Lee County Unconditional Waiver and Release of Lien upon Progress Payment Form (Florida)

All Lee County specific forms and documents listed below are included in your immediate download package:

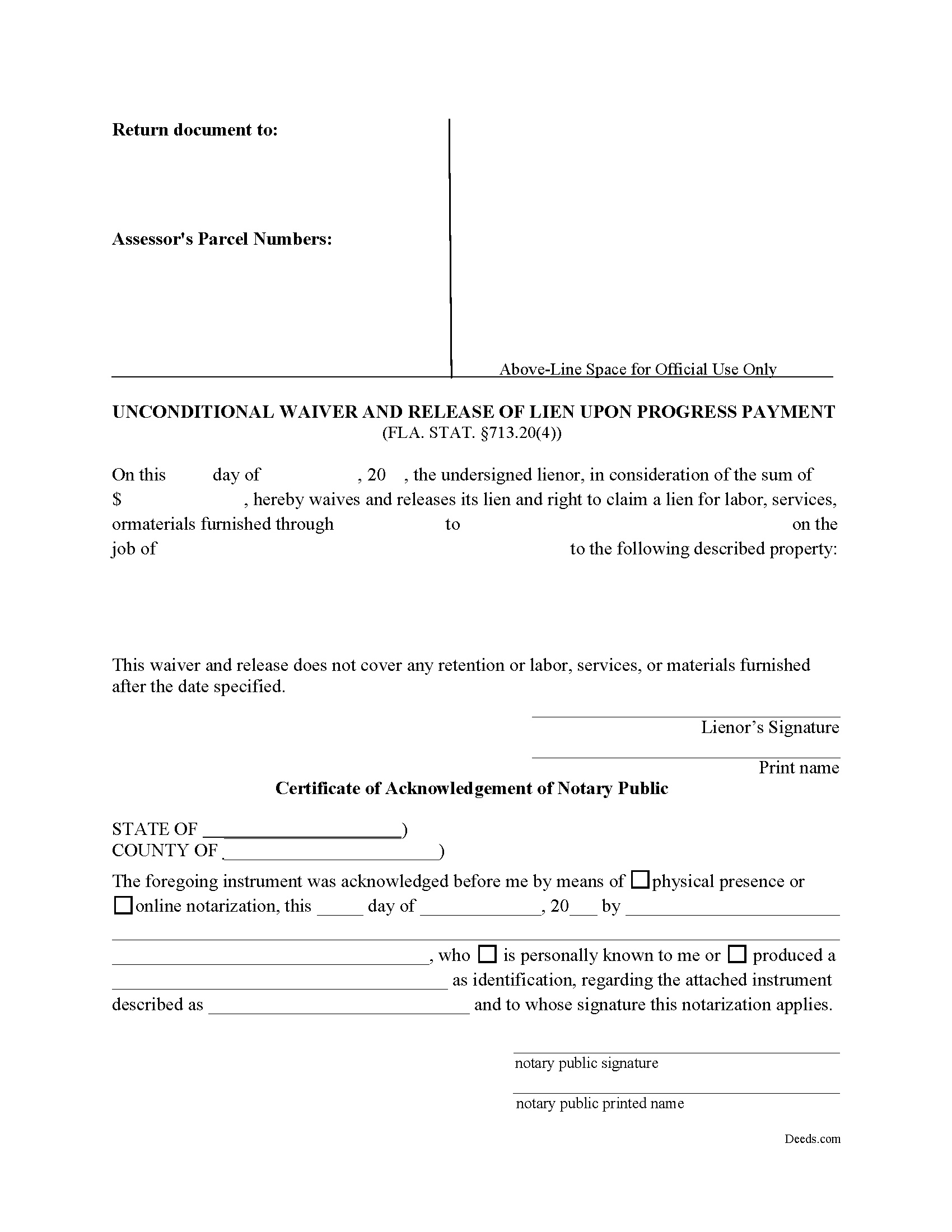

Unconditional Waiver and Release of Lien upon Progress Payment Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Lee County compliant document last validated/updated 2/22/2024

