Polk County Notice of Nonpayment Form (Florida)

All Polk County specific forms and documents listed below are included in your immediate download package:

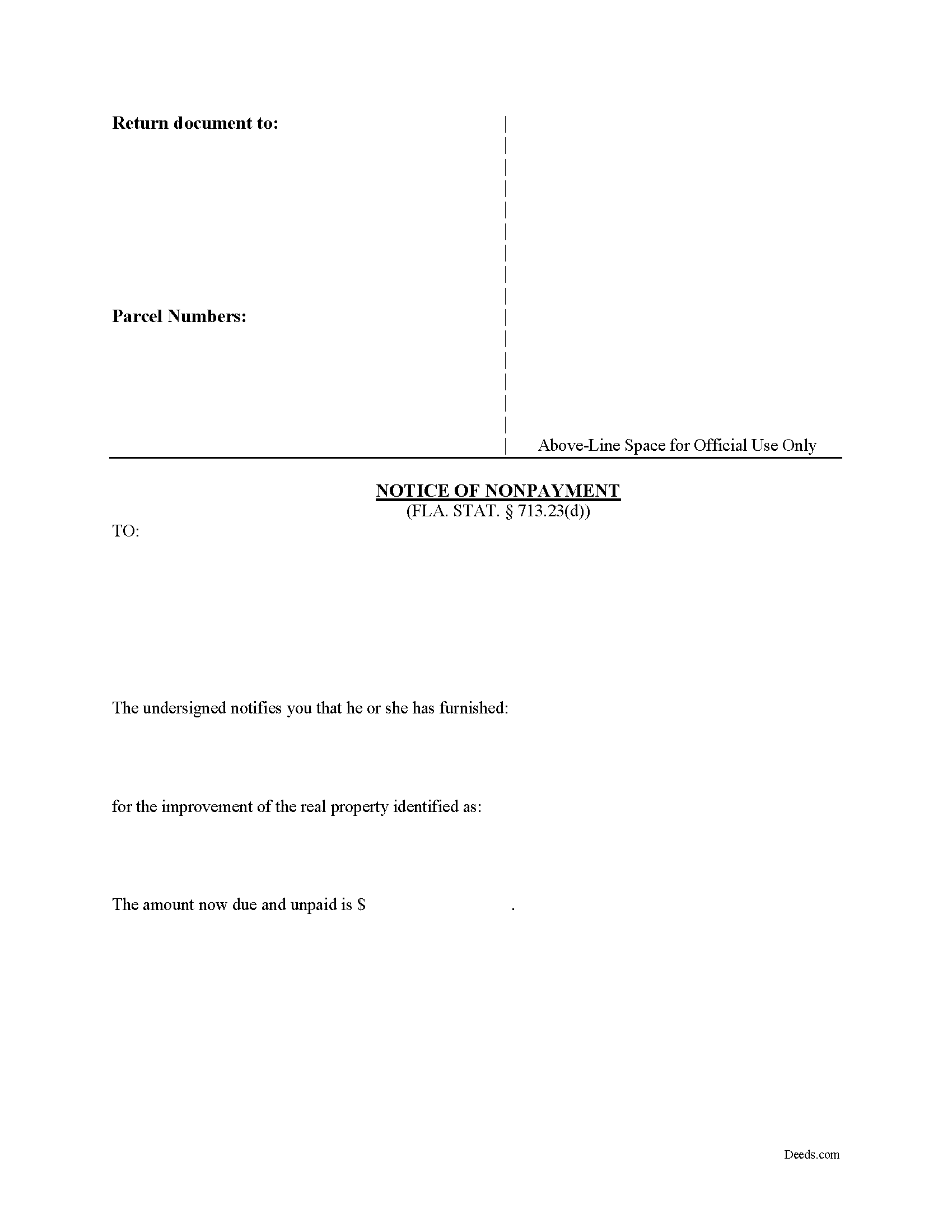

Notice of Nonpayment Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Polk County compliant document last validated/updated 5/26/2025

