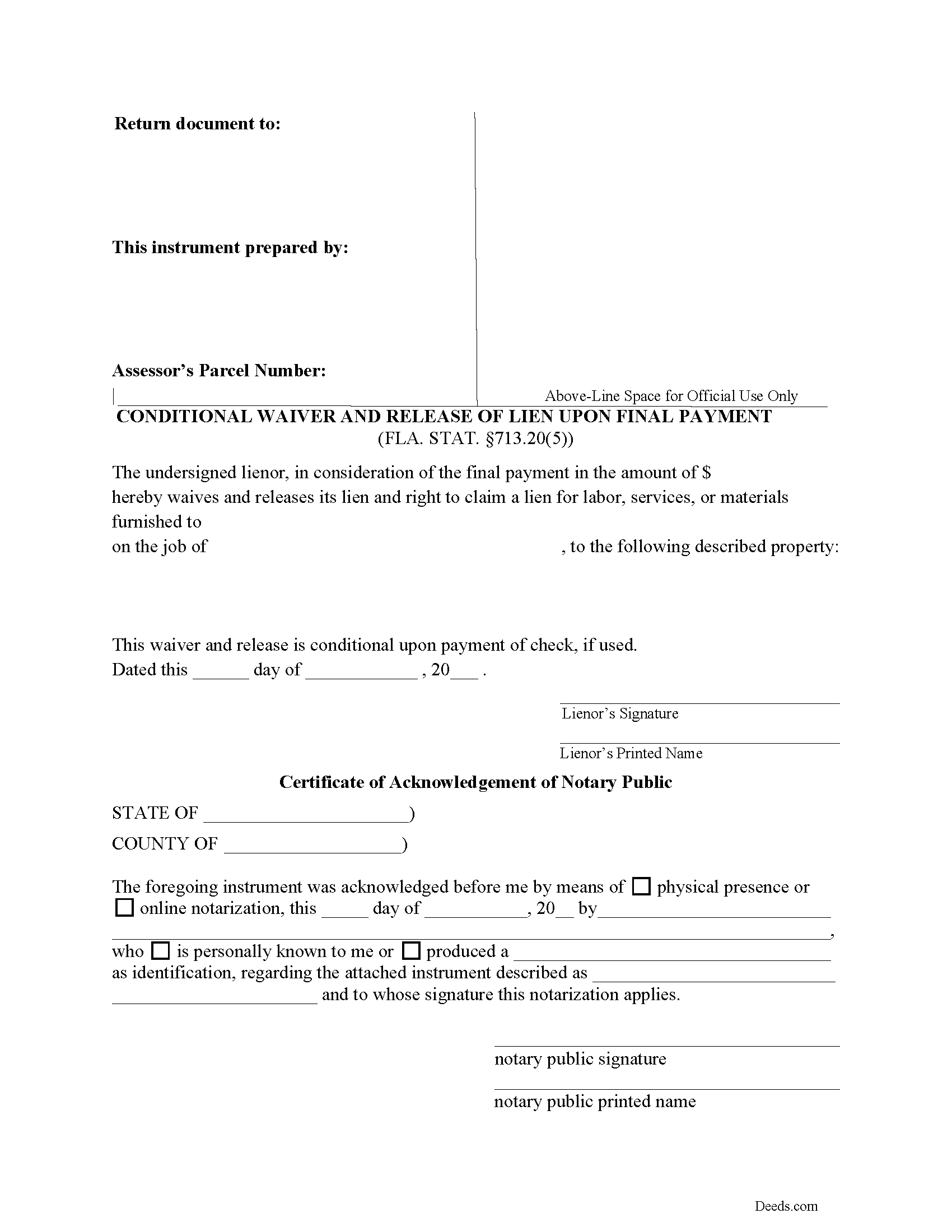

Gulf County Conditional Waiver and Release of Lien upon Final Payment Form

Gulf County Conditional Waiver and Release of Lien upon Final Payment Form

Fill in the blank form formatted to comply with all recording and content requirements.