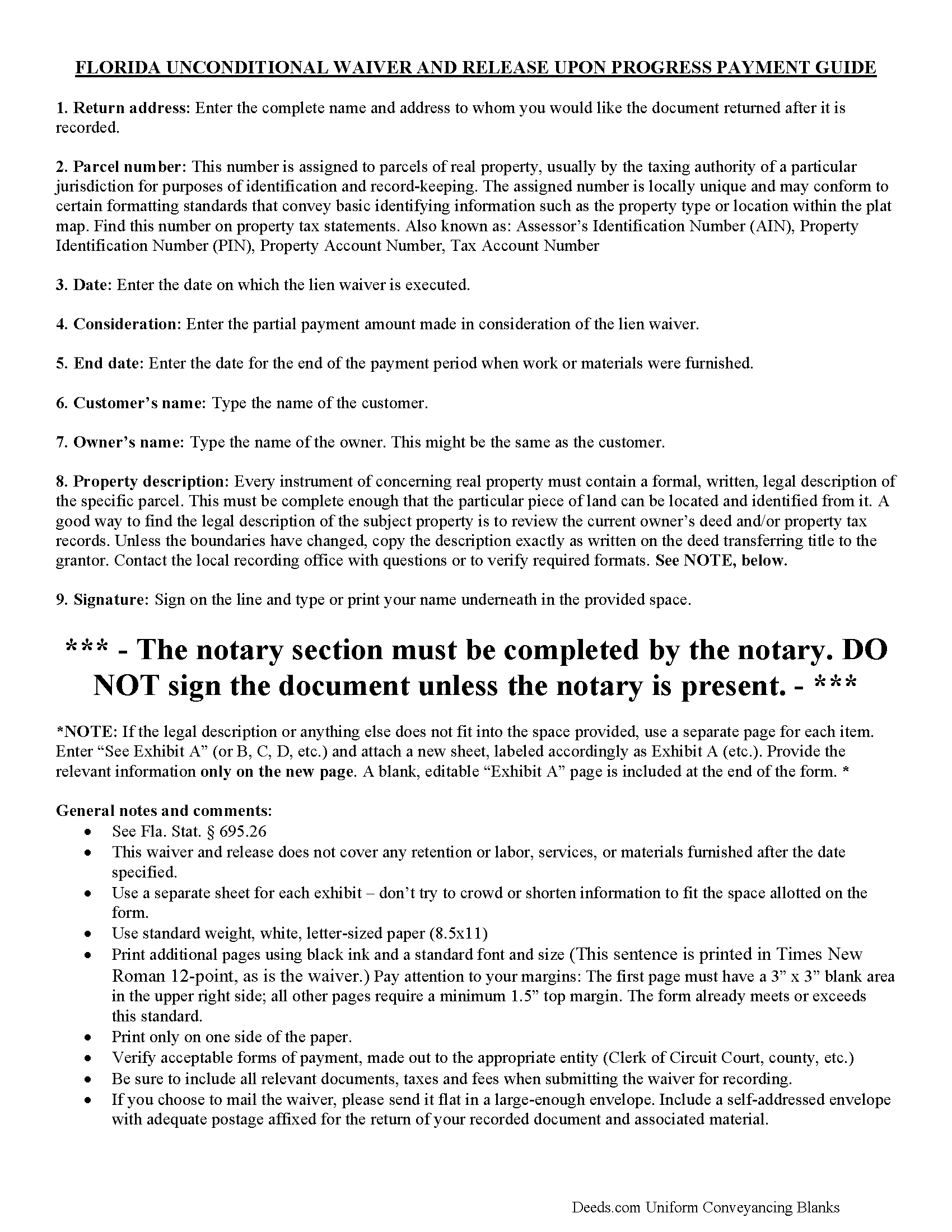

Unconditional Waiver and Release of Lien upon Progress Payment Guide

Line by line guide explaining every blank on the form.

