental forms are included as a courtesy with your order:

When using these Disclaimer of Interest forms, the subject real estate must be physically located in Litchfield County. The executed documents should then be recorded in one of the following offices:

Barkhamsted Town Clerk

67 Ripley Hill Rd, Barkhamsted, Connecticut 06063-3340

Hours: Mon, Tue, Thu 9:00 to 4:00; Wed 9:00 to 5:00; Fri 9:00 to 12:00

Phone: (860) 379-8665

Bethlehem Town Clerk

36 Main St South, Bethlehem, Connecticut 06751

Hours: Mon closed; Tue-Fri 9:00 to 12:00; Tue 5:00 to 7:00; 1st & 3rd Sat 9:00 to 12:00 (exc July & Aug)

Phone: (203) 266-7510 Ext 207

Bridgewater Town Clerk

44 Main St S / PO Box 216, Bridgewater, Connecticut 06752

Hours: Mon, Wed-Fri 8:00 to 12:30; Tue 8:00 to 3:30

Phone: (860) 354-5102

Canaan Town Clerk

108 Main St / PO Box 47, Falls Village, Connecticut 06031-0047

Hours: Mon-Thu 9:00 to 3:00

Phone: (860) 824-0707 Ext 10

Colebrook Town Clerk

562 Colebrook Rd / PO Box 5, Colebrook, Connecticut 06021

Hours: Mon-Thu 9:00 to 12:00 & 1:00 to 4:30; Fri 9:00 to 12:00

Phone: (860) 379-3359 Ext 213

Cornwall Town Clerk

26 Pine St / PO Box 97, Cornwall, Connecticut 06753

Hours: Mon-Thu 9:00 to 12:00 & 1:00 to 4:00

Phone: (860) 672-2709

Goshen Town Clerk

42C North St, Goshen, Connecticut 06756

Hours: Mon-Thu 9:00 to 12:00 & 1:00 to 4:00; Fri 9:00 to 1:00 and by appt

Phone: (860) 491-3647

Harwinton Town Clerk

100 Bentley Dr / PO Box 66, Harwinton, Connecticut 06791

Hours: Mon, Tue, Thu 8:30 to 4:00; Wed 8:30 to 6:00; Fri 8:30 to 12:30

Phone: (860) 485-9613

Kent Town Clerk

Town Hall - 41 Kent Green Blvd / PO Box 843, Kent, Connecticut 06757

Hours: Mon-Thu 9:00 to 4:00; Fri 9:00 to 12:00

Phone: (860) 927-3433

Litchfield Town Clerk

74 West St / PO Box 488, Litchfield, Connecticut 06759

Hours: Mon-Fri 9:00 to 4:30

Phone: (860) 567-7561

Morris Town Clerk

Town Hall - 3 East St / PO Box 66, Morris, Connecticut 06763

Hours: Mon-Wed 8:30 to 4:00; Thu 8:30 to 6:00; Fri & 1st Sat 8:30 to 12:00

Phone: (860) 567-7433

New Hartford Town Clerk

Town Hall - 530 Main St / PO Box 426, New Hartford, Connecticut 06057

Hours: Call for hours

Phone: (860) 379-5037

New Milford Town Clerk

Town Hall - 10 Main St, New Milford, Connecticut 06776

Hours: Mon-Fri 8:00 to 4:00

Phone: (860) 355-6020

Norfolk Town Clerk

19 Maple Ave / PO Box 552, Norfolk, Connecticut 06058

Hours: Mon-Thu 8:30 to 12:00 & 1:00 to 4:00; Fri 8:30 to 12:00

Phone: (860) 542-5679

North Canaan Town Clerk

Town Hall - 100 Pease St #7, North Canaan, Connecticut 06018

Hours: Mon-Fri 9:30 to 12:00 & 1:00 to 4:00

Phone: (860) 824-7313 Ext 106

Plymouth Town Clerk

Town Hall - 80 Main St, Terryville, Connecticut 06786

Hours: Mon-Fri 8:30 to 4:30

Phone: (860) 585-4039

Roxbury Town Clerk

29 North St / PO Box 203, Roxbury, Connecticut 06783

Hours: Tue,Thu 9:00 to 12:00 & 1:00 to 4:00; Wed, Fri 9:00 to 12:00

Phone: (860) 354-3328

Salisbury Town Clerk

27 Main St / PO Box 548, Salisbury, Connecticut 06068

Hours: Mon-Fri 9:00 to 3:30

Phone: (860) 435-5182

Sharon Town Clerk

63 Main St / PO Box 224, Sharon, Connecticut 06069

Hours: Mon-Thu 8:30 to 12:00 & 1:00 to 4:00; Fri 8:30 to 12:00

Phone: (860) 364-5224

Thomaston Town Clerk

Town Hall - 158 Main St, Level 3, Thomaston, Connecticut 06787

Hours: Mon, Tue, Wed 8:00 to 4:00; Thu 8:30 to 6:00; Fri 8:30 to 12:00

Phone: (860) 283-4141

Torrington City Clerk

City Hall - 140 Main St, 1st floor, Torrington, Connecticut 06790

Hours: Mon-Wed 8:30-4:00; Thu 8:30-6:30; Fri 8:30-12:30

Phone: (860) 489-2236

Warren Town Clerk/Registrar

50 Cemetery Rd, Warren , Connecticut 06754

Hours: Mon, Thu 9:00 to 1:00; Tue, Wed 9:00 to 4:00; Fri closed

Phone: (860) 868-7881 Ext 101

Washington Town Clerk

Bryan Memorial Hall - 2 Bryan Plaza / PO Box 383, Washington Depot, Connecticut 06794