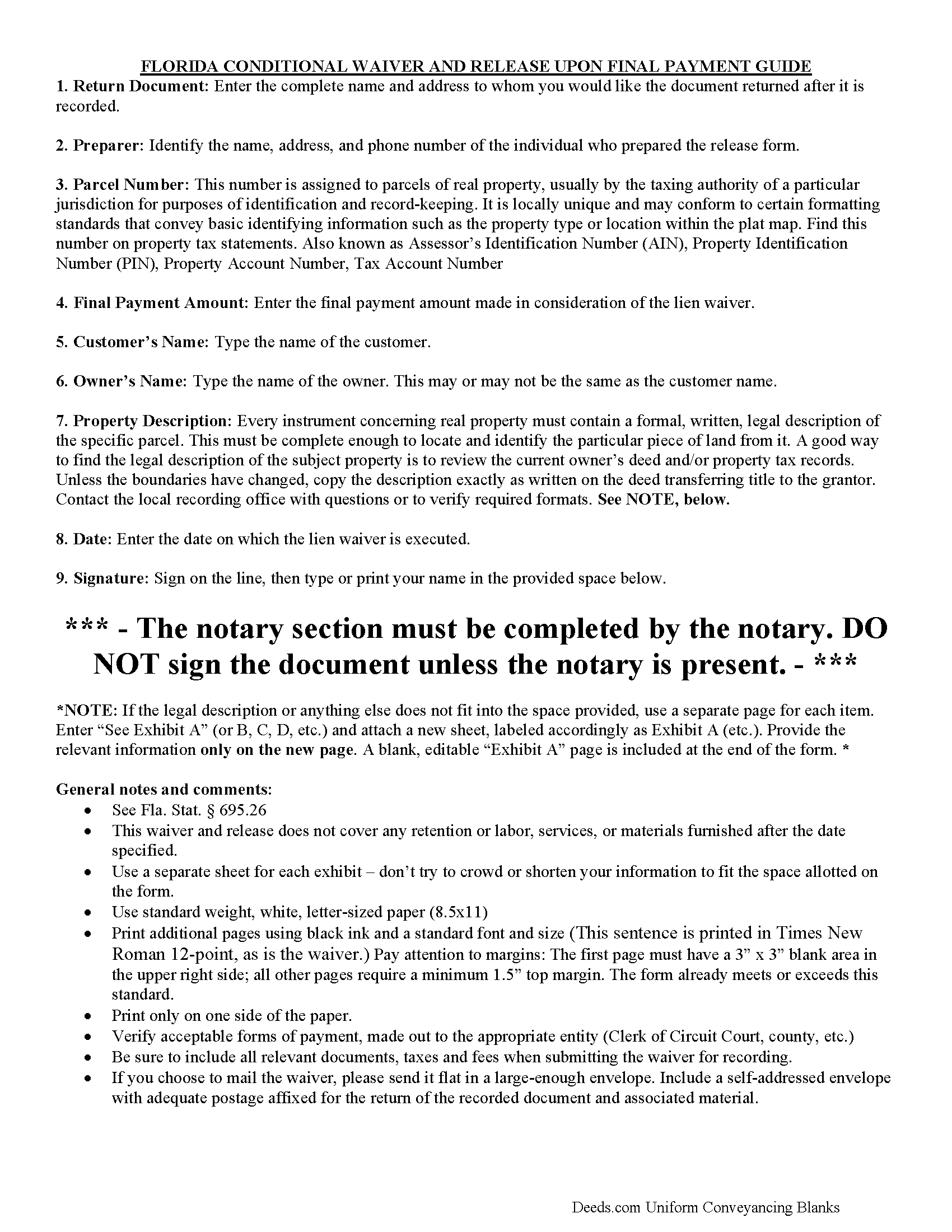

Gulf County Conditional Waiver and Release of Lien upon Final Payment Guide

Line by line guide explaining every blank on the form.

