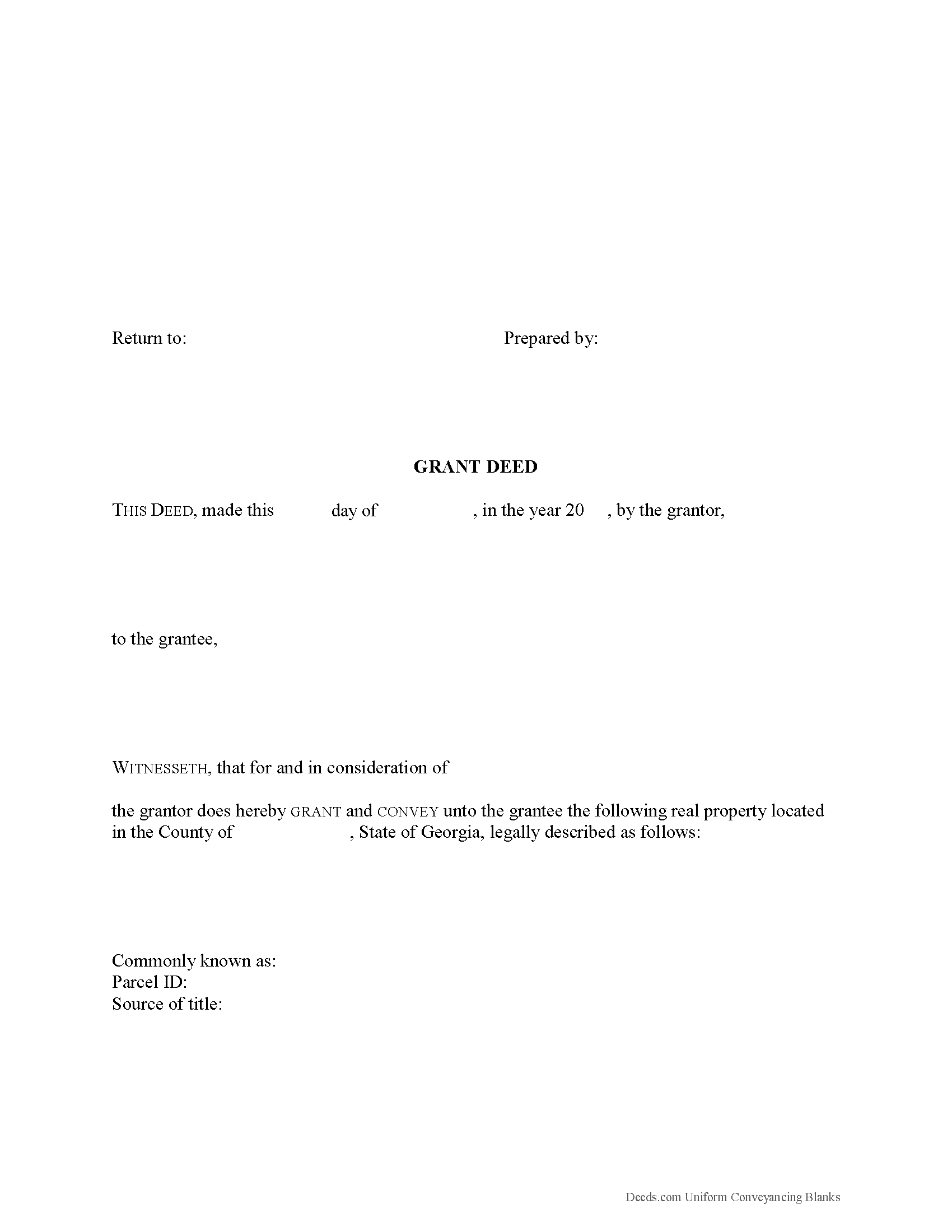

Wayne County Grant Deed Form

Wayne County Grant Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