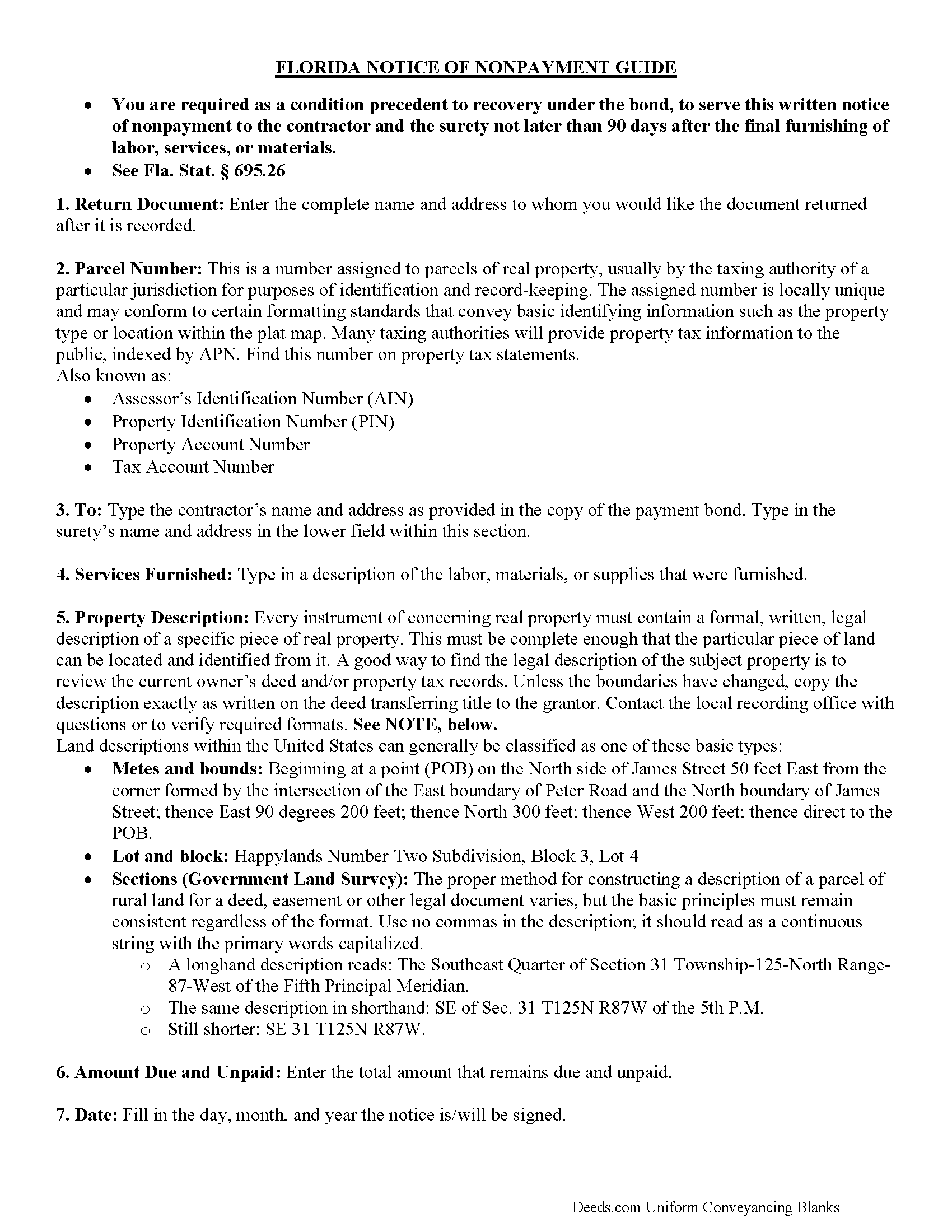

Notice of Nonpayment Guide

Line by line guide explaining every blank on the form.

