Lafayette County Decedent Interest in Homestead Affidavit Form

Lafayette County Decedent Interest in Homestead Affidavit Form

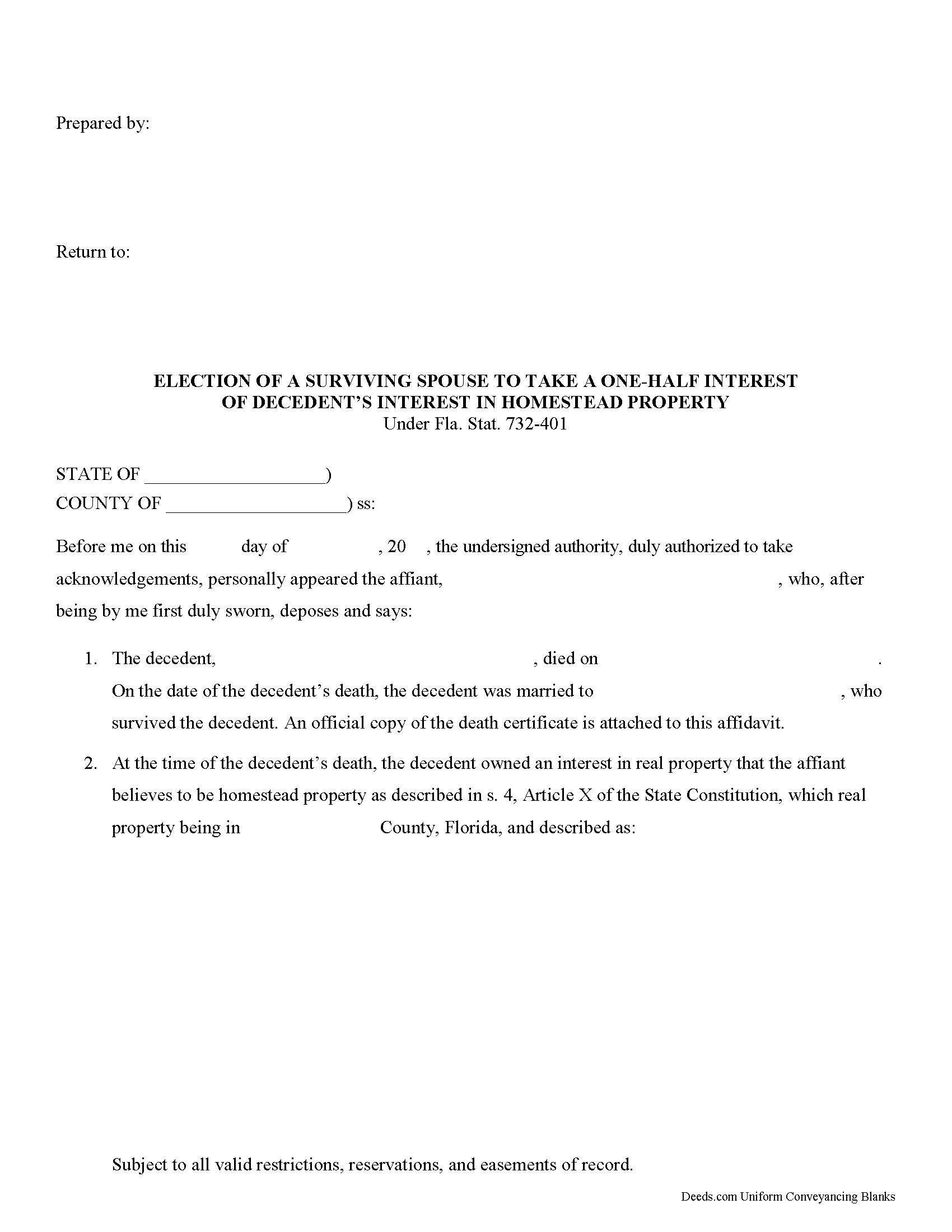

Fill in the blank Decedent Interest in Homestead Affidavit form formatted to comply with all Florida recording and content requirements.