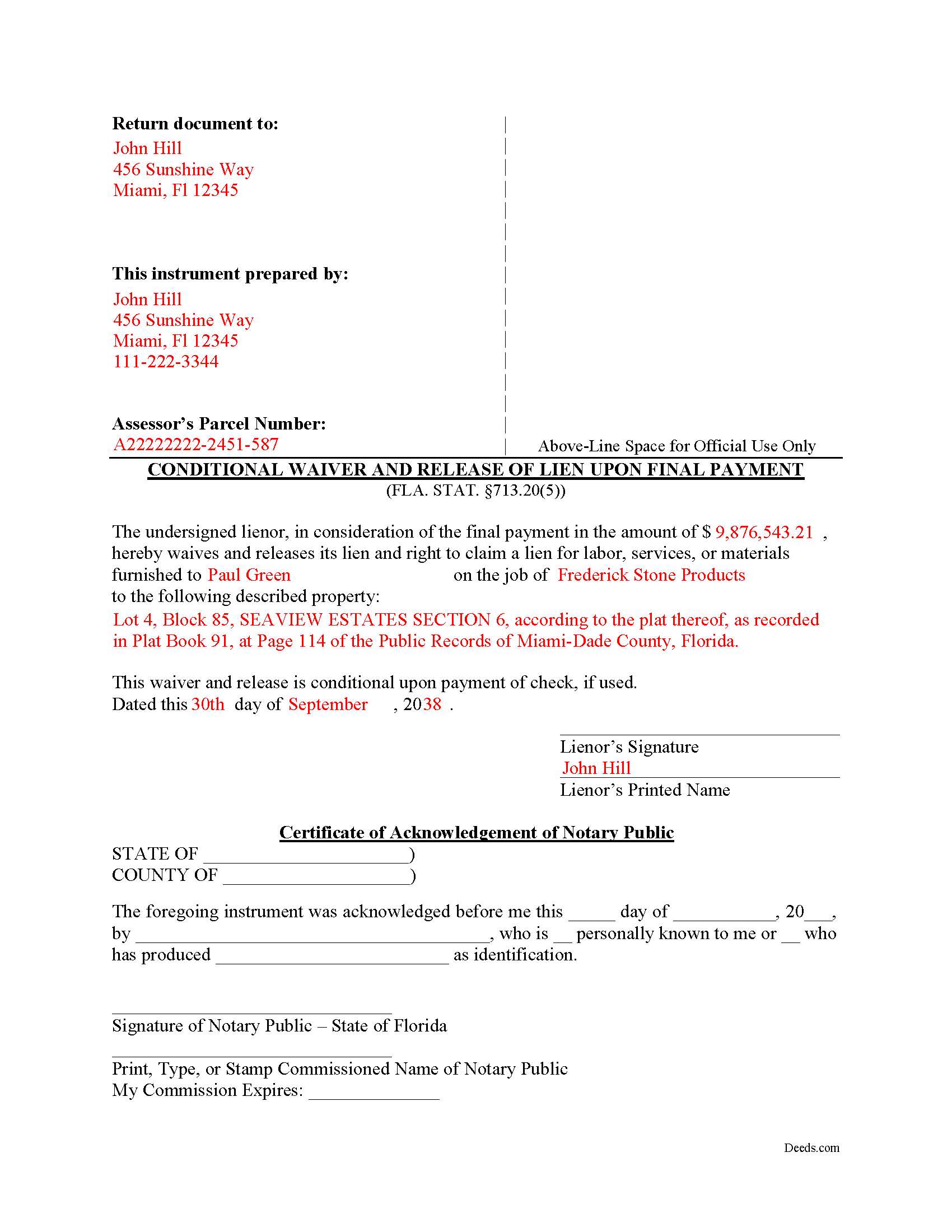

Gulf County Completed Example of the Conditional Waiver and Release of Lien upon Final Payment Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Florida and Gulf County documents included at no extra charge:

Where to Record Your Documents

Gulf County Clerk of Court - Courthouse

Port St. Joe, Florida 32456

Hours: 9:00am to 5:00pm M-F

Phone: (850) 229-6112 Ext. 1105 and 1117

Clerk's Annex Office

Wewahitchka, Florida 32465

Hours: 8:00am to 11:30 & 12:30 to 4:00pm M-F CS time

Phone: 850-639-2175

Recording Tips for Gulf County:

- Both spouses typically need to sign if property is jointly owned

- Ask about their eRecording option for future transactions

- Check margin requirements - usually 1-2 inches at top

Cities and Jurisdictions in Gulf County

Properties in any of these areas use Gulf County forms:

- Port Saint Joe

- Wewahitchka

Hours, fees, requirements, and more for Gulf County

How do I get my forms?

Forms are available for immediate download after payment. The Gulf County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Gulf County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Gulf County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Gulf County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Gulf County?

Recording fees in Gulf County vary. Contact the recorder's office at (850) 229-6112 Ext. 1105 and 1117 for current fees.