Included Polk County compliant document last validated/updated 5/16/2025

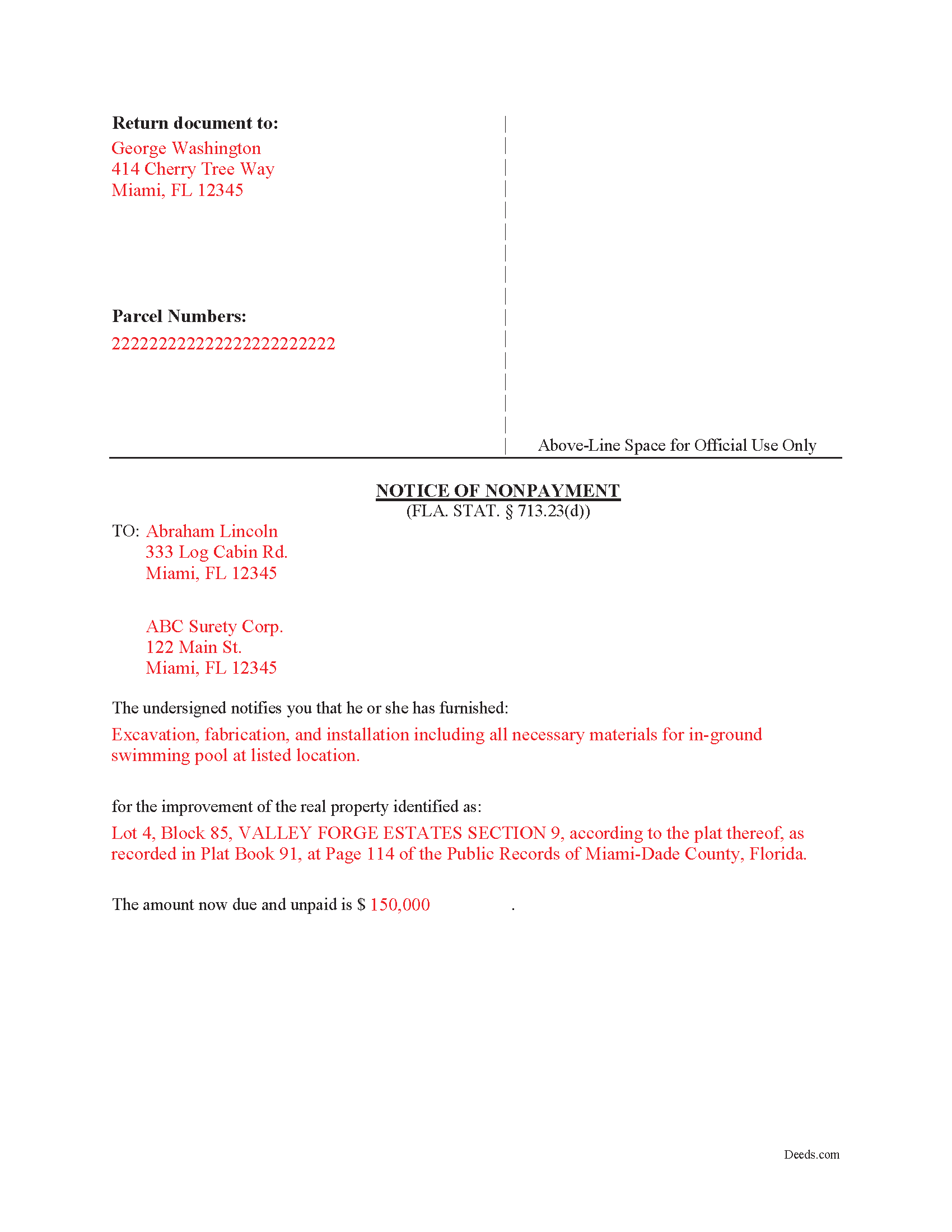

Completed Example of the Notice of Nonpayment Document

Example of a properly completed form for reference.

Included Polk County compliant document last validated/updated 5/15/2025

The following Florida and Polk County supplemental forms are included as a courtesy with your order:

When using these Notice of Nonpayment forms, the subject real estate must be physically located in Polk County. The executed documents should then be recorded in one of the following offices:

Clerk of Circuit Court - Official Records

255 N Broadway Ave, Bartow, Florida 33830

Hours: 8:00am - 5:00pm M-F

Phone: (863) 534-4516

Mail to: Clerk of Circuit Court - Official Records

P.O. Box 9000 Drawer CC-8 , Bartow, Florida 33831

Hours: for mailing purposes

Phone: N/A

Northeast Branch - NE Polk Co. Gov. Center

3425 Lake Alfred Rd, Winter Haven, Florida 33881

Hours: 8:00am - 5:00pm M-F

Phone: (863) 401-2400

Lakeland Branch

930 E Parker St, Rm 240, Lakeland, Florida 33801

Hours: 8:00am - 5:00pm M-F

Phone: (863) 603-6412

Local jurisdictions located in Polk County include:

- Alturas

- Auburndale

- Babson Park

- Bartow

- Bradley

- Davenport

- Dundee

- Eagle Lake

- Eaton Park

- Fort Meade

- Frostproof

- Haines City

- Highland City

- Homeland

- Indian Lake Estates

- Kathleen

- Kissimmee

- Lake Alfred

- Lake Hamilton

- Lake Wales

- Lakeland

- Lakeshore

- Loughman

- Mulberry

- Nalcrest

- Nichols

- Polk City

- River Ranch

- Waverly

- Winter Haven

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Polk County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Polk County using our eRecording service.