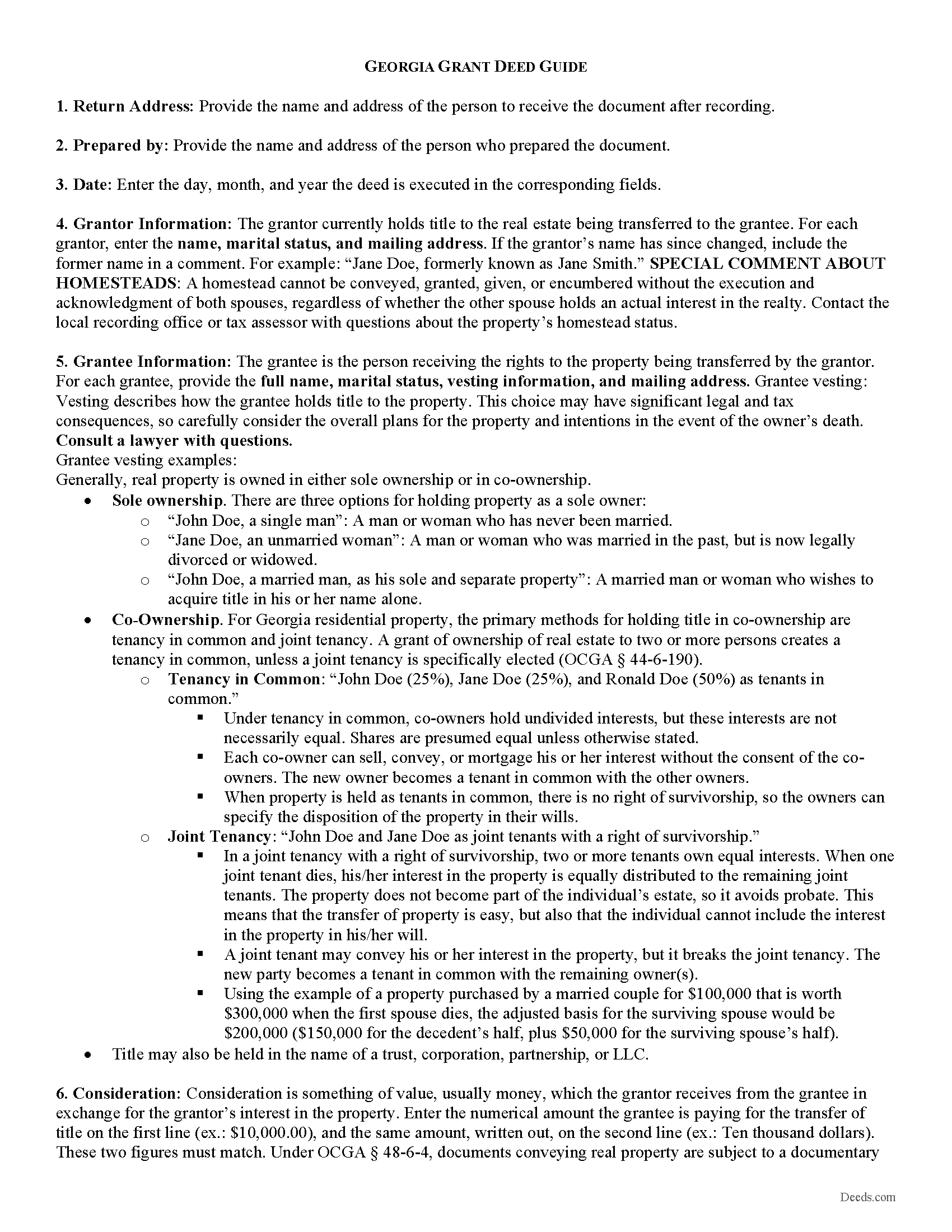

Wayne County Grant Deed Guide

Line by line guide explaining every blank on the form.

