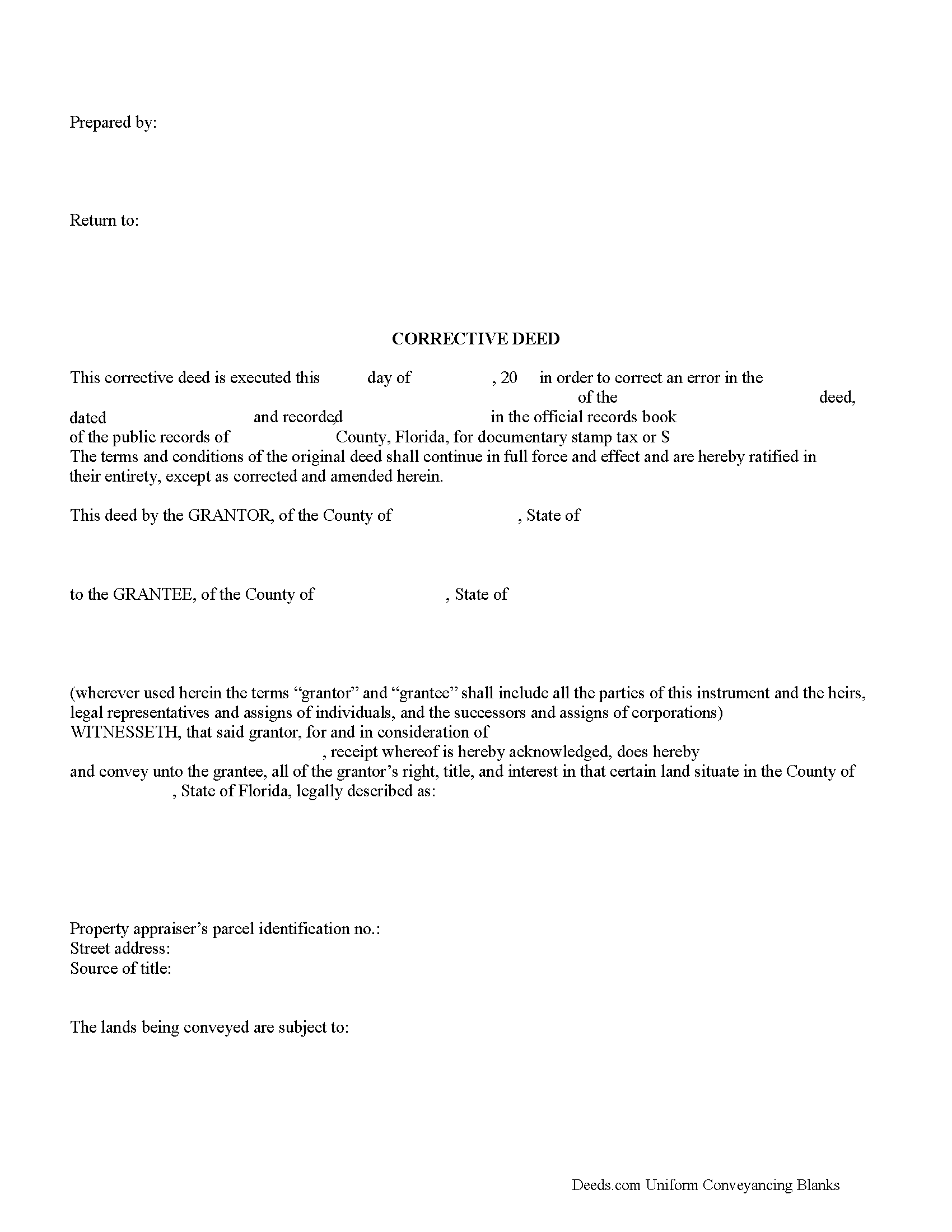

Taylor County Correction Deed Form

Taylor County Correction Deed Form

Fill in the blank Correction Deed form formatted to comply with all Florida recording and content requirements.

