Levy County Notice of Contest of Lien Form (Florida)

All Levy County specific forms and documents listed below are included in your immediate download package:

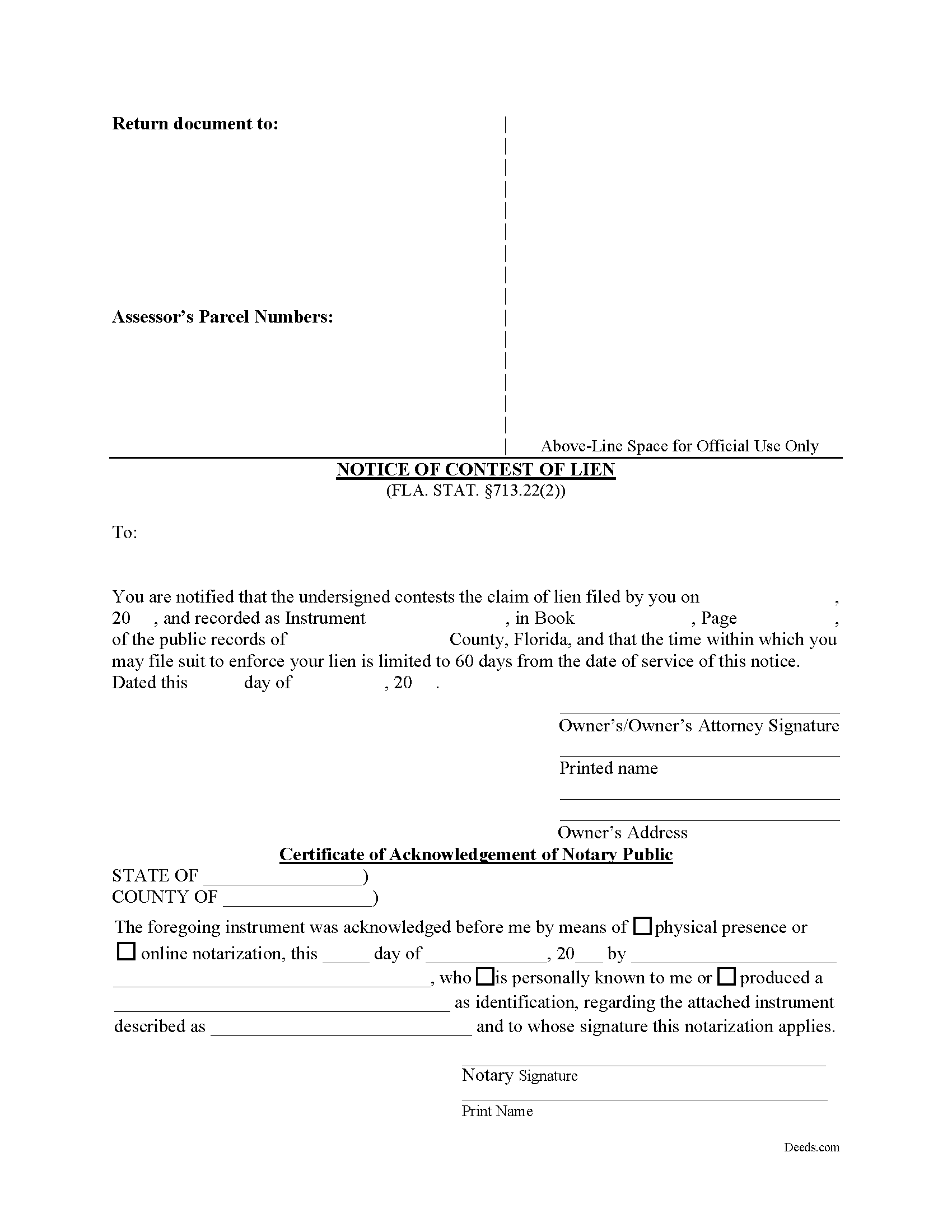

Notice of Contest of Lien Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Levy County compliant document last validated/updated 2/5/2025

