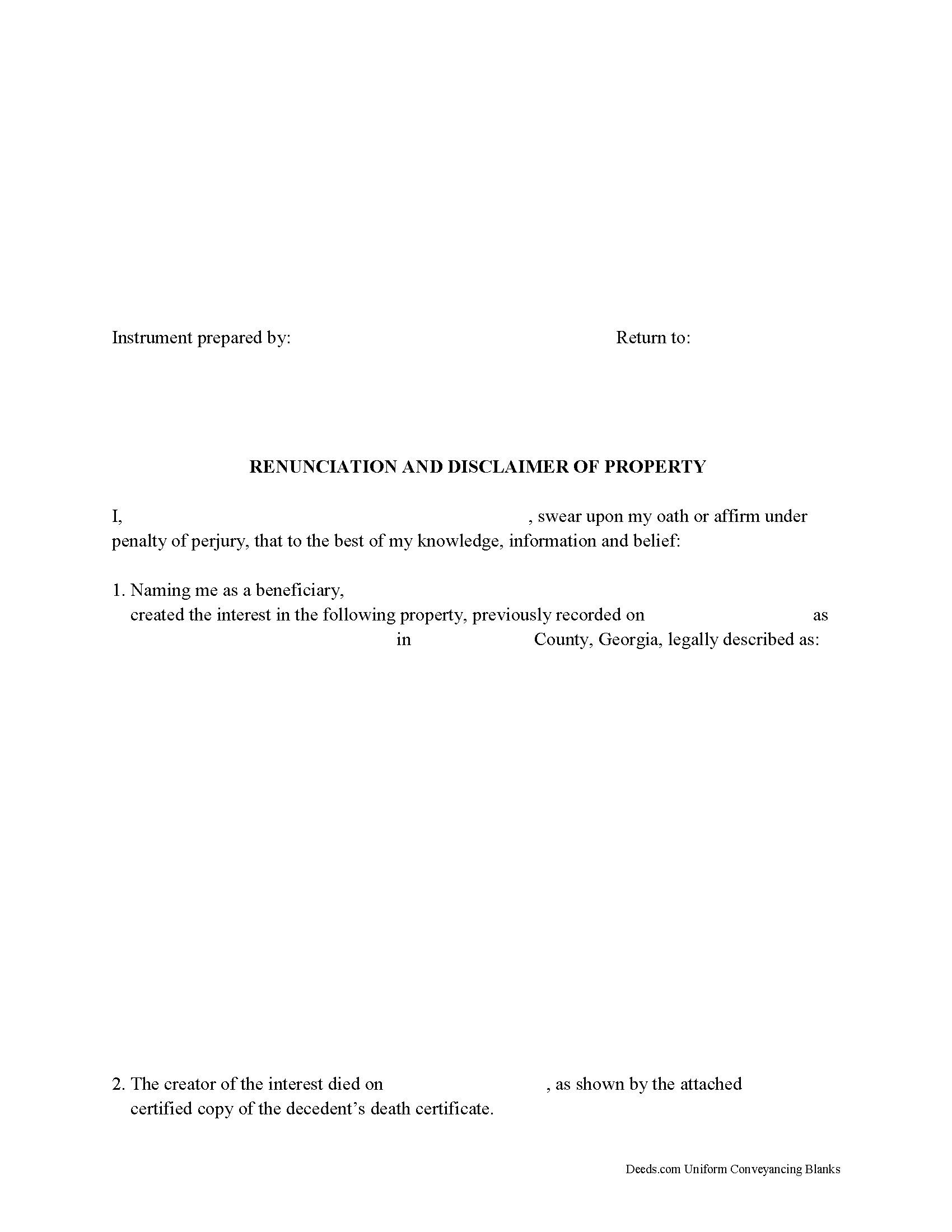

Clay County Disclaimer of Interest Form

Clay County Disclaimer of Interest Form

Fill in the blank form formatted to comply with all recording and content requirements.