Questions answered? Let's get started!

Lien waivers or releases are used to surrender the right to a lien, either in full or in part depending on the type of lien release form selected. Florida's Construction Lien Law authorizes statutory waivers at 713.20 Fla. Stat. (2016).

Under 713.20(5), lienors may waive, on condition of payment, a lien they already filed against the owner's interest in the improved property. The release contains information about the lienor, the customer, the property owner, the property description, the payment amount, and a date to finalize the work covered by the waiver.

Each case is unique, so contact an attorney with specific questions on lien waivers or any other issues related to Florida Construction Liens.

Important: Your property must be located in Gulf County to use these forms. Documents should be recorded at the office below.

This Conditional Waiver and Release of Lien upon Final Payment meets all recording requirements specific to Gulf County.

Our Promise

The documents you receive here will meet, or exceed, the Gulf County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Gulf County Conditional Waiver and Release of Lien upon Final Payment form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4588 Reviews )

Terri B.

April 5th, 2021

It's worth the money. I would like to have seen a variety of examples showing different scenarios for completing a quitclaim deed.

Thank you!

Nicole D.

January 12th, 2021

Very pleased with Deed.com. Quick response with instructions. Great service and will use again.

Thank you for your feedback. We really appreciate it. Have a great day!

MARC G.

June 26th, 2020

Very easy. Very helpful.

Thank you!

HELEN F.

September 1st, 2019

Process was easy... paperwork was on point... process took less then one day...

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Mary B.

February 8th, 2023

Your information was orderly and very clear and helpful. Thanks!

Thank you for your feedback. We really appreciate it. Have a great day!

Michael H.

November 5th, 2019

Site was easy to understand and use. Service was prompt. Good job Montgomery County!

Thank you!

Robert F.

June 30th, 2025

Breeze.... It feels silly to hire an attorney to do this for just one beneficiary. Thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

Debra D.

January 2nd, 2019

Really good forms, easy to understand and use. The guide was a must have, made the process very simple.

Thank you!

Erik N.

May 31st, 2025

I liked it, very much.

Thank you!

Maria S.

January 10th, 2019

The paperwork/forms are fine, but there isn't enough explanation for me to figure out how to file the extra forms (which I do need in my case). The main form, Deed Upon Death is fine. I think the price is pretty high for these forms. I wouldn't have purchased it because there are places to get them for much cheaper (about 6 dollars), but this site had the extra forms I wanted (property in a trust and another form). Unfortunately these were included as a "courtesy" and there are no instructions for them. So three stars for being clear about what was in the package, having the right forms that I need, but instructions for putting them to use and price took a couple of stars off. Downloading was easy and once you download you can type the info into the PDF--that makes working with the forms much easier.

Thank you for the feedback Maria. Regarding the supplement documents, it is best to get assistance from the agency that requires them. These are not legal documents, they should provide full support and guidance for them.

Susan S.

April 4th, 2019

Very quick, easy and readily available forms. No wait, no advertisements, no pressure to purchase MORE. I expected to only get part of the information I needed, and for there to be a hidden cost to get the complete package, but surprisingly, I got immediate access to all the forms I ordered, AND THERE WERE NO ADDITIONAL HIDDEN COSTS! How refreshing!

Thank you Susan, we really appreciate your feedback.

William P.

June 11th, 2019

Good timely service. Returned my fee on a document that could not be located.

Thank you!

Scott A.

August 3rd, 2019

The information and instructions provided is thorough and great. But, the fill-in-the-blanks form does not work well and is very frustrating. The font size of the information I was adding on each individual line varies and is determined by the number of characters entered on that individual line. So the font size is different on each line. And the number of lines is fixed making it impossible to fill in the full legal name of the trust I needed to fill out the form for. My needs are somewhat unusual, but the form should have been designed to be flexible enough to handle it. A blank paper form would have been more useful.

Thank you for your feedback. We really appreciate it. Have a great day!

Terri A.

April 3rd, 2019

So far so good --- I'm helping a friend with her property! Thanks!

Thank you Terri.

Scott K.

July 2nd, 2022

The beneficiary deed was acceptable to the county clerk and my notarized official deed was mailed to me. The Missouri-based deed met with official approval so all is well in the land that time forgot.

Thank you!