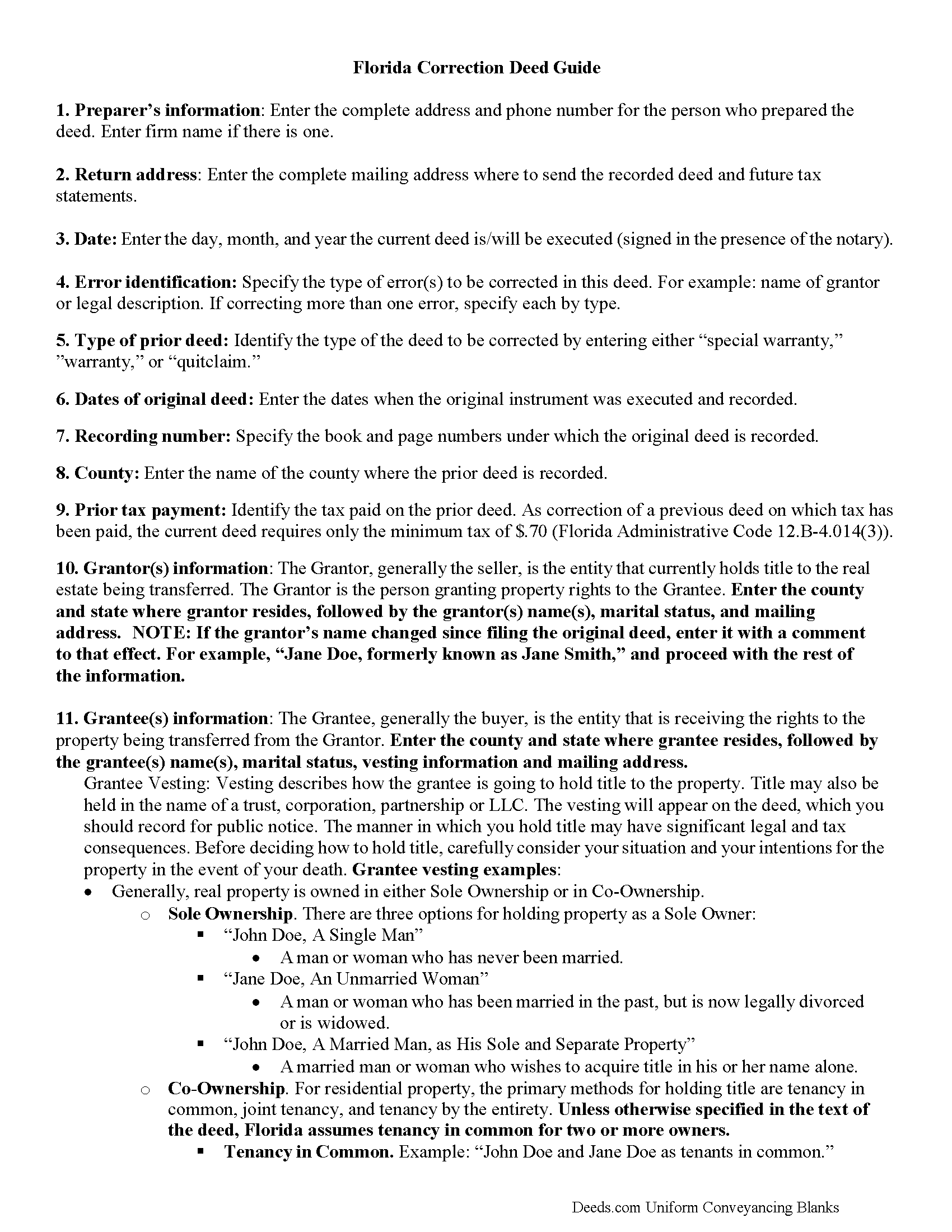

Taylor County Correction Deed Guide

Line by line guide explaining every blank on the Correction Deed form.