Hours: Mon-Fri 9:00 to 12:00 & 1:00 to 4:45

Phone: (860) 868-2786

Watertown Town Clerk

Town Hall - 37 DeForest St, Watertown, Connecticut 06795

Hours: Mon-Fri 9:00 to 5:00

Phone: (860) 945-5230

Winchester Town Clerk

338 Main St, Suite 201, Winsted, Connecticut 06098-1697

Hours: Mon-Wed 8:00 to 4:00; Thu 8:00 to 7:00; Fri 8:00 to 12:00

Phone: (860) 738-6963

Woodbury Town Clerk

275 Main St South / Mail: 281 Main St South, Woodbury, Connecticut 06798

Hours: Mon-Fri 8:00 to 4:00

Phone: (203) 263-2144

Local jurisdictions located in Litchfield County include:

- Bantam

- Barkhamsted

- Bethlehem

- Bridgewater

- Canaan

- Colebrook

- Cornwall

- Cornwall Bridge

- East Canaan

- Falls Village

- Gaylordsville

- Goshen

- Harwinton

- Kent

- Lakeside

- Lakeville

- Litchfield

- Morris

- New Hartford

- New Milford

- New Preston Marble Dale

- Norfolk

- Northfield

- Oakville

- Pequabuck

- Pine Meadow

- Plymouth

- Riverton

- Roxbury

- Salisbury

- Sharon

- South Kent

- Taconic

- Terryville

- Thomaston

- Torrington

- Washington

- Washington Depot

- Watertown

- West Cornwall

- Winchester Center

- Winsted

- Woodbury

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Litchfield County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Litchfield County using our eRecording service.

Are these forms guaranteed to be recordable in Litchfield County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Litchfield County including margin requirements, content requirements, font and font size requirements.

Can the Disclaimer of Interest forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Litchfield County that you need to transfer you would only need to order our forms once for all of your properties in Litchfield County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Connecticut or Litchfield County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Litchfield County Disclaimer of Interest forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Under the Connecticut statutes, the beneficiary of an interest in property may renounce the gift, either in part or in full (General Statutes 802g-45a-578 to 590). Note that the option to disclaim is only available to beneficiaries who have not acted in any way to indicate acceptance or ownership of the interest.

The disclaimer must be in writing and include a description of the interest, a declaration of intent to disclaim all or a defined portion of the interest, and be signed by the disclaimant (802g-45a-579 & 583 (c)).

Deliver the disclaimer within nine months of the transfer (e.g., the death of the creator of the interest) to the legal representative of the decedent's estate, or with the probate court having jurisdiction over said estate (802g-45a-579 & 583 (d) (3)). In the case of real property, record a copy of the disclaimer in the office of the town clerk in the town in which the property is situated in order to make it effective against any person other than the disclaimant (802g-45a-579 & 583 (d) (4)).

A disclaimer is irrevocable and binding for the disclaiming party and his or her creditors, so be sure to consult an attorney when in doubt about the drawbacks and benefits of disclaiming inherited property. If the disclaimed interest arises out of jointly-owned property, seek legal advice as well.

Our Promise

The documents you receive here will meet, or exceed, the Litchfield County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Litchfield County Disclaimer of Interest form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4564 Reviews )

Michael G.

July 14th, 2025

Very helpful and easy to use

Your appreciative words mean the world to us. Thank you.

JAMES D.

July 10th, 2025

Slick as can be and so convenient.rnrnWorked like a charm

Thank you for your feedback. We really appreciate it. Have a great day!

MARY LACEY M.

June 30th, 2025

Great service! Recording was smooth and swiftly performed. Deeds.com is an excellent service.rn

We are delighted to have been of service. Thank you for the positive review!

Celeste G.

January 23rd, 2019

Very helpful!!! Thanks again.

Thank you Celeste.

Nick A.

January 13th, 2022

Easy to use website. Found what I was looking for.

Thank you for your feedback. We really appreciate it. Have a great day!

Janice U.

July 26th, 2019

So far everything is going really well. Thank you!

Thank you!

Christian M.

June 11th, 2019

Easy to find the necessary documents needed

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Thomas G.

December 16th, 2019

fast and easy

Thank you!

Lynn H.

January 12th, 2023

A very informative WEB site. It was simple to access the forms I needed for my specific situation. I would highly recommend Deeds.com.

I will be back with future needs when they arise! I was left with a very positive impression.

Thank you so much!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jerry B.

May 14th, 2023

Easy to use and fully comprehensive.

Thank you for your feedback Jerry, we appreciate you.

sakkubai p.

November 18th, 2019

It was easy to download and I love it.I am going to take them to our attorney. If she approve it I am going to print for other counties too, where we have other properties.

thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

frederic m.

January 1st, 2021

surprisingly good, gave me all the info I needed to prepare a deed and necessary attachments for recording.

Thank you!

James A.

January 2nd, 2020

Good.

Thank you!

Mitchell S.

April 25th, 2024

This service was very helpful, quick, inexpensive and easy to use. Should I ever need it again, I know right where to go.

We are sincerely grateful for your feedback and are committed to providing the highest quality service. Thank you for your trust in us.

Patricia C.

December 29th, 2021

Deeds.com saved me time and research by offering a beneficiary deed and full instructions for filling it out. My home will now pass directly to my only son without probate. This form and other complimentary forms was an excellent value.

Thank you for your feedback. We really appreciate it. Have a great day!