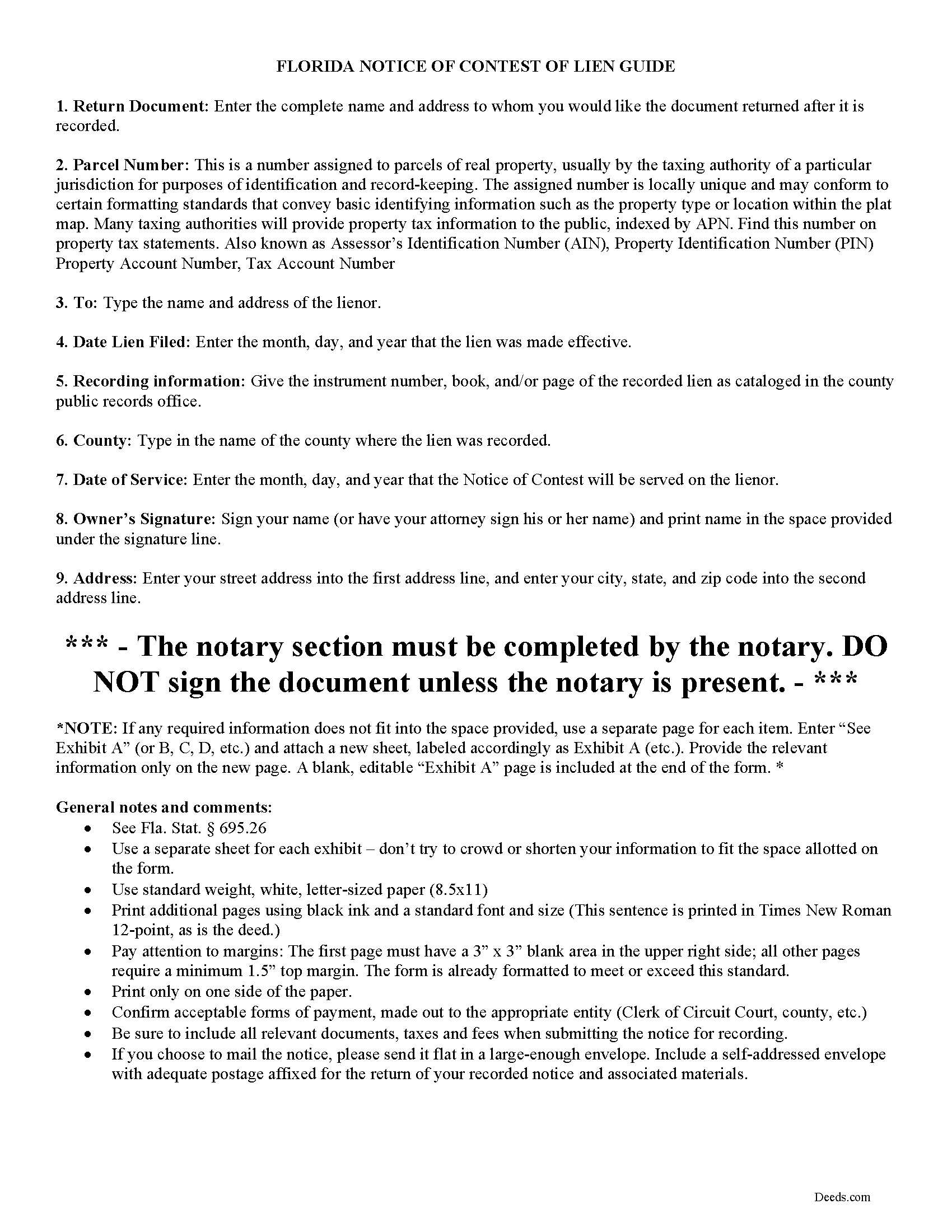

Notice of Contest of Lien Guide

Line by line guide explaining every blank on the form.