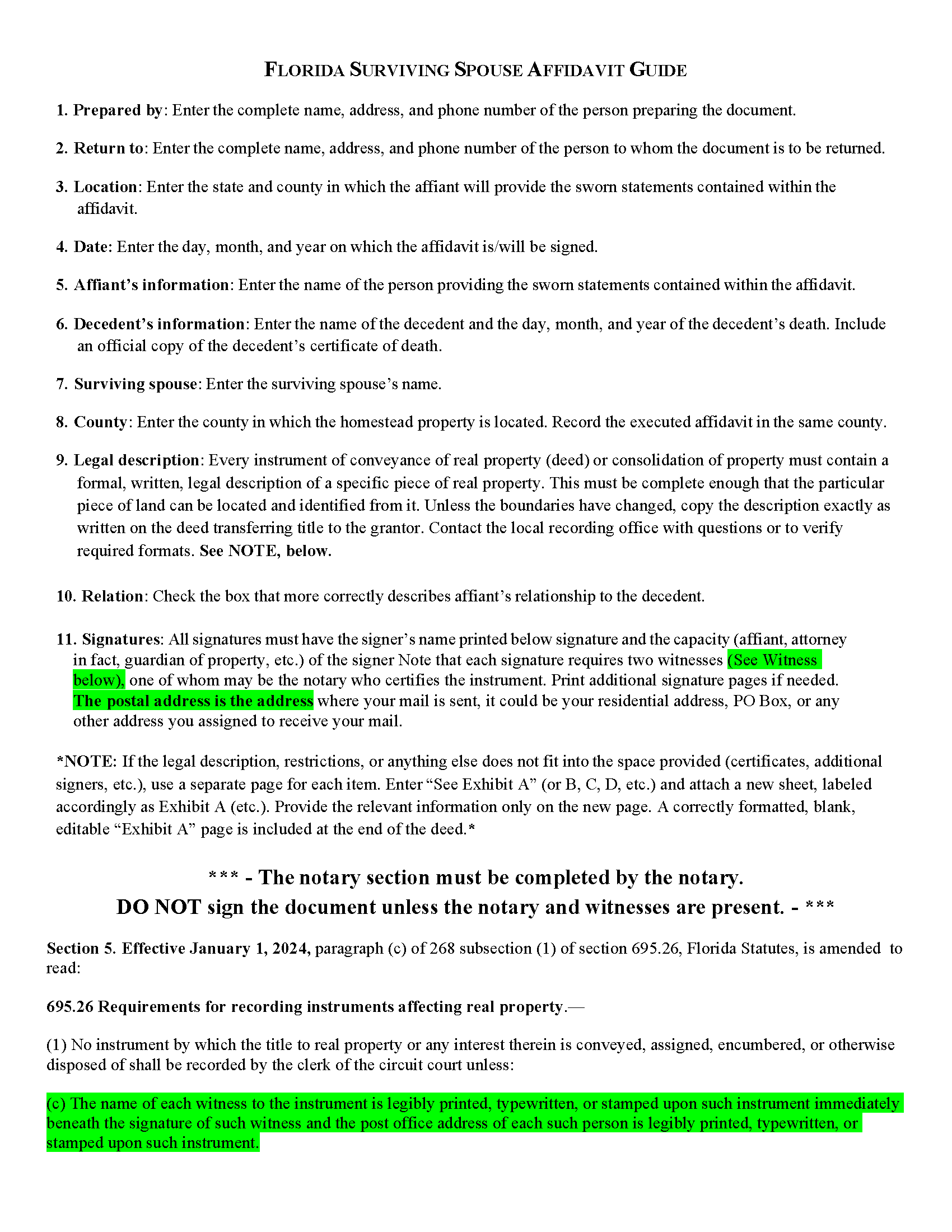

Lafayette County Decedent Interest in Homestead Affidavit Guide

Line by line guide explaining every blank on the Decedent Interest in Homestead Affidavit form.