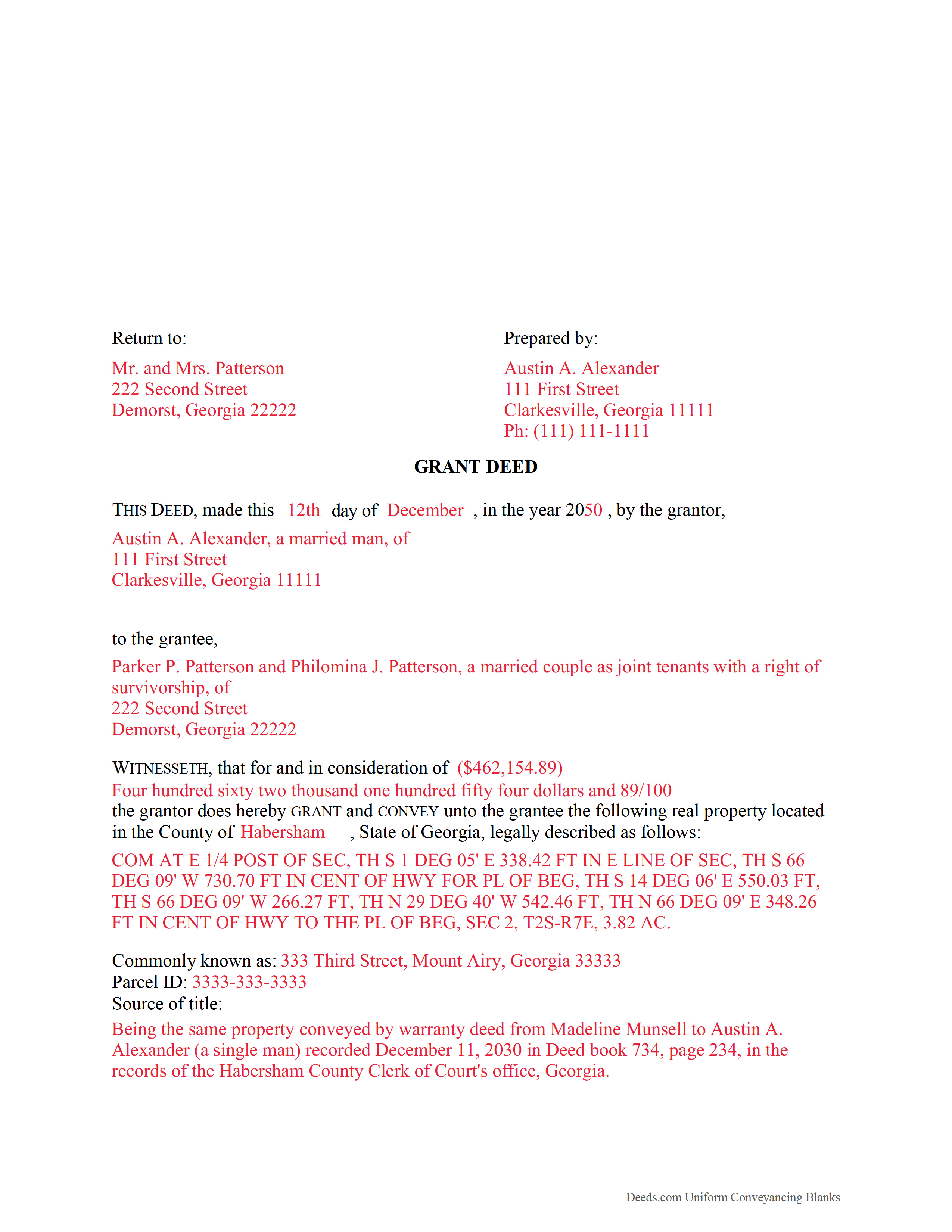

Wayne County Completed Example of the Grant Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Georgia and Wayne County documents included at no extra charge:

Where to Record Your Documents

Clerk of Courts

Jesup, Georgia 31546

Hours: 8:30 to 5:00 M-F

Phone: (912) 427-5930

Recording Tips for Wayne County:

- Avoid the last business day of the month when possible

- Both spouses typically need to sign if property is jointly owned

- Recorded documents become public record - avoid including SSNs

- Request a receipt showing your recording numbers

Cities and Jurisdictions in Wayne County

Properties in any of these areas use Wayne County forms:

- Jesup

- Odum

- Screven

Hours, fees, requirements, and more for Wayne County

How do I get my forms?

Forms are available for immediate download after payment. The Wayne County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Wayne County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Wayne County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Wayne County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Wayne County?

Recording fees in Wayne County vary. Contact the recorder's office at (912) 427-5930 for current fees.

Questions answered? Let's get started!

A grant deed is a real estate deed that is used to transfer real property in Georgia from one entity to another. There are no statutory forms provided for a grant deed in Georgia. If a deed sufficiently makes known the transaction between the parties, no want of form will invalidate it ( 44-5-33). In a grant deed, the grantor warrants and forever defends the right and title to the described property unto the grantee and the grantee's heirs and assigns against the claims of all persons owning, holding, and claiming by, through, or under the grantor.