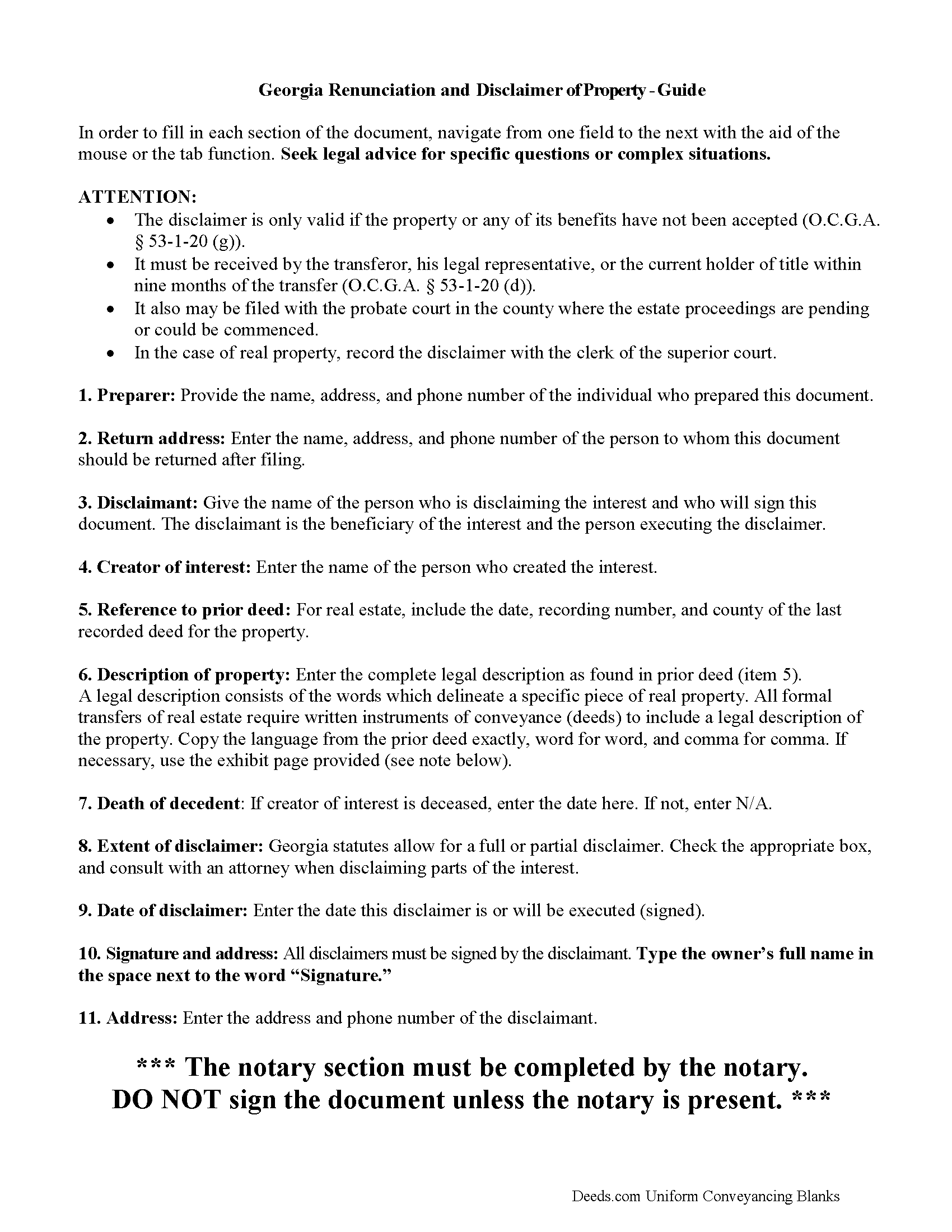

Clay County Disclaimer of Interest Guide

Line by line guide explaining every blank on the form.