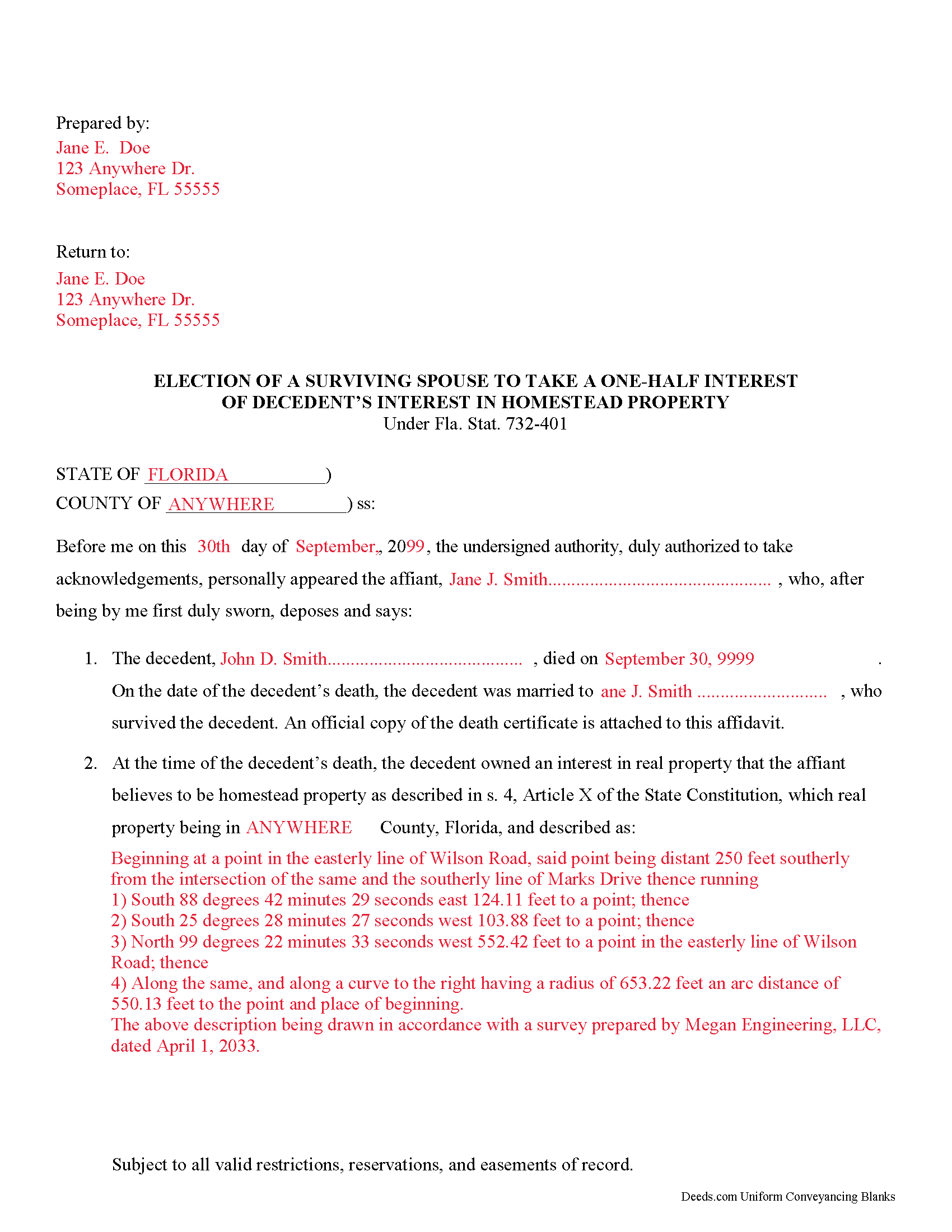

Lafayette County Completed Example of the Decedent Interest in Homestead Affidavit Document

Example of a properly completed Florida Decedent Interest in Homestead Affidavit document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Florida and Lafayette County documents included at no extra charge:

Where to Record Your Documents

Clerk of Court - Lafayette County Courthouse

Mayo, Florida 32066

Hours: 8:00am to 5:00pm M-F

Phone: (386) 294-1600

Recording Tips for Lafayette County:

- Ask if they accept credit cards - many offices are cash/check only

- Both spouses typically need to sign if property is jointly owned

- Recorded documents become public record - avoid including SSNs

- Leave recording info boxes blank - the office fills these

- Make copies of your documents before recording - keep originals safe

Cities and Jurisdictions in Lafayette County

Properties in any of these areas use Lafayette County forms:

- Day

- Mayo

Hours, fees, requirements, and more for Lafayette County

How do I get my forms?

Forms are available for immediate download after payment. The Lafayette County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Lafayette County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Lafayette County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Lafayette County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Lafayette County?

Recording fees in Lafayette County vary. Contact the recorder's office at (386) 294-1600 for current fees.

Questions answered? Let's get started!

Decedent's interest in homestead affidavit

Under Florida law, real estate that is identified as a homestead but is not included in a deceased owner's will passes to beneficiaries in the same manner as other intestate property. If the decedent is survived by a spouse and one or more descendants, however, the surviving spouse has three main options as set out in section 732.401 of the Florida Statutes:

- take a life estate in the homestead, with a vested remainder to the descendants alive at the time of the decedent's death per stirpes (according to Black's Law Dictionary, 8th ed., "proportionately divided between beneficiaries according to their deceased ancestor's share").

