Martin County Enhanced Life Estate Deed Quitclaim Ladybird Deed Form

Martin County Enhanced Life Estate Deed Quitclaim Ladybird Deed Form

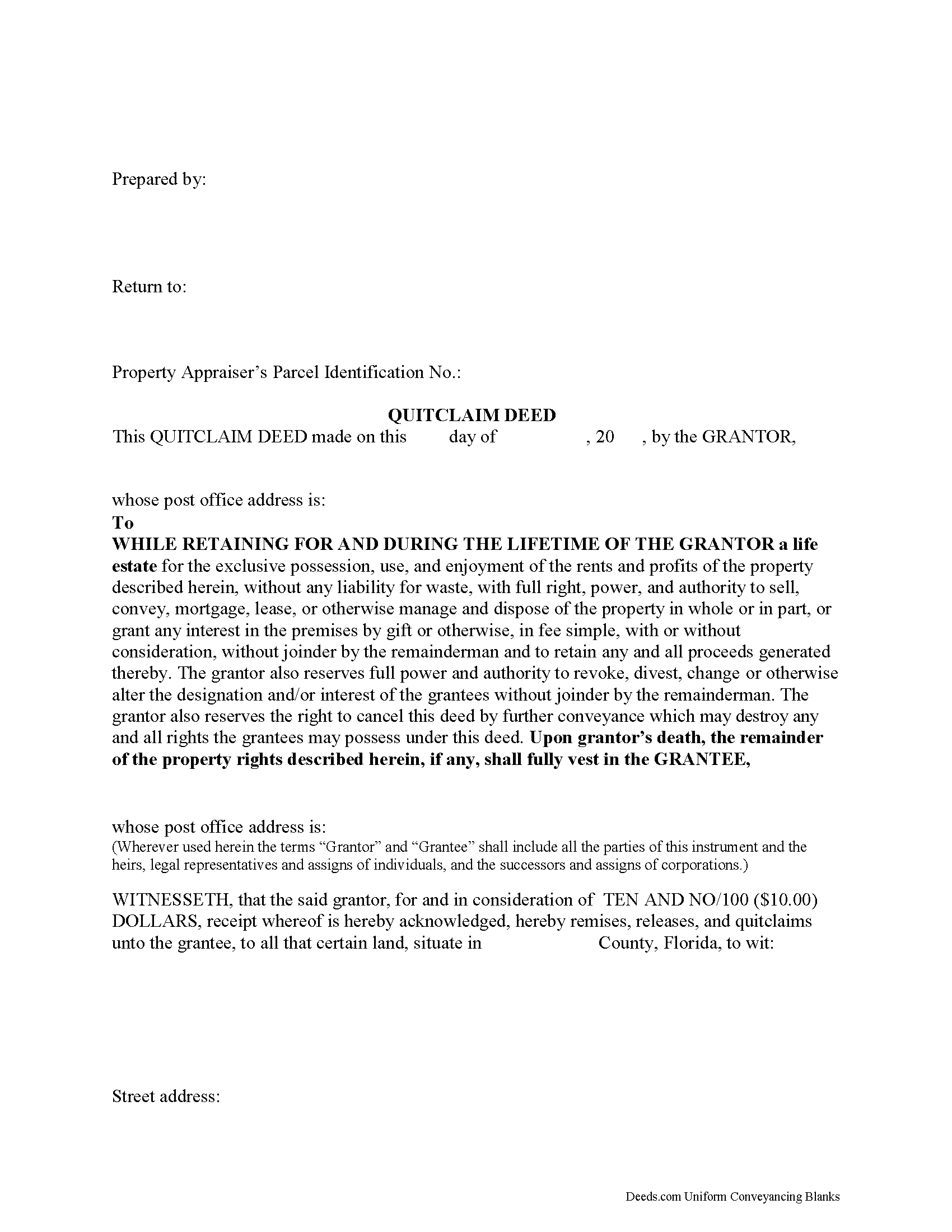

Fill in the blank Enhanced Life Estate Deed Quitclaim Ladybird Deed form formatted to comply with all Florida recording and content requirements.