When submitting a grant deed for recordation, it must be an original, signed by the grantor, and should be attested or acknowledged as required by law ( 44-2-14). Grant deeds executed in Georgia may be attested by a judge of a court of record, including a judge of a municipal court, or by a magistrate, a notary public, or a clerk or deputy clerk of a superior court or of a city court created by a special act of the General Assembly. With the exception of notaries public and judges of courts of record, such officers may only attest instruments only in the county in which they respectively hold their offices ( 44-2-15). In order to record a grant deed that has been executed out of state, the deed must be attested or acknowledged before one of the officers listed in 44-2-21 and must be attested before two witnesses, one of whom may be the official taking acknowledgments ( 44-2-21). Grant deeds executed in Georgia also require two witnesses. A grant deed must also be accompanied by a completed real estate transfer tax form.

A grant deed should be recorded in the office of the clerk of the superior court in the county where the property is located. The recording act in Georgia is a race-notice act. A grant deed can be recorded at any time, but a prior unrecorded deed will lose its priority over a subsequent recorded deed from the same vendor when the purchaser takes such deed without notice of the existence of the prior deed ( 44-2-1). Deeds, mortgages, and liens of all kinds that are required by law to be recorded in the office of the clerk of the superior court and which are against the interests of third parties who have acquired a transfer or lien binding the same property and who are acting in good faith and without notice will take effect only from the time they are filed for record in the clerk's office ( 44-2-2b).

(Georgia Grant Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Wayne County to use these forms. Documents should be recorded at the office below.

This Grant Deed meets all recording requirements specific to Wayne County.

Our Promise

The documents you receive here will meet, or exceed, the Wayne County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Wayne County Grant Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4588 Reviews )

Wayne A.

June 10th, 2021

good service but pricey.

Thank you for your feedback. We really appreciate it. Have a great day!

Rene S.

December 23rd, 2022

Amazing forms and great value. That may sound like hyperbole talking about legal forms but it's not, you really are getting way more than you pay for here.

Thank you for your feedback. We really appreciate it. Have a great day!

Patsy B.

February 19th, 2020

This website is very user friendly. I easily found the form I needed and was given an example for filling it out. Highly recommend this website!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Scott W.

March 31st, 2020

Wow! That was easy! I was expecting a more difficult process. Upload your docs and wait for a response. Which was minutes later. I would give it 6 stars.

Thank you for your kind words Scott, glad we could help.

Raymond R C.

September 10th, 2019

Old document deeds were not available and my cost was returned. Was referred to another location and was able to get some help there.

Thank you for your feedback. We really appreciate it. Have a great day!

William O.

June 13th, 2025

form worked great but was over priced for such a simple form , should be around $10 and most people could easily create this themselves.

Hi William, thank you for your review. We’re glad the form worked well for you. We understand it may seem simple on the surface, but Transfer on Death Deeds—especially in New York—require precise language and adherence to both state and county-level rules. Our forms are attorney-prepared, regularly reviewed for legal compliance, and include helpful instructions to reduce the risk of costly filing errors. We appreciate your feedback and hope the document serves its purpose smoothly.

Barbara A.

April 25th, 2024

Always helpful!

We are thankful for your continued support and feedback, which inspire us to continuously improve. Thank you..

Anna C.

February 9th, 2021

It was more detailed than the forms on other website, plus cheaper. I do not have date it was recorded in 2000 but did have date of warranty deed. Will that be ok with Recorder? Also did not want to date it today till I know when and where the Recorders office is located.

Thank you for your feedback. We really appreciate it. Have a great day!

Beverly J. A.

April 24th, 2022

Thank you for the paperwork. It was so much easier to do at home than go out and have to have people miss work.

Thank you!

Arletta B.

September 16th, 2021

Fantastic service, saved me a ton of time and running around. Thanks!

Thank you!

Kris D.

February 7th, 2022

The Executor's Guide needs more info about what to put for grantee (estate of deceased or my name as executor?) and the price (something nominal like $10?) before there is a buyer. The guide seems to use only one example.

Thank you for your feedback. We really appreciate it. Have a great day!

Christina W.

September 4th, 2019

I stand corrected. I received my report and it was exactly what I requested.

Thank you!

Annie R.

December 7th, 2019

Excellent service. Documents easy to understand and use.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Michael F.

March 12th, 2020

Very useful and right at your fingers when you need a form. Recommend these forms highly. Thank you!!!!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Robert h.

February 25th, 2019

excellent and simple to use. Great price for this.

Thank you Robert! We really appreciate your feedback.