Included Lee County compliant document last validated/updated 6/20/2024

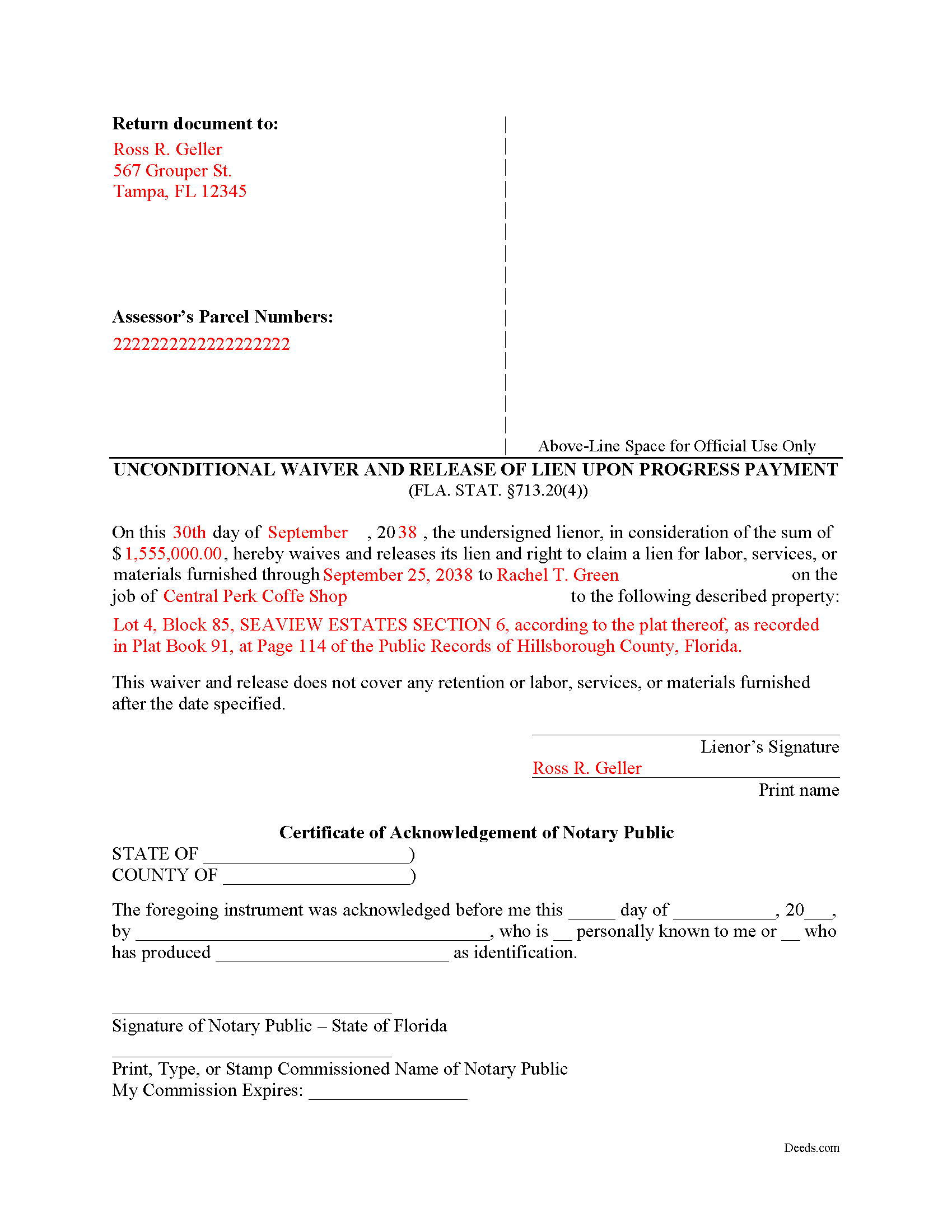

Completed Example of the Unconditional Waiver and Release of Lien upon Progress Payment Form

Example of a properly completed form for reference.

Included Lee County compliant document last validated/updated 7/12/2024

The following Florida and Lee County supplemental forms are included as a courtesy with your order:

When using these Unconditional Waiver and Release of Lien upon Progress Payment forms, the subject real estate must be physically located in Lee County. The executed documents should then be recorded in the following office:

Lee County Clerk of Courts - Official Records

2115 2nd St, 2nd floor / PO Box 2278, Fort Meyers, Florida 33901 / 33902

Hours: 8:00am - 5:00pm M-F

Phone: (239) 533-5007

Local jurisdictions located in Lee County include:

- Alva

- Boca Grande

- Bokeelia

- Bonita Springs

- Cape Coral

- Captiva

- Estero

- Fort Myers

- Fort Myers Beach

- Lehigh Acres

- North Fort Myers

- Pineland

- Saint James City

- Sanibel

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Lee County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Lee County using our eRecording service.

Are these forms guaranteed to be recordable in Lee County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Lee County including margin requirements, content requirements, font and font size requirements.

Can the Unconditional Waiver and Release of Lien upon Progress Payment forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Lee County that you need to transfer you would only need to order our forms once for all of your properties in Lee County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Florida or Lee County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Lee County Unconditional Waiver and Release of Lien upon Progress Payment forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Florida's Construction Lien Law codifies statutory waivers at section 713.20.

A lien waiver operates by waiving (disclaiming) the lienor's right to all or part of an established lien. Lien waivers can be conditional, or only effective when the payment is actually received, or unconditional, meaning the lien is waived upon execution of the form, regardless of any remaining balance due. s. 713.20(7) Fla. Stat. (2016). They can also release a lien based on partial or full payment.

This form unconditionally releases a portion of the lien based on an agreed-upon progress payment. It requires a return address, the parcel identifier and legal description for the property being improved, the lienor's name, the customer's name, the owner's name, the amount paid, and an ending date for the period of time covered by the payment. 713.20(4).