Are these forms guaranteed to be recordable in Polk County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Polk County including margin requirements, content requirements, font and font size requirements.

Can the Notice of Nonpayment forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Polk County that you need to transfer you would only need to order our forms once for all of your properties in Polk County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Florida or Polk County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Polk County Notice of Nonpayment forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

What is a Notice of Nonpayment?

Codified at FLA. STAT. 713.23(d), the Notice of Nonpayment form is used to provide the contractor or surety with notice that the lienor has furnished certain labor, services or materials for improvement of real property and to notify each party of the amount that remains due and unpaid.

After the completion (or termination) of the furnishing of labor or materials on a bonded project for which you are still owed payment, you should complete and record this form. The Notice is like a lien but instead of attaching to the subject property, it attaches to the payment bond.

To recover an outstanding balance under the bond, the lienor must serve the contractor with a notice of nonpayment in addition to a notice to contractor form. The lienor must serve this written notice no later than 90 days after the final furnishing of labor, services, or materials. Remember that the time for serving the written notice of nonpayment is ONLY measured from the last day that the lienor furnishes labor, services, or materials. Id.

A valid notice of nonpayment form must include both the contractor's and surety's name and address, a description of the labor or materials furnished, a property description, and the amount owed and unpaid.

Each case is unique, so contact an attorney with specific questions or for complex situations relating to a notice of nonpayment or other issues with Florida mechanic's liens.

Our Promise

The documents you receive here will meet, or exceed, the Polk County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Polk County Notice of Nonpayment form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4560 Reviews )

Pauline C.

June 29th, 2025

Everything that was stated to be included in my order was complete. Very satisfied

Thank you for your positive words! We’re thrilled to hear about your experience.

Ed H.

June 28th, 2025

I filled out the Kansas form and presented it to the Clerk of Deeds in Rawlins Co and there were no problems and no expensive attorney involved for a simple transaction.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Loretta W.

June 26th, 2025

Thank you for your excellent service

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

barbara s.

June 3rd, 2020

I was in a rush to record a quit claim deed, however due to covid 19 Miami dade county recorders office are not open to public. According to staff I would have to mail in the quit claim deed and wait approximately two weeks for the deed to get recorded. Thanks to Deeds.com I got my document recorded in less than one day. You guys are awesome, I will use this company anytime I need something like this again. Very reliable.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Chase J.

June 2nd, 2022

This is the best service. It has made my life so easy when I have to record things with the county! Thanks so much for such a streamlined no hassle process.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Rhonda D.

February 24th, 2021

The boxes do not allow you to add the entire information. The after recording return to box would not let me add a zipcode.

Thanks for the feedback Rhonda, we’ll take a look at that input field.

Phoenix D.

August 17th, 2020

I was looking for the proper quit claim deed for my state. I found it on deeds.com along with instructions and a sample. I couldn't have filed without them.

Thank you for your feedback. We really appreciate it. Have a great day!

Jessica H.

March 3rd, 2021

As a first time user I was a little skeptical of the service. But Deeds.com put all my worries aside. Their service is quick and easy. I will definitely be using it again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Bruce C.

February 13th, 2024

Easy to navigate. The guide and sample helped a lot, including the availability of "Exhibit A". Knowing your documents are guaranteed to be in the required format and the ease of using your forms has been a great service, Thank you!

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Sally F.

January 22nd, 2020

Amazing forms, thanks so much for making these available.

Thank you!

Scott G.

June 4th, 2024

Frankly, if our tax dollars were being used to run government "services" correctly, we wouldn't need Deeds.comrnrnSince the sun will burn out before government is run correctly, Deeds.com provides an important, efficient, time-saving service that, all things considered, offers big savings over time-and-soul-draining struggles with government agencies.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Ralph E.

March 24th, 2019

I wish I had found this site earlier!!! Not only was it helpful and just what I needed but I got my information so fast AND on the weekend. I would recommend this site to everyone. I plan on using it more. Its cheap and I can get my information while sitting at home. Very impressed!

Thank you for the kinds words Ralph. Have a great day!

Lenore B.

January 13th, 2019

Thank you for making this deed available. The guide was such a big help.

Thanks Lenore, have a great day!

Charles F.

November 19th, 2020

Quick and Easy

Thank you for your feedback. We really appreciate it. Have a great day!

Rebecca K.

January 12th, 2022

I was able to find EXACTLY what I was looking for in just a couple minutes, plus a helpful guide, all for less than $30. I was very impressed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!