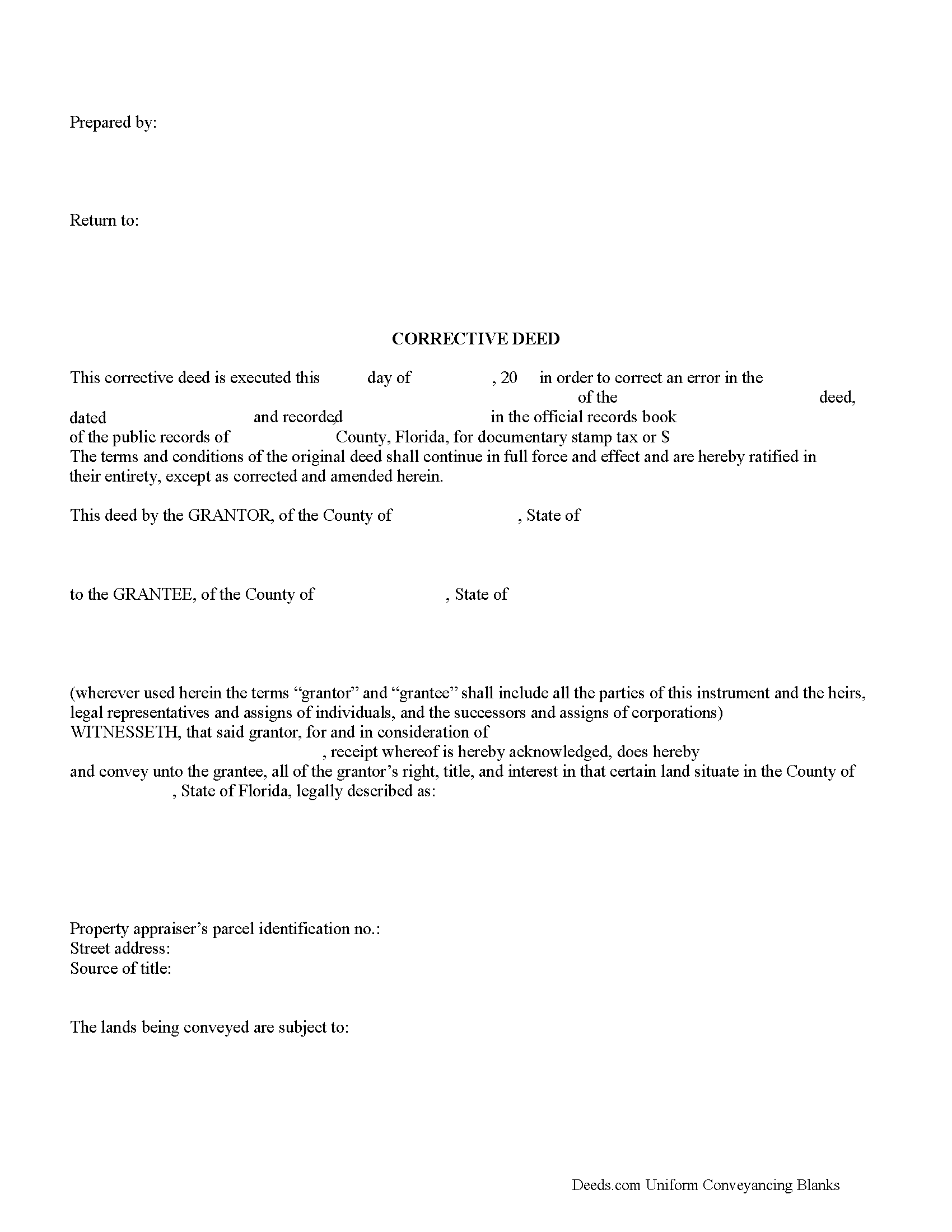

Taylor County Completed Example of the Correction Deed Document

Example of a properly completed Florida Correction Deed document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Florida and Taylor County documents included at no extra charge:

Where to Record Your Documents

Taylor County Clerk of Court

Perry, Florida 32347 / 32348

Hours: 8:00 to 4:30 M-F

Phone: (850) 838-3506

Recording Tips for Taylor County:

- Avoid the last business day of the month when possible

- Request a receipt showing your recording numbers

- Make copies of your documents before recording - keep originals safe

Cities and Jurisdictions in Taylor County

Properties in any of these areas use Taylor County forms:

- Perry

- Salem

- Shady Grove

- Steinhatchee

Hours, fees, requirements, and more for Taylor County

How do I get my forms?