Included Levy County compliant document last validated/updated 7/10/2025

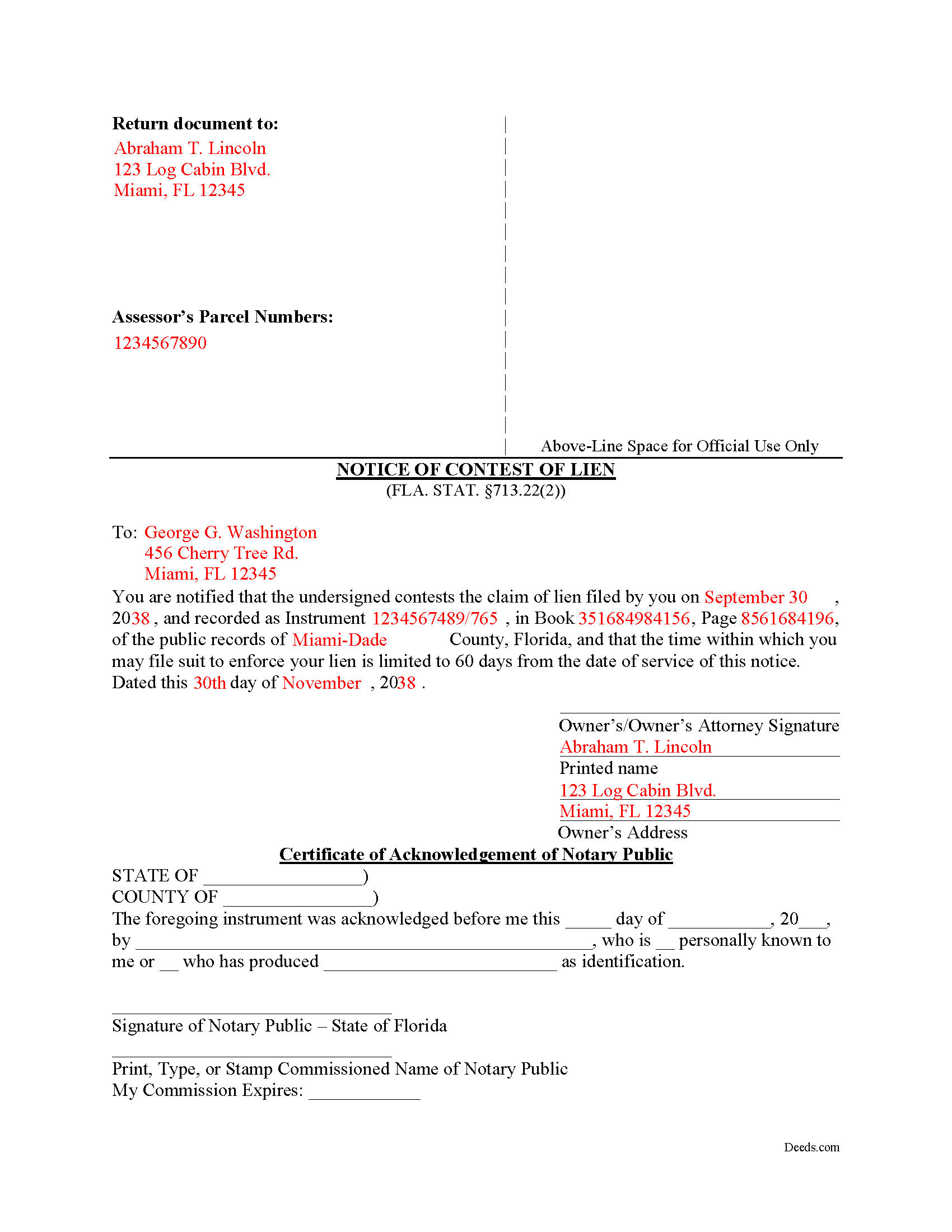

Completed Example of the Notice of Contest of Lien Document

Example of a properly completed form for reference.

Included Levy County compliant document last validated/updated 3/6/2025

The following Florida and Levy County supplemental forms are included as a courtesy with your order:

When using these Notice of Contest of Lien forms, the subject real estate must be physically located in Levy County. The executed documents should then be recorded in the following office:

Clerk of Circuit Court - Levy County Courthouse

355 South Court St, Bronson, Florida 32621

Hours: 8:30am to 4:30pm M-F

Phone: (352) 486-5266

Local jurisdictions located in Levy County include:

- Bronson

- Cedar Key

- Chiefland

- Gulf Hammock

- Inglis

- Morriston

- Otter Creek

- Williston

- Yankeetown

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Levy County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Levy County using our eRecording service.