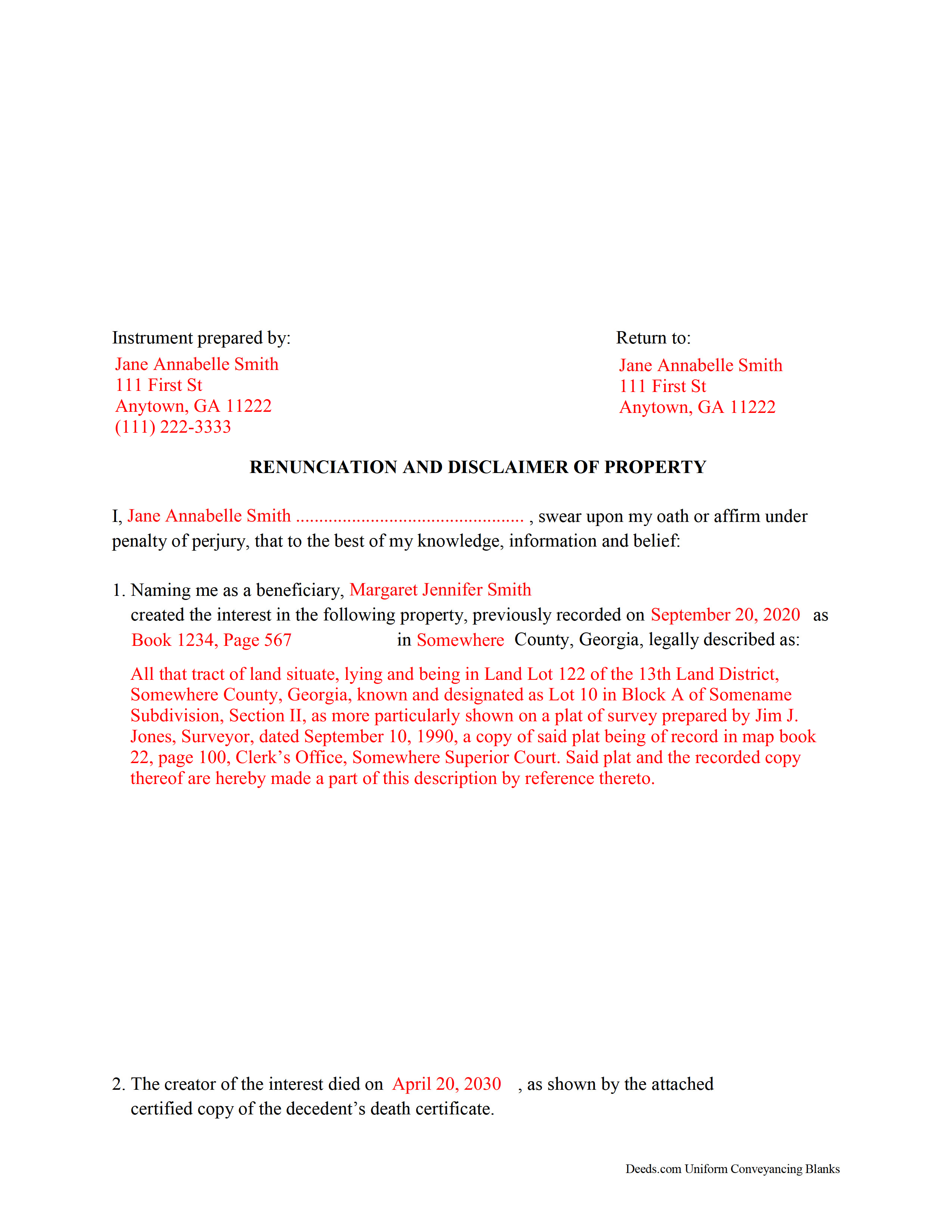

Clay County Completed Example of the Disclaimer of Interest Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Georgia and Clay County documents included at no extra charge:

Where to Record Your Documents

Clay Clerk of Superior Court

Fort Gaines, Georgia 39851

Hours: 8:00am - 4:30pm Monday - Friday

Phone: (229) 768-2631

Recording Tips for Clay County:

- Ensure all signatures are in blue or black ink

- Documents must be on 8.5 x 11 inch white paper

- White-out or correction fluid may cause rejection

- Recorded documents become public record - avoid including SSNs

- Bring extra funds - fees can vary by document type and page count

Cities and Jurisdictions in Clay County

Properties in any of these areas use Clay County forms:

- Bluffton

- Fort Gaines

Hours, fees, requirements, and more for Clay County

How do I get my forms?

Forms are available for immediate download after payment. The Clay County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Clay County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Clay County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Clay County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Clay County?

Recording fees in Clay County vary. Contact the recorder's office at (229) 768-2631 for current fees.

Questions answered? Let's get started!

Georgia Disclaimer/Renunciation of Property

A beneficiary of an interest in property in Georgia can disclaim and renounce all or part of a bequeathed interest in, or power over, that property under O.C.G.A. 53-1-20, as long as it has not been accepted through actions that indicate ownership or through a written waiver of the right to disclaim (53-1-20 (g)).

The written disclaimer must identify the creator of the interest, provide a description of the disclaimed interest, a declaration of the disclaimer and its extent, and it must be signed by the person making the renunciation (53-1-20 (c)).

The disclaimer must be filed, recorded and/or delivered pursuant to 53-1-20 (d) as follows:

* It must be received by the transferor, his legal representative, or the current holder of title within nine months of the transfer. This is consistent with the Internal Revenue Code Section 2518.

* It also may be filed with the probate court in the county where the estate proceedings are pending or could be commenced.

* In the case of real property, the renunciation may be recorded with the clerk of the superior court.

A disclaimer relates back to the death of the decedent or to the date it was created (53-1-20 (g)). It is irrevocable and binding to the disclaimant and generally to those who claim under him or her. Be sure to consult an attorney when in doubt about the drawbacks and benefits of disclaiming inherited property.

(Georgia Disclaimer of Interest Package includes form, guidelines, and completed example)

Important: Your property must be located in Clay County to use these forms. Documents should be recorded at the office below.

This Disclaimer of Interest meets all recording requirements specific to Clay County.

Our Promise

The documents you receive here will meet, or exceed, the Clay County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Clay County Disclaimer of Interest form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4574 Reviews )

Armando R.

December 13th, 2022

Great service and support!

Thank you!

Loretta W.