Martin County Enhanced Life Estate Deed Quitclaim Ladybird Deed Guide

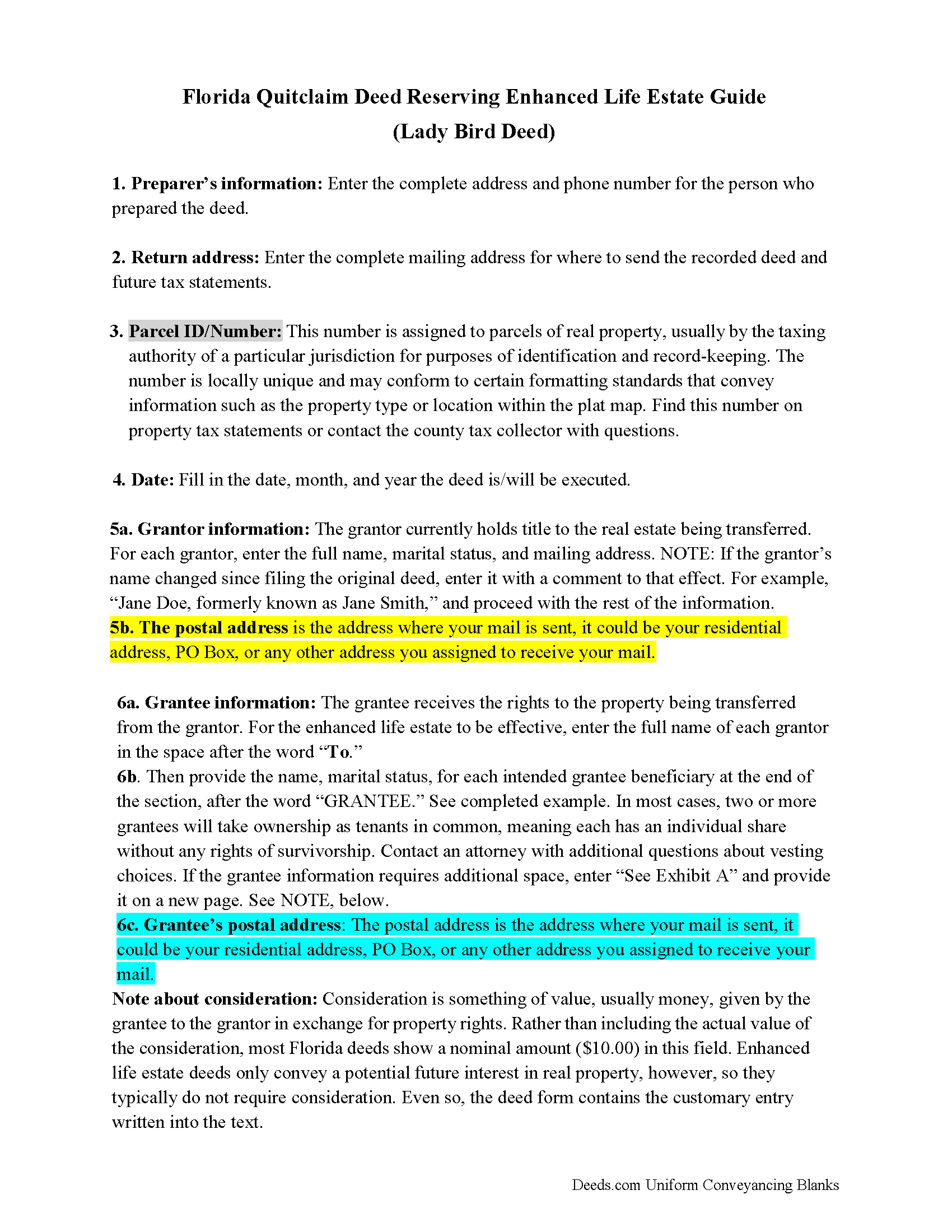

Line by line guide explaining every blank on the Enhanced Life Estate Deed Quitclaim Ladybird Deed form.