- take an undivided one-half interest in the late spouse's homestead as a tenant in common, with the remaining one-half interest held by any descendants per stirpes.

- disclaim the interest as directed in chapter 739.

When a surviving spouse chooses to take the one-half interest in the property, he/she files a decedent's interest in homestead affidavit. This document allows the spouse to waive the marital rights to a life estate in the property. Instead, the surviving spouse and any descendants hold title as tenants in common. As tenants in common, each party can independently sell his/her interests to the property without notice or joinder from the others.

In most cases, the affidavit must be filed within six months of the decedent's death. The affidavit can be made by the surviving spouse him/herself or, with the court's approval, an attorney in fact or guardian of the property of the surviving spouse. The document is then filed in the county or counties in which the homestead property is located. Once recorded, the surviving spouse's decision is irrevocable.

Each case is unique, so contact an attorney with specific questions or for complex situations.

Product description:

Use this document when the owner of homestead property dies without including the real estate in the will and the surviving spouse elects to forego his/her life estate interest in favor of one-half share and convert his/her interest in a life estate to a tenancy in common with the descendants.

(Florida Decedent Interest in Homestead Package includes form, guidelines, and completed example)

Important: Your property must be located in Lafayette County to use these forms. Documents should be recorded at the office below.

This Decedent Interest in Homestead Affidavit meets all recording requirements specific to Lafayette County.

Our Promise

The documents you receive here will meet, or exceed, the Lafayette County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Lafayette County Decedent Interest in Homestead Affidavit form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Jean K.

February 25th, 2021

The website worked fine and I would have been happy to pay the extra money except the deed I needed was "not available". Ended up calling the courthouse anyway.

Thank you for your feedback. We really appreciate it. Have a great day!

Susan L.

January 4th, 2022

Instructions easy to follow, example form was a big help.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jennifer B.

February 8th, 2019

I didn't care for it because I was having to do other things in between filling it out and all of a sudden it would not allow me back in it to make changes. Luckily I had saved it and then had to do FILL/SIGN option which looks ugly but that was the only way I could add what I needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Theresa M.

June 5th, 2020

Deeds.com was simple to use and had a quick turnaround. Saved me so much time hunting around on the internet and recorder's office website to try and figure out the process. would definitely use again!

Thank you!

TEDDY Y.

January 29th, 2022

this experience was made possible with the ease of using your service thank you

Thank you!

Gloria B.

September 1st, 2022

Super easy and efficient. One time charge for the form with no commitment to a recurring charge for monthly membership. *****

Thank you for your feedback. We really appreciate it. Have a great day!

James K.

May 15th, 2024

Looks like a very professional site. I just don’t know what it would cost using this site.

Thanks for the kind words about the website James, sorry to hear that you could not find pricing information, we will try harder.

Tracey M.

August 9th, 2022

Using Deeds.com was unbelievably quick and easy to file a deed restriction with our local county office. From uploading the initial file to deeds.com, to having a fully recorded document was right on one hour - and all from the comfort of my home. I found your service was easy to use and your staff were very quick in responding to my filing. I will definitely use and recommend deeds.com in the future.

Thank you for your feedback. We really appreciate it. Have a great day!

Billie W.

April 23rd, 2021

Excellent way to do this kind of transaction.

Thank you!

Janepher M.

January 27th, 2019

Easy and informative site. Helped me figure out what I was looking for.

Thank you Janepher, we appreciate your feedback!

Peter M.

February 3rd, 2020

Quick and complete. Thanks!

Thank you!

Beverly L J.

August 6th, 2020

The process for receiving the quitclaim document worked well. I couldn't use the document. If I had been able to view the document before I had to pay for it, I would have known, but that isn't how your process works. However, that's the only snag I found. Otherwise the process for paying and downloading the document worked well. Thank you.

Thank you for your feedback Beverly. We certainly do not want you to pay for something you are unable to use. To that end we have canceled your order and refunded your payment. We do hope that you find something more suitable to your needs. Have a wonderful day.

Charles B.

November 20th, 2023

The support received was far above expectations.

We are grateful for your feedback and looking forward to serving you again. Thank you!

Nancy J.

June 17th, 2020

This is a great service recommended by CSC. I only had one document to e-file. I would recommend to anyone.

Thank you for your feedback. We really appreciate it. Have a great day!

Dan V.

December 24th, 2021

Very happy, thanks.

Thank you!