Forms are available for immediate download after payment. The Taylor County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Taylor County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Taylor County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Taylor County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Taylor County?

Recording fees in Taylor County vary. Contact the recorder's office at (850) 838-3506 for current fees.

Questions answered? Let's get started!

Correct common errors in a deed, such as typographical mistakes or omissions in various sections of the original deed, by using a corrective deed, which must be signed by the grantor and witnesses and re-acknowledged.

The Florida Bar Association points out that the lack of a date or a wrong date does not invalidate a deed according to Florida Uniform Title Standard 3.6. They recommend against correcting deeds that are valid in spite of an error. When title has not passed to the grantee due to an error, however, use of a corrective instrument can be crucial. This would be in the case of an insufficient legal description, a lack of witnesses, a failure to obtain joinder of a grantor's spouse on a deed to homestead property, or if the deed lacks proper acknowledgement so that its recording does not impart proper notice. Five years after recording, however, a deed is presumed to be valid even if there was a defective acknowledgement or lack of witnesses (F.S. 95.231).

A corrective deed is not capable of divesting an unintended grantee, which can be remedied by the new grantor passing title to himself and another grantee. A corrective deed is also incapable of re-vesting portions of the land back to the grantor. Both situations require substantive changes that must be made by executing and recording a new deed.

The necessary elements for a legal conveyance must be present in a corrective deed, such as signature of the deed by the grantor in the presence of two witnesses, one of whom can be the notary. Constructive notice in the form of recording is necessary for the deed to be valid not only between the two parties but for prospective purchasers. Furthermore, the spousal joinder applies when the grantor is married and the property in question is the grantor's homestead. Title transfer of designated homestead property must be signed by the spouse to be valid.

(Florida Correction Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Taylor County to use these forms. Documents should be recorded at the office below.

This Correction Deed meets all recording requirements specific to Taylor County.

Our Promise

The documents you receive here will meet, or exceed, the Taylor County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Taylor County Correction Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4587 Reviews )

Sherry A L.

August 22nd, 2020

fAST AND REASONABLE.. WOULD DO IT AGAIN IF I NEED TO. THANK YOU

Thank you!

John H.

August 1st, 2019

Great service

Thank you!

Stuart C.

April 29th, 2019

Quit, clear, simple...just the way it shouldbe! Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

john o.

August 8th, 2020

very simple to use

Thank you!

John L.

February 26th, 2023

excellent...exactly what i need....

Thank you!

Jordan L.

February 16th, 2023

Quick and easy. Lets do it again!

Thank you!

John D.

September 30th, 2020

I was quite impressed by the quality of your documents and the ease of the download.

Thank you for your feedback. We really appreciate it. Have a great day!

Roxanne G.

April 16th, 2023

That was easy(I think). Hopefully they saved to my computer intact so I don't have to come back begging for a repeat. Great service!

Thank you!

John F.

January 28th, 2021

The document I purchased was perfect for what I needed done. Very easy to obtain the document. Website very easy to navigate. Would use again and would recommend to anyone who needs the documents.

Thank you for your feedback. We really appreciate it. Have a great day!

Rachel E.

April 3rd, 2020

Our firm is working remotely and a lot of court services are limited with the corona-virus shutdowns, but we needed to record a Deed at the last minute. There was no other way we'd could get it done that quick without Deeds.com (staff) helped us work out some kinks and we got it recorded in less than 1 business day! Thank you!

Thank you for your feedback, we really appreciate it. Glad we could help.

DAVID K.

April 6th, 2019

Already gave a review Great site and help

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Thomas S.

April 13th, 2019

Very nice.

Thank you!

Ann M.

February 11th, 2022

I was extremely pleased with how easy this process was, and how quickly my document was recorded. I will definitely use this again!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lisa W.

December 19th, 2019

Great E-Service Provider!

Thank you!

James G.

November 18th, 2019

Deed.com had some hard to find mineral interest deeds for Oklahoma.I'm an attorney in Texas with no Ok experience. The examples on Deed.com were very useful and saved me lots of time. James G.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!