Martin County Completed Example of the Enhanced Life Estate Deed Quitclaim Ladybird Deed Document

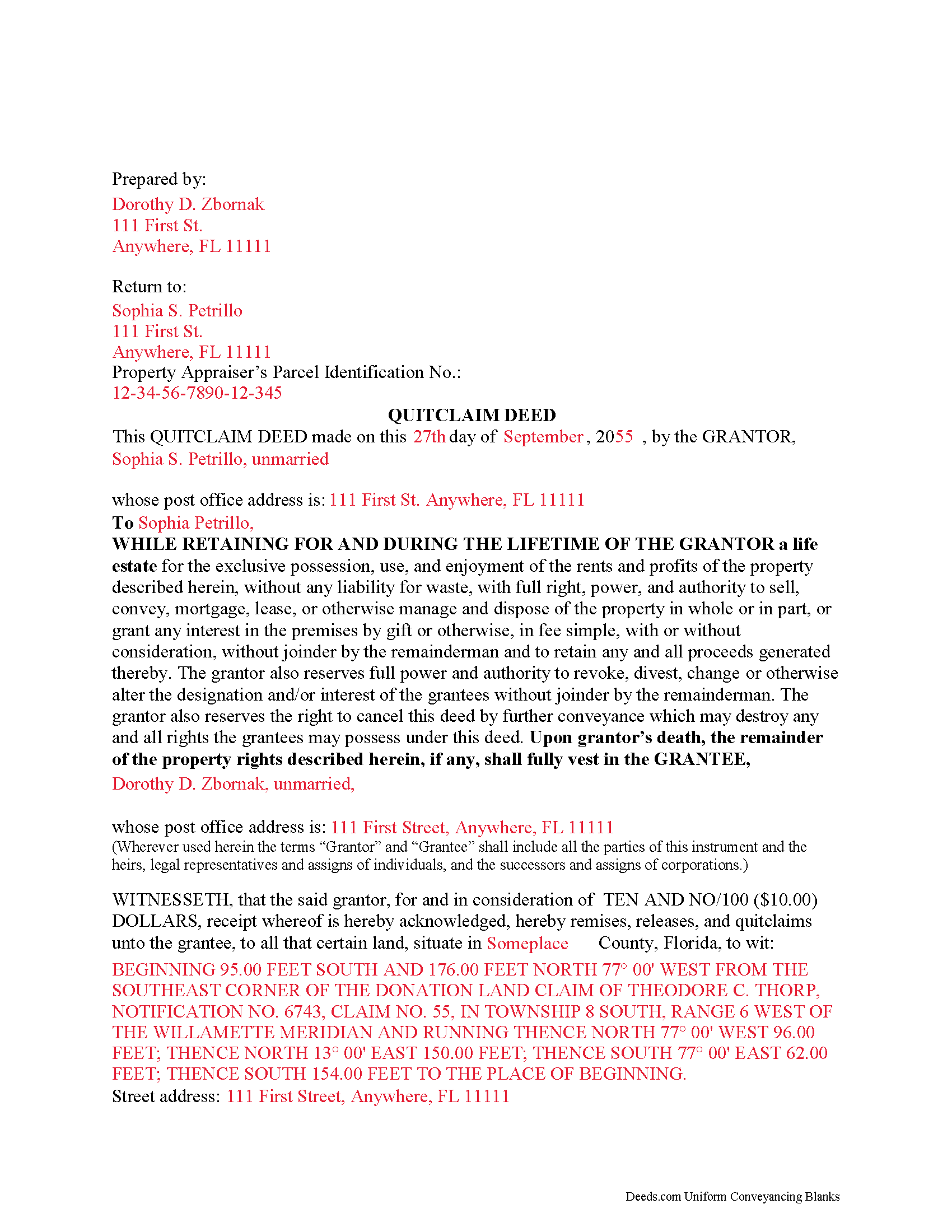

Example of a properly completed Florida Enhanced Life Estate Deed Quitclaim Ladybird Deed document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Florida and Martin County documents included at no extra charge:

Where to Record Your Documents

Courthouse Stewart Office

Stuart, Florida 34994

Hours: 8:00am - 5:00pm M-F

Phone: (772) 288-5576

Hobe Sound Branch Office

Hobe Sound, Florida 33455

Hours: 8:00am - 4:30pm Monday - Friday

Phone: (772) 546-1308

Indiantown Branch Office

Indiantown, Florida 34596

Hours: 8:00am - 1:00 & 2:00 - 4:30pm Wednesdays only

Phone: (772) 223-7921

Recording Tips for Martin County:

- Bring your driver's license or state-issued photo ID

- Check that your notary's commission hasn't expired

- Make copies of your documents before recording - keep originals safe

- Bring extra funds - fees can vary by document type and page count

- Ask for certified copies if you need them for other transactions

Cities and Jurisdictions in Martin County

Properties in any of these areas use Martin County forms:

- Hobe Sound

- Indiantown

- Jensen Beach

- Palm City

- Port Salerno

- Stuart

Hours, fees, requirements, and more for Martin County

How do I get my forms?