June 26th, 2025

Thank you for your excellent service

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

James S.

April 22nd, 2019

easy to use

Thank you James.

Joice W G.

May 5th, 2019

Easy to use and able to individualize, which was important since I needed to print more than one doc. I just wish I had an option for a less expensive purchase - seemed like a lot for just a couple docs.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Maria S.

January 10th, 2019

The paperwork/forms are fine, but there isn't enough explanation for me to figure out how to file the extra forms (which I do need in my case). The main form, Deed Upon Death is fine. I think the price is pretty high for these forms. I wouldn't have purchased it because there are places to get them for much cheaper (about 6 dollars), but this site had the extra forms I wanted (property in a trust and another form). Unfortunately these were included as a "courtesy" and there are no instructions for them. So three stars for being clear about what was in the package, having the right forms that I need, but instructions for putting them to use and price took a couple of stars off. Downloading was easy and once you download you can type the info into the PDF--that makes working with the forms much easier.

Thank you for the feedback Maria. Regarding the supplement documents, it is best to get assistance from the agency that requires them. These are not legal documents, they should provide full support and guidance for them.

Dexter Lamar H.

August 4th, 2023

Quick service!

Thank you!

William P.

June 11th, 2019

Good timely service. Returned my fee on a document that could not be located.

Thank you!

Billie G.

October 14th, 2021

Loved this service! It was quick, easy and effective! I'll definitely be using them again!

Thank you!

Richard L.

February 13th, 2021

Thanks for the complete and reasonably priced set of docs. I was specifically looking for and glad to find a current version of a TOD deed following the California extension.

Thank you for your feedback. We really appreciate it. Have a great day!

Marilyn S.

January 7th, 2021

I was fine. But I don't like surveys.

Thank you!

Ralph H.

October 22nd, 2022

They must have busy when I applied. The screen said it should be done in under10 mins unless heavier traffic. I was a little nervous because of a time deadline. It was completed in 45 mins and for under $30 it was worth every penny to have my deed details at my fingertips. So I give it a 5 on ease of use and quick handling. You can get it done less expensively, but great in a time crunch.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sheryl C.

July 28th, 2021

Very Very helpful easy to navigate the guides and examples were great and informative. Great to have will be using for future transactions.

Thank you for your feedback. We really appreciate it. Have a great day!

Connie H.

January 18th, 2019

I really appreciated the detailed instructions provided with the document. The instructions made it easy to fill it out correctly. Filed the document with the courthouse the next day and have received confirmation that it has been filed.

Thanks Connie! Have a great day!

L B W.

January 22nd, 2021

Bottom line - it was certainly worth the $21 (+-?) I paid for the form and instructions, etc. Admittedly the form is a little inflexible in terms of editing for readability but I understand that offering greater flexibility would likely make theft more likely. So I'm happy with what I got. One suggestion - add more info about what's required in the "Source of Title" section.

Thank you for your feedback. We really appreciate it. Have a great day!

Christina H.

December 29th, 2022

I appreciate having forms available and not having to go to a business supply or attorney. This is great. However, there are two individual quit claim deed forms and I don't know which one is appropriate.

Thank you for your feedback. We really appreciate it. Have a great day!

Legal Forms Disclaimer

Use of Deeds.com Legal Forms:On our Site, we provide self-help "Do It Yourself Legal Forms." By using a form from our Site, you explicitly agree to our Terms of Use. You acknowledge and agree that your purchase and/or use of a form document does not constitute legal advice nor the practice of law. Furthermore, each form, including any related instructions or guidance, is not tailored to your specific requirements and is not guaranteed or warranted to be up-to-date, accurate, or applicable to your individual circumstances.

NO WARRANTY:The Do It Yourself Legal Forms provided on our Website are not guaranteed to be usable, accurate, up-to-date, or suitable for any legal purpose. Any use of a Do It Yourself Legal Form from our website is undertaken AT YOUR OWN RISK.

Limitation of Liability:If you use a Do It Yourself Legal Form available on Deeds.com, you acknowledge and agree that, TO THE EXTENT PERMITTED BY APPLICABLE LAW, WE SHALL NOT BE LIABLE FOR DAMAGES OF ANY KIND (INCLUDING, WITHOUT LIMITATION, LOST PROFITS OR ANY SPECIAL, INCIDENTAL, OR CONSEQUENTIAL DAMAGES) ARISING OUT OF OR IN CONNECTION WITH THE LEGAL FORMS OR FOR ANY INFORMATION OR SERVICES PROVIDED TO YOU THROUGH THE DEEDS.COM WEBSITE.

Damage Cap:In circumstances where the above limitation of liability is prohibited, OUR SOLE OBLIGATION TO YOU FOR DAMAGES SHALL BE CAPPED AT $100.00.