Exercise caution when using unconditional waivers. If the lienor suspects for any reason that the payment is or will be invalid, he or she should consider a conditional waiver instead.

Each case is unique. Contact an attorney for complex situations or with questions about using an unconditional waiver and release of lien upon progress payment, or any other issues relating to Florida's Construction Lien Law.

Our Promise

The documents you receive here will meet, or exceed, the Lee County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Lee County Unconditional Waiver and Release of Lien upon Progress Payment form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4363 Reviews )

AARON D.

July 26th, 2024

Forms were great ! Cancelled my lawyer's appointment & utilized your forms.rn

We are grateful for your feedback and looking forward to serving you again. Thank you!

Anne H.

July 25th, 2024

After some initial general confusion -- (we sold a small piece of land privately and therefore do not typically prepare such documentation (!)) -- we were able to purchase and download all forms from Deeds.com and understand how to complete it/them. The help is all there, we just needed to read and study it - the "Example" helped alot. We were able to complete the Document per your online form(s) and then take it to be signed/notarized - and take the completed paper document to the Registry -- and it is now all registered and we are All Set. rn Took the morning (only). THANK YOU. A wonderful tool!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

charles b.

July 21st, 2024

The product I needed was available, easy to download, access and complete. The instructions were very helpful. I had previously purchased another product which was terrible. I highly recommend Deeds.com

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Joanne W.

January 20th, 2020

I was very pleased to find this service, as (another website) charges about $40 for the same service, so yours was a bargain.

Thank you!

Eddy C & Tina H.

May 11th, 2021

did not use, much to expensive.

Thank you for your feedback. We do hope that you found something more suitable to your needs elsewhere. Have a wondaful day.

Joe D.

June 15th, 2019

Complete coverage of deeds, laws, etc.

Thank you!

Linda D.

July 17th, 2019

It was easy to download the form I wanted BUT there were 2 other options listed for "open/download." I didn't want to risk more charges for something I couldn't determine I needed so I passed them up. There were a few others listed with the option to "view" so I did that, without down-loading, and there were no additional charges. I would've liked that opportunity for 2 others that didn't offer "view" so maybe deeds.com missed a sale?

Thank you for your feedback Linda. All the documents available for download in your account are included with your payment, no additional charges.

Tim M.

February 2nd, 2024

This is my first time using this amazing service. I wish I was told about this before I went all the way downtown, drove thru construction zones, paid for parking only to be told the computer system had crashed. rnI was referred to Deeds.com and I will not use the downtown system again.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Don M.

February 17th, 2023

The process was easy going. The process is one thing, the results another. I have attempting to resolve this matter, of claiming sole ownership of the property for several YEARS. I lost my Bride of 65 years in 2015. A lawyer I hired failed in his attempt, so I'm waiting to see the actual results.

I also have two parcels in New Mexico under the same situation, so if this is successful, I'll gladly be back. Thank You so very much. Don Martin

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

James S.

December 2nd, 2020

It worked great. But it turns out I didn't need it.

Thank you!

DONALD S.

March 11th, 2020

Using the Administrators Deed, pay attention to "Exhibit A". The blank will allow you to type a full legal description BUT it will not save it. Use "Exhibit A" to type the legal description.

The form was great and I filed it this morning with no problems.

Thank you for your feedback. We really appreciate it. Have a great day!

Robert T.

January 2nd, 2019

Perfect. Downloaded the forms with no issues, filled them out, had them notarized and recorded all in just a few hours (most of that time was spent at the recorder's office). Highly recommend.

Thank you for your feedback. We really appreciate it. Have a great day!

Catherine B.

October 26th, 2021

Was looking for information and forms relating to a trust my parents created, but what I purchased seems geared toward trusts containing real estate only, which is not what I needed. Clearly I missed something prior to purchasing something I can not use. Perhaps additional clarification for us without any experience is this area would be helpful.

Thank you for your feedback. We really appreciate it. Have a great day!

Kari G.

July 15th, 2021

The service was prompt and attentive to my questions. I would've just appreciated a heads up that I also needed to contact the county directly (and provide contact info) to receive a certified copy of the document (Notice of Commencement) in order to submit the certified copy to the Building Department. This was an extra step that I haven't had to complete before using another eRecording service. Even if this extra step is a result of the county's system. I would still have expected a head's up (since there wasn't any info regarding this on the county's site for eRecording).

Thank you for your feedback. We really appreciate it. Have a great day!

cosmin B.

March 19th, 2021

It's all good!!!!

Thank you!