Forms are available for immediate download after payment. The Martin County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Martin County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Martin County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Martin County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Martin County?

Recording fees in Martin County vary. Contact the recorder's office at (772) 288-5576 for current fees.

Questions answered? Let's get started!

This enhanced life estate deed is a document that transfers ownership of real property, while reserving full access to the property for the duration of the grantor's life. It allows the original owner (grantor) to remain on the premises with the rights to use or dispose of it at will, with no penalty for waste. The grantor may even reconvey the property to someone else without the grantee's knowledge. The grantee under the deed reserving a life estate for the grantor is not entitled to possession of the property until the grantor dies.

When the enhanced life estate is applied to a quitclaim deed, the transfer of ownership is completed upon the death of the life tenant, but there are no warranties of title.

(This Package includes form, guidelines, and completed example)

Important: Your property must be located in Martin County to use these forms. Documents should be recorded at the office below.

This Enhanced Life Estate Deed Quitclaim Ladybird Deed meets all recording requirements specific to Martin County.

Our Promise

The documents you receive here will meet, or exceed, the Martin County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Martin County Enhanced Life Estate Deed Quitclaim Ladybird Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Barbara C.

September 5th, 2021

I have used these forms now at least 3 times in order to sell the same parcel of land. The forms are great and I'm happy that I could use them more than once. To no fault of Deeds.com I used them many times to sell the same land. First the man died that was buying, before it got recorded. Then his wife was going to finish it, but then decided it should be sold to another party who was a friend of hers.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sharon D.

December 29th, 2018

Very easy to understand forms...

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

William U.

December 1st, 2020

Prompt service, reasonable price.

Thank you!

Rox Ann S.

April 15th, 2023

Very impressed with how fast the service was. Got what I needed within 20 to 30 minutes.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jacqueline B.

November 7th, 2020

Very easy process to have this document recorded through Deeds.com! The amount of time it saved me was greatly appreciated. highly recommend Deeds.com!

Thank you for your feedback. We really appreciate it. Have a great day!

Roberta J B.

February 17th, 2021

User friendly

Thank you!

Anthony N.

January 31st, 2021

The site was not easy to navigate. Maybe putting the different things offered at the heading instead of searching for it.

Thank you for your feedback. We really appreciate it. Have a great day!

Jean S.

July 2nd, 2019

Service was outstanding. I had the results very quickly. Definitely will use this service again

Thank you!

EARL R.

June 4th, 2023

easy to use once i found out i could fill it out right on the deeds website instead of downloading it to word duh.

Thank you for your feedback Earl. We'll work on ways to make it more clear that the forms are fill in the blank right in the PDF. Have an amazing day!

Jordan L.

February 16th, 2023

Quick and easy. Lets do it again!

Thank you!

Javel L.

November 28th, 2019

The idea is great. I was not able to have my deed retrieved. Would have needed a verifies copy anyway.

Thank you for your feedback. We really appreciate it. Have a great day!

John K.

July 11th, 2020

I was unable to finish what I started due to computer crash. I'll get back soon. I paid off my mortgage last year in November. I need to see what to do to get the deed to my property.

Thank you!

DAVID K.

April 6th, 2019

Already gave a review Great site and help

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Johnny H.

September 15th, 2022

The format presented is exactly what is needed to produce a perfect listing in the registry of The Maricopa County Office of the Recorder. Thanks for an effective solution to a very important document.

Thank you!

Marsha D.

September 25th, 2020

Outstanding product and so easy to use! Highly recommend this product. We successfully used the Virginia deeds. Thank you.

Thank you!