Are these forms guaranteed to be recordable in Levy County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Levy County including margin requirements, content requirements, font and font size requirements.

Can the Notice of Contest of Lien forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Levy County that you need to transfer you would only need to order our forms once for all of your properties in Levy County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Florida or Levy County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Levy County Notice of Contest of Lien forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Contesting a Mechanic's Lien in Florida

Under Florida law, filing a statutory Notice of Contest of Lien can defend property against a lien. See 713.22 Fla. Stat (2016).

A mechanic's lien, when filed against property, is valid for one year after the recording date. ( 713.22(1)). The lienor can extend that time past one year by filing a lawsuit to enforce the lien prior to its expiration. When a lien is recorded, however, a property owner may file a Notice of Contest of Lien within the one-year period to dispute the lien's validity. This Notice includes the lienor's name and address, details about the recorded lien, the owner's name, and the signing date. It should also meet all state and local formatting requirements for documents submitted for recording.

Once the notice is recorded, the clerk serves it on the lienor at the address in the lien, putting the lienor on notice that he or she must file a lawsuit to enforce the lien within 60 days. This can shorten the enforceability period because once the lienor receives the Notice of Contest of Lien. If the lienor fails to file a lawsuit within the shortened timeframe, it renders the lien invalid.

Each case is unique, so contact an attorney for more information about contesting a lien or other questions about Florida's Construction Lien Law.

Our Promise

The documents you receive here will meet, or exceed, the Levy County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Levy County Notice of Contest of Lien form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4563 Reviews )

JAMES D.

July 10th, 2025

Slick as can be and so convenient.rnrnWorked like a charm

Thank you for your feedback. We really appreciate it. Have a great day!

MARY LACEY M.

June 30th, 2025

Great service! Recording was smooth and swiftly performed. Deeds.com is an excellent service.rn

We are delighted to have been of service. Thank you for the positive review!

Robert F.

June 30th, 2025

Breeze.... It feels silly to hire an attorney to do this for just one beneficiary. Thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

Ben C.

December 8th, 2024

Easy and Quick,Thanks

Thank you for your feedback. We really appreciate it. Have a great day!

Seth T.

January 8th, 2019

THE BEST WEBSITE I HAVE EVER SEEN FOR LEGAL DOCUMENTS!!! THANKS

Thanks Seth, we appreciate your feedback.

Jenny E.

March 21st, 2021

I thought the website was good. But once I paid the money and downloaded the papers I needed for Grays Harbor. I had to end up calling a escrow company that we had worked with only to find out that they work with a slightly different version. The escrow company was kind enough to email me the version Grays Harbor recommends and uses. There is a chance I could use theses in the future.

Thank you for your feedback. We really appreciate it. Have a great day!

Melody S.

February 11th, 2021

Although I was given quite a bit of information, I wanted my property title. I was not informed of what I would receive before I paid for this service.

Thank you!

spencer d.

February 9th, 2023

Great and quick service!

Thank you!

David W.

February 9th, 2021

Excellent assistance provided by your forms, guide and example.

Thank you!

Jan C.

May 20th, 2020

Wow - finding your service was a lifesaver! I know my forms, but I don't have the time right now to draft them from "scratch". So once I found this site it was a couple of quick clicks and VOILA!! almost a done deal. Thanks for the assistance.

Thank you for your feedback. We really appreciate it. Have a great day!

Fawn T.

March 31st, 2023

So easy, forms were great, examples of filled out forms, and instructions guide. Made it way easier, totally worth it!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sharon H.

April 28th, 2020

I was able to print the deed and follow the instructions and sample deed quite easily. Thank you

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

rita t.

November 4th, 2019

Thanks for asking, everything was fine. Forms worked as expected, no problems.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jennifer J.

March 21st, 2022

I have to admit this process was a scary one but you have made it very clear and simple to follow along with. I felt their virtual hand holding, that is how user friendly it is. Thank you for being top notch.

Thank you!

Tony W.

May 27th, 2022

I have not completed the forms yet but they appear to be exactly what I need for the purpose they are intended. Thanks

We appreciate your business and value your feedback. Thank you. Have a wonderful day!